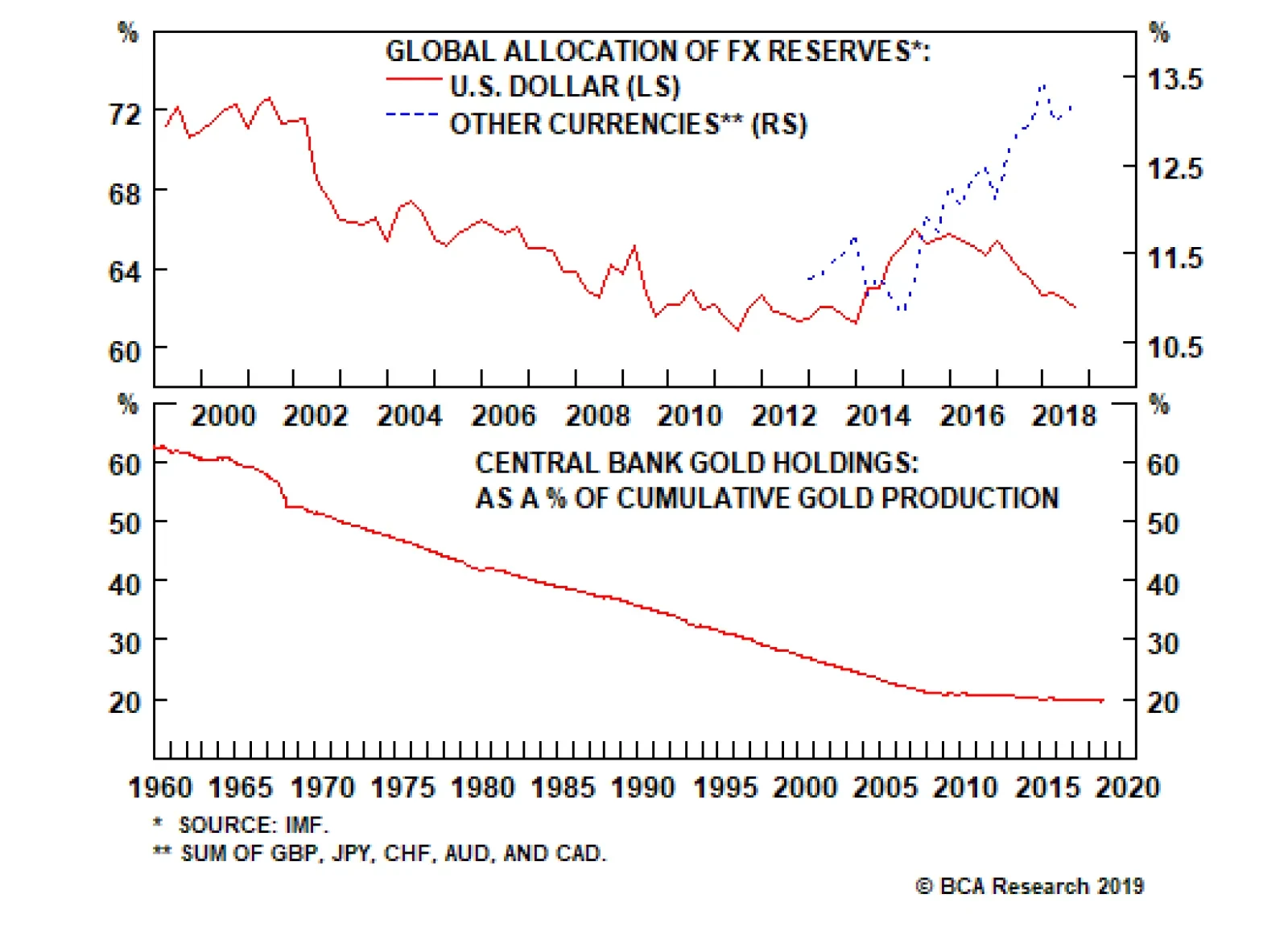

Data from the International Monetary Fund (IMF) shows that the global allocation of foreign exchange reserves towards the U.S. dollar peaked at about 72% in the early 2000s and has been in a downtrend since. Meanwhile, allocation…

Highlights U.S. growth remains robust, despite some temporary softness in recent months. Ex U.S., growth continues to fall but, with China probably now ramping up monetary stimulus, should bottom in the second half. Central banks…

Highlights Global equities and other risk assets will trade sideways with elevated volatility over the coming weeks before grinding higher for the remainder of the year, as global growth finally accelerates after a series of false…

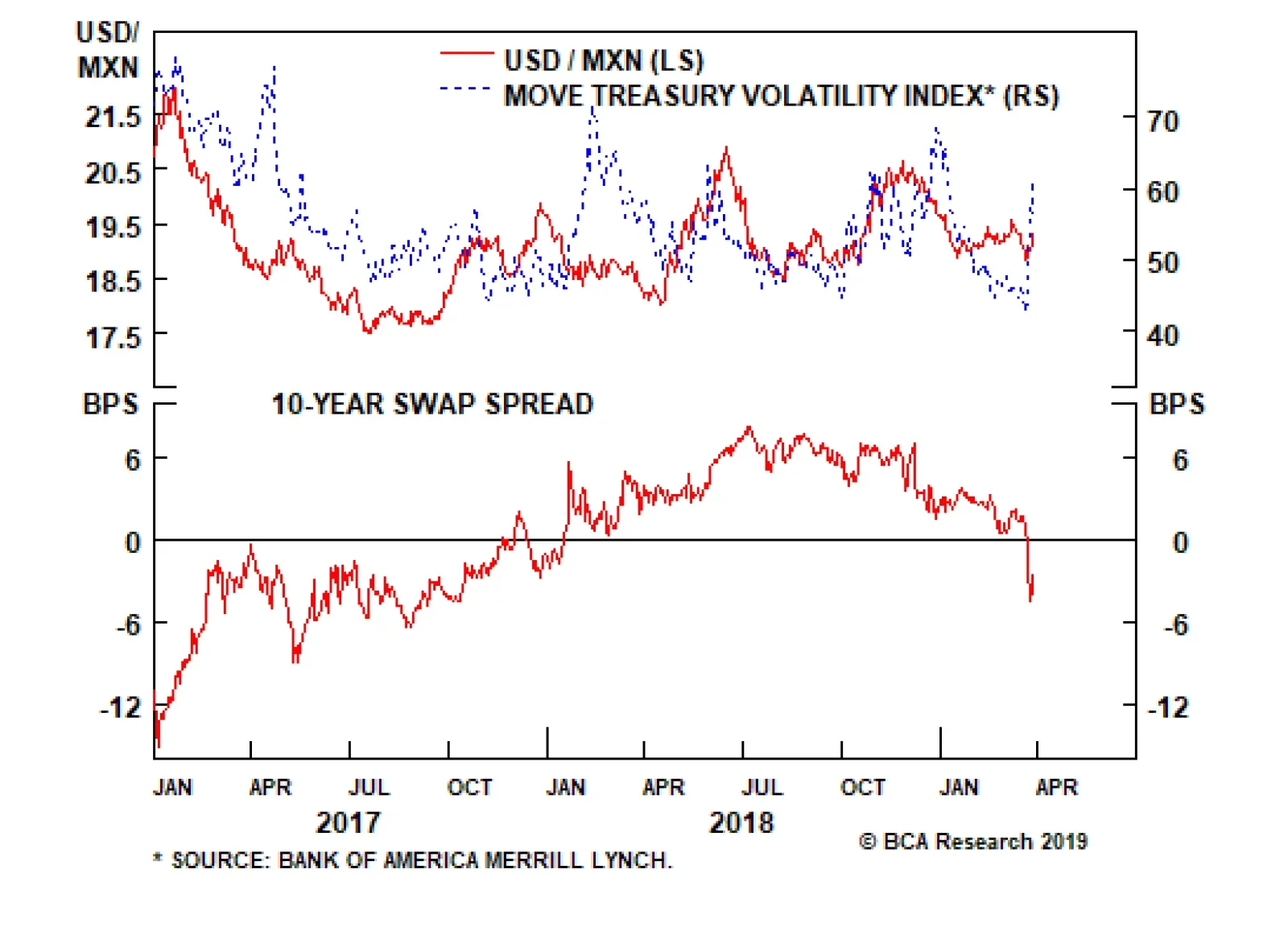

Following last week’s dovish FOMC meeting, the OIS curve has moved to expect lower interest rates. This has dragged down Treasury rates to below 2.4%, raising the specter of an incoming wave of mortgage refinancing. In…

Highlights For the Eurostoxx50 to outperform the S&P500, the big euro area banks have to outperform the big U.S. tech stocks. Tactically overweight Eurostoxx50 versus S&P500 as well as other pro-cyclical positions such as…

Highlights The odds of a continued earnings contraction have not yet fallen to the point that would warrant an overweight stance towards Chinese versus global stocks over the coming 6-12 months. While we maintain Chinese stocks on…

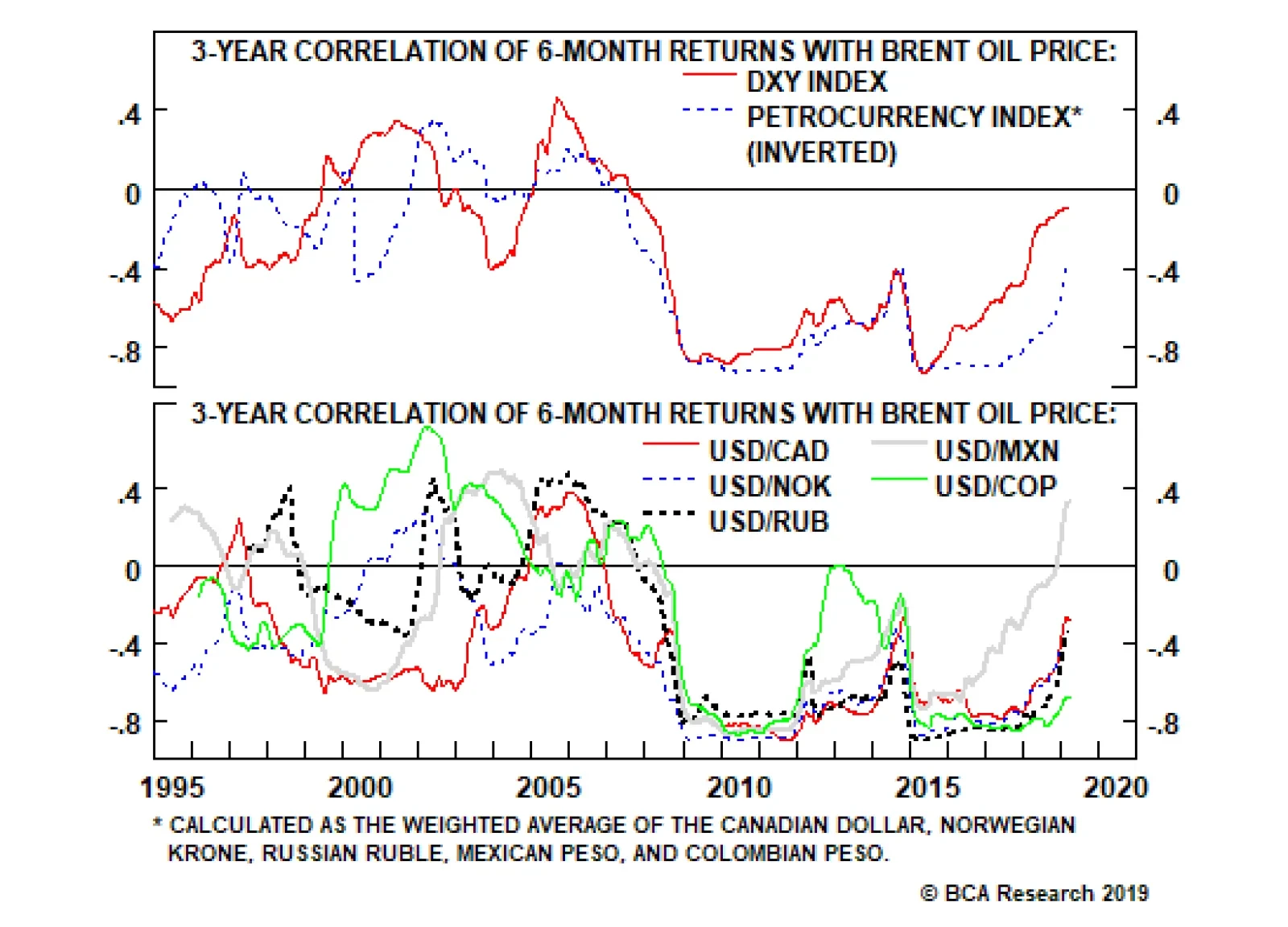

In 2010, only about 6% of global crude output came from the U.S. Fast forward to today and the U.S. produces almost 15% of global crude, having grabbed market share from both OPEC and non-OPEC countries. At the same time, the…