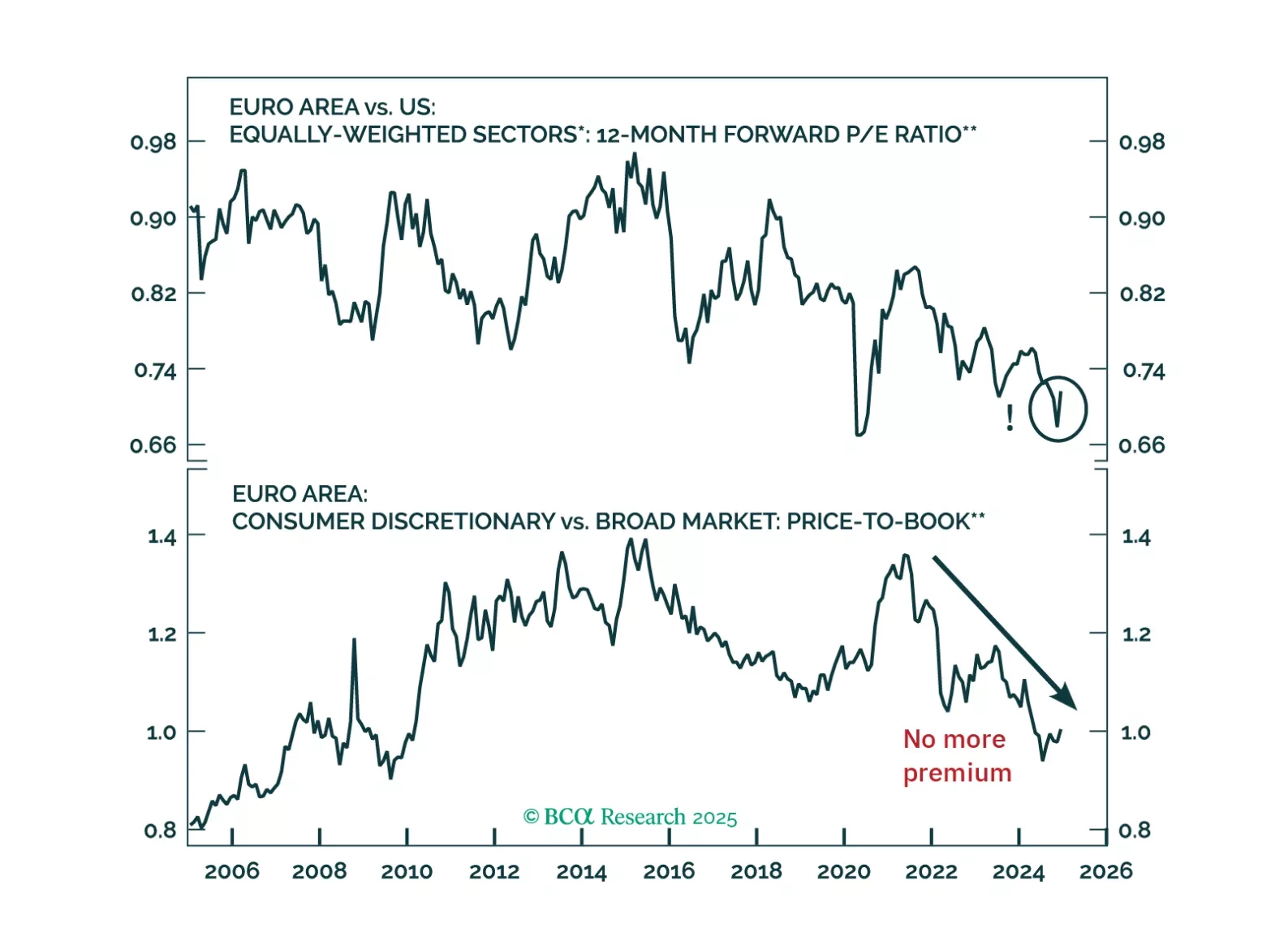

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

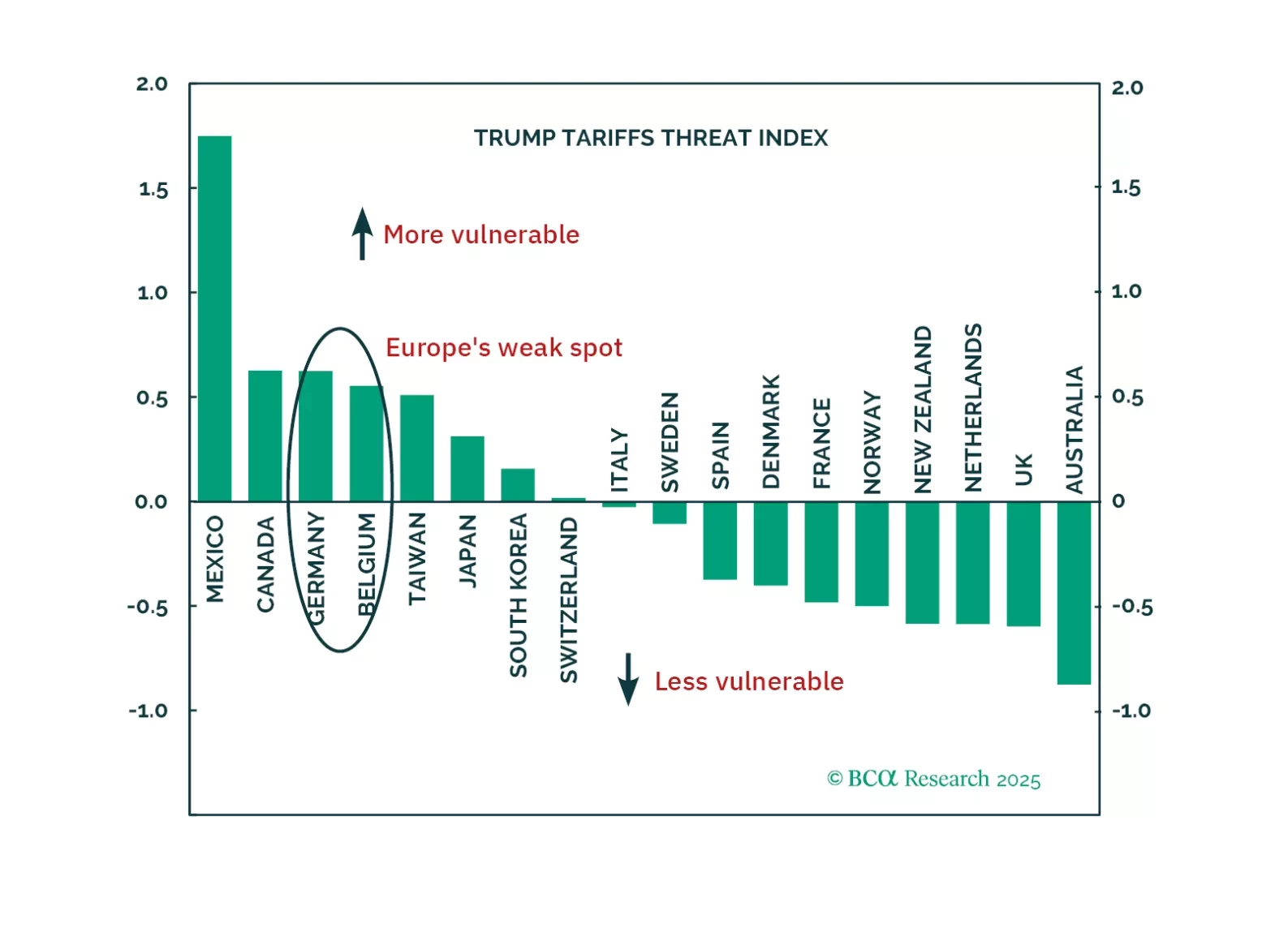

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

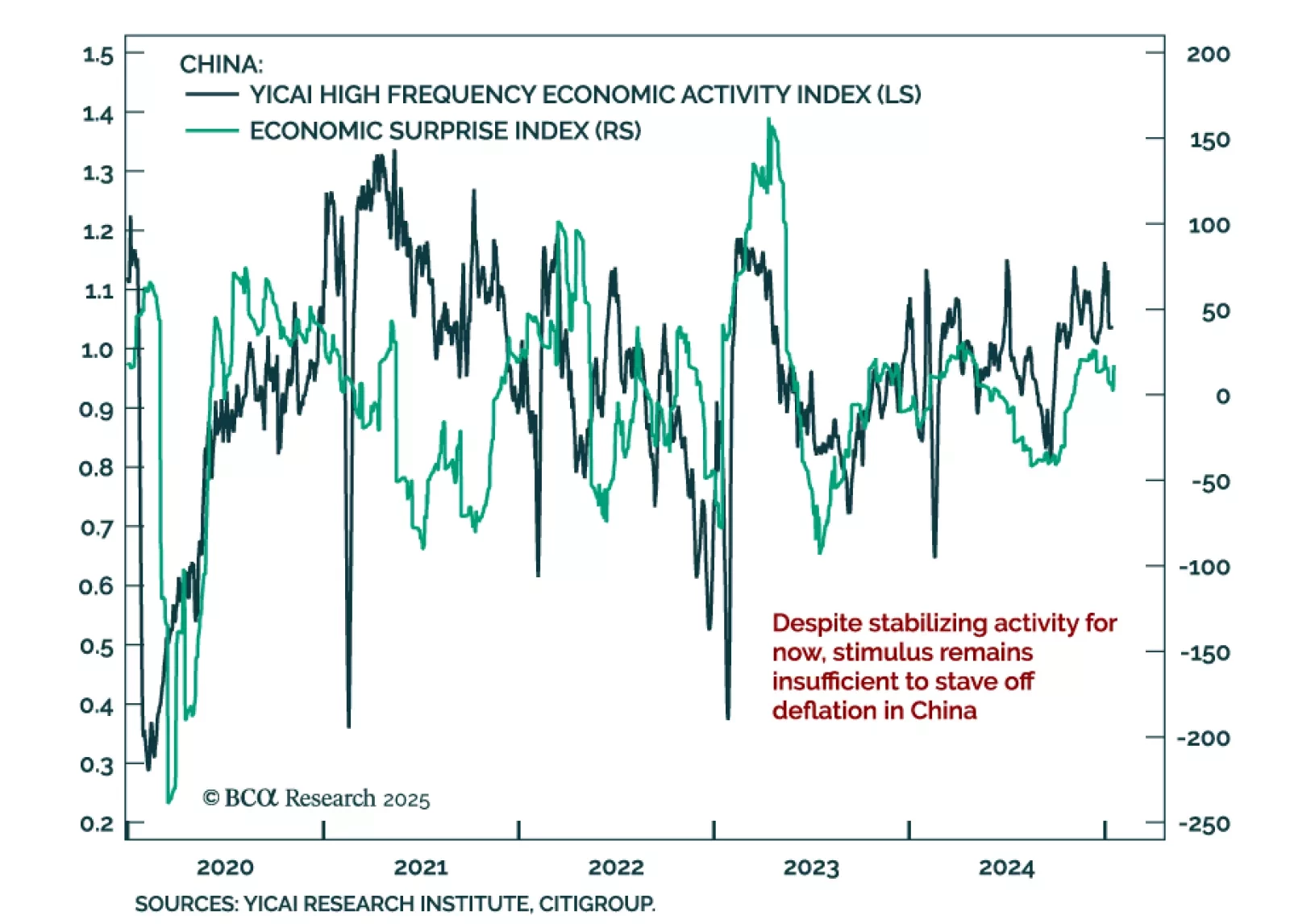

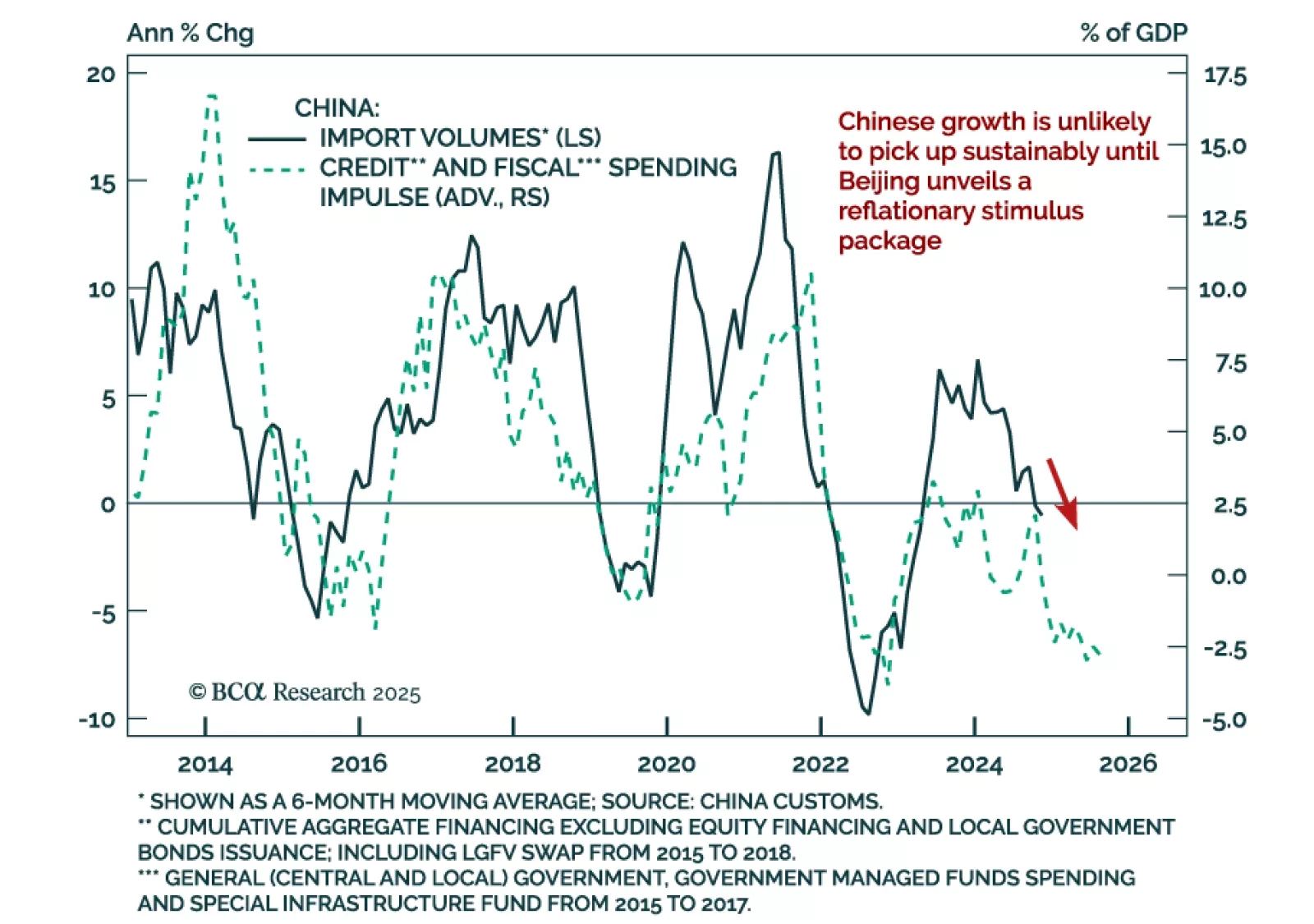

Chinese activity was decent in December, with GDP growth topping the 5% target for 2024. Industrial production growth ticked up to 6.2% y/y from 5.4% in November. Retail sales also picked up, increasing to 3.7% from 3.0% a month…

China’s monetary and credit data was relatively strong. New yuan loans increased more than expected, as did aggregate financing. M2 met estimates at 7.3% y/y. As was the case for trade in December, seasonality plays a big role…

China’s December trade data was positive, with exports in USD terms rebounding to 10.7% y/y from 6.7% in November, and imports rebounding to 1.0% from -3.9%. Taken at face value, the numbers are positive for both the Chinese and…

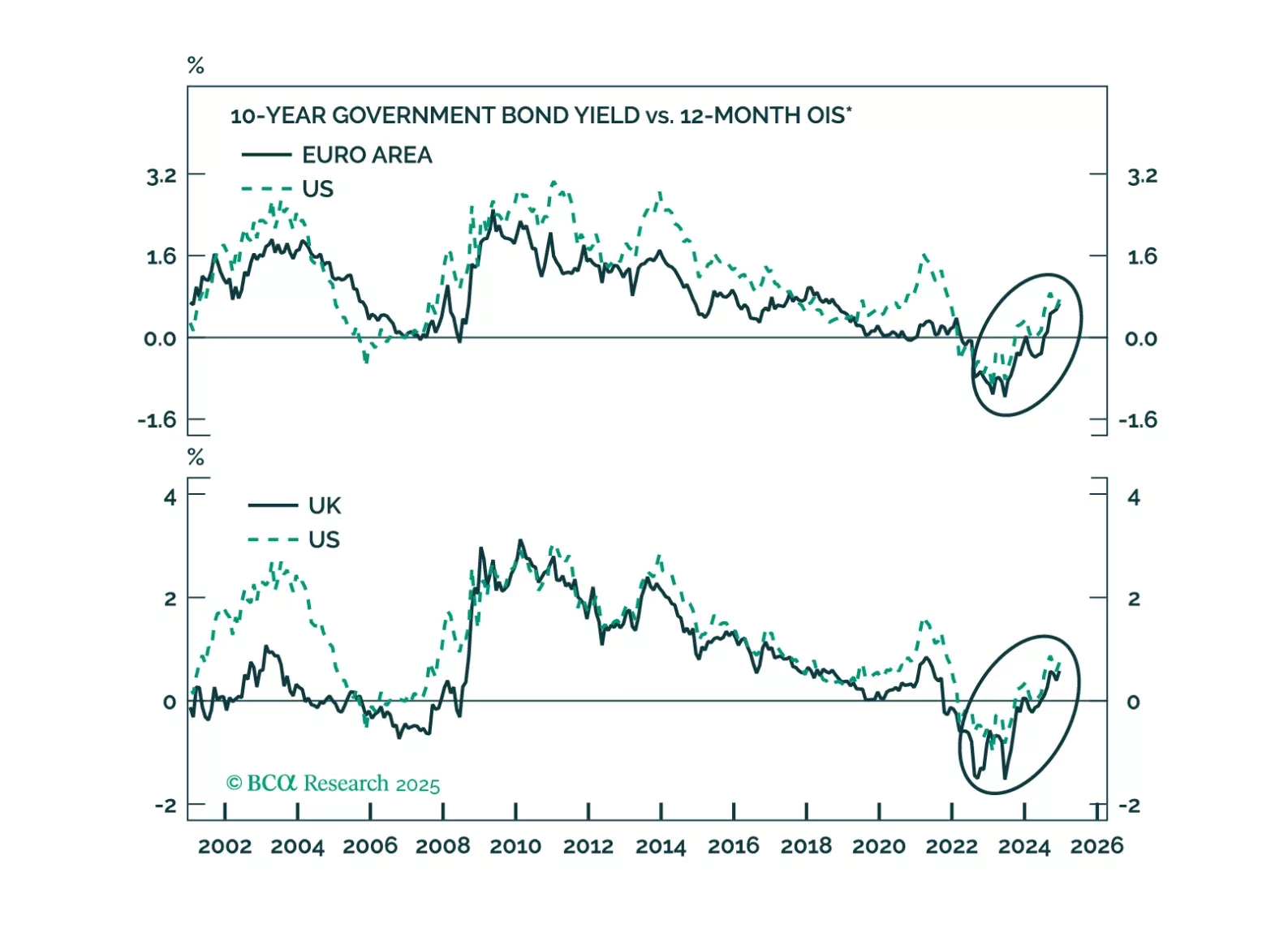

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

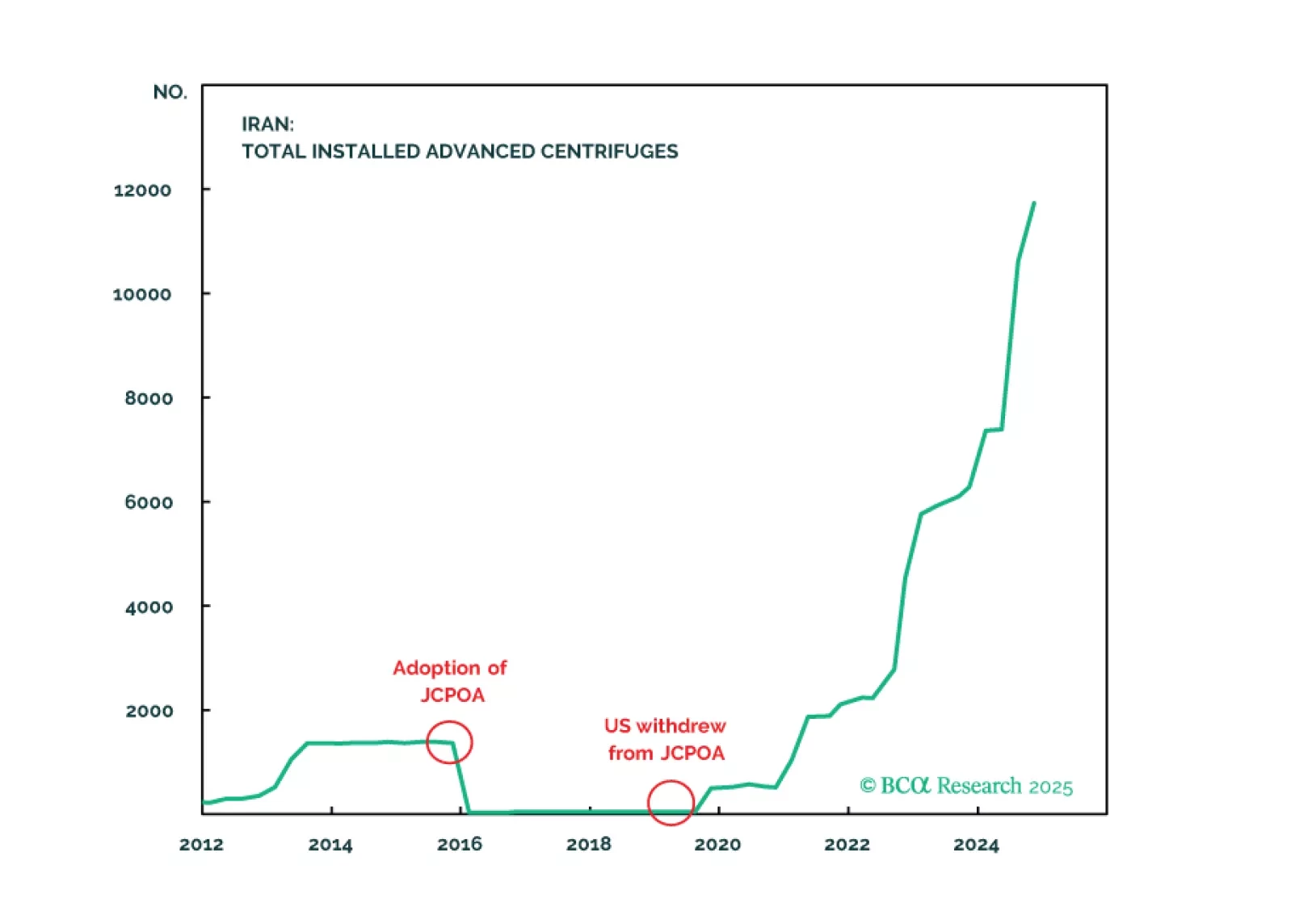

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

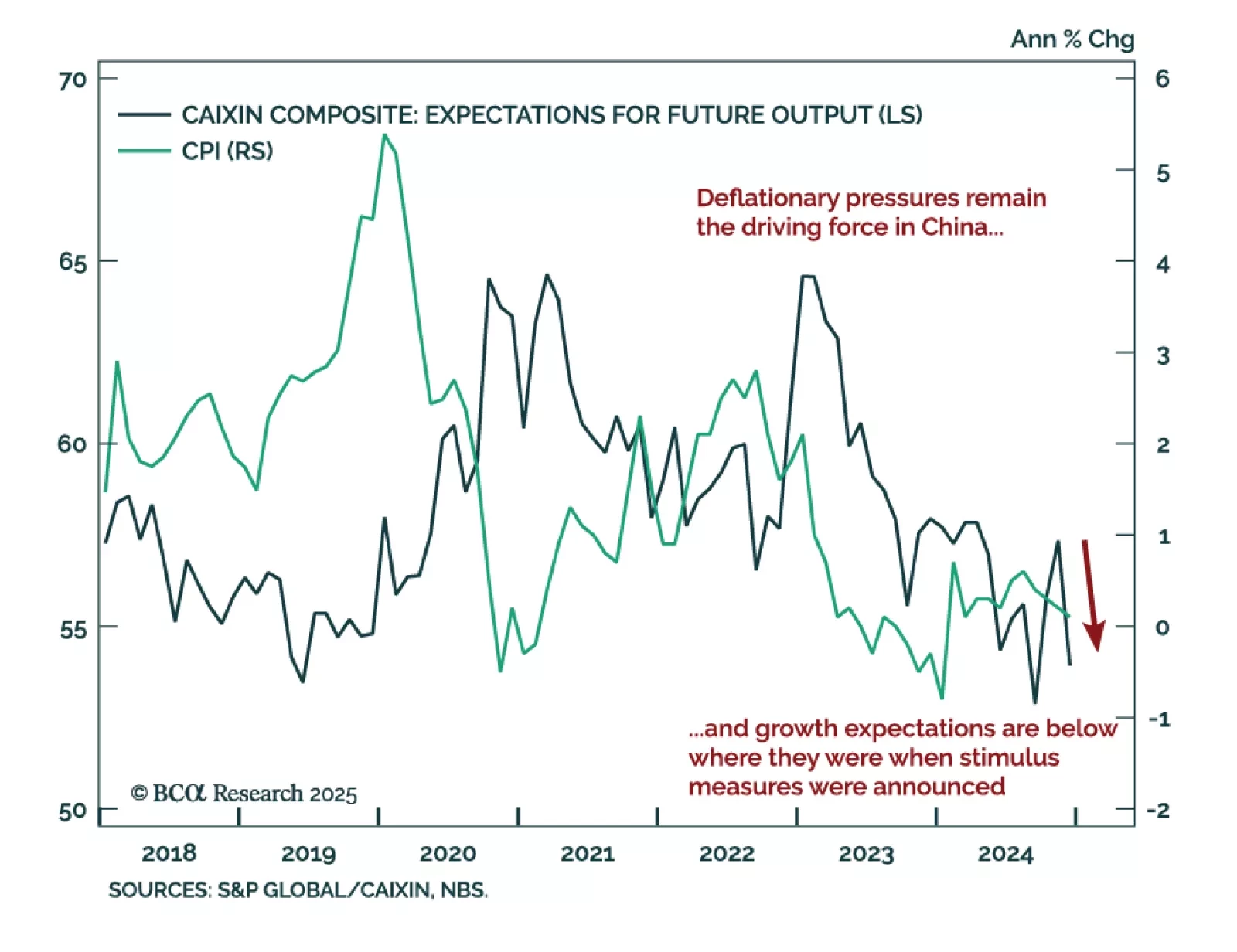

Chinese December CPI and PPI releases show deflationary pressures are not abating. CPI slowed to a 0.1% y/y pace from 0.2% in November, while producer prices fell 2.3%. The Chinese economy has not meaningfully changed course…

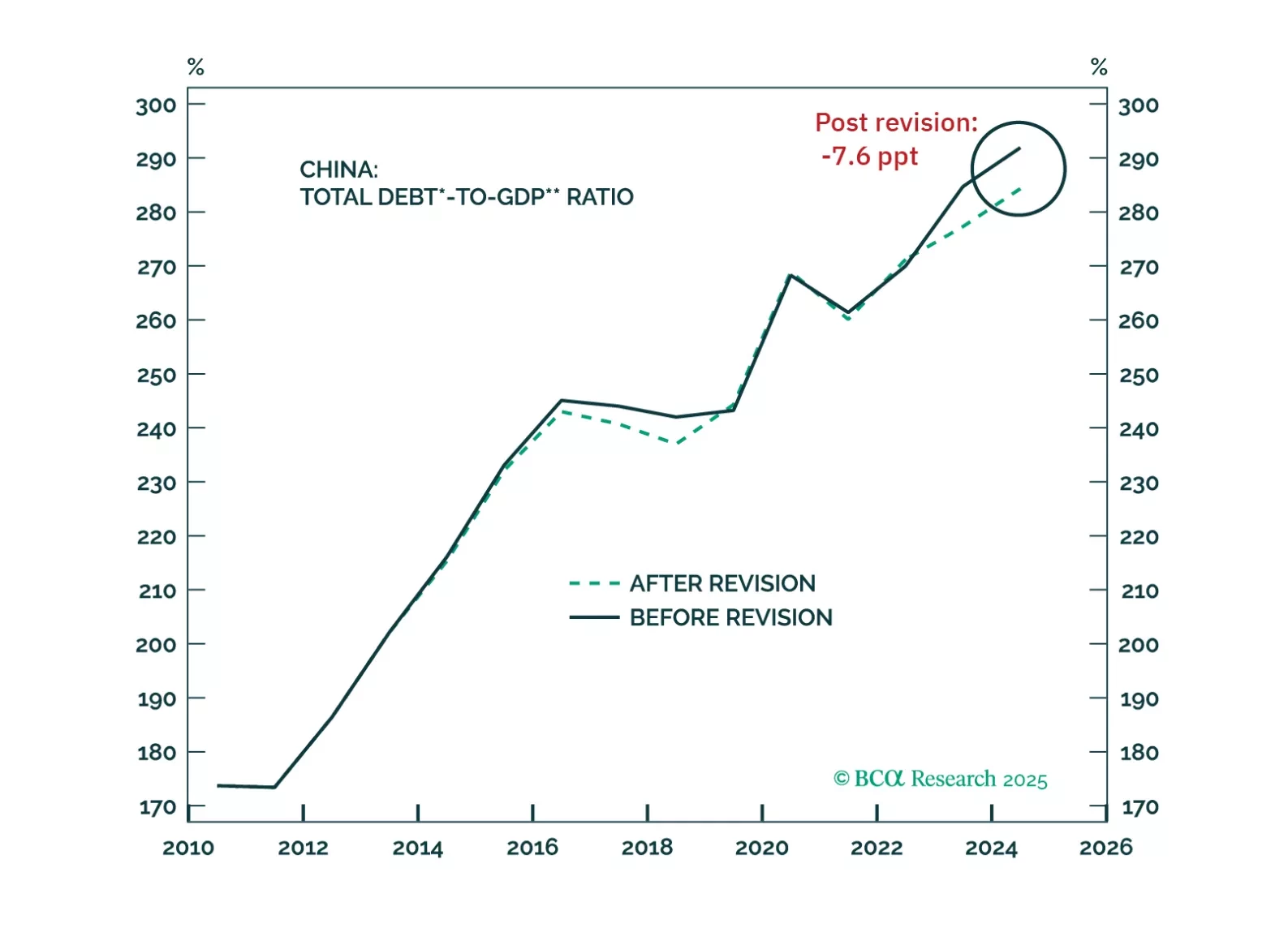

In this week’s report, we present our key takeaways from China's two notable adjustments recently implemented: an upward revision to its 2023 GDP and the reduction of the USD weighting in the RMB Exchange Rate Index.