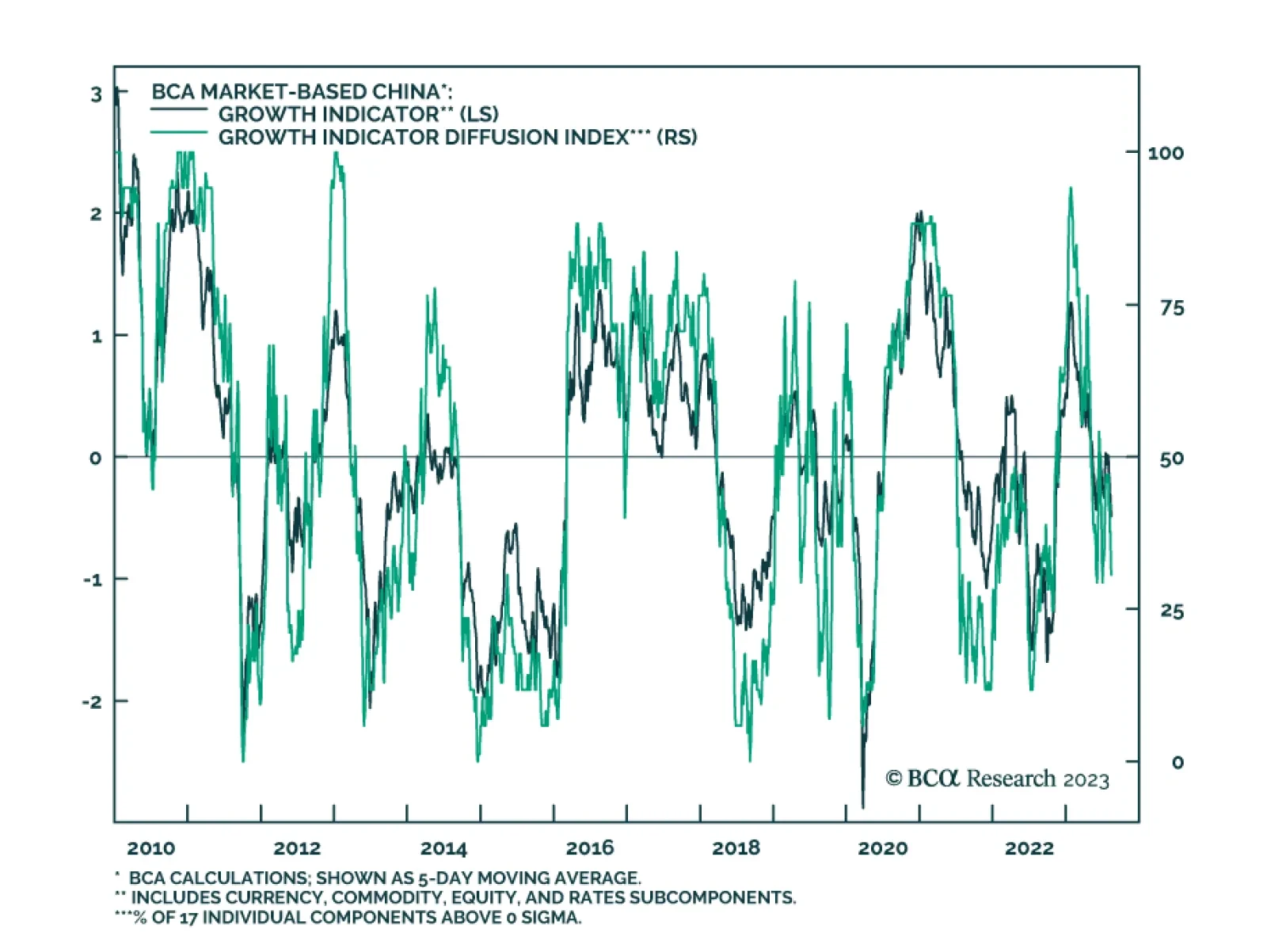

The above chart illustrates the BCA Market-Based China Growth Indicator, which is made up of 17 series grouped into four asset class subcomponents: currencies, commodities, equities, and rates/fixed-income. The purpose of the…

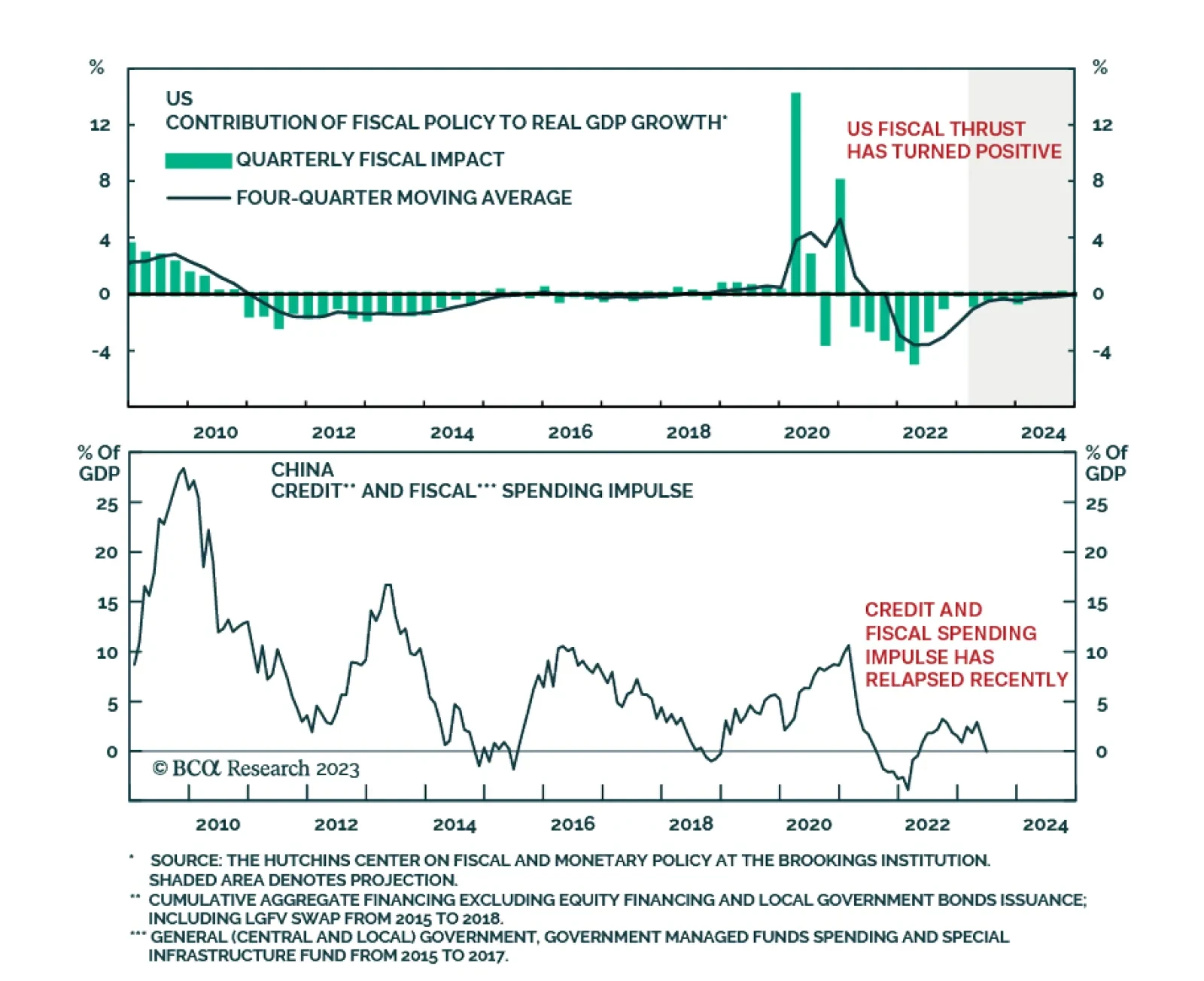

The fiscal impulse philosophies of the two largest economies of the world are set to pull in opposite directions in 2023. After the massive fiscal stimulus of 2020, the US had been cutting back on its deficit. But US fiscal…

On Monday, Asia Pacific equity markets closed in the red due to the news that China’s largest real estate developer, Country Garden, is suspending the trading of some of its bonds. This recent episode is a continuation of…

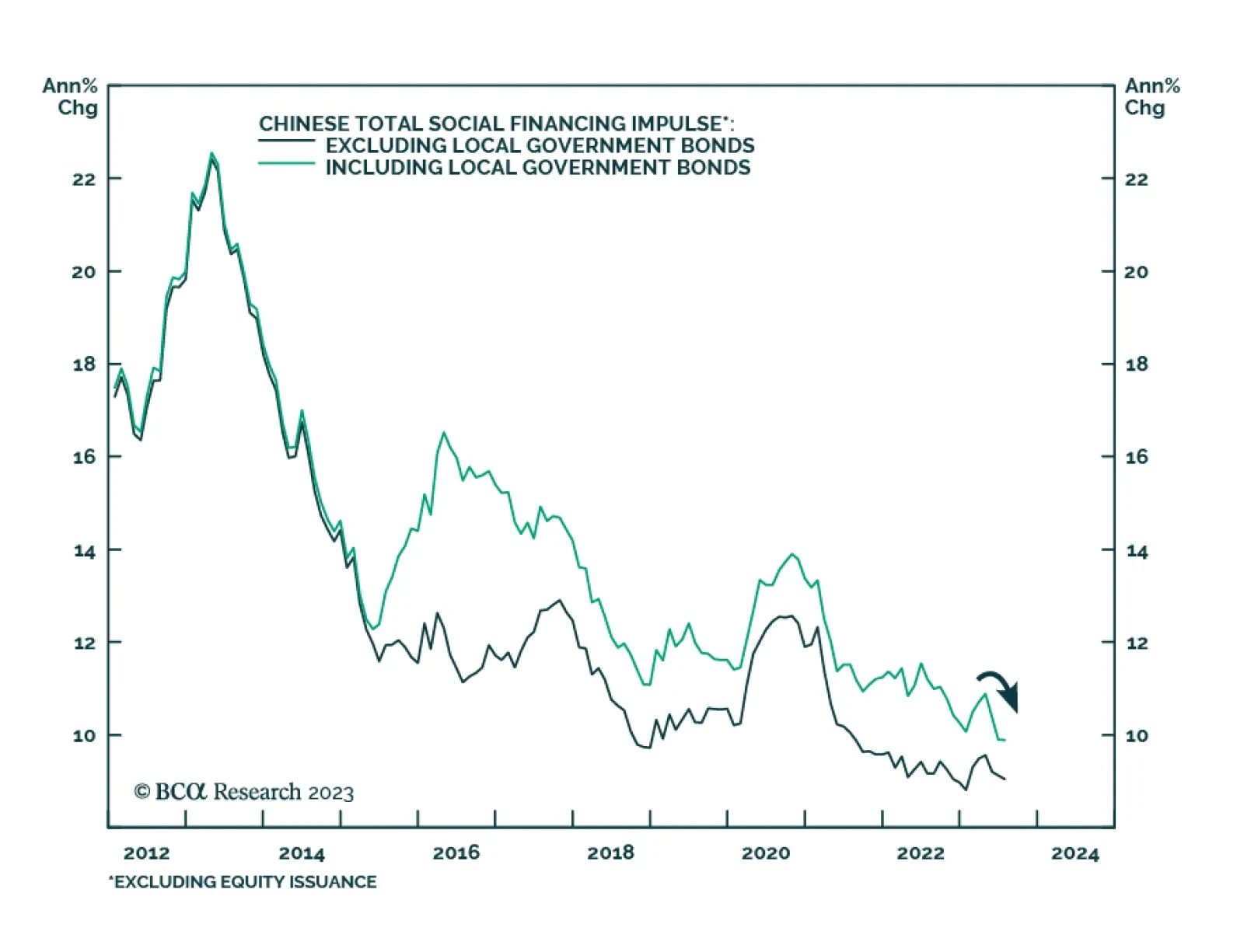

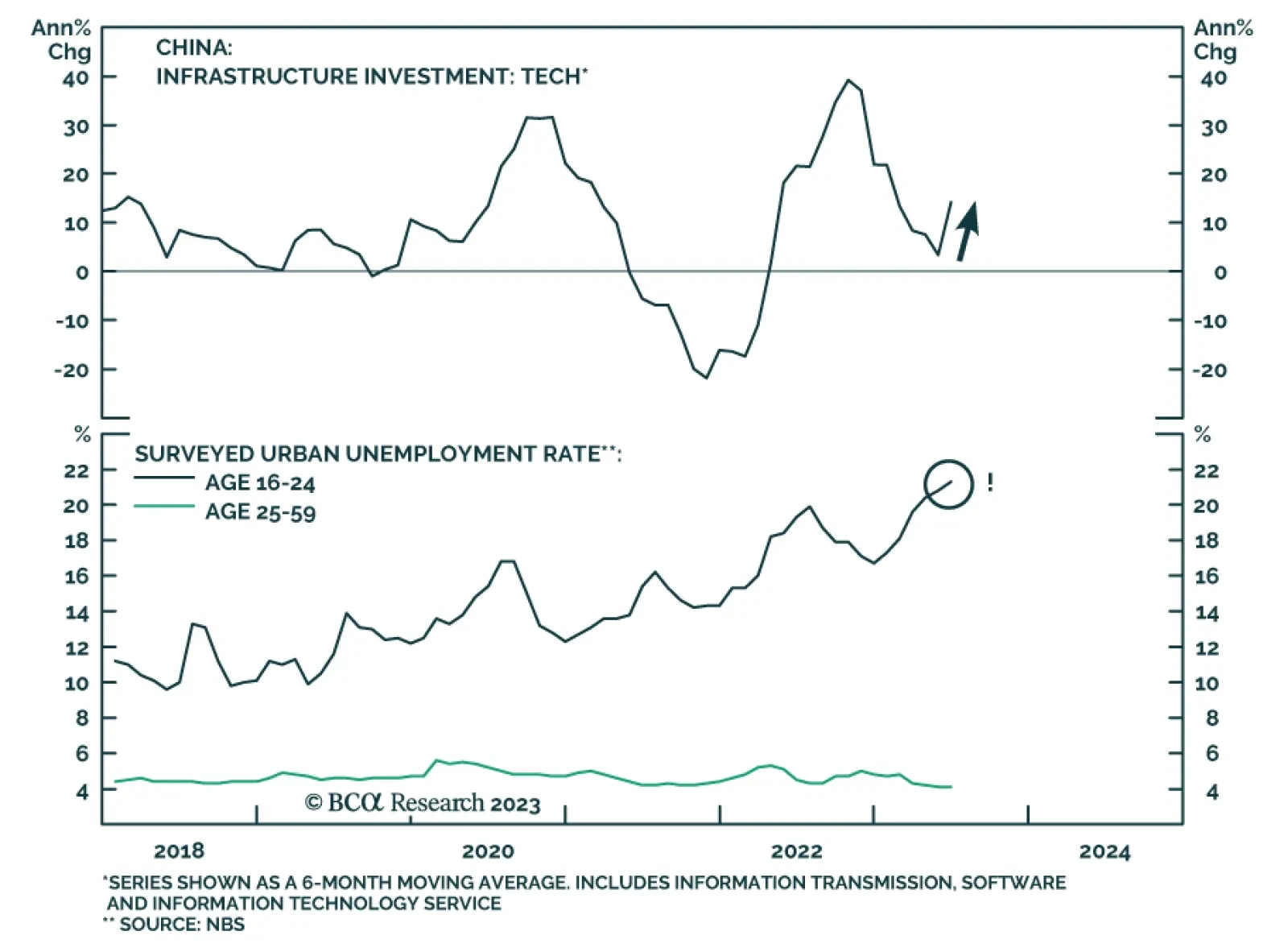

Chinese credit and money data fell significantly below expectations in July. The CNY 0.53 trillion increase in aggregate social financing marks a significant slowdown from CNY 4.22 trillion in June and came in significantly below…

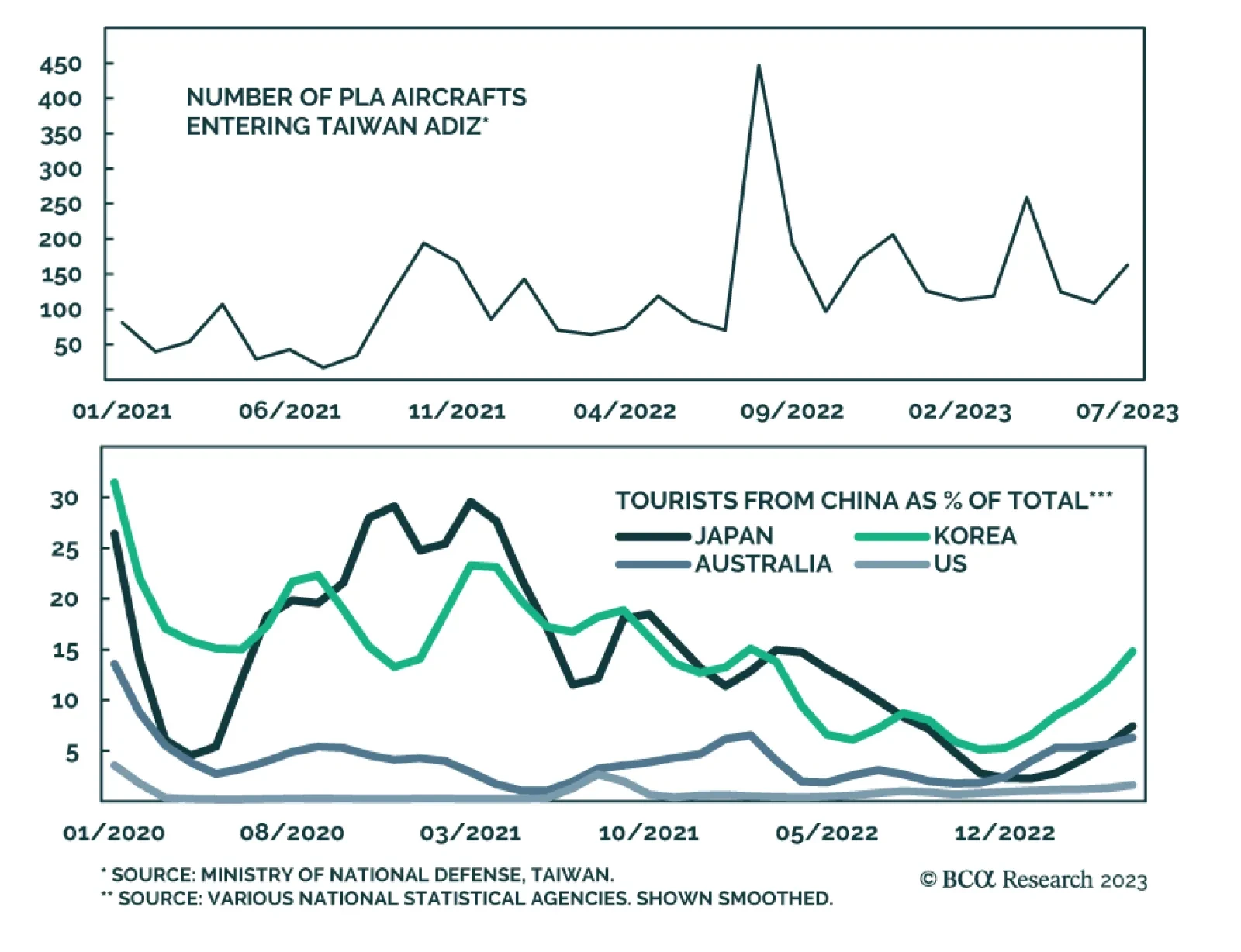

On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

China’s CPI and PPI inflation release for July indicates that deflationary pressures dominate the domestic economy. After remaining unchanged in June, consumer prices fell by 0.3% y/y. Meanwhile, the 4.4% y/y drop in…

China has generated 41 percent of the world’s economic growth through the past ten years, al-most double the 22 percent contribution from the US. Now that the Chinese growth engine is failing, we explain why it is arithmetically…

Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

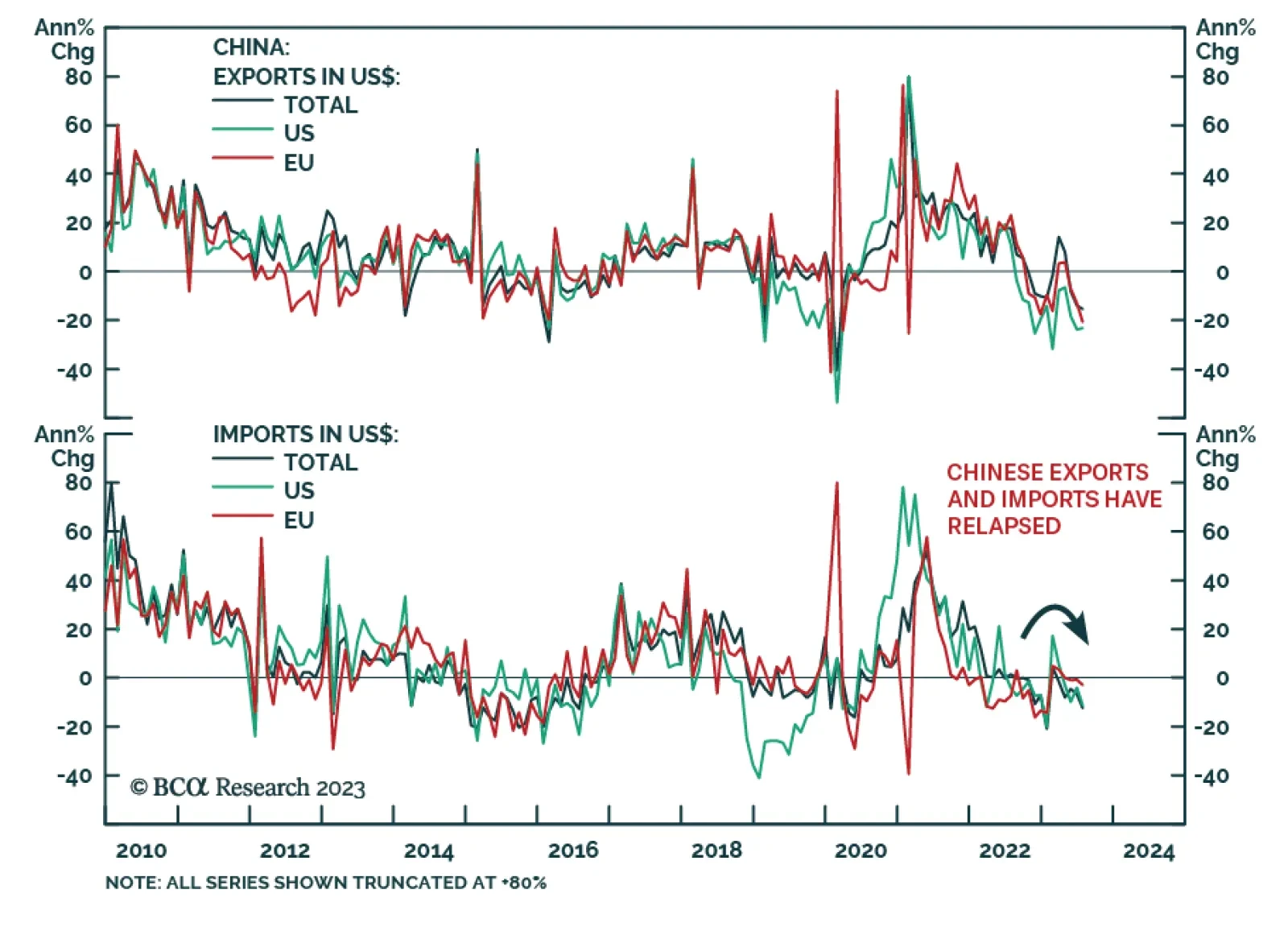

Chinese trade data continued to deliver a pessimistic signal about the global manufacturing cycle. The export contraction deepened to -14.5% y/y in US dollar terms in July – below expectations of a -13.2% y/y decline and…