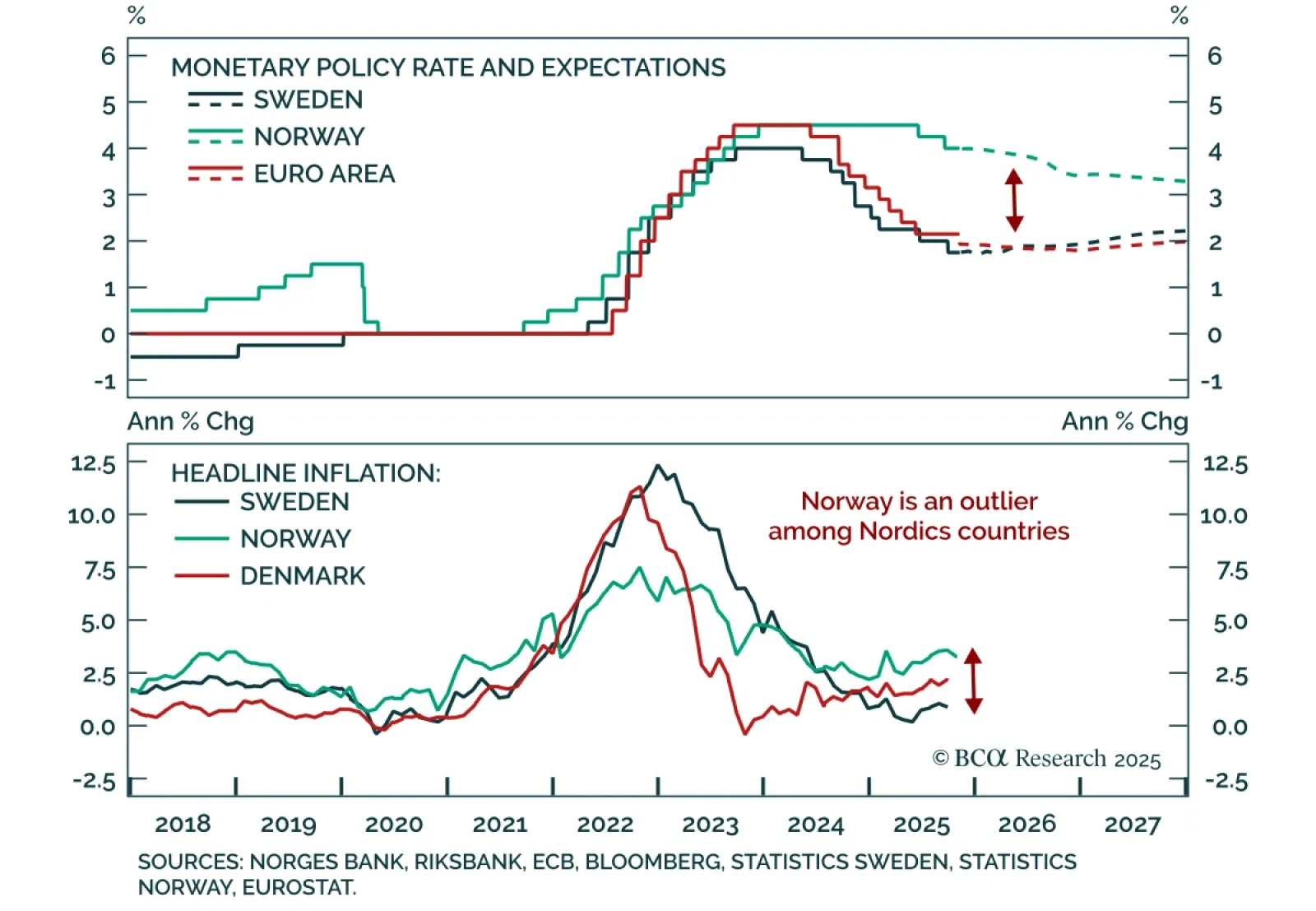

Our European strategists turn overweight Swedish equities and initiate a short NOK/SEK position as Nordic central banks pause but their economies diverge. Sweden’s recovery and stable inflation allow the Riksbank to join the “easing-…

The Nordic central banks are now aligned in pause mode, but their economies are diverging. With Swedish prospects improving and Norwegian headwinds mounting, we are turning overweight on Swedish equities and shorting NOK/SEK.

Please join Chief Strategists Mathieu Savary and Jeremie Peloso for a Roundtable on Tuesday, June 25 at 3:00 PM CEST (2:00 PM BST, 9:00 AM EDT).

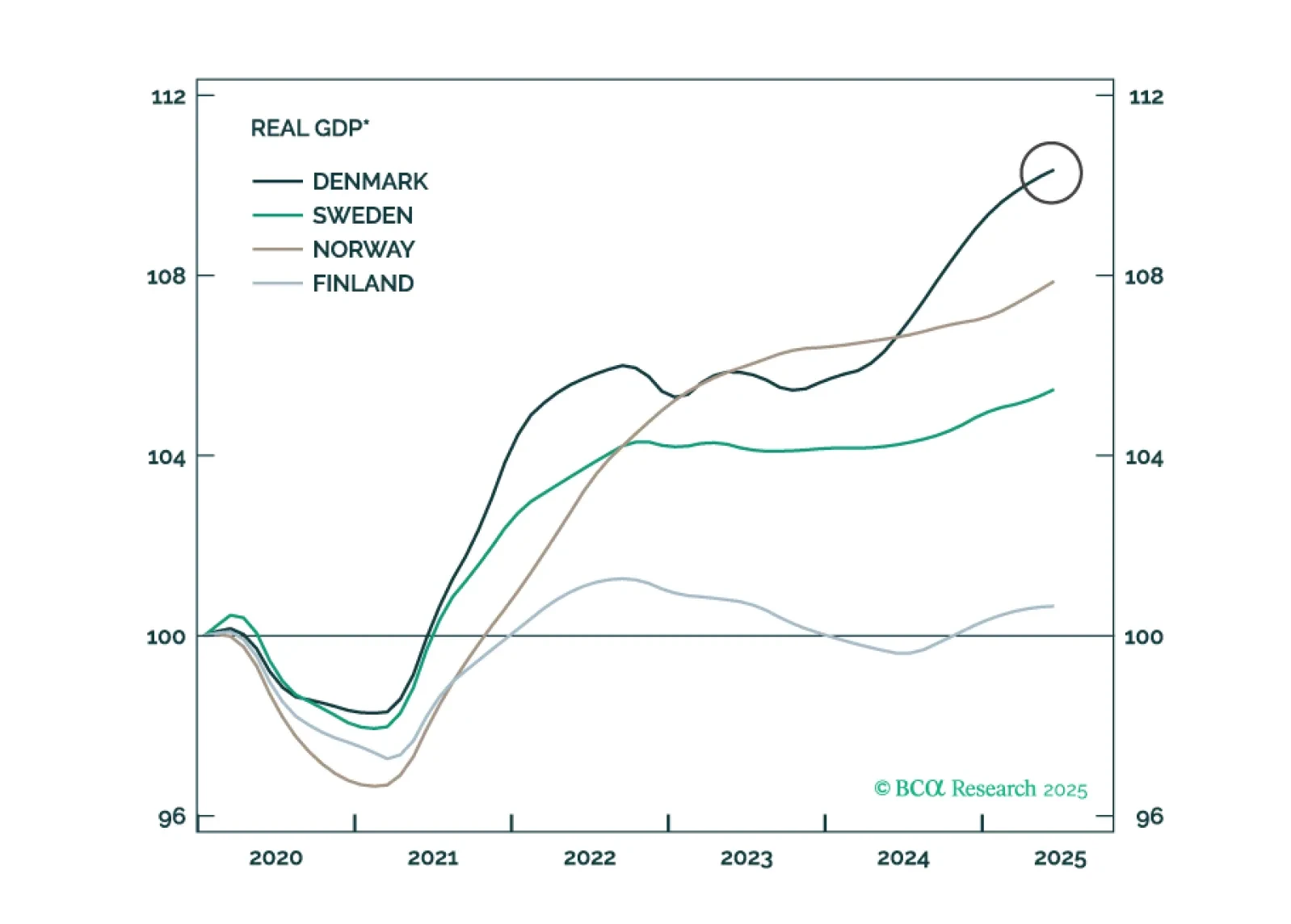

Highlights The economic performance of Sweden, which did not have a lockdown, has been almost as bad as Denmark, which did have a lockdown. This proves that the current recession is not ‘man-made’, it is ‘pandemic-…

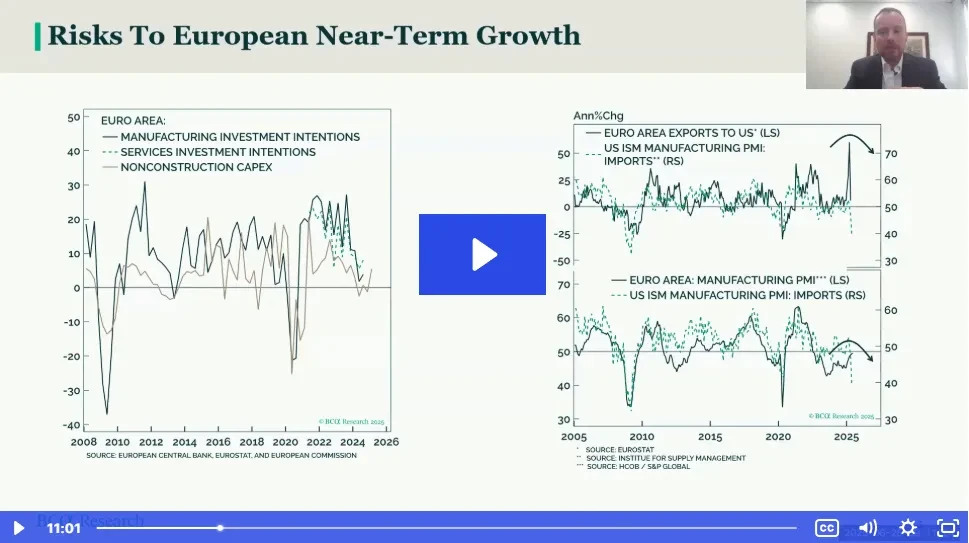

In a webcast this Friday I will be joined by our Chief US Equity Strategist, Anastasios Avgeriou to debate ‘Sectors To Own, And Sectors To Avoid In The Post-Covid World’. Today’s report preludes five of the points…

In lieu of the next weekly report I will be presenting the quarterly webcast ‘The Japanification Of Europe: Should We Fear It, Or Celebrate It?’ on Monday 4 November at 10.00AM EST, 3.00PM GMT, 4.00PM CET, 11.00PM HKT. As…

Highlights Open an equity market relative overweight to Europe versus China. Upgrade Denmark to neutral. Downgrade the Netherlands to underweight. Maintain Switzerland at overweight. With the Euro Stoxx 50 now up almost 20 percent…

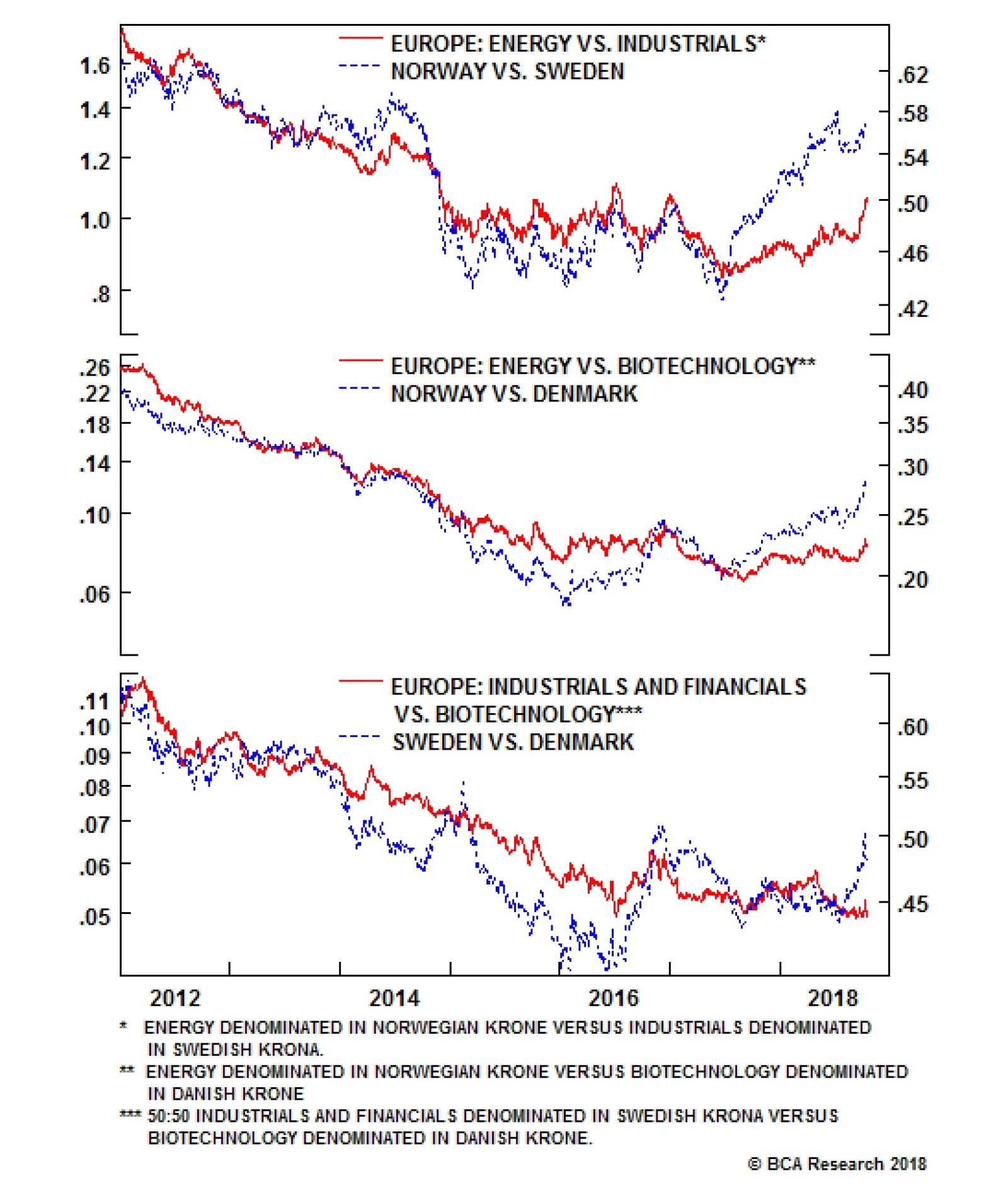

Looking at these three bourses, each has a defining dominant sector (or sectors) whose market weighting swamps all others. In Norway, oil and gas accounts for over 40 percent of the market; in Sweden, industrials accounts for 30…