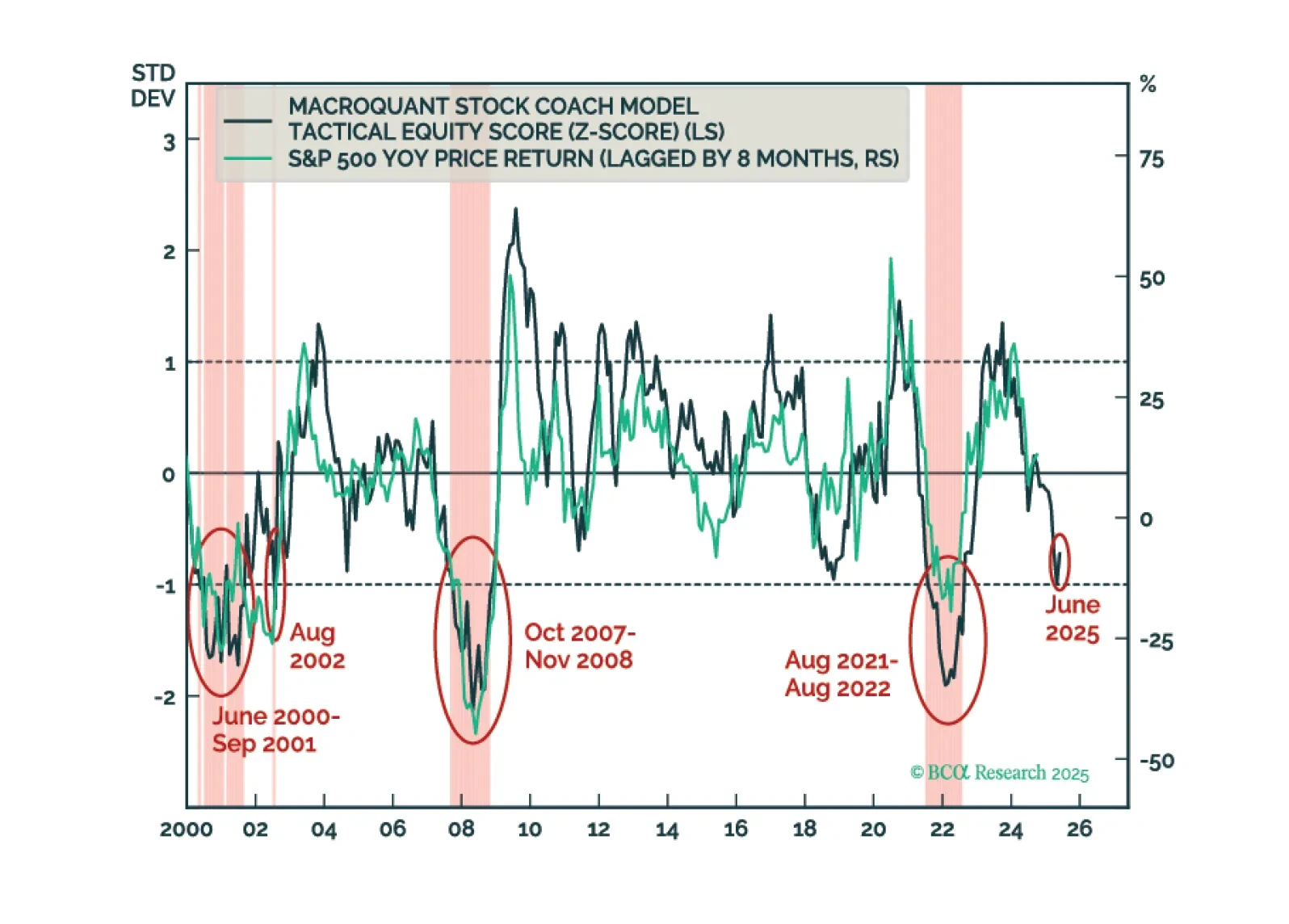

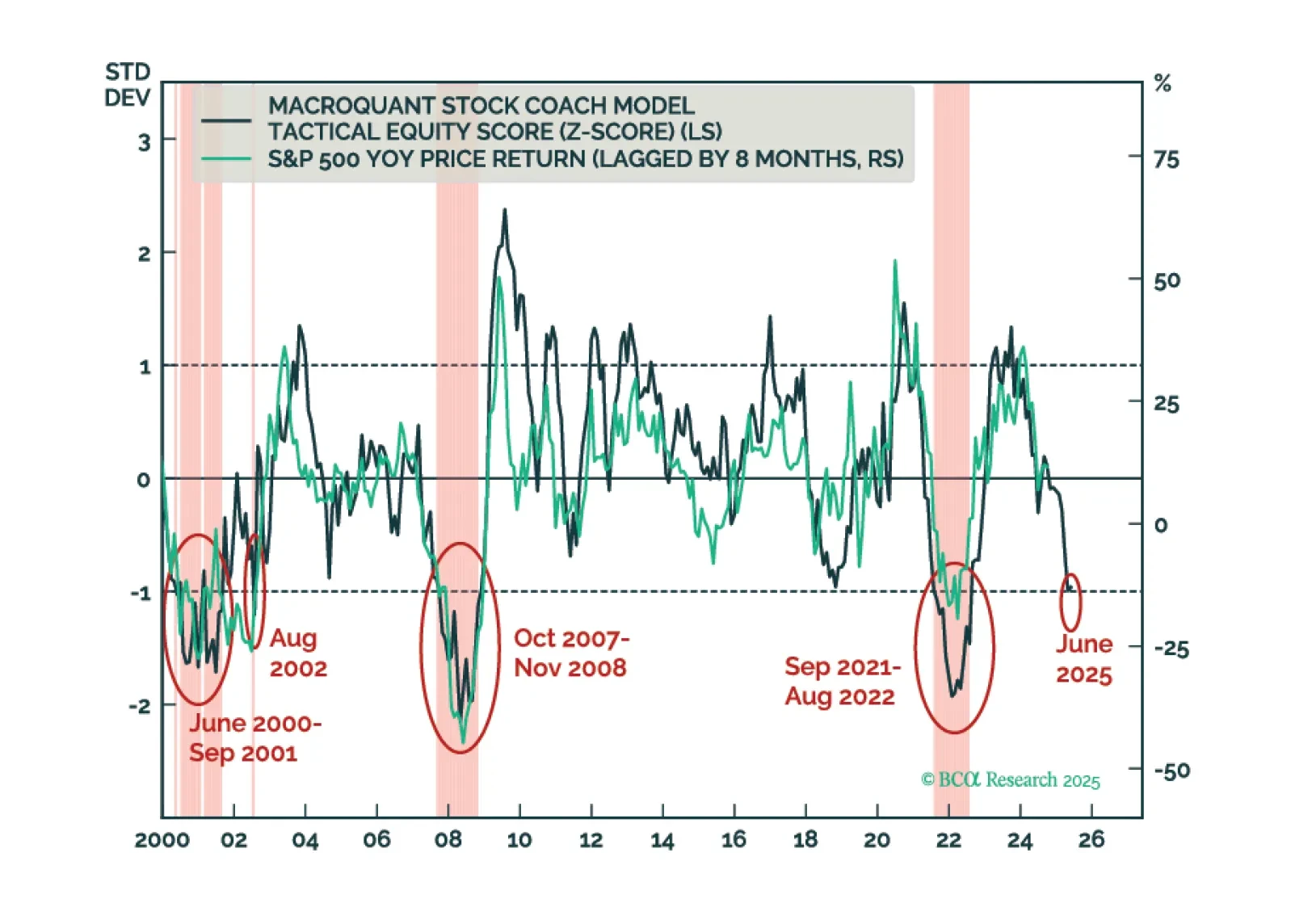

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

Regional Fed surveys confirm sluggish US manufacturing and tame inflation, supporting long duration positioning outside the US. The June Dallas Fed Manufacturing survey missed expectations, rising to -12.7 from -15.3, still deep in…

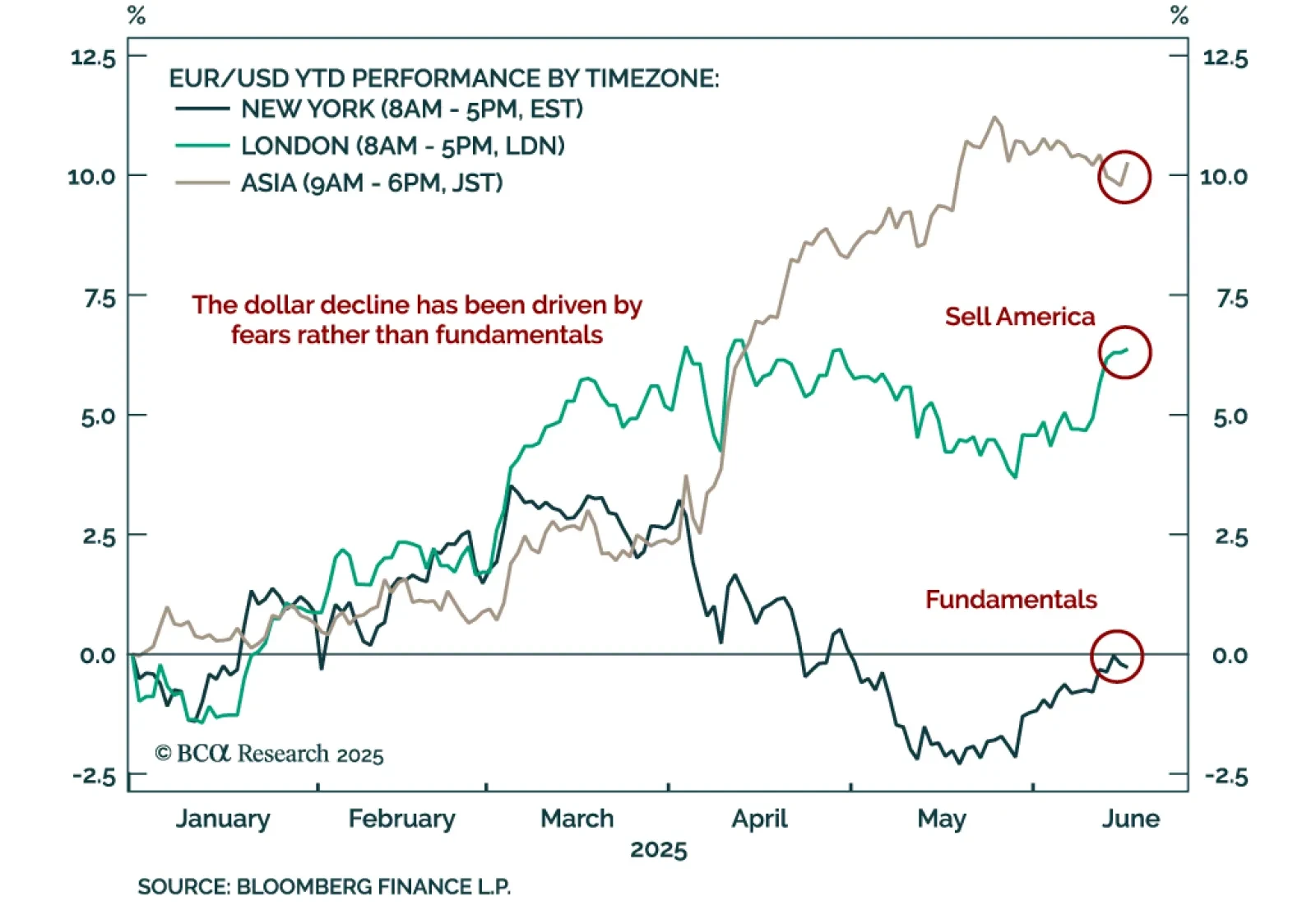

Foreign investors are selling US assets. Our Chart Of The Week comes from Juan Correa, Chief Global Asset Allocation Strategist. Splitting cumulative year-to-date EUR/USD returns by trading session reveals a clear pattern:…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

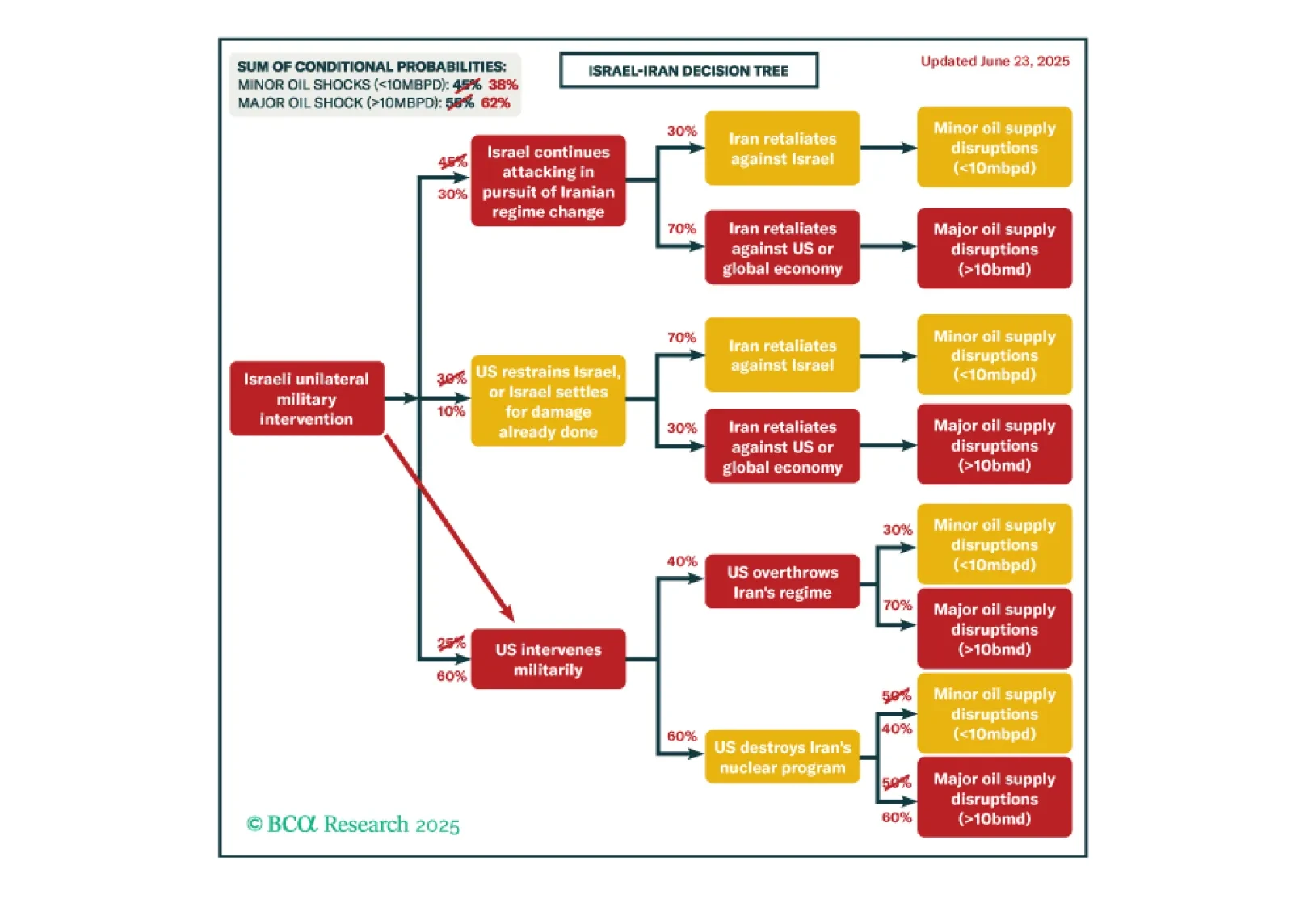

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

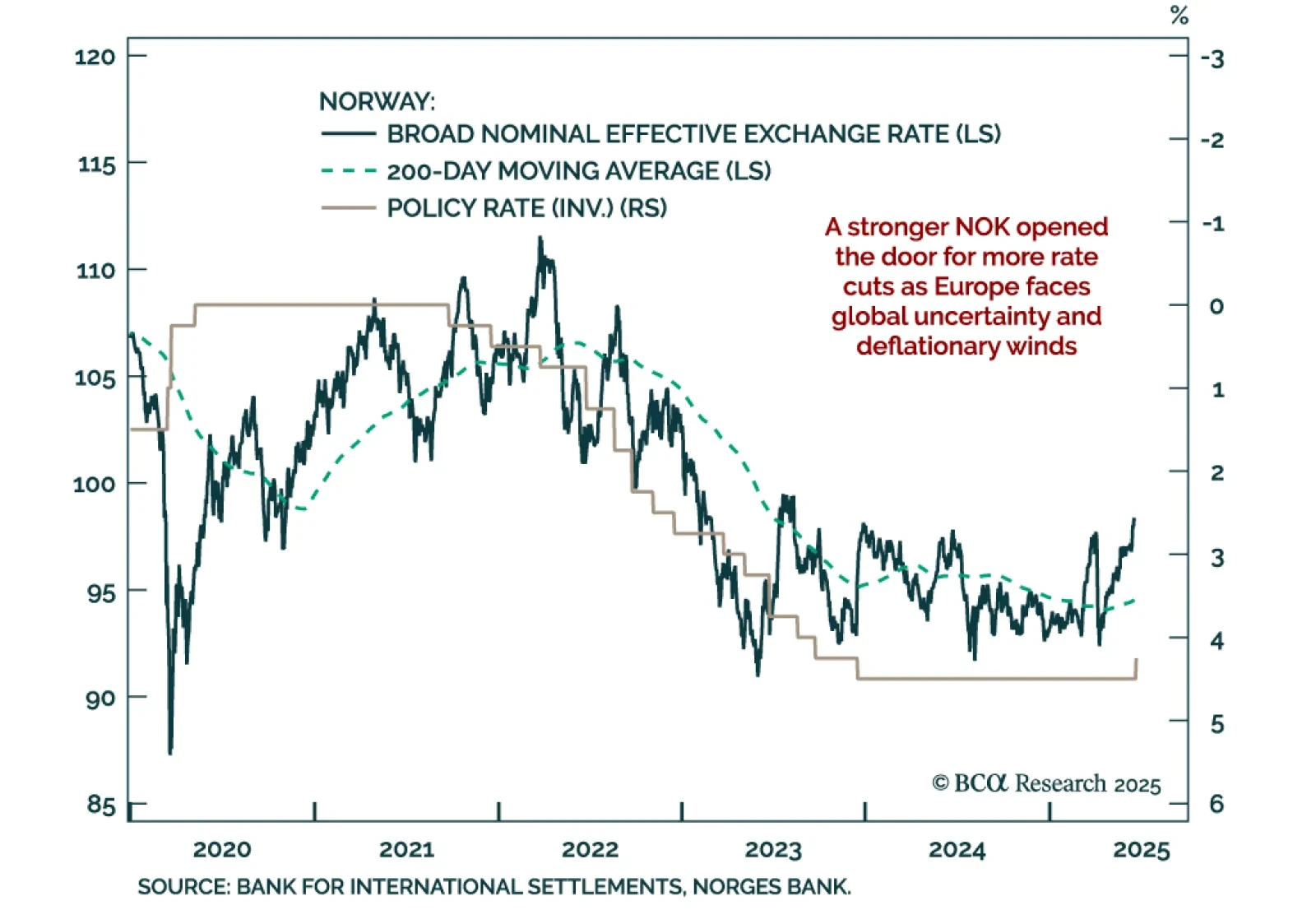

A stronger Norwegian krone has opened the door to more rate cuts, making Norwegian government bonds more attractive. Our Chart Of The Week comes from Jeremie Peloso, European Strategist. With its surprise 25 basis point cut, the…

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.

Sweden’s economic fragility and disinflation support further easing, reinforcing our long SEK rates and NOK/SEK trades. The Riksbank cut rates by 25 bps to 2.0% and projected an additional cut, consistent with prior OIS pricing.…

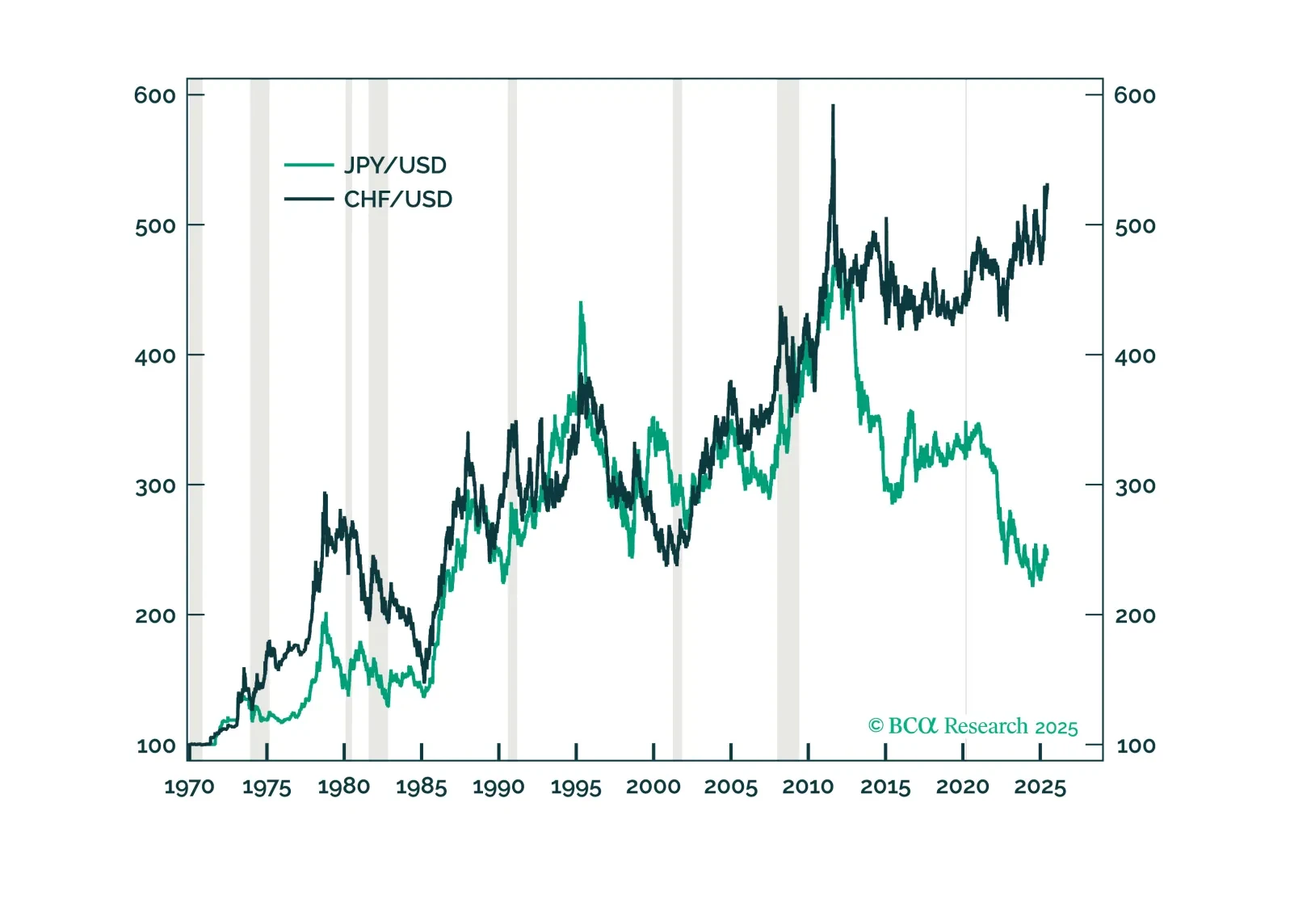

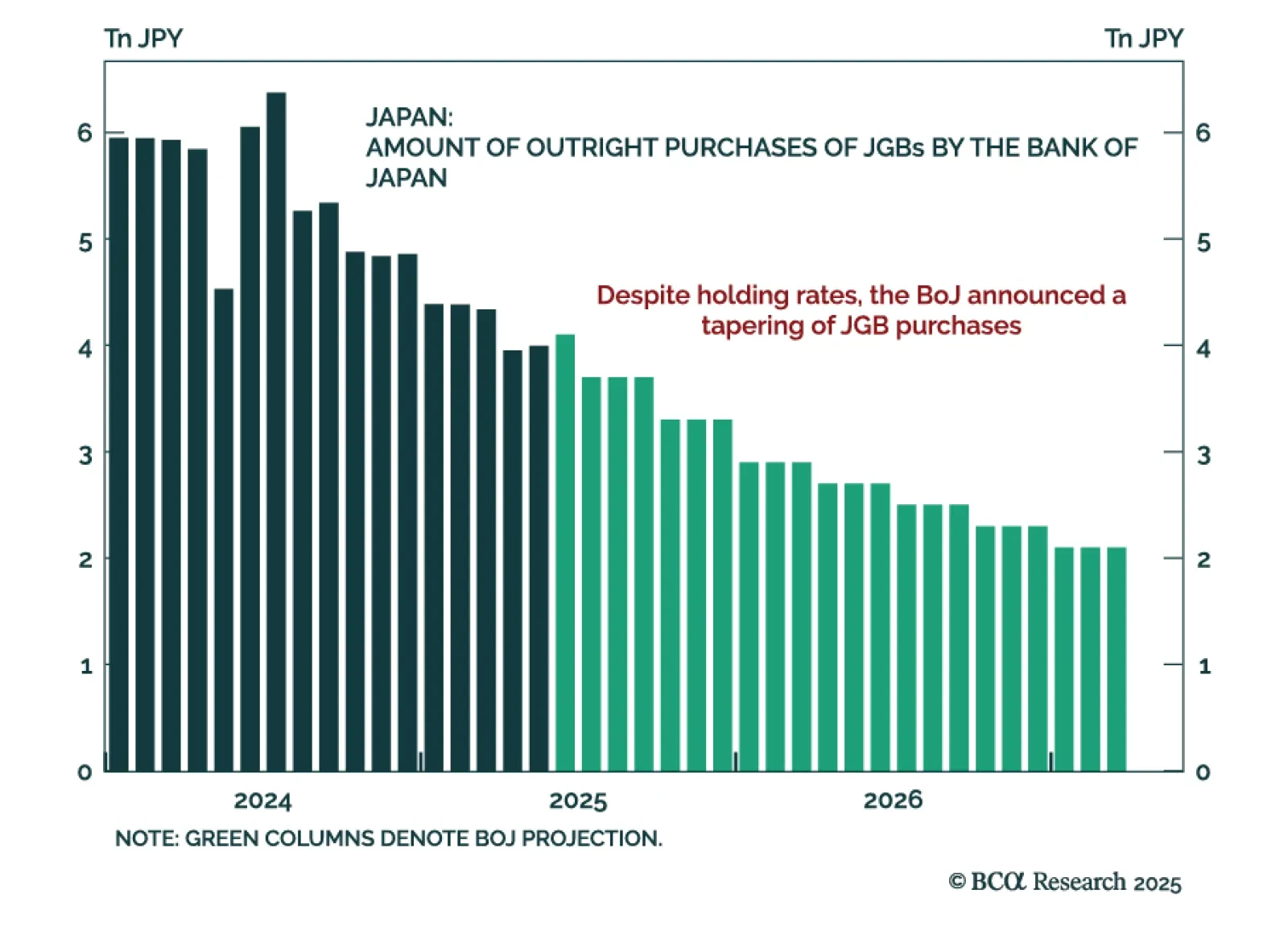

The BoJ’s decision to keep rates unchanged while announcing a tapering of bond purchases reinforces our underweight stance on JGBs and long bias on the yen. While the decision was broadly neutral, the reduction in asset purchases…