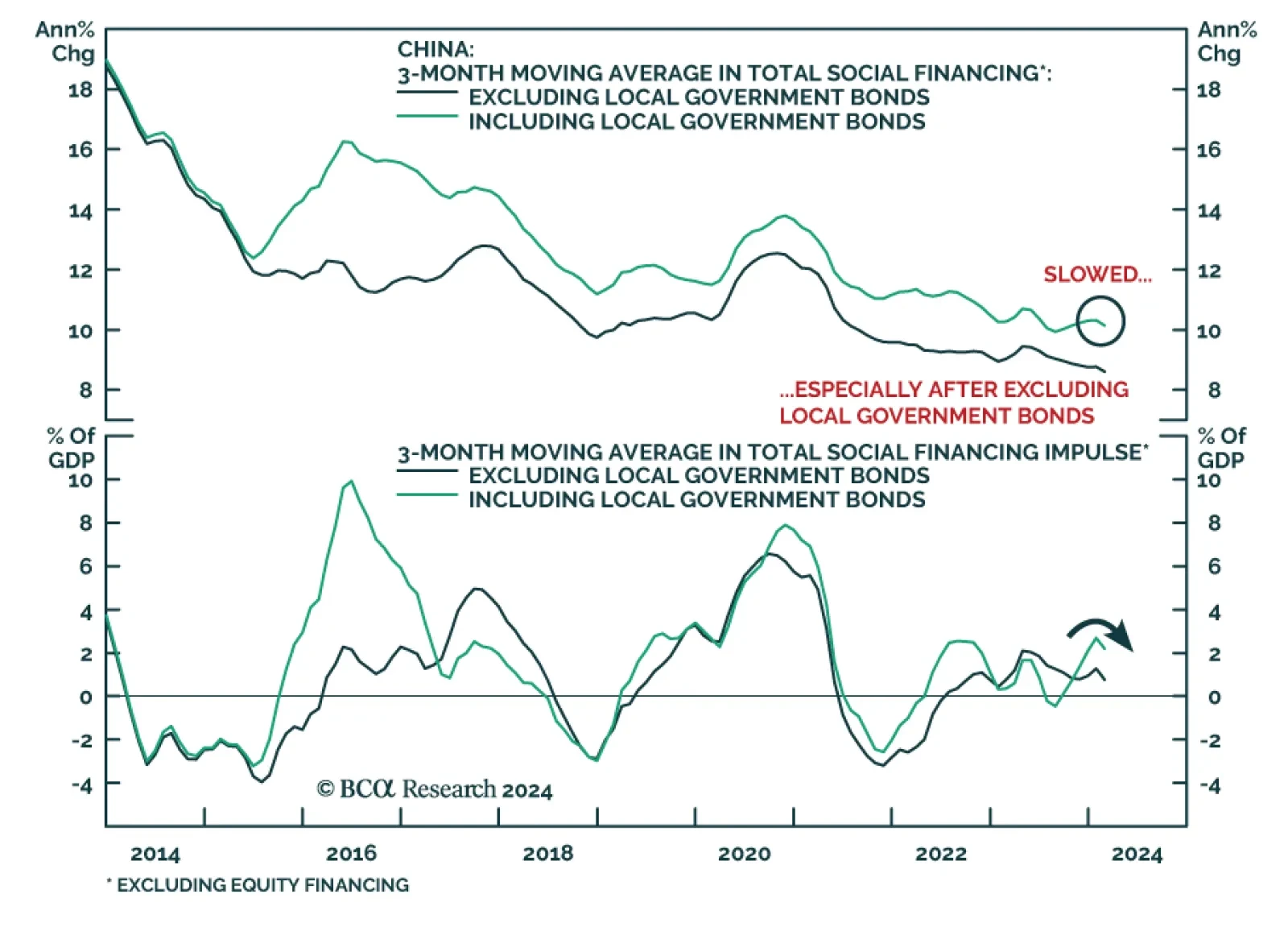

Chinese private sector credit demand remained weak in February, sending a negative signal about domestic economic conditions. Total social financing growth slowed from a record CNY6.5 trillion in January to CNY1.56 trillion,…

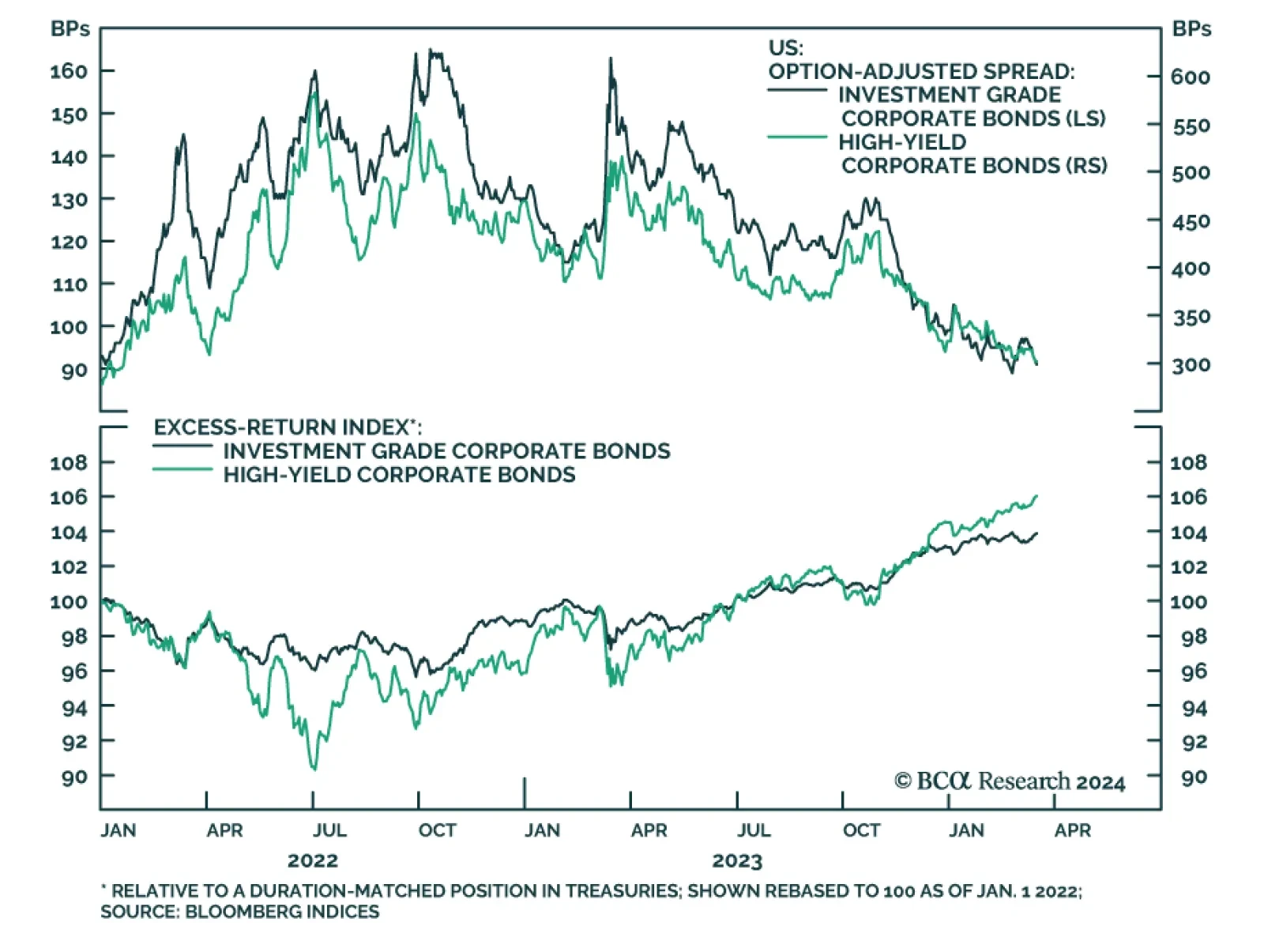

US Investment grade and high yield spreads have tightened 39 and 133 bps since their October 2023 highs, resulting in the outperformance of both fixed income sectors relative to equivalent-duration Treasuries. Still robust…

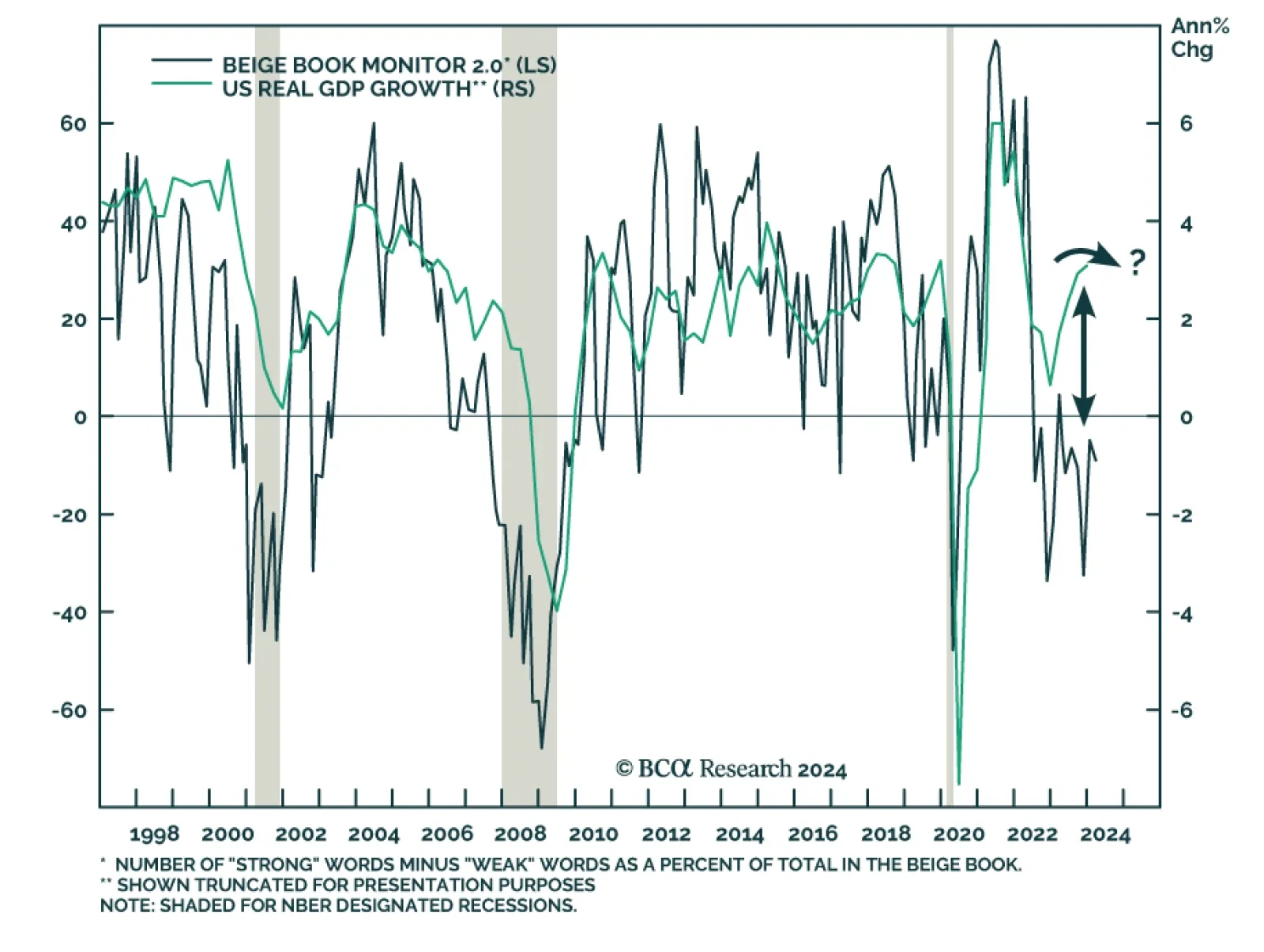

Our US Beige Book monitor – which we use to gauge changes in the language of the Fed’s report – continues to signal lackluster US economic conditions. Historically, the monitor has closely tracked real GDP…

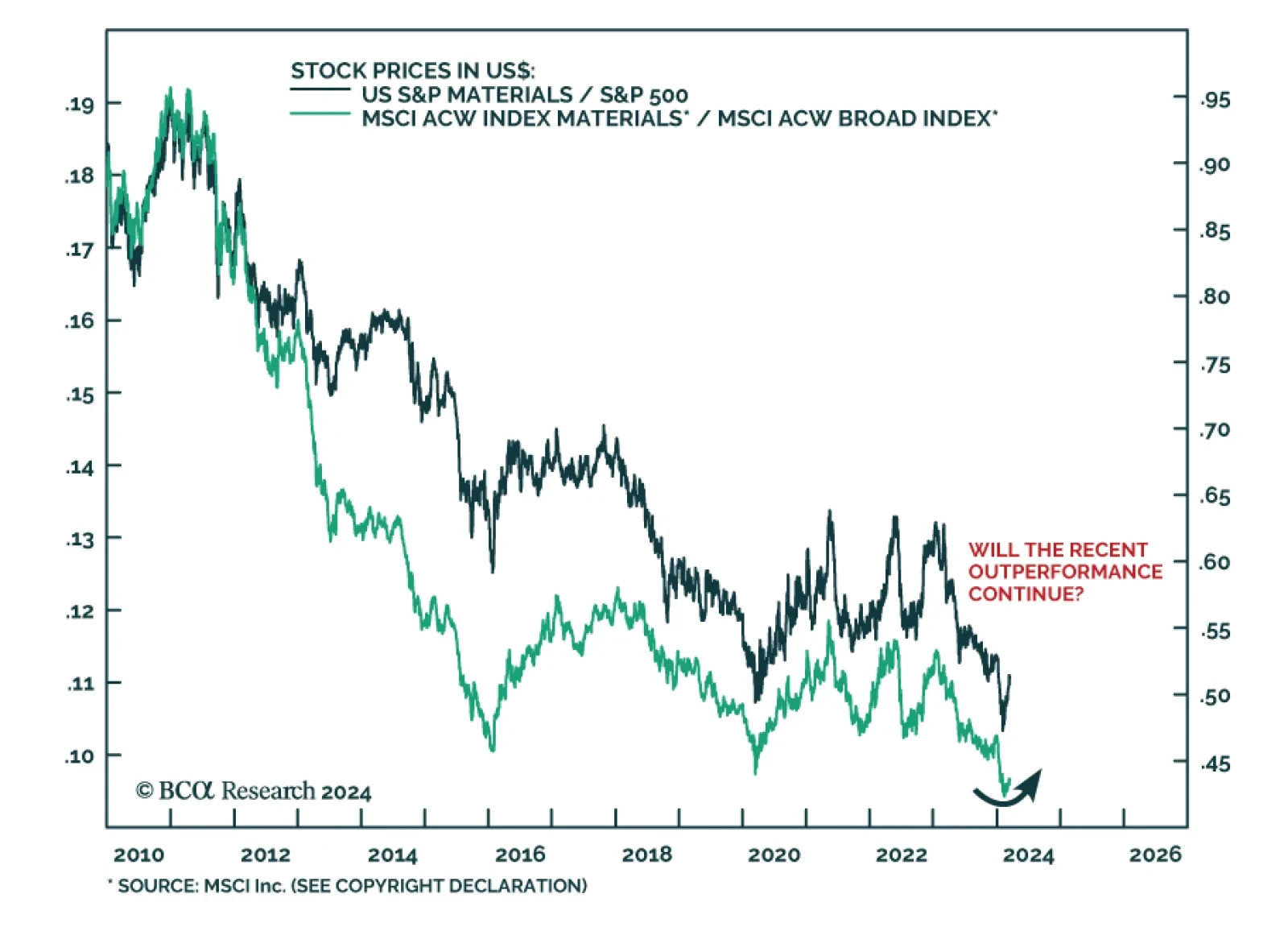

As we highlighted in a recent Insight, dynamics have shifted beneath the surface of the S&P 500. The Materials sector has been rallying sharply since the end of January, gaining 9.9% over this period and taking the top spot…

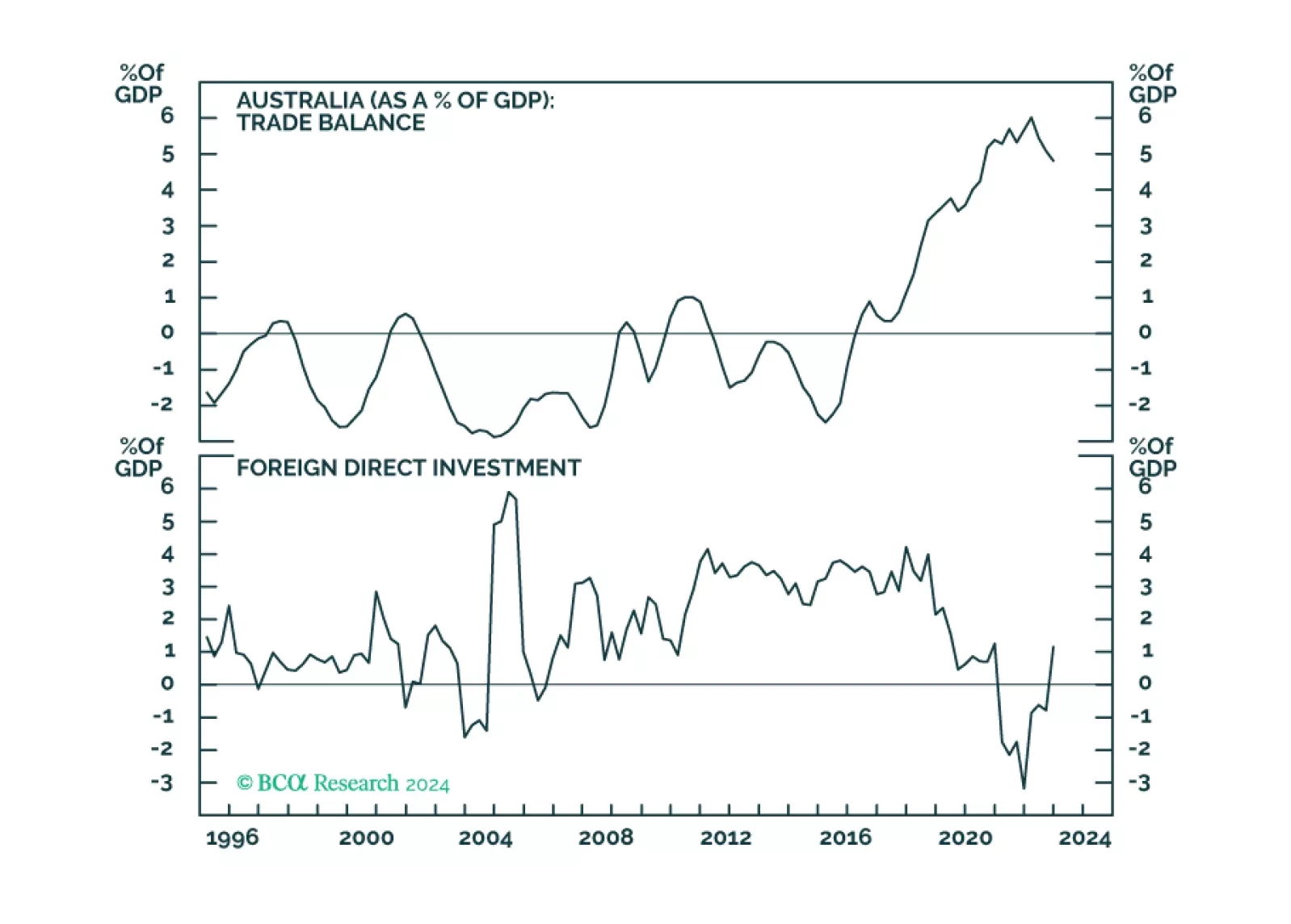

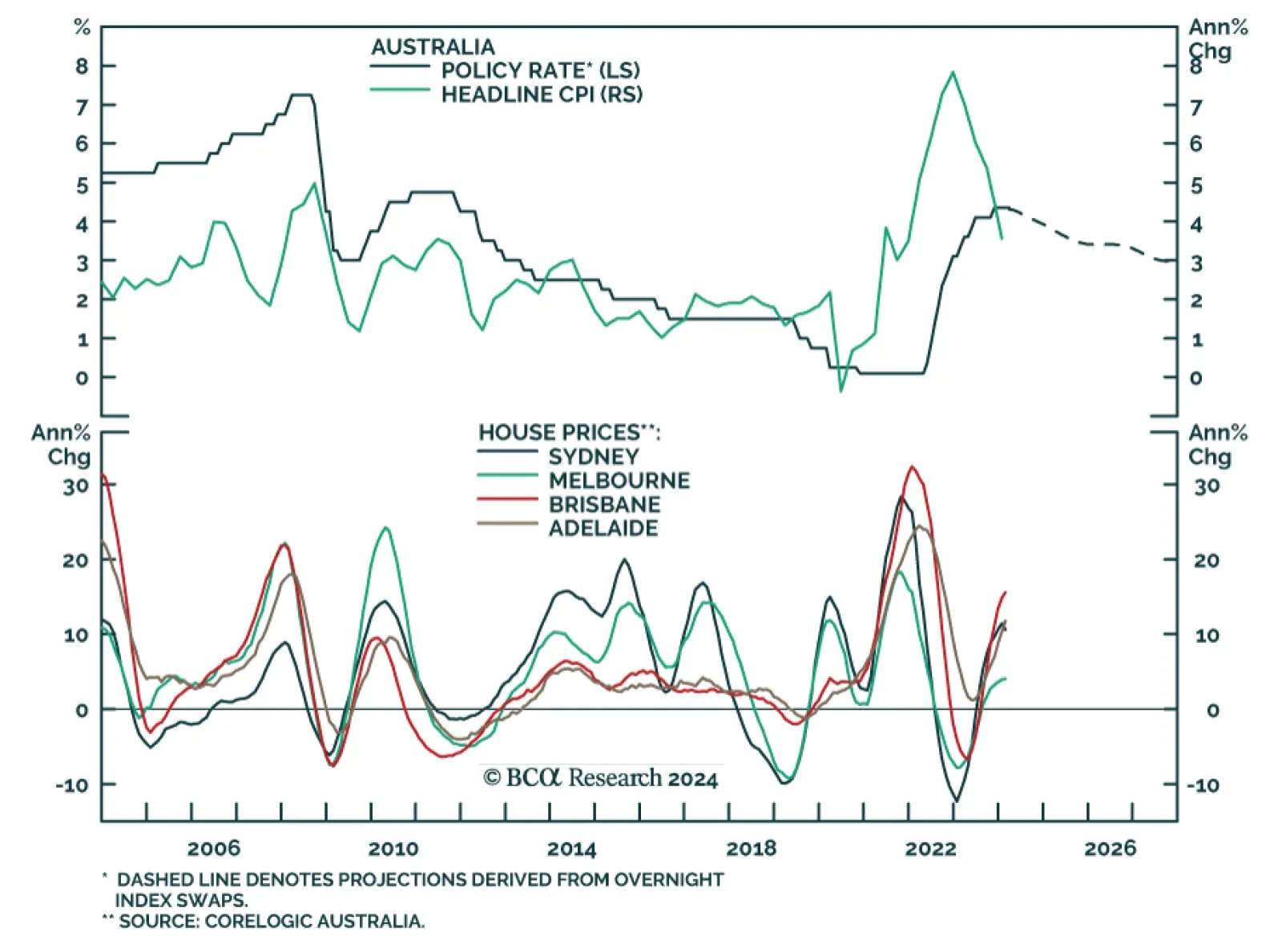

According to BCA Research’s Foreign Exchange Strategy service, Australia’s macroeconomic environment validates a long AUD position, especially at the crosses. The market expects that the RBA will cut interest rates…

In this Insight, we revisit our long AUD trades, after the upgrade from our attractiveness ranking last week.

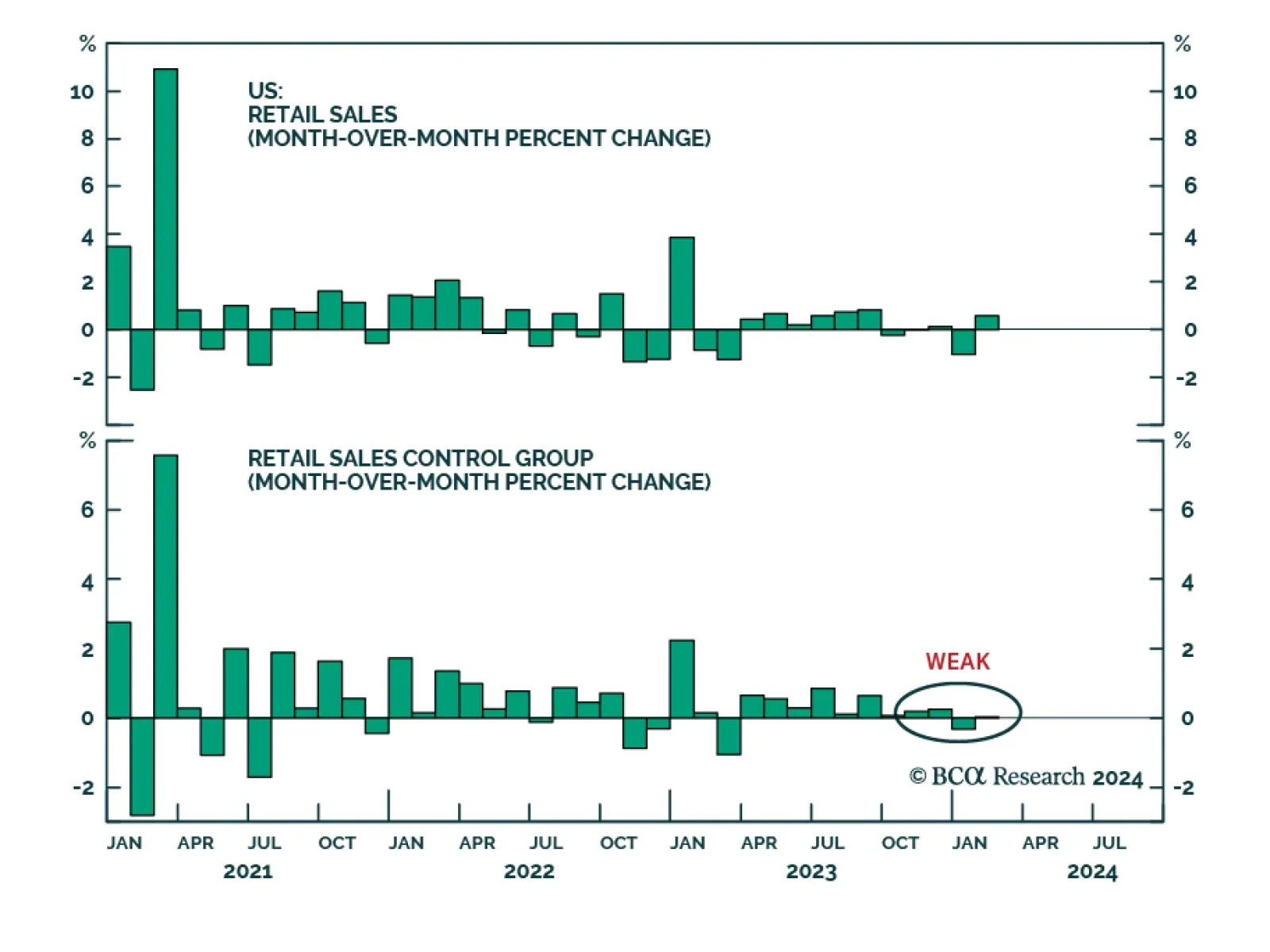

The US retail sales report for February delivered a disappointing signal on Thursday. Although retail sales returned to expansion, the 0.6% m/m increase fell below anticipations of a 0.8% m/m rise. In addition, the prior month…

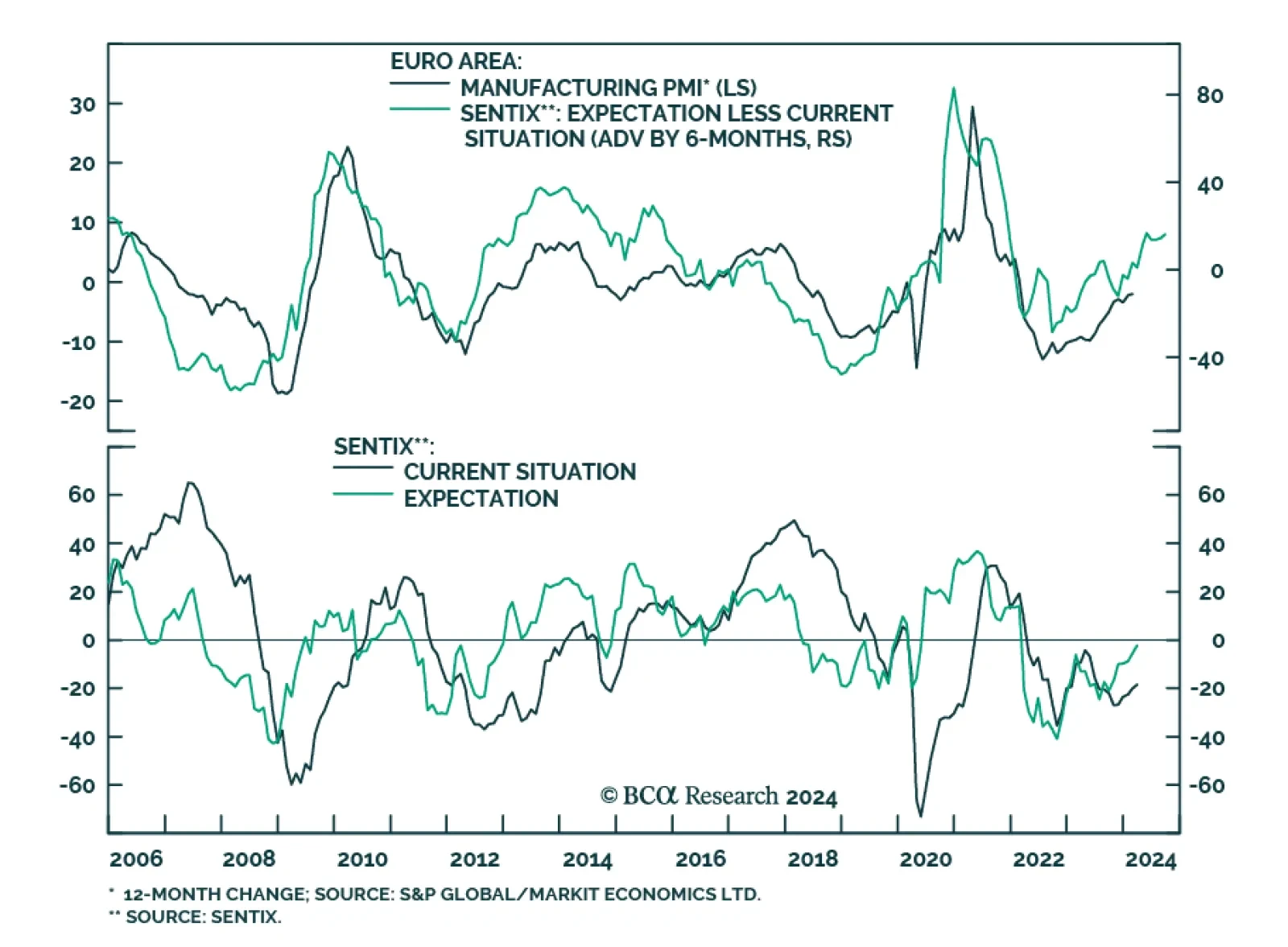

The Eurozone Sentix Economic index improved from -12.9 to -10.5 in March, marking a fifth month of improved sentiment amongst investors and economic agents. Notably, the Expectation subindex rose to a 25-month high of -2.3 from -…

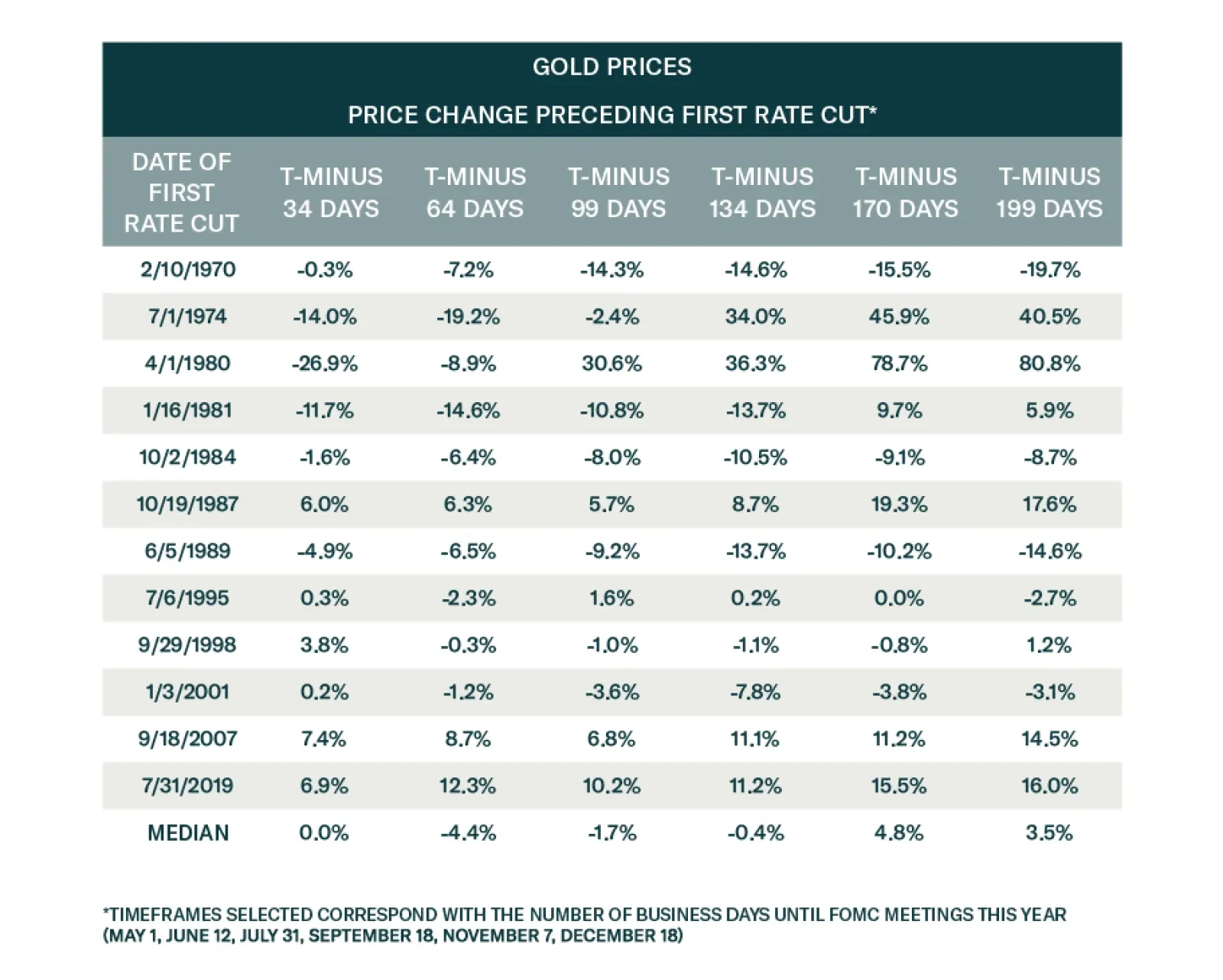

Gold has had a stunning rally over the past few weeks, gaining 9.2% since February 14 and reaching consecutive all-time highs last week before paring back some of its gains. Indeed, the drivers of gold have moved in a bullish…