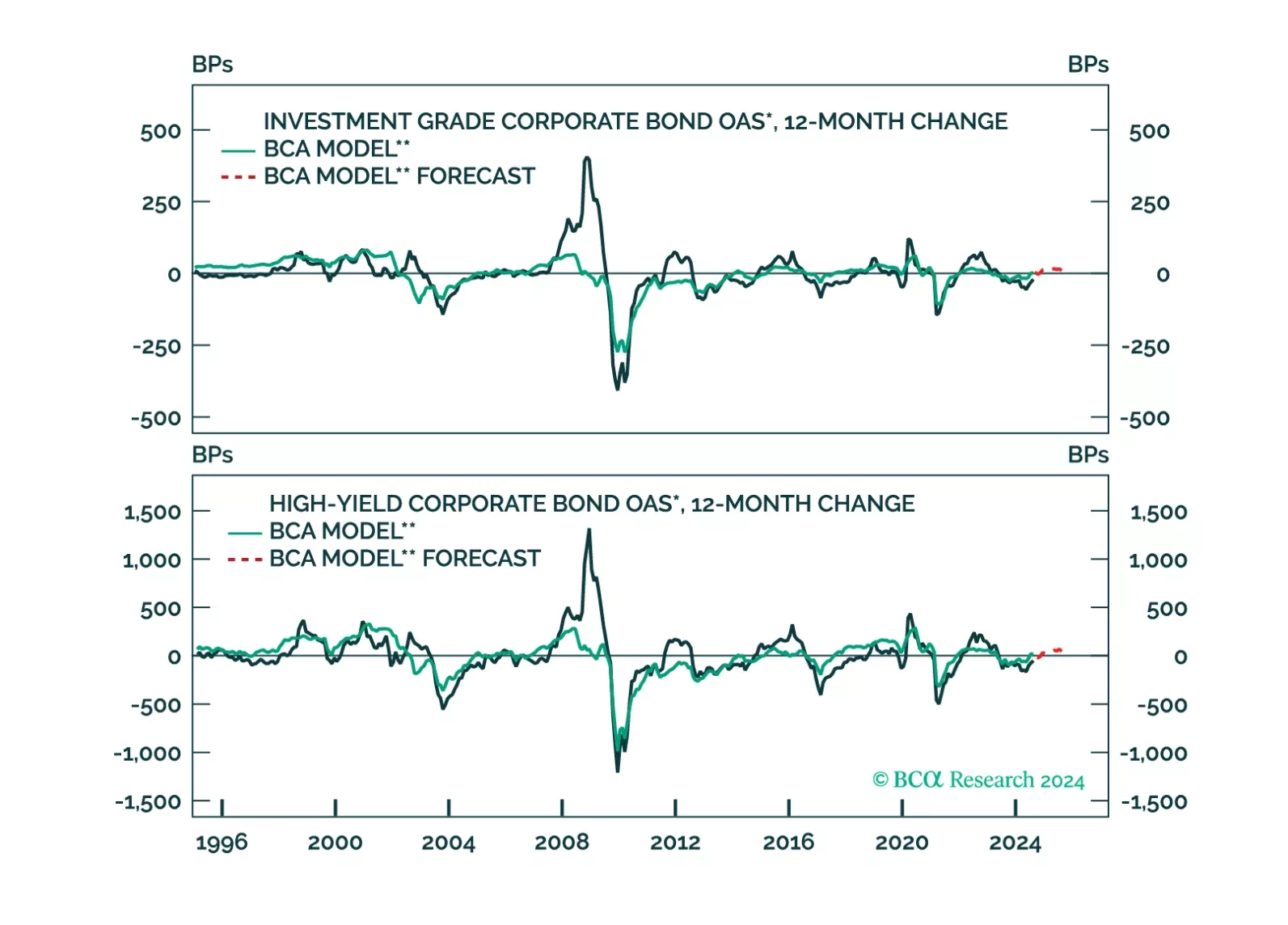

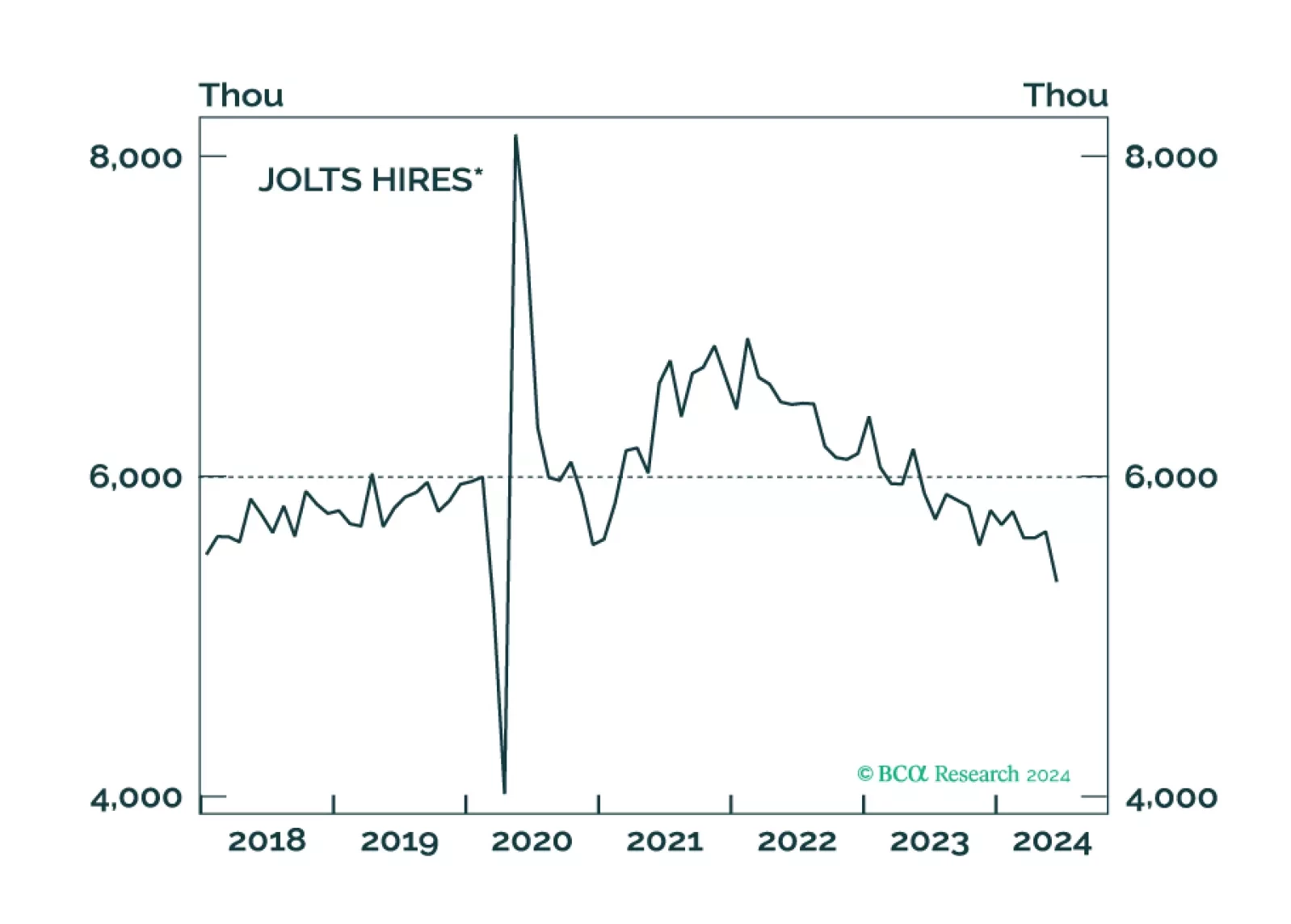

We update our corporate default rate model and consider the implications for corporate bond spreads.

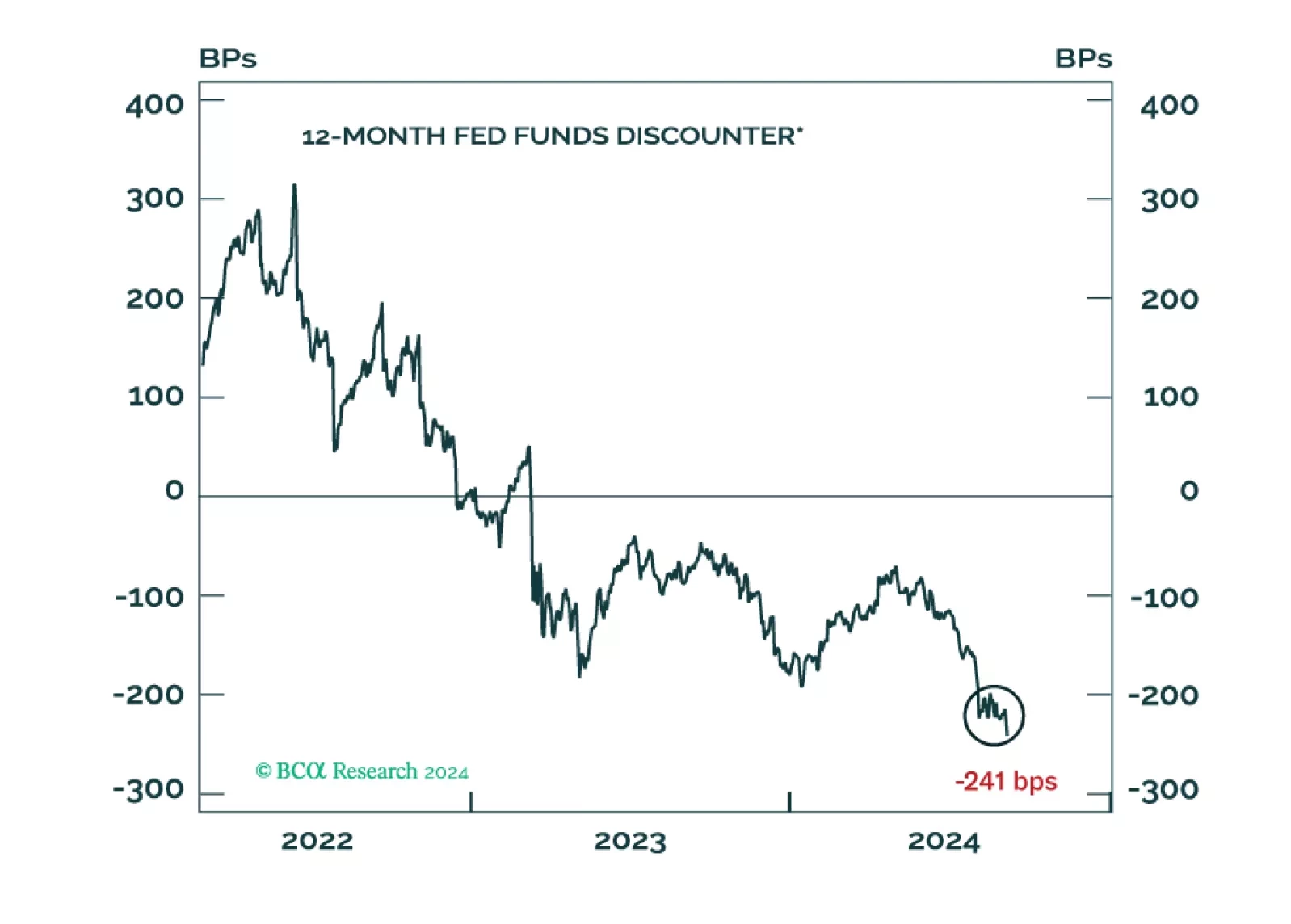

The pro-cyclical Eurozone economy is highly exposed to a global downturn, which we expect will materialize by early 2025. The ECB is behind the curve and we thus expect it to ease more aggressively than markets expect next year…

Our Portfolio Allocation Summary for September 2024.

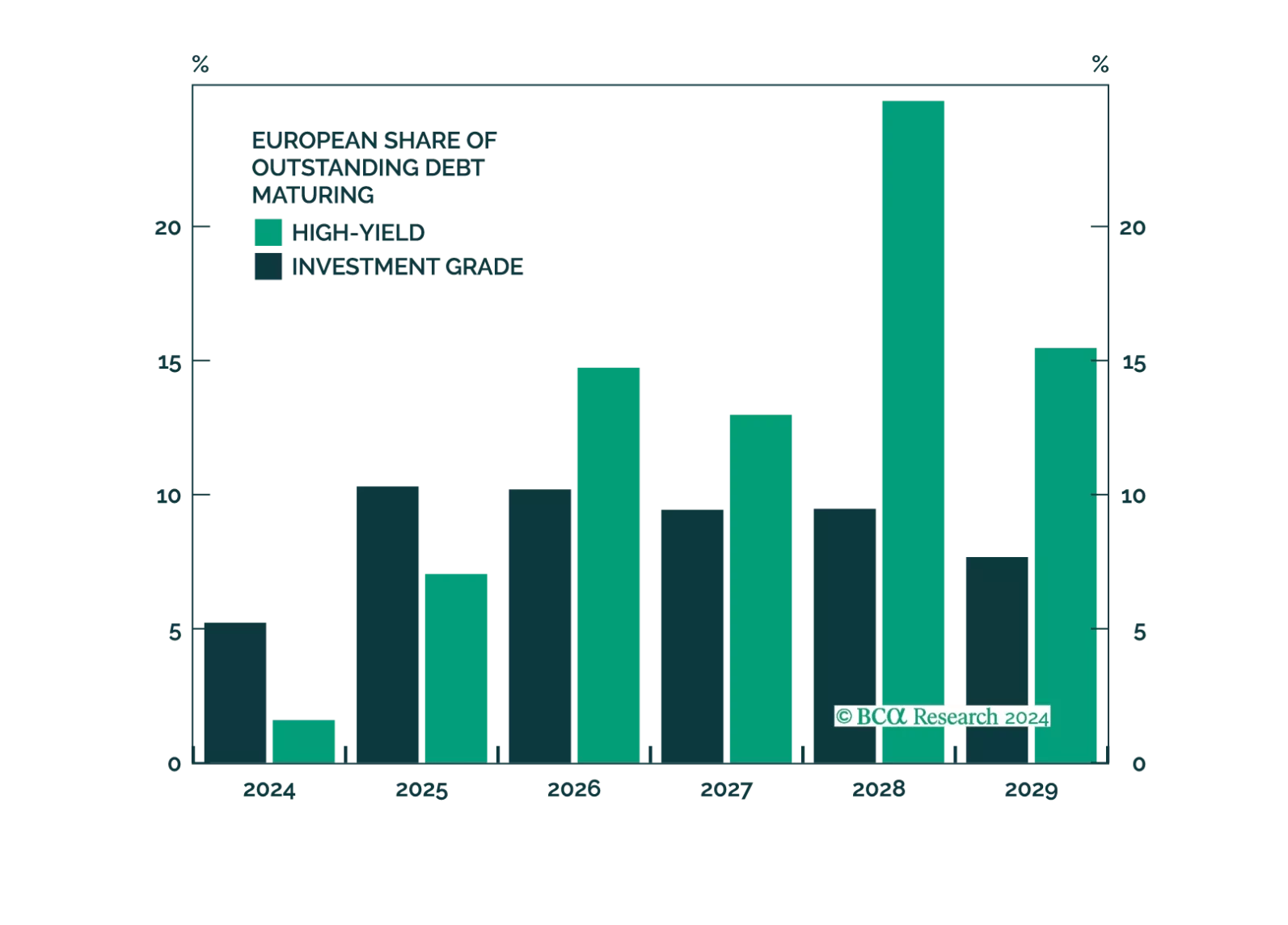

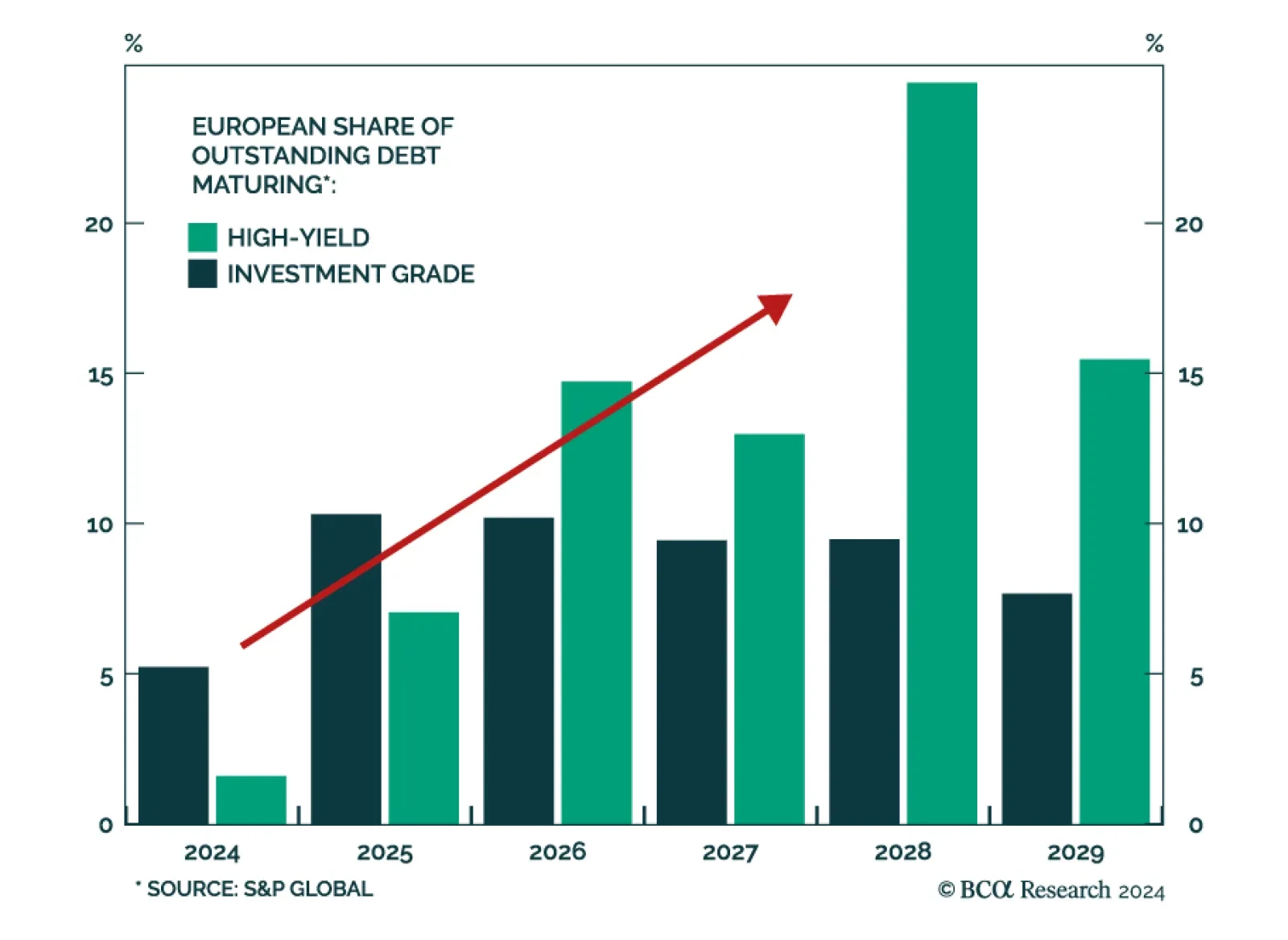

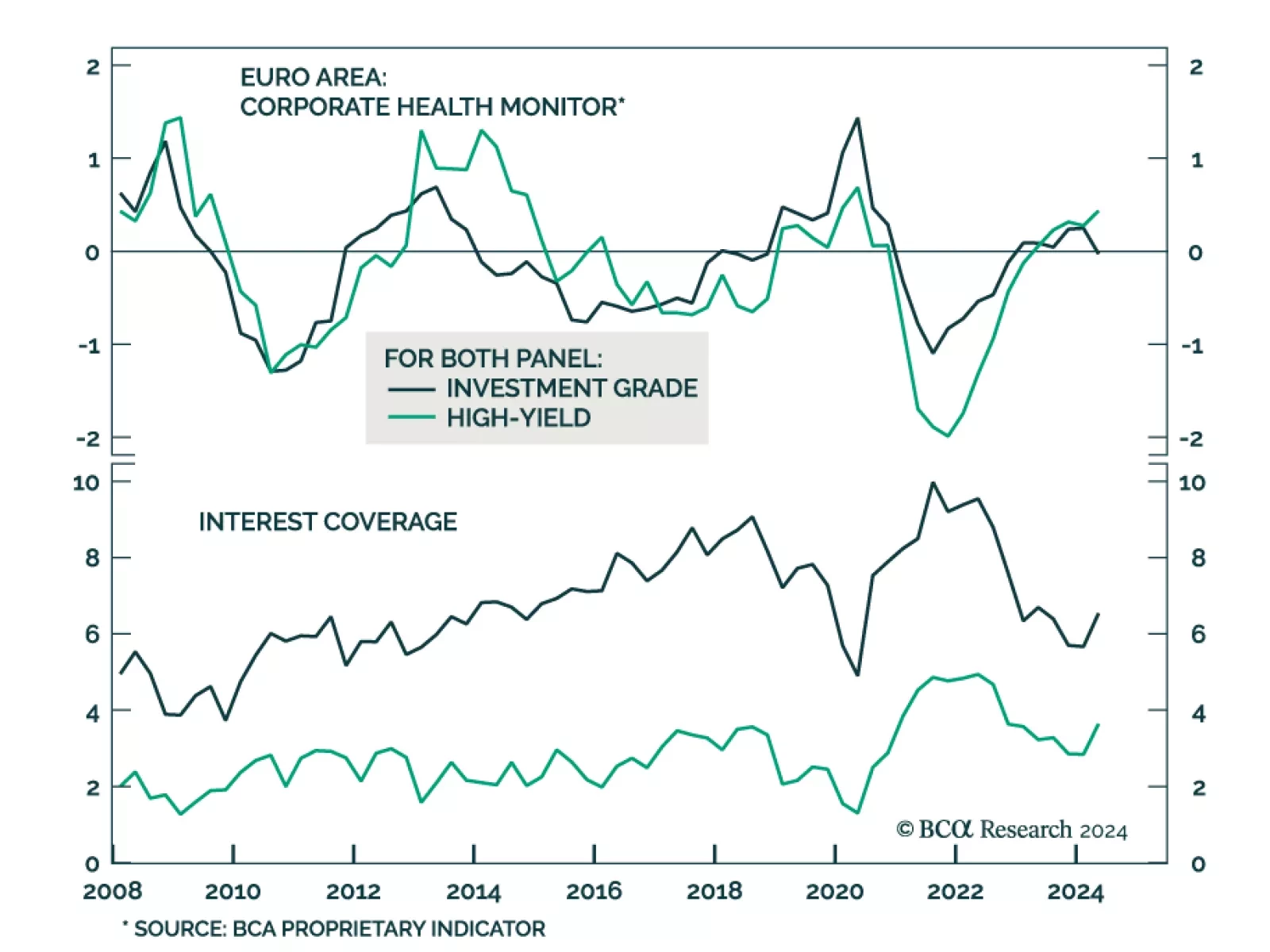

According to BCA Research’s European Investment Strategy service, an increase in borrowing costs will further weaken vulnerable corporate balance sheets. As suggested by their Corporate Health Monitors (CHMs), the health of…

Our Portfolio Allocation Summary for August 2024.

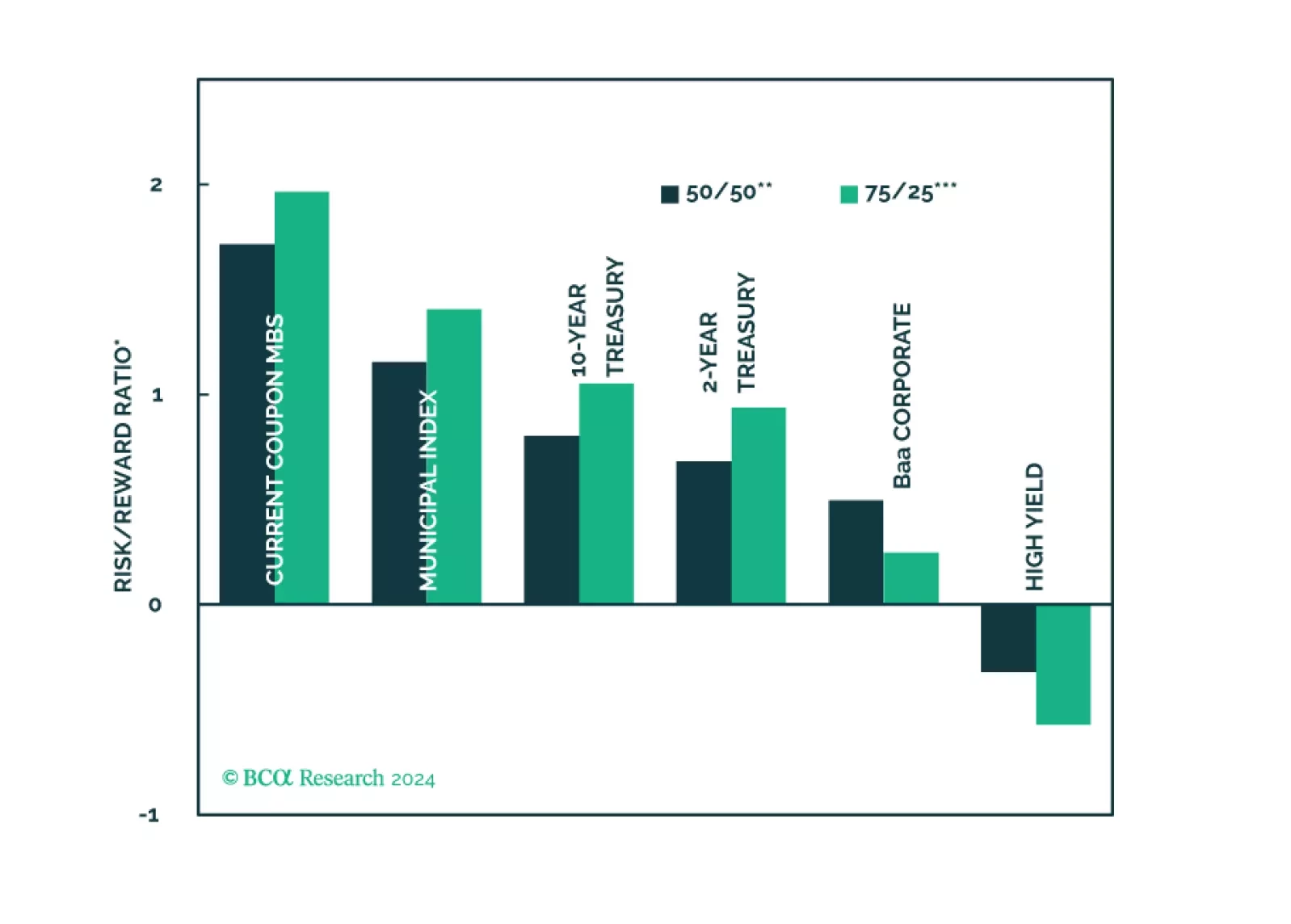

We calculate expected returns for several different US fixed income sectors with a focus on how municipal bonds stack up against the investment alternatives.

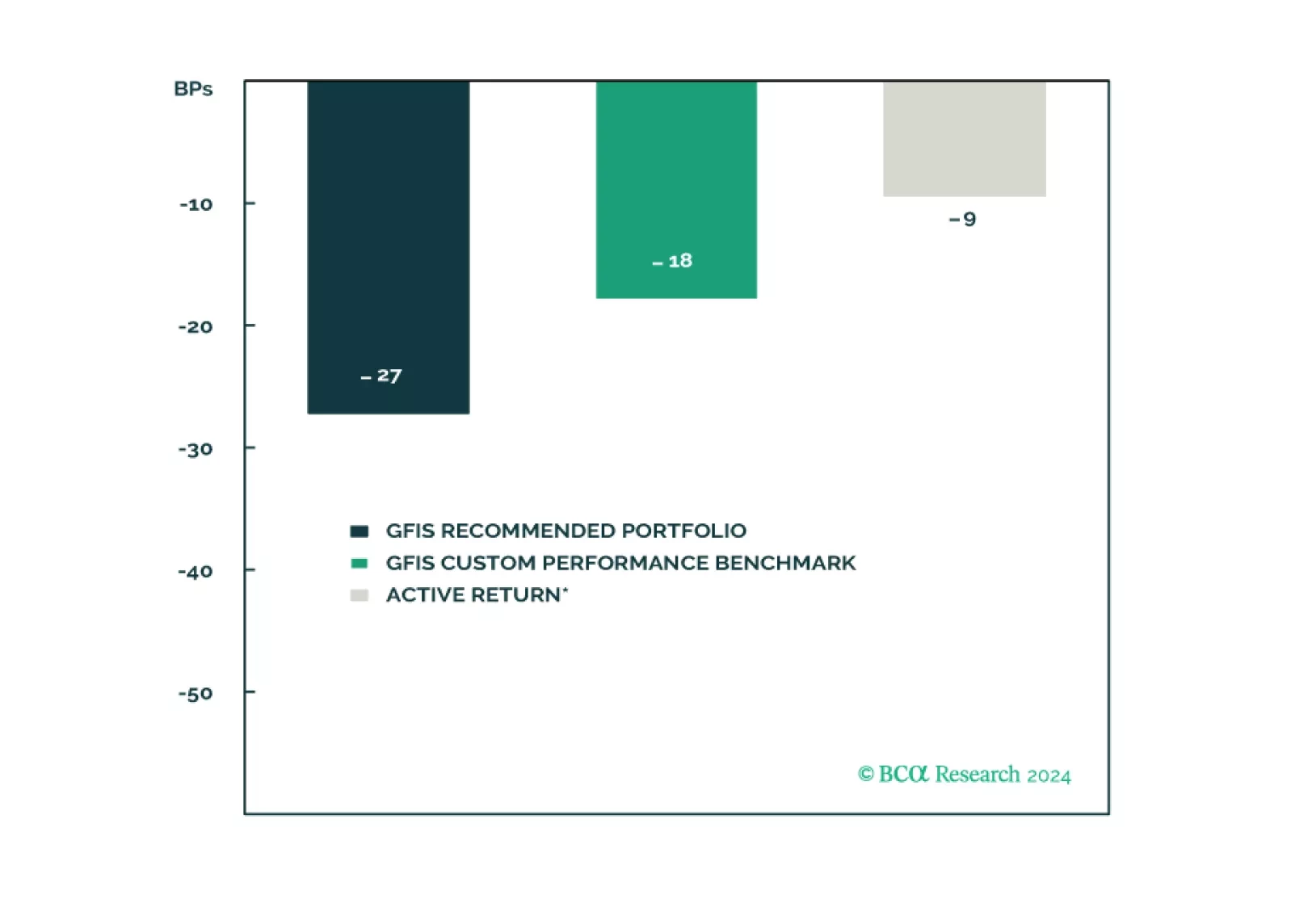

In this report, we present the quarterly review of our Model Bond Portfolio. Rebounding growth and political instability led to slightly negative portfolio performance in Q2/2024. As global growth starts to moderate, we continue to…

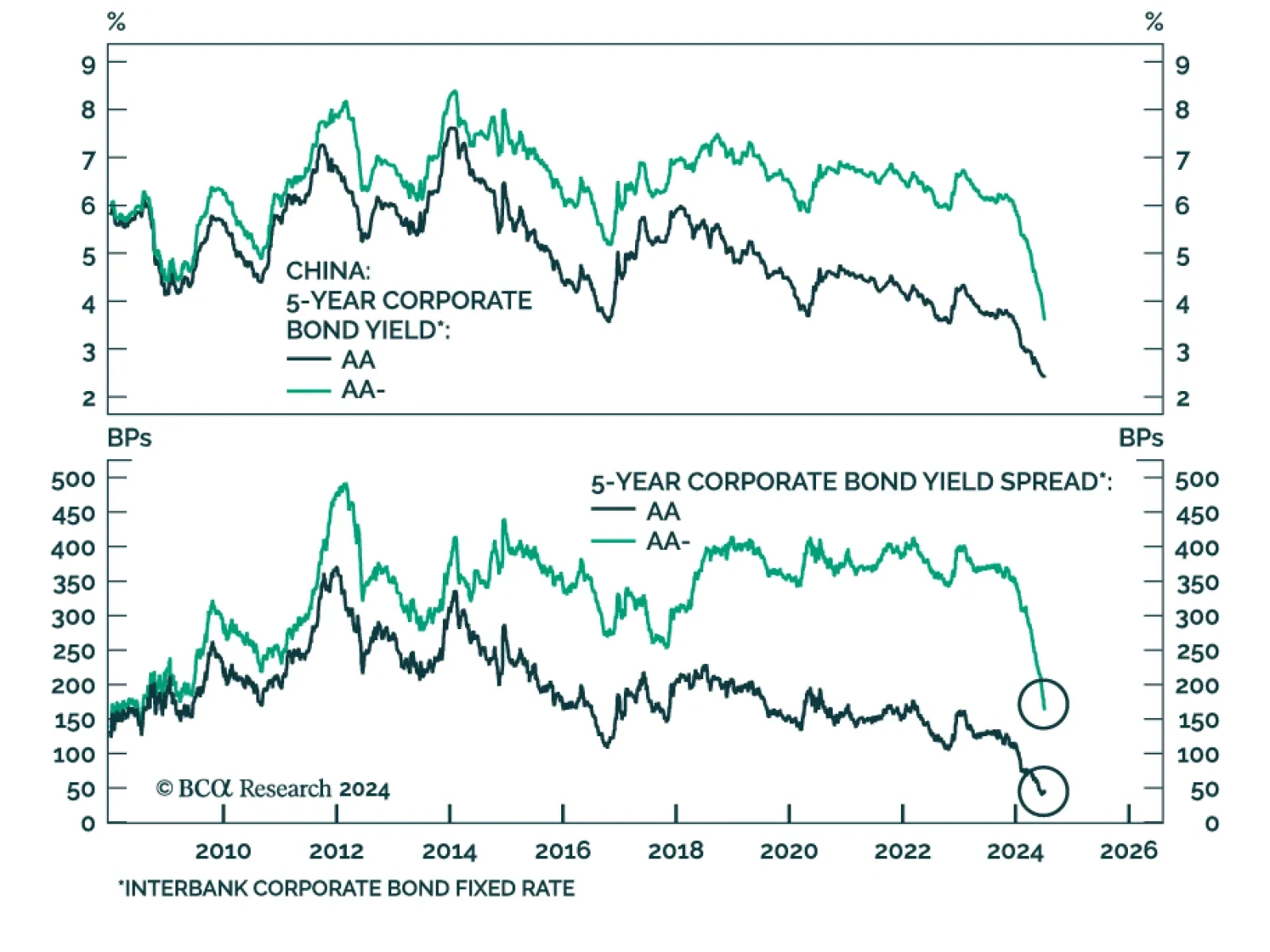

According to BCA Research’s China Investment Strategy service, onshore bonds are vulnerable to an investor sentiment reversal. Chinese 10-year government bond yields will likely trend lower to below 2% over the next 12…

Our Portfolio Allocation Summary for July 2024.