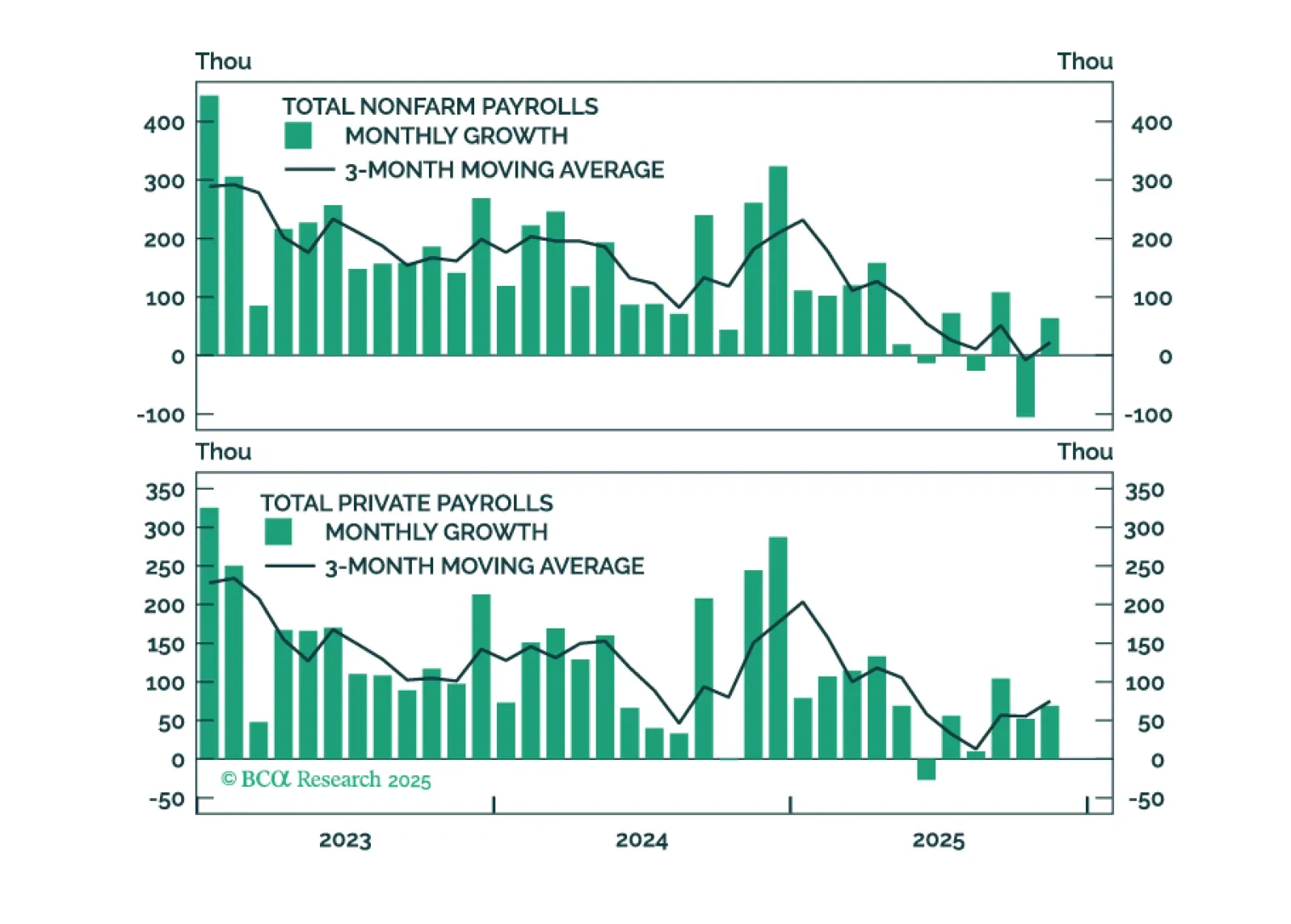

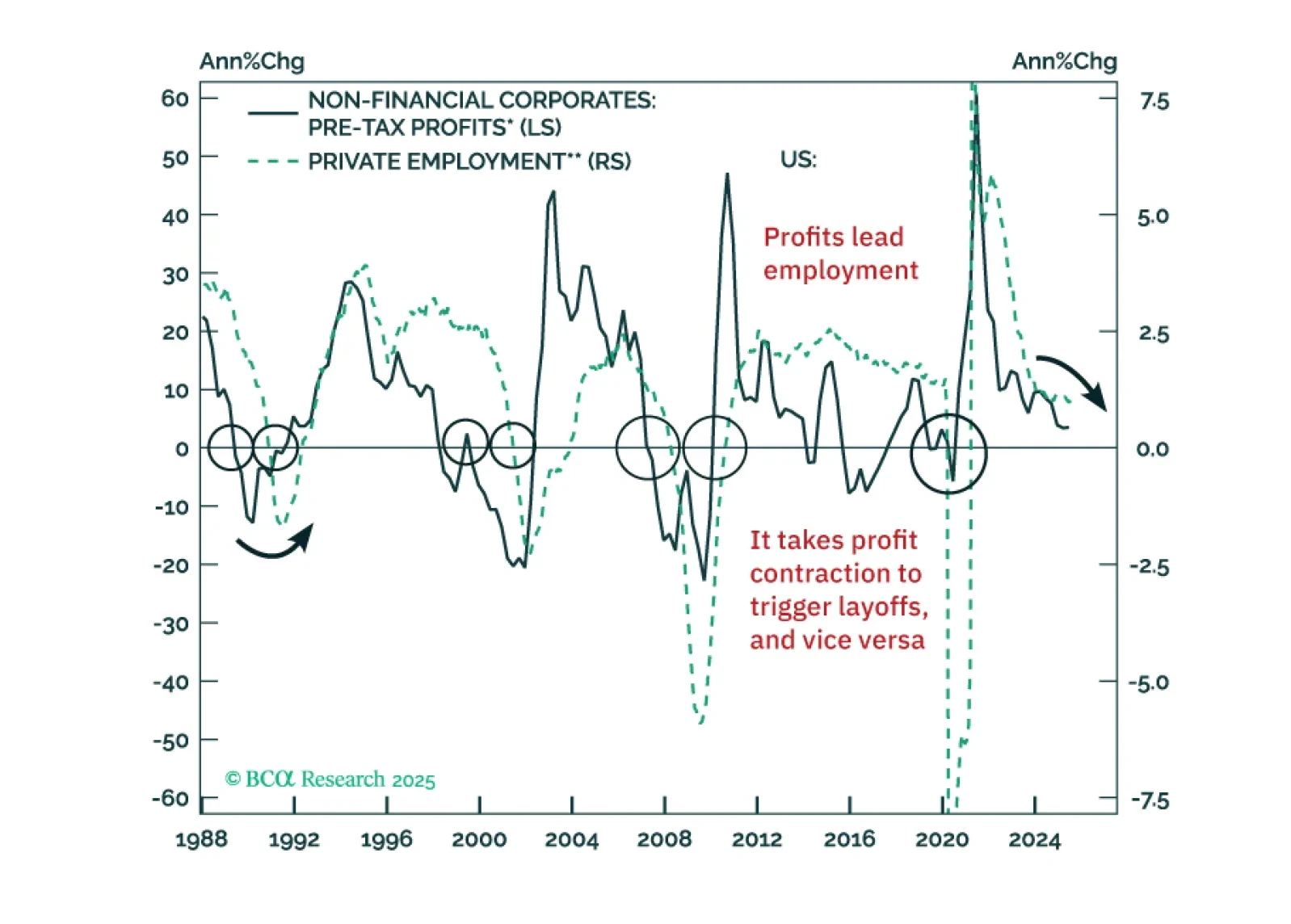

Employment Data Point To Dovish Policy Surprises In 2026

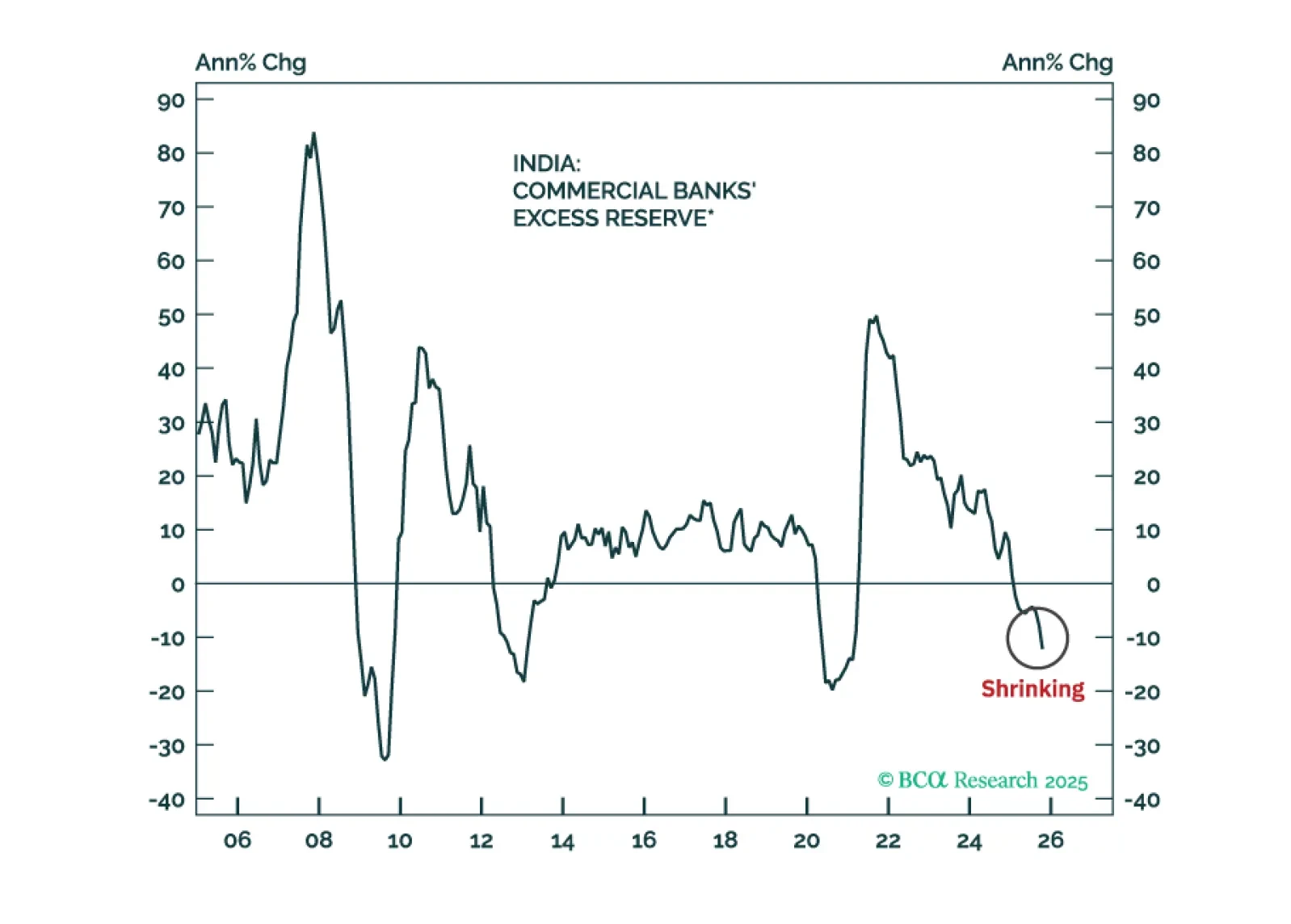

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

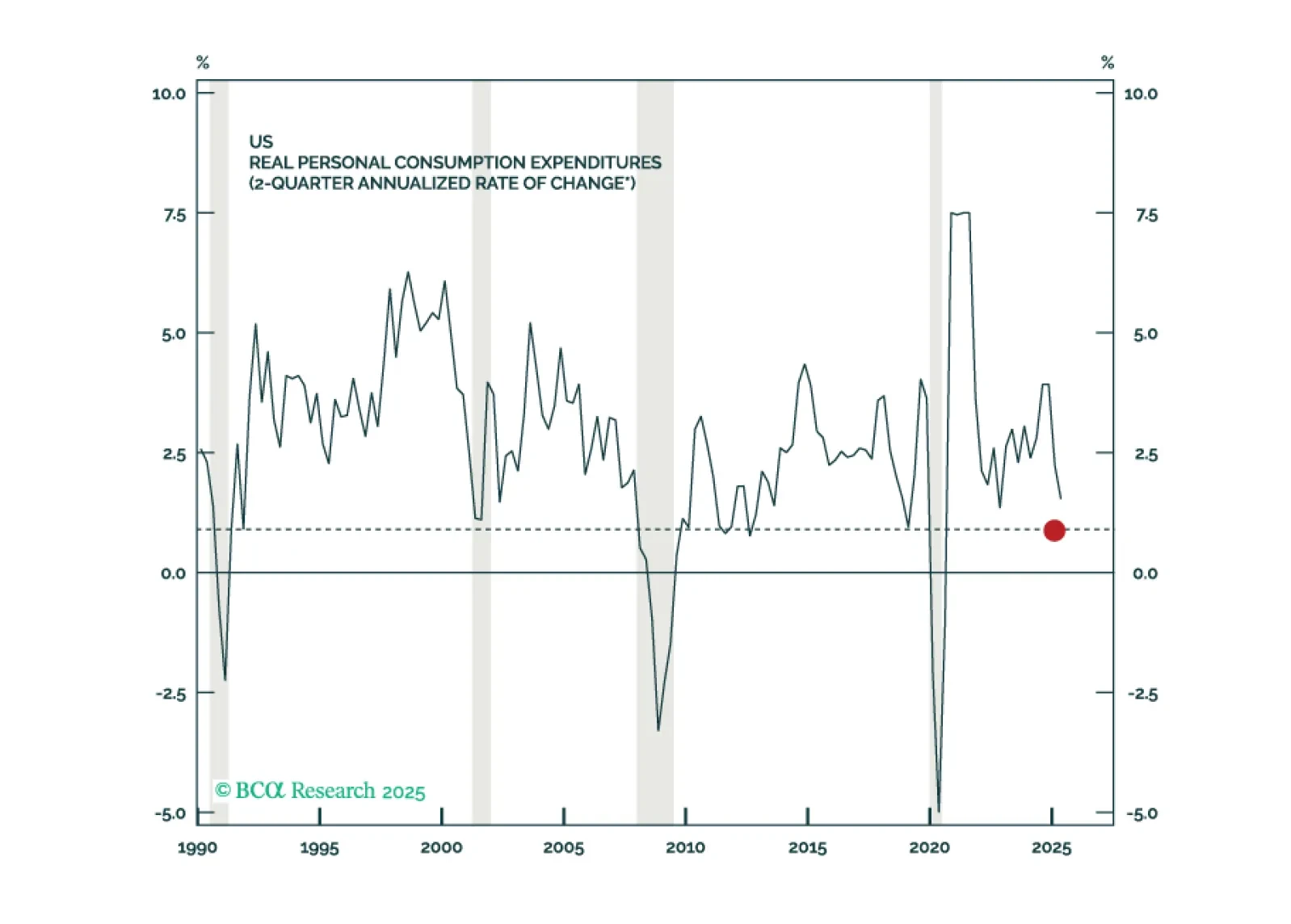

In Section I, Doug explains how the sharp upward revision to second-quarter consumption in the final GDP estimate has reduced our recession conviction and could lead us to abandon our recession call altogether. The situation is fluid…

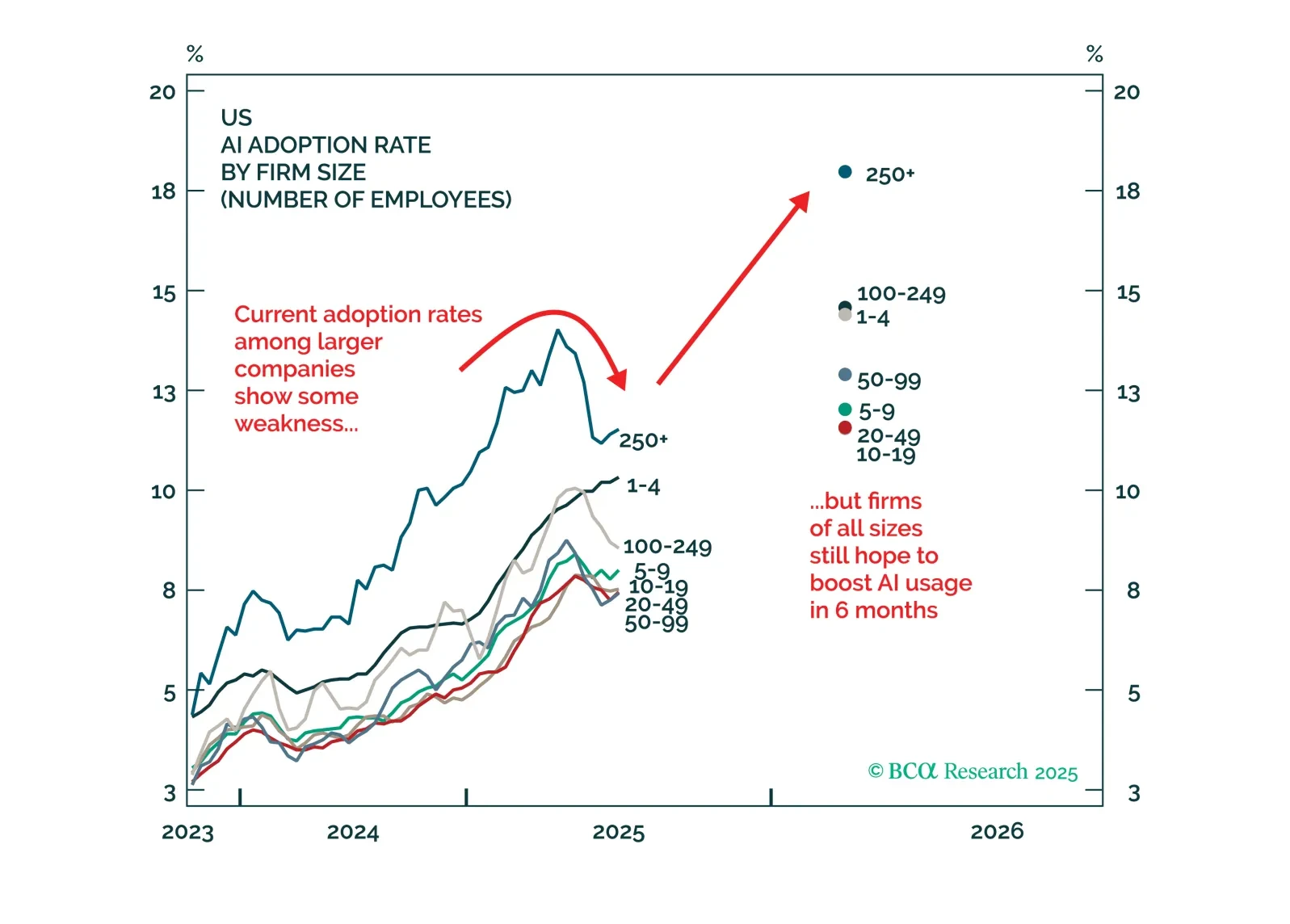

The rush to build AI infrastructure is based on a false premise: that there are significant advantages to being the first to come to market.

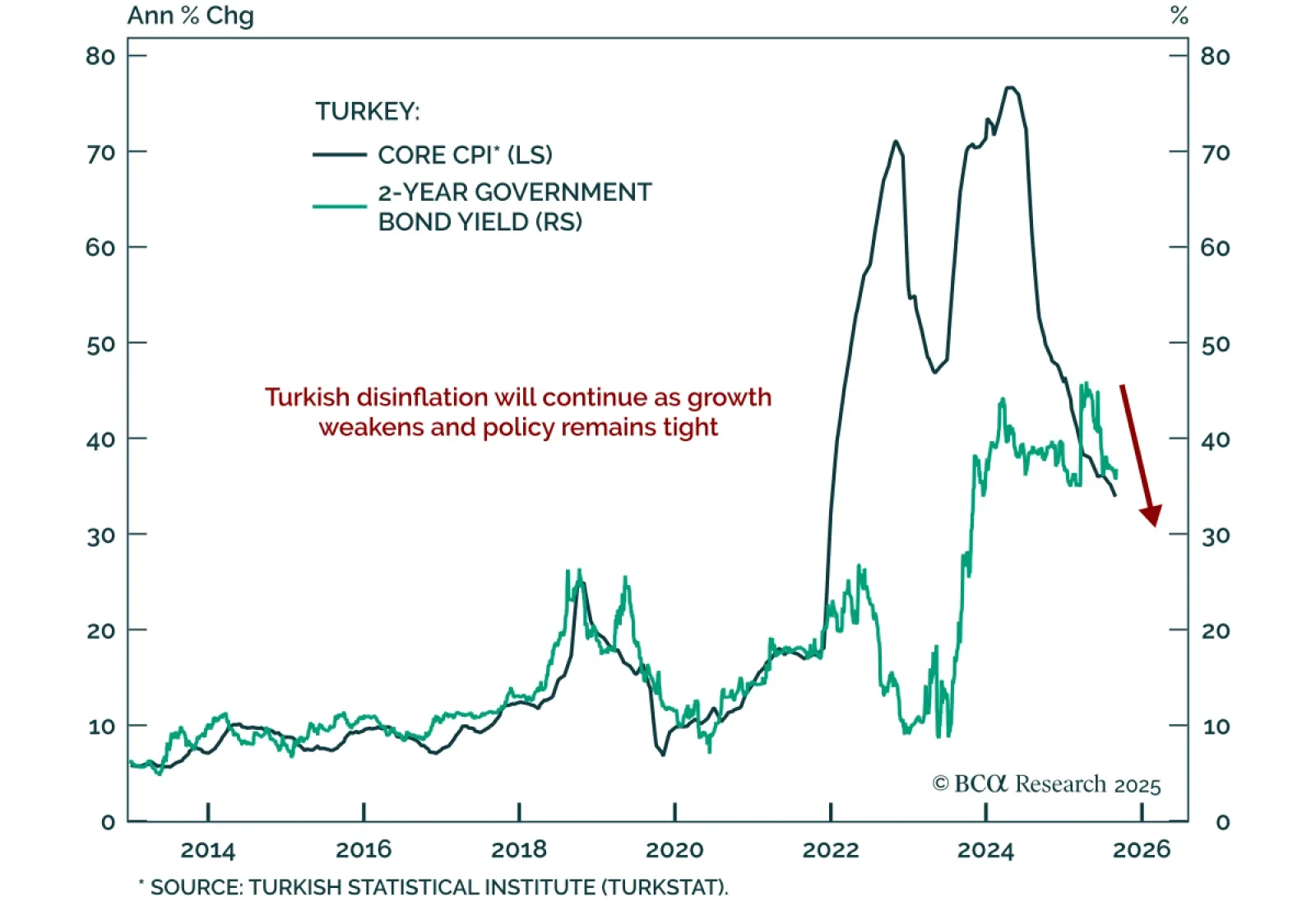

Turkey’s disinflation trend remains intact, supporting a bullish case for short-term bonds. Headline inflation eased to 33% y/y in August from 33.5% in July. Our Emerging Markets strategists expect further slowing as monetary and…

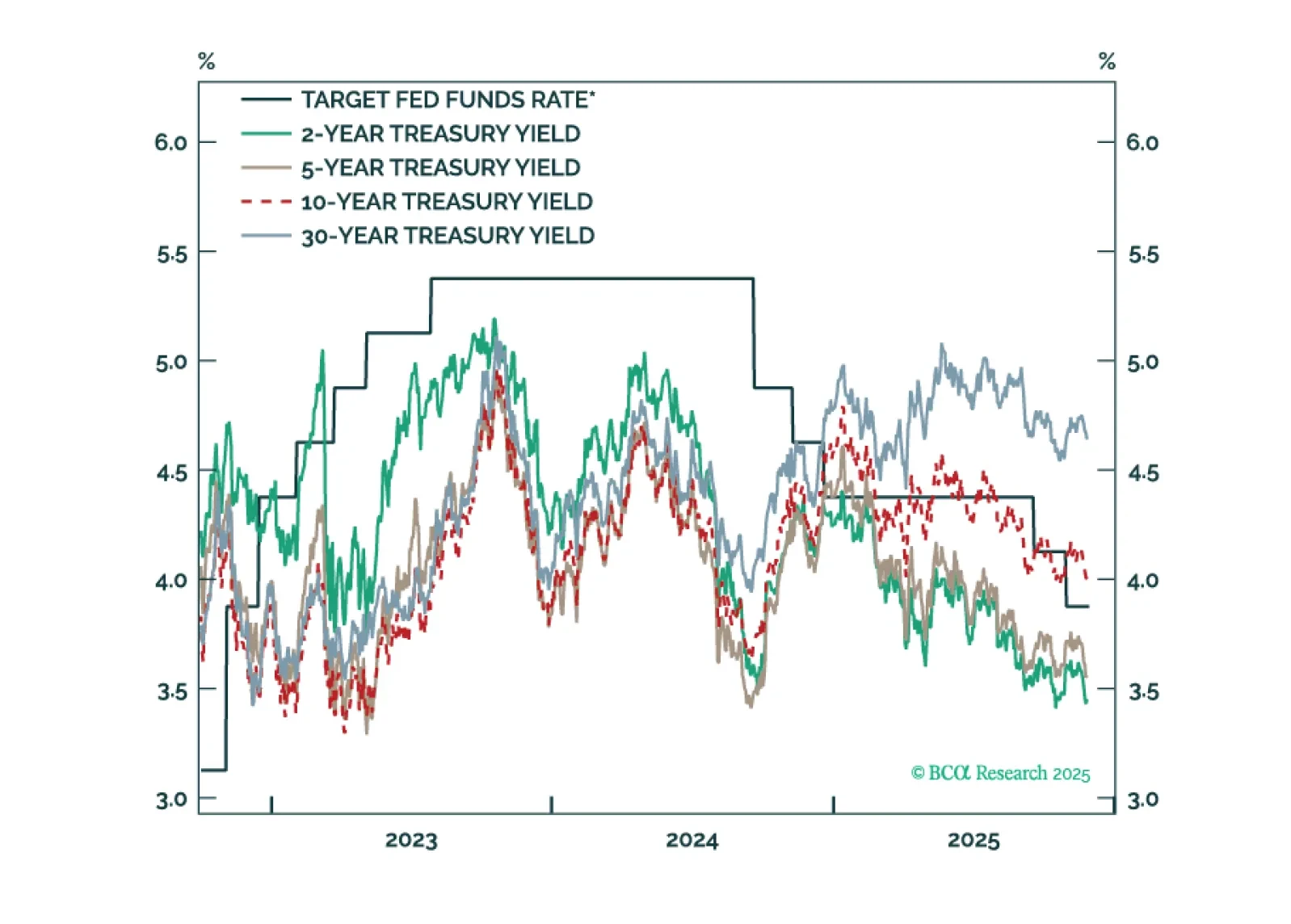

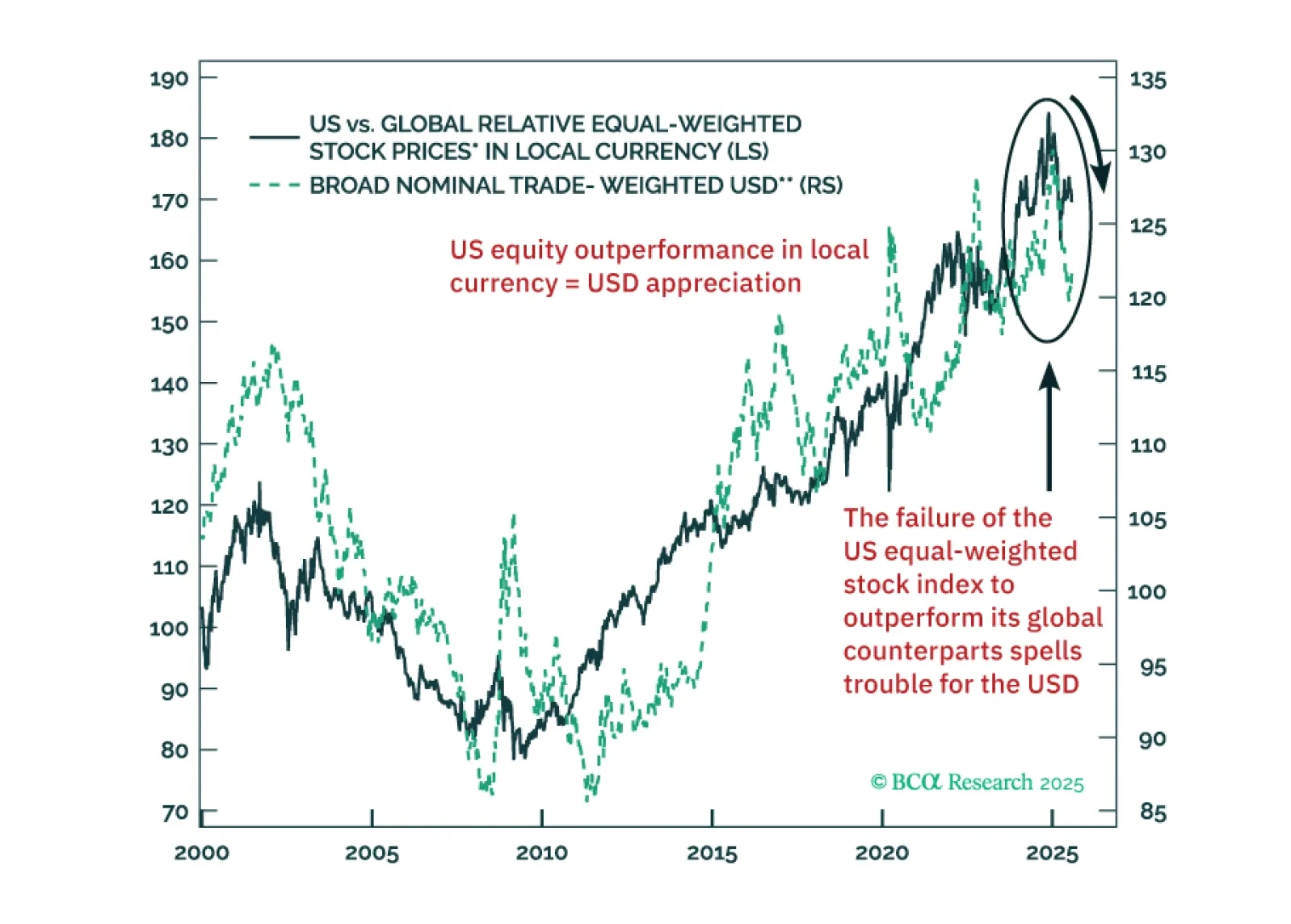

We see two risks that could spoil the rally in US risk assets: (1) a tariff-driven stagflation, and (2) a US Treasury tantrum. Our negative view on EM risk assets is primarily driven by the outlook for global trade, which is set…

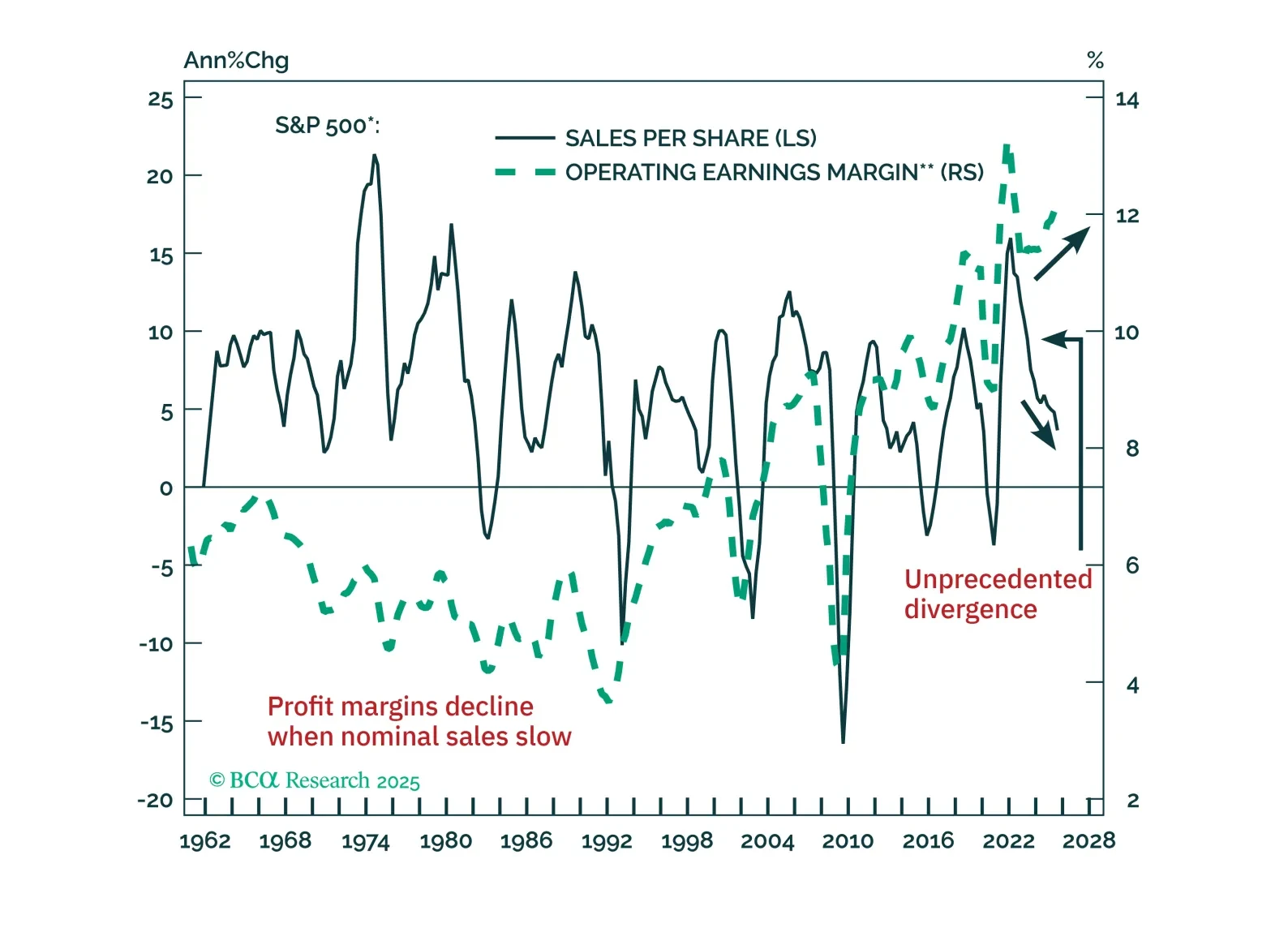

US TMT stocks have been delivering miraculous profit performance. Yet, outside US large tech, global equity fundamentals and technicals are troublesome. A near-term USD rebound should be faded.