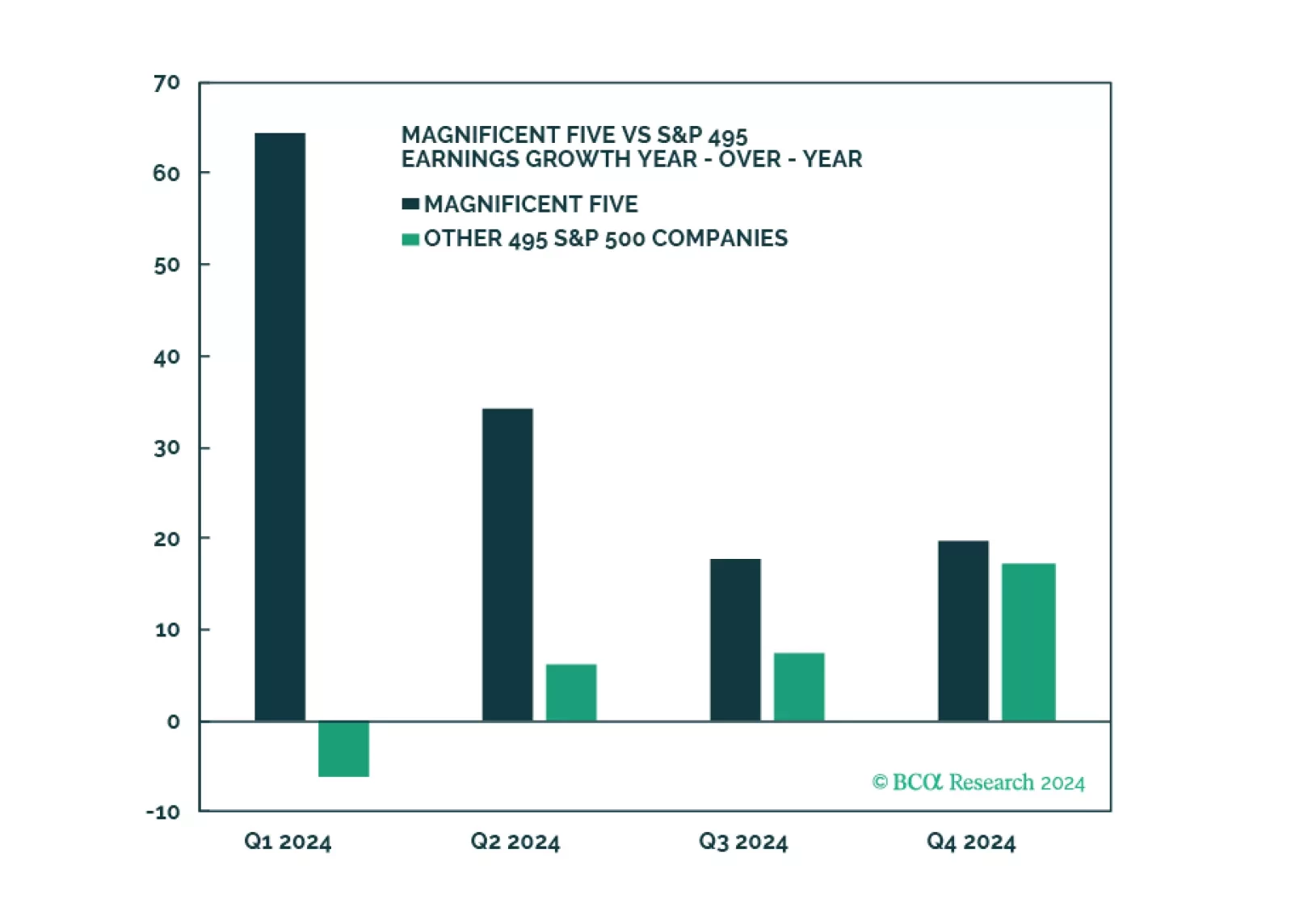

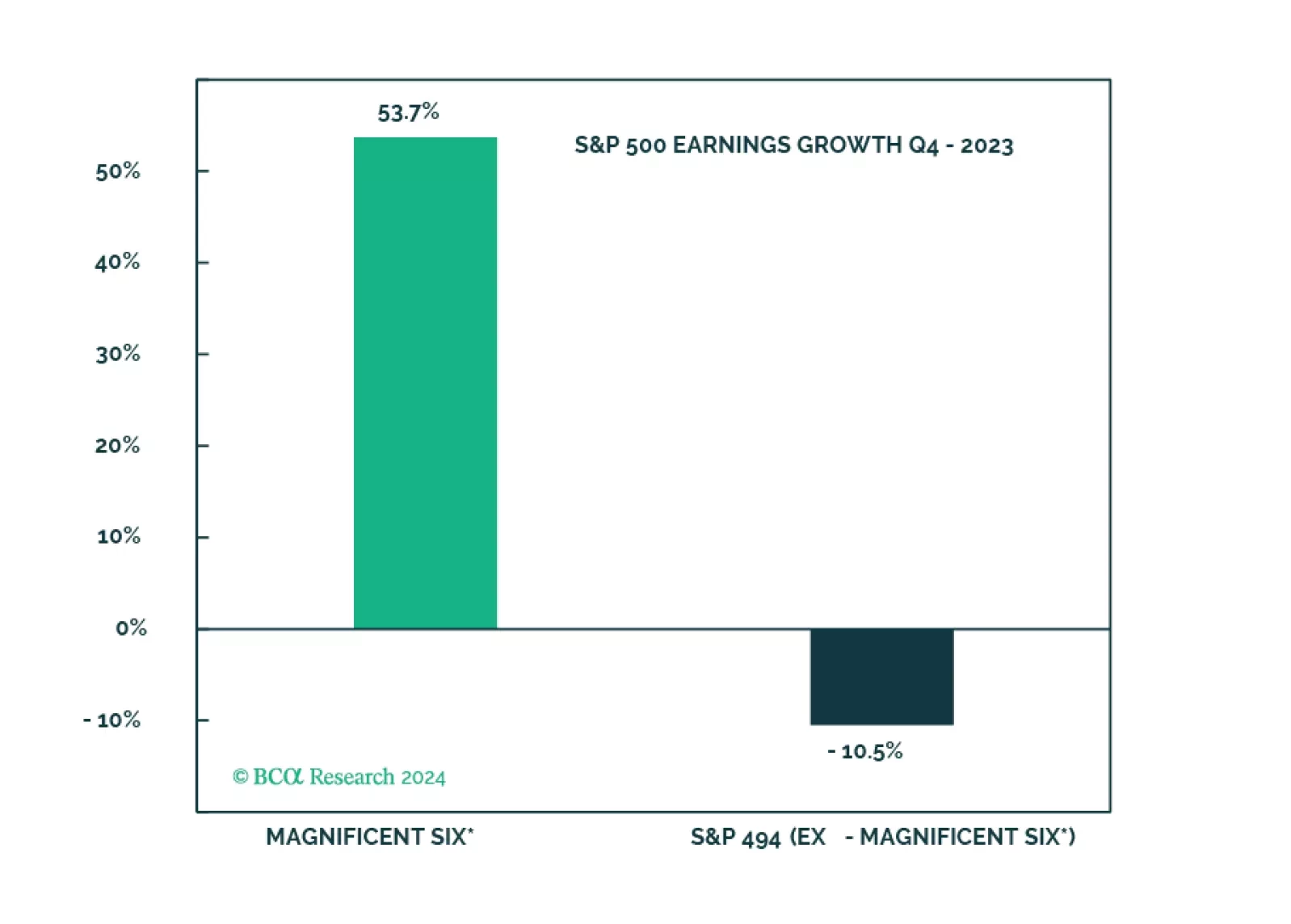

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

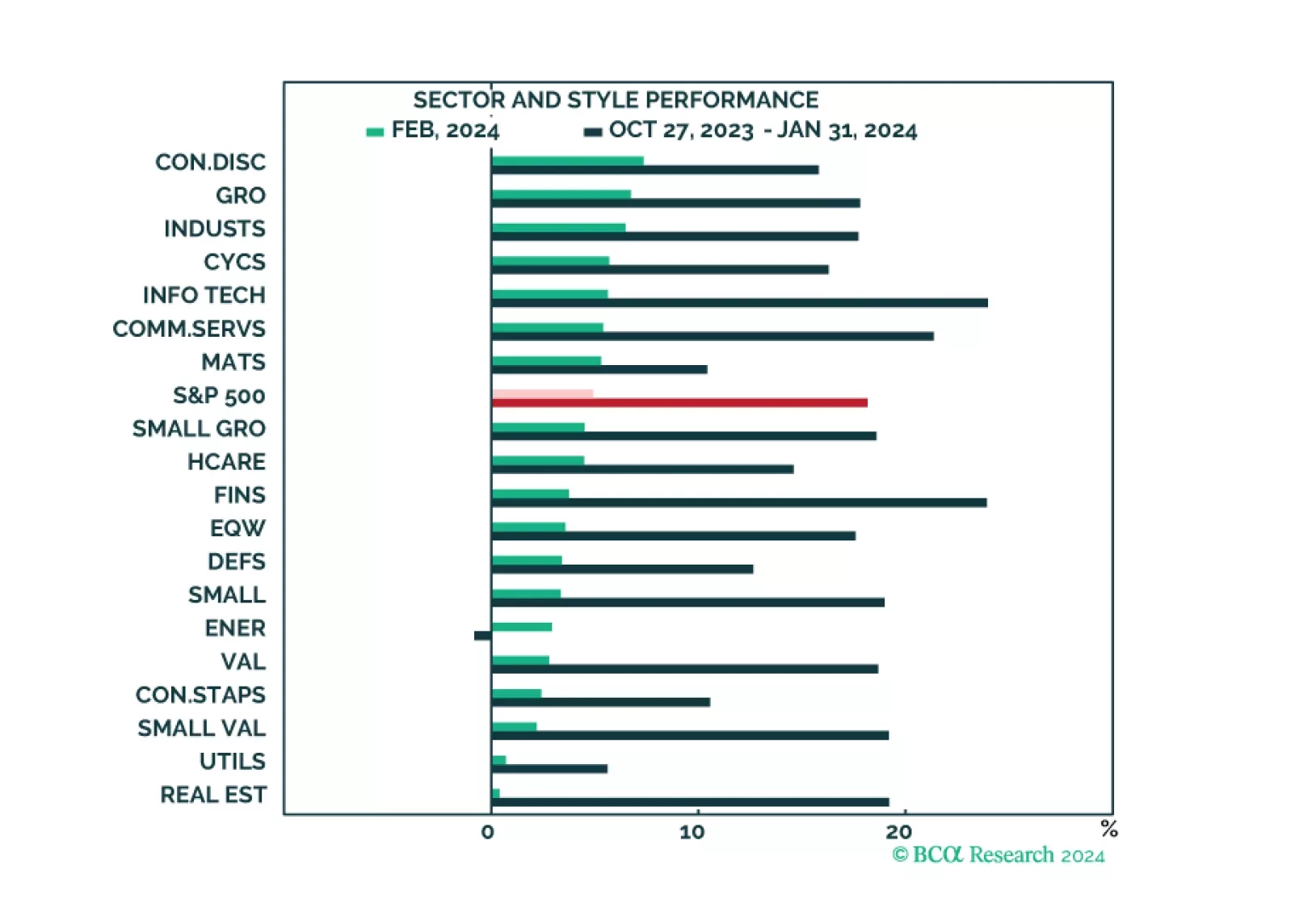

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…

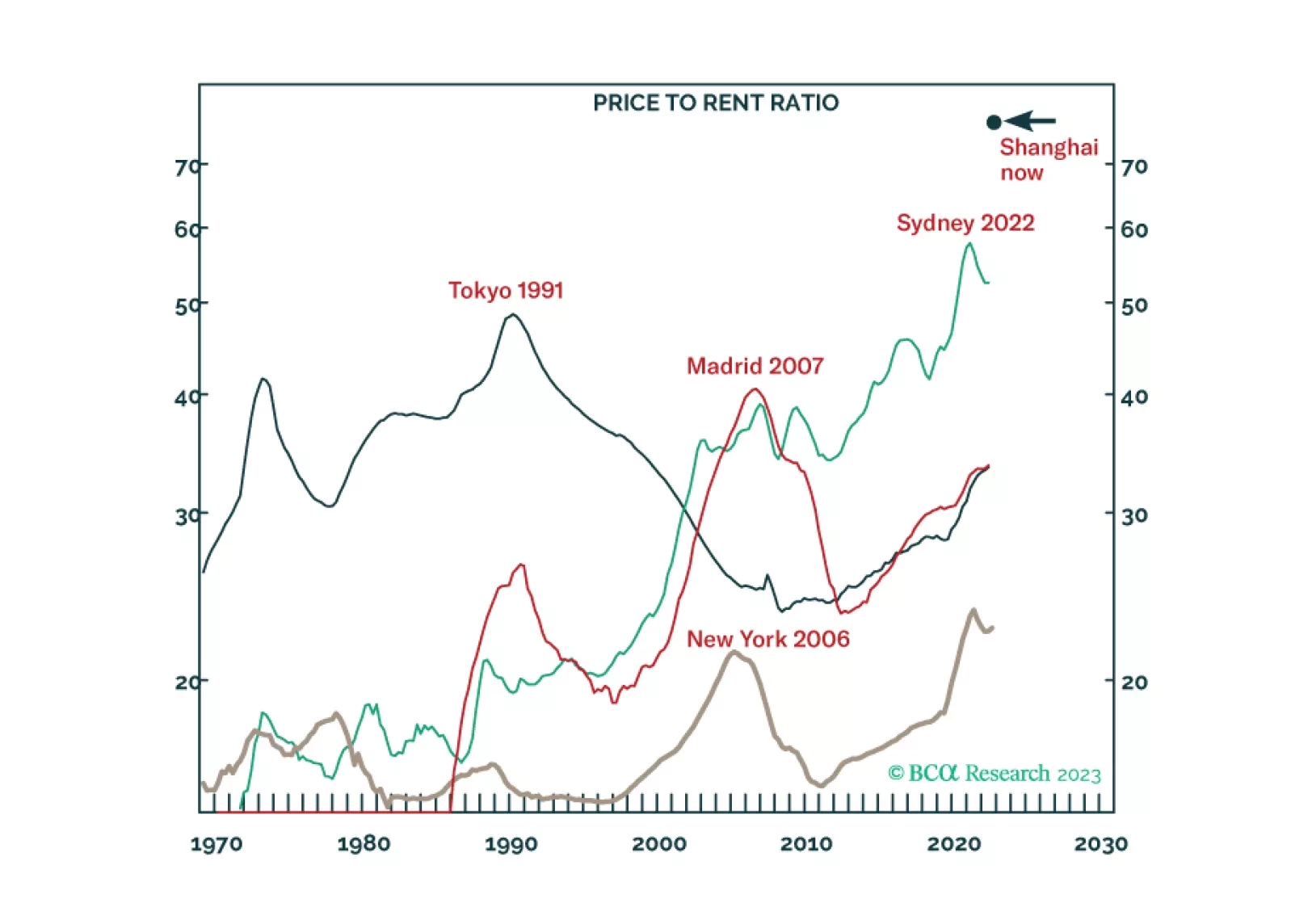

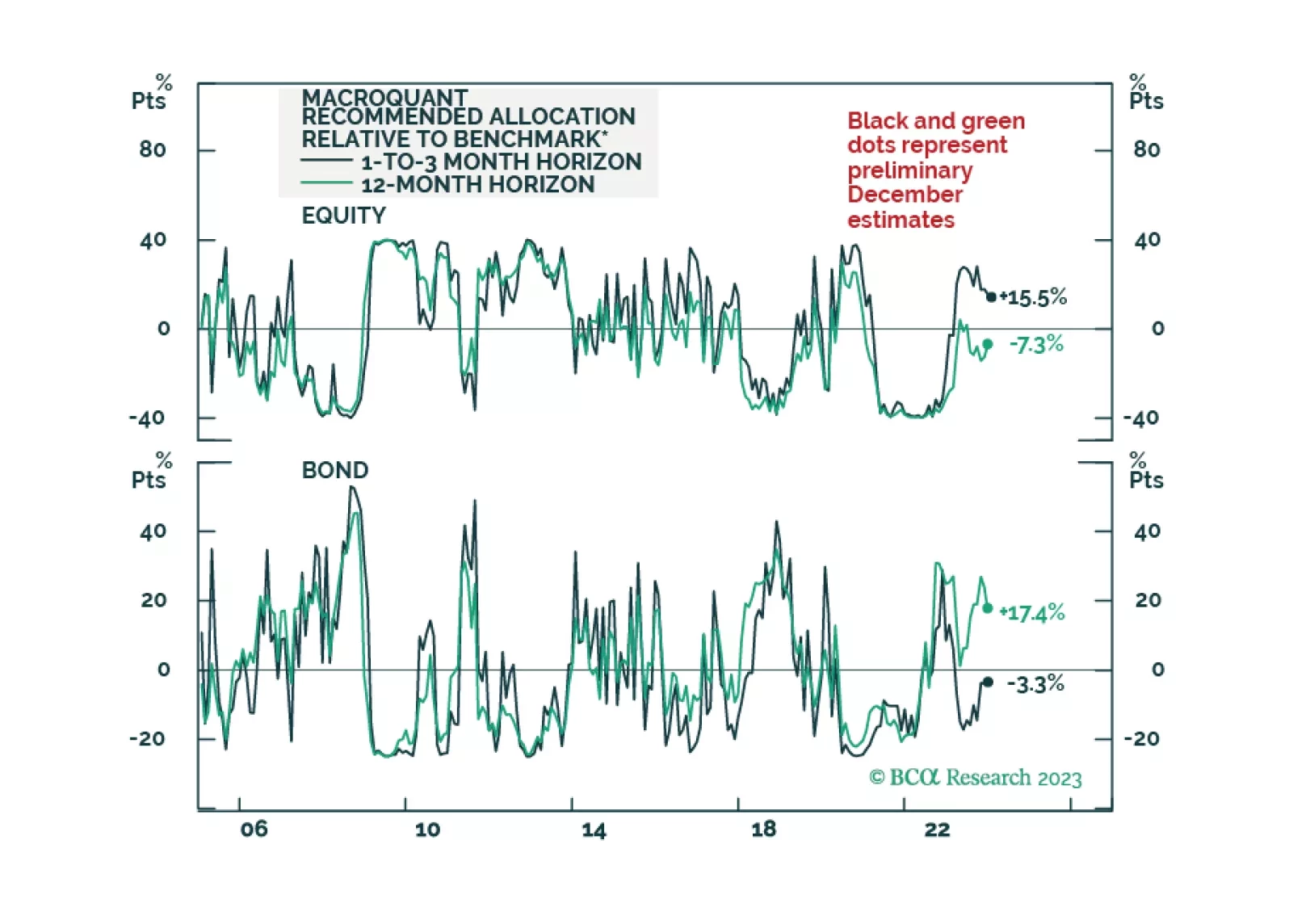

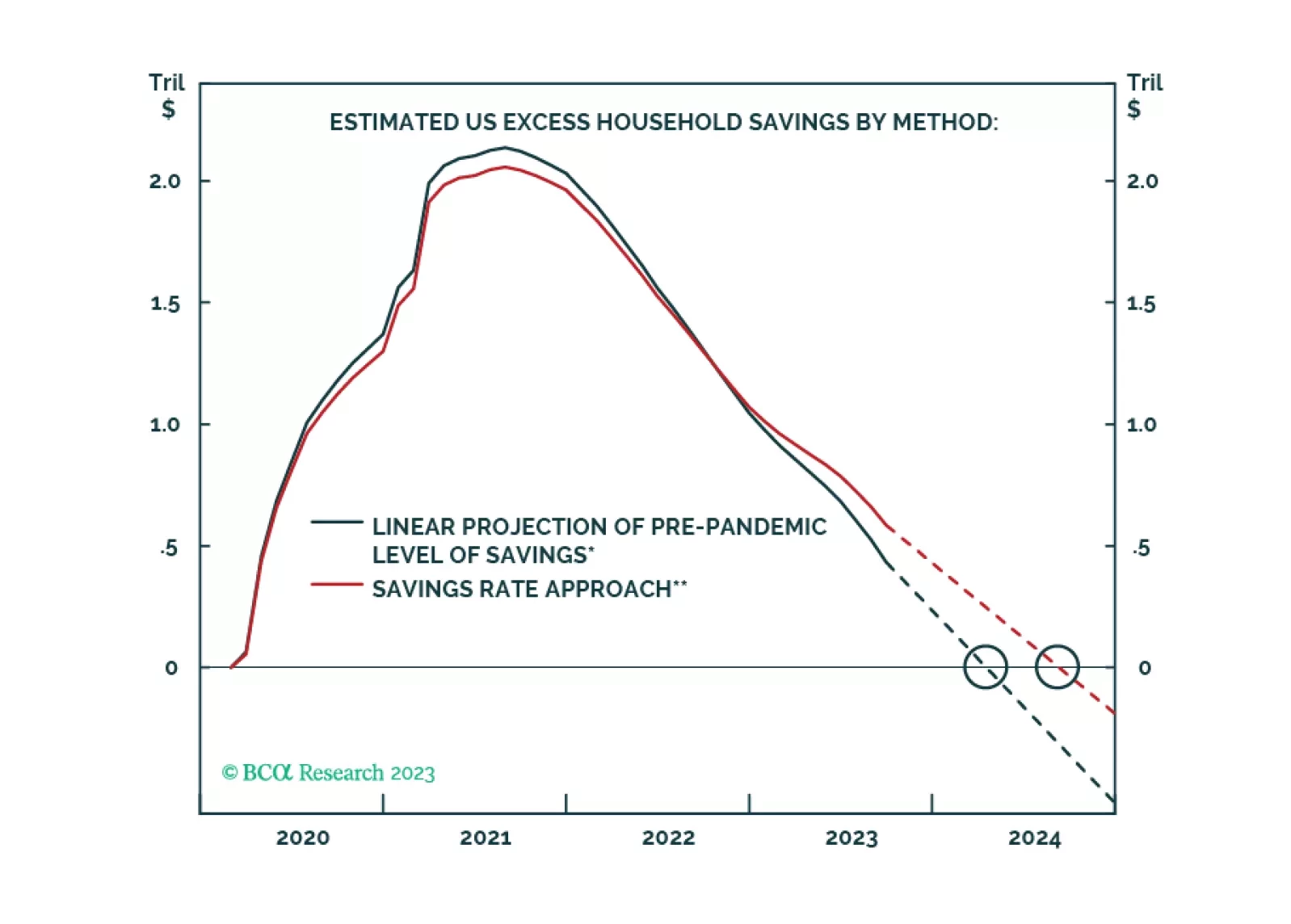

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…