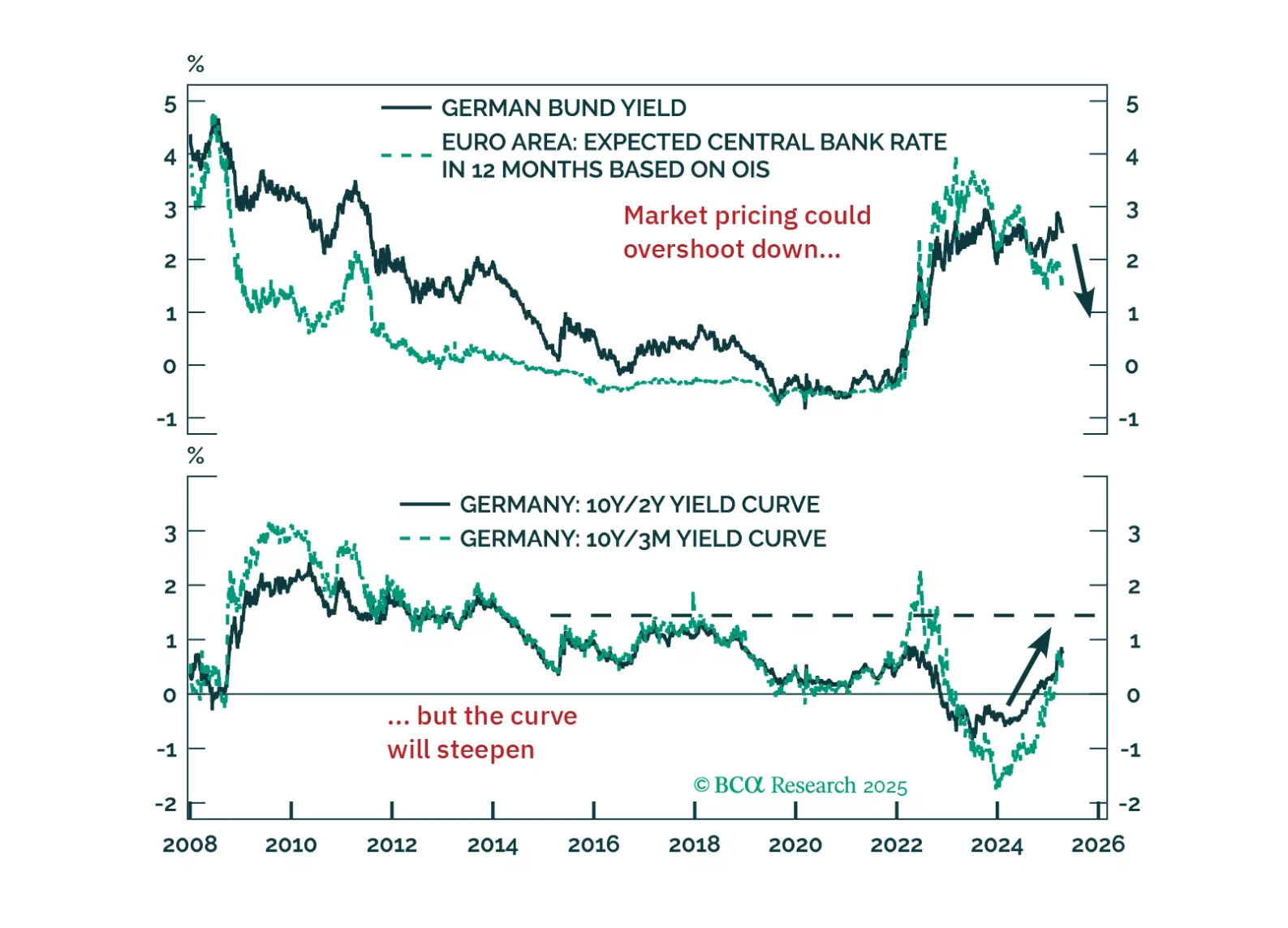

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

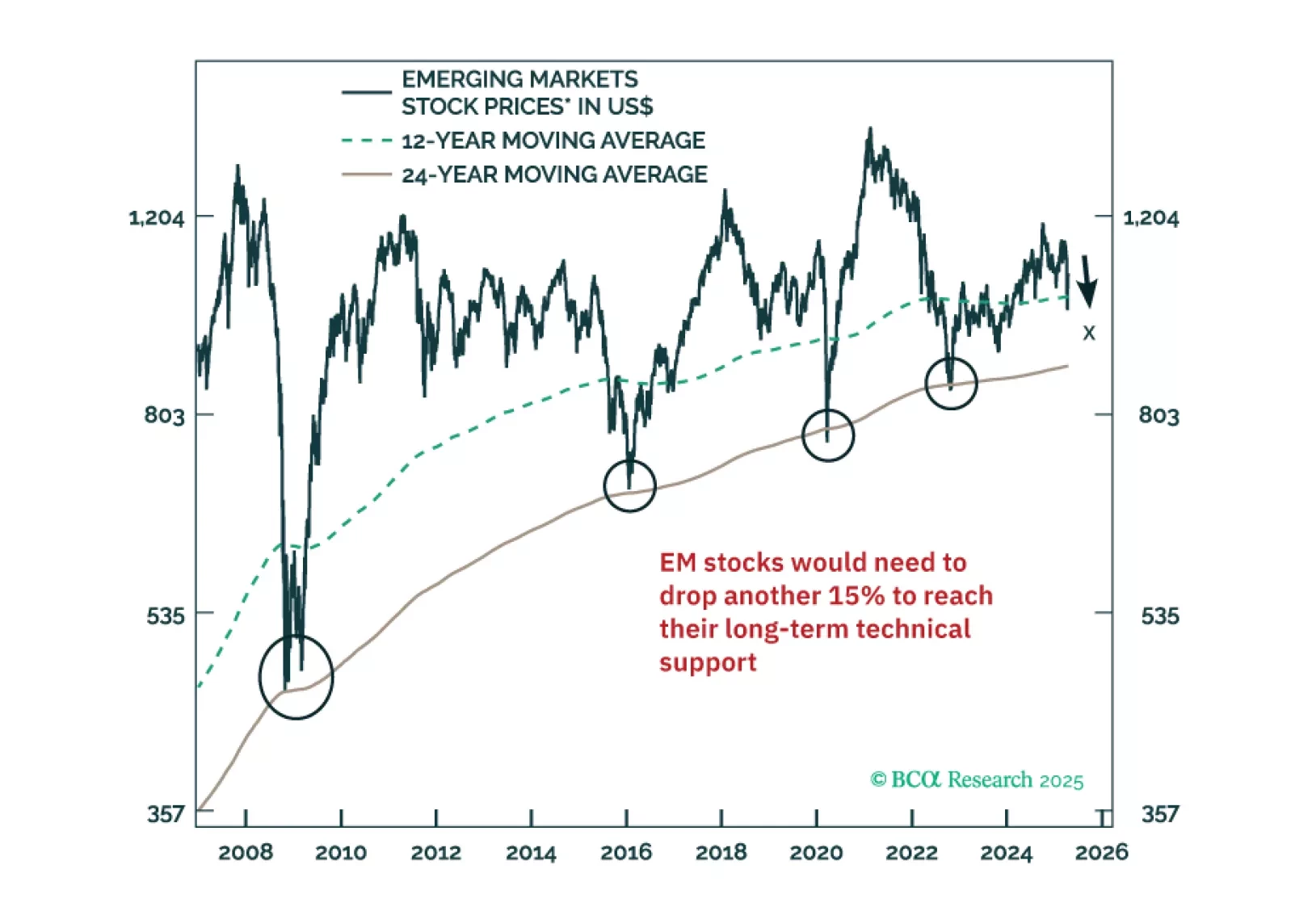

Even after policymakers retract their prejudicial actions, financial markets might continue selling off. We compare the current tariff shock with two past episodes when policy reversals did not produce market turnarounds: (1) the RMB…

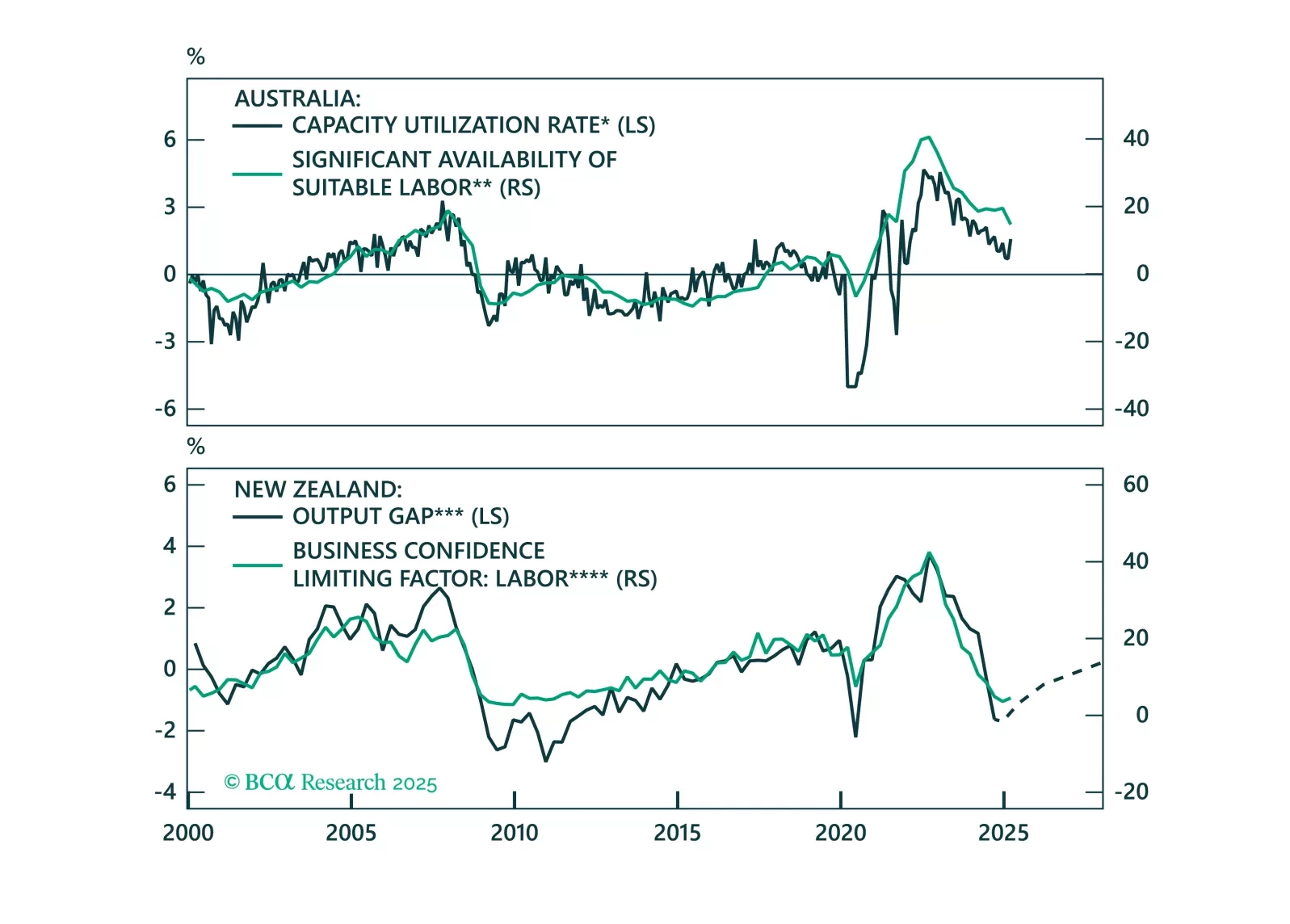

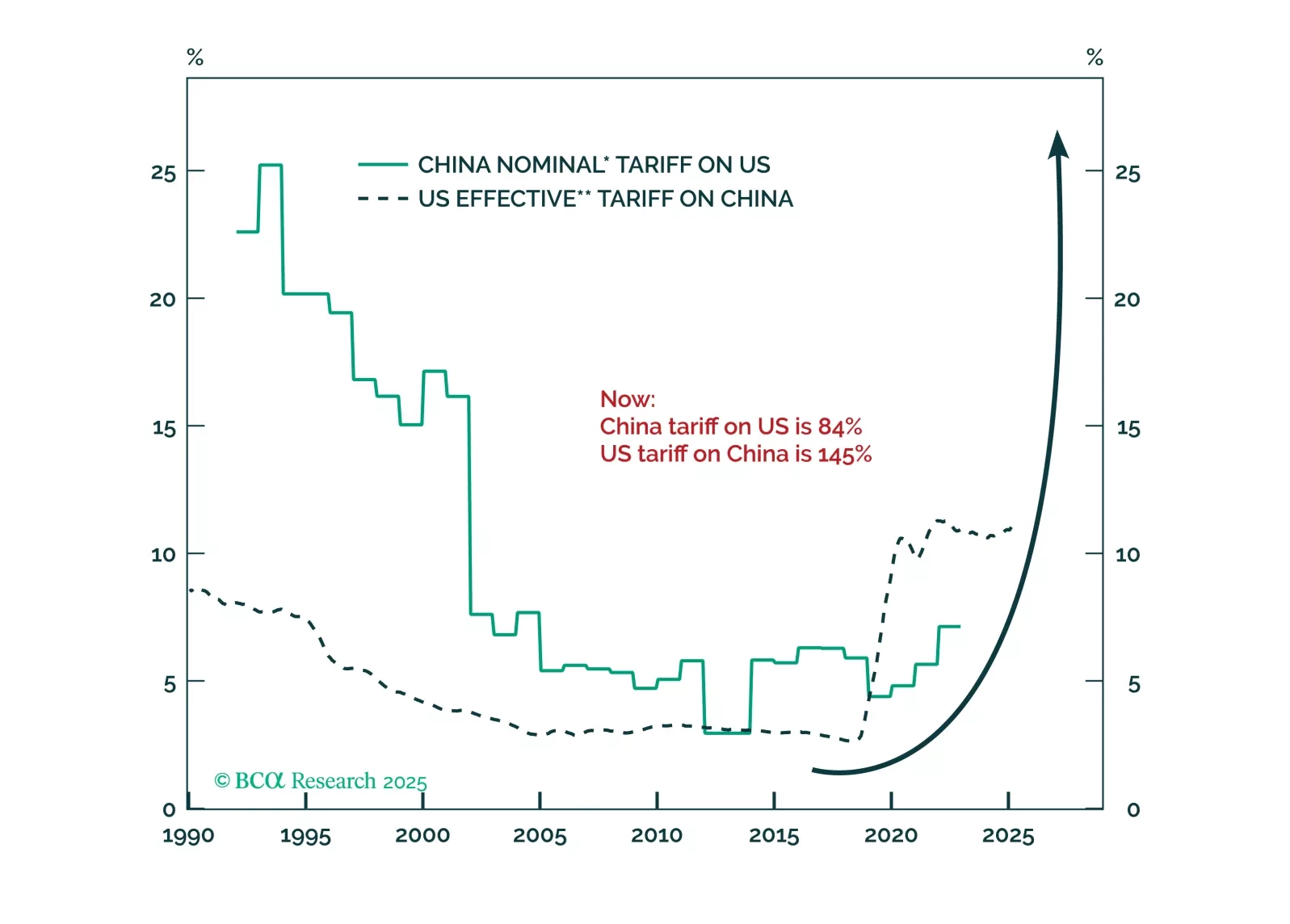

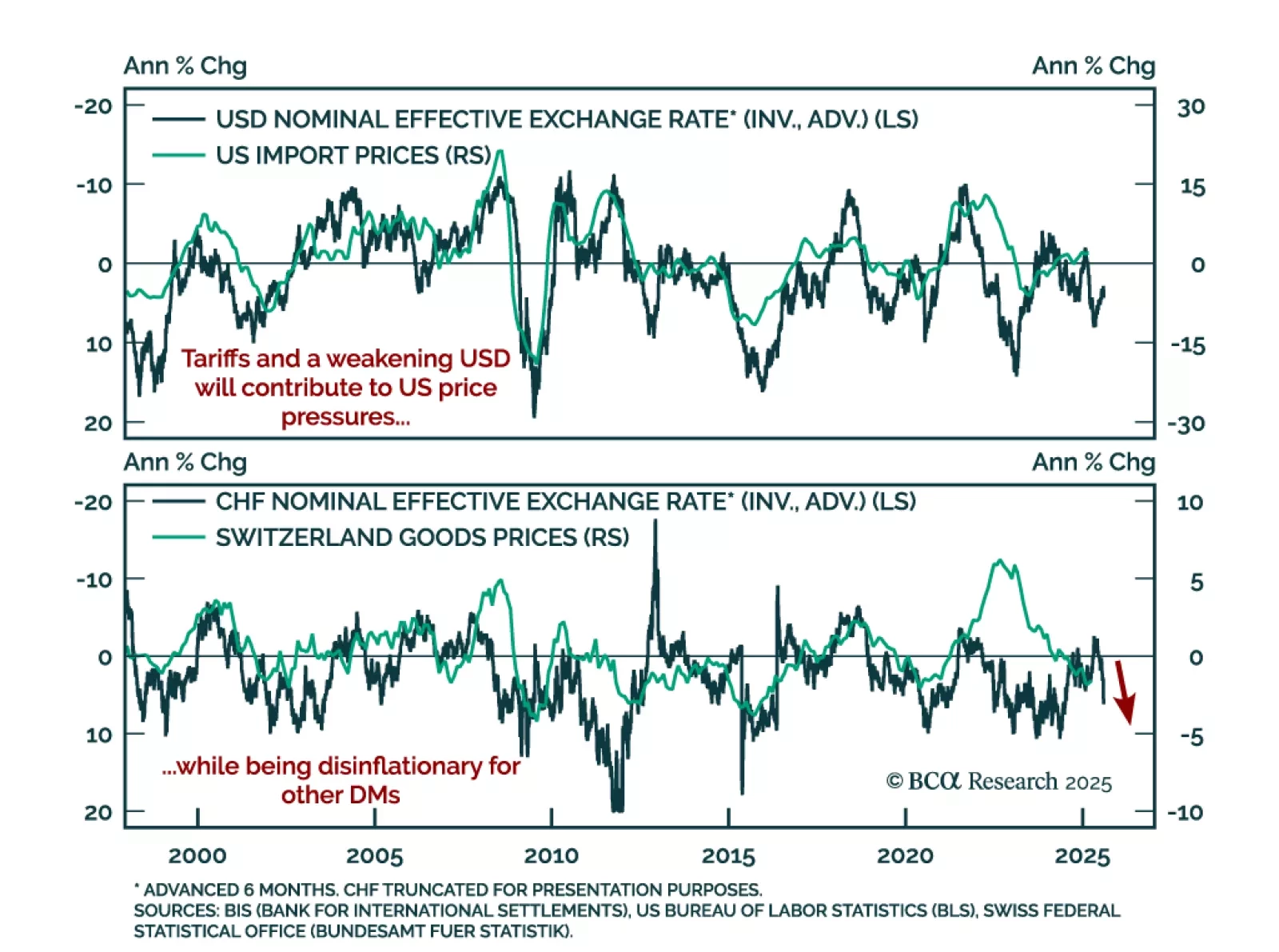

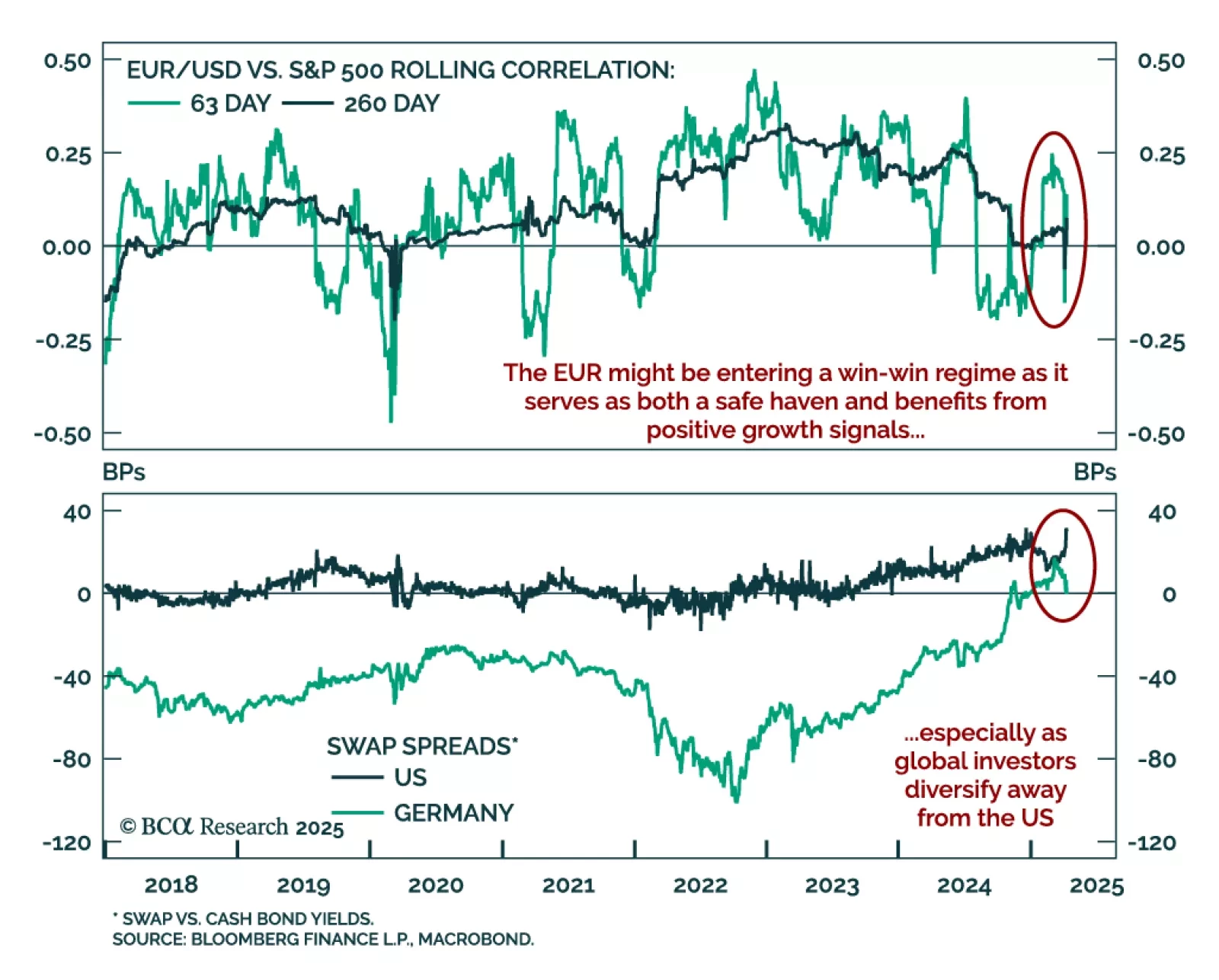

Tariff-driven inflation is diverging across economies, with the US facing mounting pressures while disinflation persists elsewhere. In theory, US tariffs should strengthen the dollar and weaken targeted currencies. In practice, the…

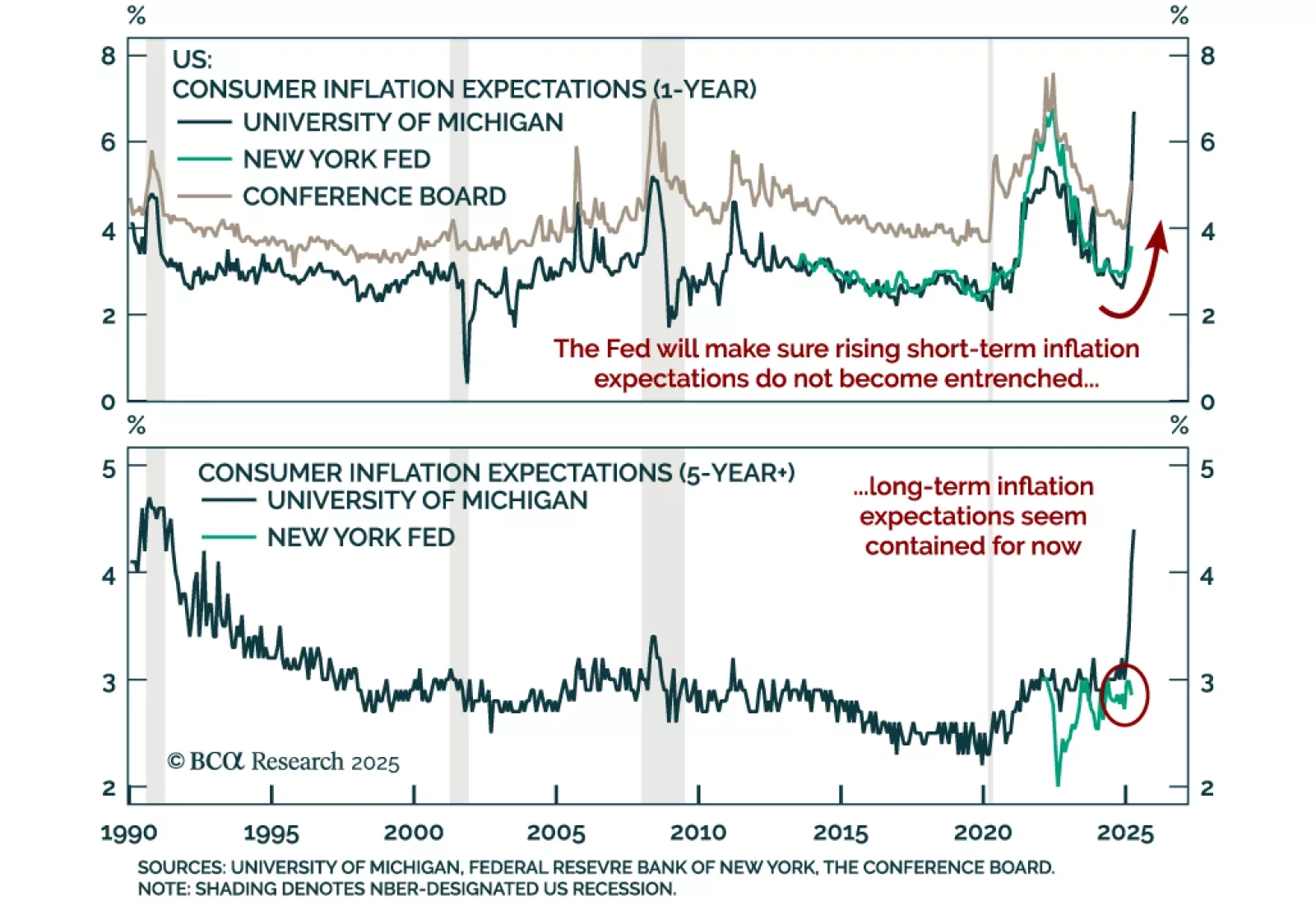

The latest NY Fed Survey of Consumer Expectations reinforces our defensive stance, with growth concerns deepening even as long-term inflation expectations remain anchored. The survey is a useful cross-check against broader sentiment…

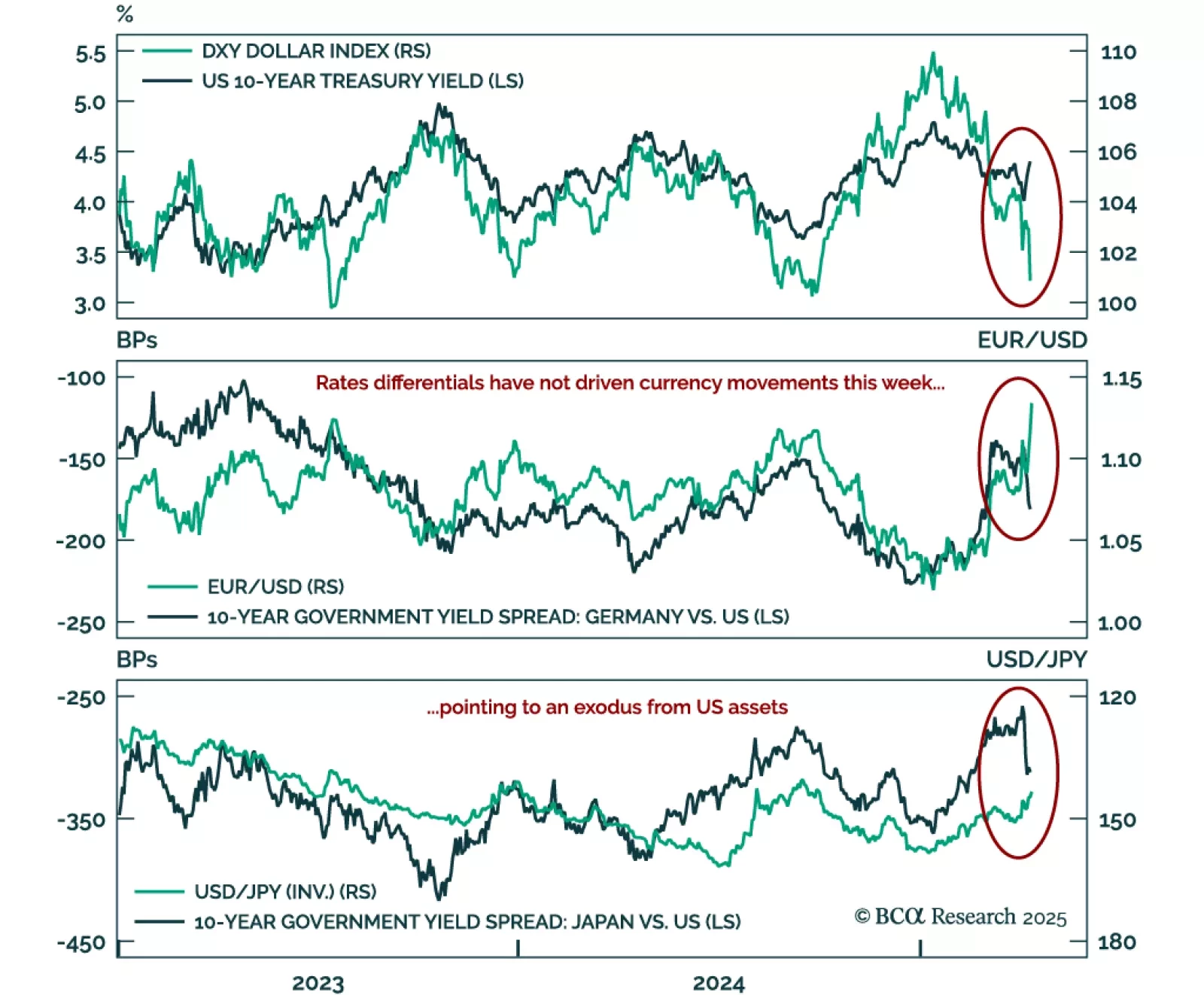

The recent breakdown in cross-asset correlations highlights mounting risk premia on US assets. Last week, the long-standing correlations underpinning our understanding of global markets violently broke down. The Treasury market…

Dips in European assets remain long-term buying opportunities, even though short-term risks abound. A notable feature of the recent selloff is that US safe havens failed to rally. In a global growth scare, both the US dollar and…

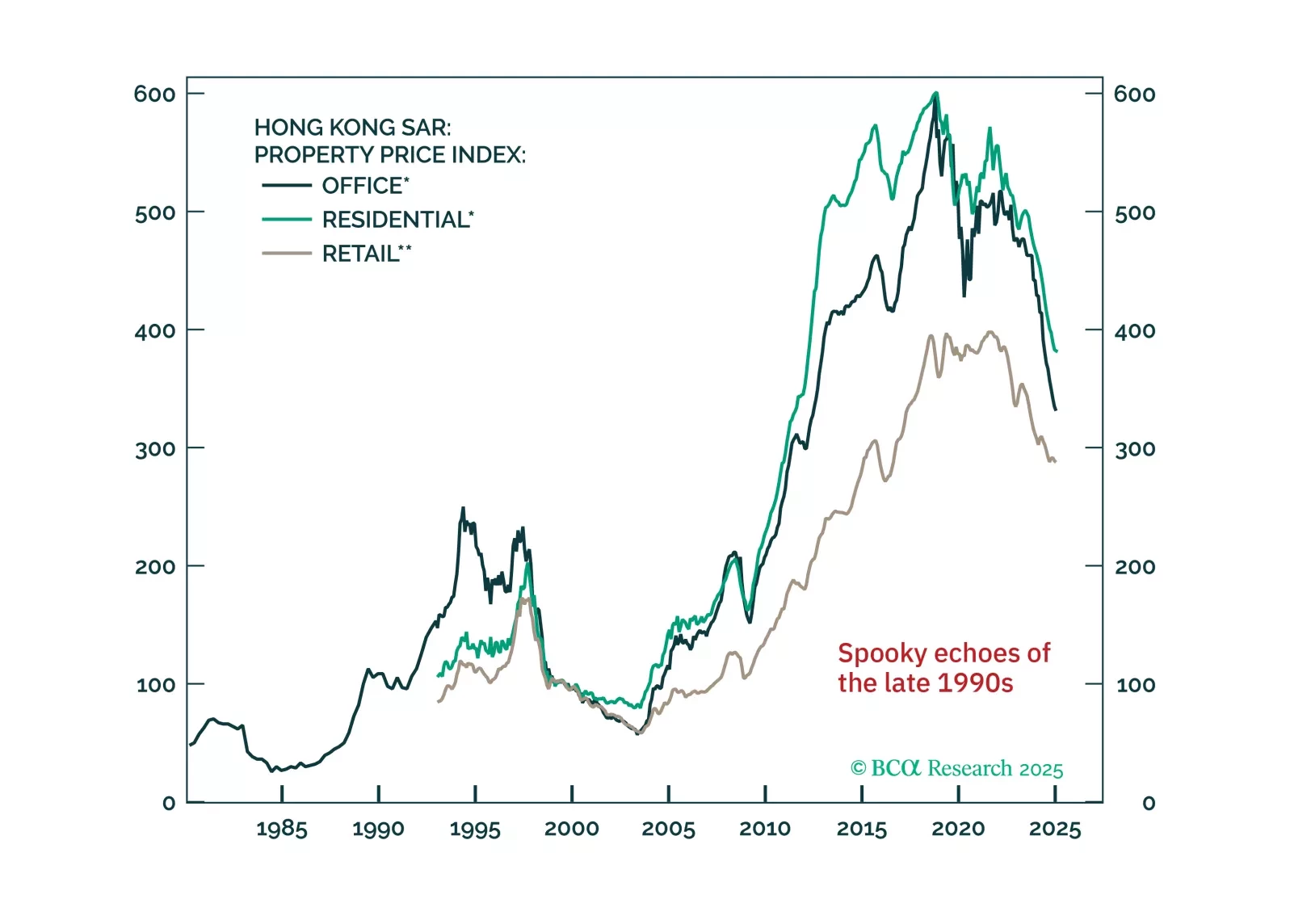

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…