Is the BoE’s emergency intervention in its bond market a British idiosyncrasy that global investors can ignore? No, the UK’s near death experience sends three salutary warnings, with implications for all investors.

In this report, we assess that sterling likely bottomed below 1.04. We expect volatility in the currency to remain in place but are buyers below current levels. On balance, there is a tug of war between irresponsible fiscal policy…

The Fed says that to get back to 2 percent inflation, the US unemployment rate must increase by ‘just’ 0.6 percent through 2023-24. All well and good you might think, except that the Fed is forecasting something that has been…

Investors should go long US treasuries and stay overweight defensive versus cyclical sectors, large caps versus small caps, and aerospace/defense stocks. Regionally we favor the US, India, Southeast Asia, and Latin America, while…

This week’s Global Investment Strategy report titled Fourth Quarter 2022 Strategy Outlook: A Three-Act Play discusses the outlook for the global economy and financial markets for the rest of 2022 and beyond.

In Section I, we note that the Fed’s new interest rate projections show that US monetary policy is set to rise soon into restrictive territory even relative to what we consider to be the neutral rate of interest, and to a level that…

Executive Summary For the first time in a decade, it is much less attractive to buy than to rent a home. In both the UK and US, the mortgage rate is now almost double the average rental yield. To reset the equilibrium between buying…

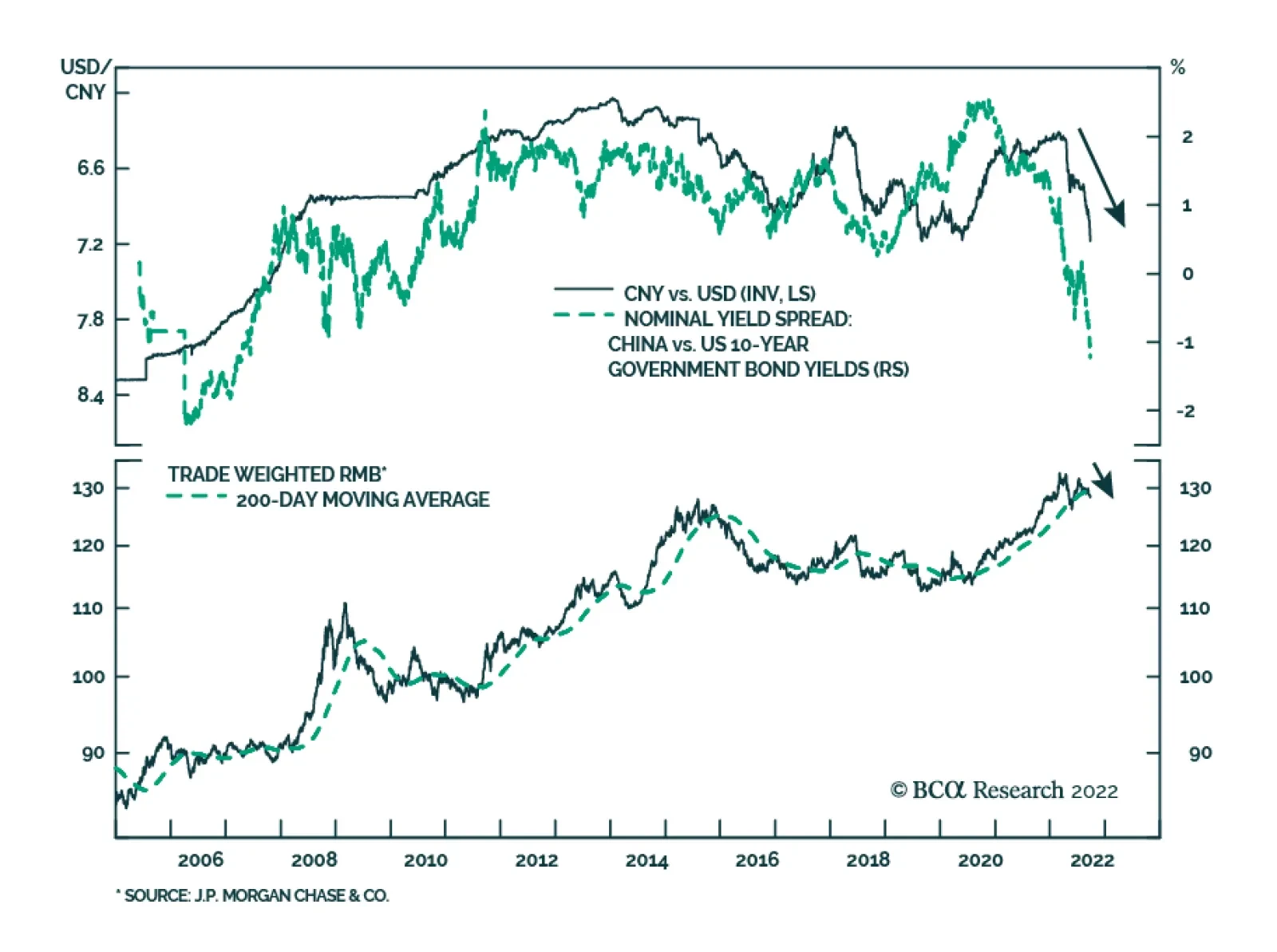

The depreciation of the Chinese yuan has intensified over the past few weeks. The onshore yuan fell to its lowest level vis-à-vis the greenback since the 2008 GFC on Wednesday while the offshore yuan reached a record low.…