Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

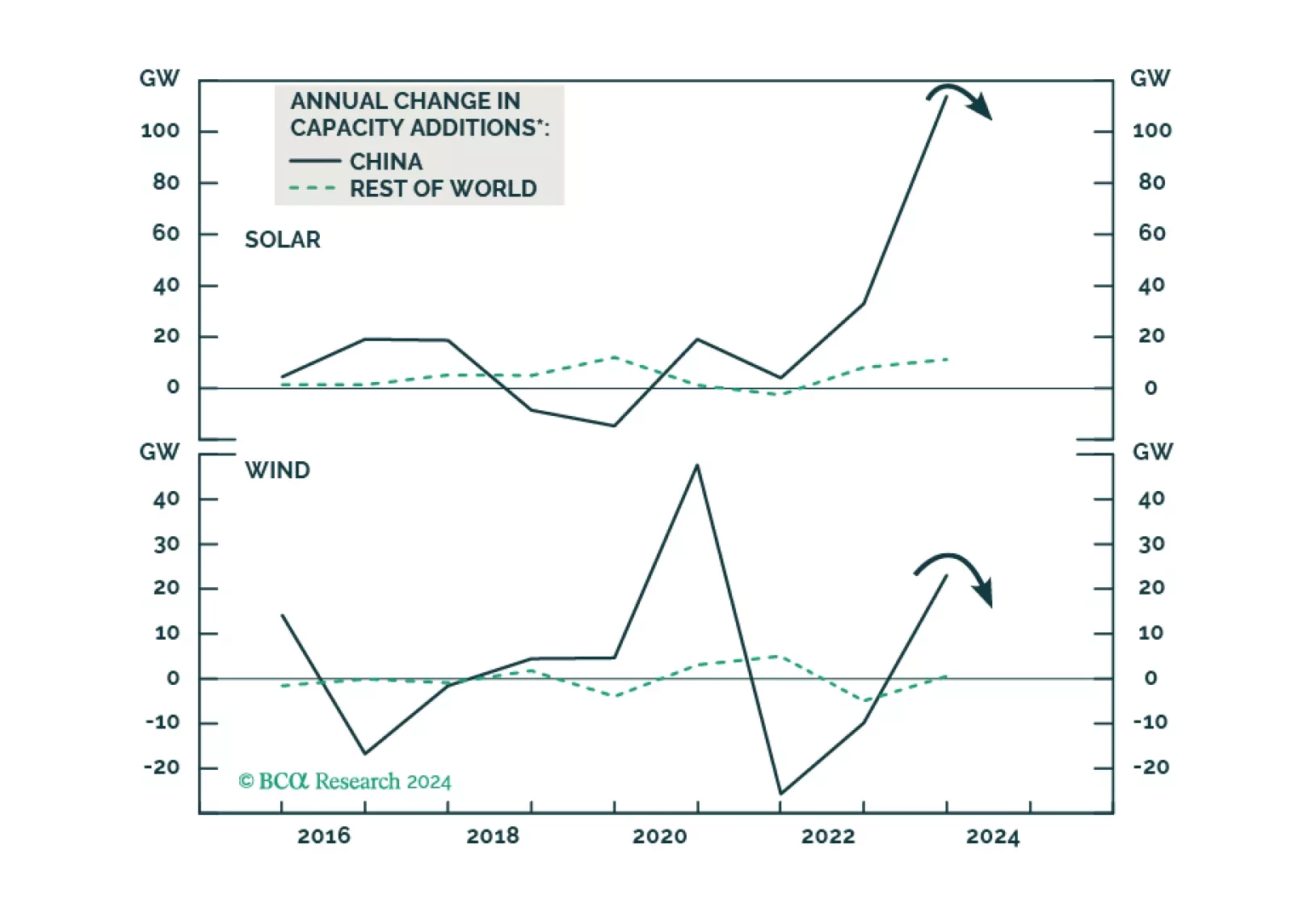

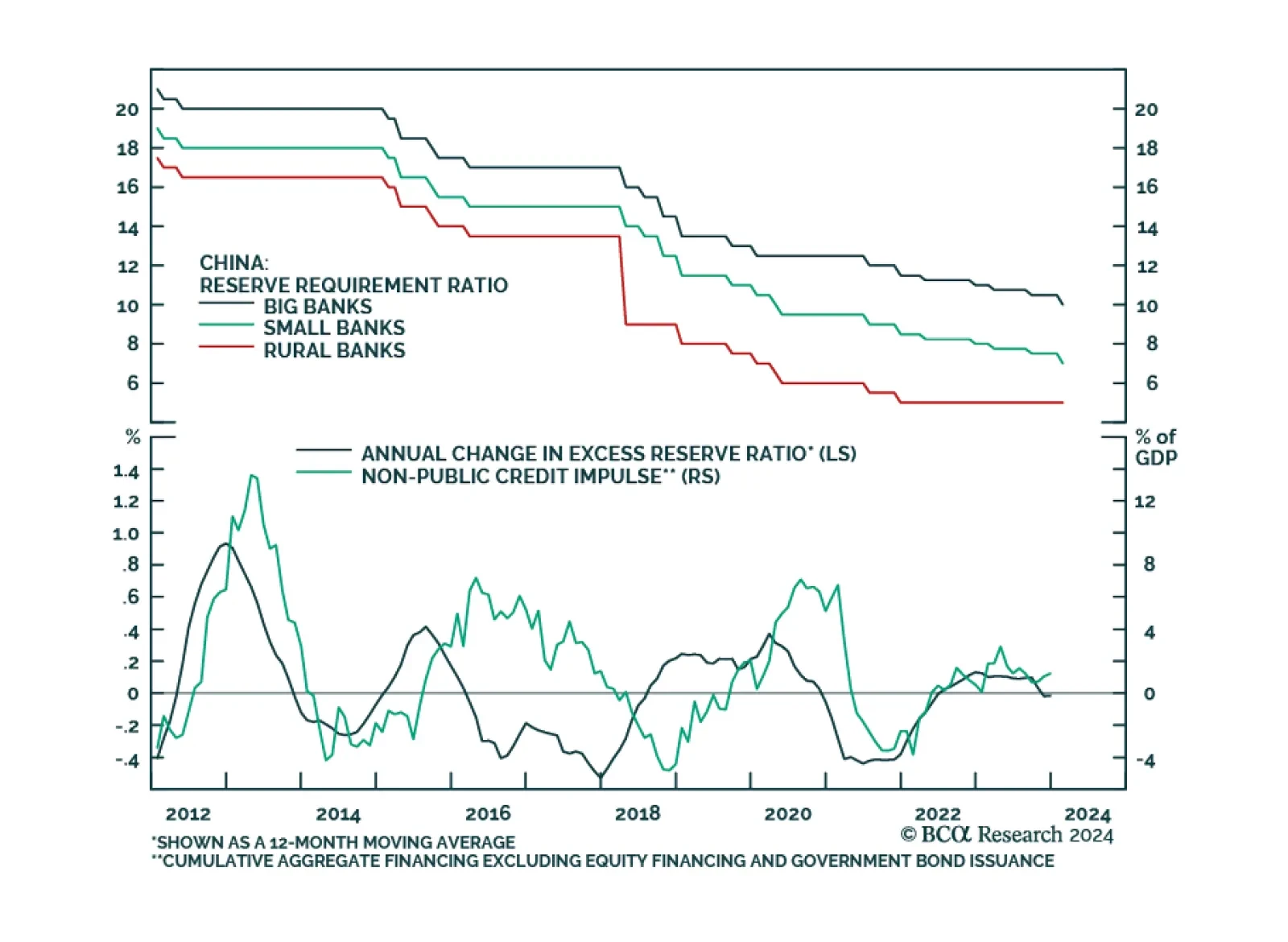

Chinese policymakers have ramped up their efforts to support the economy and financial markets over the past few days. On Wednesday, the People’s Bank of China (PBoC) announced that on February 5 it will cut the reserve…

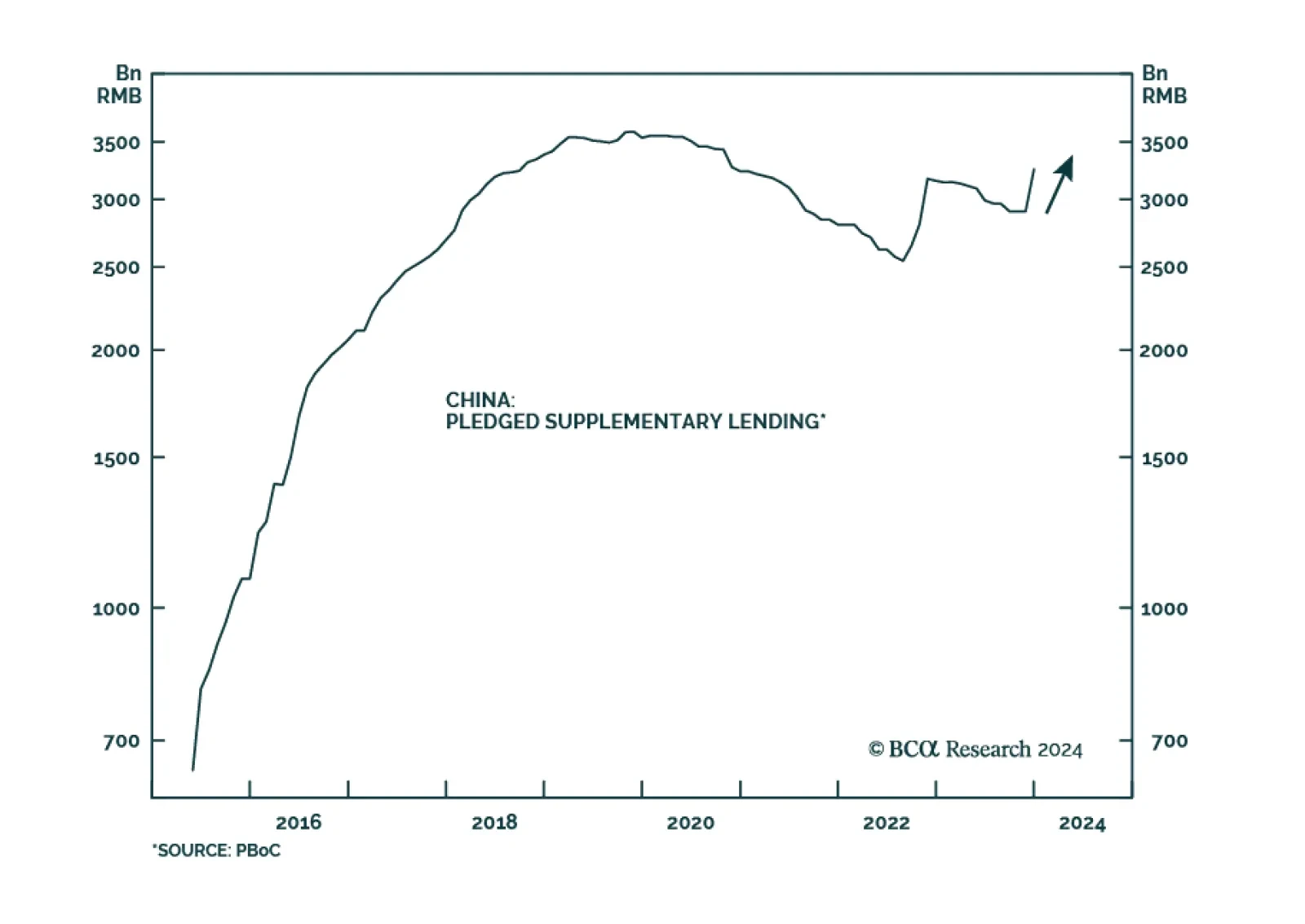

According to BCA Research’s China Investment Strategy service, the current Pledged Supplementary Lending (PSL) program will provide much less support to the housing market and construction activity than the 2015-2018…

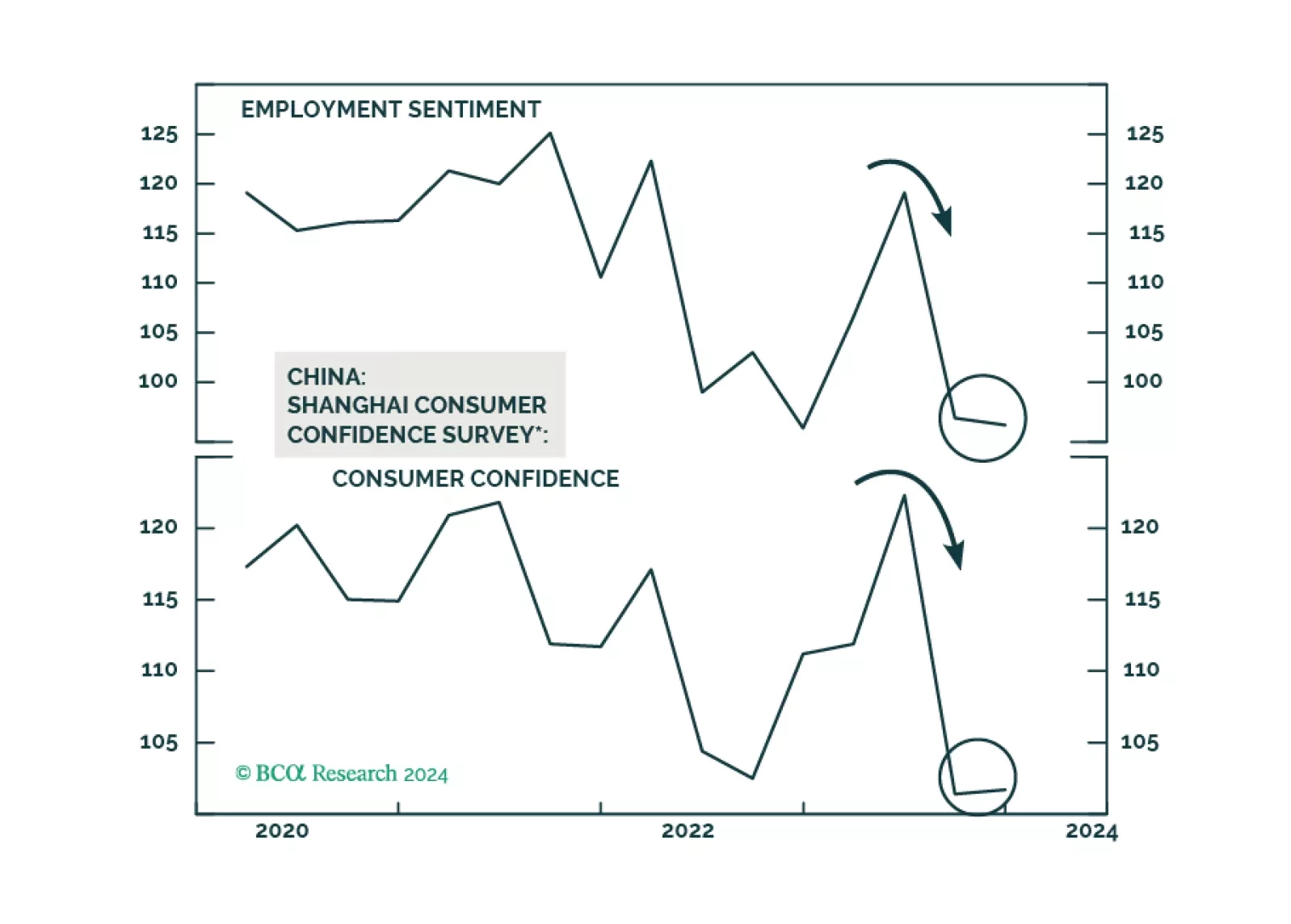

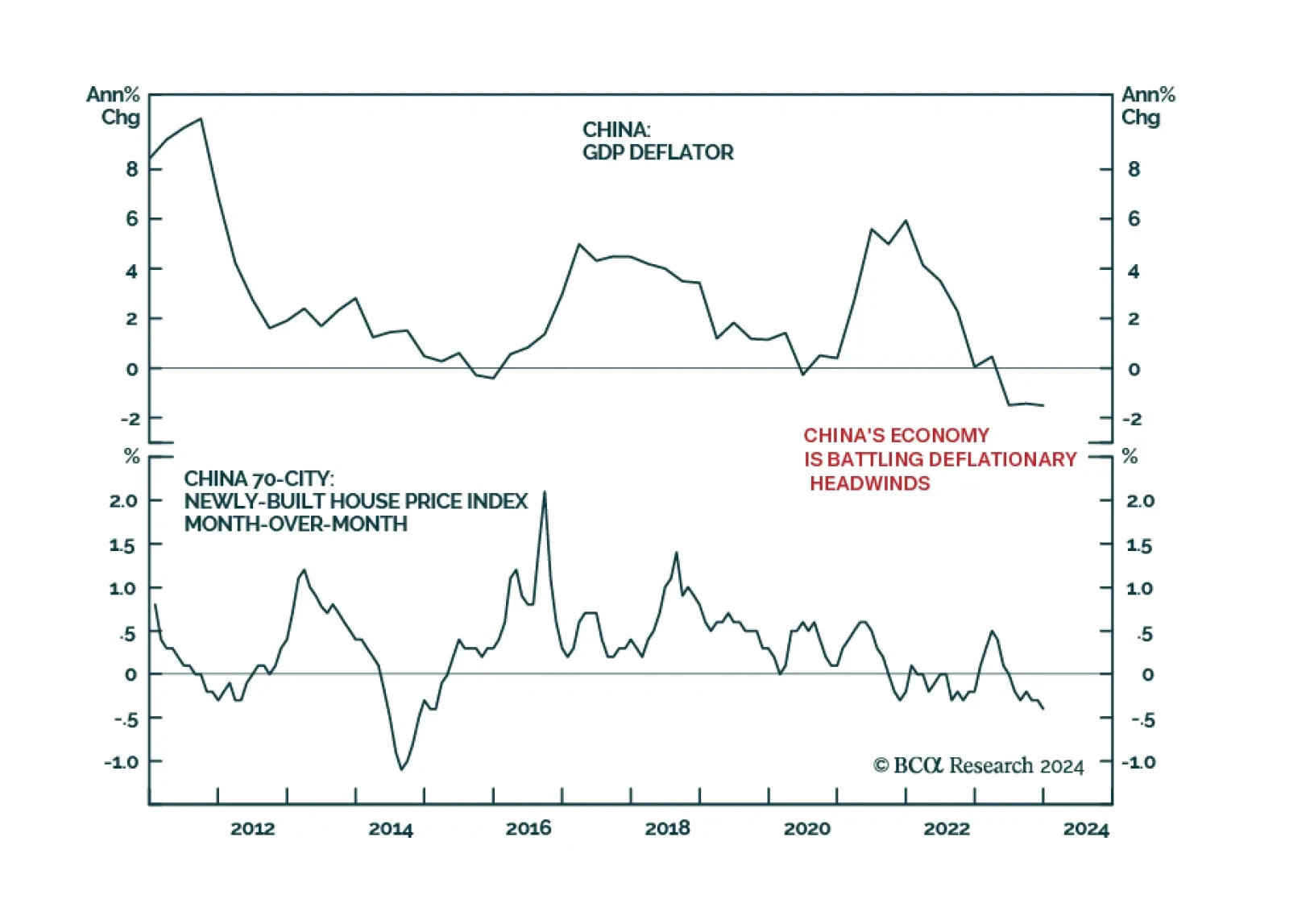

There is no easy way for China to forestall deflation. Provided policymakers are still reluctant to unleash large-size stimulus, more economic disappointments are likely in the coming months, and Chinese stocks will continue to sell…

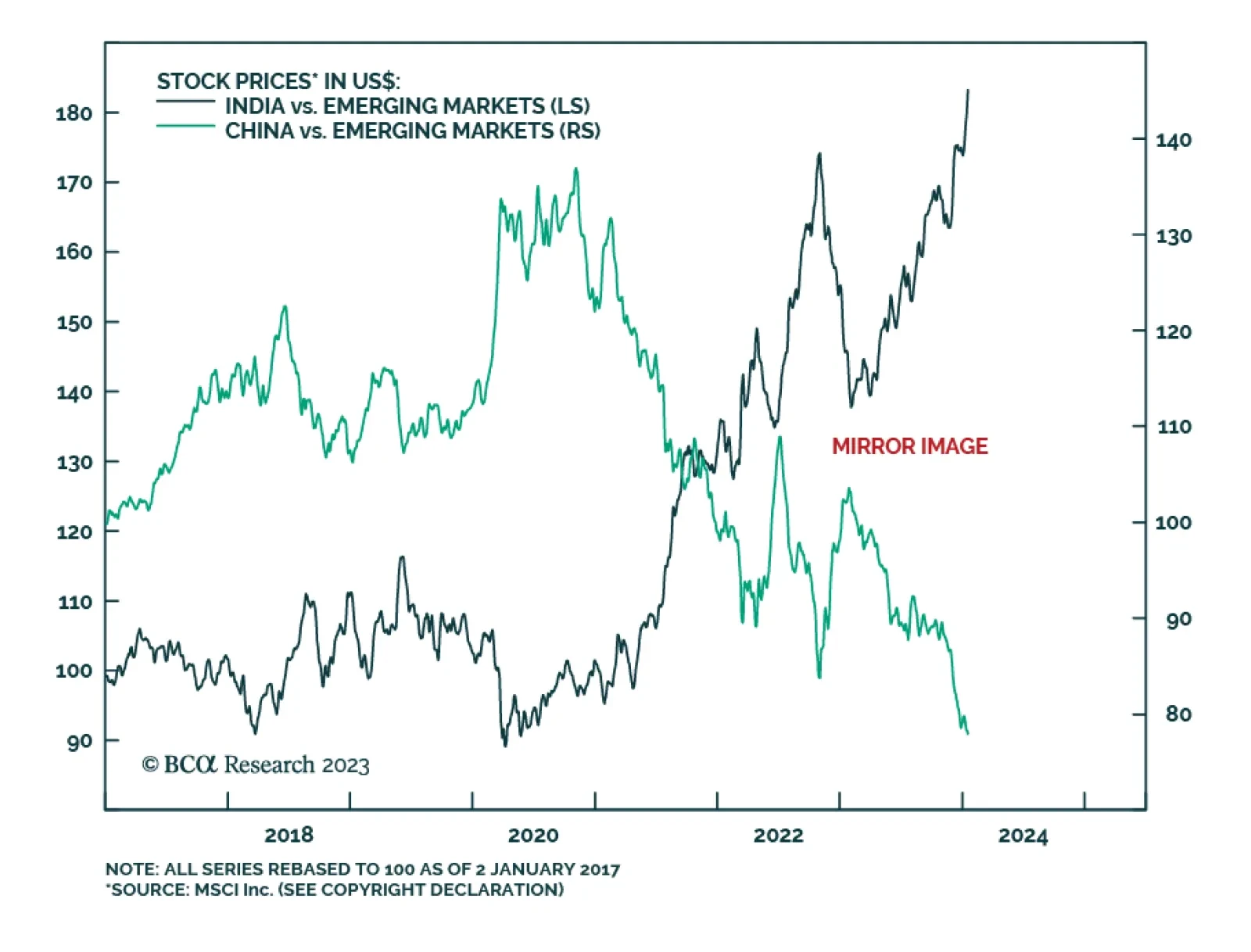

According to BCA Research’s Emerging Markets Strategy service, Indian stocks, which benefitted immensely from foreign portfolio inflows and are now very expensive, remain vulnerable to any global risk-off sentiment. The…

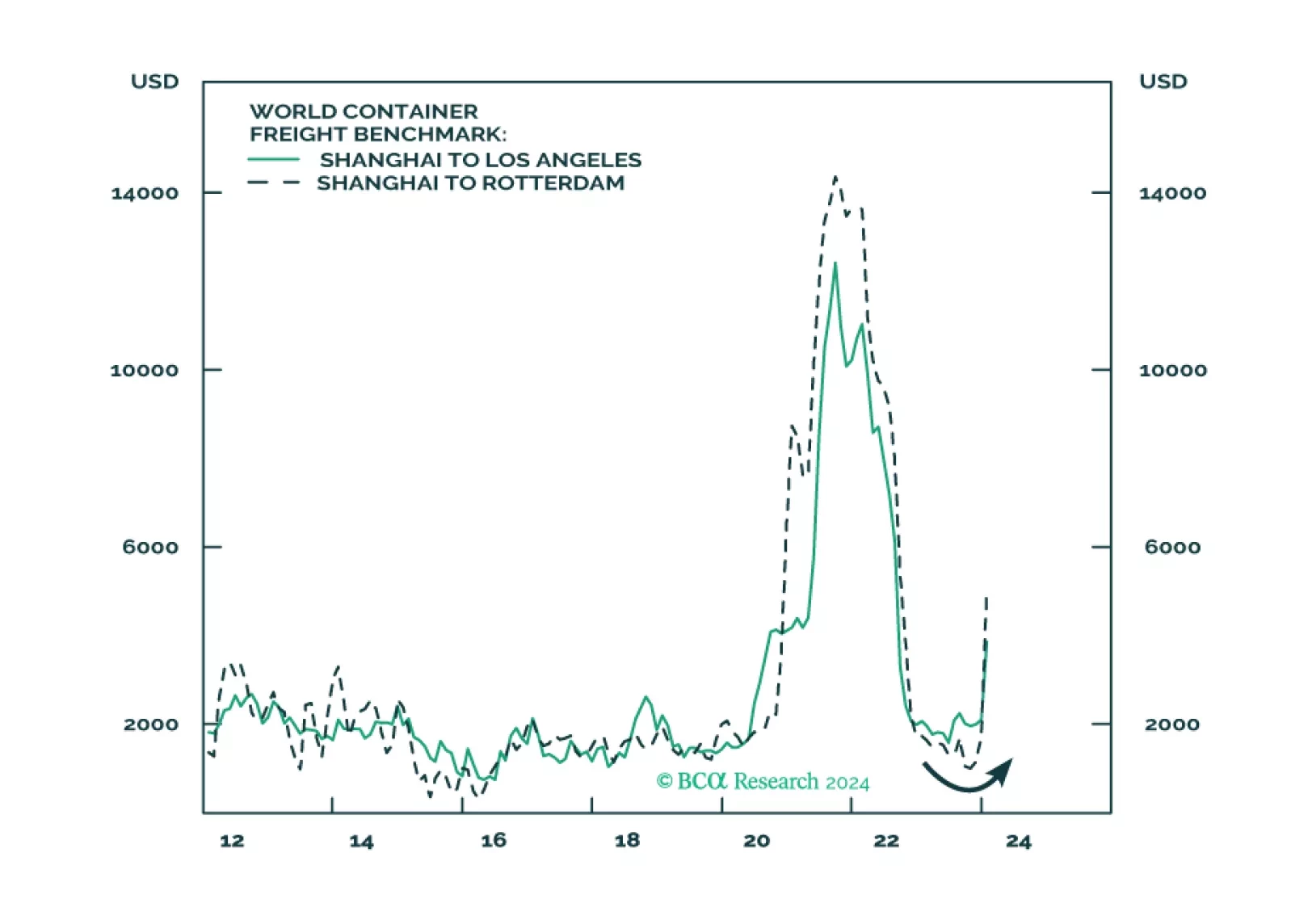

Chinese data continues to send a pessimistic signal for domestic risk assets and China plays. Although at 5.2% in Q4, GDP growth stands above the official target, it underwhelmed anticipations of 5.3%. Moreover, other data…

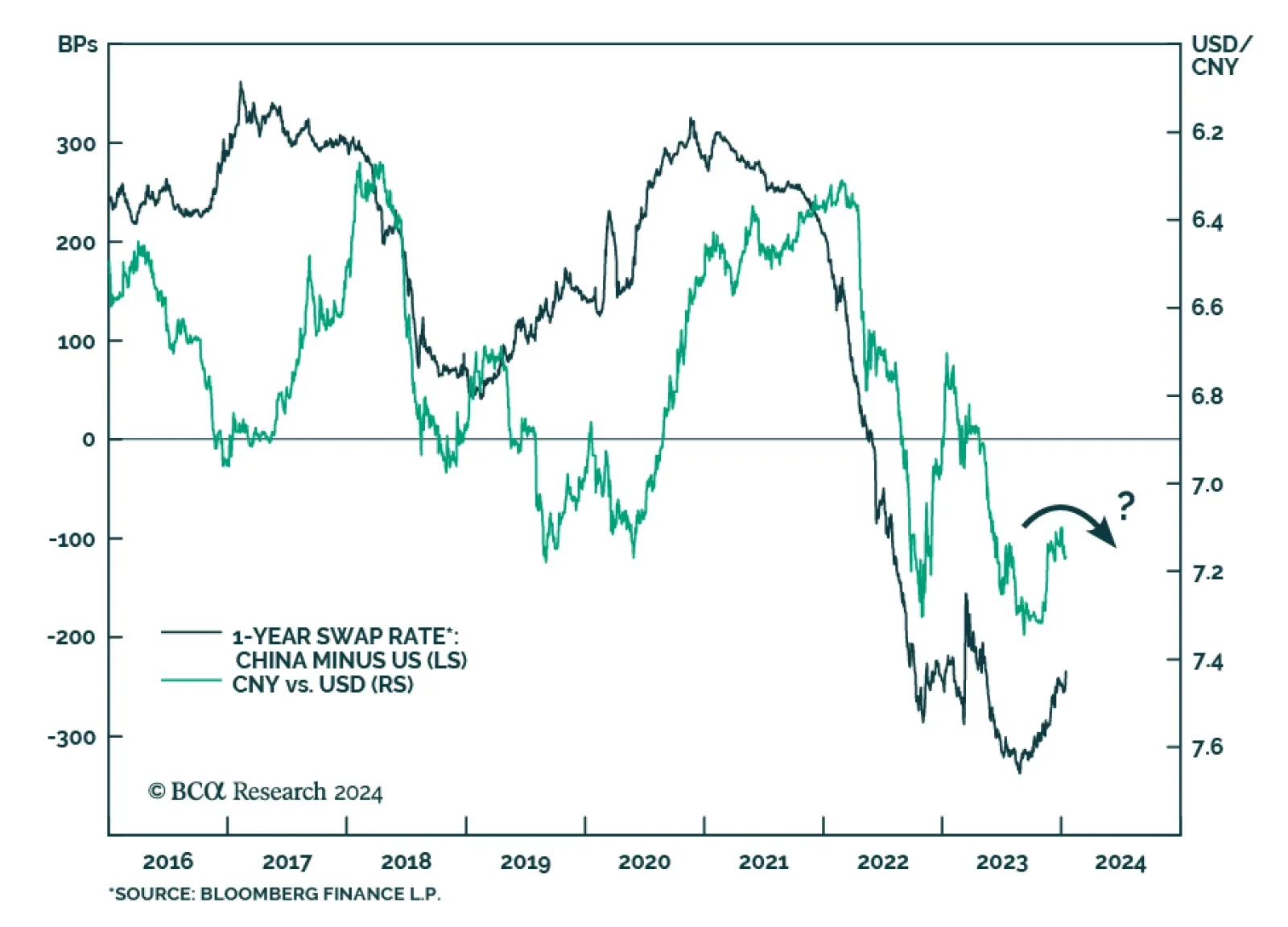

China’s central bank unexpectedly held the medium-term policy rate unchanged at 2.5% on Monday, surprising expectations of a 10 basis point cut. Given that deflationary forces dominate China’s economy, the decision to…

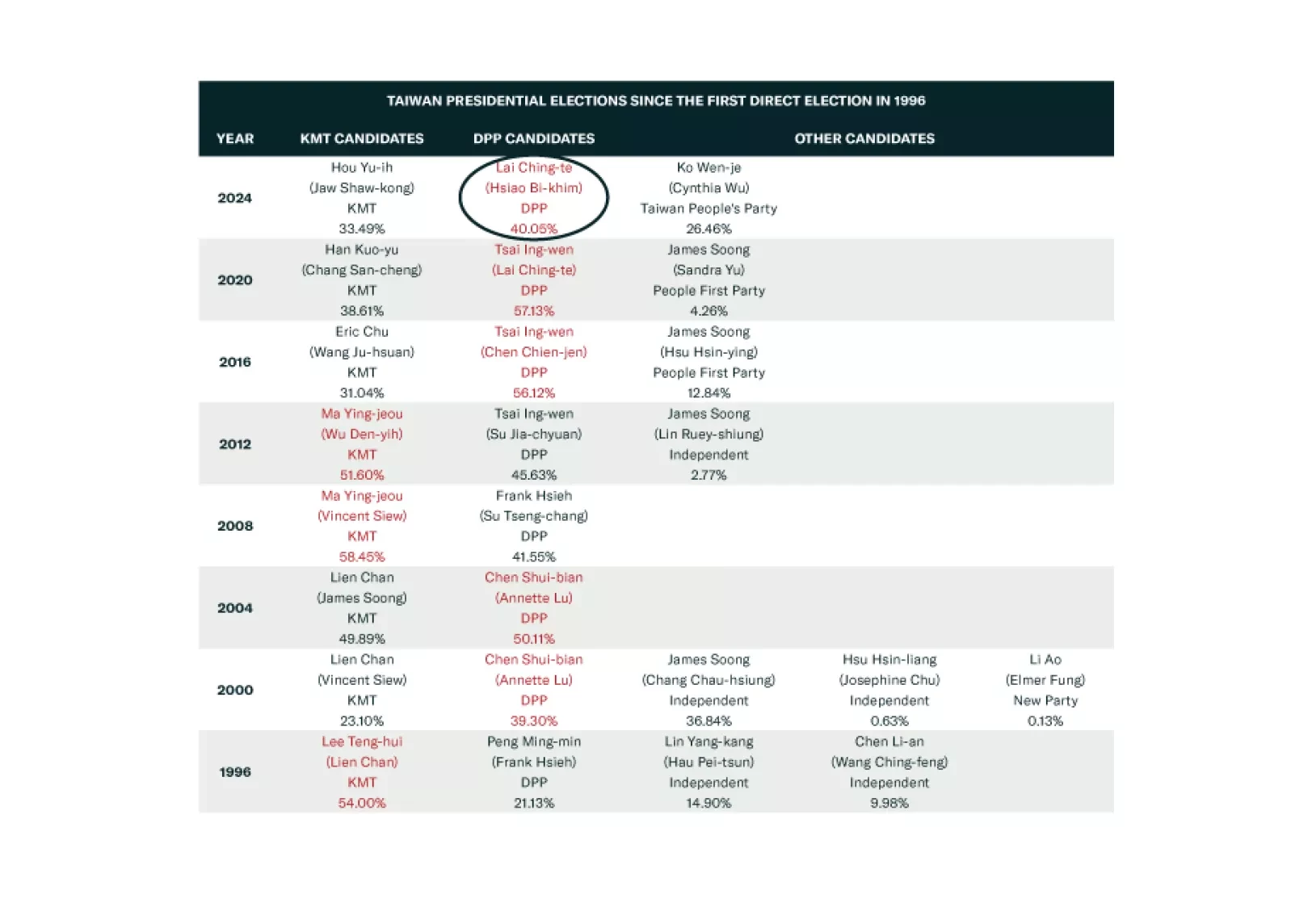

China will increase economic and military pressure on Taiwan but there is no basis for immediate full-scale war. That is the takeaway from the Taiwanese election on January 13, which returned the nominally pro-independence…

Taiwan’s election will lead to serious Chinese military and economic pressure but not full-scale war. War is a long-term concern. Investors should short TWD-USD.