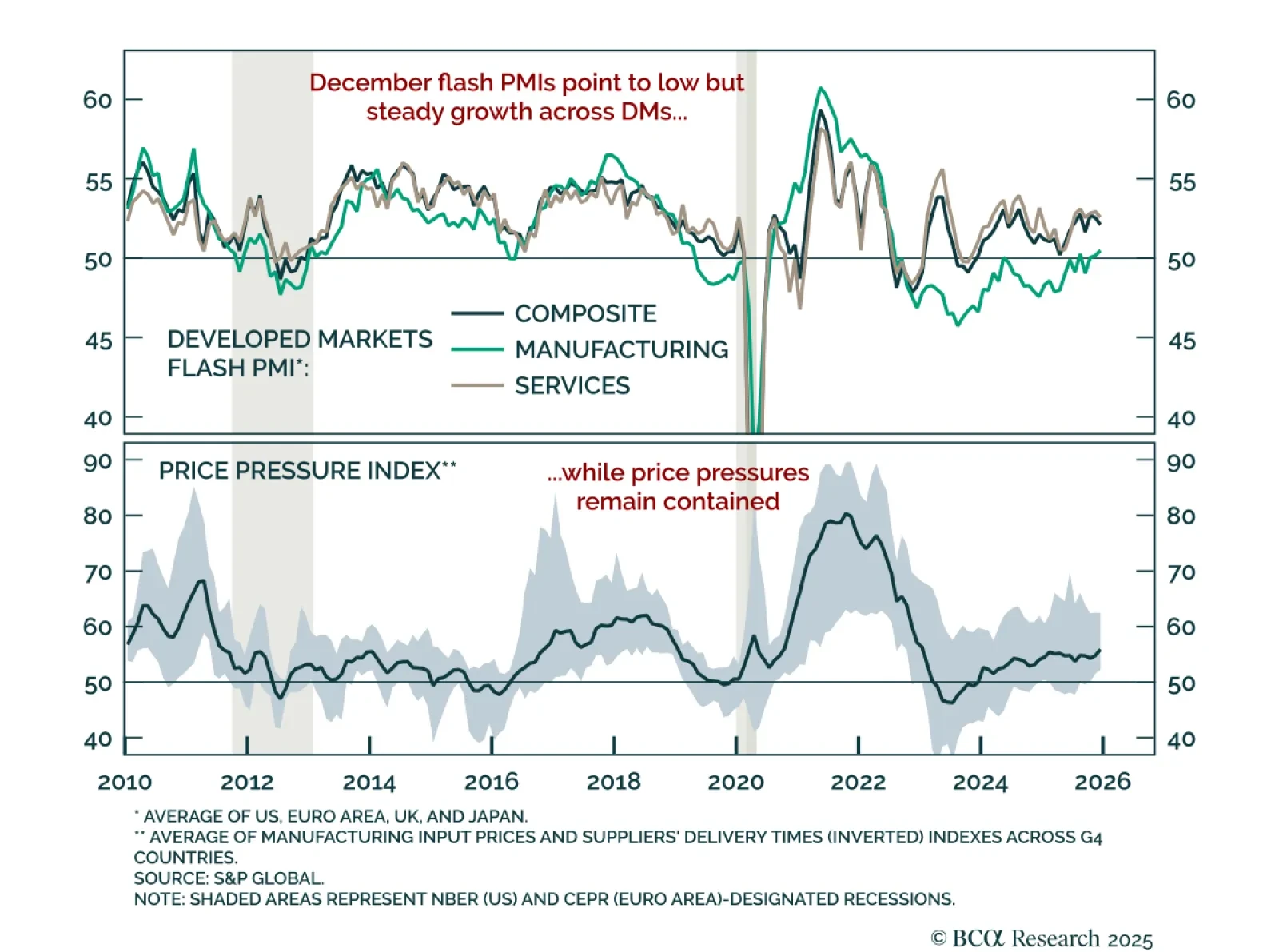

Maintain an underweight in industrial commodities as flash PMIs confirm weak global growth momentum. December flash PMIs for developed markets pointed to subdued activity. The US composite slowed to 53 from 54.2, a six-month low,…

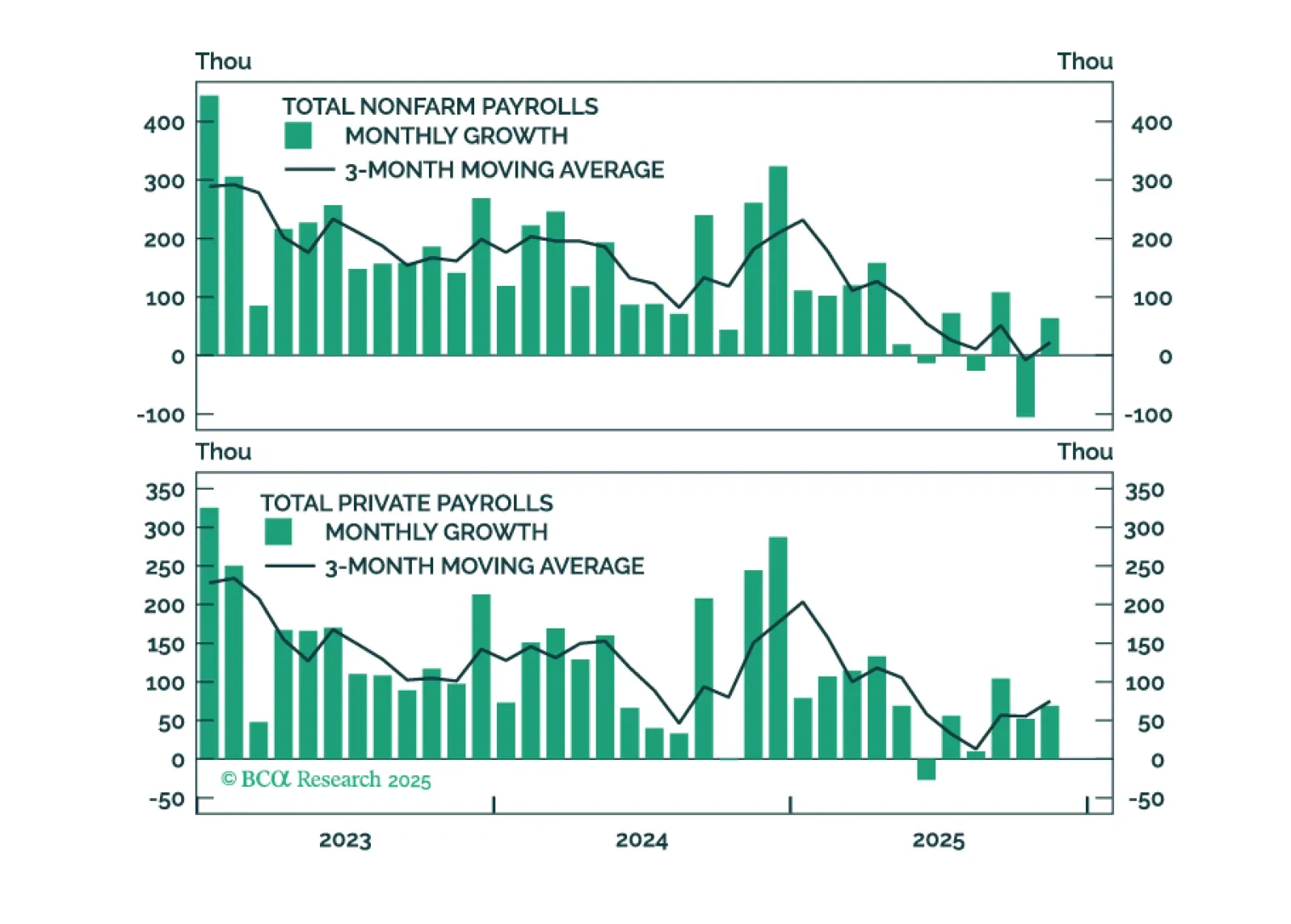

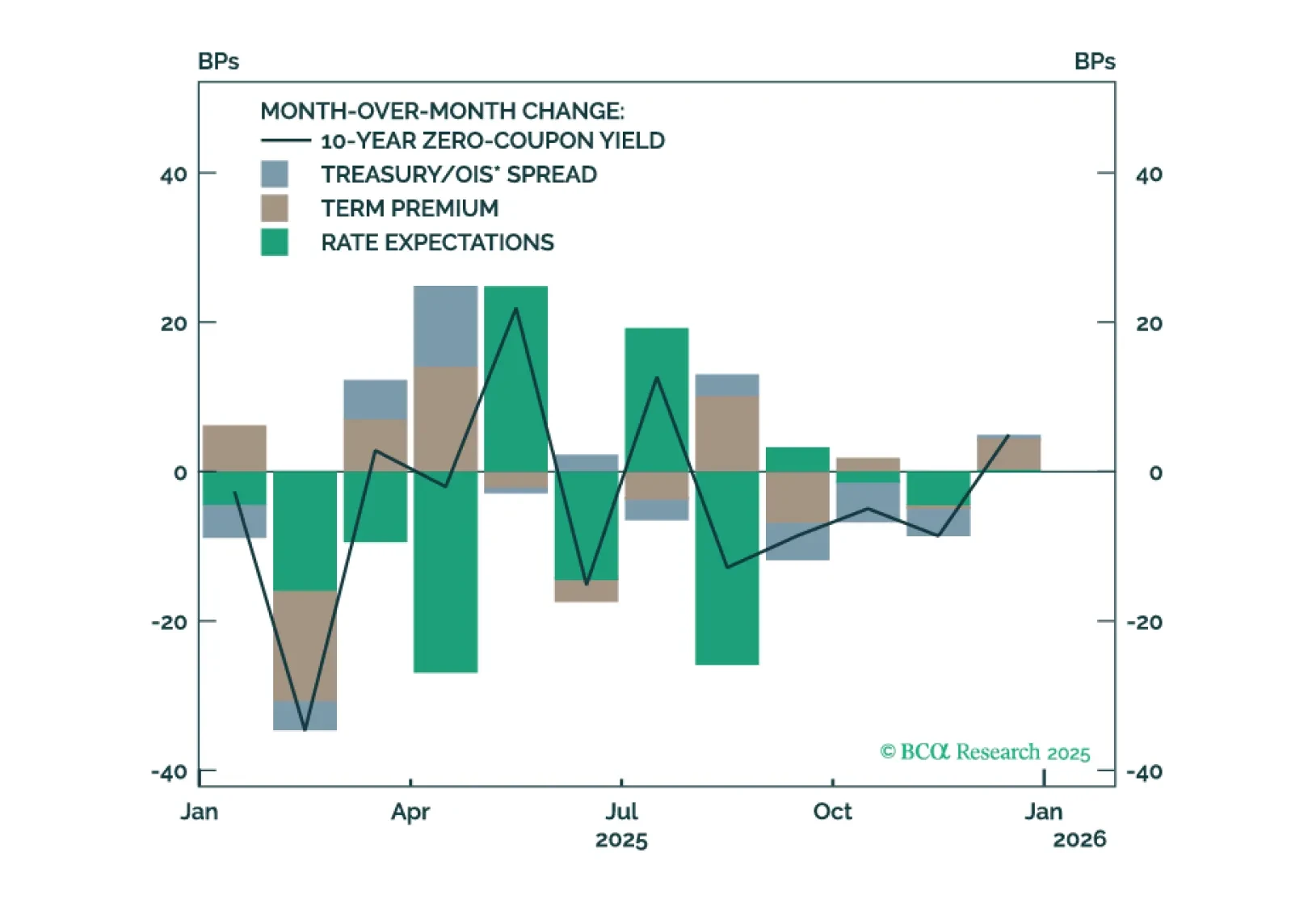

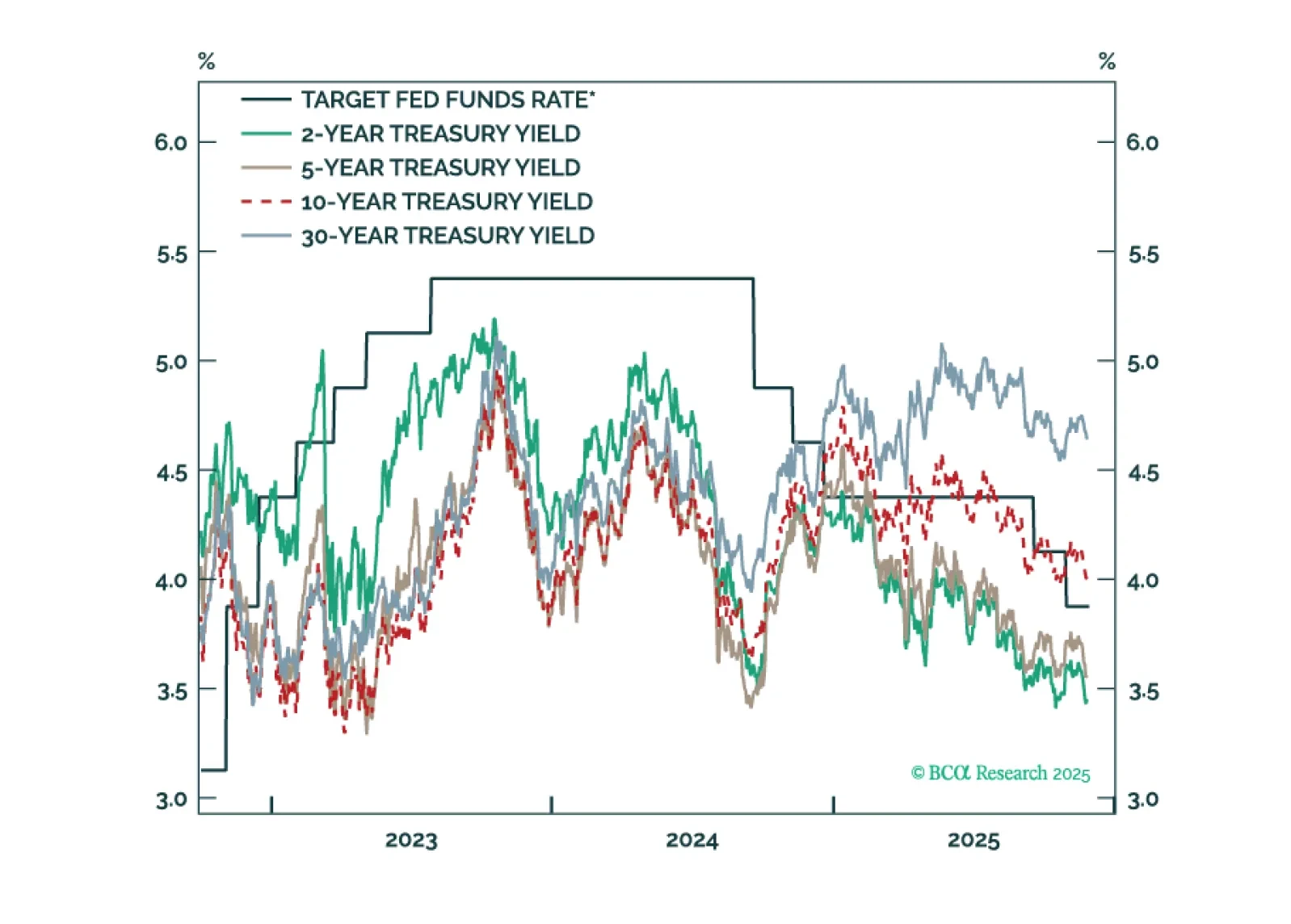

Employment Data Point To Dovish Policy Surprises In 2026

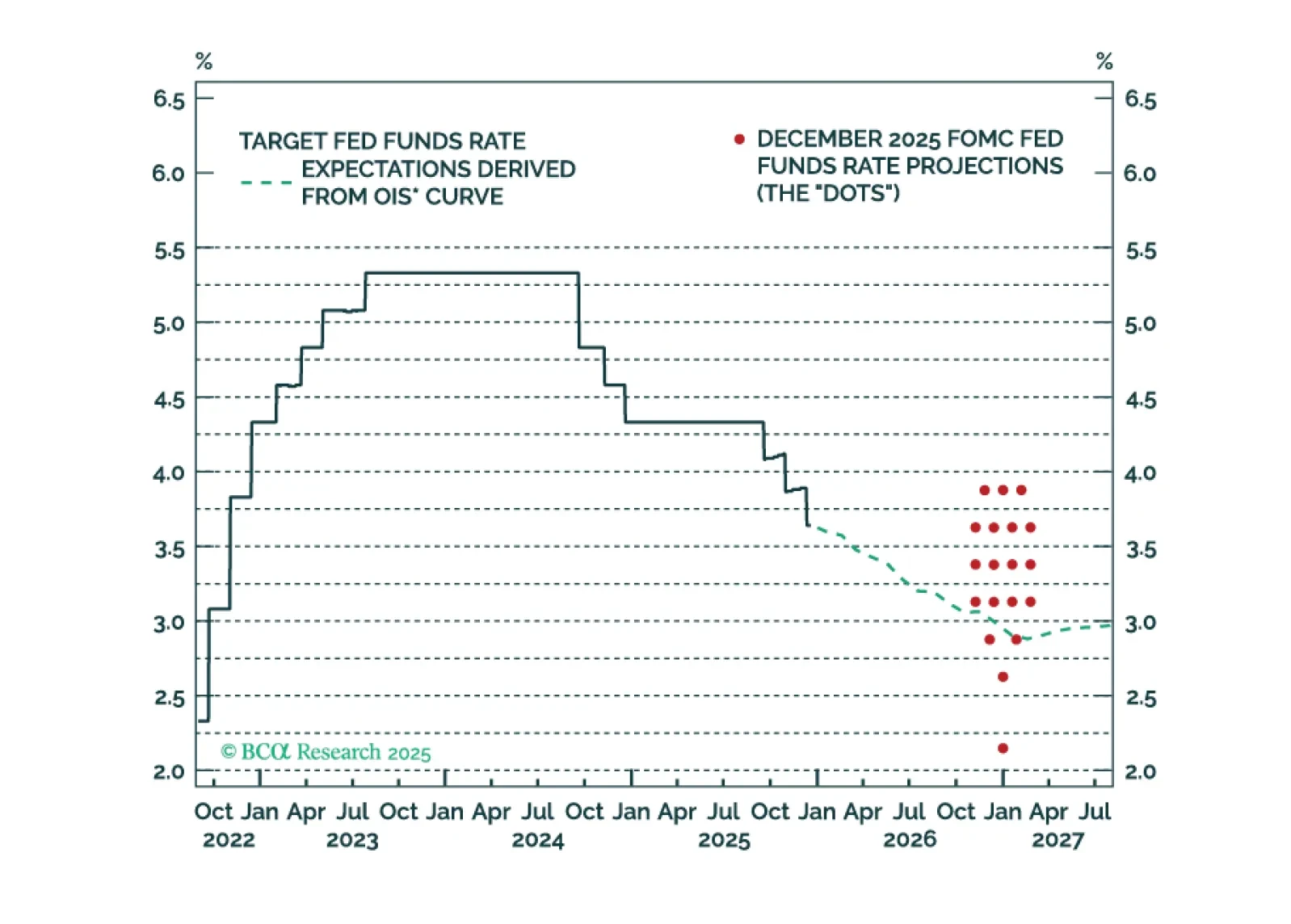

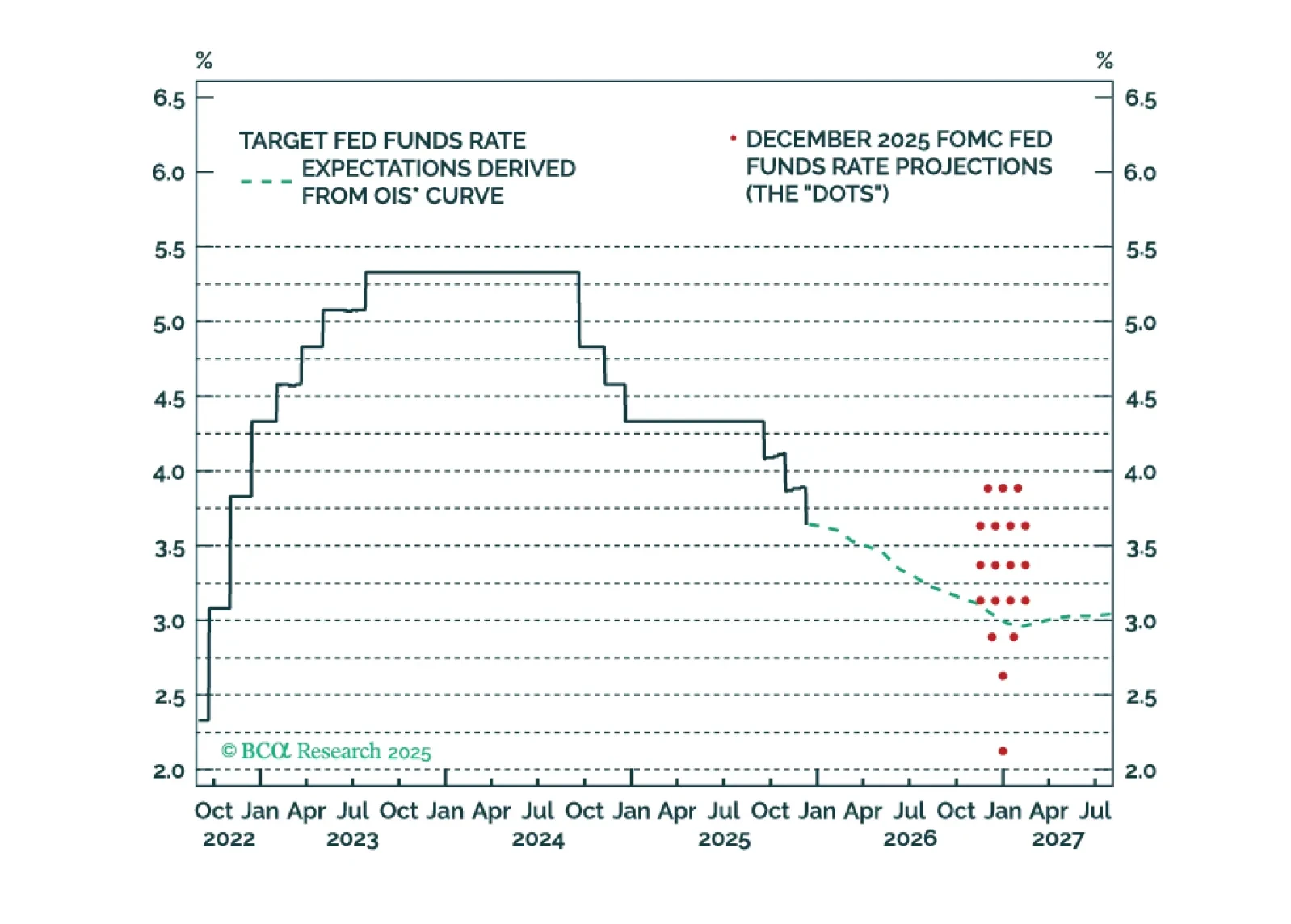

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.

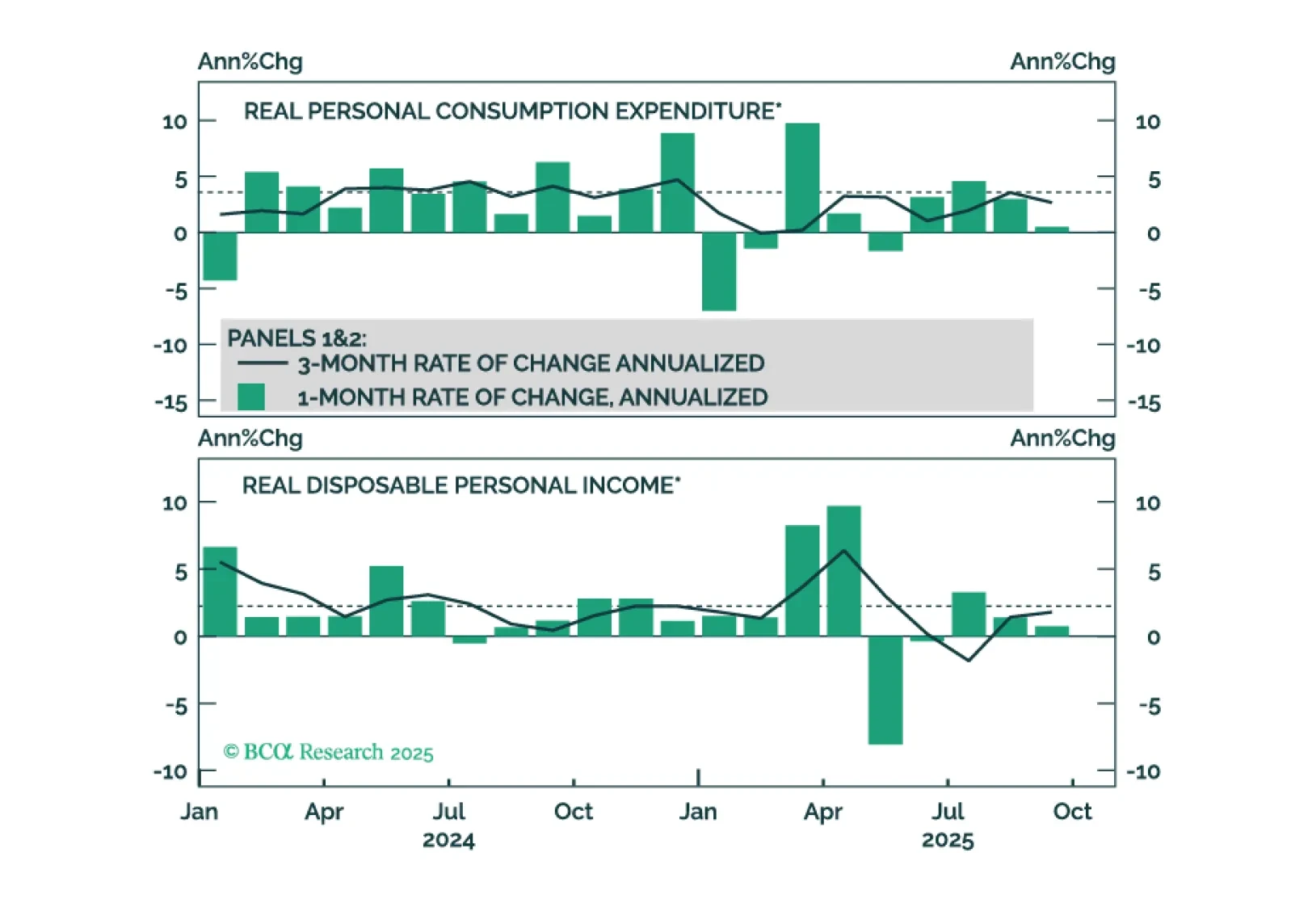

September’s weak consumer spending data challenge the K-shaped recovery narrative and suggest that spending will slow to match already-weak employment growth.

Our Portfolio Allocation Summary for December 2025.

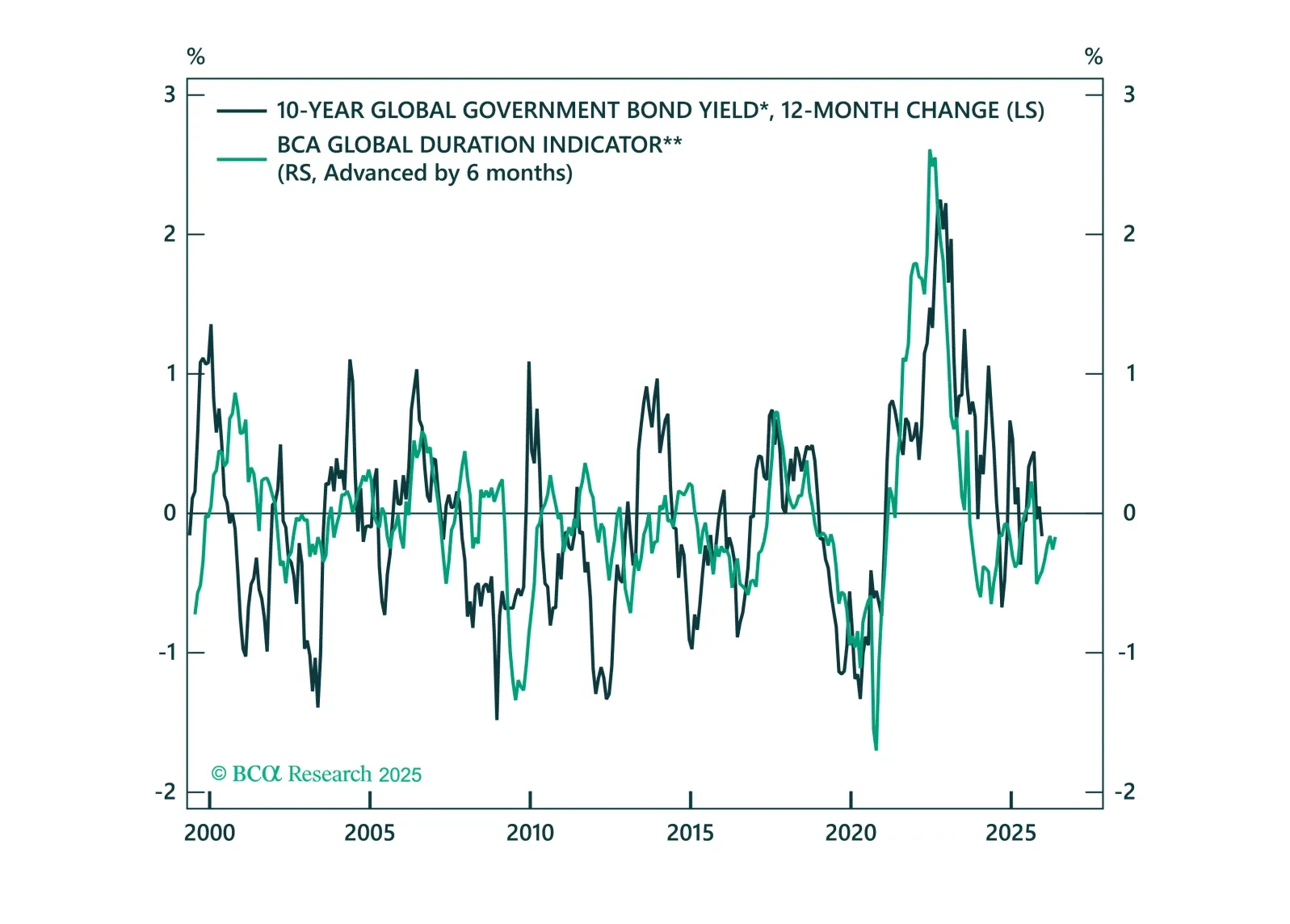

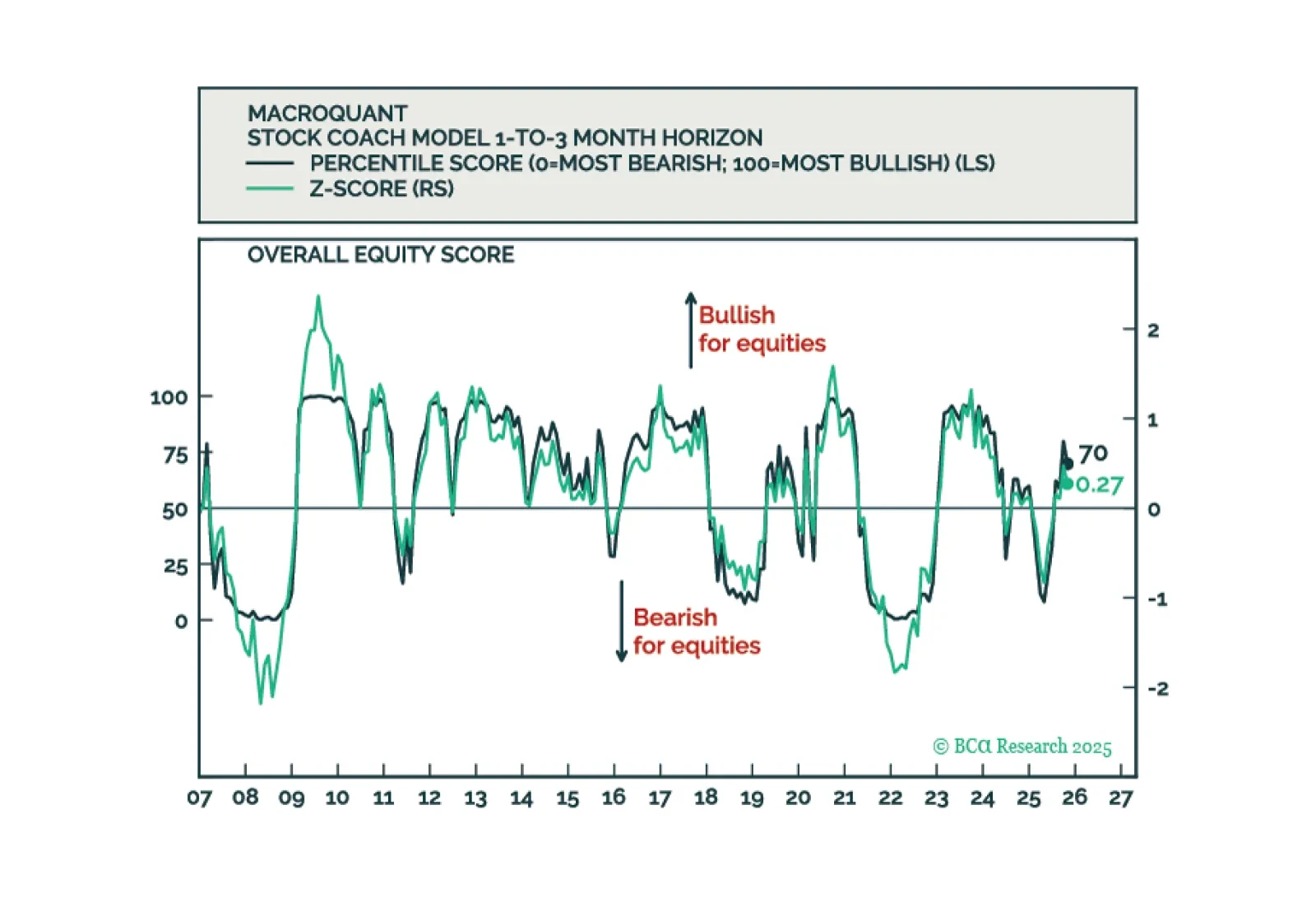

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

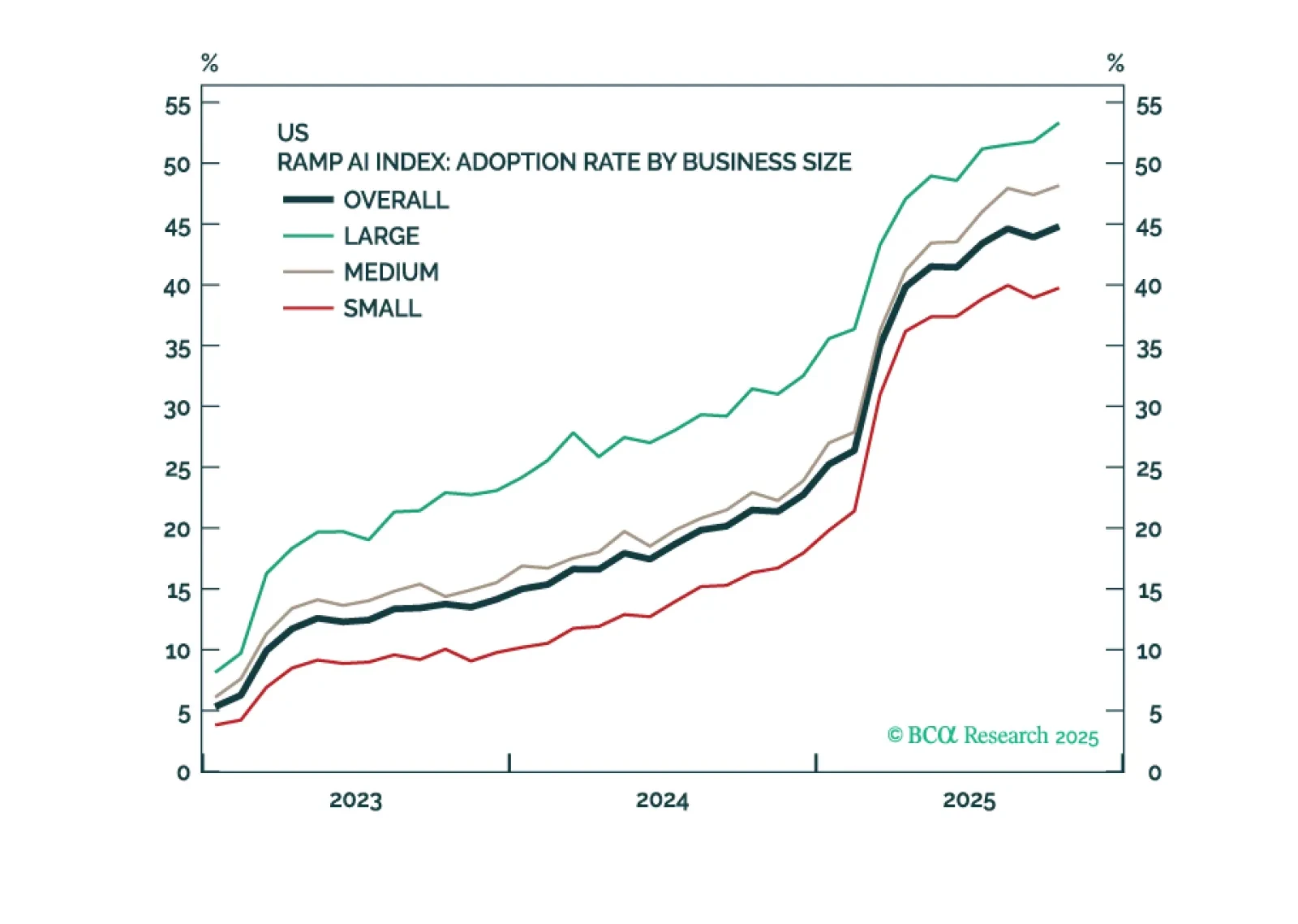

The odds have risen that we have reached a “Metaverse Moment” – a situation where investors punish AI companies for increasing capex. This warrants greater caution towards AI stocks specifically, and the broader S&P 500 more…