Cryptocurrencies tumbled on Friday following the PBoC’s announcement that it will consider all crypto-related transactions – including services provided by off-shore exchanges – as illicit financial activity. This follows a…

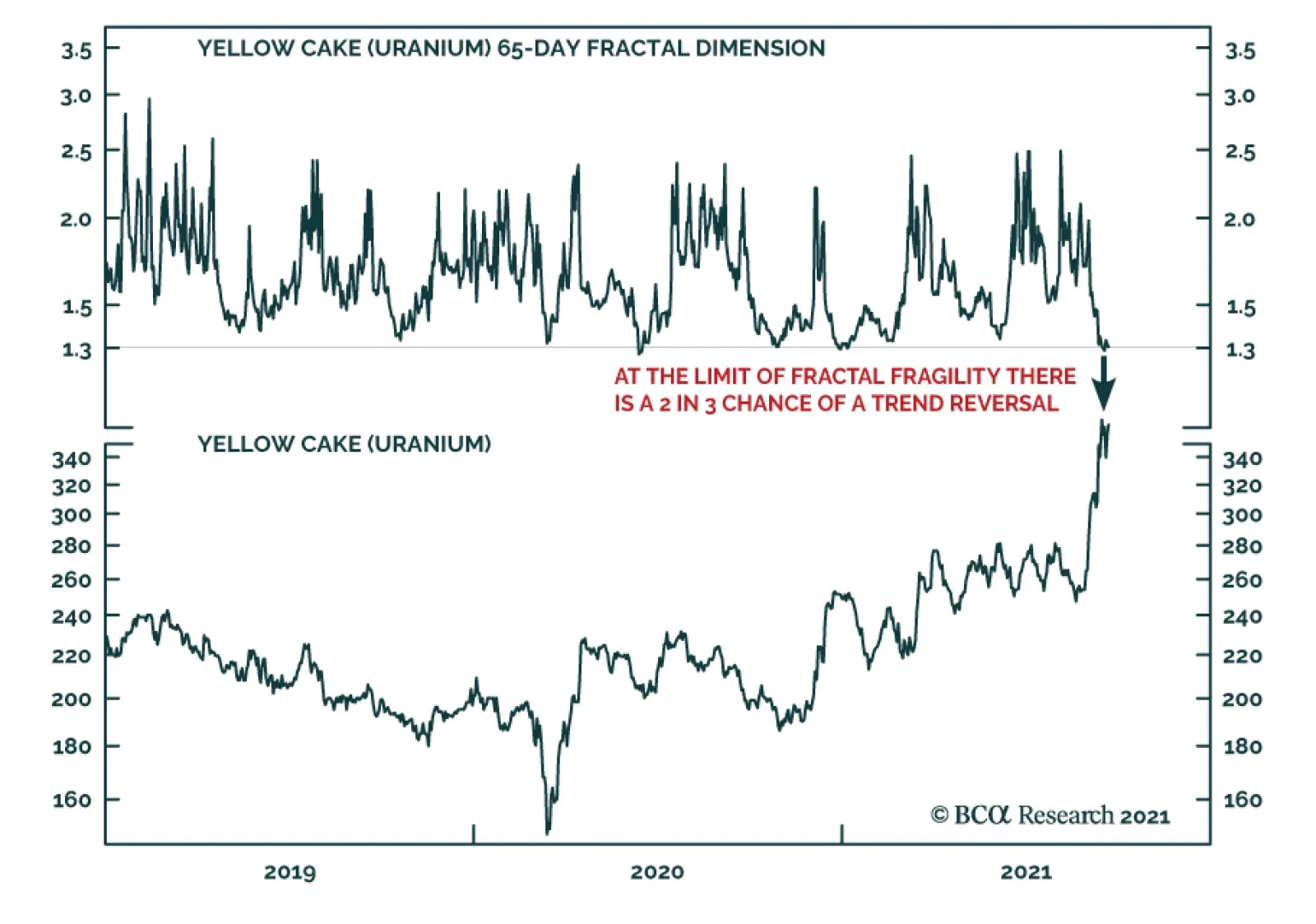

BCA Research’s Counterpoint service’s favored trade this week is to short the rally in uranium plays. The recent near-vertical ascent in uranium plays have left many investors scratching their heads and wondering: what’s going…

Highlights The sharp drop in Chinese lending over the past year is highly likely to weigh on (non-oil) commodity demand and prices through the remainder of 2021. Commodity demand shocks dominate commodity supply shocks. Commodity…

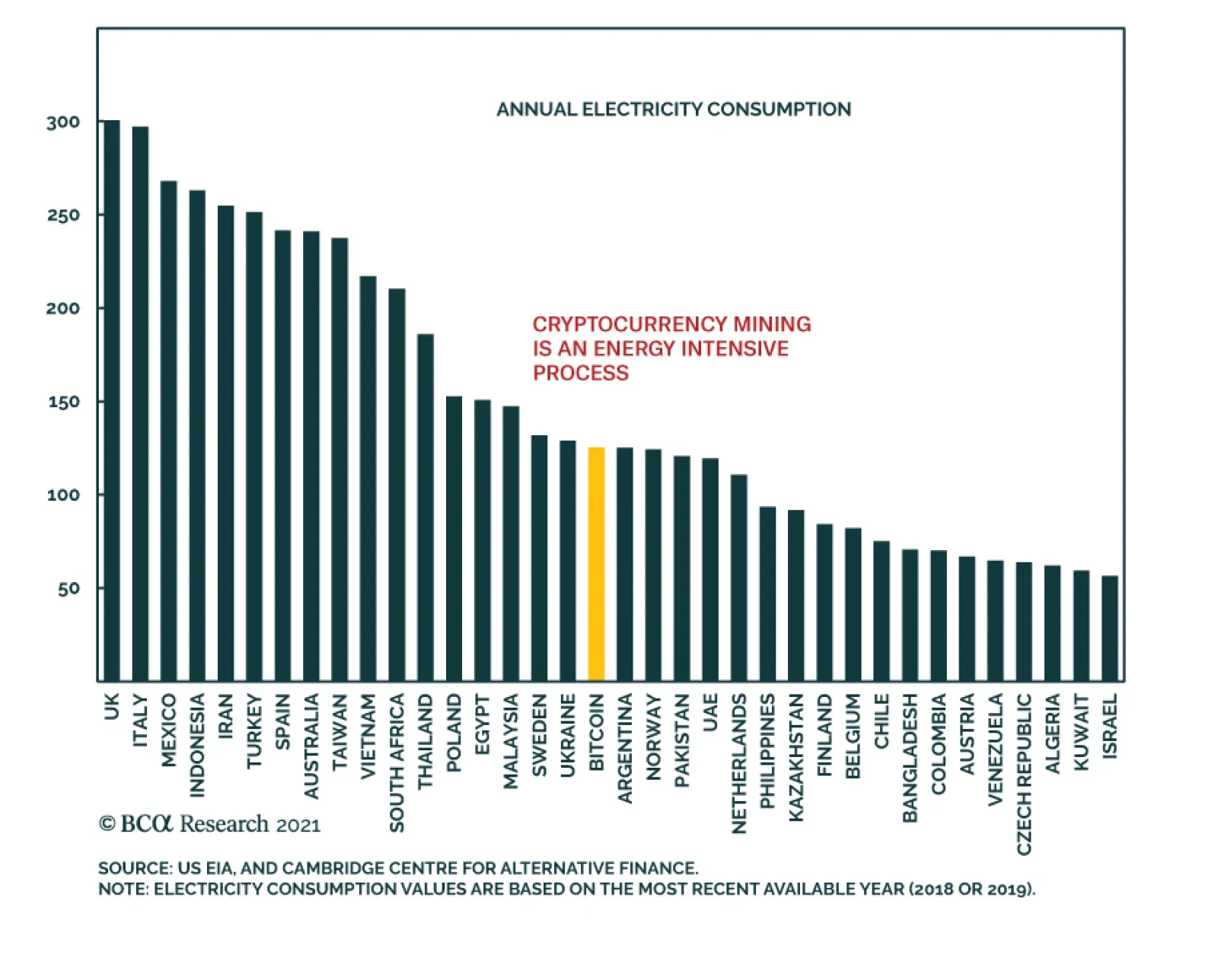

Highlights The drubbing that cryptocurrencies have received over the past two weeks is just a taste of things to come. Crypto markets will continue to face tighter regulation, as this week’s announcements from China and the US…

Highlights The US is only one deflationary shock away from a European level of bond yields. On a multi-year horizon, a deflationary shock is a near-certainty. The shock will be deflationary, because even if it starts inflationary, it…

Highlights Massive slack in the US labour market means that the current uplift in US inflation is highly likely to fade by the end of the year. On a long-term horizon, investors should own US T-bonds. Equity investors should fade the…

Highlights On a timeframe of a few years, a net deflationary shock is a near-certainty even if we do not know its precise nature or its precise timing. Hence, investors must build such a deflationary shock or shocks into their long-…