In Section I, Doug underscores that the US labor market remains weak, crimping the outlook for disposable income growth. It is too soon to decisively bet against the bull market, but downside risks remain quite elevated. In Section…

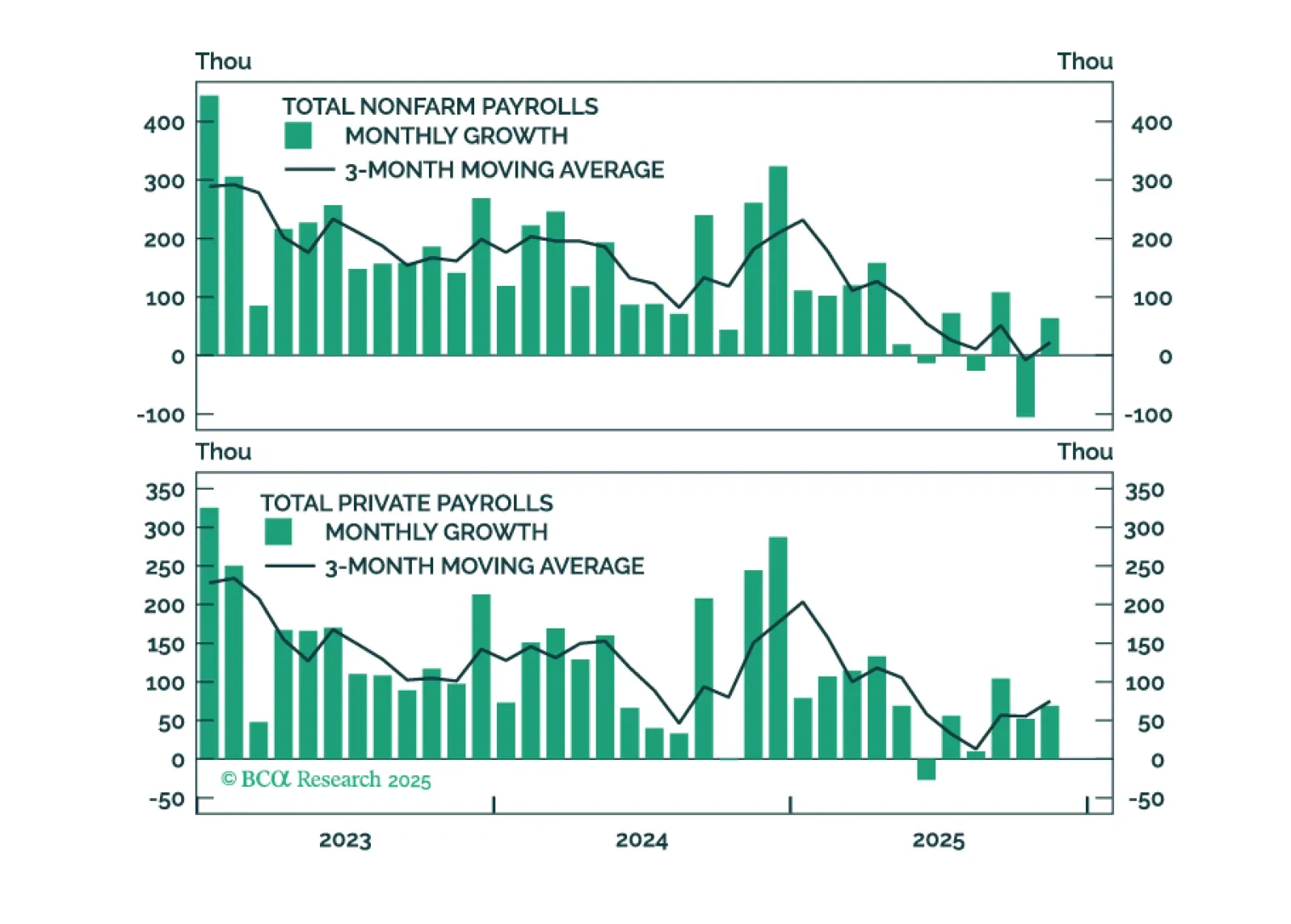

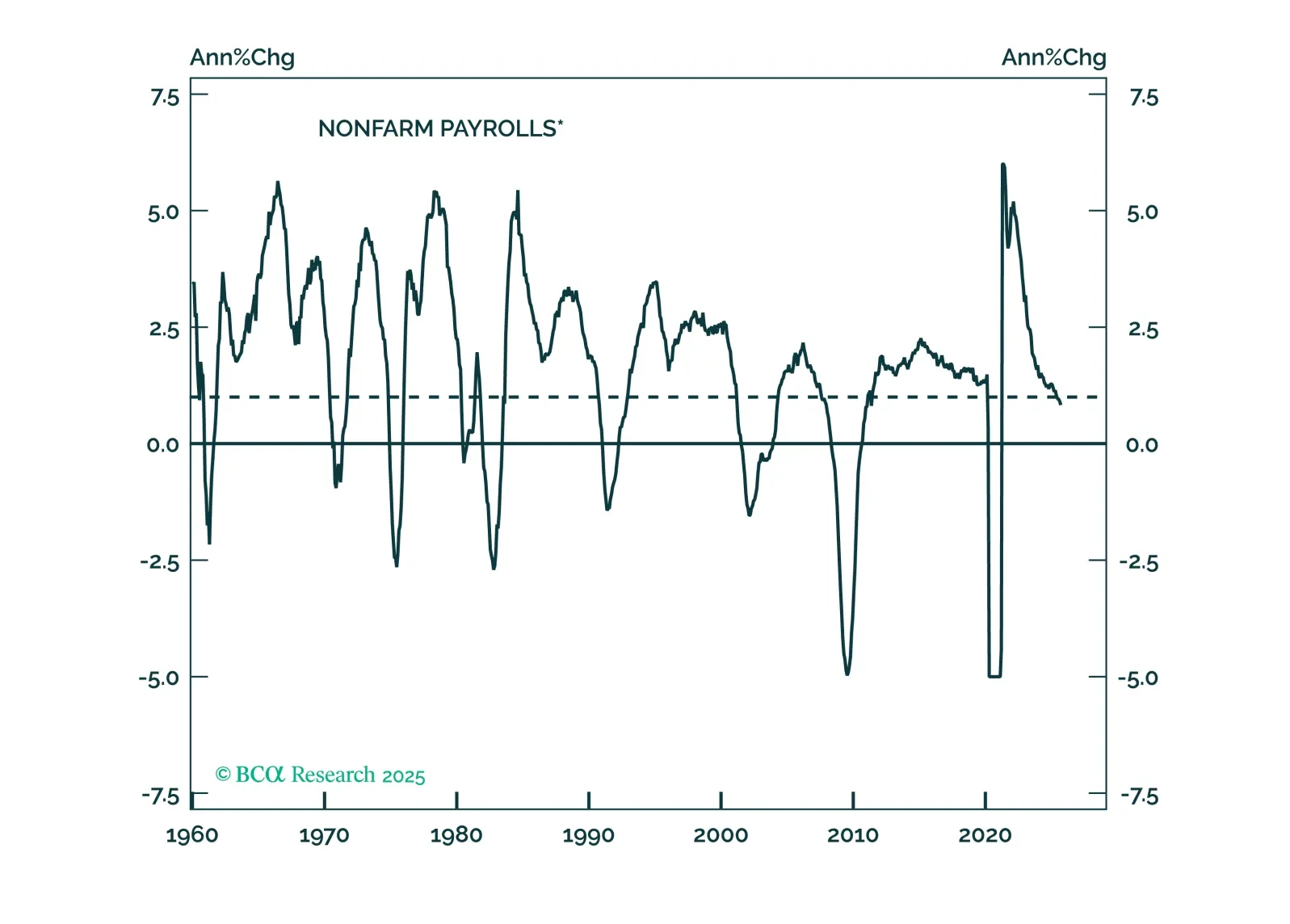

Employment Data Point To Dovish Policy Surprises In 2026

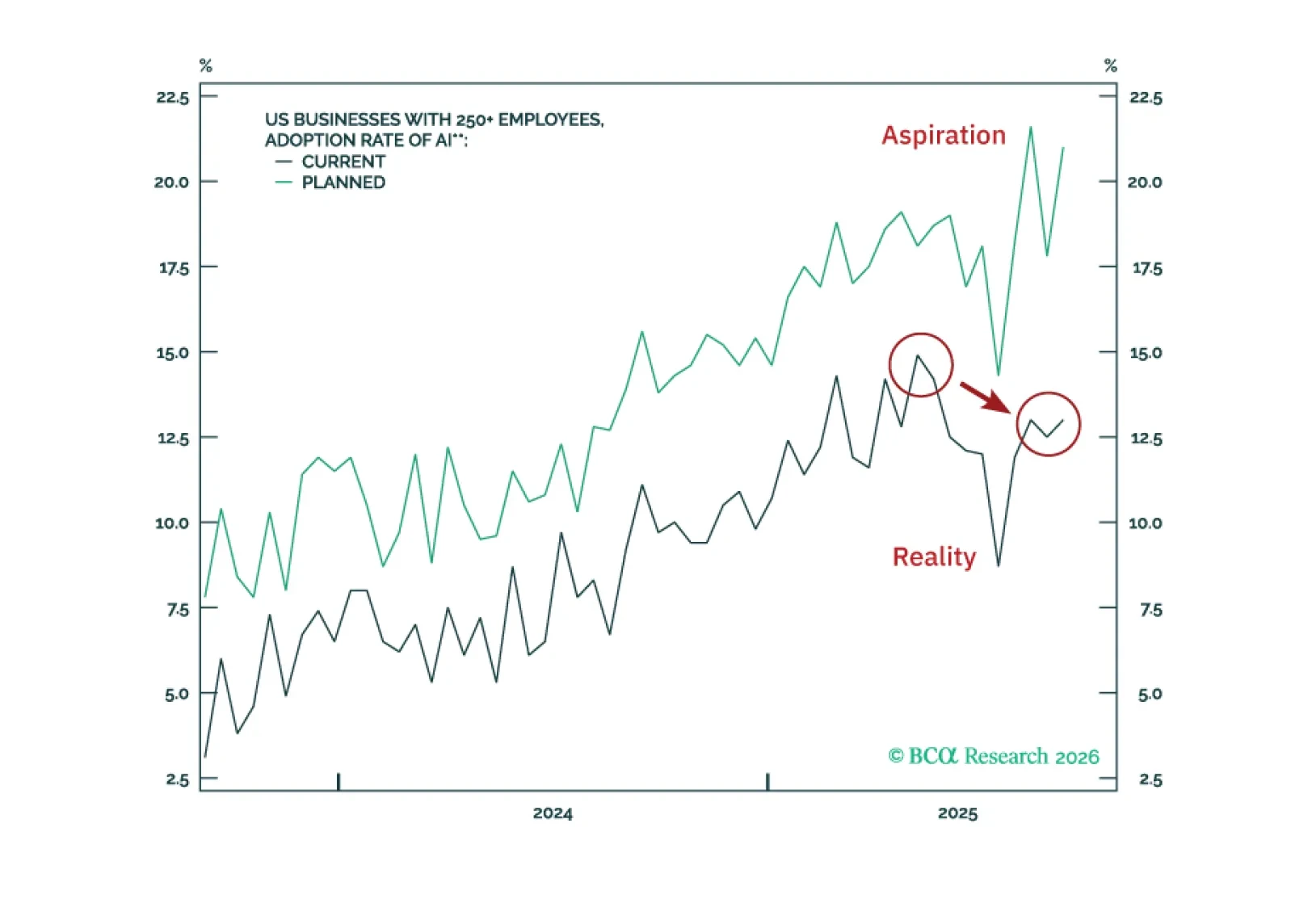

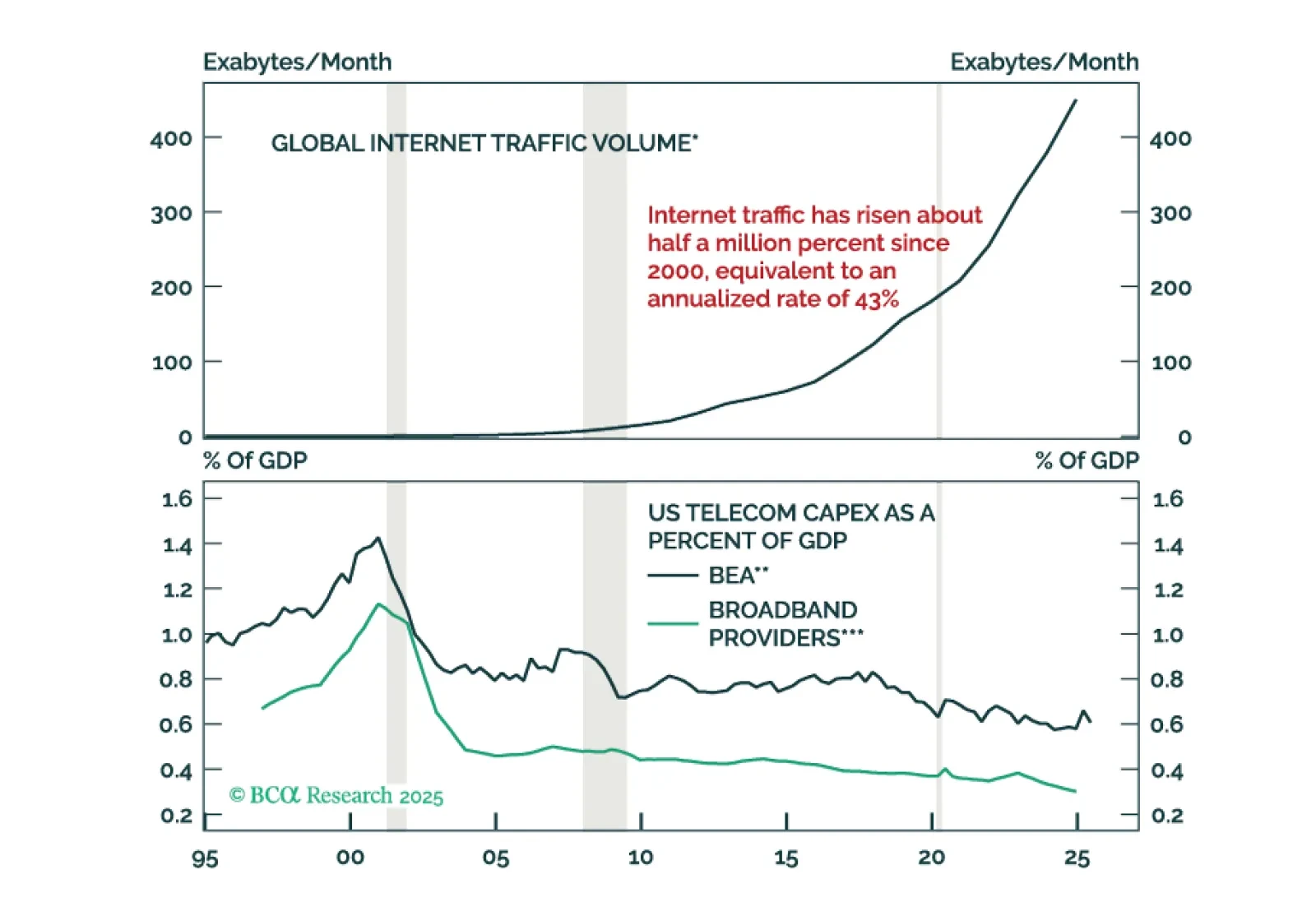

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

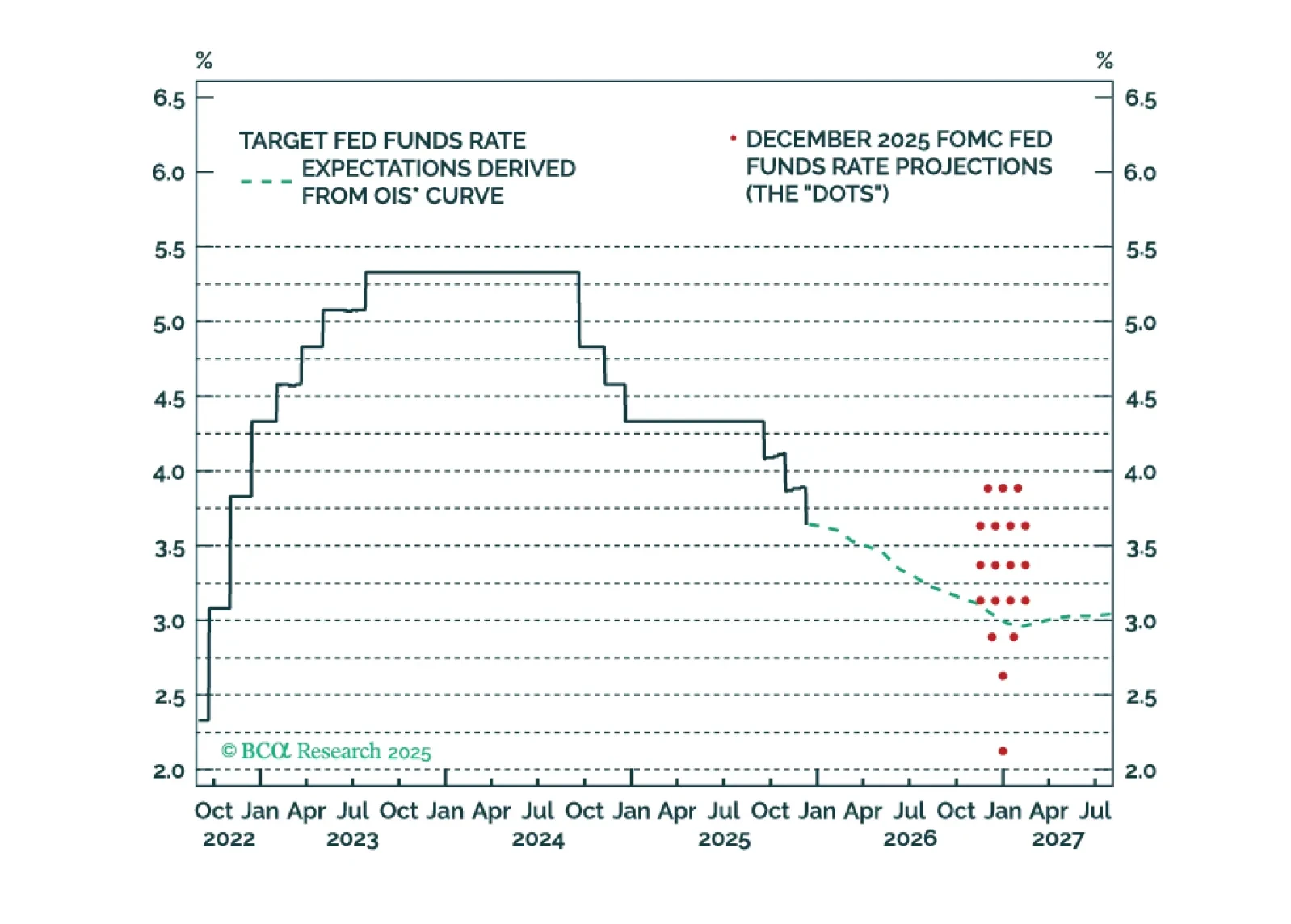

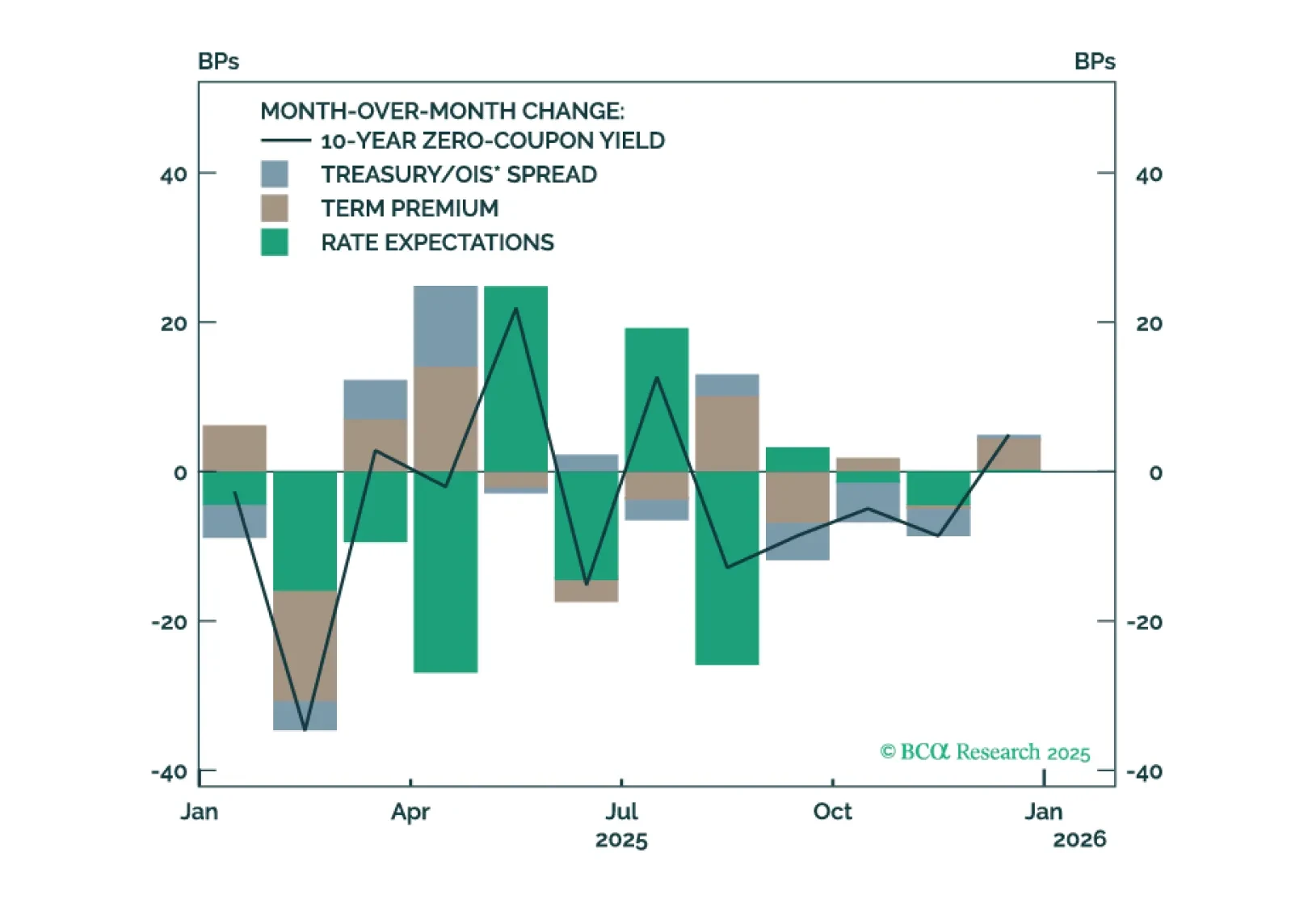

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.

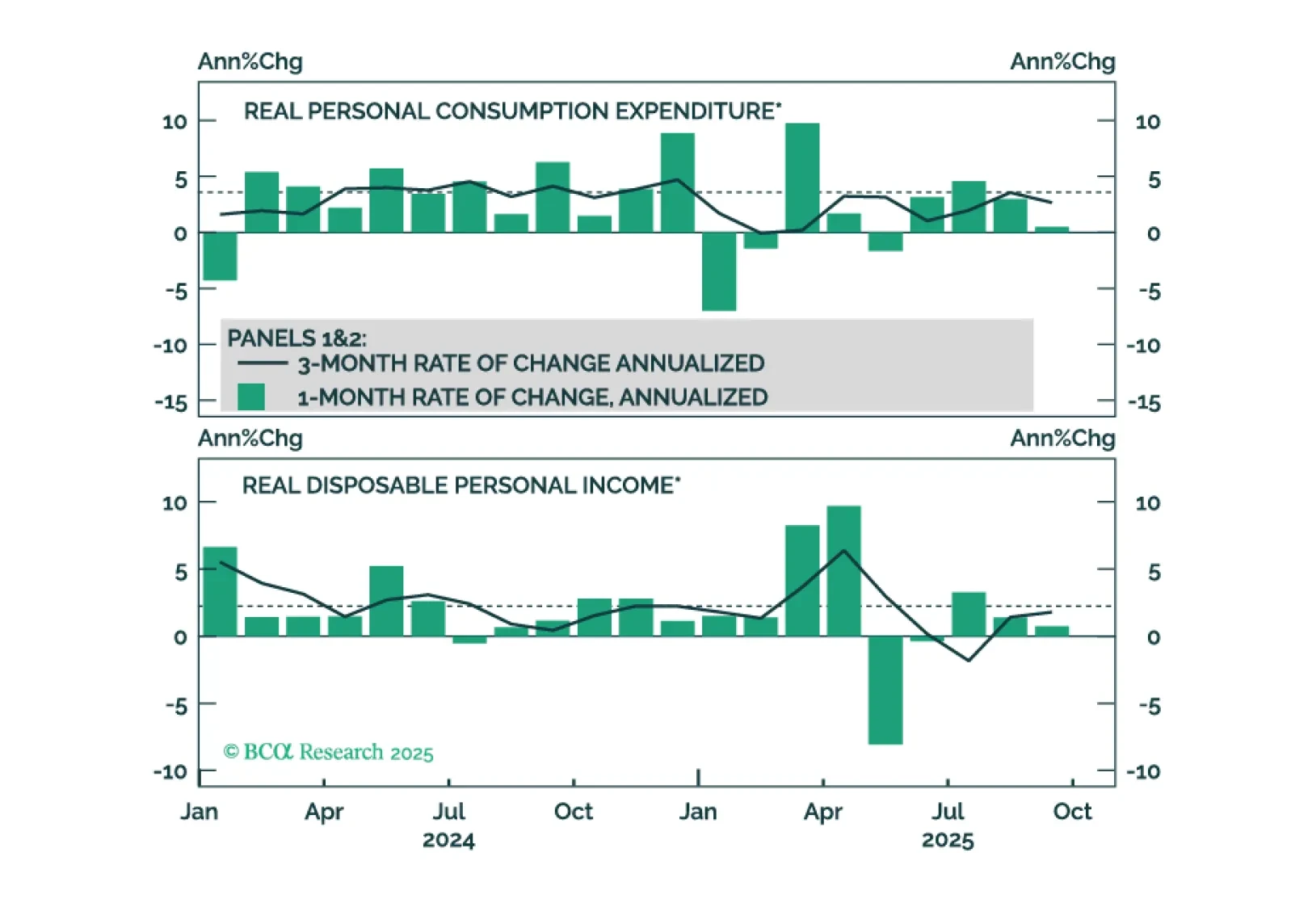

September’s weak consumer spending data challenge the K-shaped recovery narrative and suggest that spending will slow to match already-weak employment growth.

Our Portfolio Allocation Summary for December 2025.

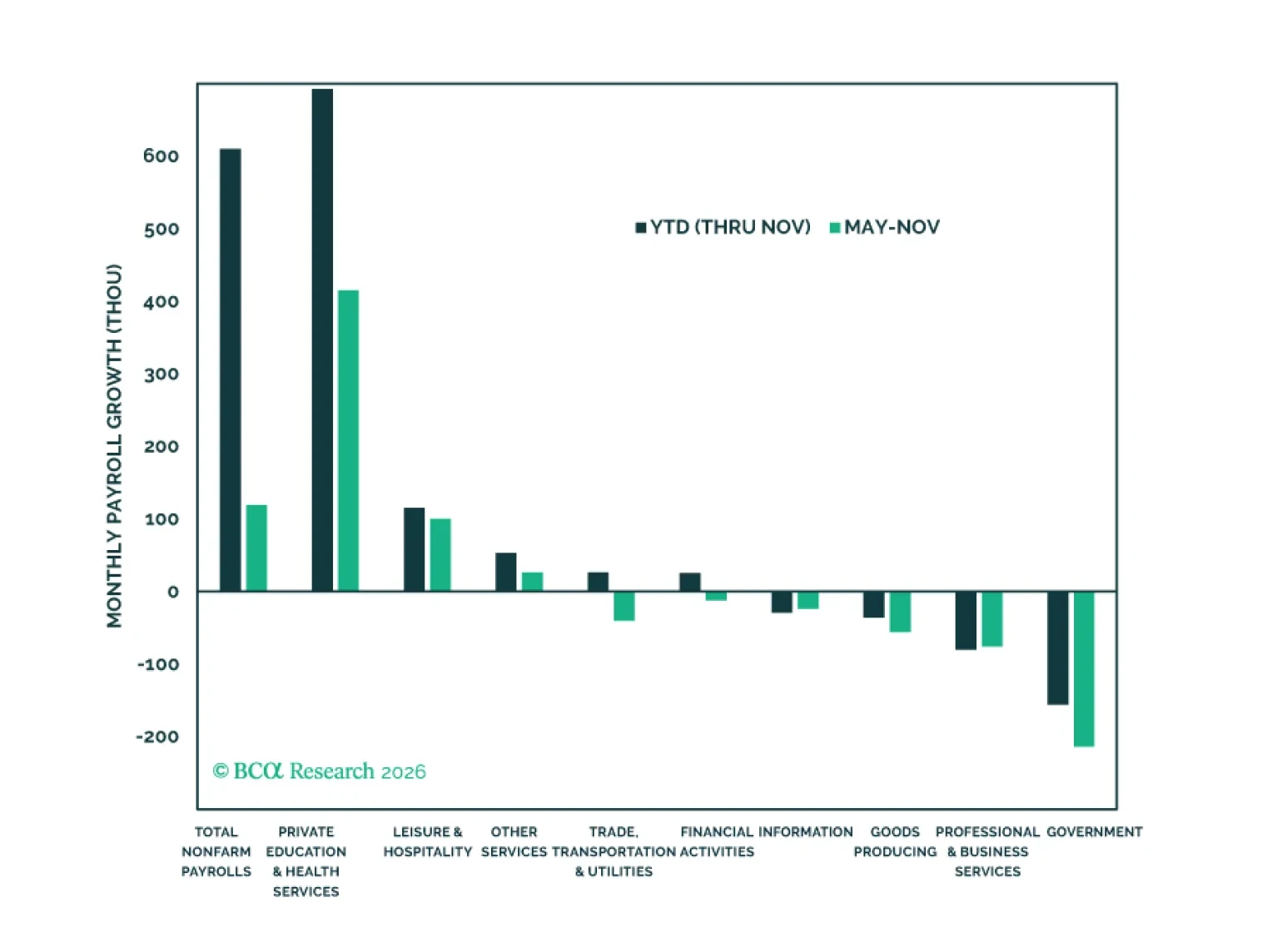

September job gains topped modest expectations, but year-over-year payrolls growth appears to have fallen below stall speed. We remain concerned about US activity.

Q3 results were strong but failed to impress investors, and Q4 will likely prove more challenging. Beneath the surface, earnings diverged sharply: Firms catering to affluent consumers maintained solid momentum, while those reliant on…