In this final note for the year, we take profits and close several long-term investment positions: Overweights in Insurance and Commercial Services, and underweights in Utilities, and Retail and Commercial REITs.

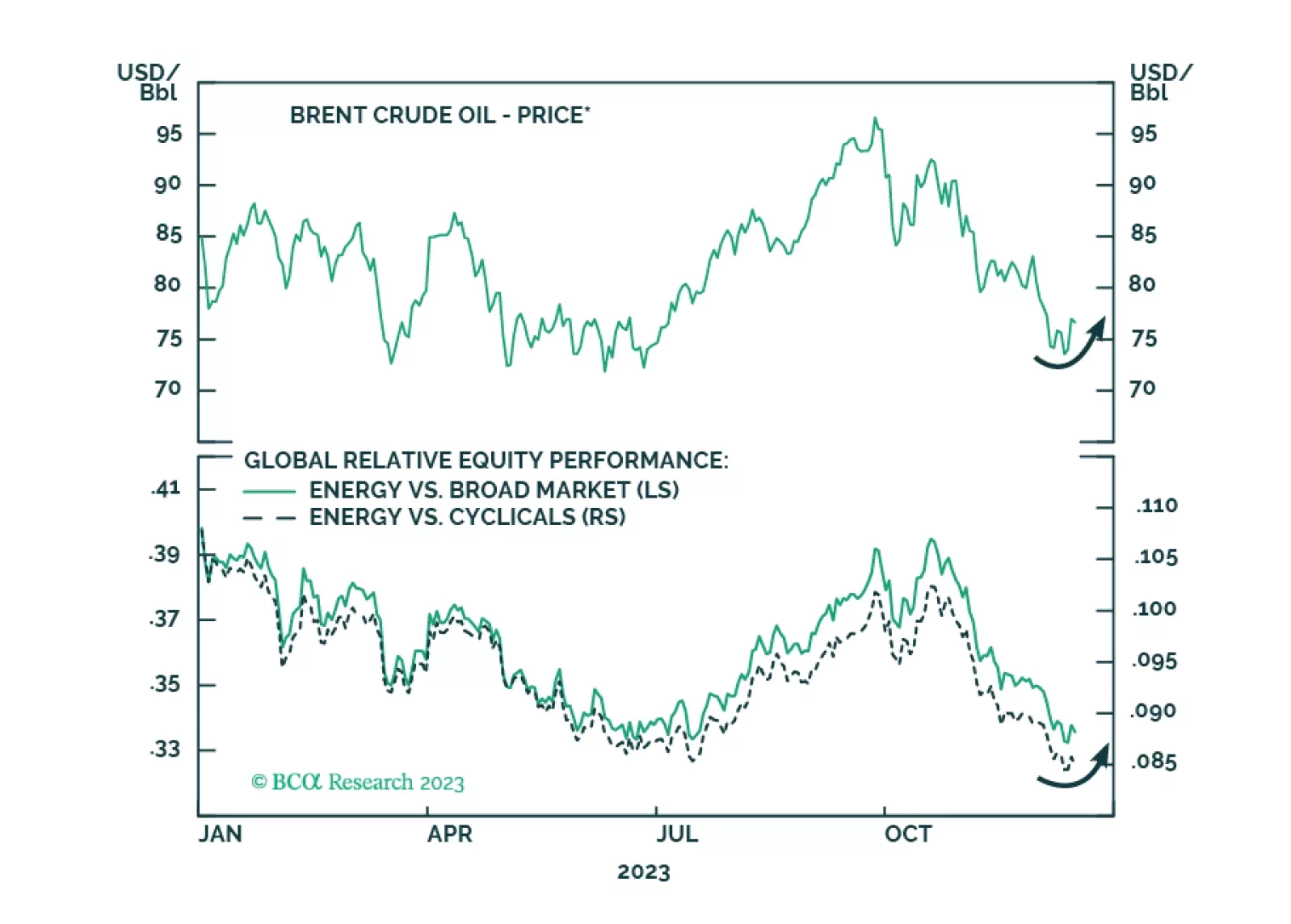

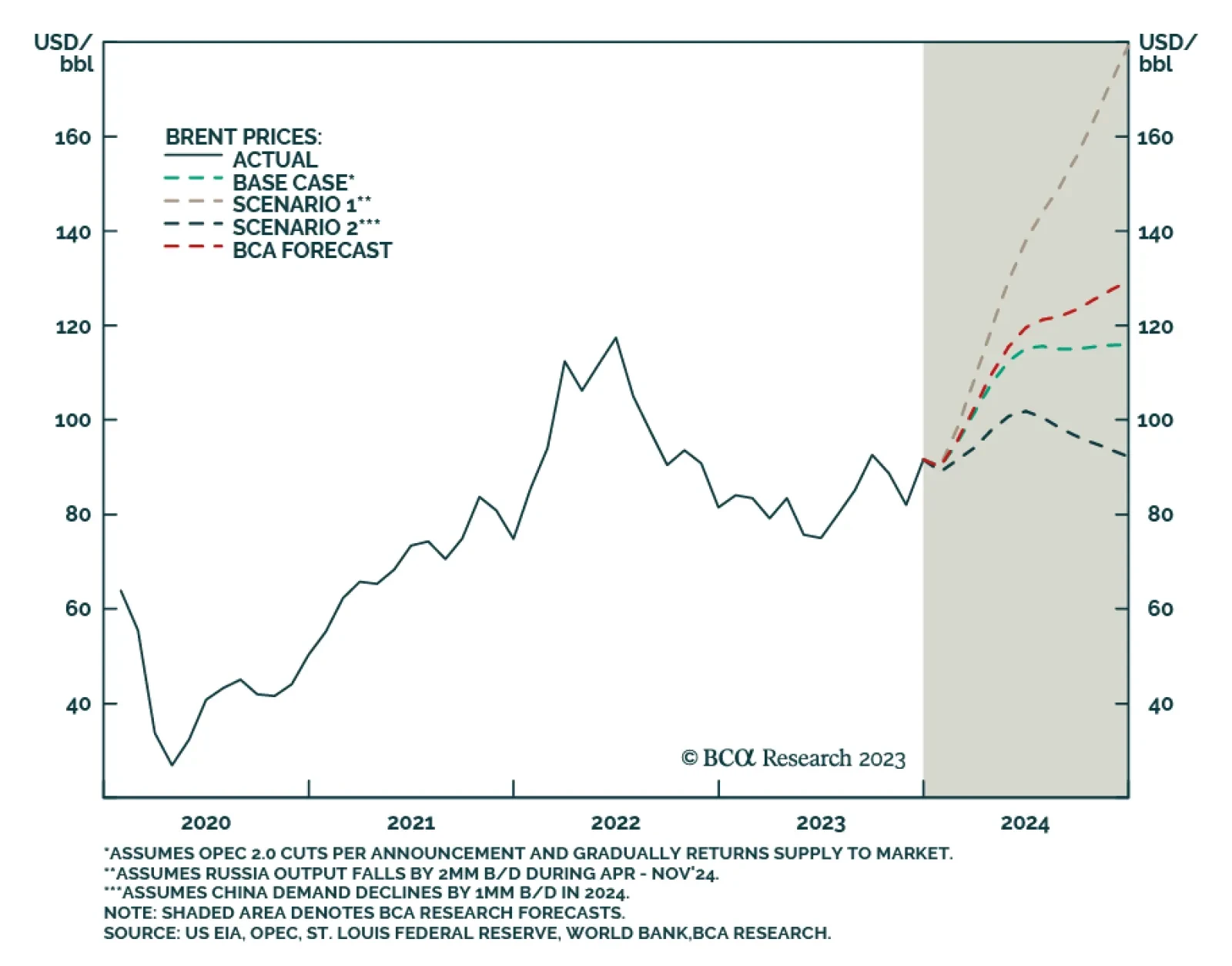

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…

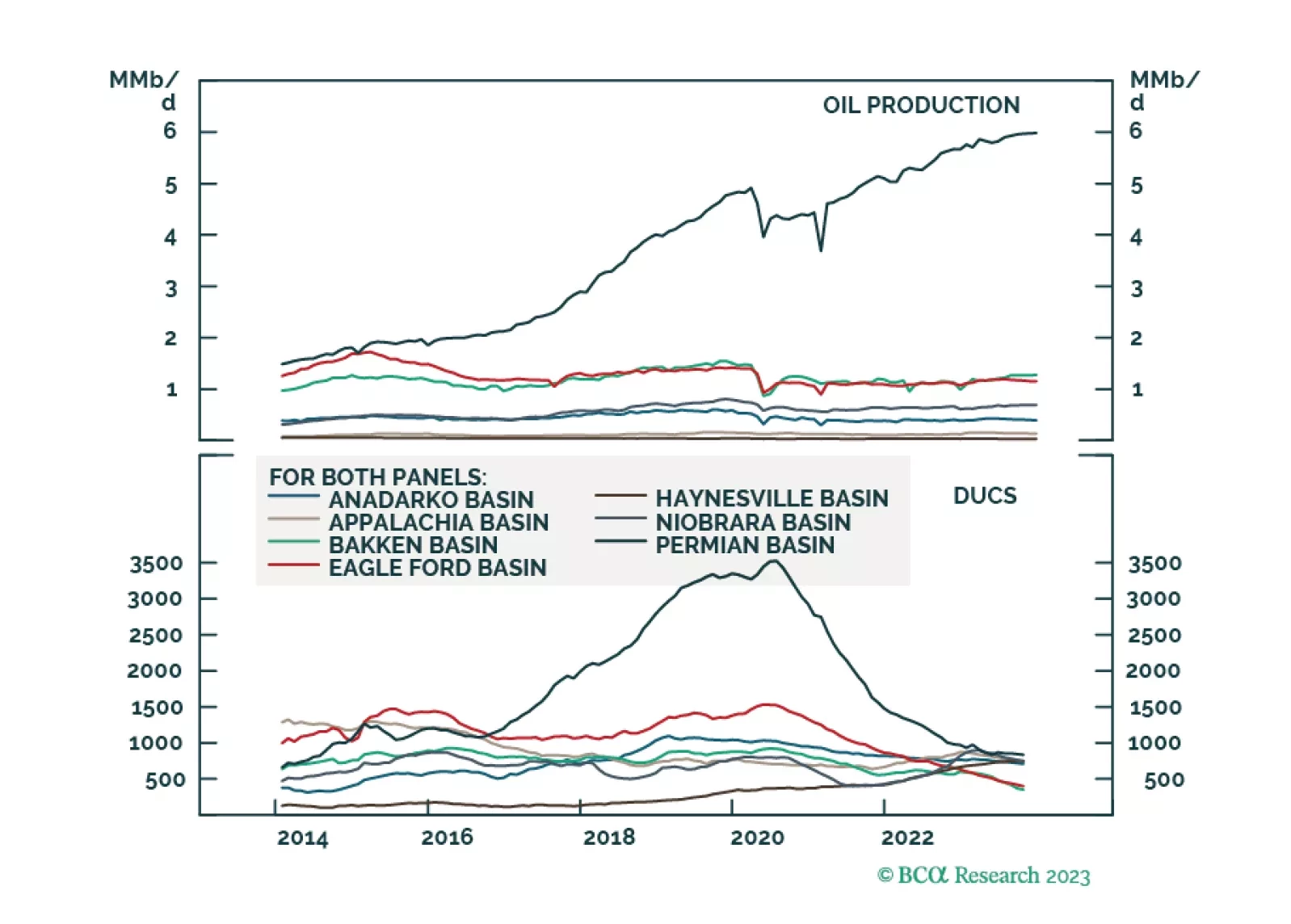

The short answer, according to our colleagues at BCA’s Commodity & Energy Strategy (CES) is straightforward, but not simple: Political economy – i.e., how states organize and operate their economies to support…

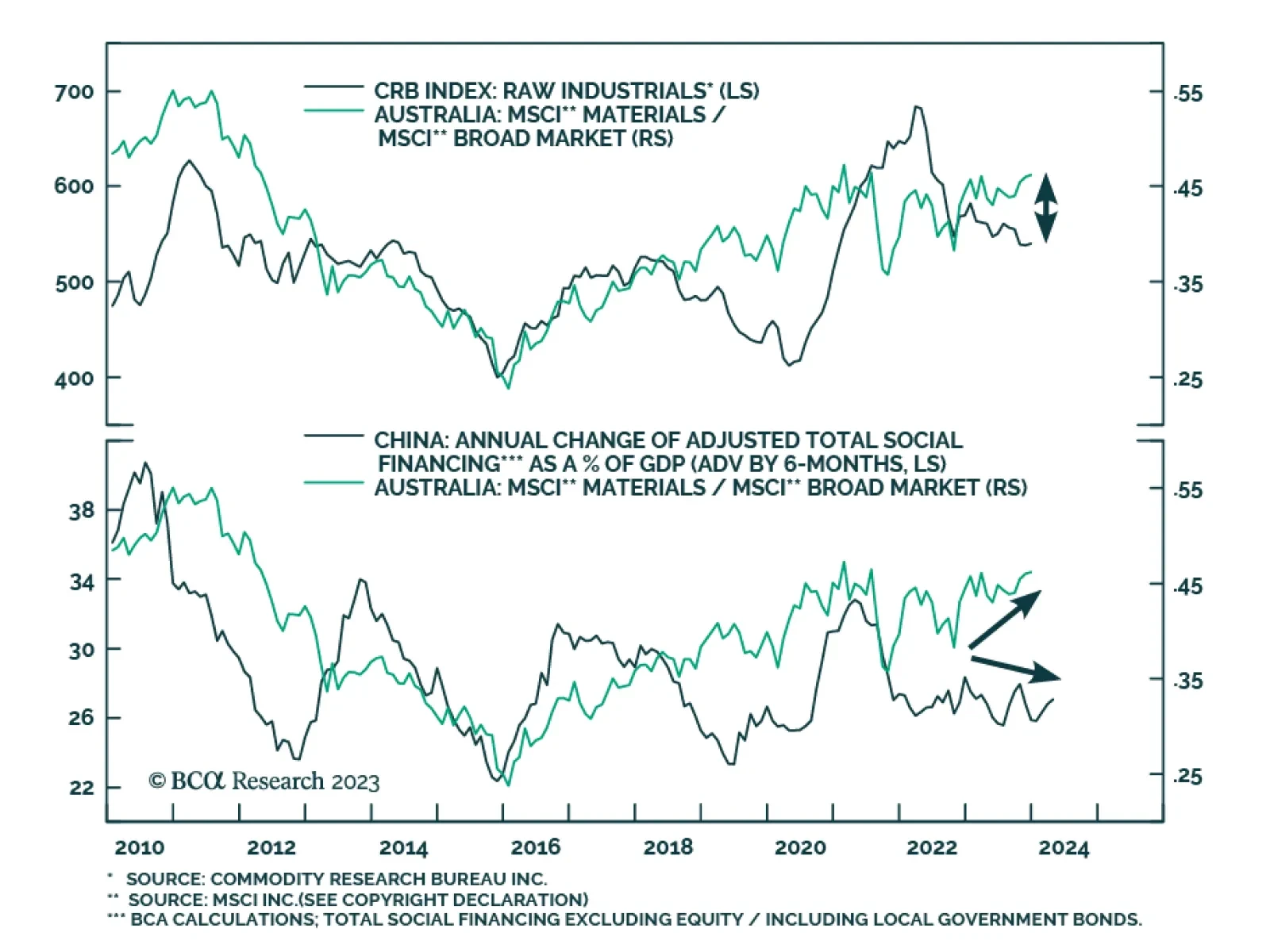

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

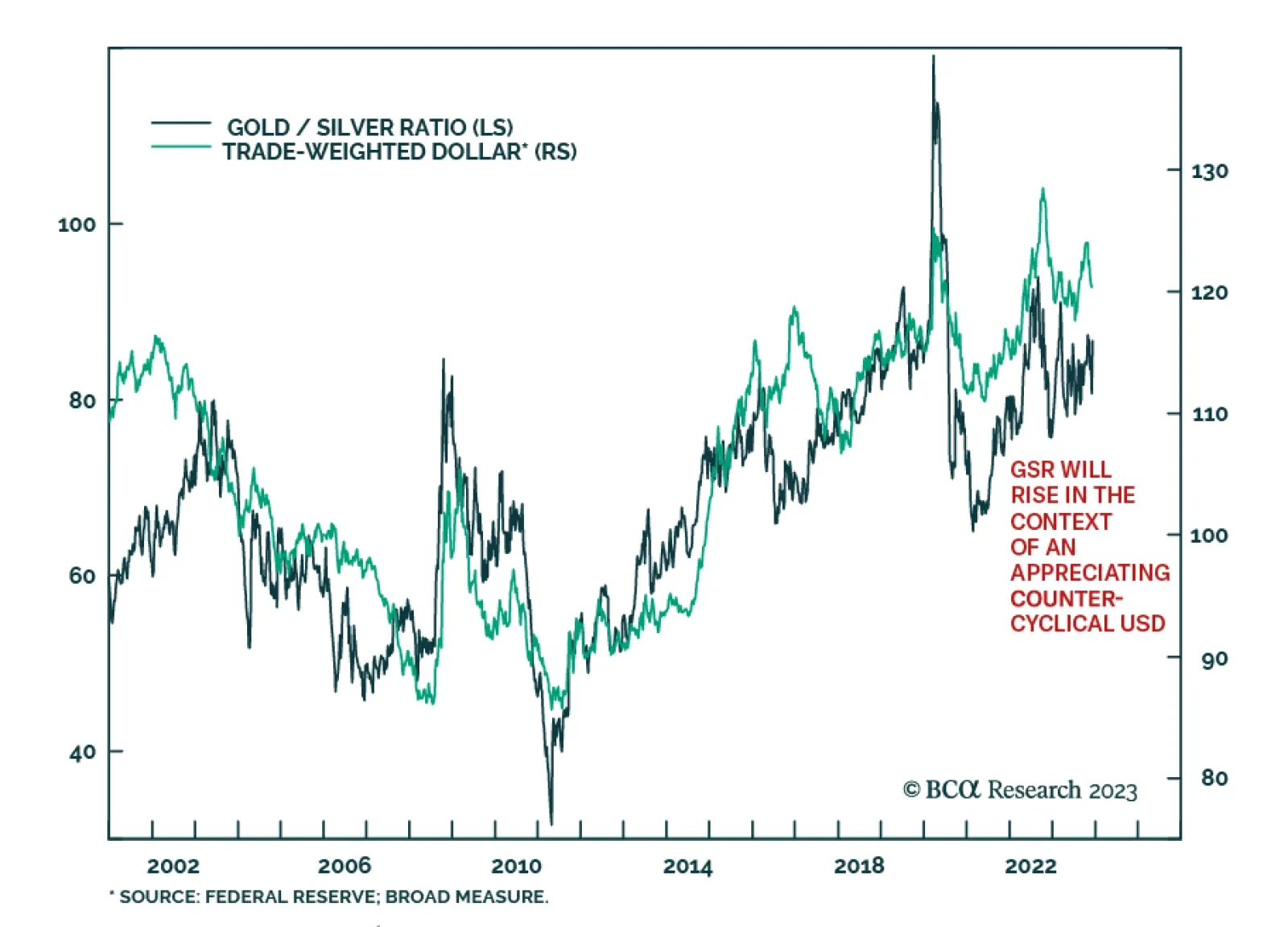

The gold/silver ratio (GSR) confirmed the improvement in global risk sentiment in November. It declined on the back of a 9.2% rally in silver, which outpaced the 1.9% rise in gold. Since then, the GSR has soared amid a more…

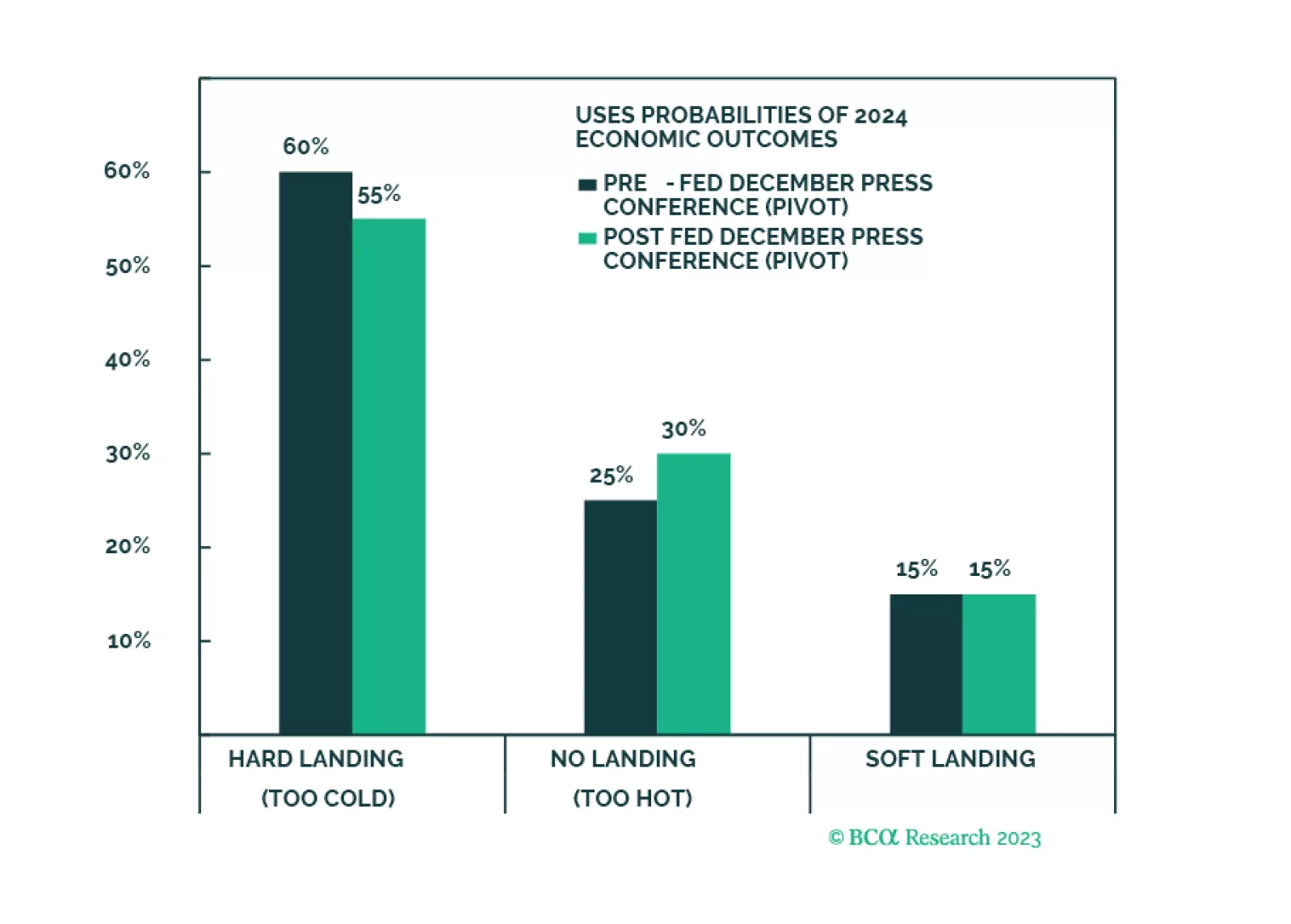

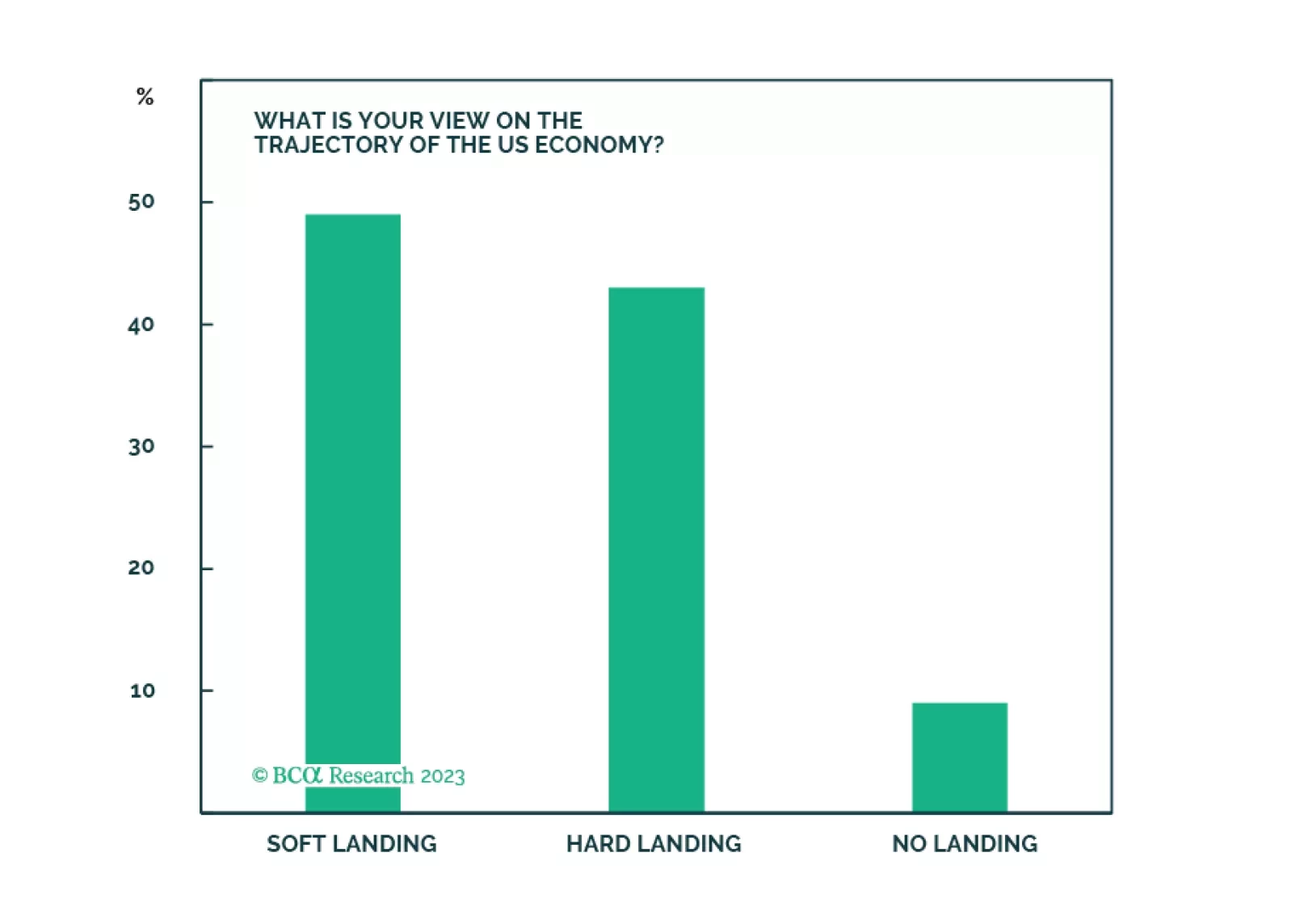

The Santa Claus rally is a repricing of the "soft landing" scenario as a likely economic outcome. Yet, many investors remain cautious, and harbor significant cash balances. Next year, repricing of various scenarios will continue, and…

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.