Stocks should continue to rally in the near term, but investors should prepare to turn more defensive towards the end of the year in advance of a recession in 2024.

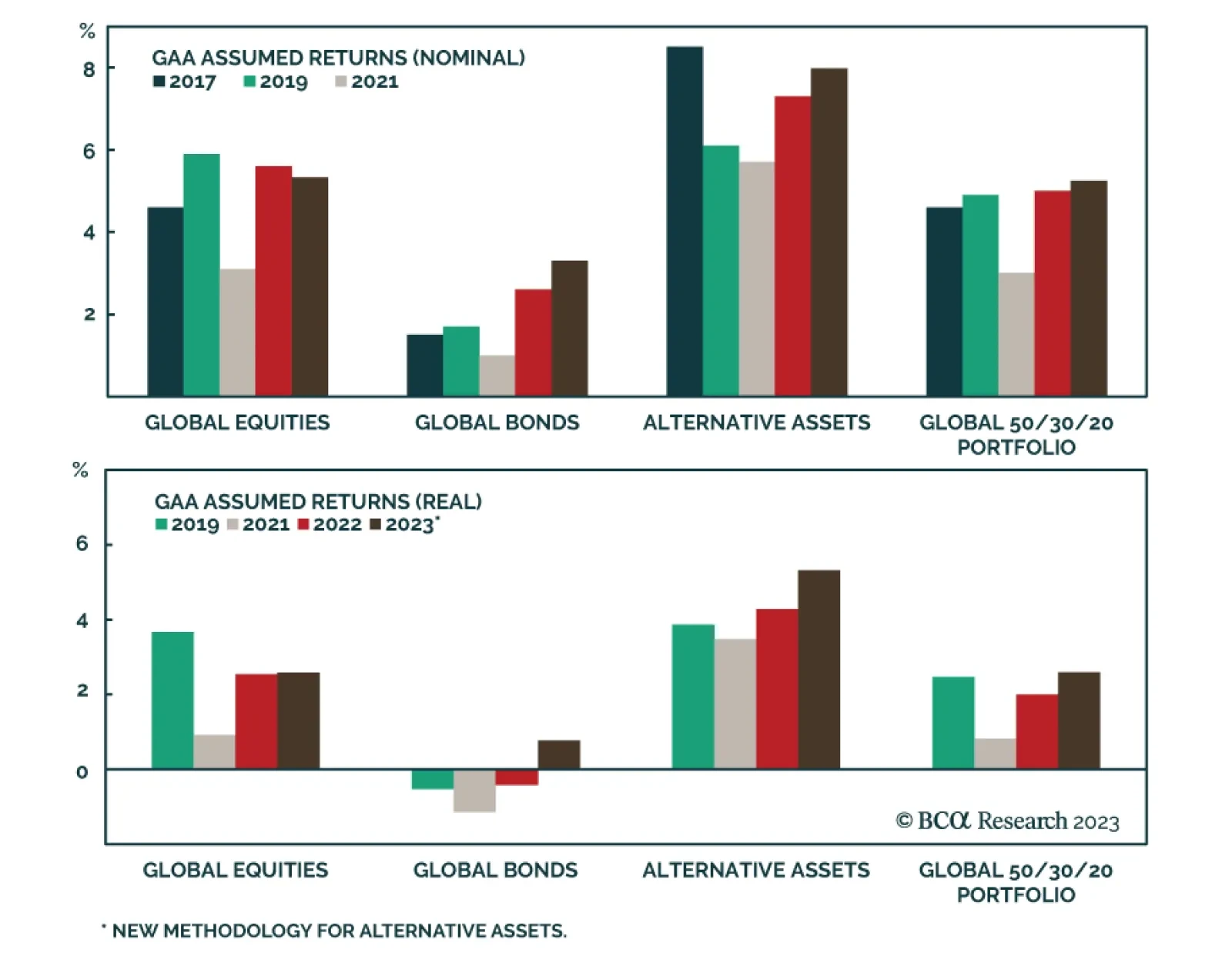

In a recent report, BCA Research’s Global Asset Allocation service updated its long-term return assumptions for a wide range of public and private assets. While still lower than the historical returns, the team’s…

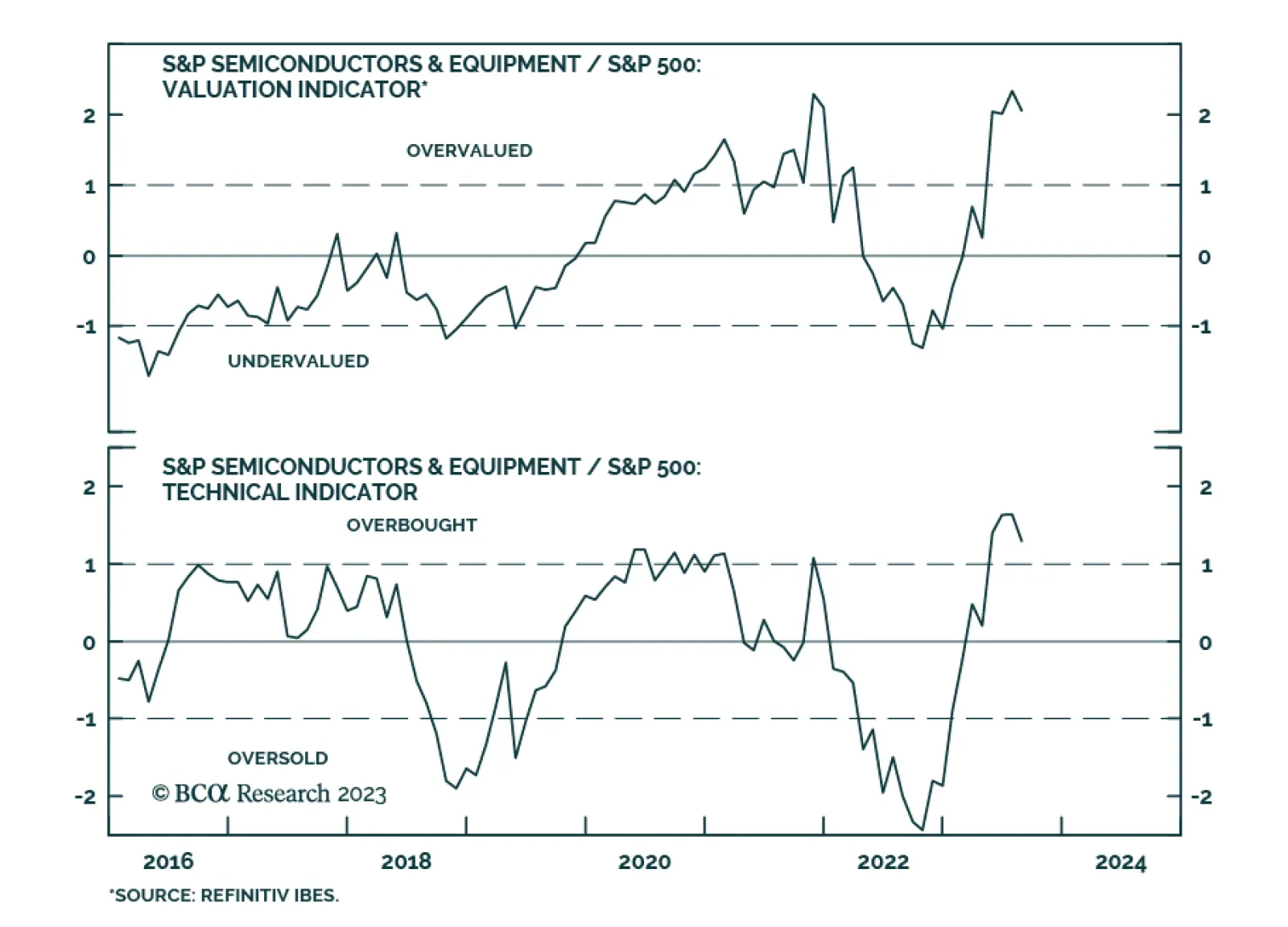

Nvidia’s stock price hit a fresh all-time high on Thursday after its blockbuster Q2 earnings call. The company reported it generated $13.51 billion in revenue last month (above expectations of $11.2 billion) and forecasted…

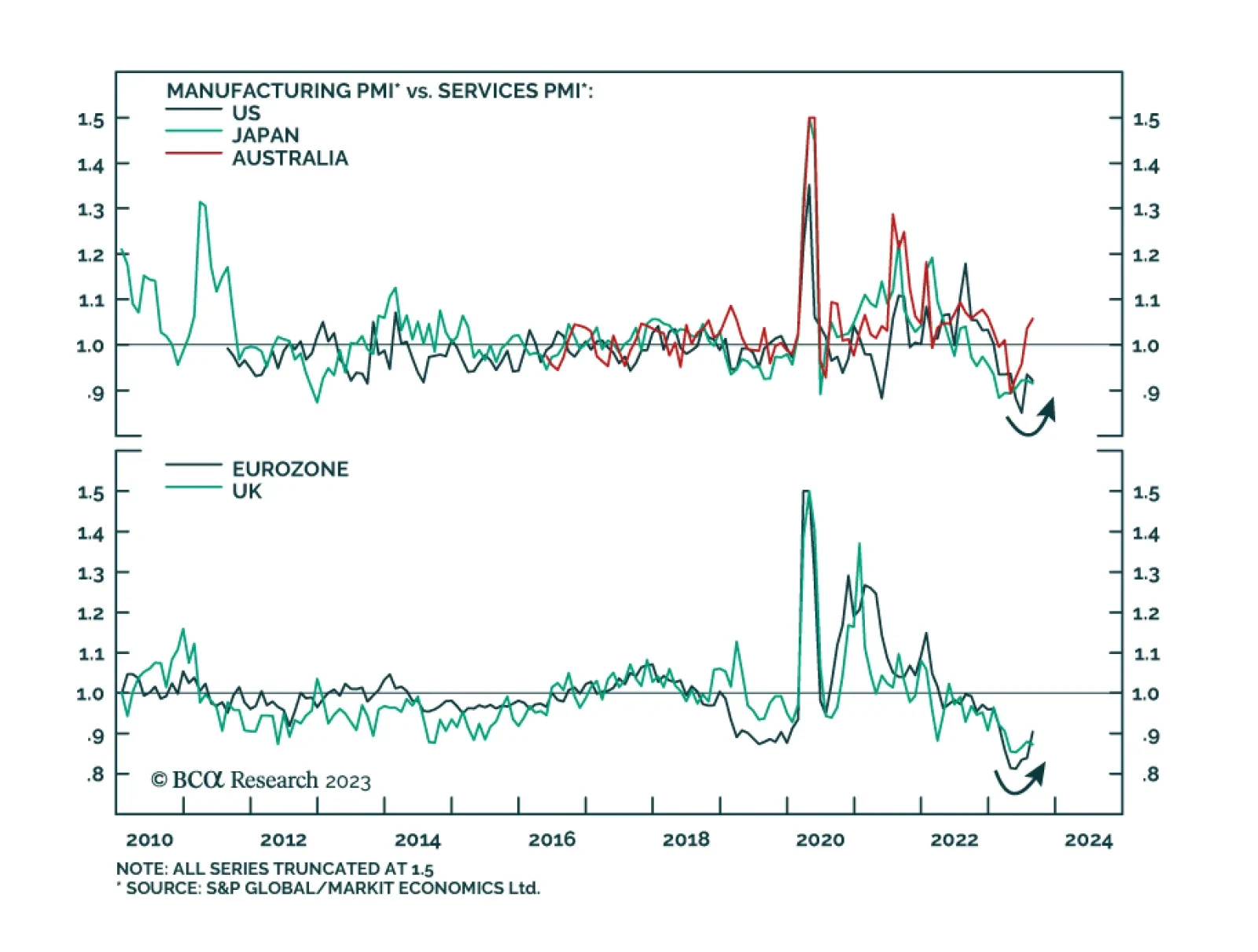

Yesterday we highlighted that the August update of the Philly Fed’s Nonmanufacturing Business Outlook survey sent a negative signal, with the New Orders, Sales, and Employment components all deteriorating. On Wednesday, the…

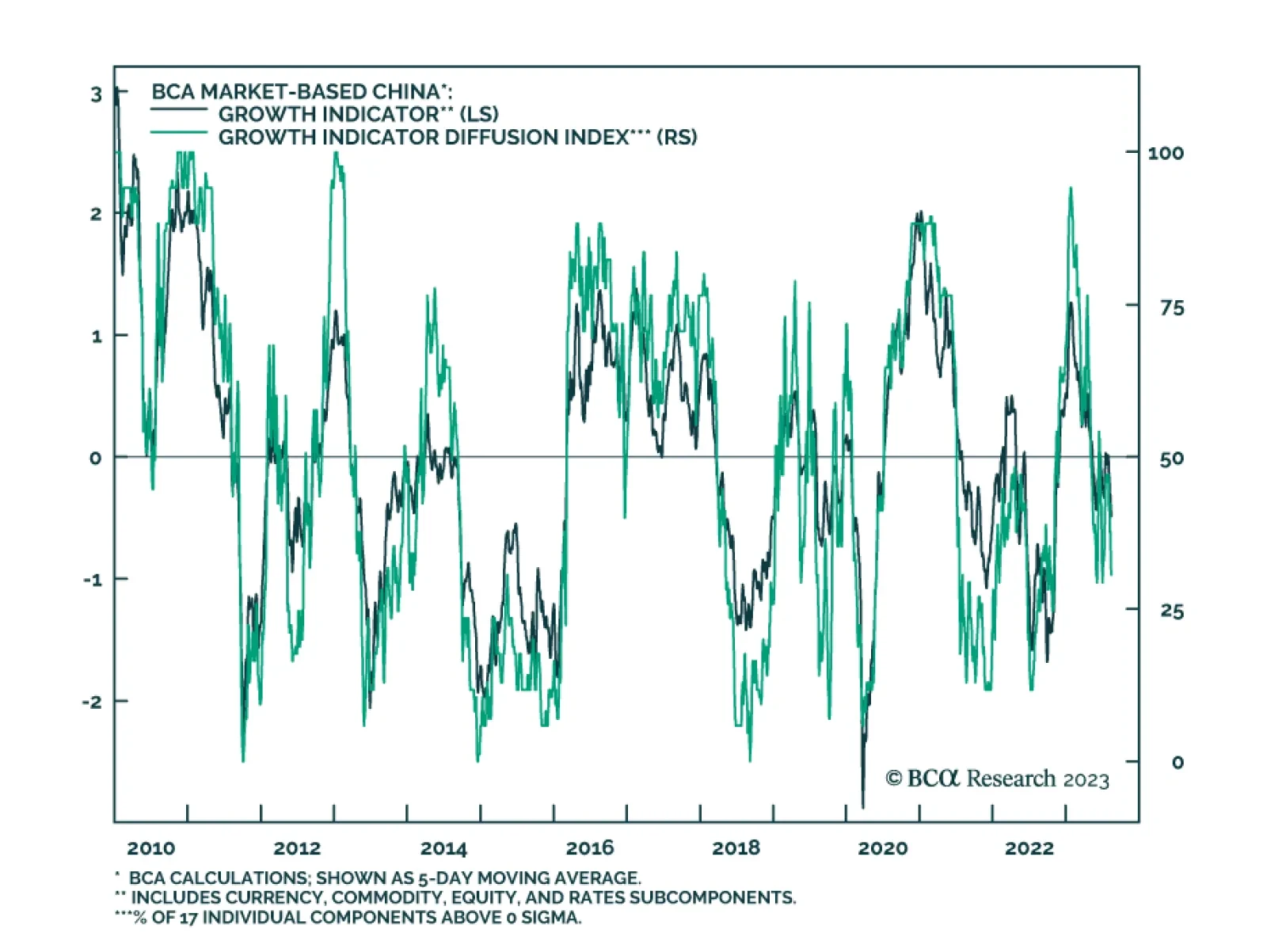

The above chart illustrates the BCA Market-Based China Growth Indicator, which is made up of 17 series grouped into four asset class subcomponents: currencies, commodities, equities, and rates/fixed-income. The purpose of the…

The rise in bond yields over the past few weeks has made some investors wonder whether US Treasurys and other government bonds really are a good hedge against recession. Could there be an environment in which the economy goes…

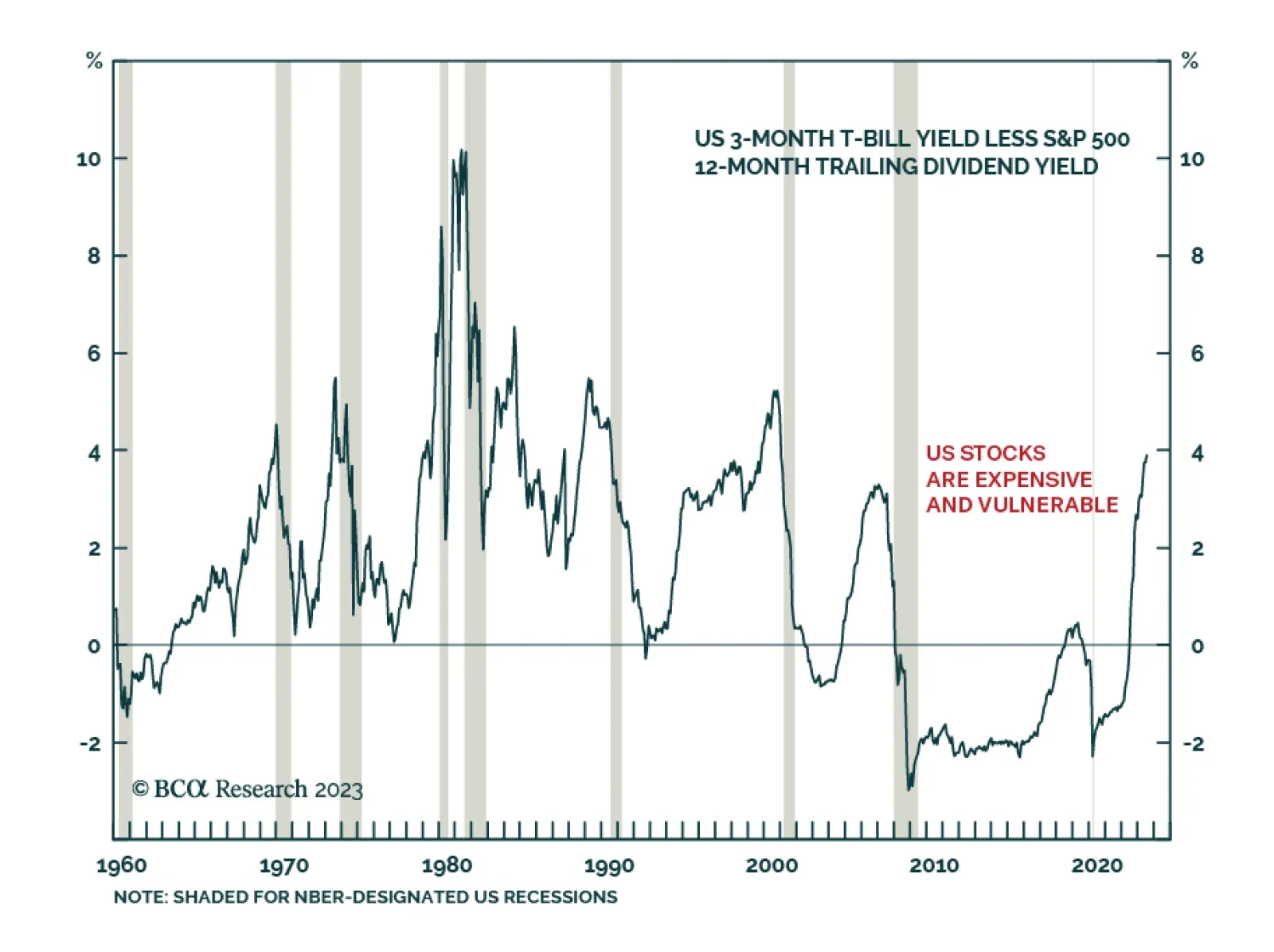

During the last economic expansion, a structurally overweight allocation to stocks was at least partially warranted by the idea that “There Is No Alternative” – or “T.I.N.A.” During the last…

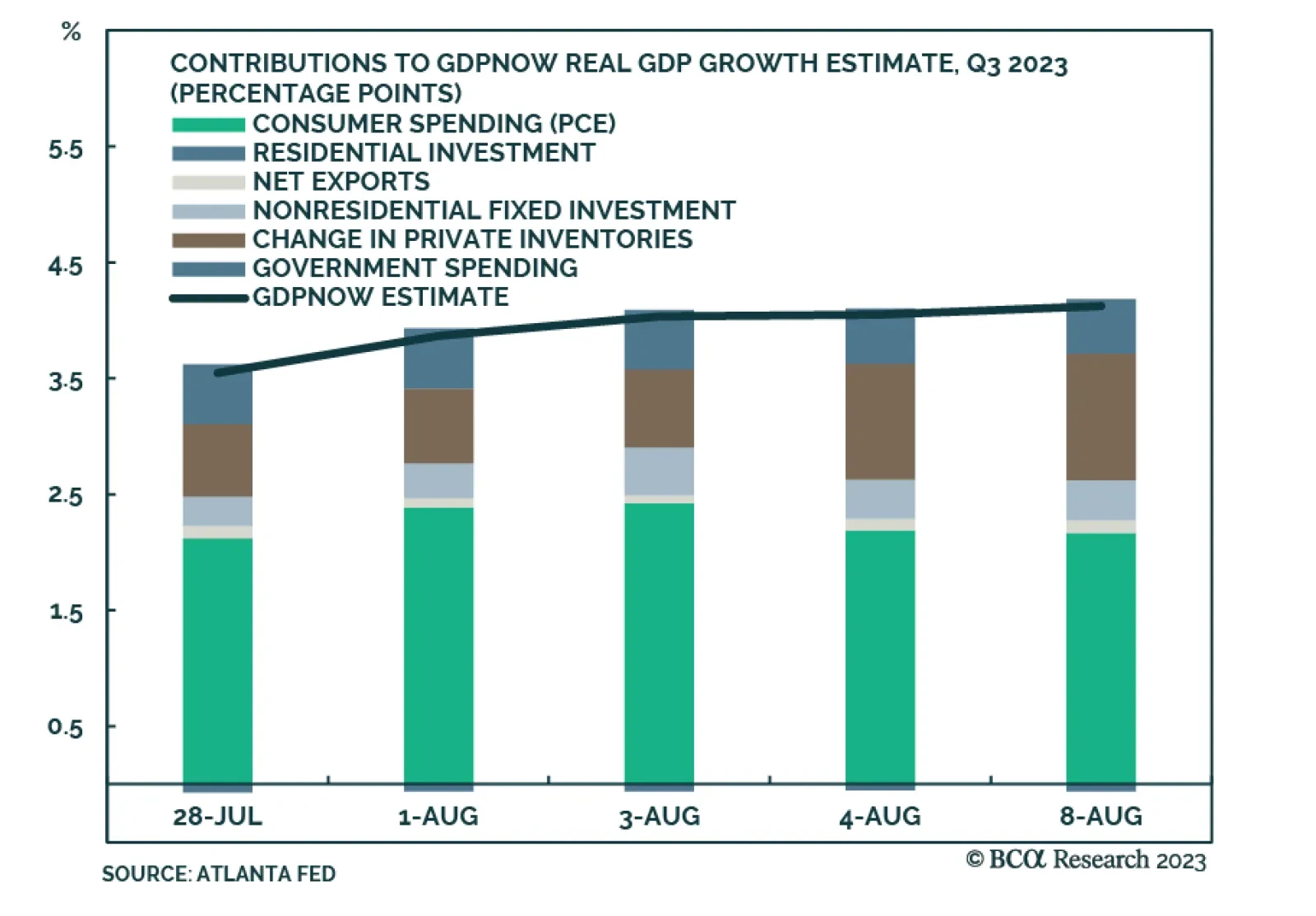

Over the past two months, risk sentiment has improved amid receding fears of an imminent US recession. Economic data have been generating strong upside surprises and the US equity rally has broadened with cyclicals outperforming…