The prices of multiple financial assets have failed to break above their technical resistances. When this occurs, a breakdown ensues. In brief, global risk assets remain vulnerable. We are upgrading Chinese onshore stocks from…

This report provides our framework for interpreting the messages from last week’s Third Plenum, and the potential implications for the economy and investors.

The PBoC appears increasingly uncomfortable with the rapid decline in the Chinese government bond yields. While the PBoC will succeed in temporarily curbing investors’ enthusiasm for bonds, the central bank will be unwilling to raise…

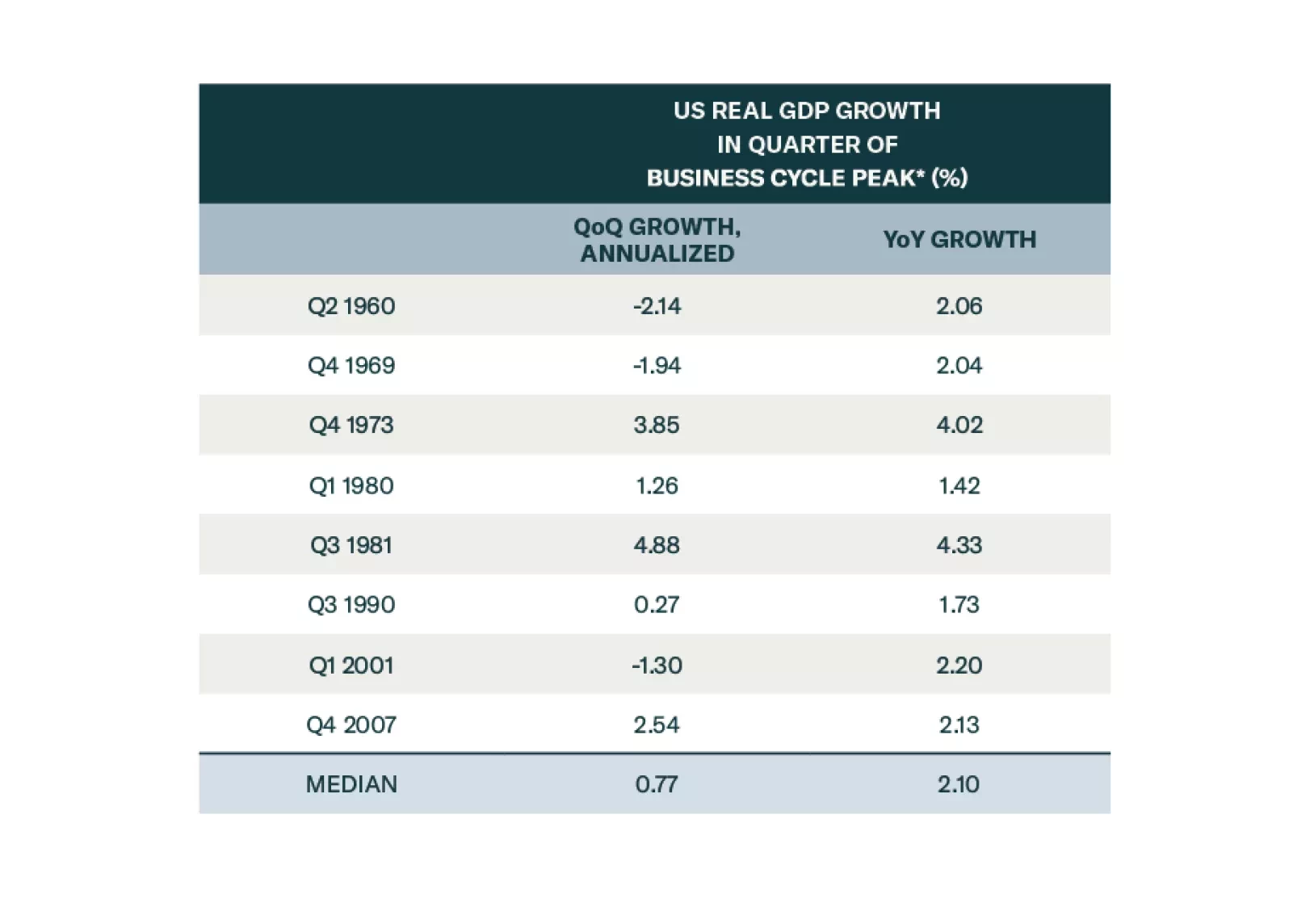

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

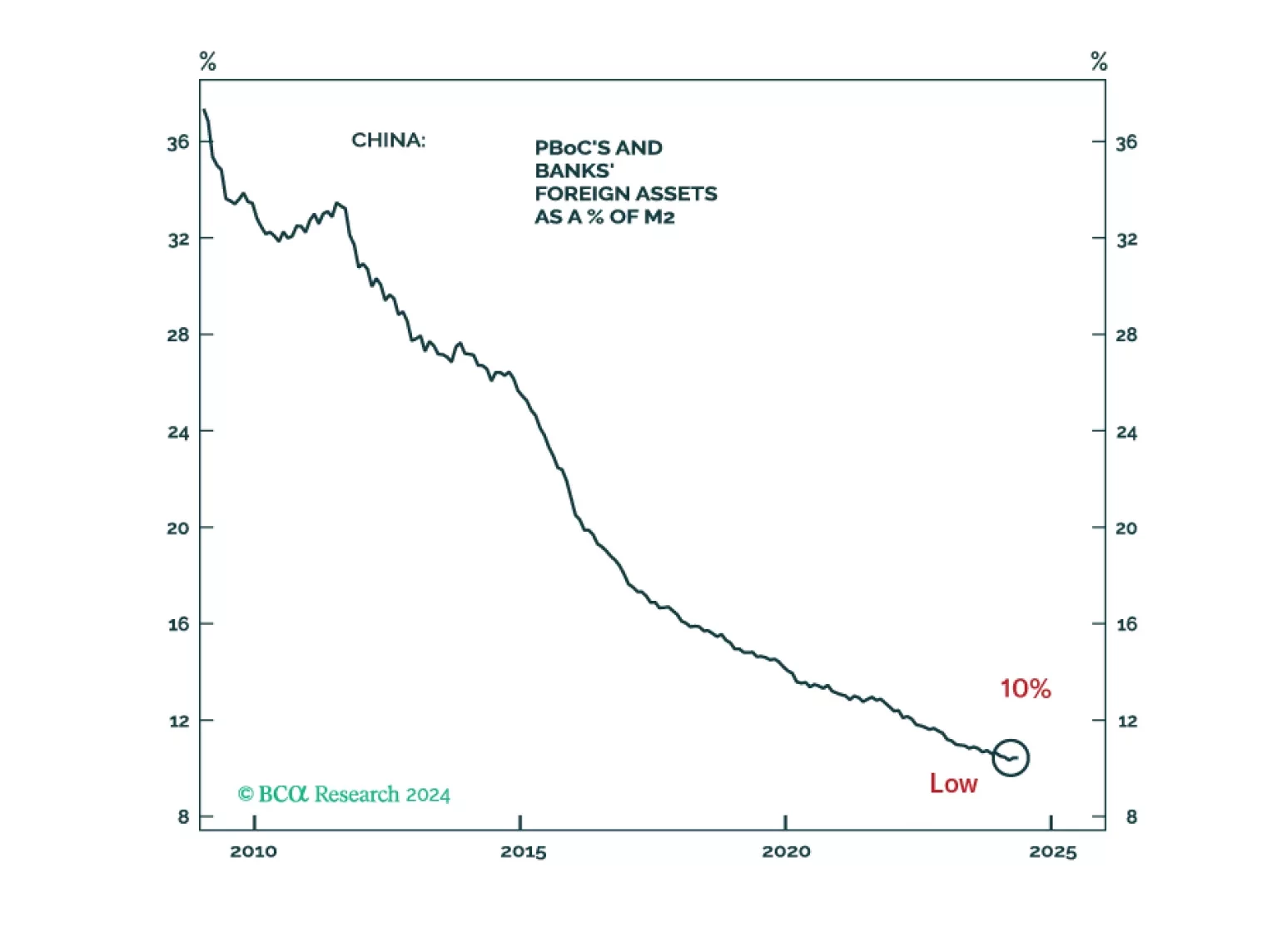

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…

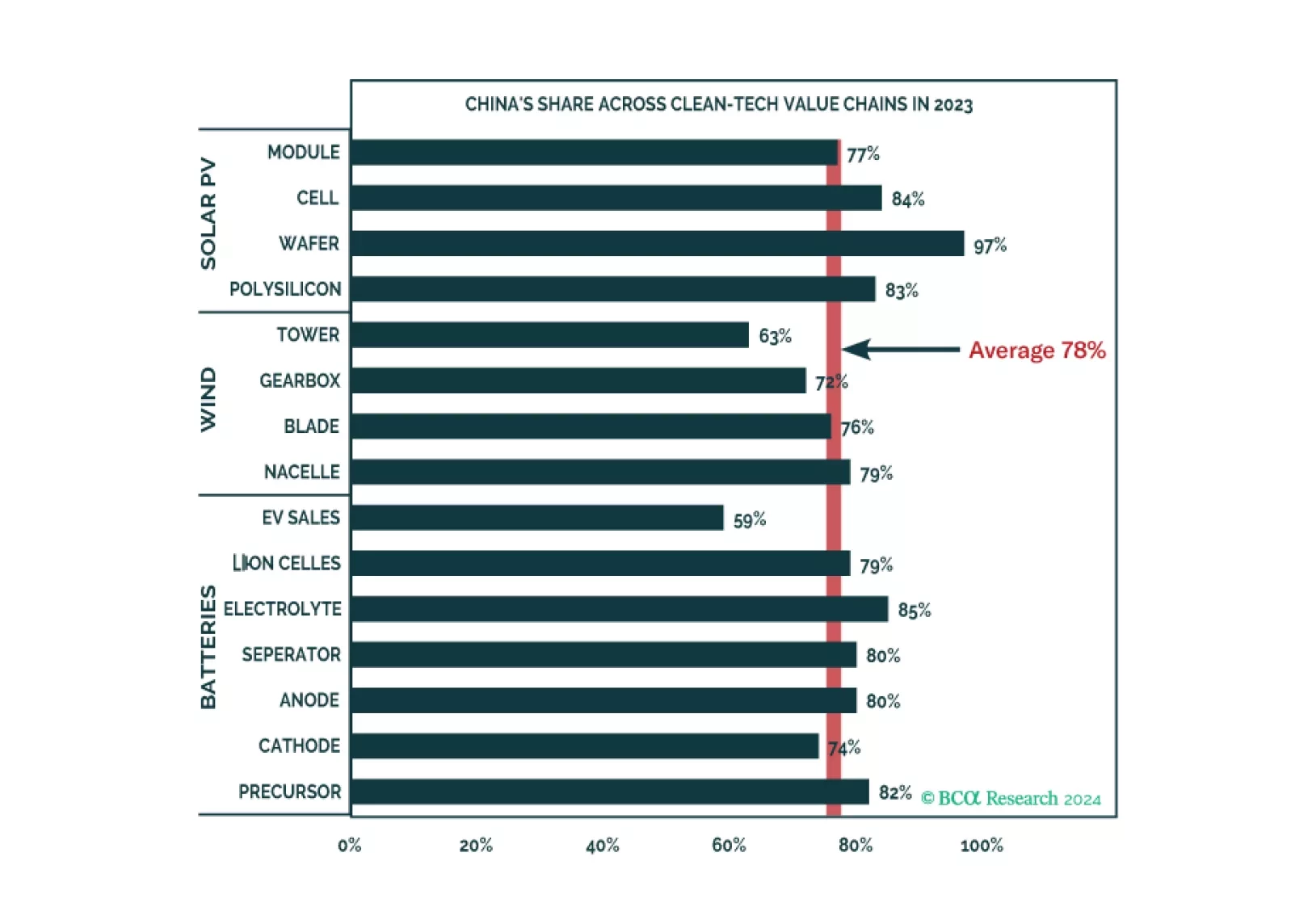

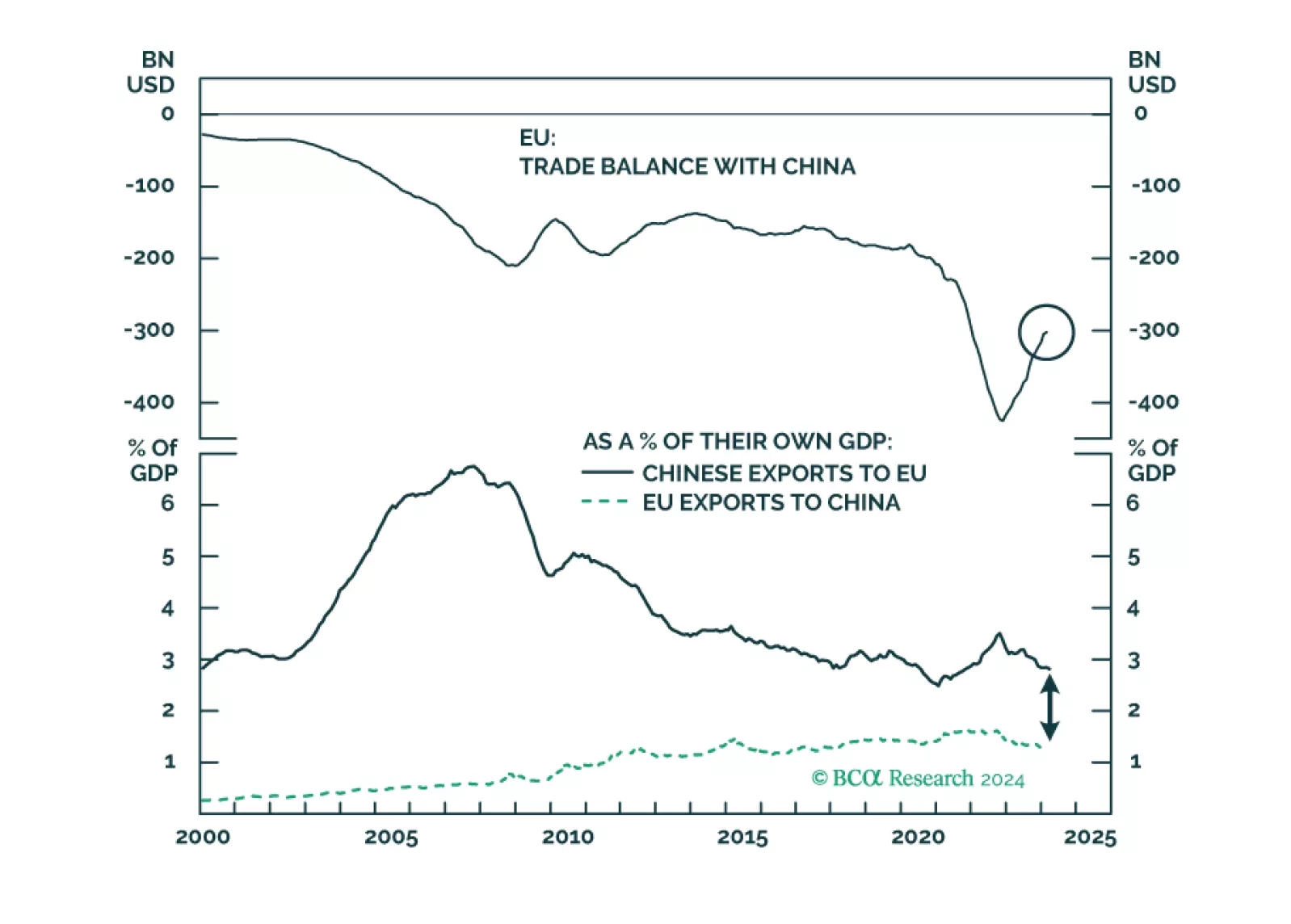

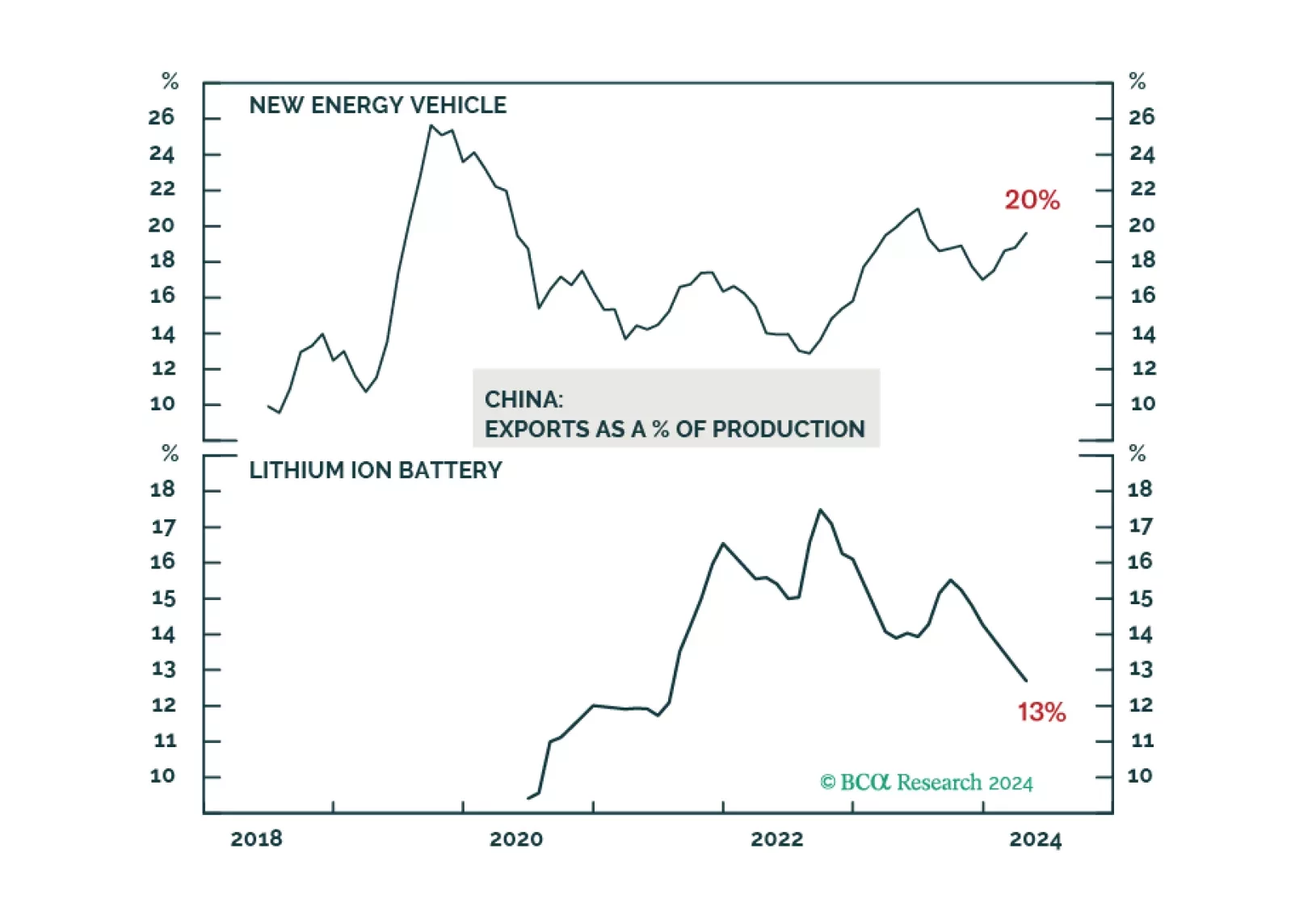

The EU's import tariff increases on Chinese EVs are expected to have a minimal impact on China's overall exports. We anticipate that most Western-brand EV shipments from China will be less affected by the EU import tax hike. Beijing…

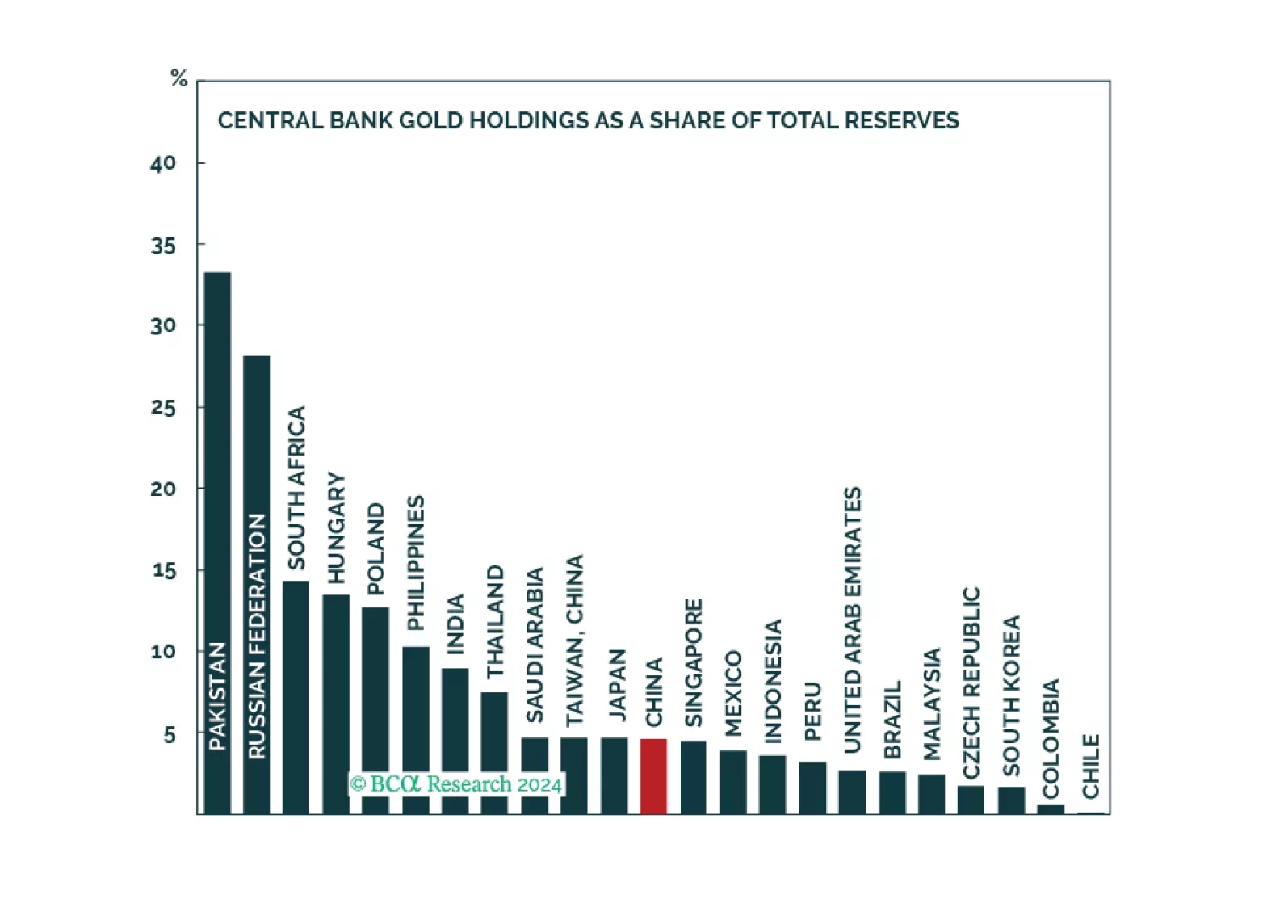

Gold prices might experience a correction or consolidation over the near term. However, cyclical and structural forces will ultimately cause the yellow metal to trend upwards.