US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

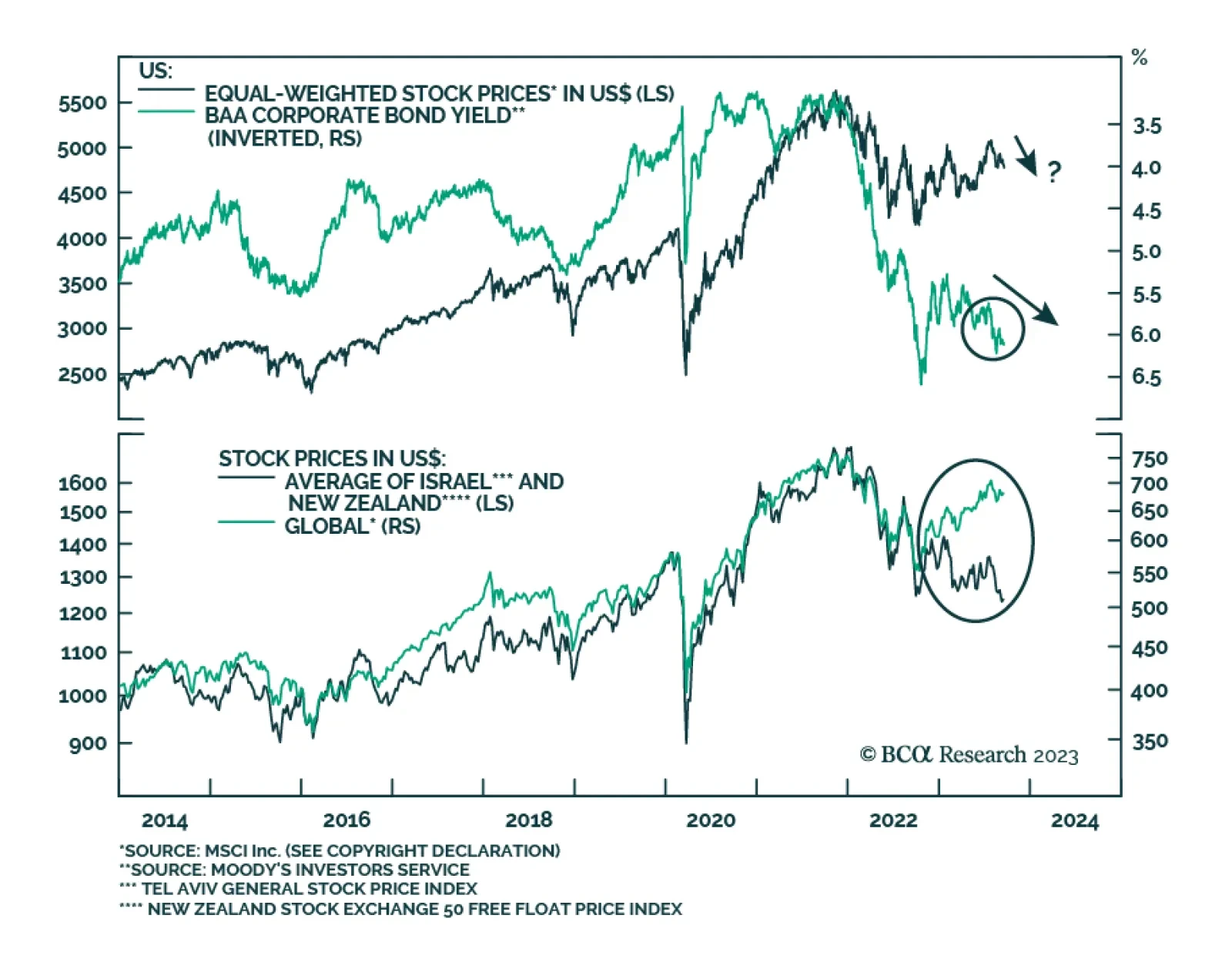

According to BCA Research’s Emerging Markets Strategy service, the combination of rising oil prices, an appreciating US dollar, and mounting US bond yields constitutes a triple whammy for US share prices. One risk that…

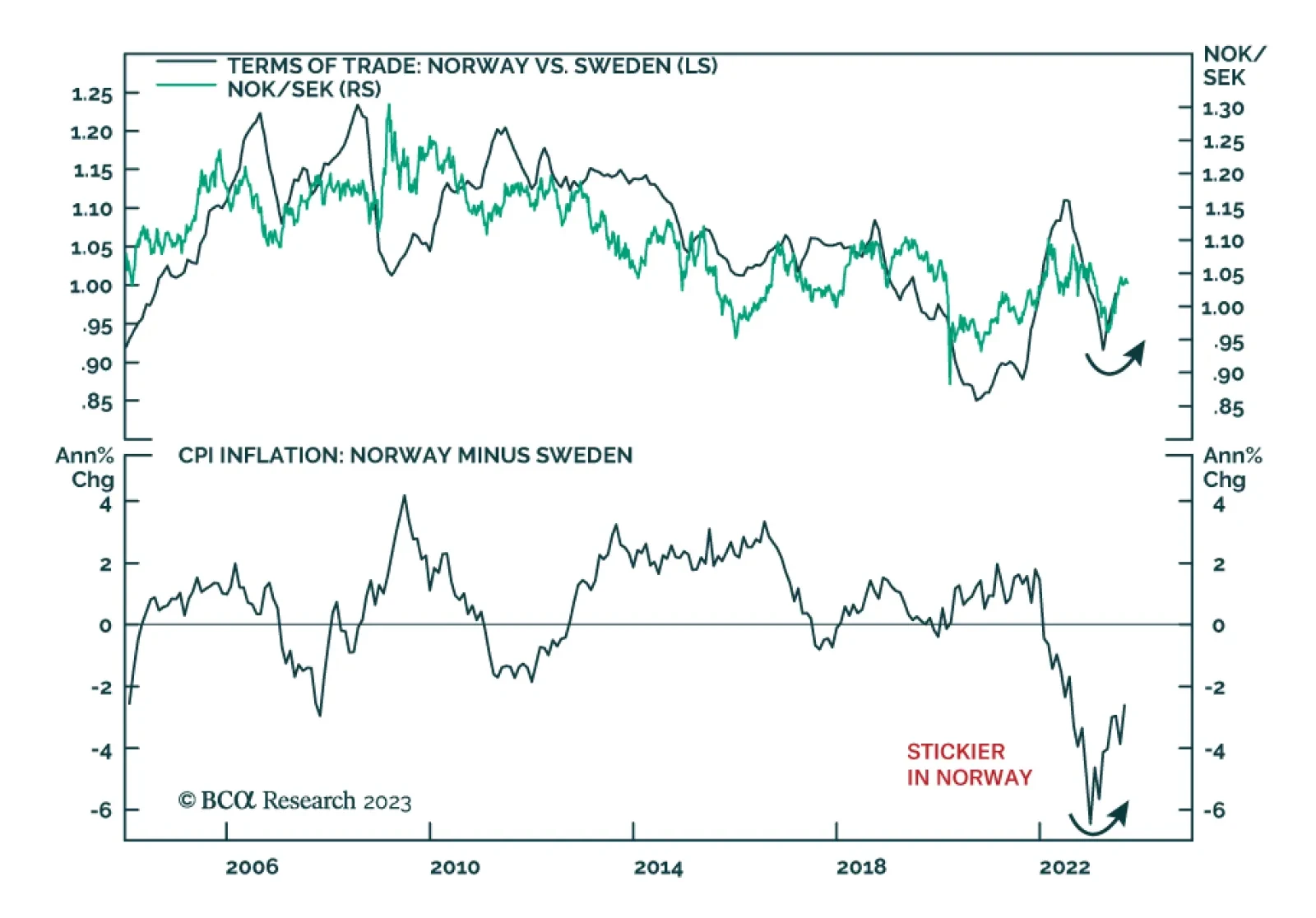

Scandinavian currencies are bearing the brunt of the recent US dollar strength. The Swedish krona and Norwegian krone are the worst performing G10 currencies since the DXY’s mid-July bottom, losing 8.6% and 7.6% of their…

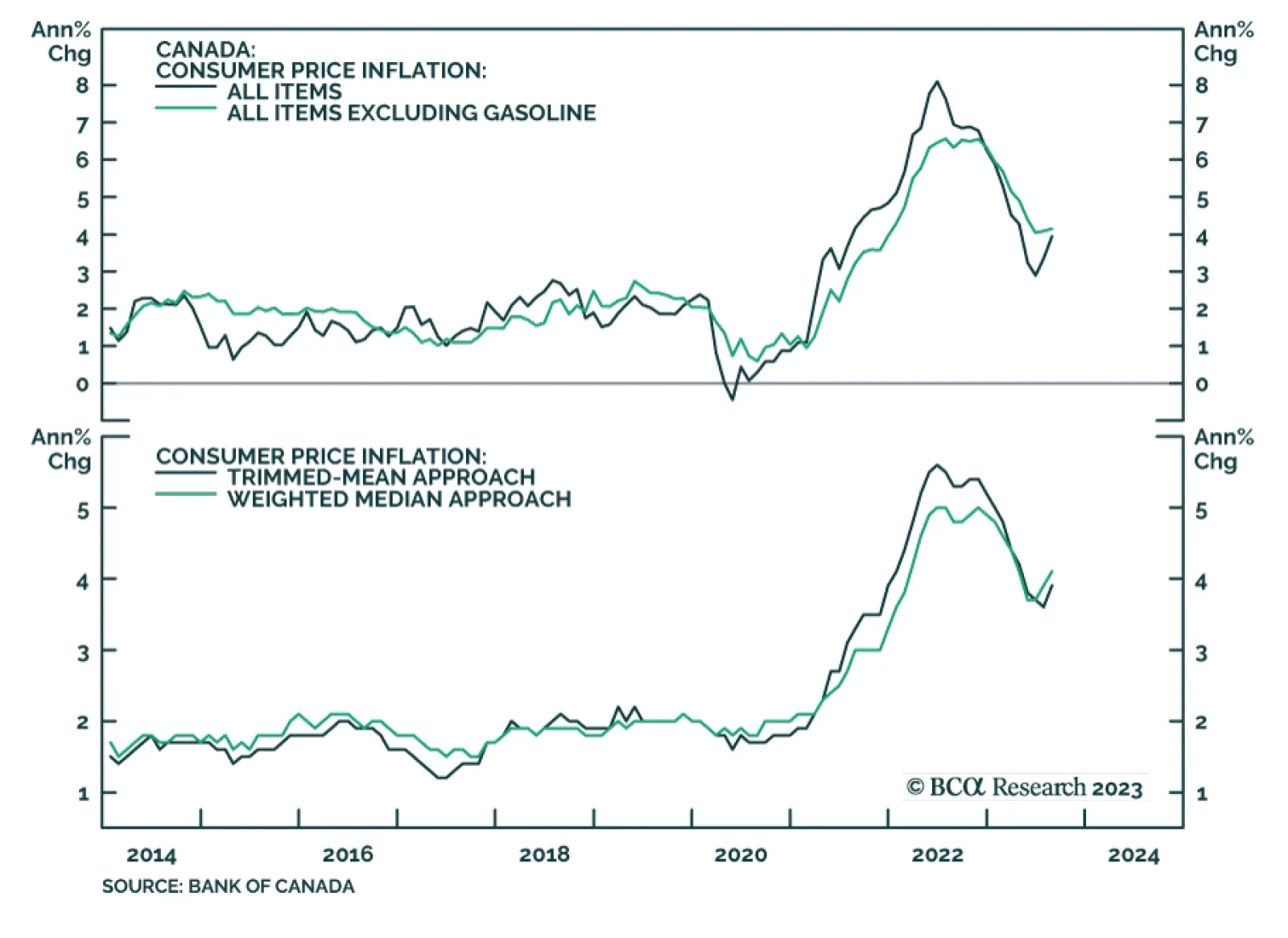

The biggest misunderstanding in the markets right now is that to keep expected inflation well-anchored at 2 percent, inflation must undershoot 2 percent for some time. This implies that interest rate futures curves are mispriced, and…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

Tuesday’s release of Canadian CPI in August raised concerns that inflationary pressures are picking up again. Headline CPI inflation rose from 3.3% y/y to 4.0% y/y – above expectations of 3.8% y/y and marking the…

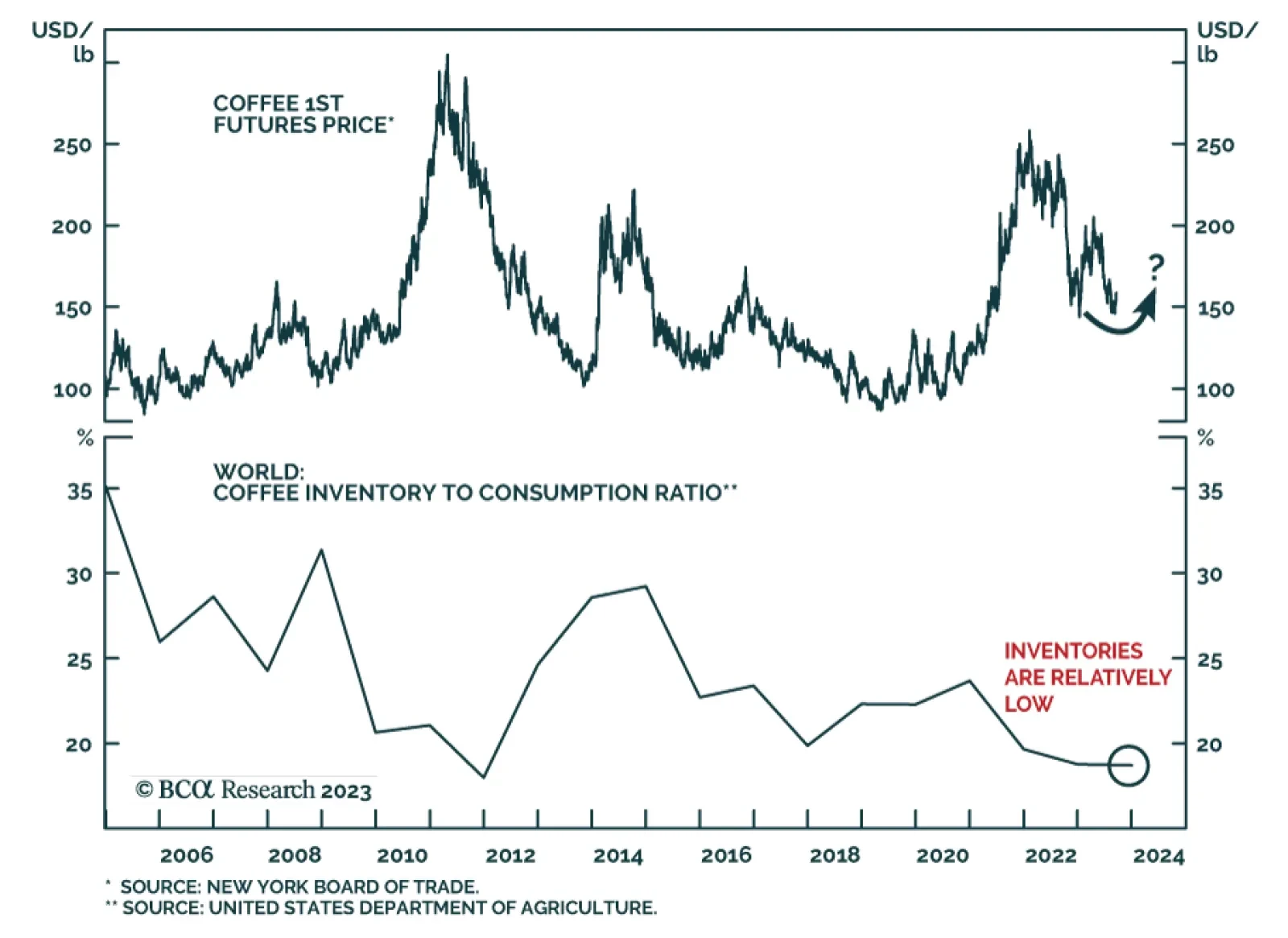

Coffee prices have surged in recent days and have now gained 8.5% over the past week. Two main forces are behind this rally. First, the recent pause in the US dollar strength is a tailwind for coffee prices. In particular, the…