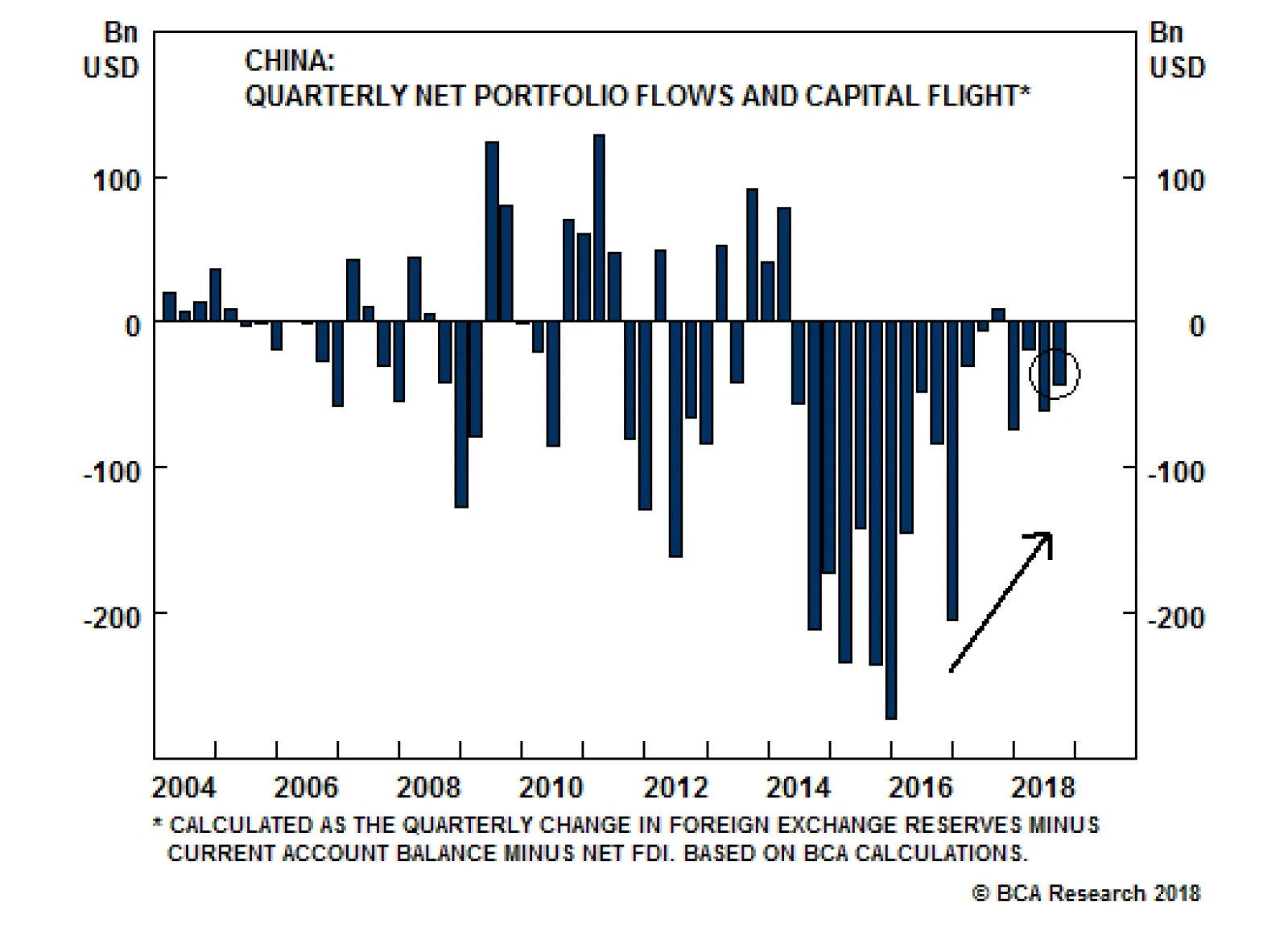

In 2015, a 4.7 percent depreciation precipitated a US$483 billion outflow of Chinese FX reserves. Conversely, the RMB has declined by about 10% in 2018 without any meaningful capital outflows or FX reserve deployment (see chart…

Highlights The ongoing selloff in EM risk assets and commodities resembles a domino effect. Given that domino effects transpire in bear markets - not corrections - we believe that EM risk assets and commodities are indeed in a bear…

Highlights So What? The Trump administration is focusing on re-election in 2020, which could push the recession call into 2021. Why? The midterms were investment-relevant, just not in the way most of our clients thought. We are…

As is tradition, during client visits in Europe last week, I had the pleasure of reconnecting with Ms. Mea, a long-term BCA client.1 It was our third encounter and, as always, Ms. Mea was eager to delve into our reasoning, challenge our…

Highlights China's old economy continues to slow in the leadup to the negative effect of U.S. import tariffs on Chinese export growth. Weaker trade data over the coming few months is likely to weigh further on investor sentiment.…

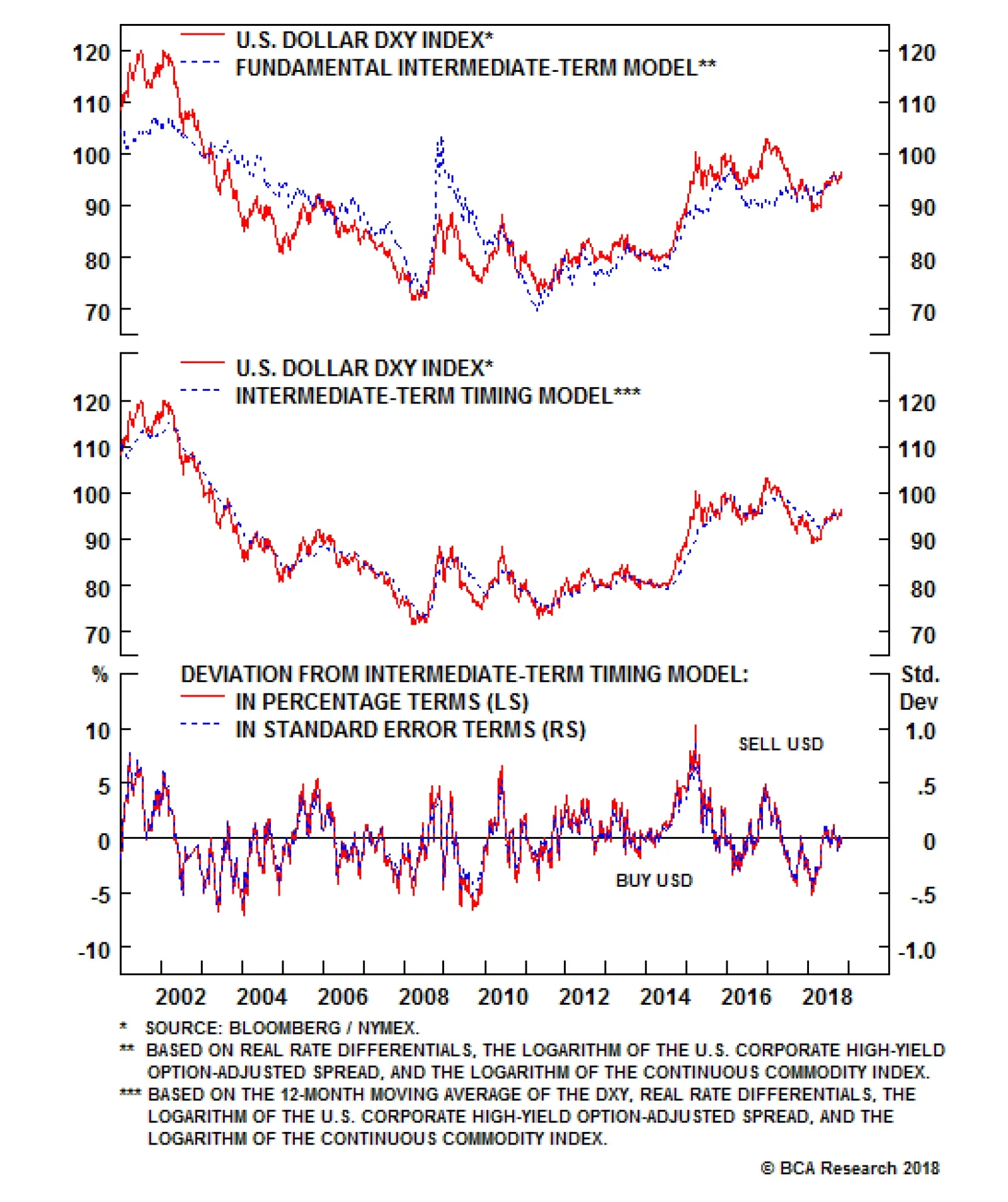

Our models are built on three variables: real rates differentials, junk spreads and commodity prices. For all countries, the variables are statistically highly significant and of the expected signs. These models help us…

Dear Client, You will see in this Monthly Portfolio Update that we have expanded our table of Recommendations to include a wider range of the views that Global Asset Allocation (GAA) regularly discusses in its publications. Please see…

Highlights Economic data and policy announcements over the past month reflect the view that policymakers are serious about restraining credit growth, and that they will attempt to combat any weakness in external demand by boosting…