We consider the possibility that lower interest rates could lead to an increase in household borrowing, prolonging the economic recovery.

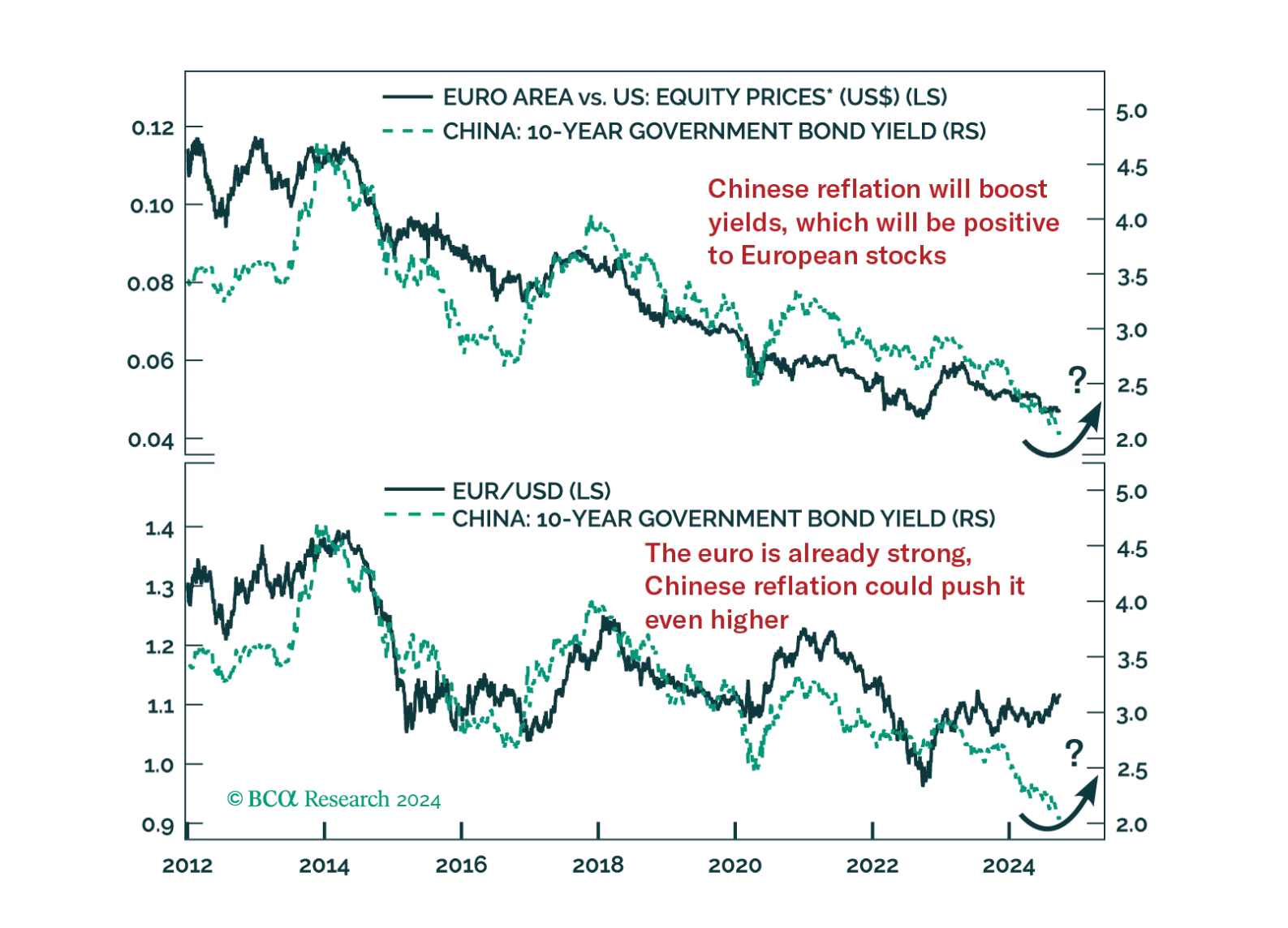

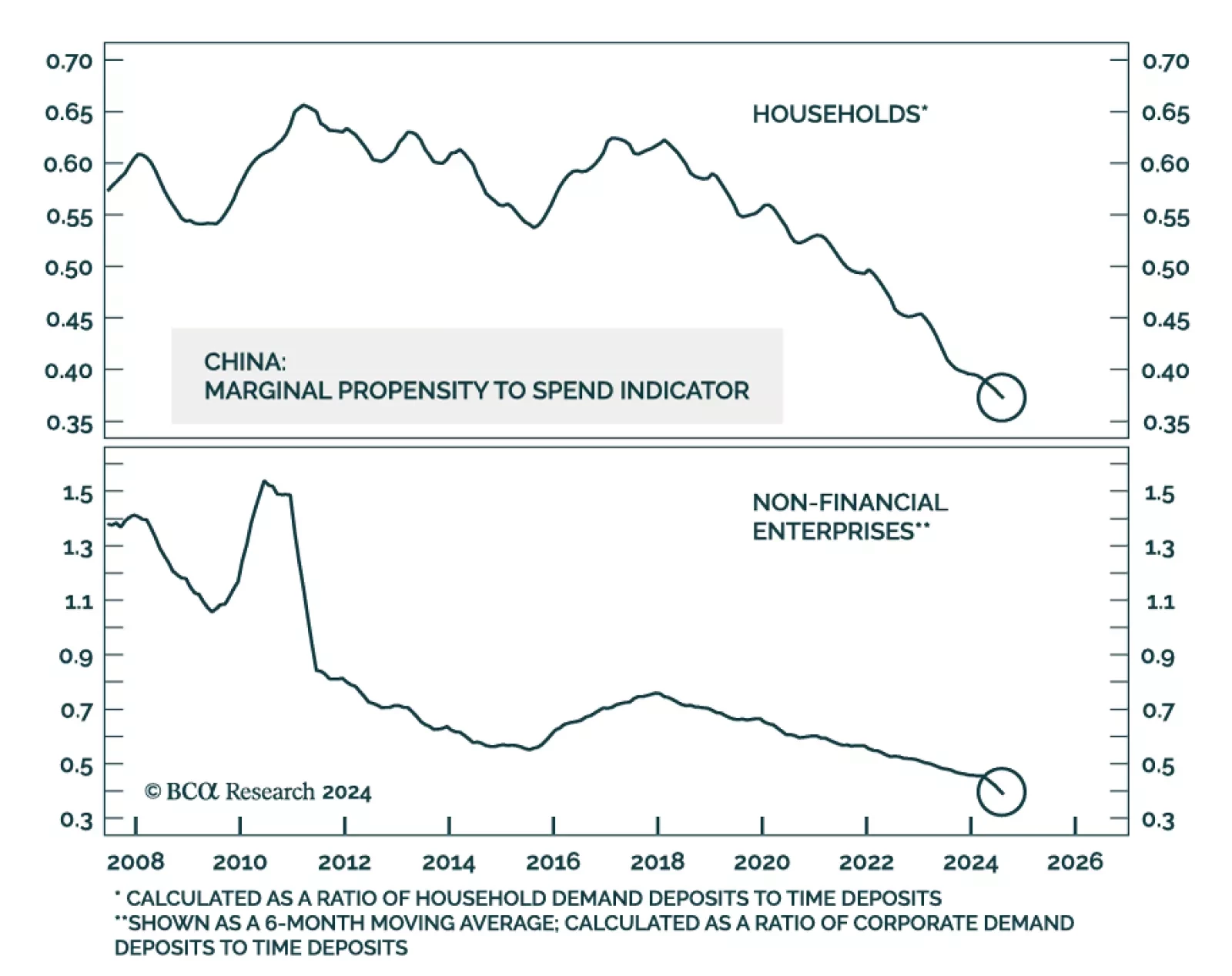

This week has not been short of developments on Chinese policy. After unleashing a monetary policy blitz, the authorities held an unscheduled Politburo meeting resulting in a pledge to take actions towards stabilizing the housing…

China’s Politburo announcement is likely to lead to a repricing of China’s growth in the near-term. Read how investors can hedge against this potent threat to our defensive investment stance.

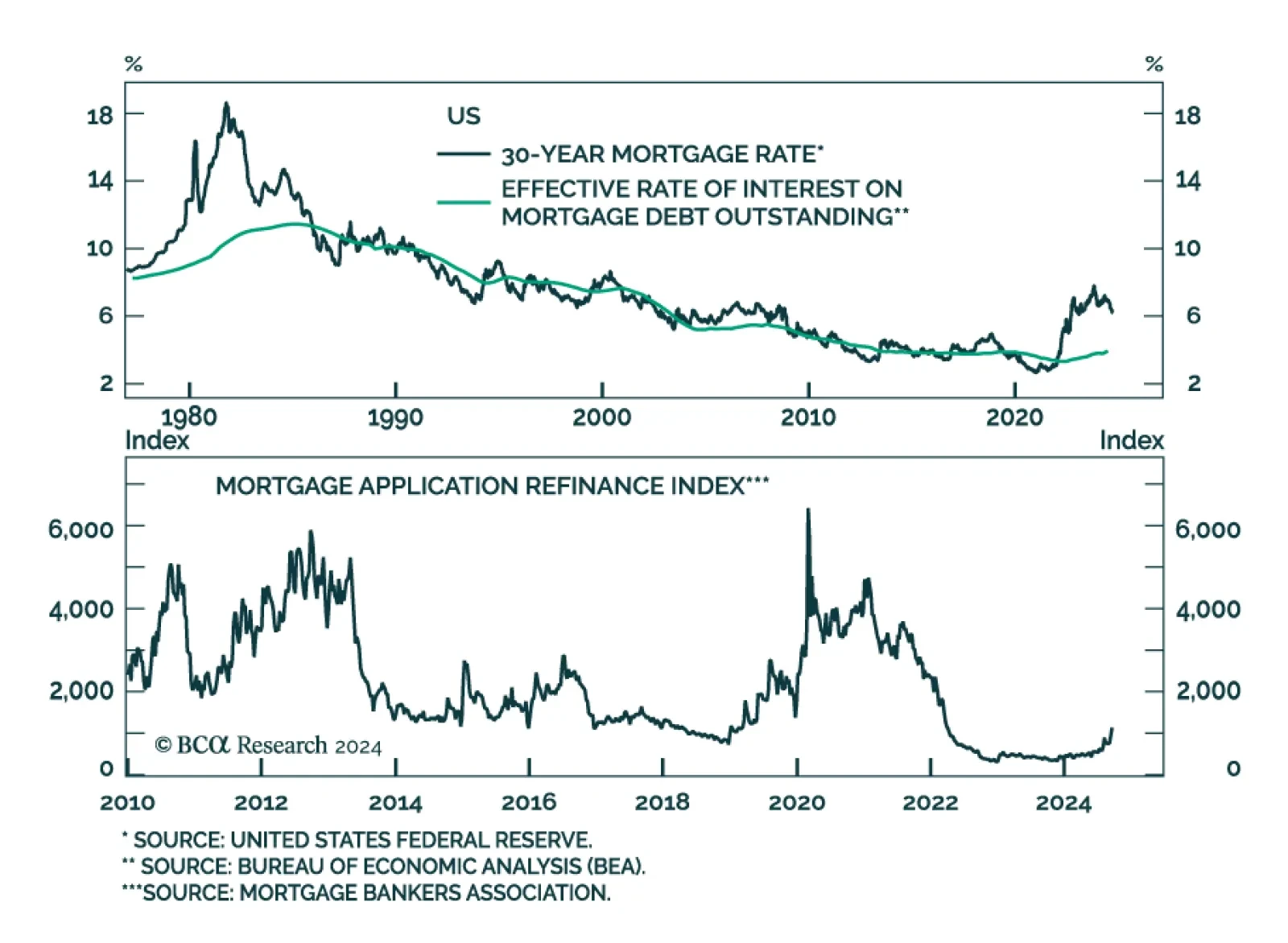

The conventional 30-year mortgage rate eased further to 6.2% from above 7% back in the spring, spurring a 20.3% surge in refinancing activity last week. Mortgage applications rose 11.0%, marking a fifth consecutive week of…

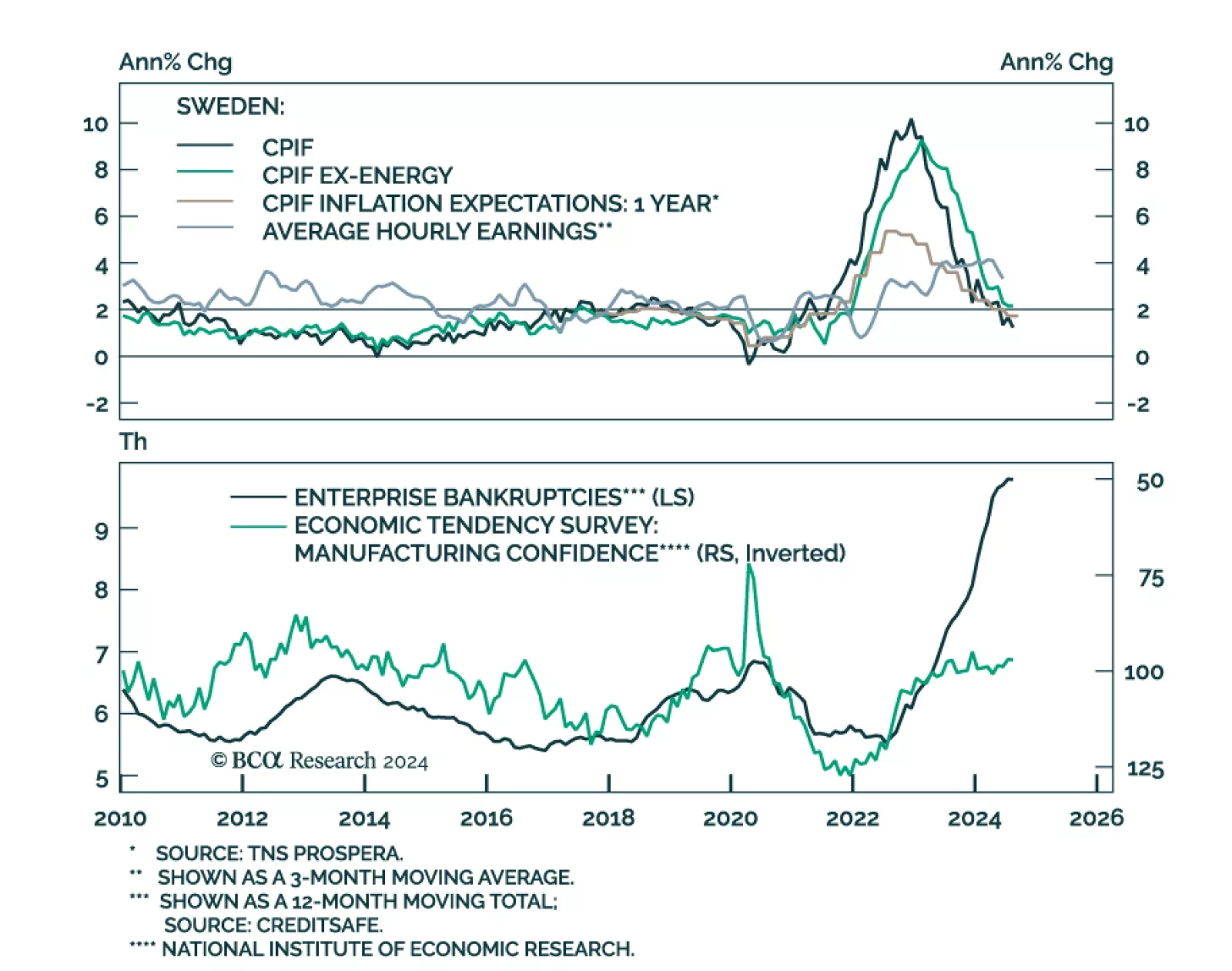

In a widely expected move, the Riksbank lowered its policy rate from 3.5% to 3.25% in September, marking its third cut this year. It embarked on its easing cycle in May, leading many other DM central banks, and has been…

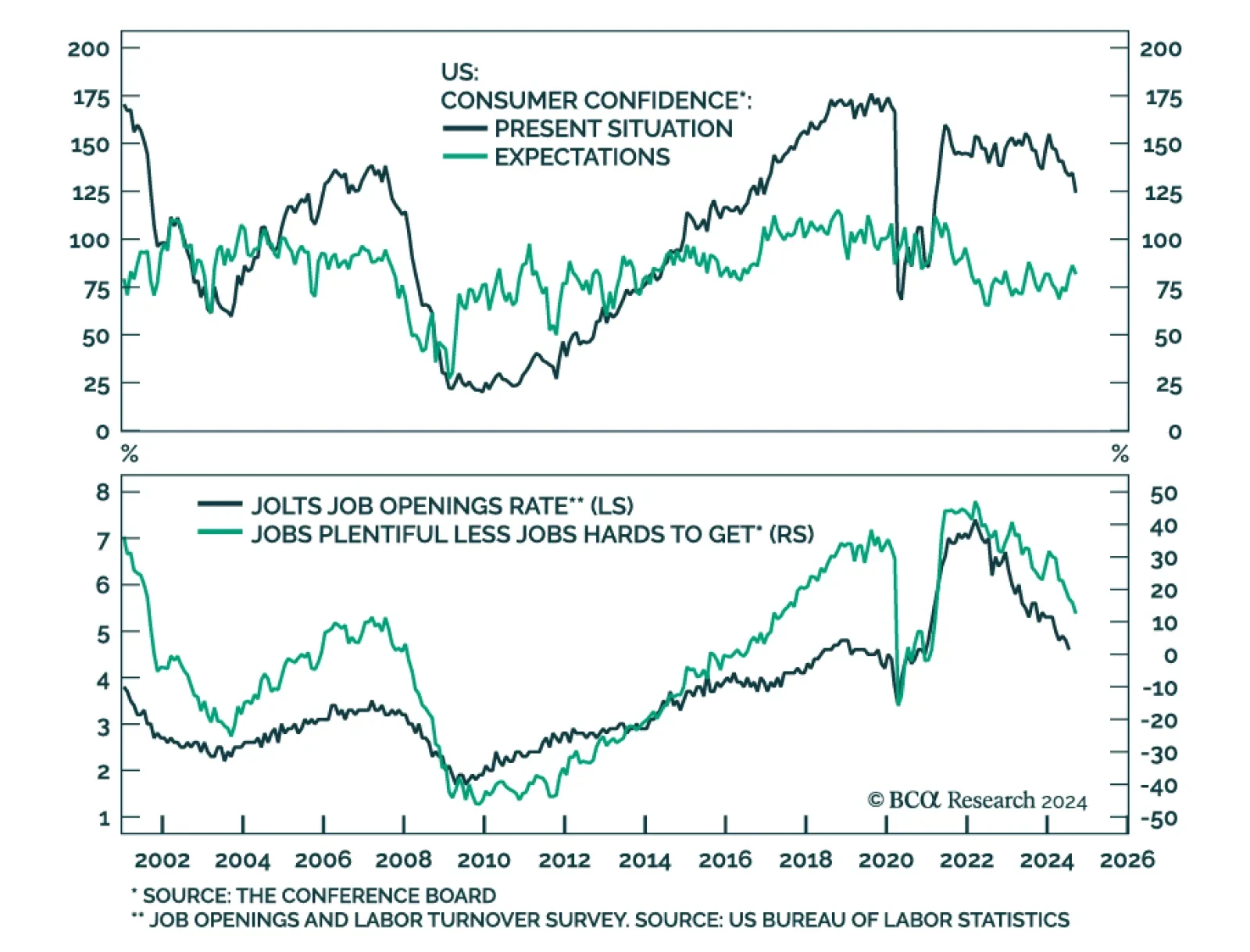

The Conference Board Consumer Confidence index unexpectedly shed 6.9 points to 98.7 in September. Both the Present Situation and Expectations components declined, by 10.3 and 4.6 points respectively. The decline in morale in…

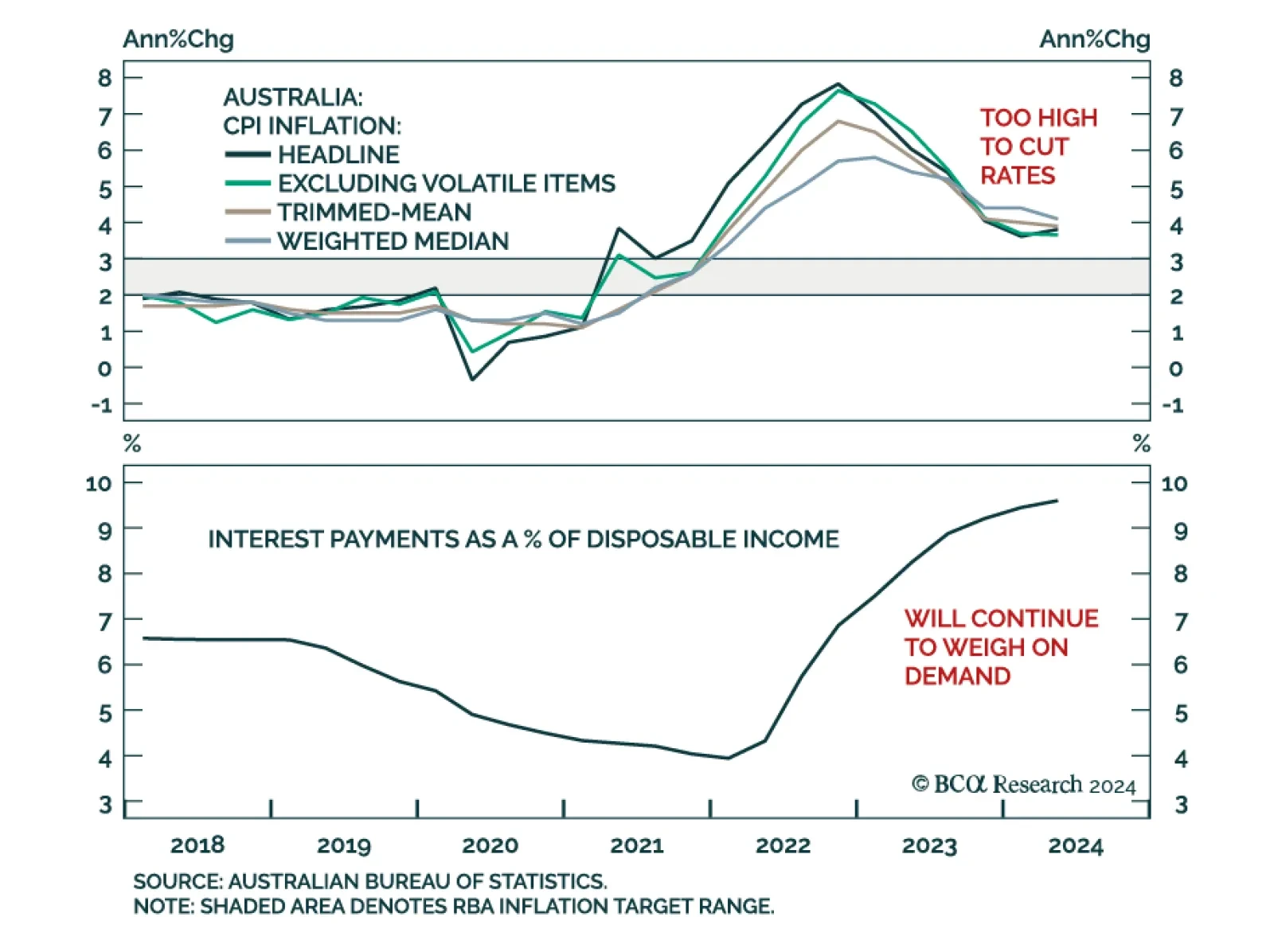

In a widely expected move, the Reserve Bank of Australia kept the cash rate unchanged at 4.35% in September. All measures of Australian CPI inflation remain well above the RBA target range. The Commonwealth Energy Bill Relief…

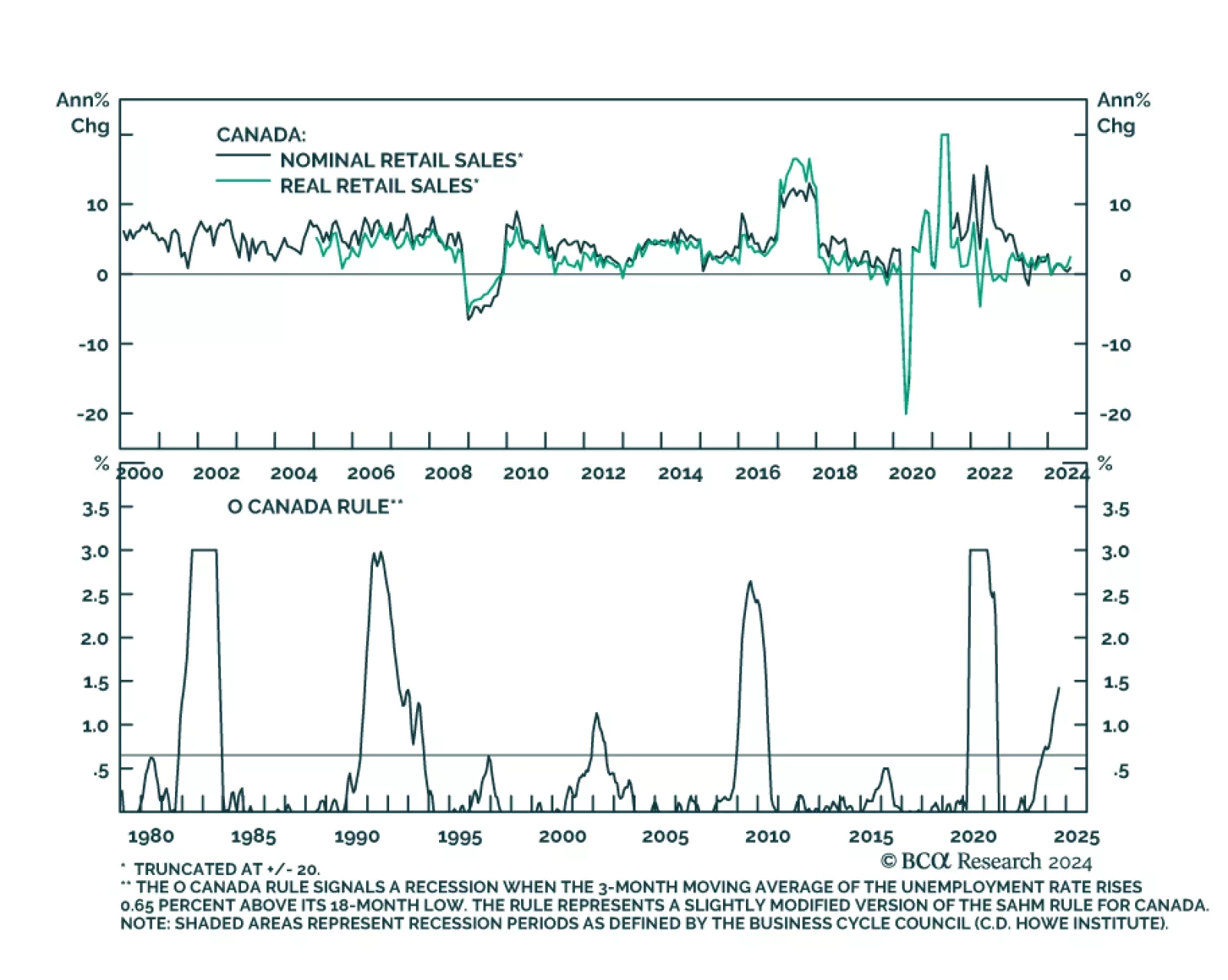

Canadian retail sales grew by a higher-than-expected 0.9% m/m in July from a 0.2% contraction in June. A 2.2% monthly rise in vehicle sales led an otherwise broad-based increase. Ex-auto retail sales also surprised positively,…

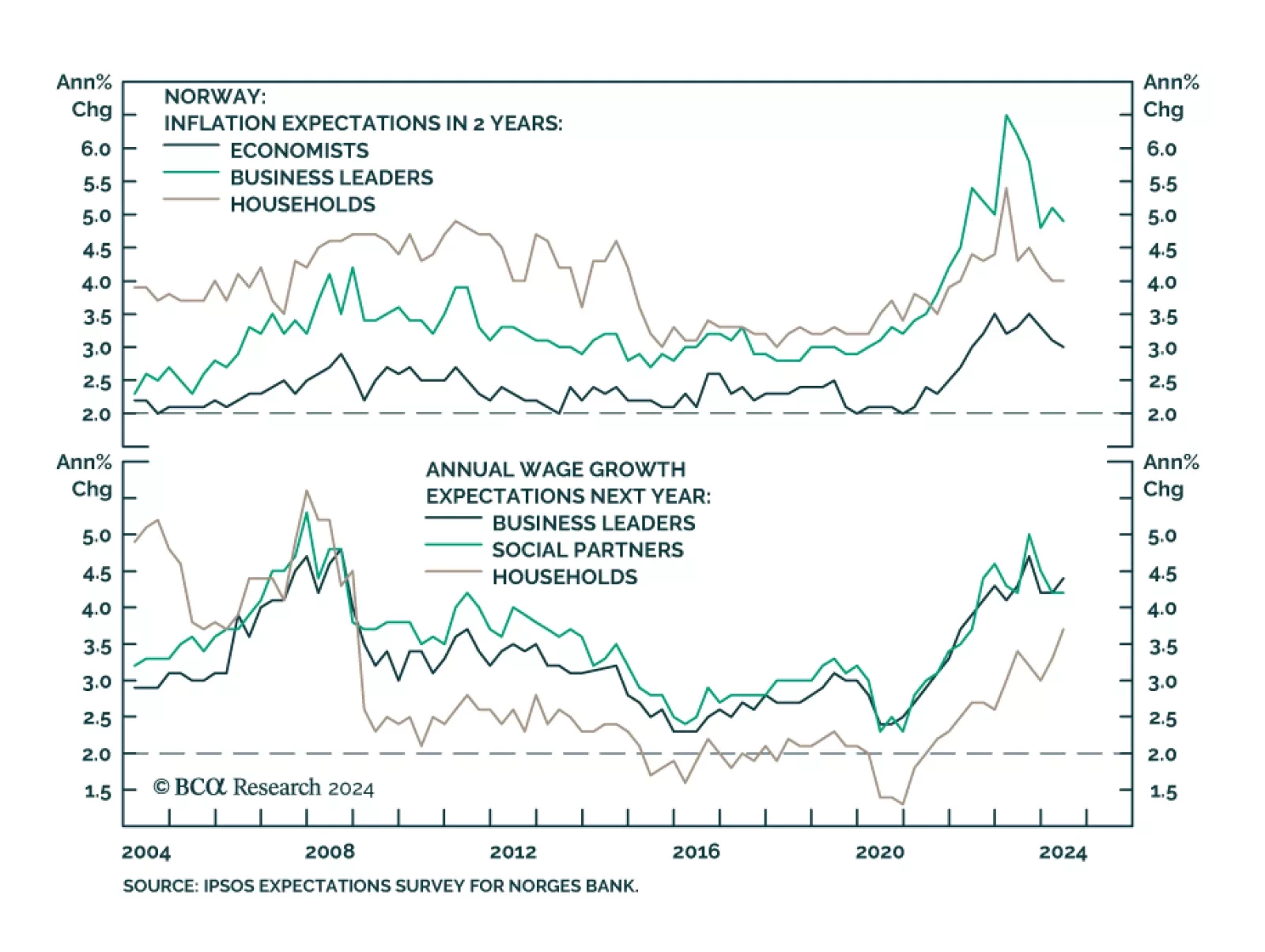

The Norges Bank kept its policy rate unchanged at 4.5% at its September meeting and signaled low odds of policy easing before the first quarter of 2025. The inflation backdrop does not warrant easing policy. Although core CPI…