The Politburo meeting in late July will set the course for economic policy for 2H23. We think China will only resort to "irrigation-style" stimulus if something breaks in the economy and/or financial markets. Furthermore, the gradual…

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…

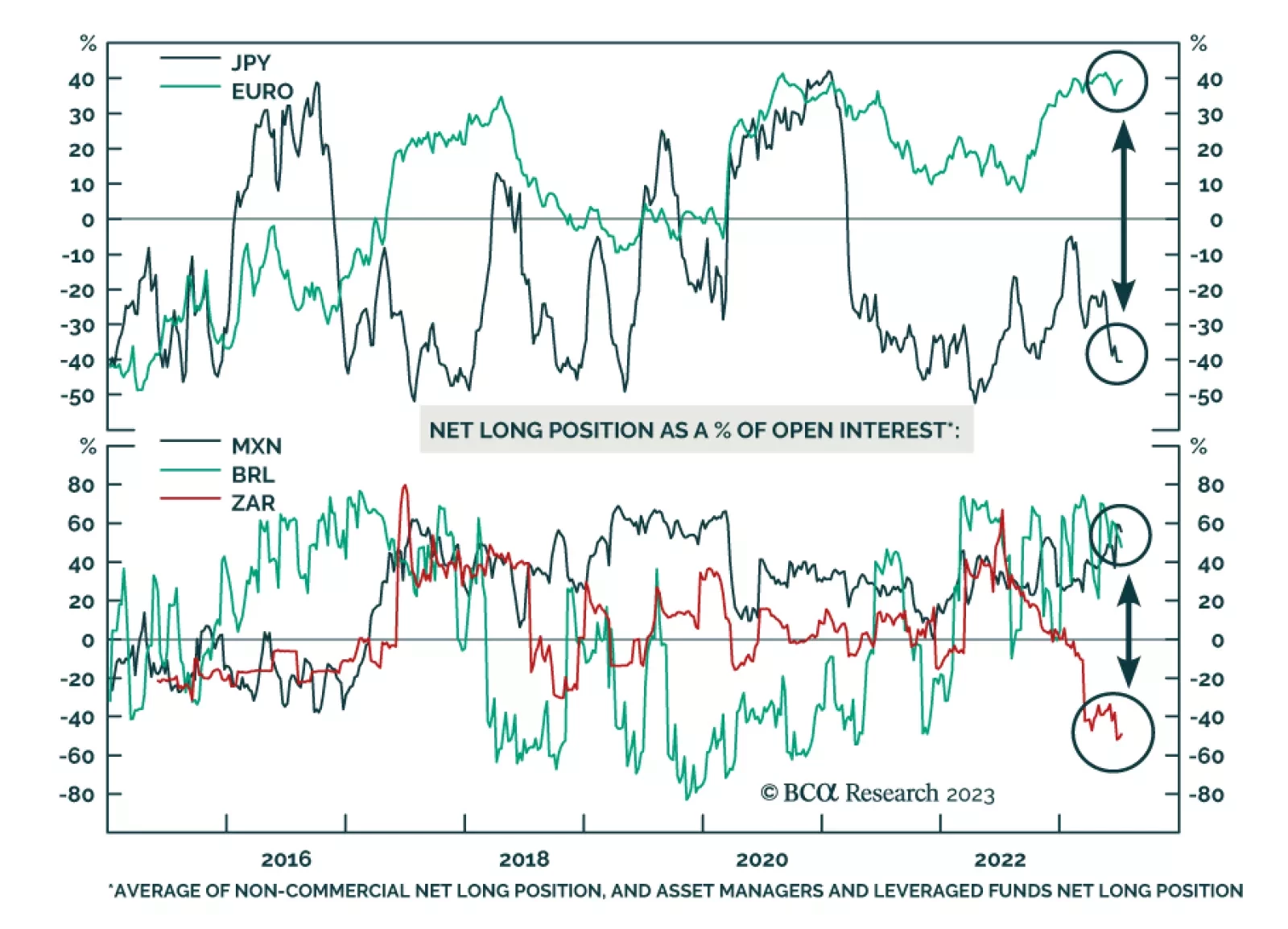

Investors’ positioning in the USD is not homogenous: they are short some currencies but long others versus the greenback. Market commentators often refer to the US dollar. They implicitly mean the US currency is moving…

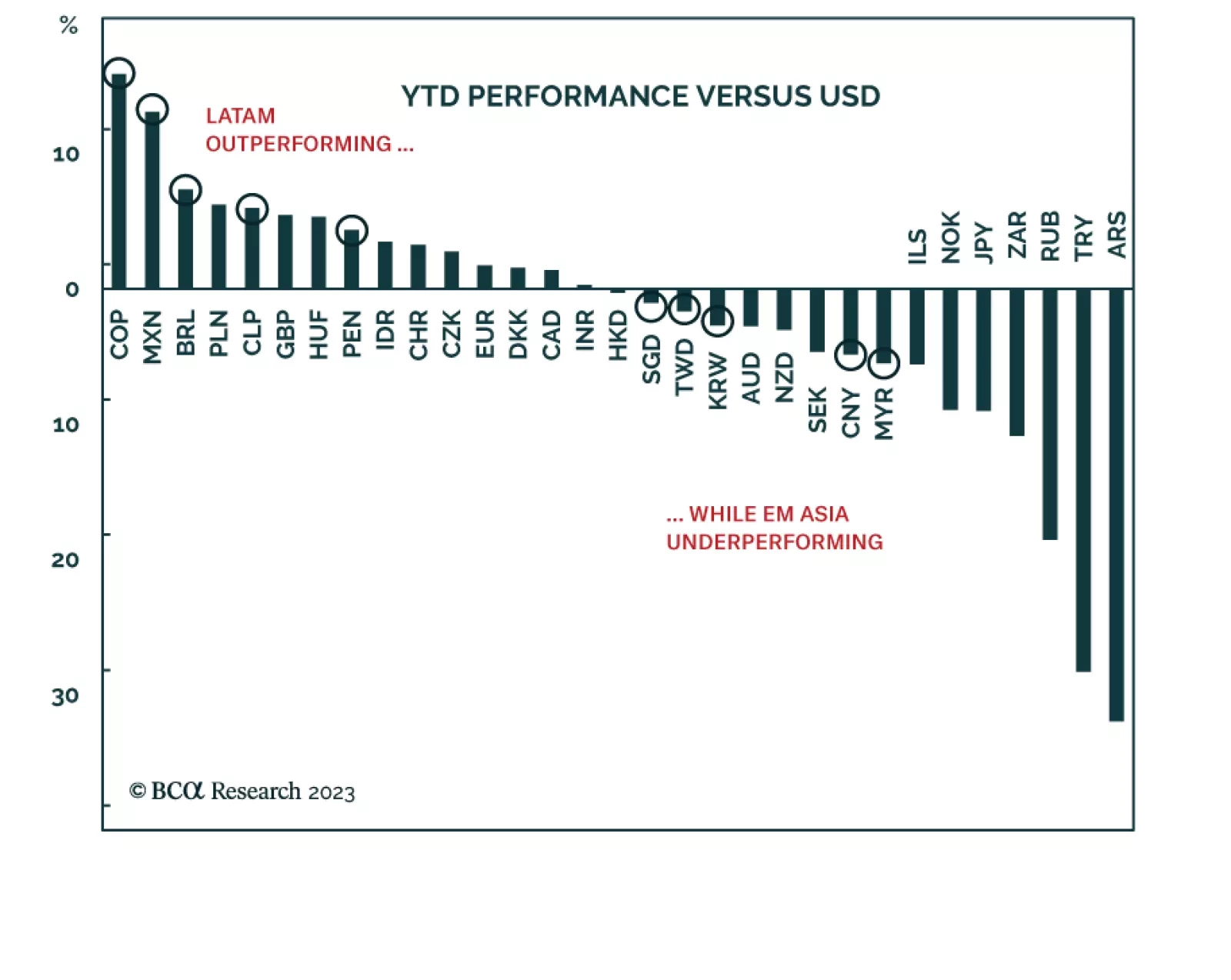

Latin American currencies are among the best performers in the FX space this year. The Colombian peso, Mexican peso, and Brazilian real occupy the top three spots among the major EM and DM currencies, up by 16%, 13%, and 7% vis-…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

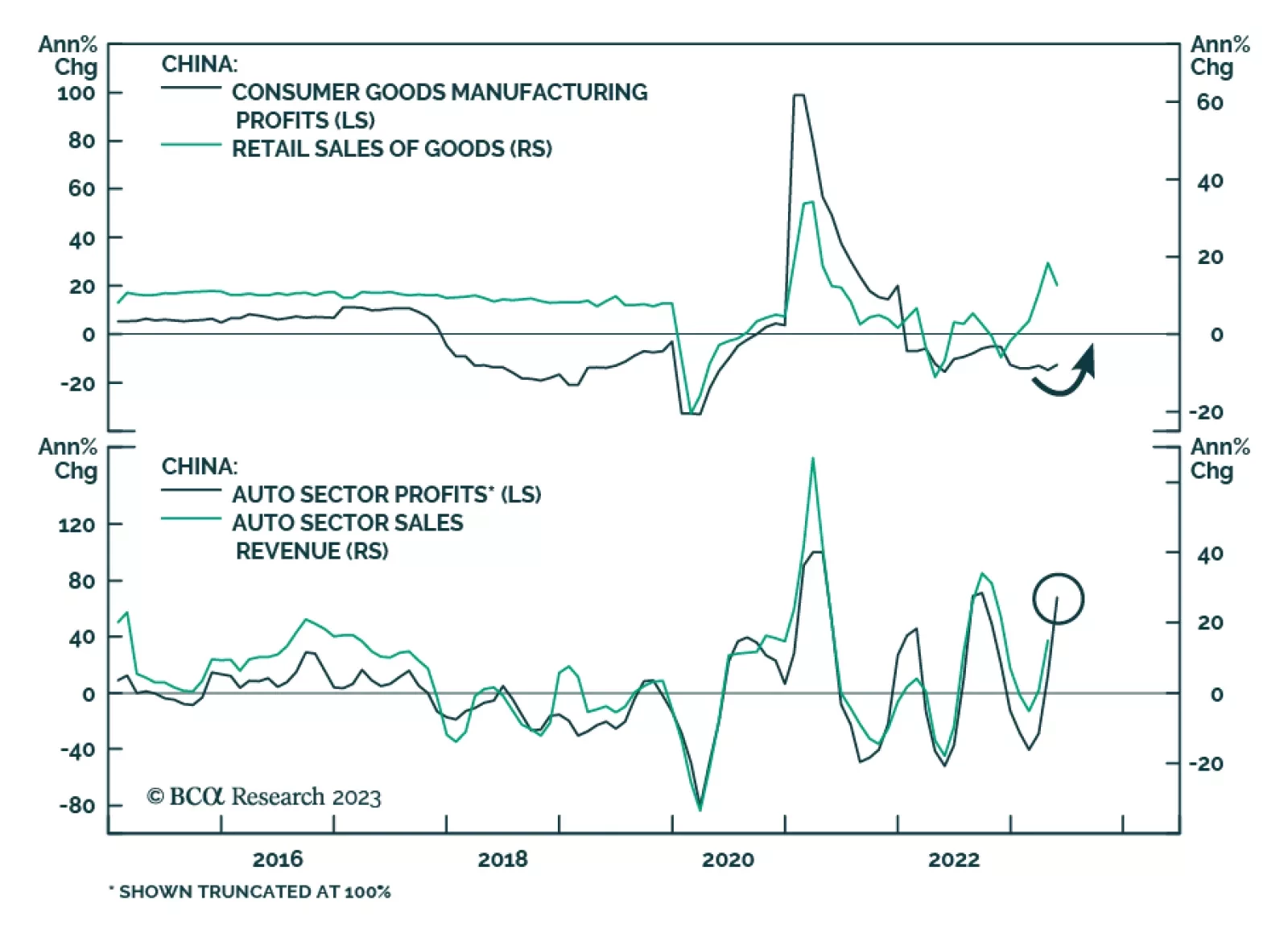

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

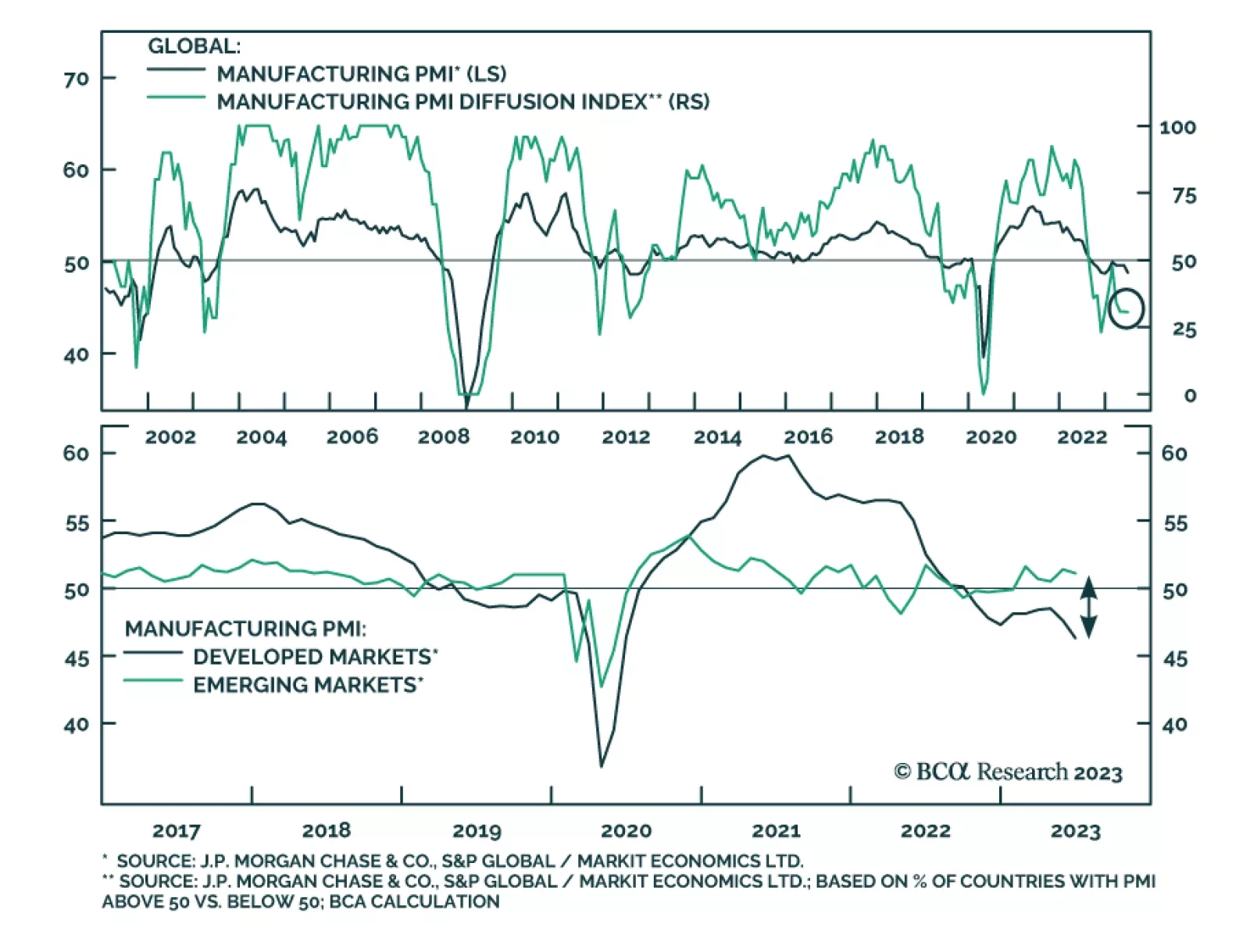

The Global Manufacturing PMI’s 0.8-point decline to a six-month low of 48.8 in June indicates that manufacturing conditions deteriorated at the end of Q2. The forward-looking New Orders and New Export Orders components both…

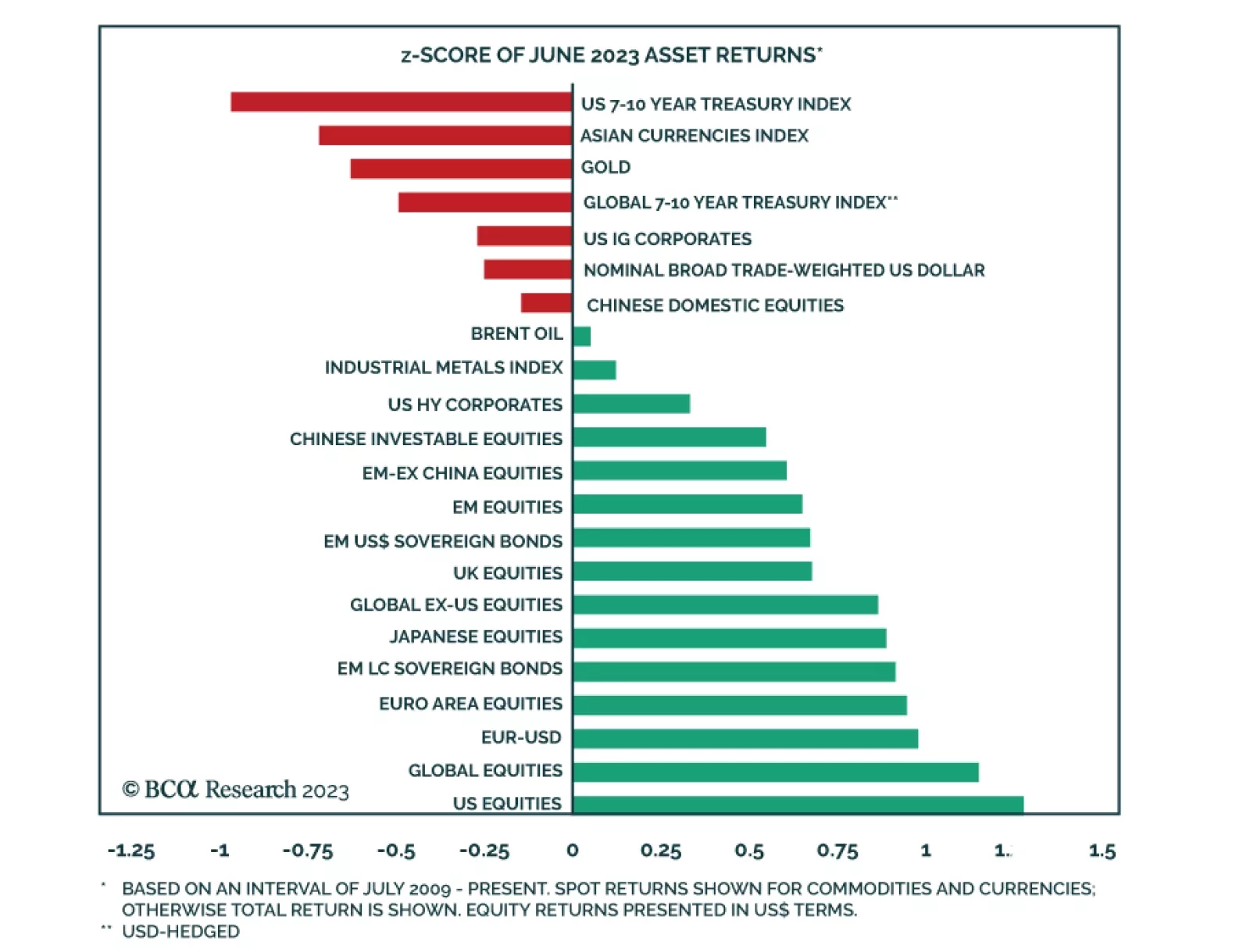

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…