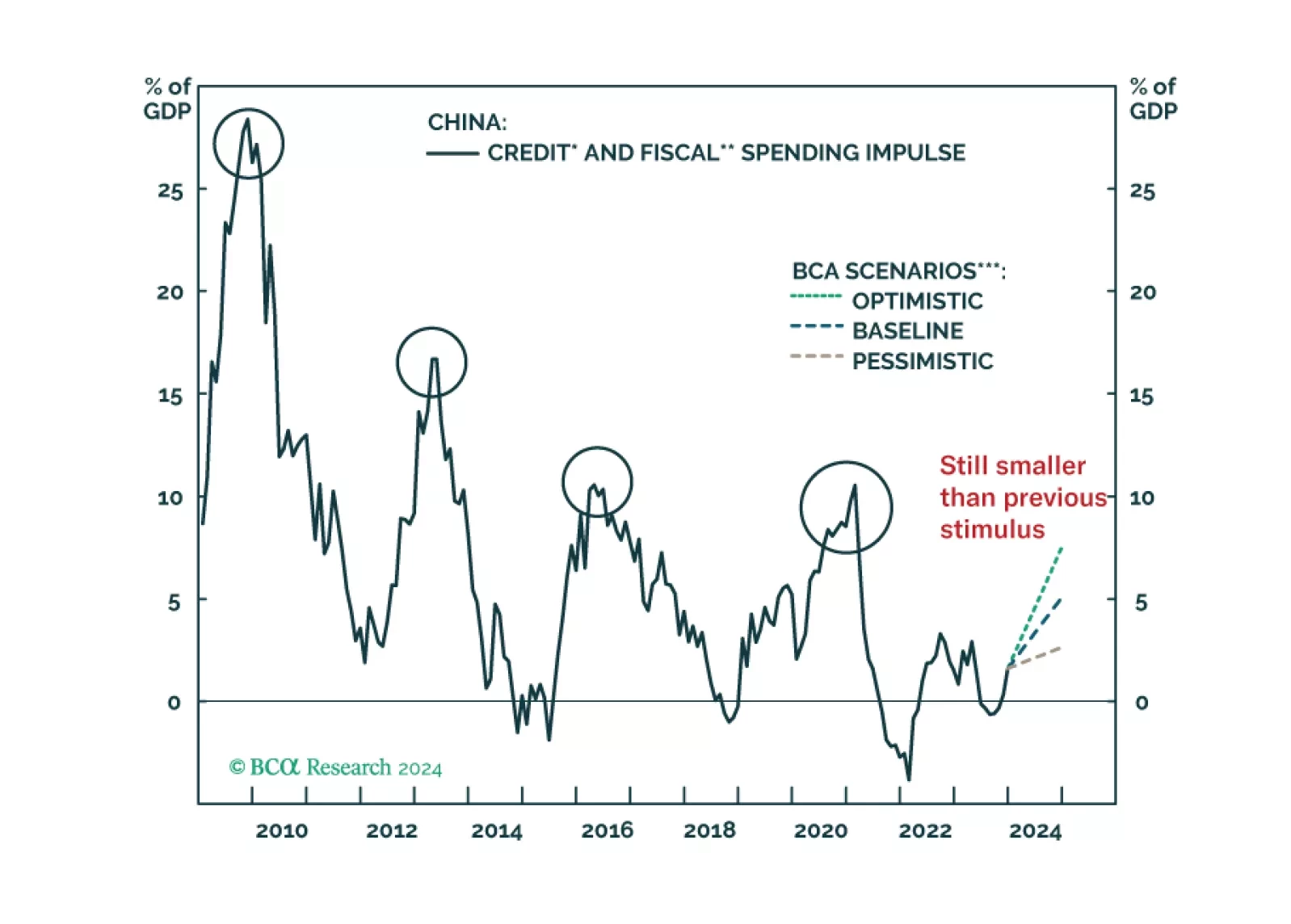

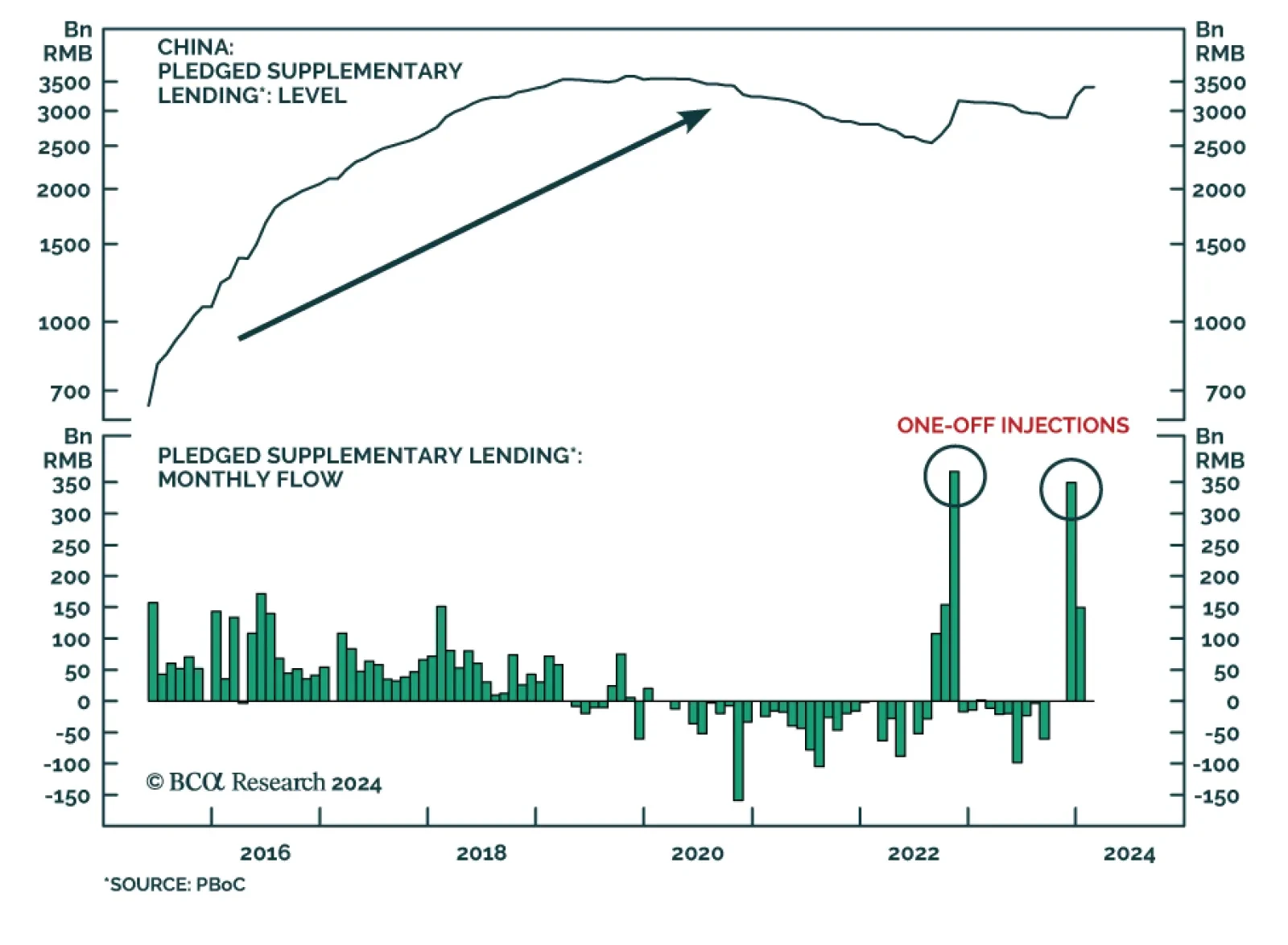

According to BCA Research’s China Investment Strategy service, a very substantial PSL financing scheme for housing, a large LG and LGFV debt swap, and considerable fiscal transfers to households—or a combination…

The stimulus measures announced at last week's NPC were not a game changer. As in 2023, we expect aggregate government spending will fall short of the budgeted amount again this year.

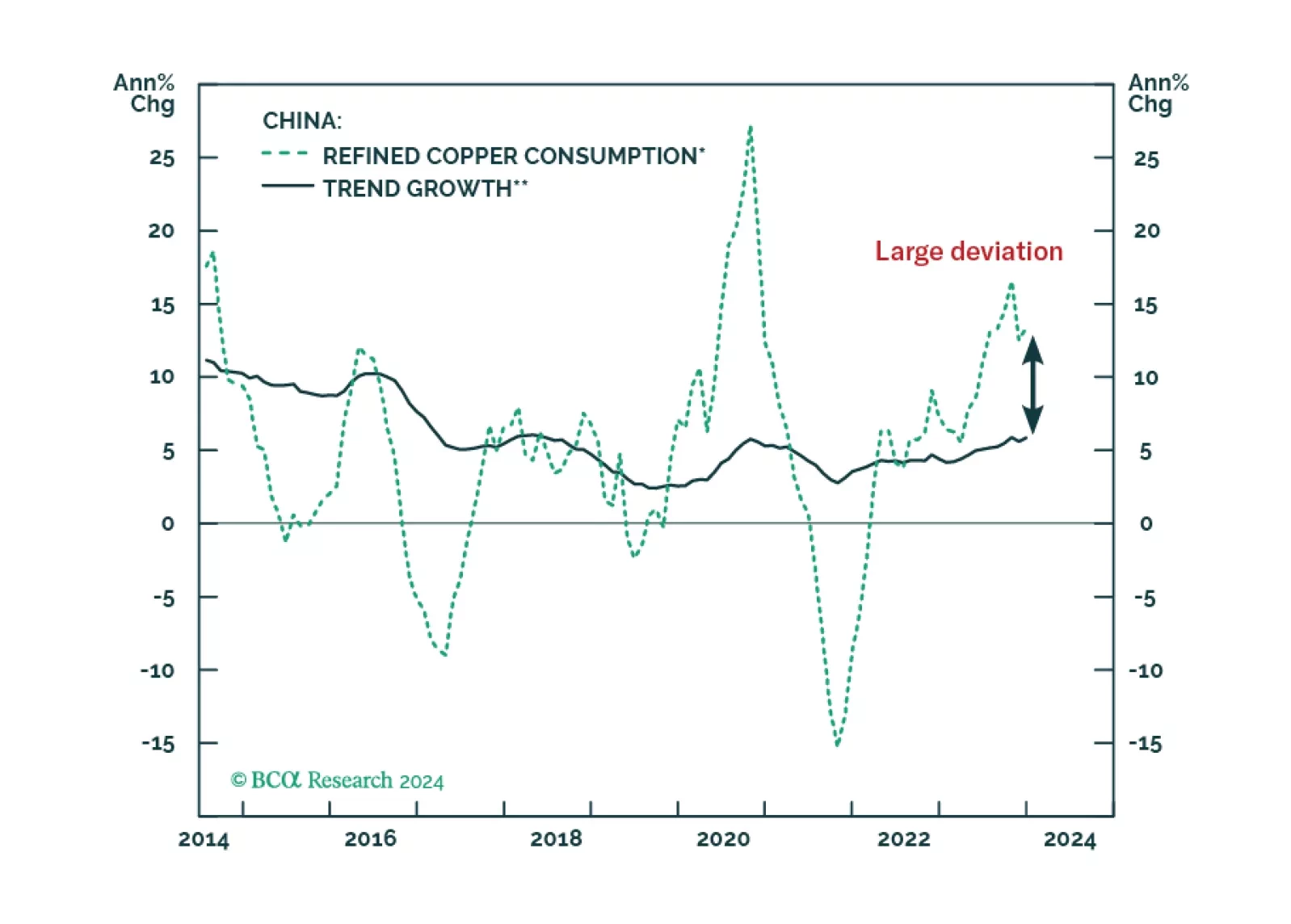

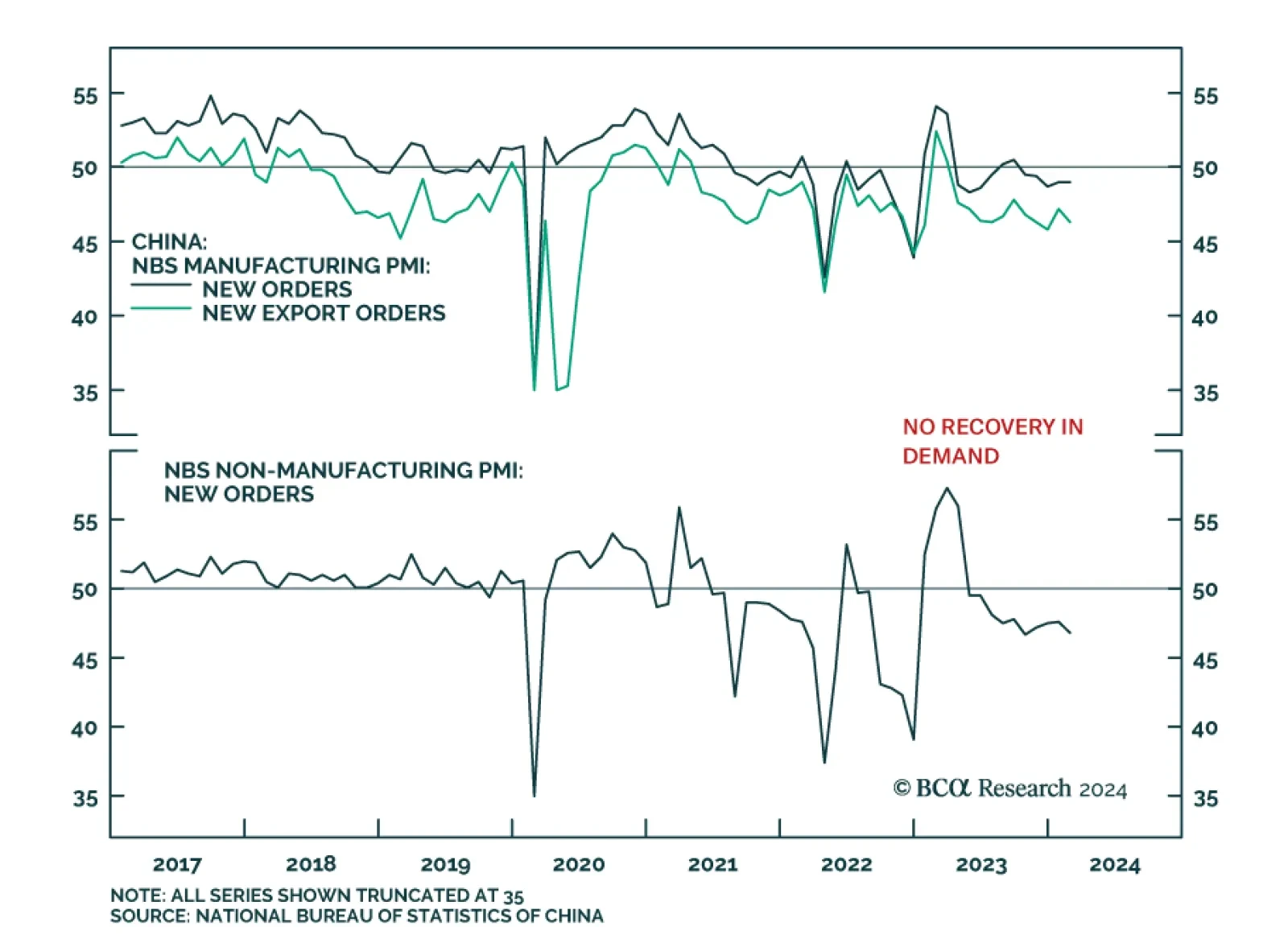

China’s NBS PMI release indicates that the Chinese growth is stabilizing at a low level. The composite PMI came in at 50.9 – unchanged from January. The stabilization was led by the non-manufacturing sector though…

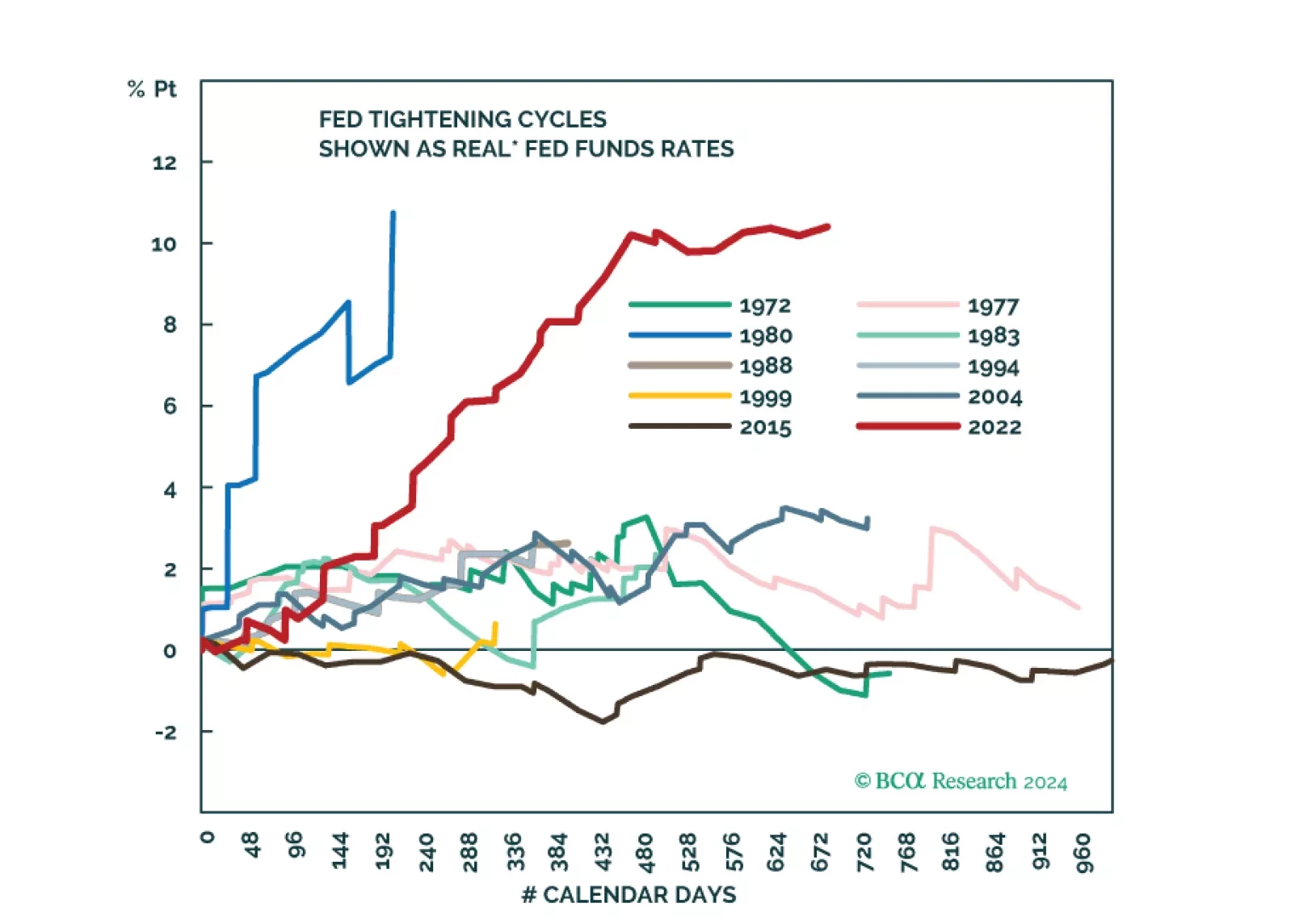

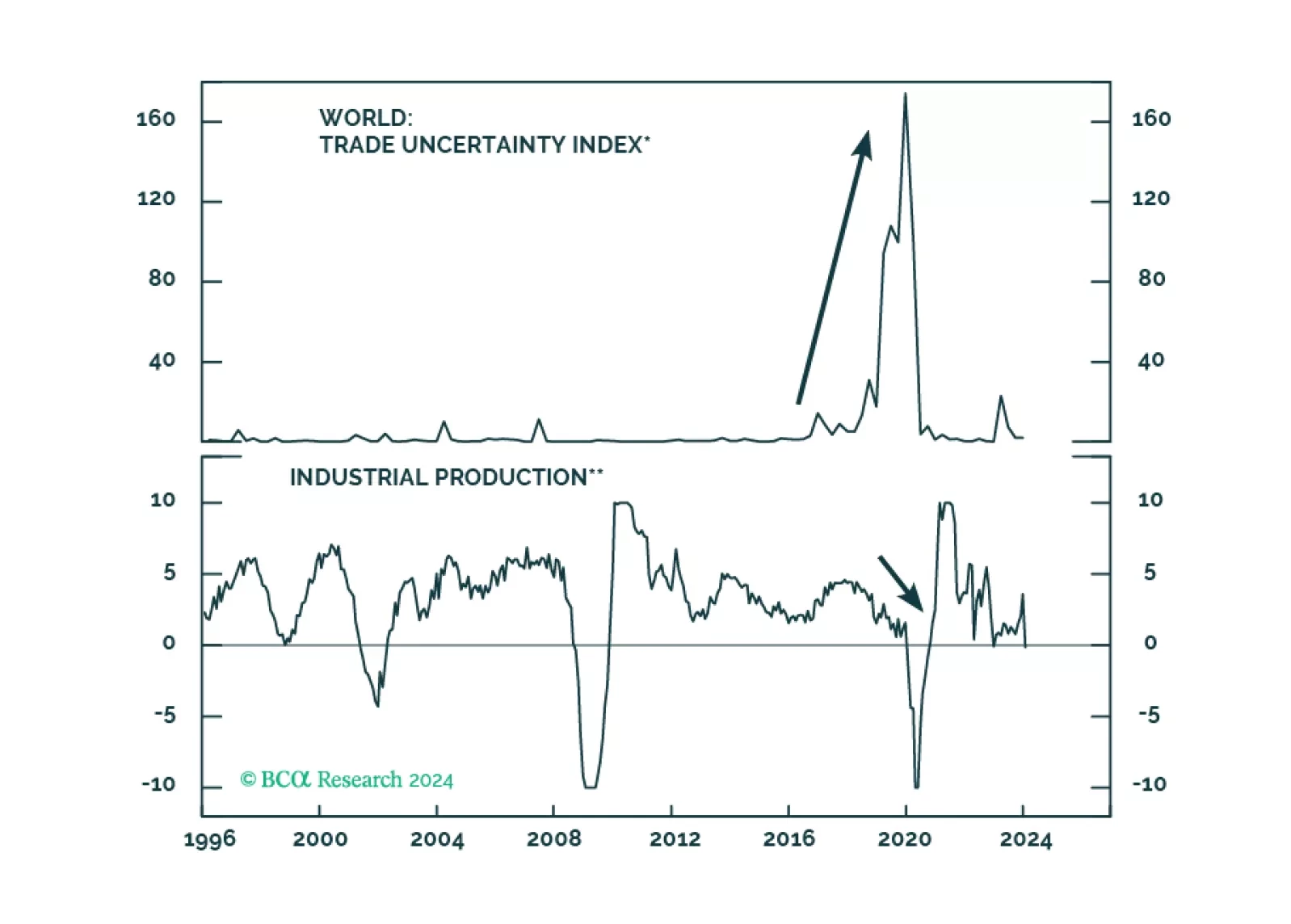

Amid patchy global growth, the US economy remains resilient. However, tight monetary policy will eventually trigger a recession in the US too. The stock market rally has been very narrow. Stay underweight risk assets.

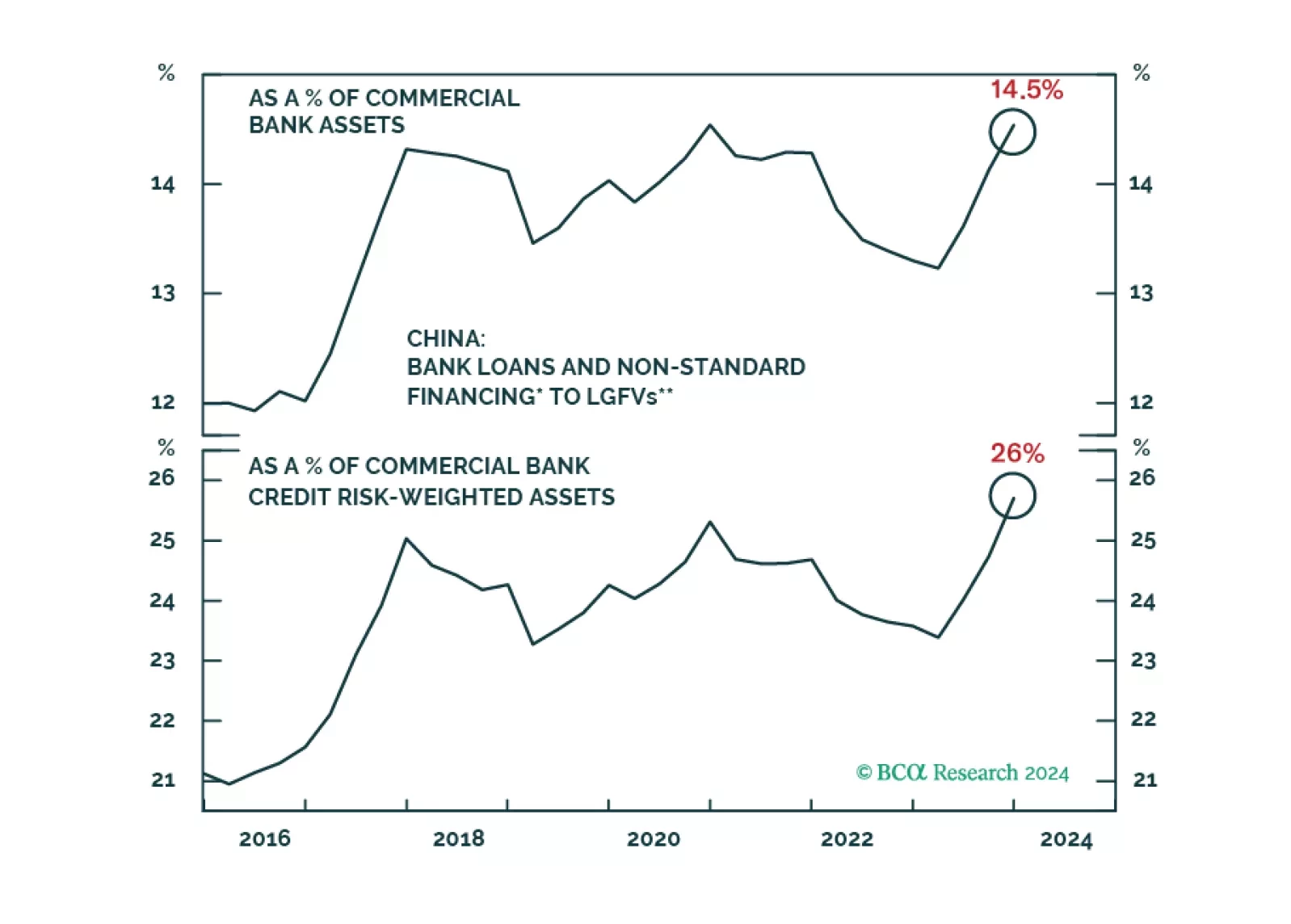

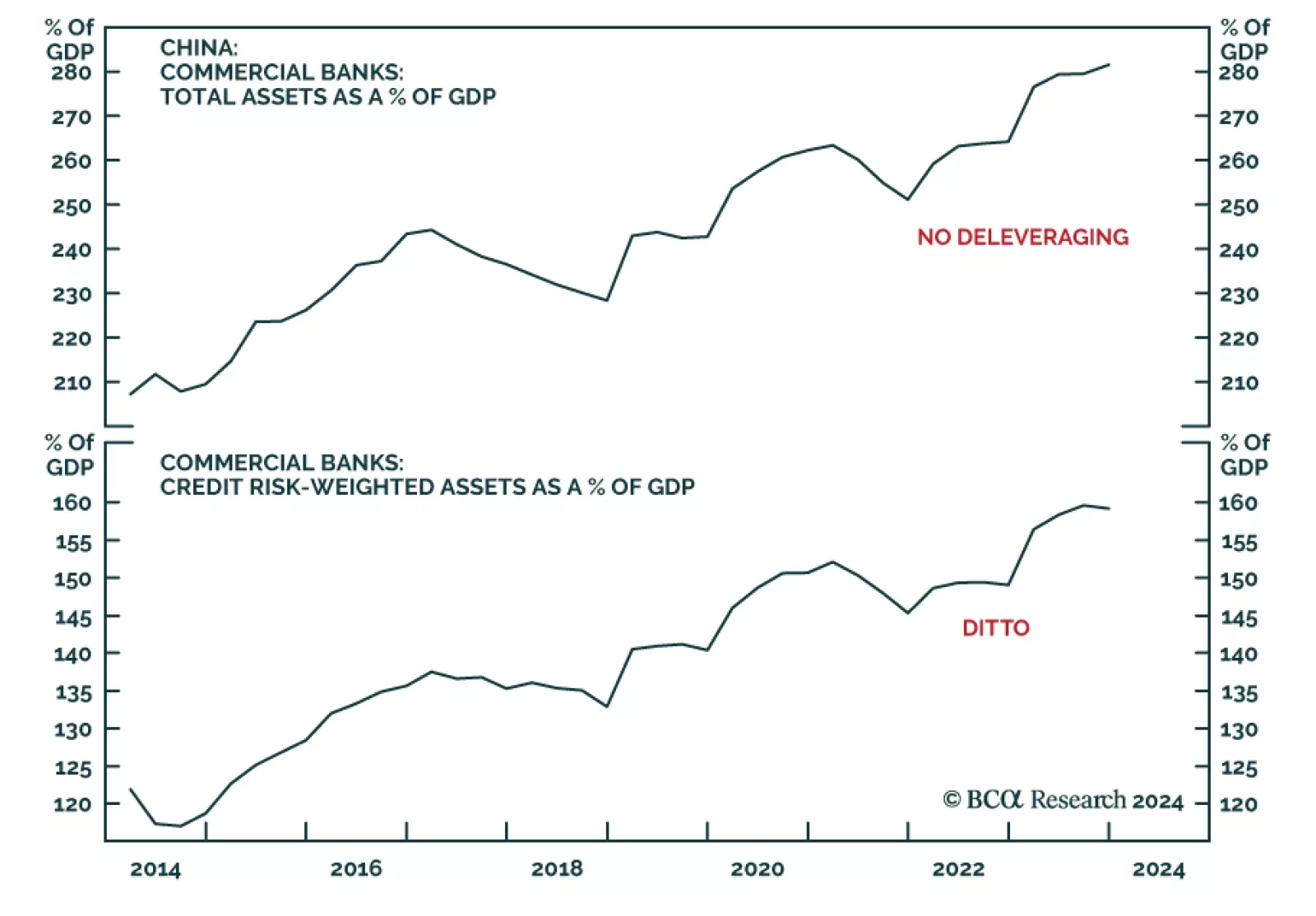

According to BCA Research’s China Investment Strategy service, the odds of a “Minsky Moment” are low for the Chinese banking sector. Chinese banks, however, will continue facing cyclical and structural headwinds…

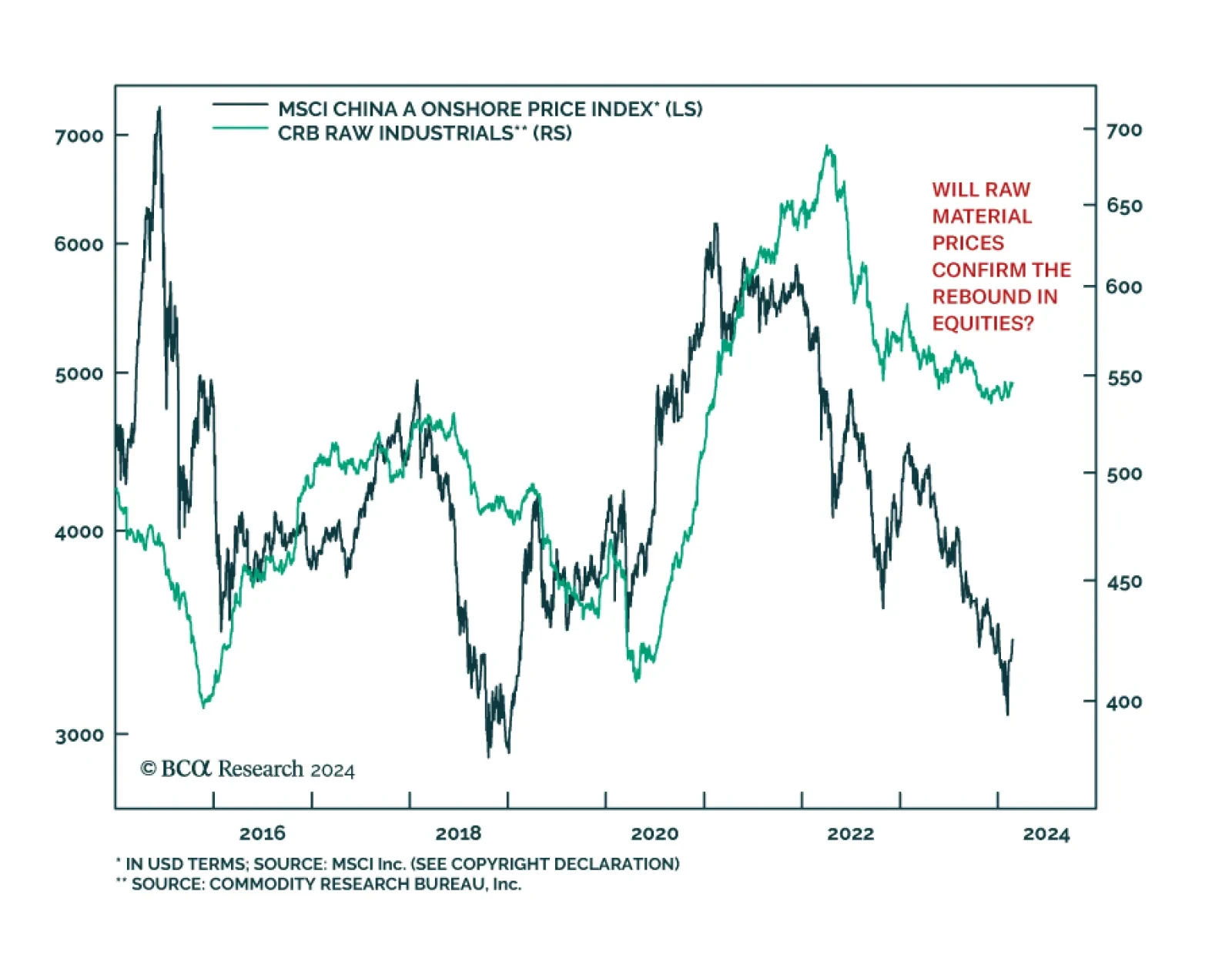

While efforts by policymakers to stabilize the stock market are buoying Chinese equities, domestic economic data remains soggy. Home prices declined further on both a monthly and annual basis in January, reinforcing the…

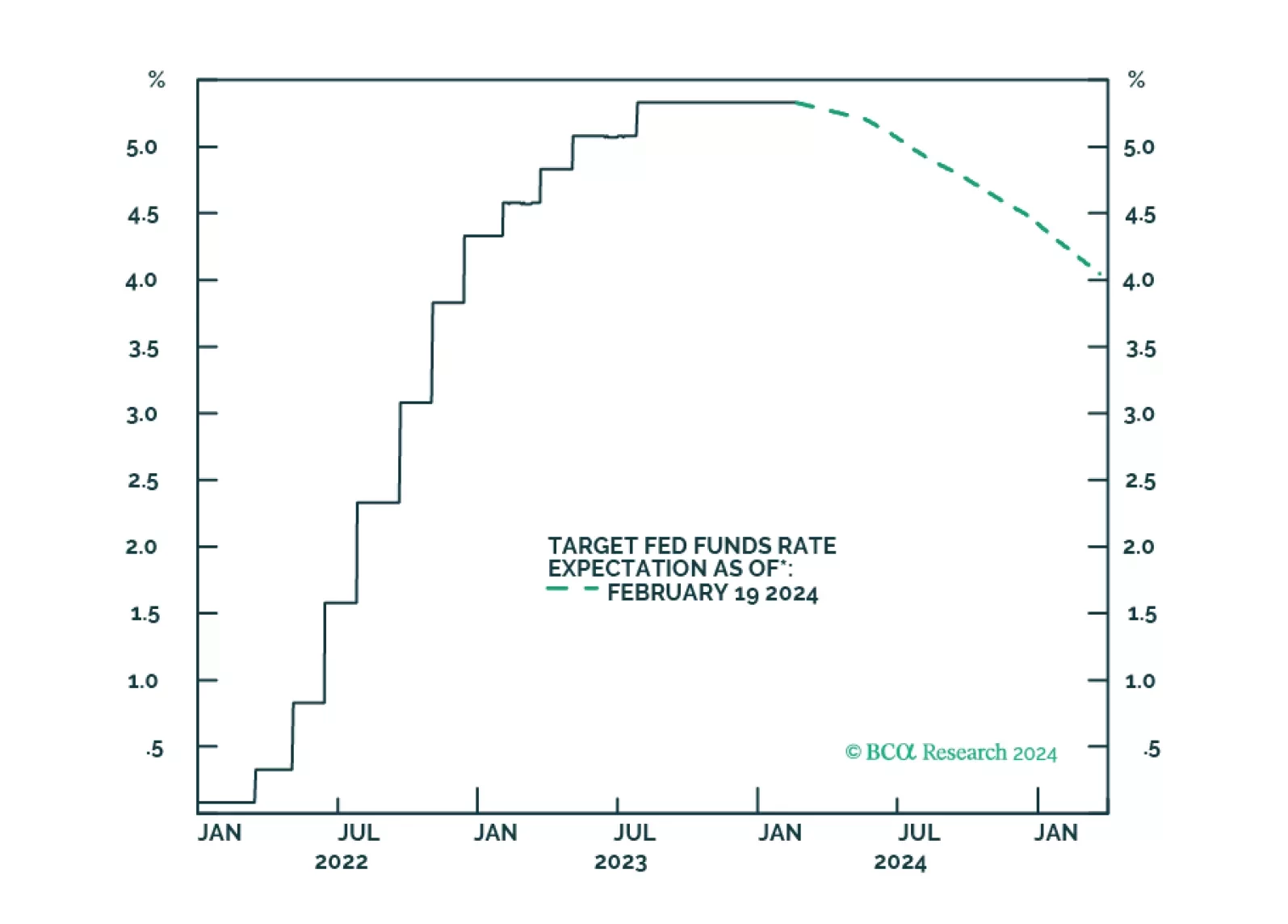

Seasonal weather and price variability in the first quarter will dissipate, which will reduce the agita caused by the recent inflation scare. This will increase the Fed’s comfort level in initiating a rate-cutting cycle in June with…