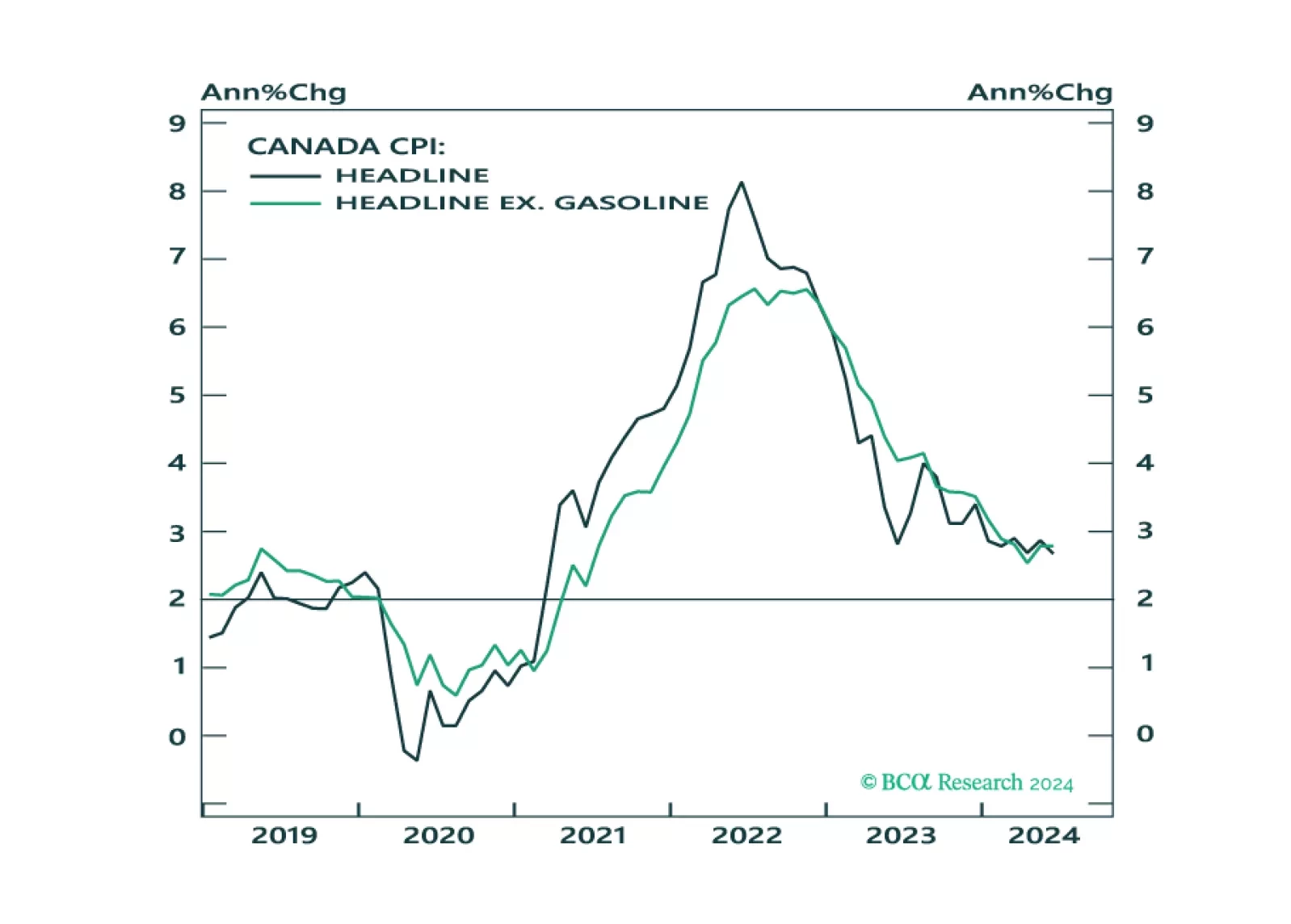

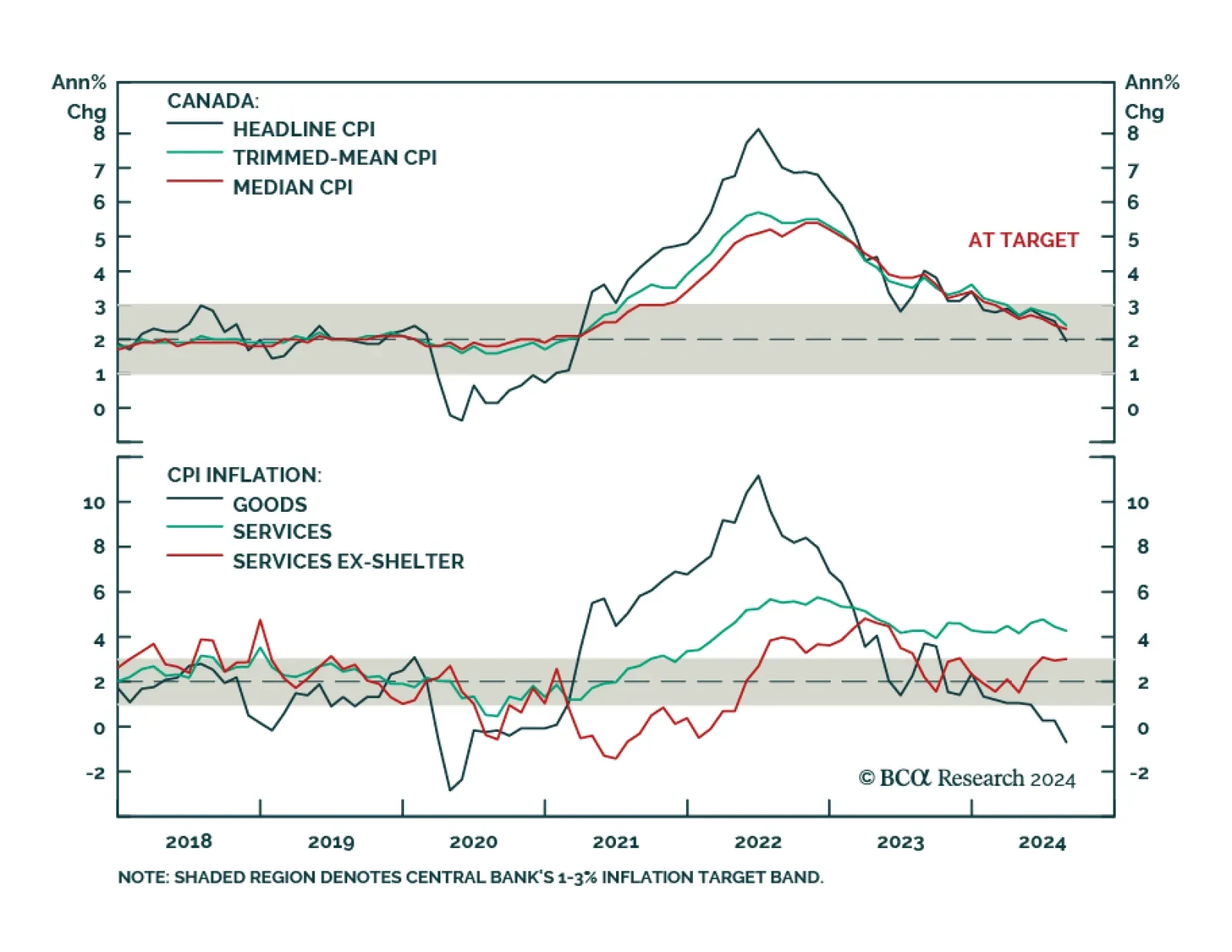

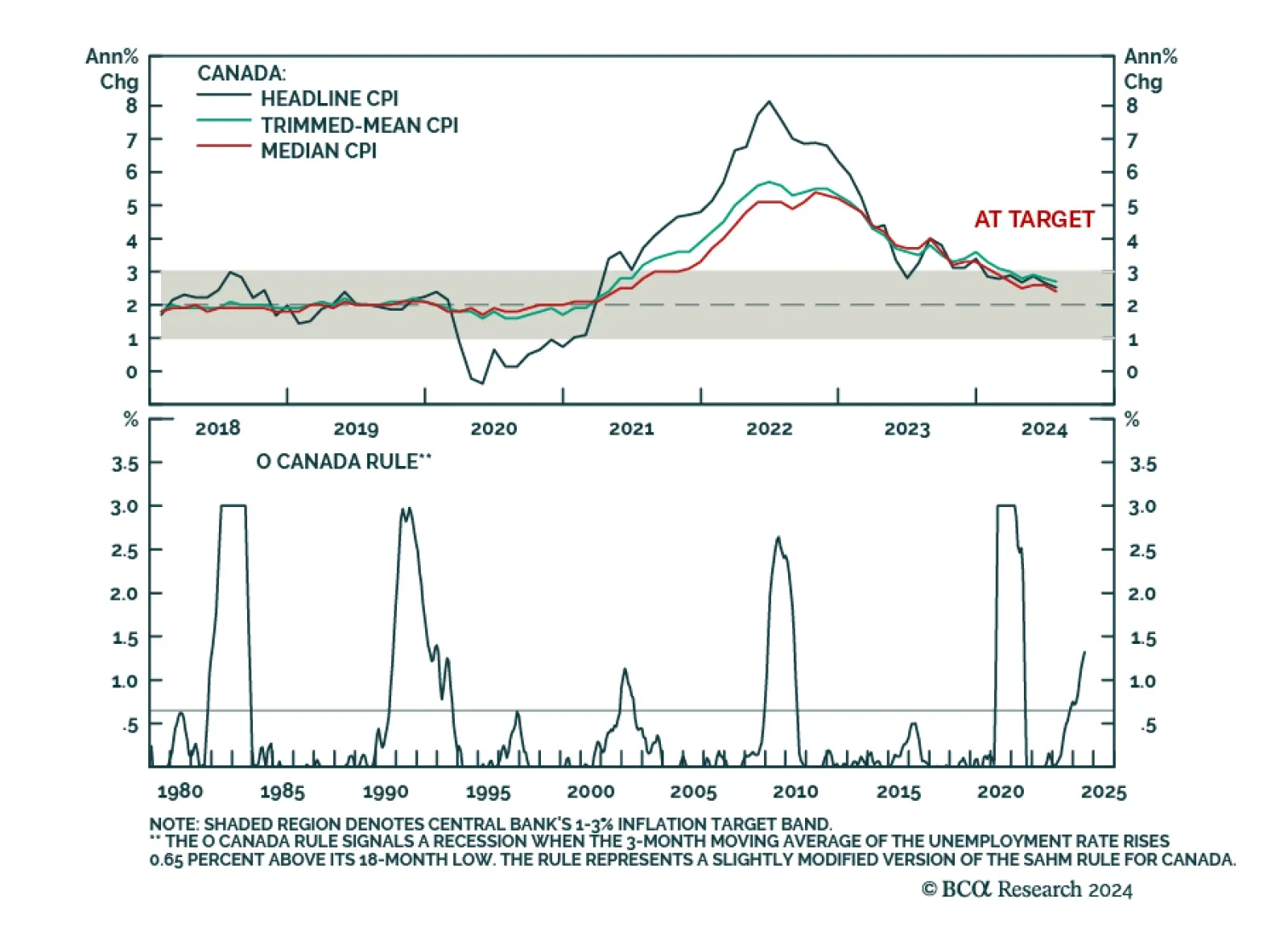

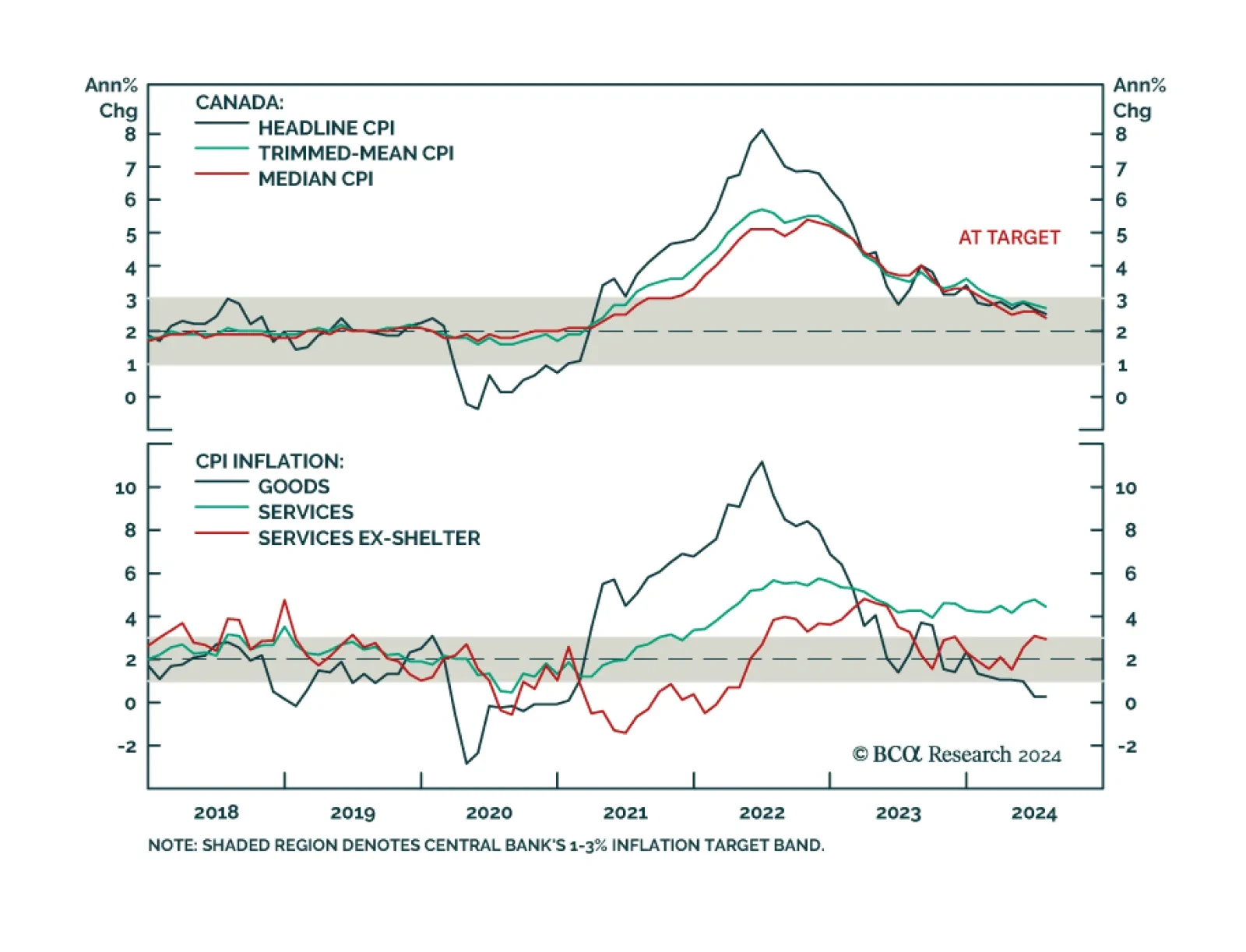

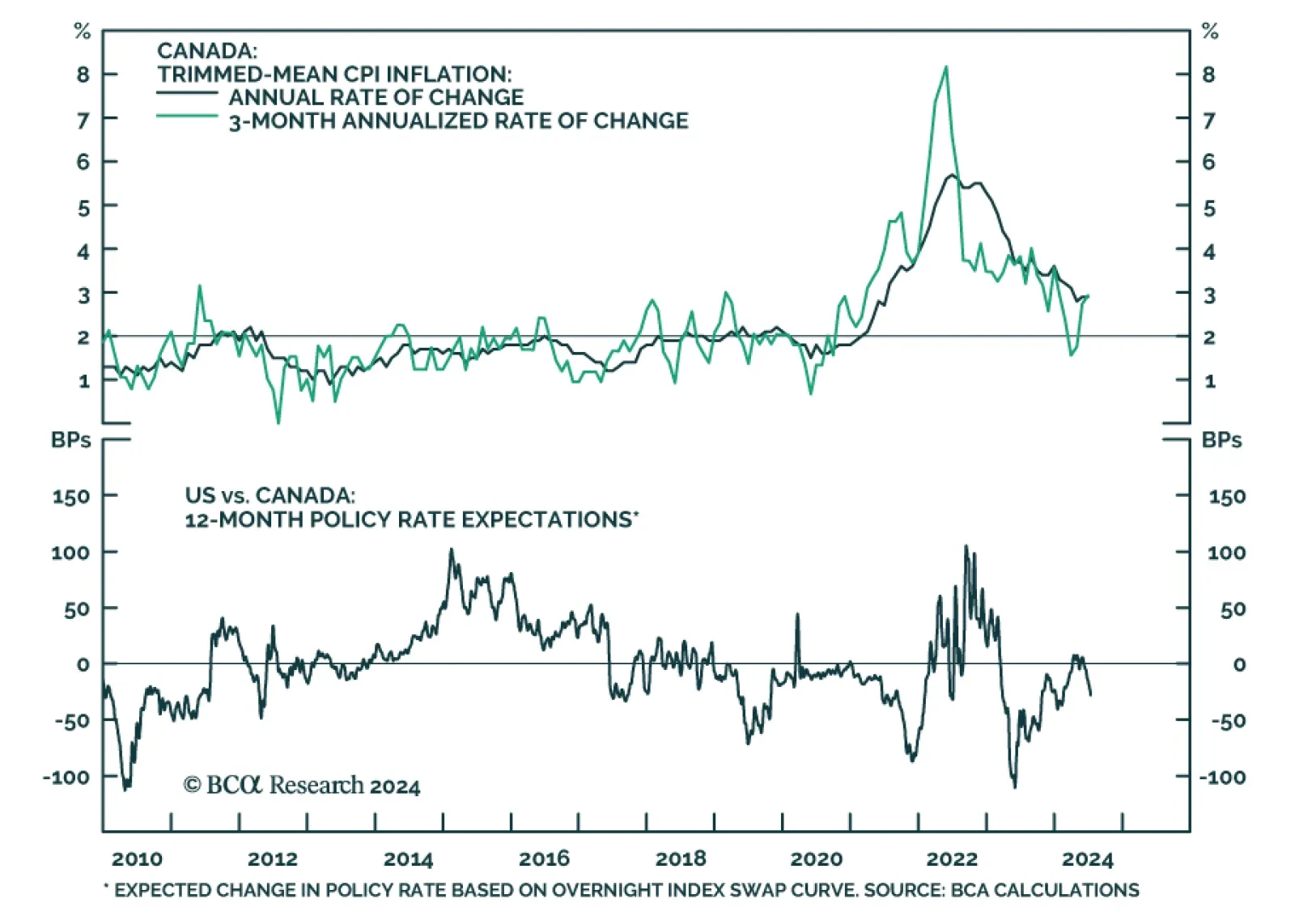

Canadian headline CPI inflation decelerated at a faster-than-anticipated pace from 2.5% y/y to 2.0% in August, the slowest since 2021. Notably, core median and trimmed-mean CPI ticked 0.1 ppt and 0.3 ppt lower to 2.3% and 2.4%,…

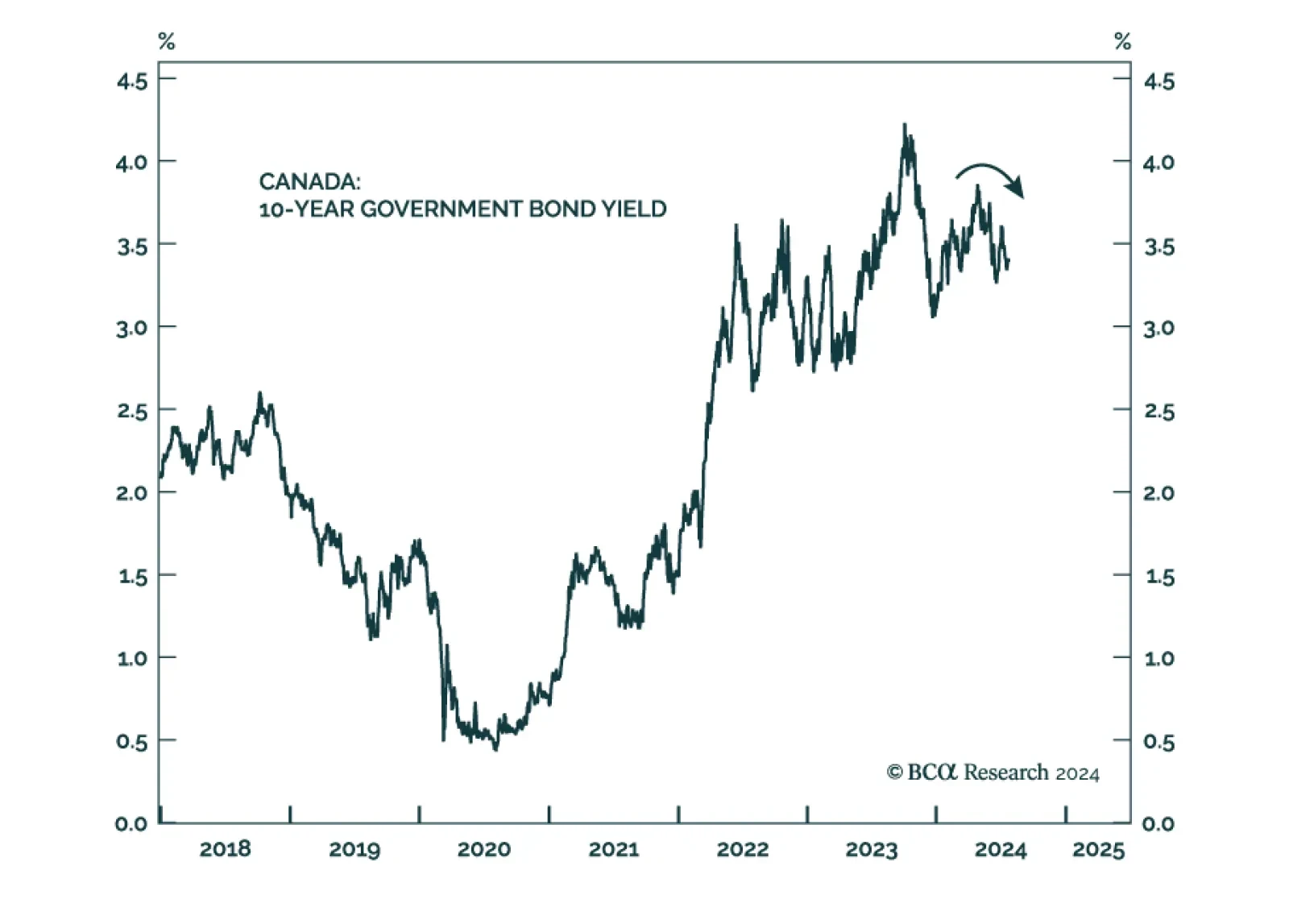

In a widely expected move, the Bank of Canada (BoC) cut interest rates by a quarter of a percentage point for a third consecutive month in September, lowering the benchmark overnight rate to 4.25%. Policymakers also signaled…

Canadian headline CPI decelerated from 2.7% y/y to 2.5% in July, the slowest pace in over 3 years. Notably, core median and trimmed-mean CPI eased further than expected, to 2.4% and 2.7% y/y respectively, 0.1 ppt below…

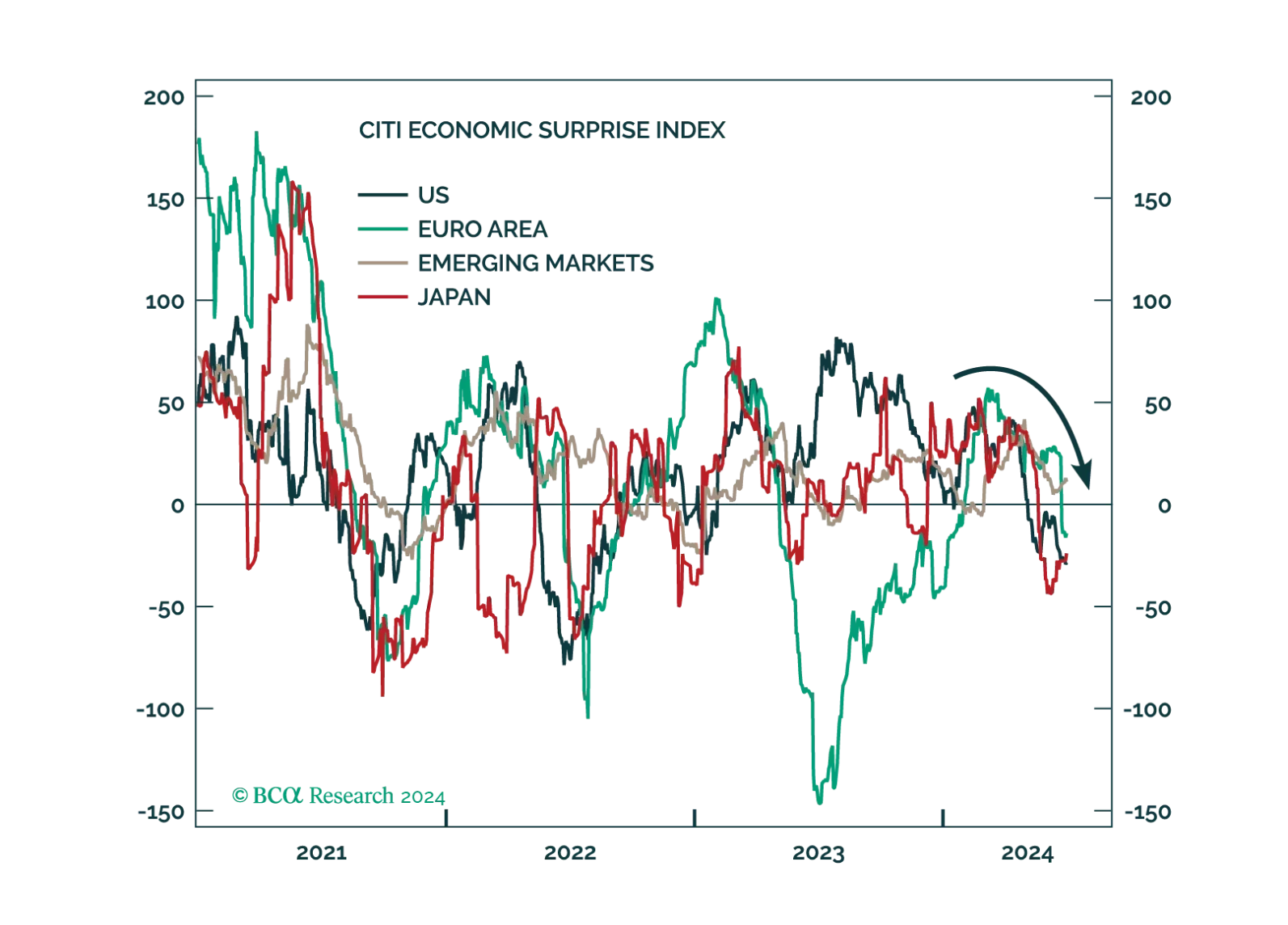

We have high conviction that continued labor market softening will tip the US economy into a recession by year-end or early next year. It will reverberate to the rest of the world given that the US has been the main driver of…

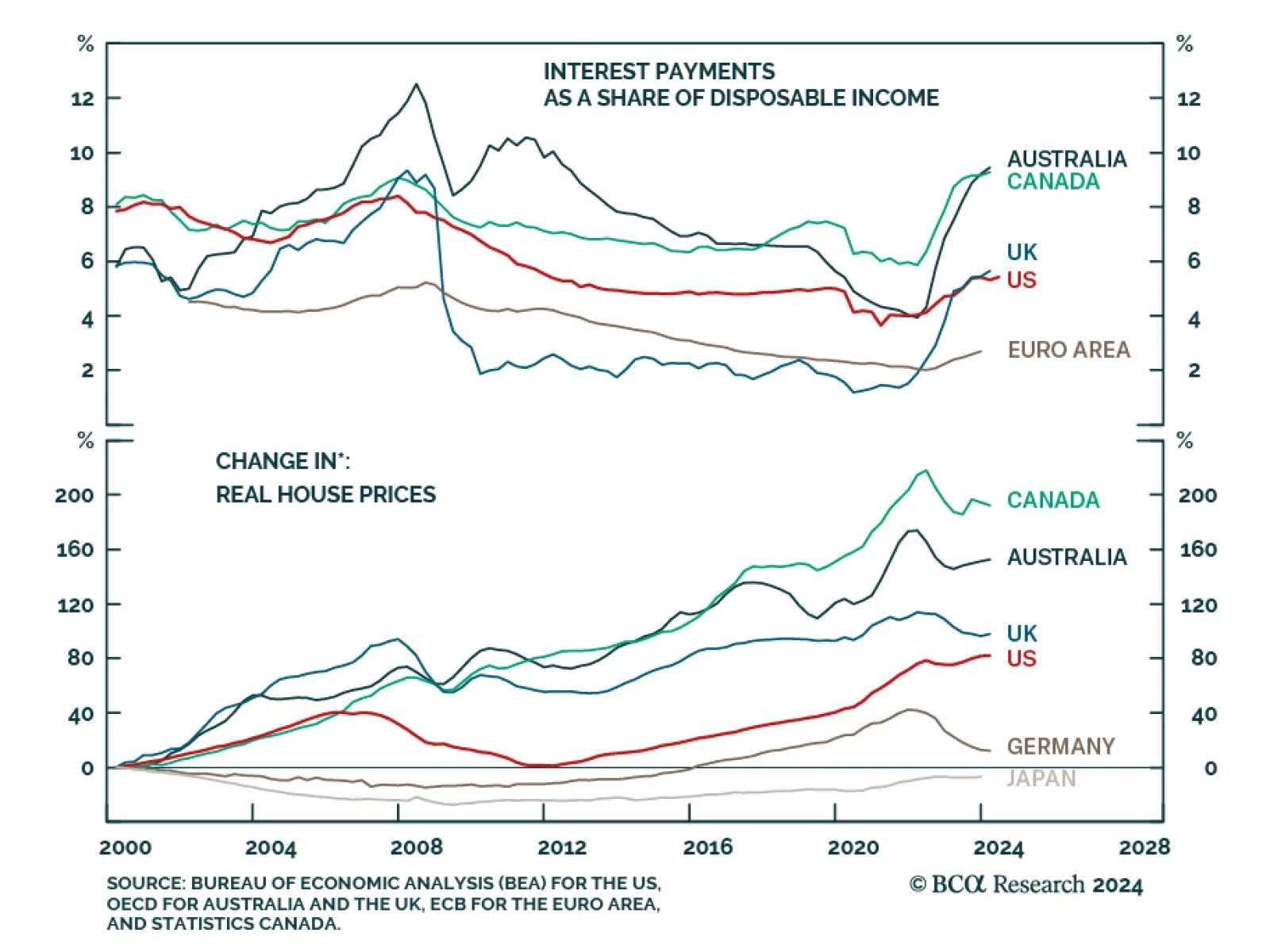

The Bank of Canada (BoC) reduced its policy rate by 25bps for the second meeting in a row on Wednesday. We highlighted in a recent Insight that the soft June inflation print and weakening labor market increased the odds of more…

In this Insight, we look into the recent CPI release in Canada, and the possible implications for fixed-income market trades.

Markets had already been sussing out that the Bank of Canada (BoC) will cut rates for the second time when it meets next week, and this morning’s soft CPI report all but confirmed it. The last remaining obstacle in the…

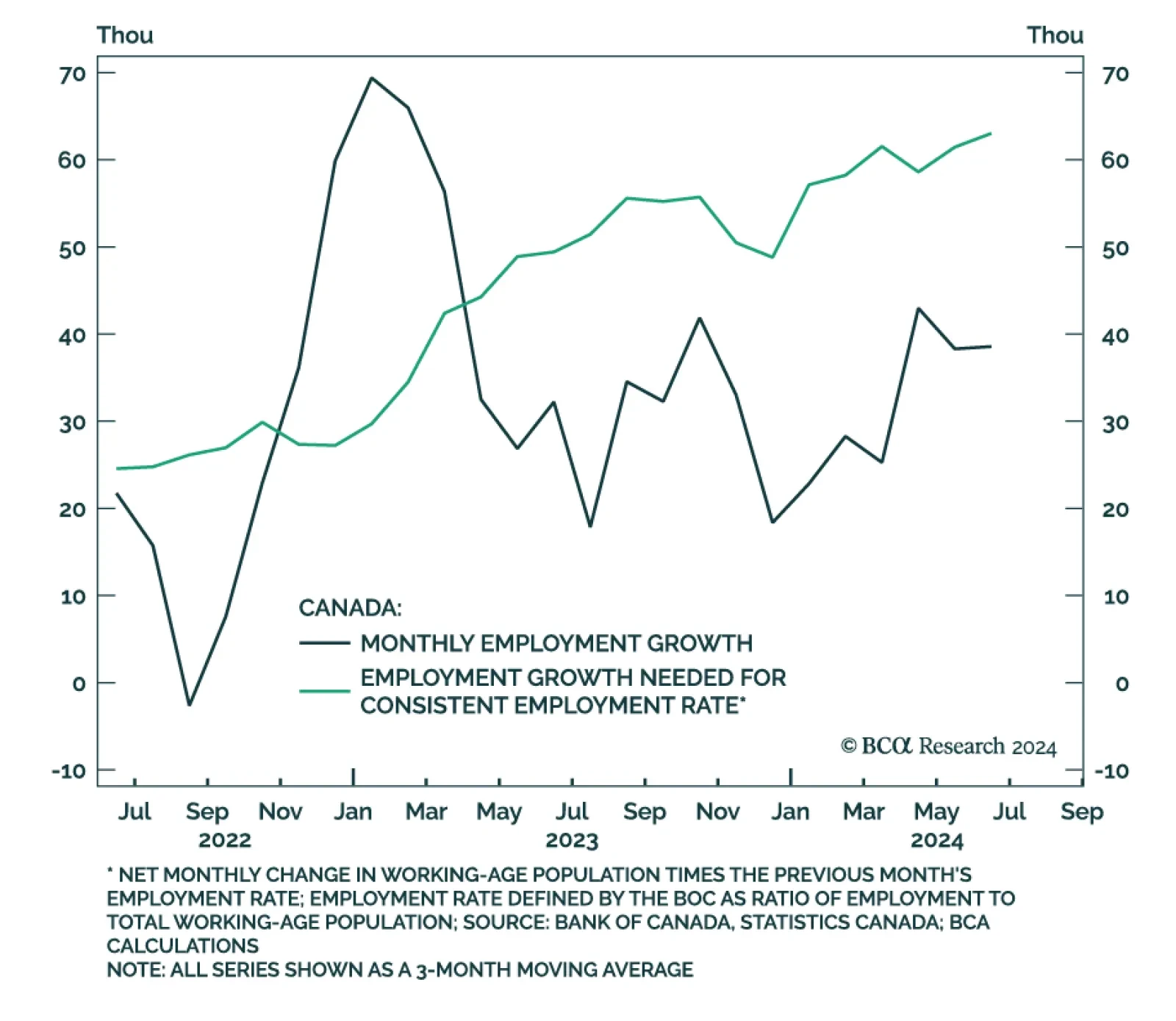

The latest release of the Canadian Labour Force Survey indicated further softening of the labor market in the Great White North. The economy experienced a net loss in total employment, shedding 1,400 jobs compared to market…

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.