In a recent Insight we highlighted that the GDP tracking indicators produced by regional Fed banks are sending different signals about economic conditions in the US. While the Atlanta Fed’s GDPNow model suggests Q3 growth…

Last week, the Federal Reserve signaled that it expects to deliver one last rate hike this year. Similarly, some of its European counterparts signaled that they are at or close to the end of their hiking cycles. Where does this…

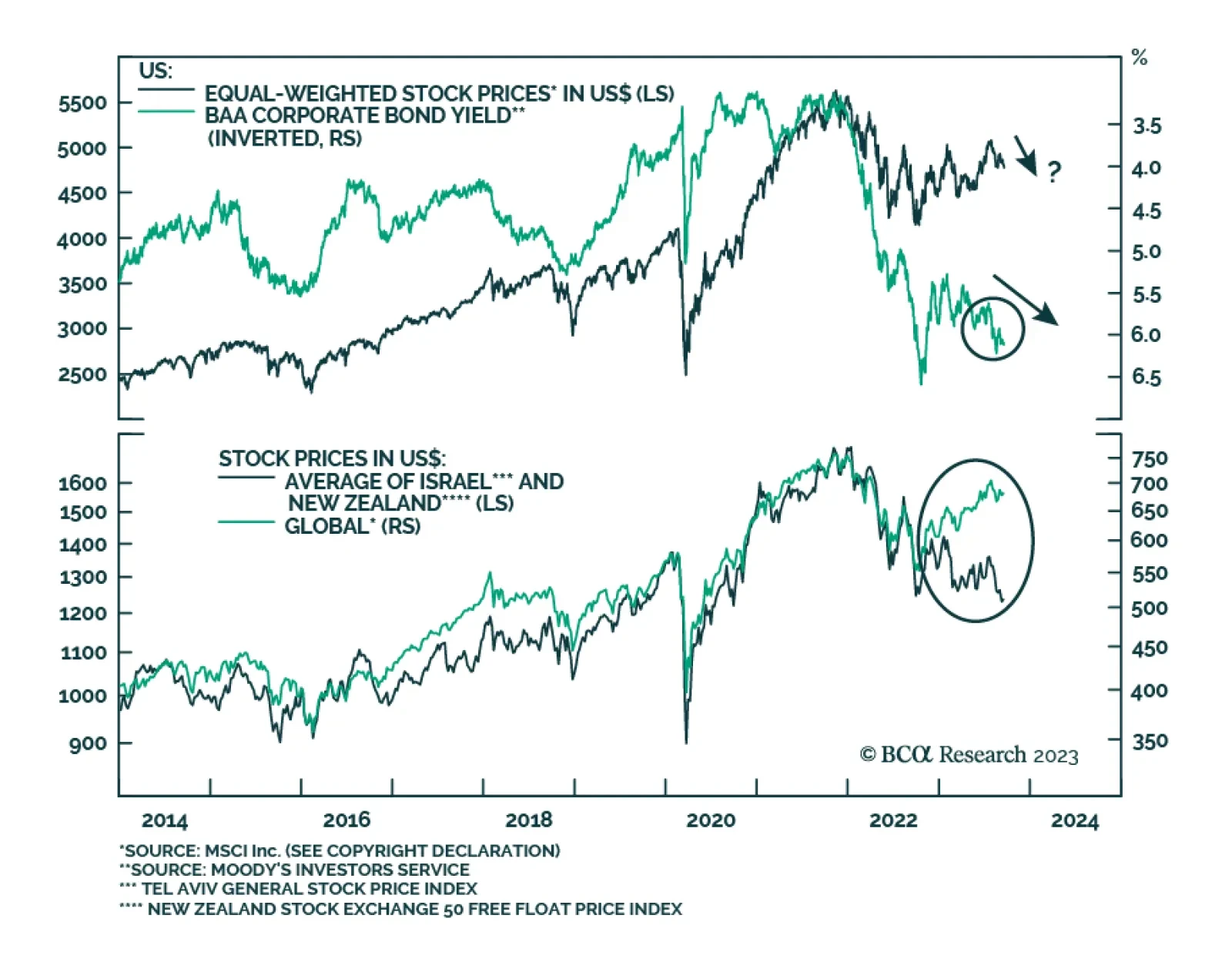

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

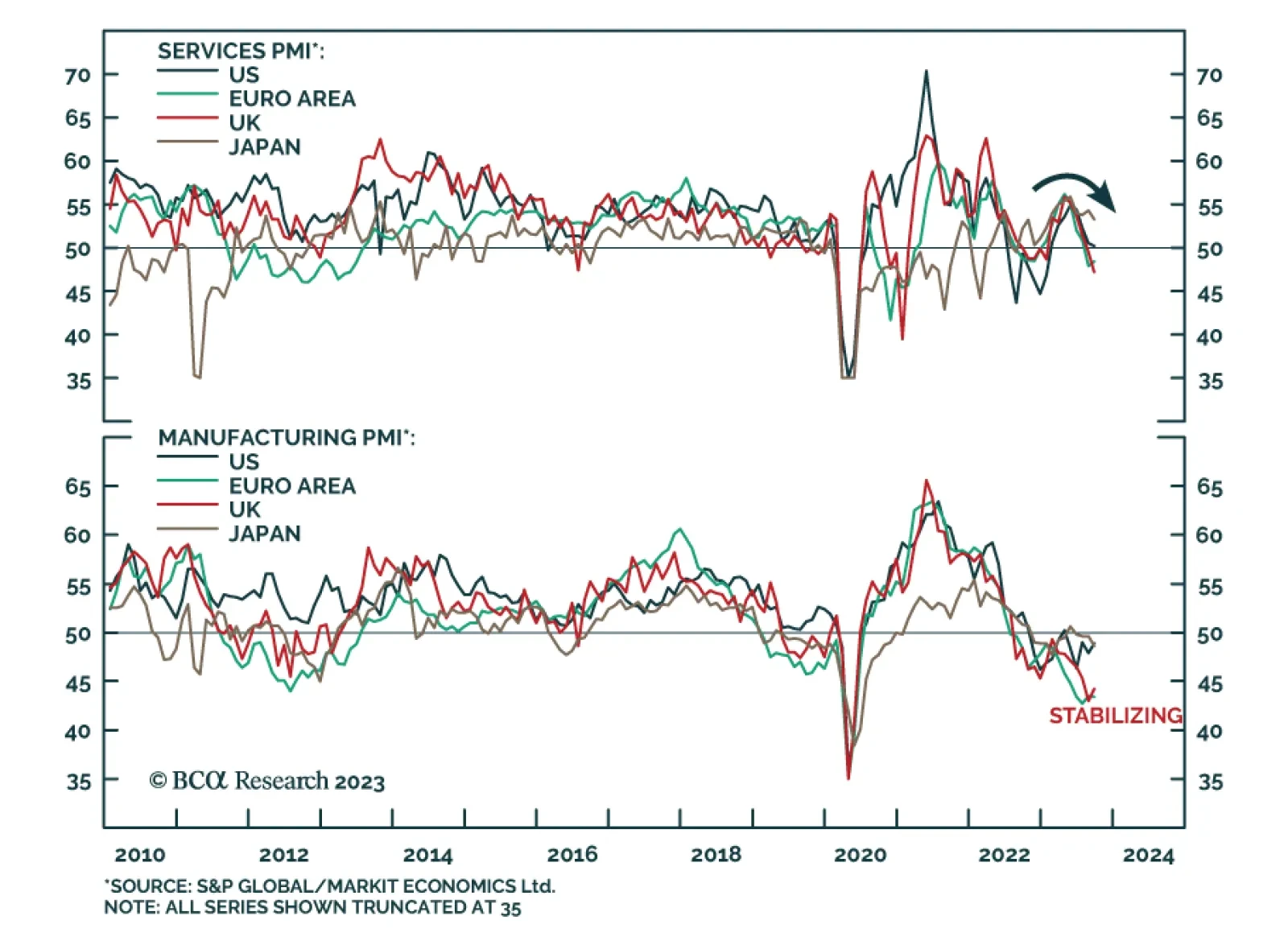

Flash PMIs suggests that the tailwind to services from pent-up demand during the pandemic is easing and that although the global manufacturing downturn is bottoming, it is not meaningfully reaccelerating. In the case of the US…

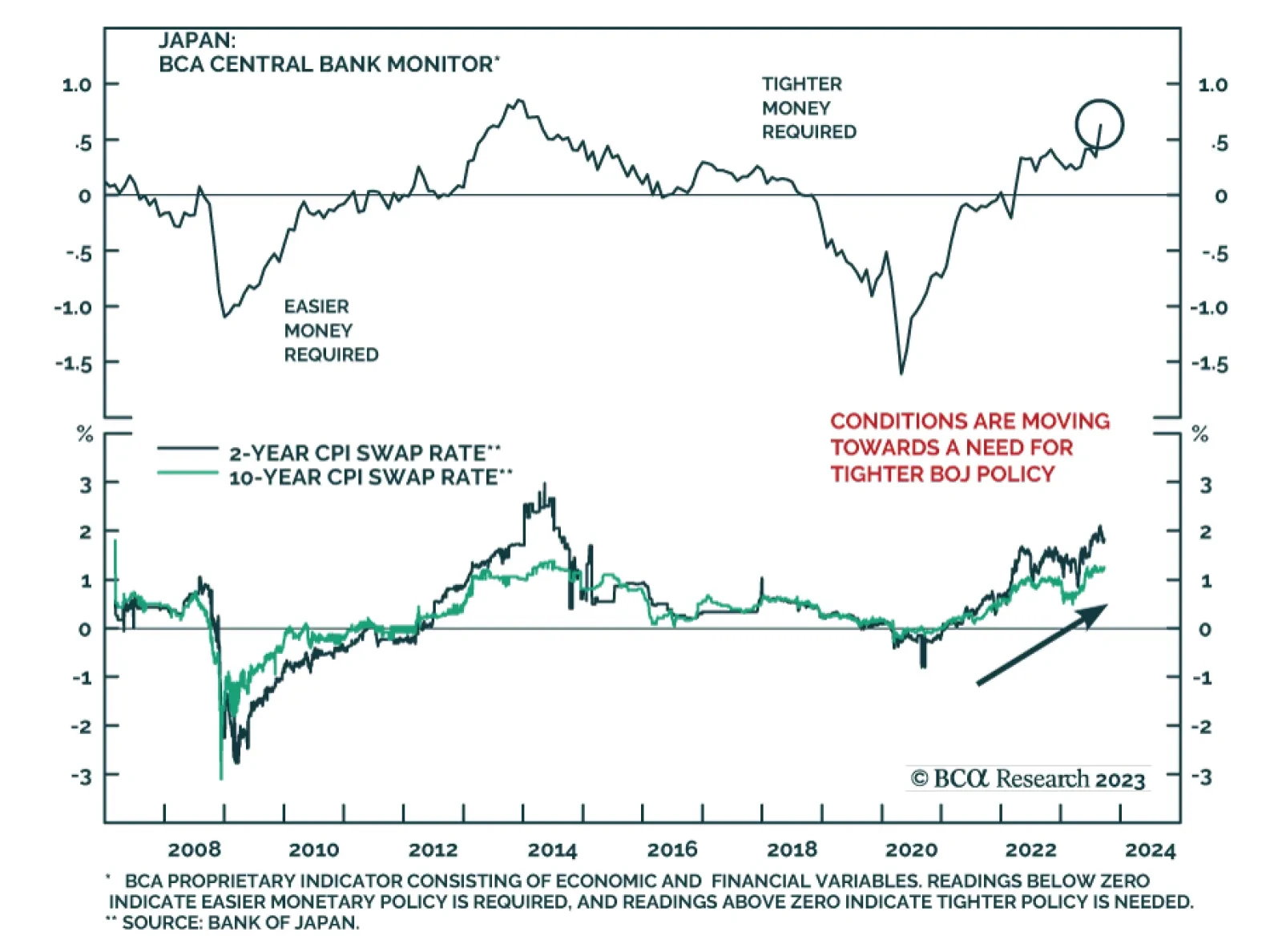

As expected, the Bank of Japan voted unanimously to keep policy unchanged on Friday. The policy rate remains at -0.1% and the central bank maintains Yield Curve Control (YCC) on 10-year JGB yields. To the extent that the BoJ…

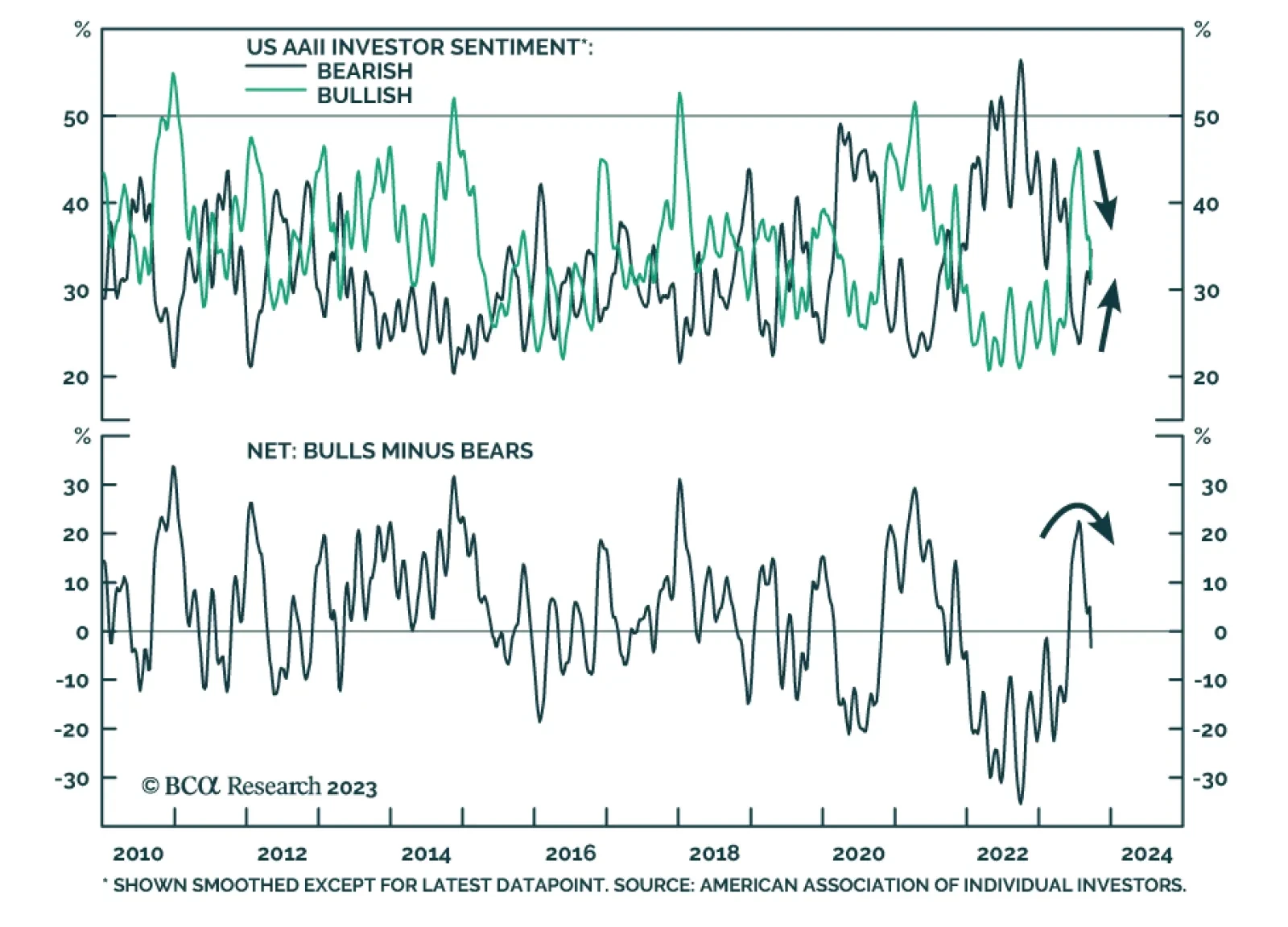

Investor sentiment has turned less optimistic. According to the latest AAII survey, the share of respondents with a bullish outlook has collapsed to 31.3% from its peak of 51.4% two months ago. It is now back down below its…

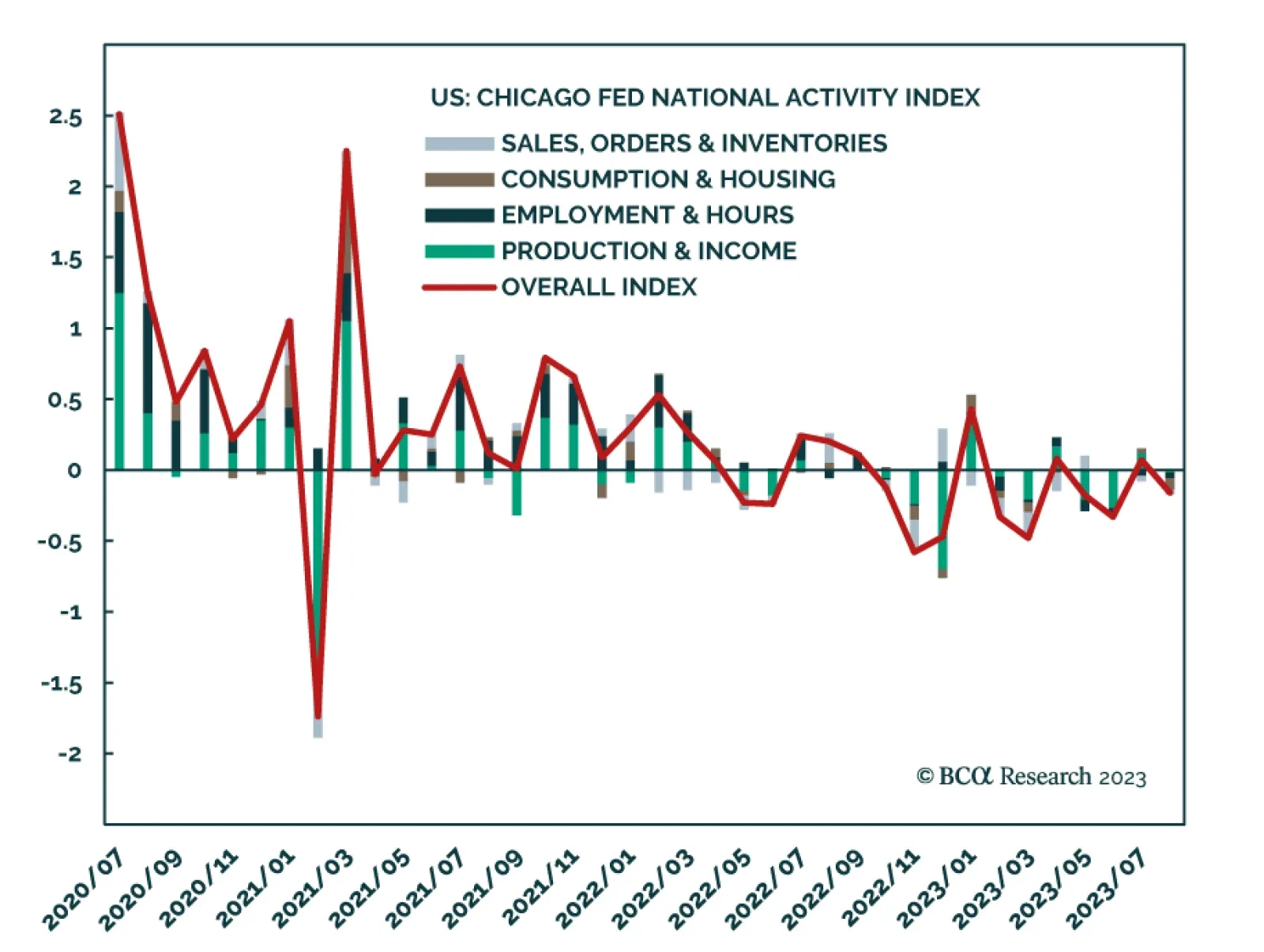

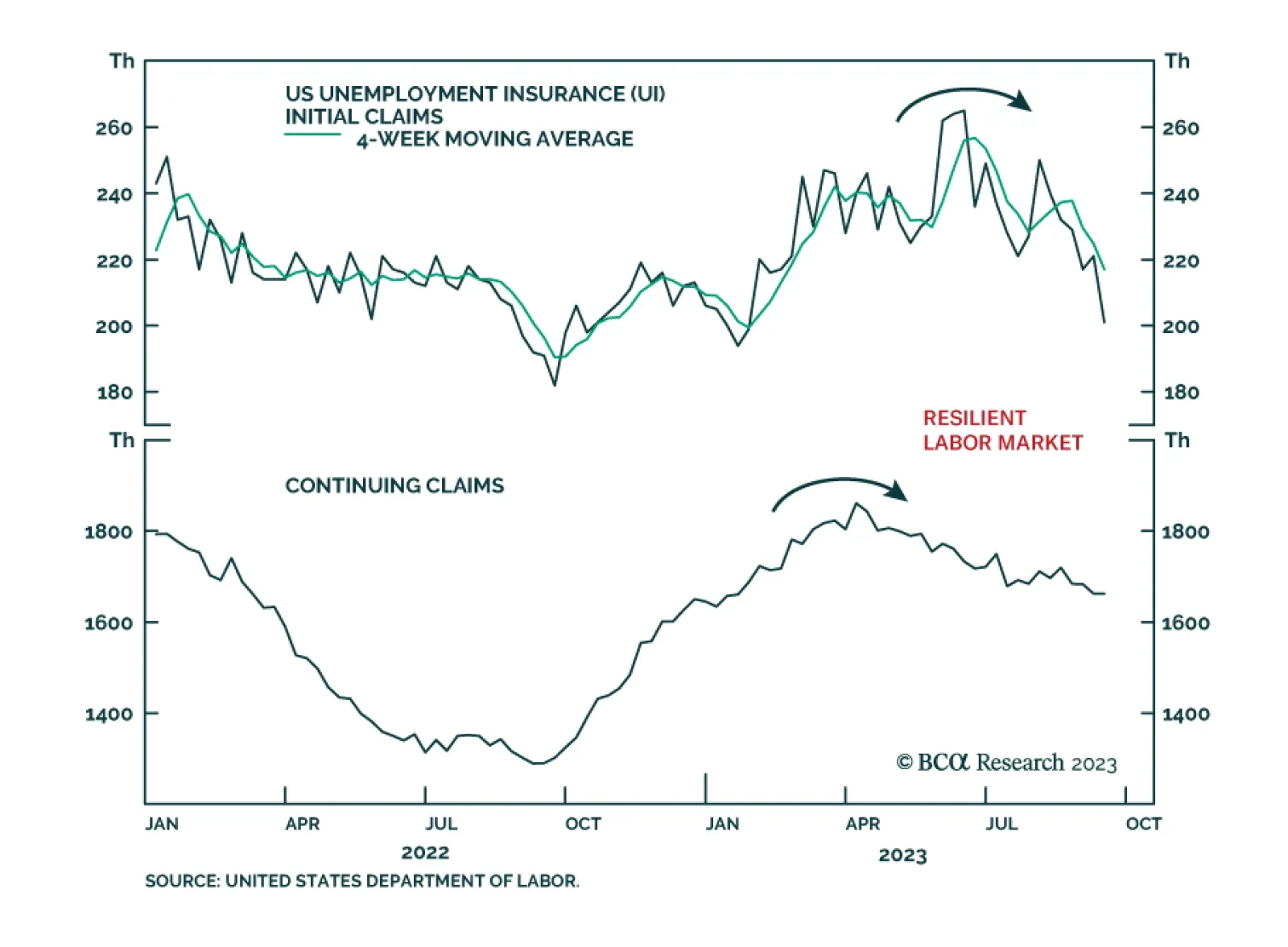

Thursday’s release of US weekly jobless claims and continuing claims delivered a positive surprise about labor market conditions. The decline in initial jobless claims to an eight-month low of 201 thousand came in below…

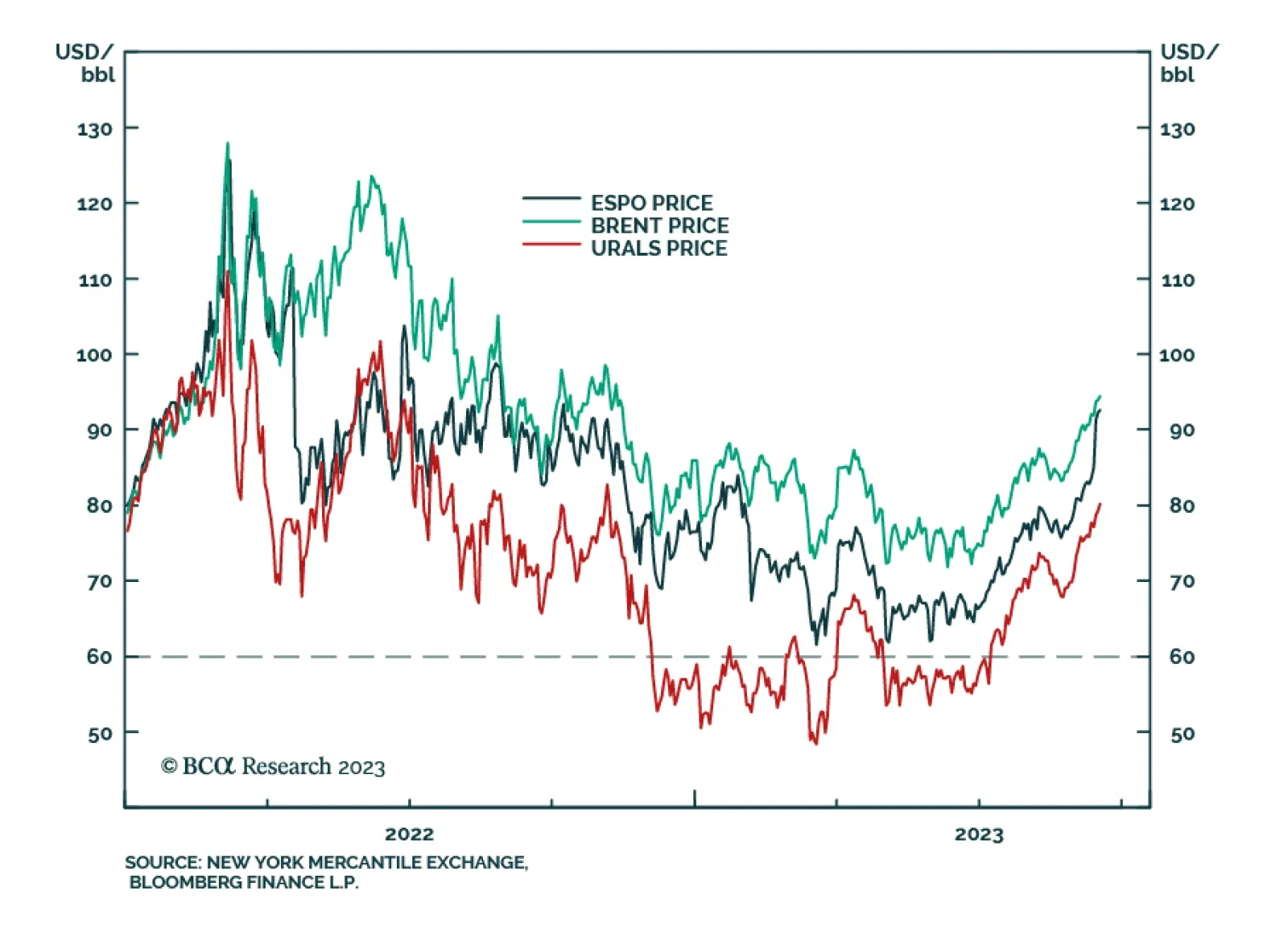

Our Commodity & Energy Strategy colleagues’ once-out-of-consensus call on crude oil prices – i.e., benchmark Brent prices averaging $94/bbl in 2H23 and trading above $100/bbl by December – now is the…

According to BCA Research’s Emerging Markets Strategy service, the combination of rising oil prices, an appreciating US dollar, and mounting US bond yields constitutes a triple whammy for US share prices. One risk that…

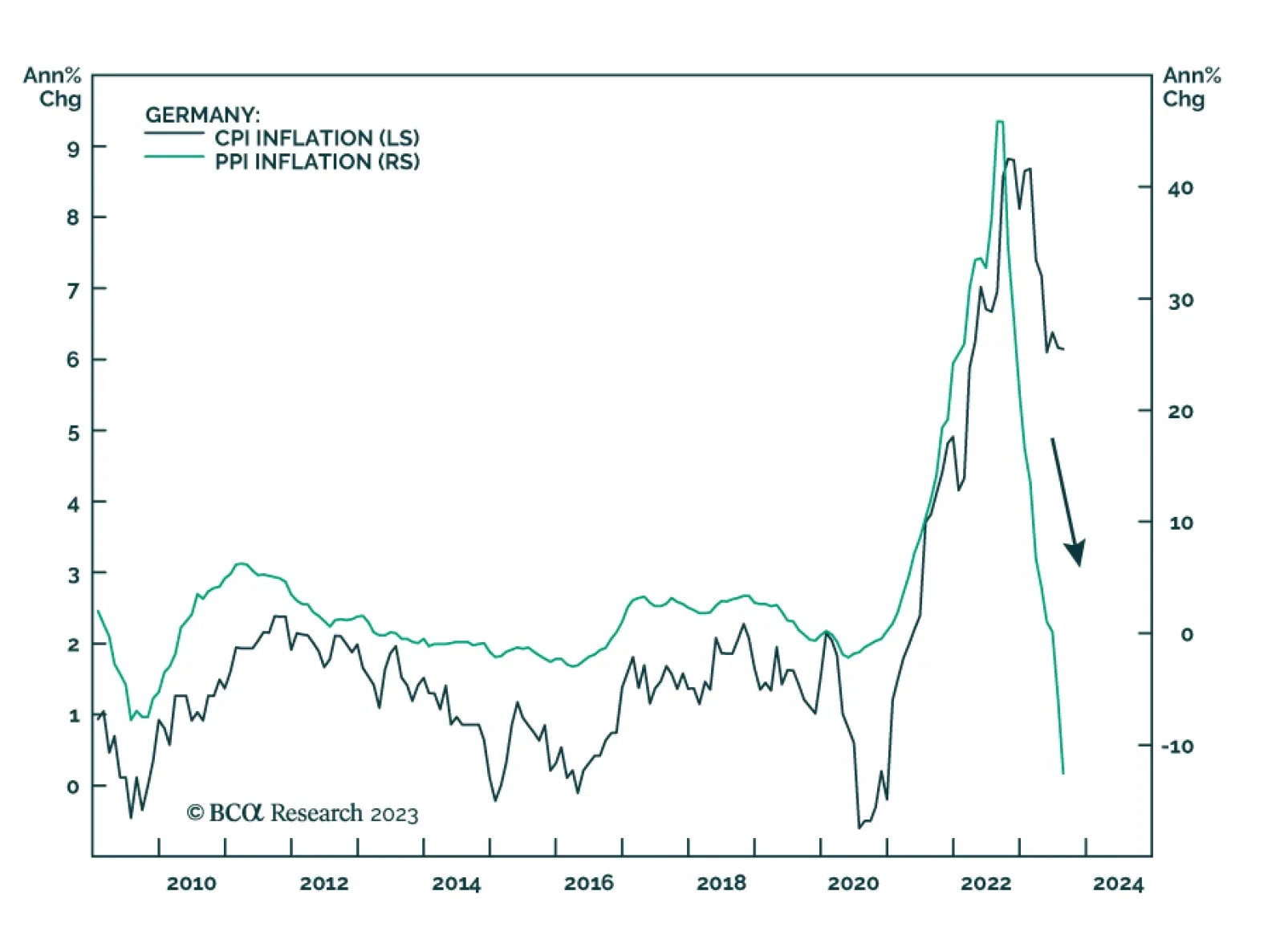

Collapsing German producer prices continue to indicate that inflationary pressures are moderating in the Eurozone. Total PPI declined by a record 12.6% y/y in August following a 6.0% y/y drop in July. While the annual decline…