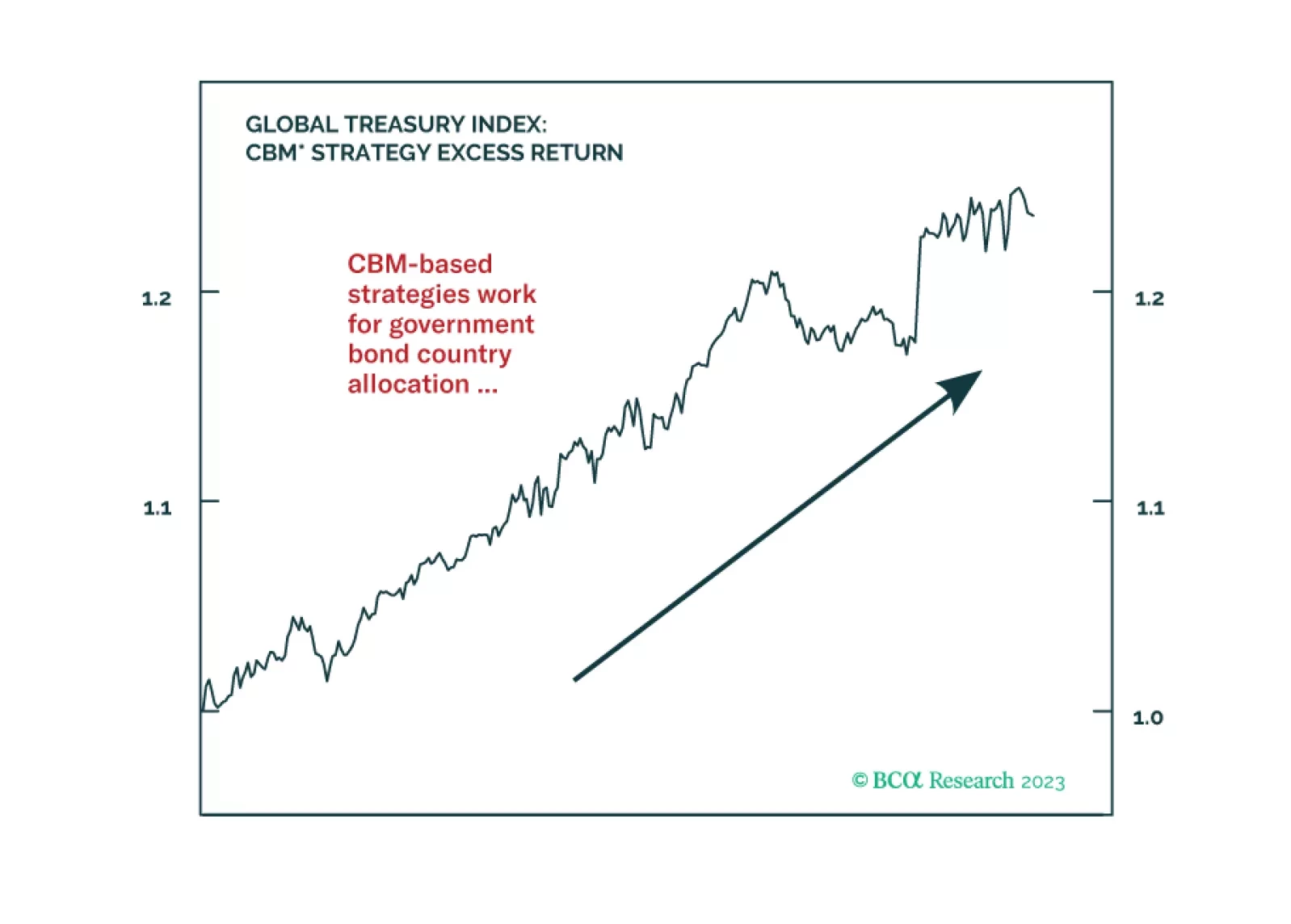

In this report, we present the quarterly review of the Global Fixed Income Strategy Model Bond Portfolio. The portfolio remains positioned for slower global growth momentum over the next 6-12 months, favoring government bonds over…

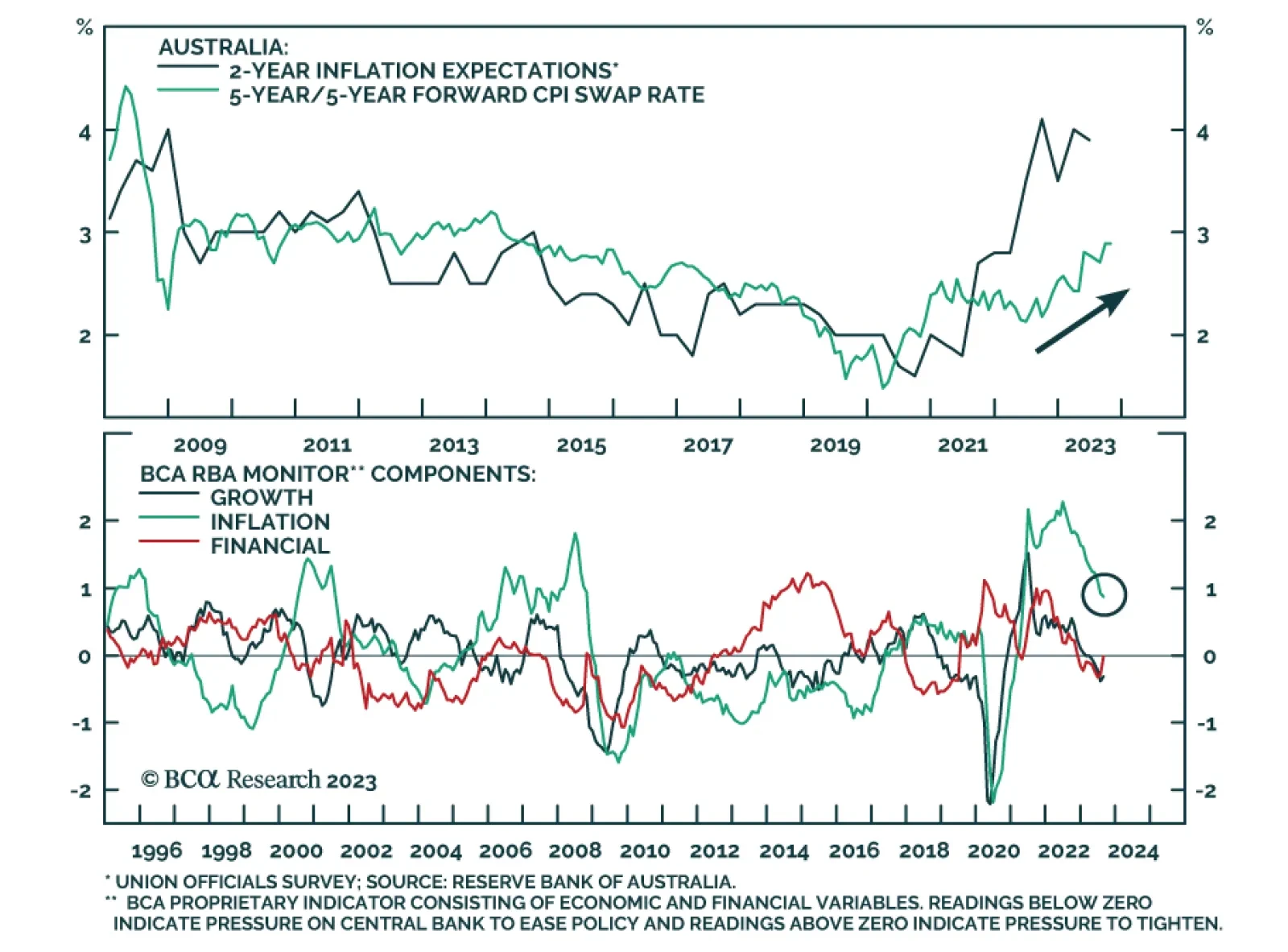

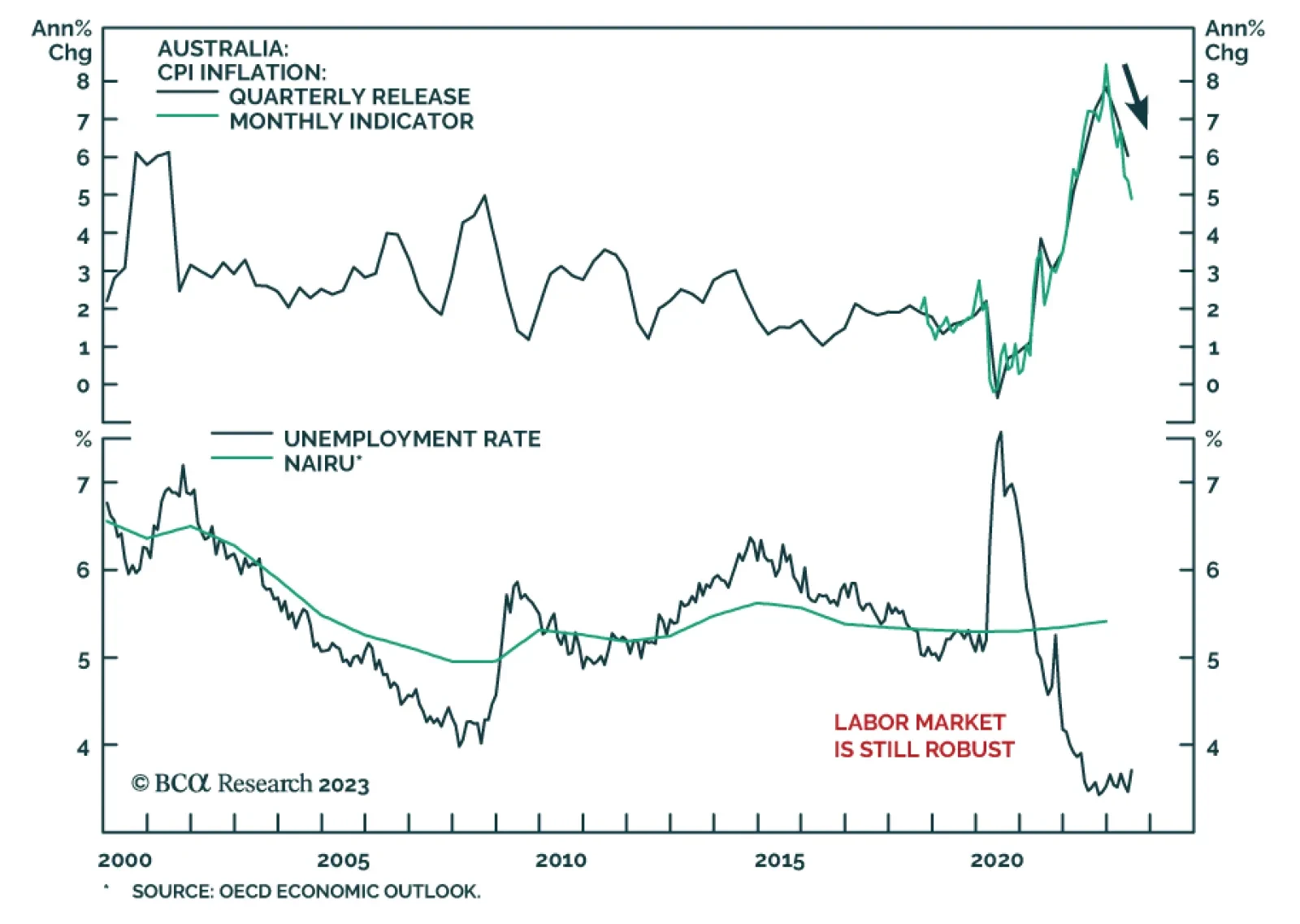

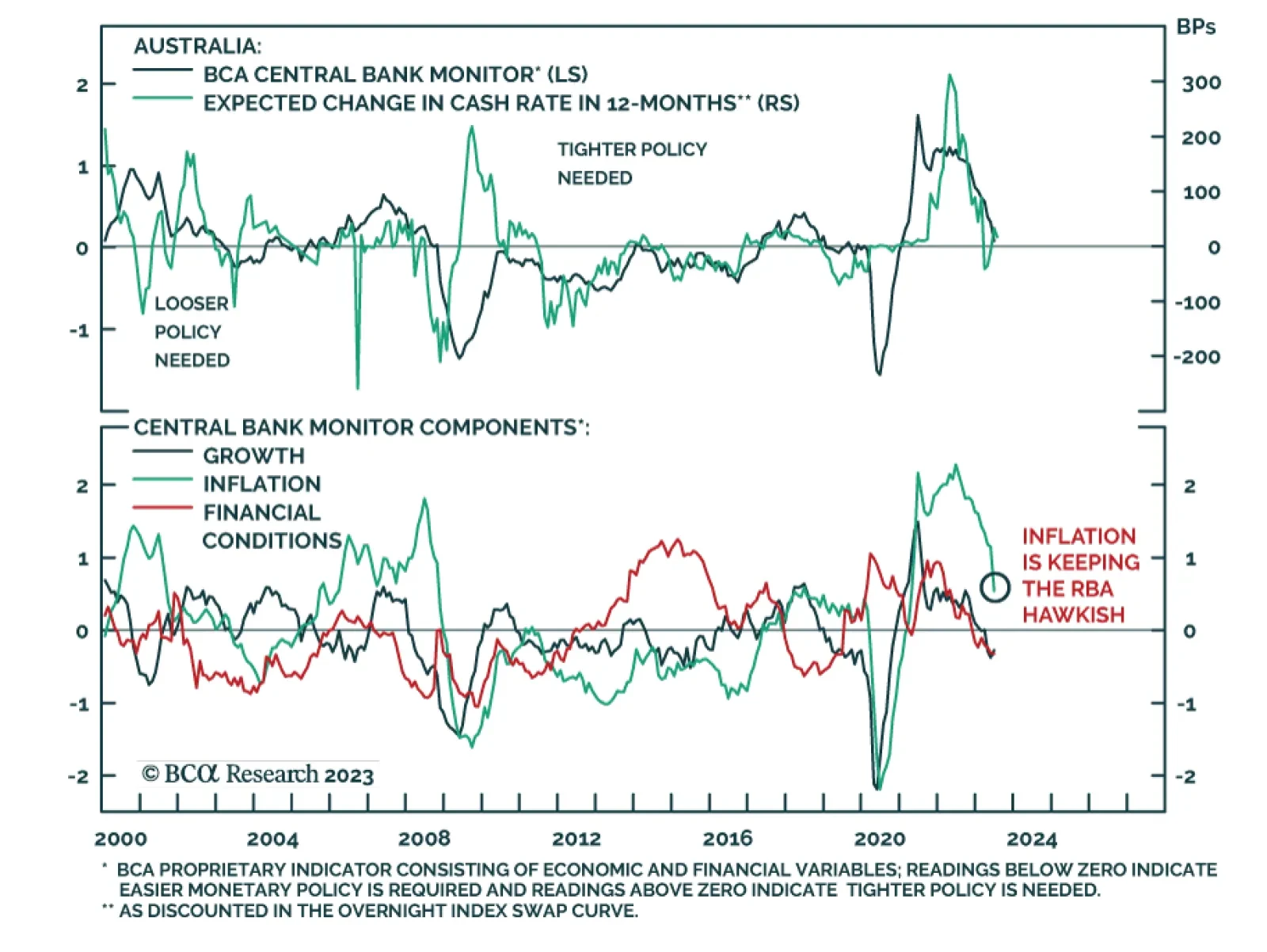

The Australian dollar was among the worst performing major currencies on Tuesday after the Reserve Bank of Australia held the cash rate at 4.1% for the fourth consecutive month. In her post meeting statement, newly appointed…

The AUD was the worst performing currency on Tuesday after the Reserve Bank of Australia kept its cash rate target unchanged at 4.1% for the third consecutive month. In particular, outgoing Governor Philip Lowe underscored that…

A global recession continues to be likely over the next 12 months. The impact of tighter monetary policy is slowly being felt. Government bonds look increasingly attractive as a safe haven.

In this report, we assess the best opportunities in inflation-linked bonds in the major developed economies, based on trends in growth, inflation and the stance of monetary policies in each country. We conclude that the environment…

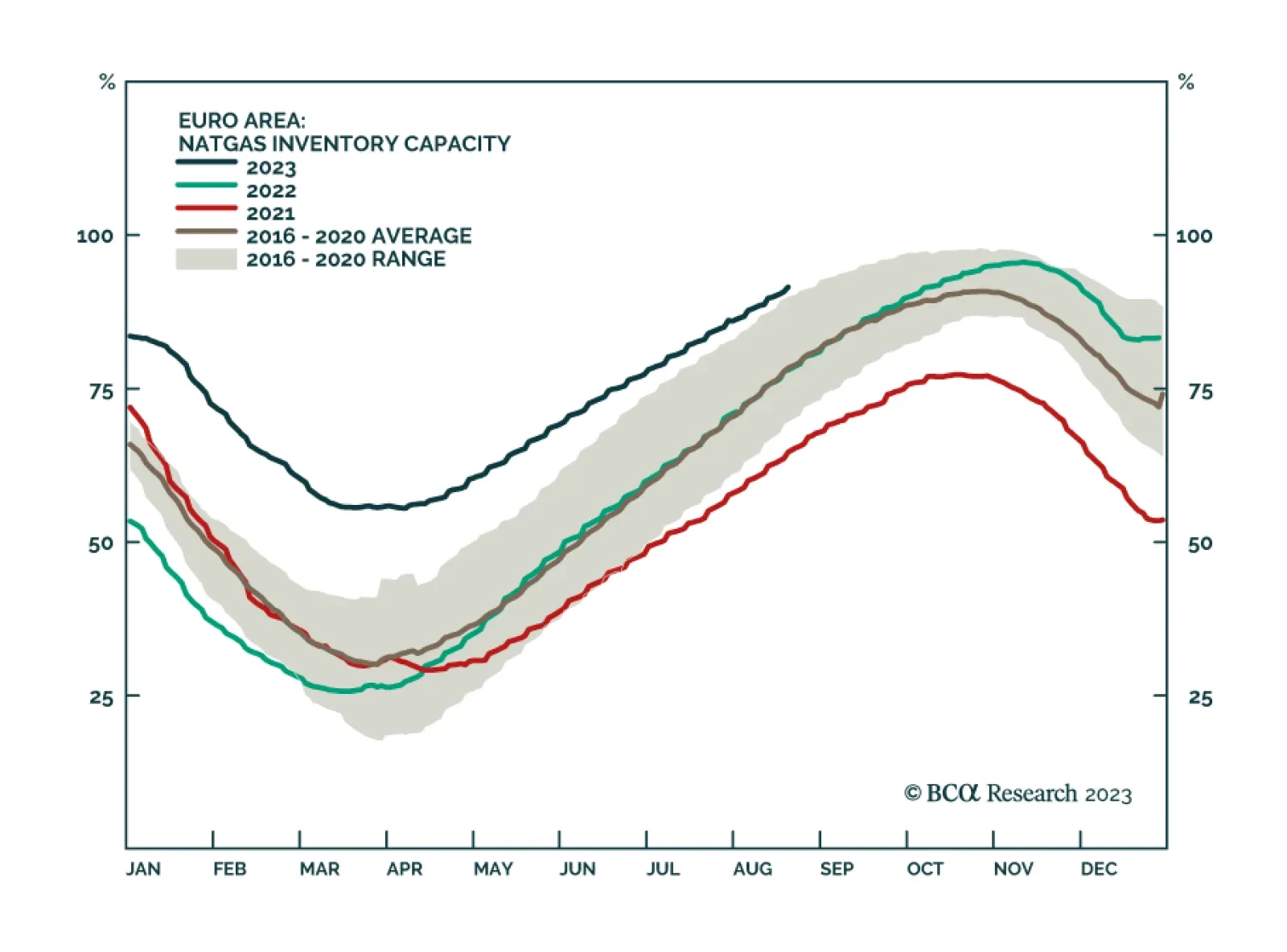

European natural gas prices have recently been trending higher with the Dutch TTF gaining 66% since late July. The proximate cause of the rally is supply concerns. The risk of strikes at Australian LNG plants are a threat to the…

The Reserve Bank of Australia kept interest rates on hold at 4.1% on Tuesday, surprising expectations of a 25bps increase. Governor Philip Lowe’s statement underscores that the decision “will provide further time…

The DXY will continue to have near-term upside, as economic growth holds up in the US, while it deteriorates in other parts of the world. Remain constructive on the DXY at current levels, but pivot to a short position on evidence US…