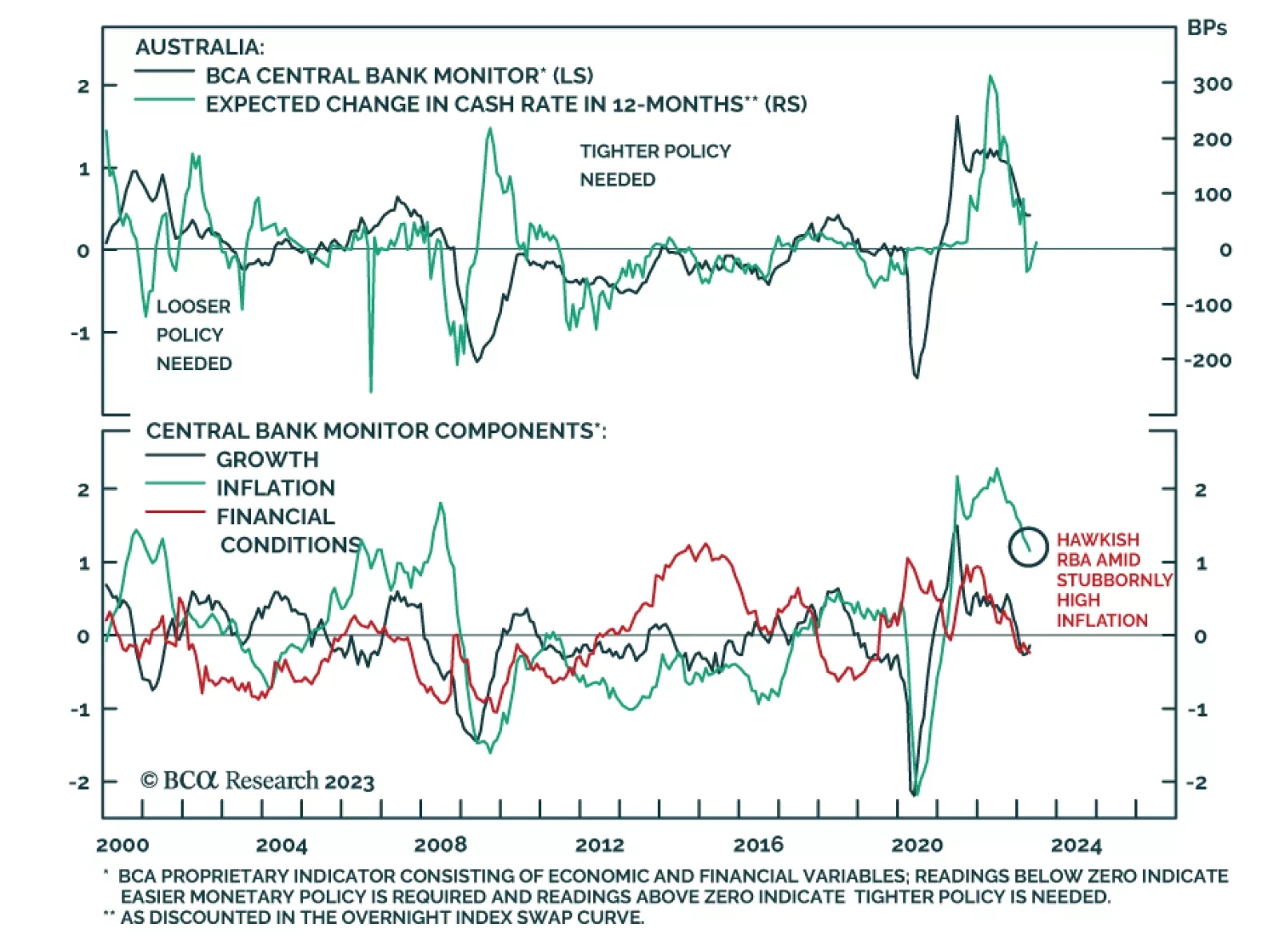

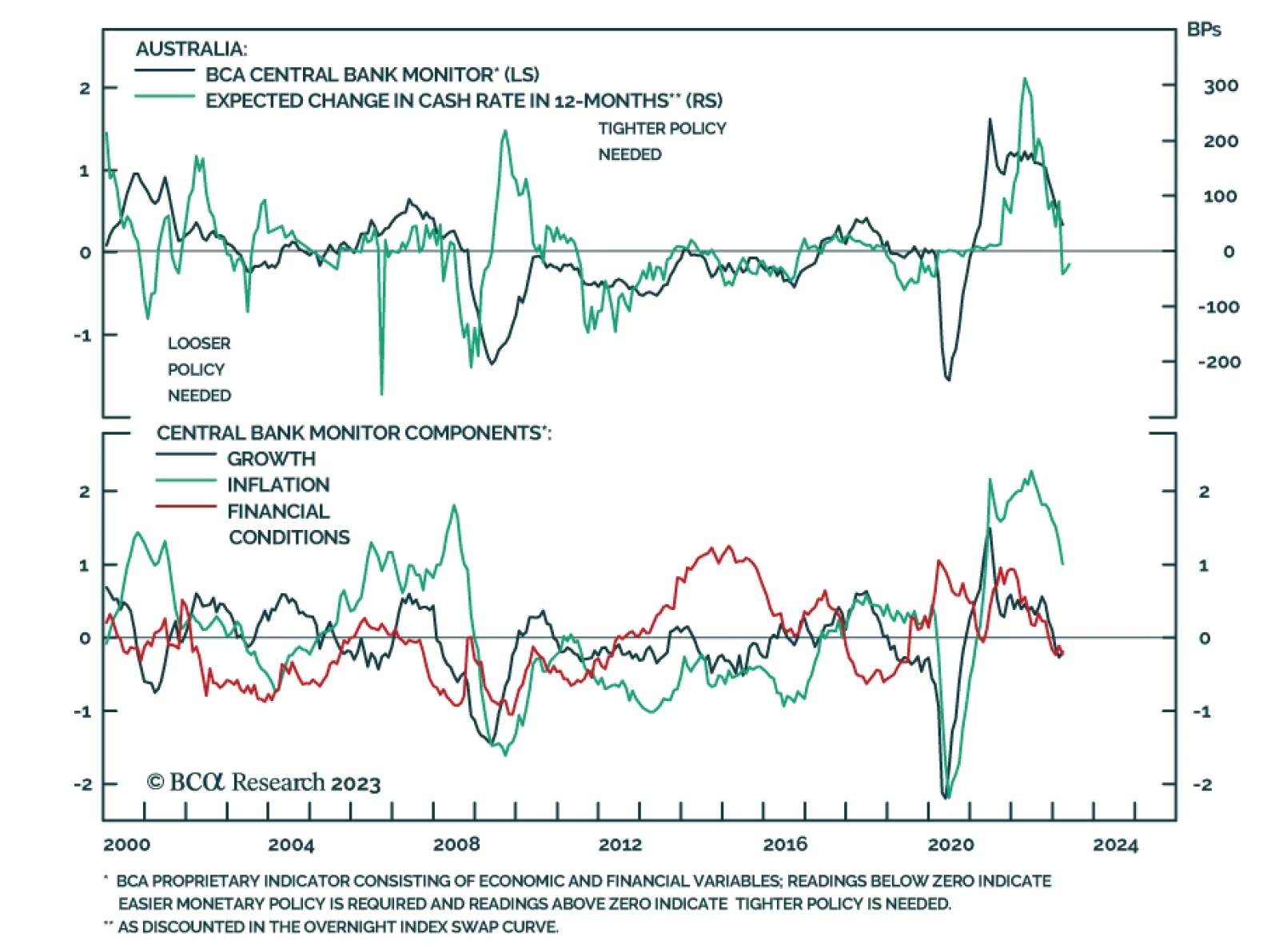

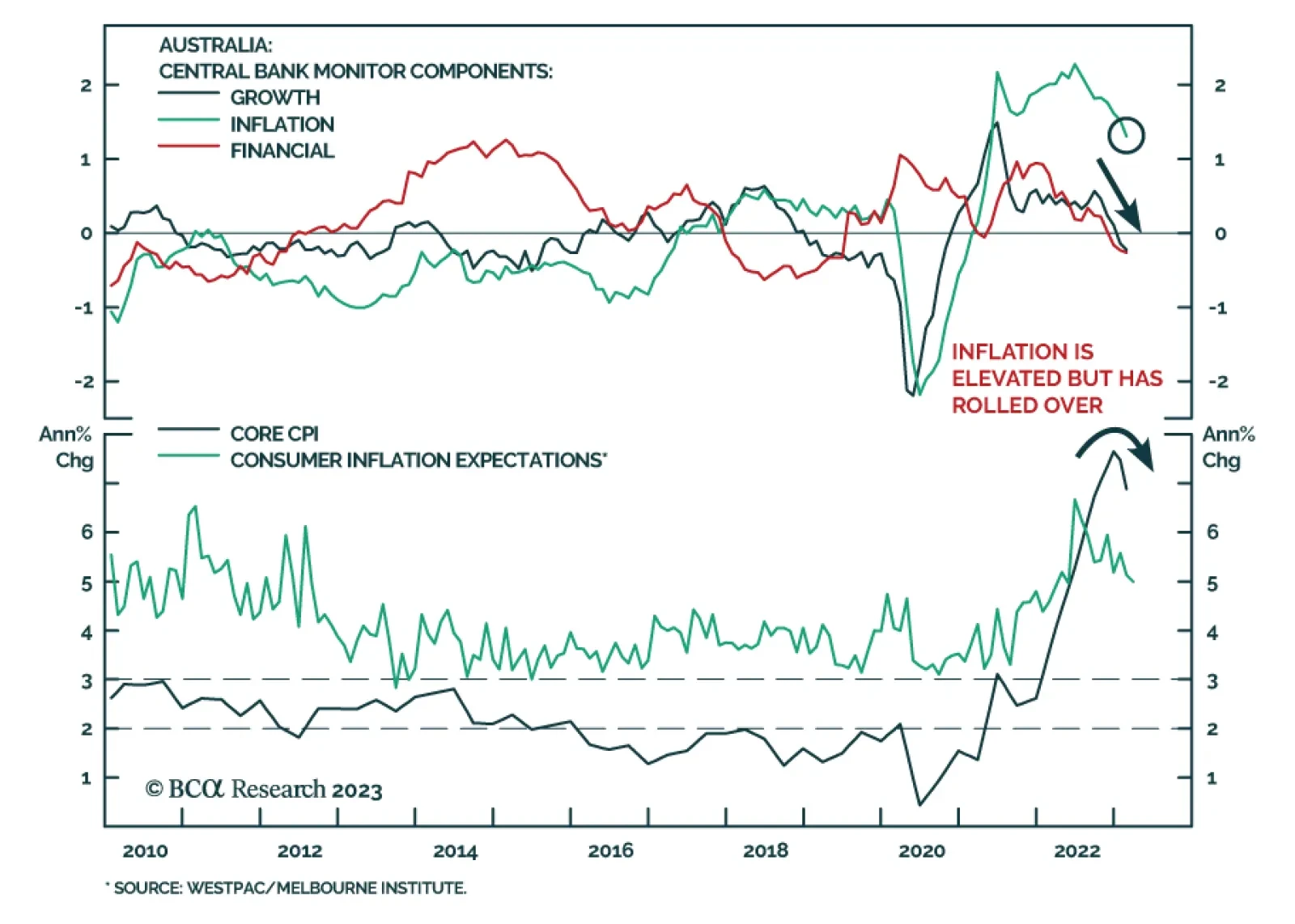

The Reserve Bank of Australia surprised markets with a 25 basis point rate hike on Tuesday, bringing the Cash Rate up to 4.1%. This marks the second consecutive rate increase following a pause in April. The post-meeting…

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…

In this Month-In-Review report, we go over the latest G10 data releases and rank currencies’ fundamental standing based on our updated macroeconomic model.

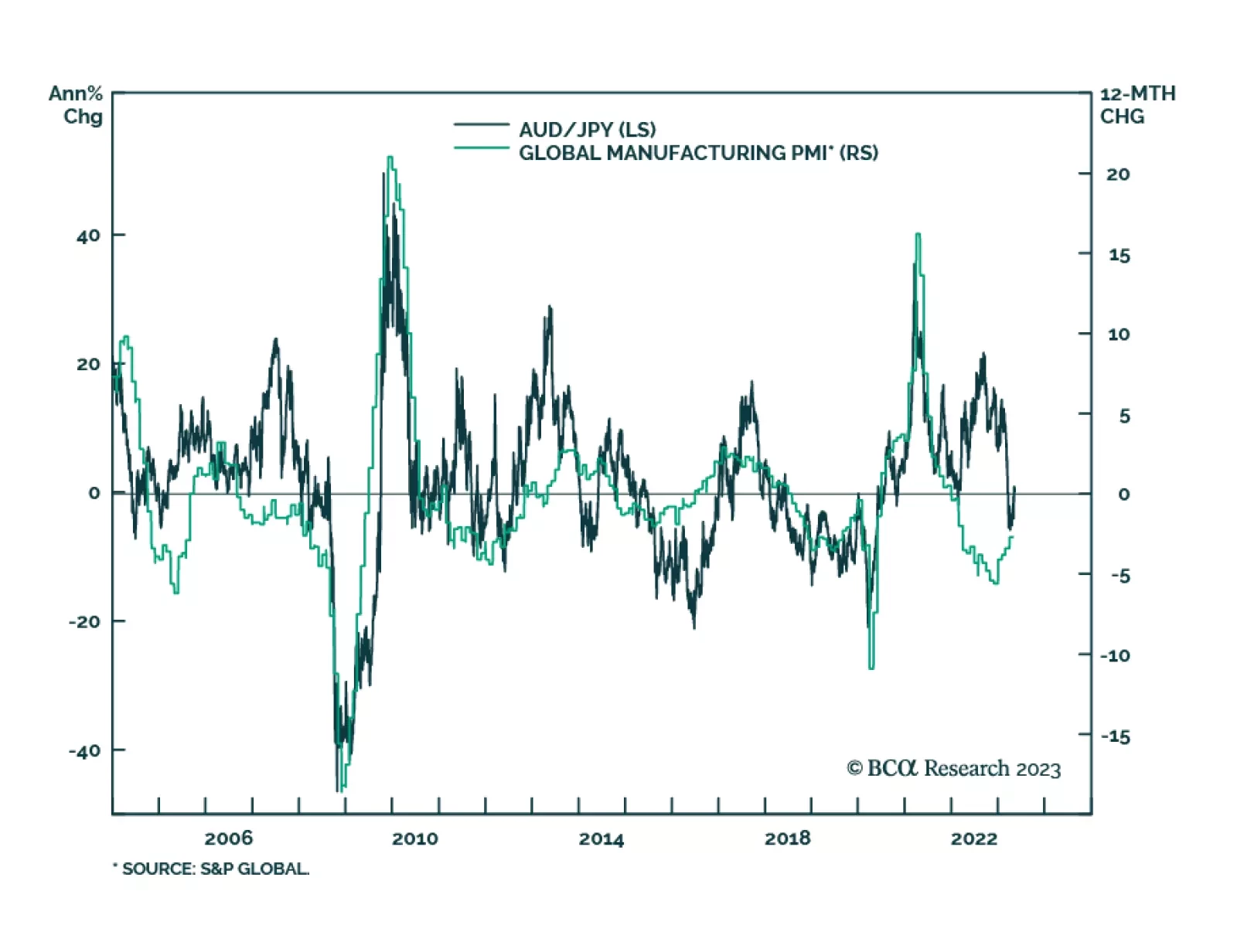

After a powerful 40% rally from the March 2020 lows, AUD/JPY peaked in September 2022 and has been consolidating those gains in bearish trading pattern of lower highs and lower lows. Although the cross is up 4.5% from the March…

The Reserve Bank of Australia surprised markets with a 25bp rate hike at its Tuesday meeting, bringing the cash rate up to 3.85%. This decision follows a pause in April, which provided policymakers some time to assess the full…

As expected, the RBA stood pat at its meeting on Tuesday following 10 consecutive rate hikes that pushed the cash rate up by 350 basis points to 3.6%. The Australian economy is starting to show the effect of the rate…

As expected, the Reserve Bank of Australia raised its Cash Rate by 25 basis points to 3.60%, delivering a 10th consecutive rate hike. However, the central bank’s dovish signal about the monetary policy outlook led to a…

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…