This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

Our Portfolio Allocation Summary for December 2025.

Our Portfolio Allocation Summary for November 2025.

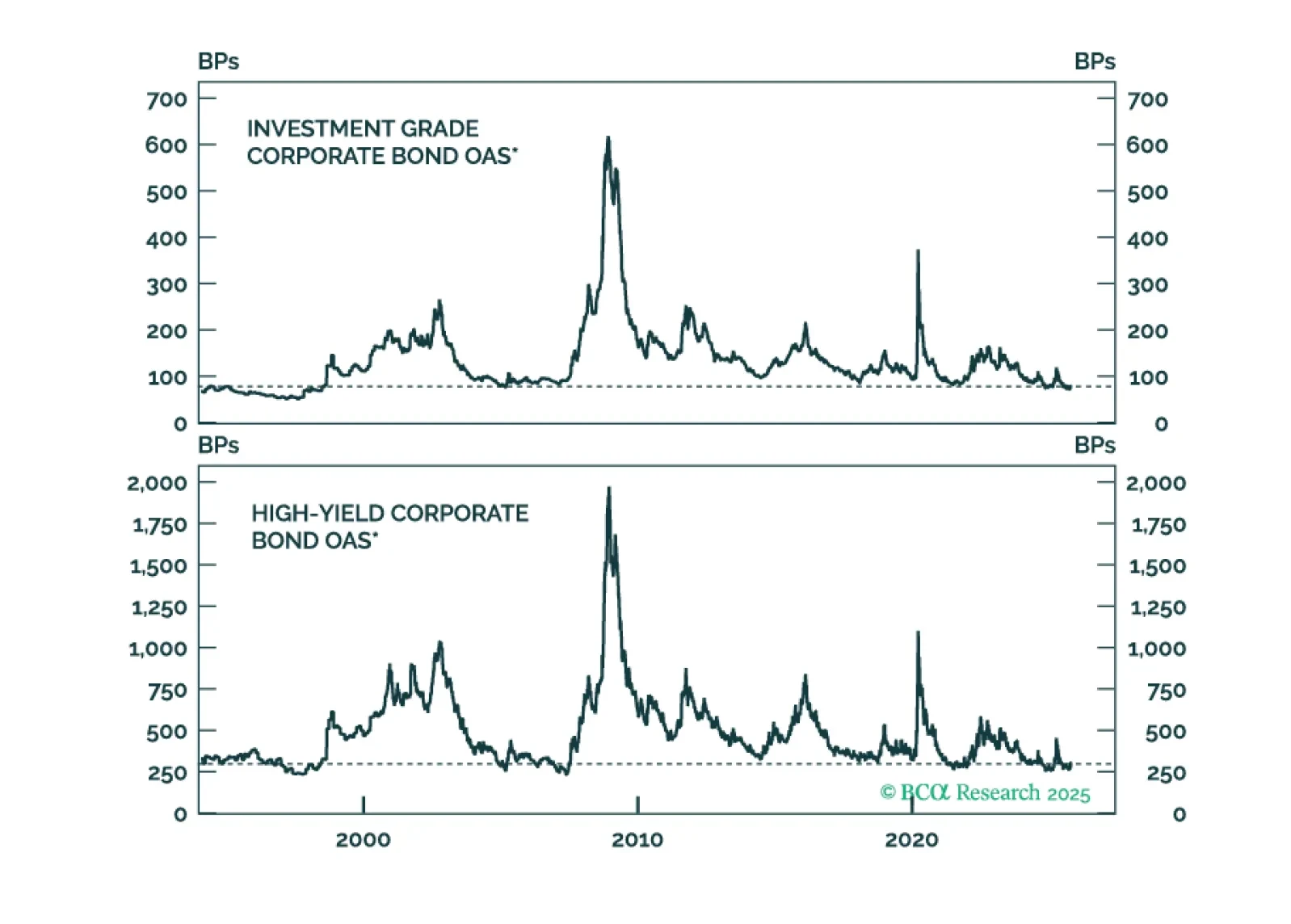

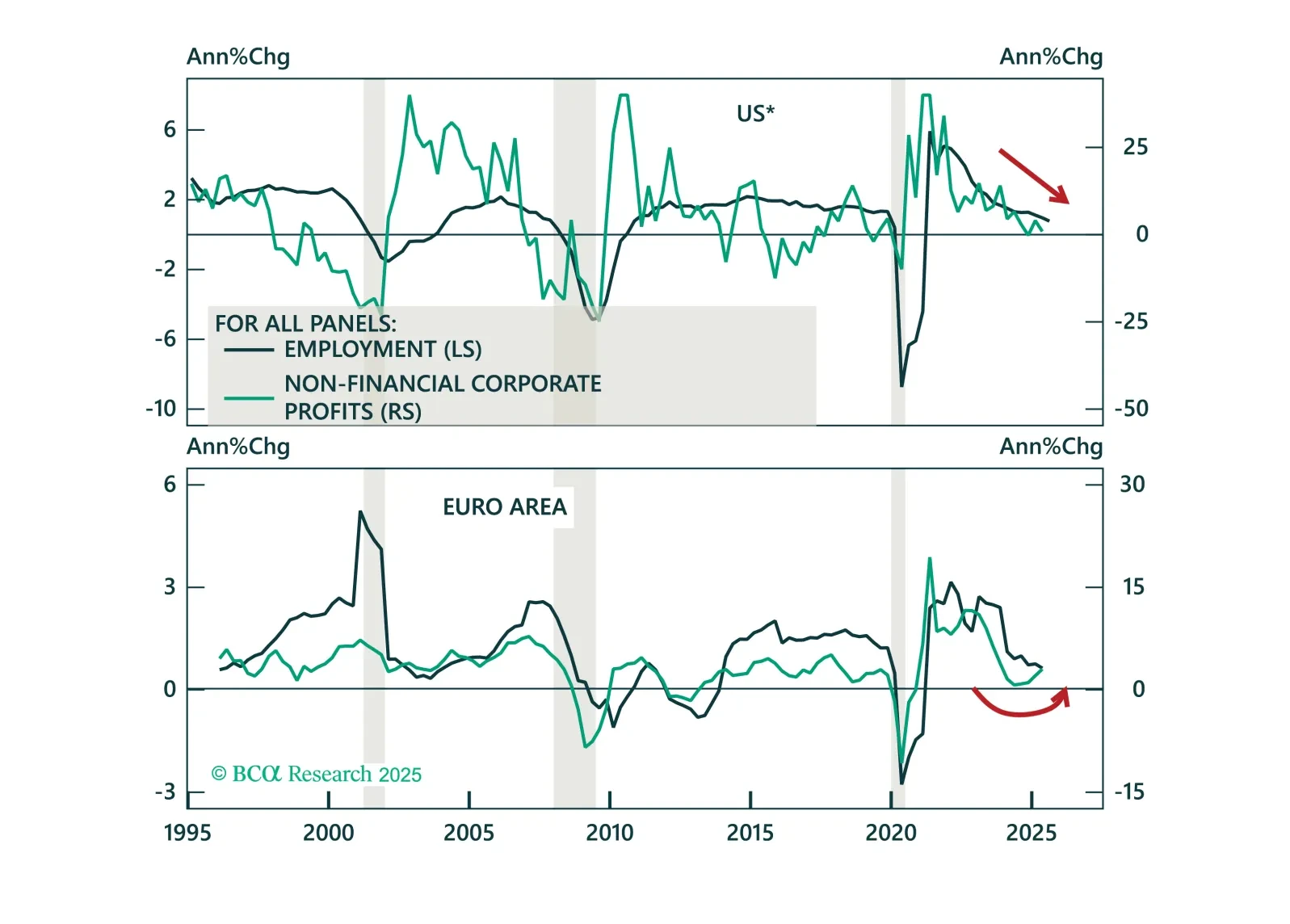

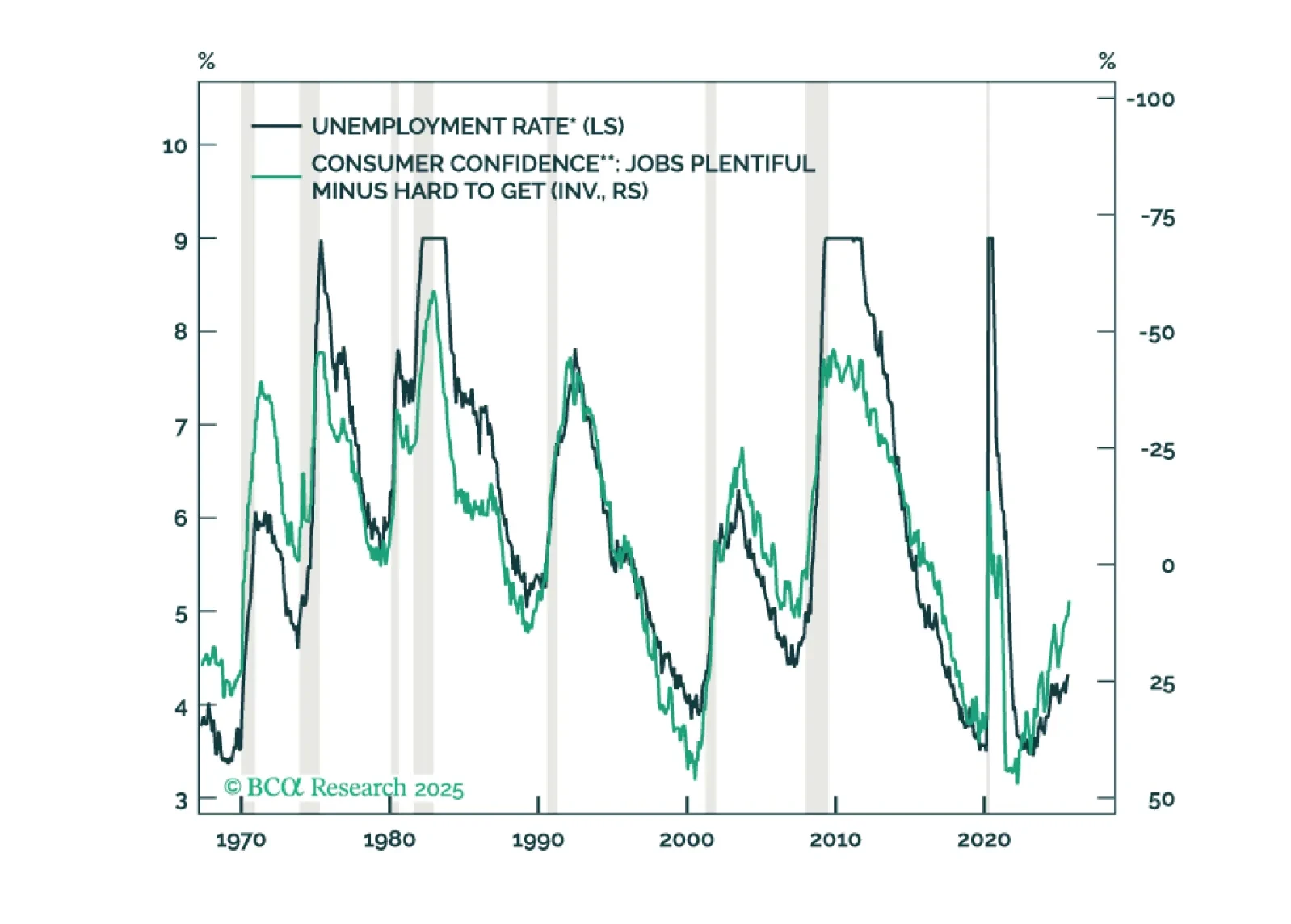

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

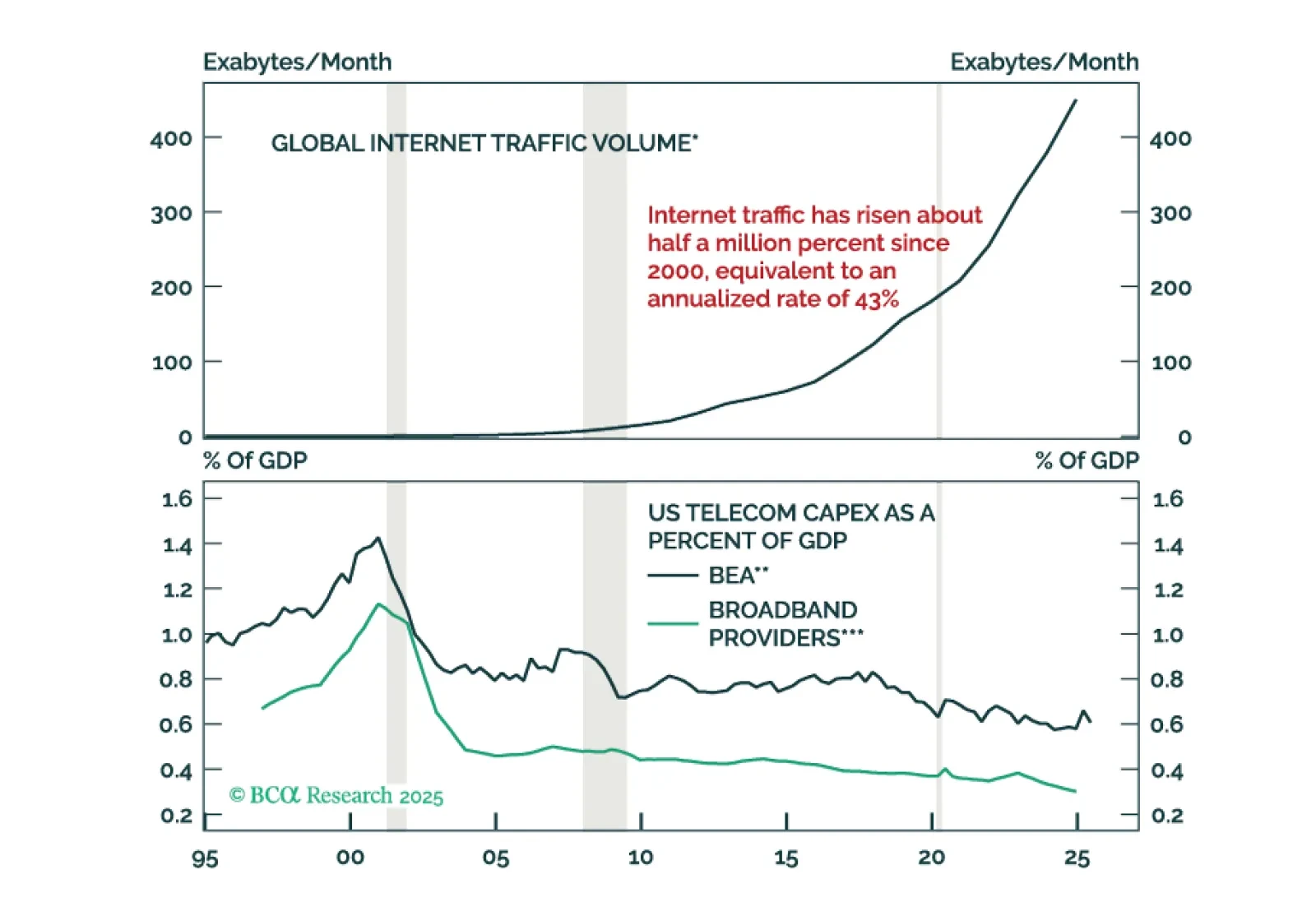

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

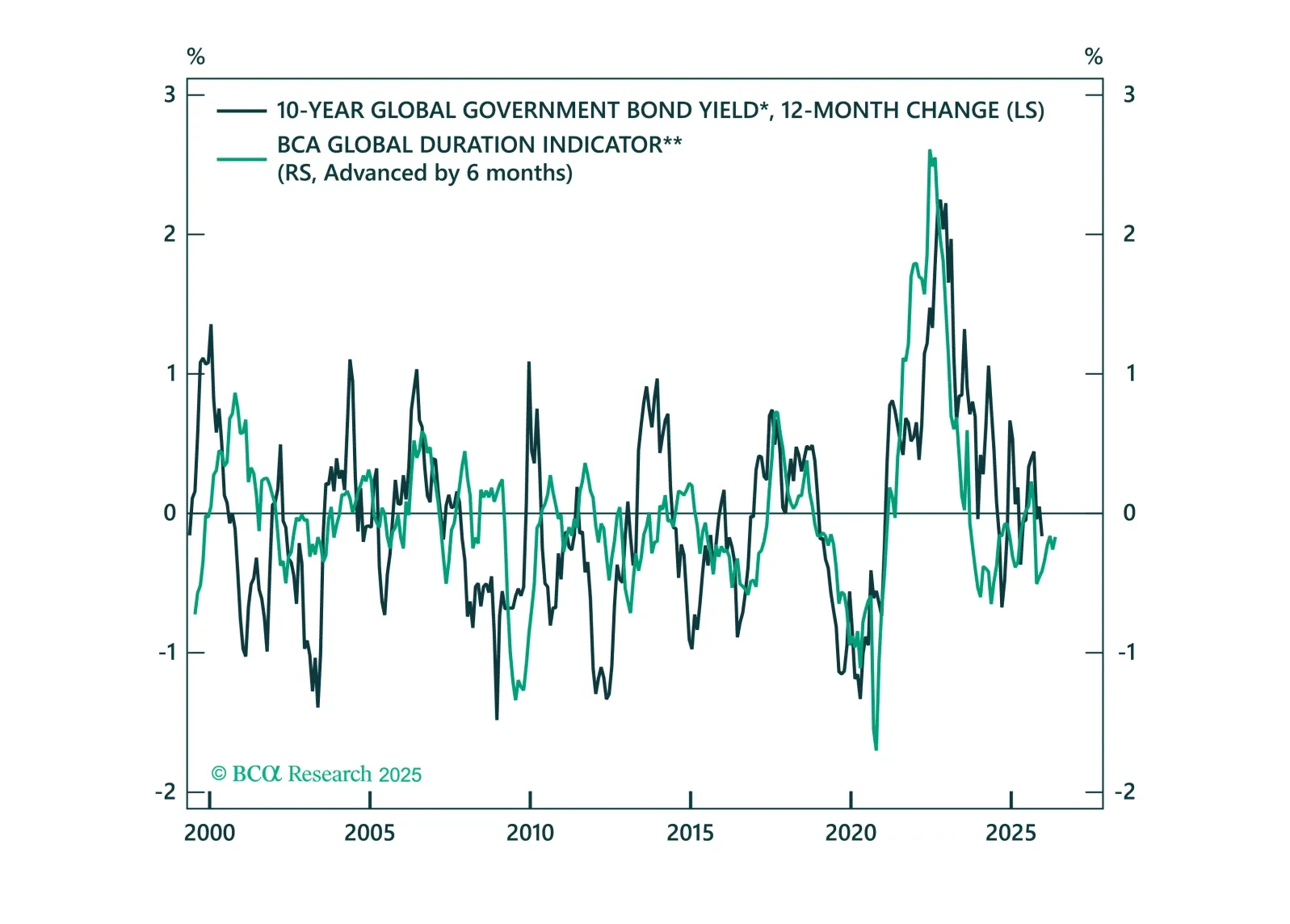

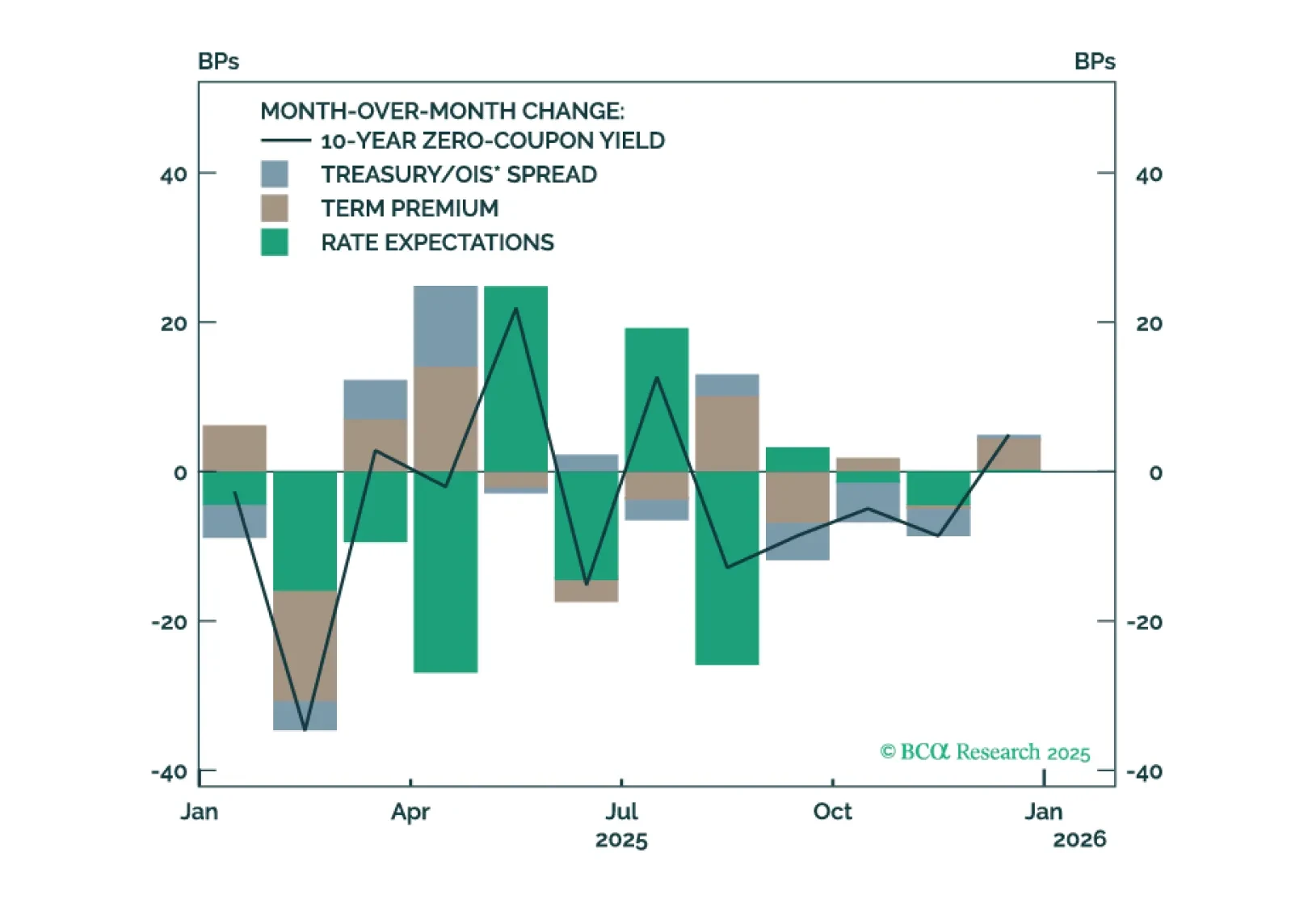

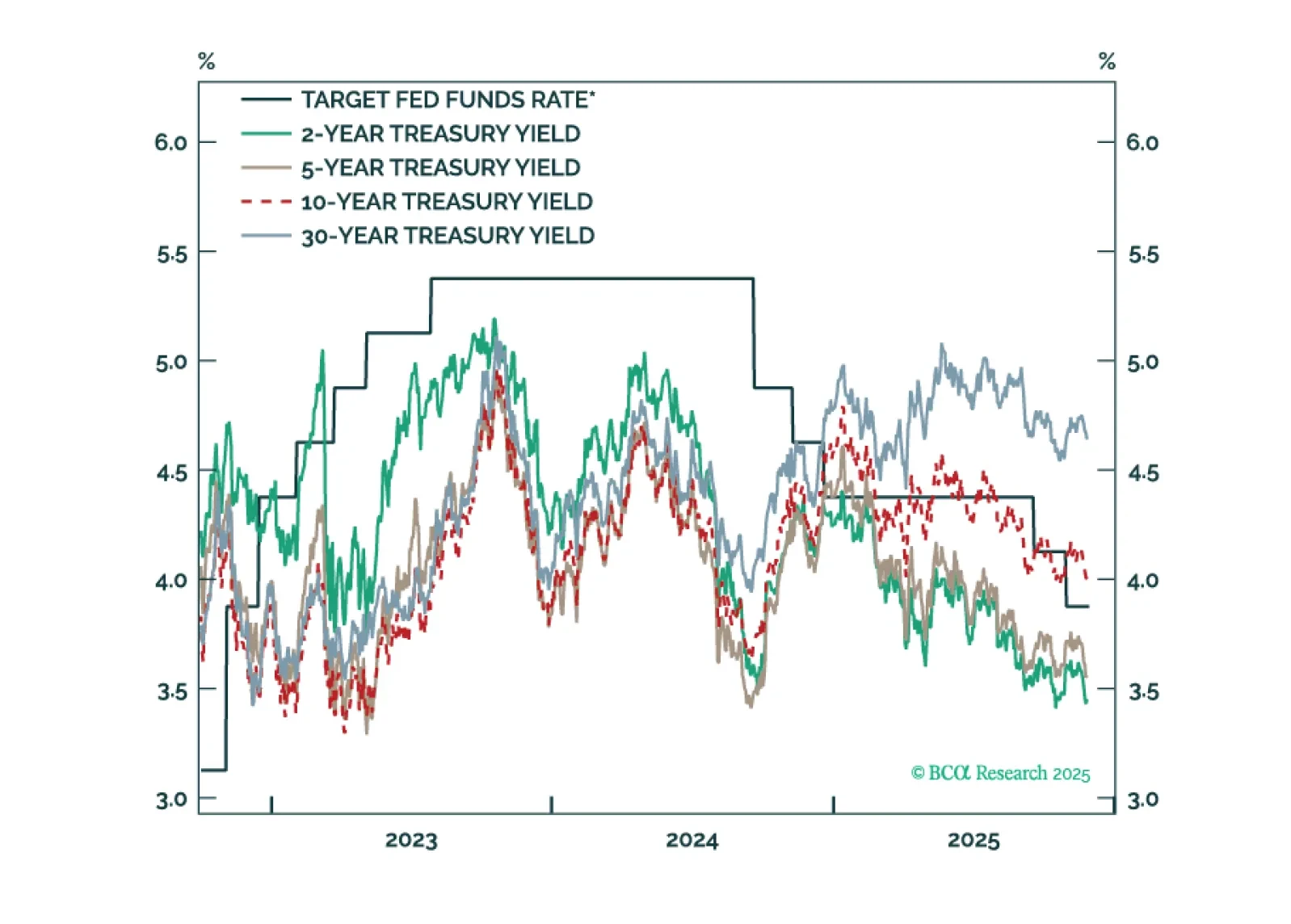

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

Our Portfolio Allocation Summary for October 2025.