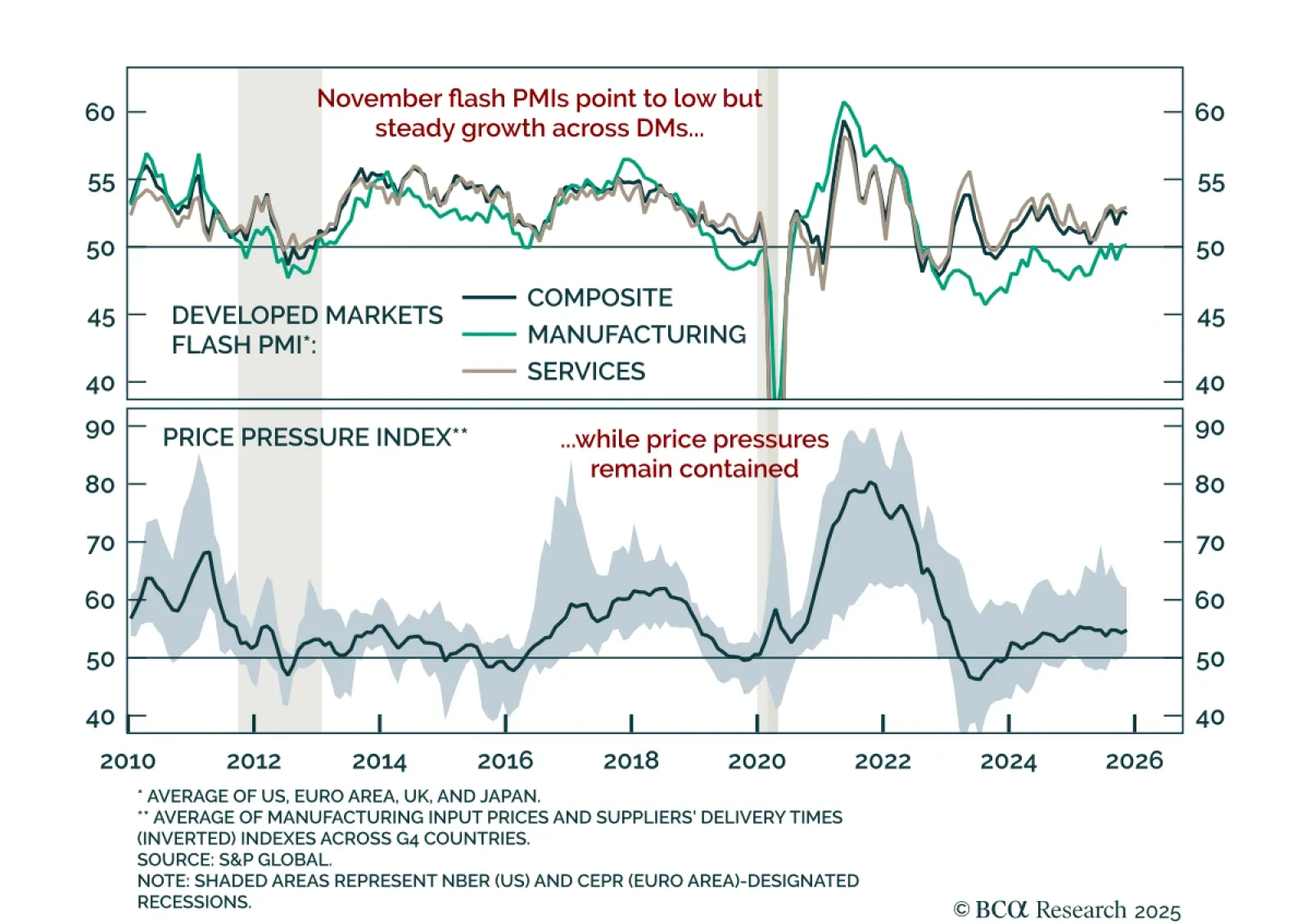

November flash PMIs confirmed sluggish global momentum, reinforcing a defensive stance with tactical support for the USD. The US composite PMI rose to 54.8, driven by stronger services but weaker manufacturing. The Euro area showed a…

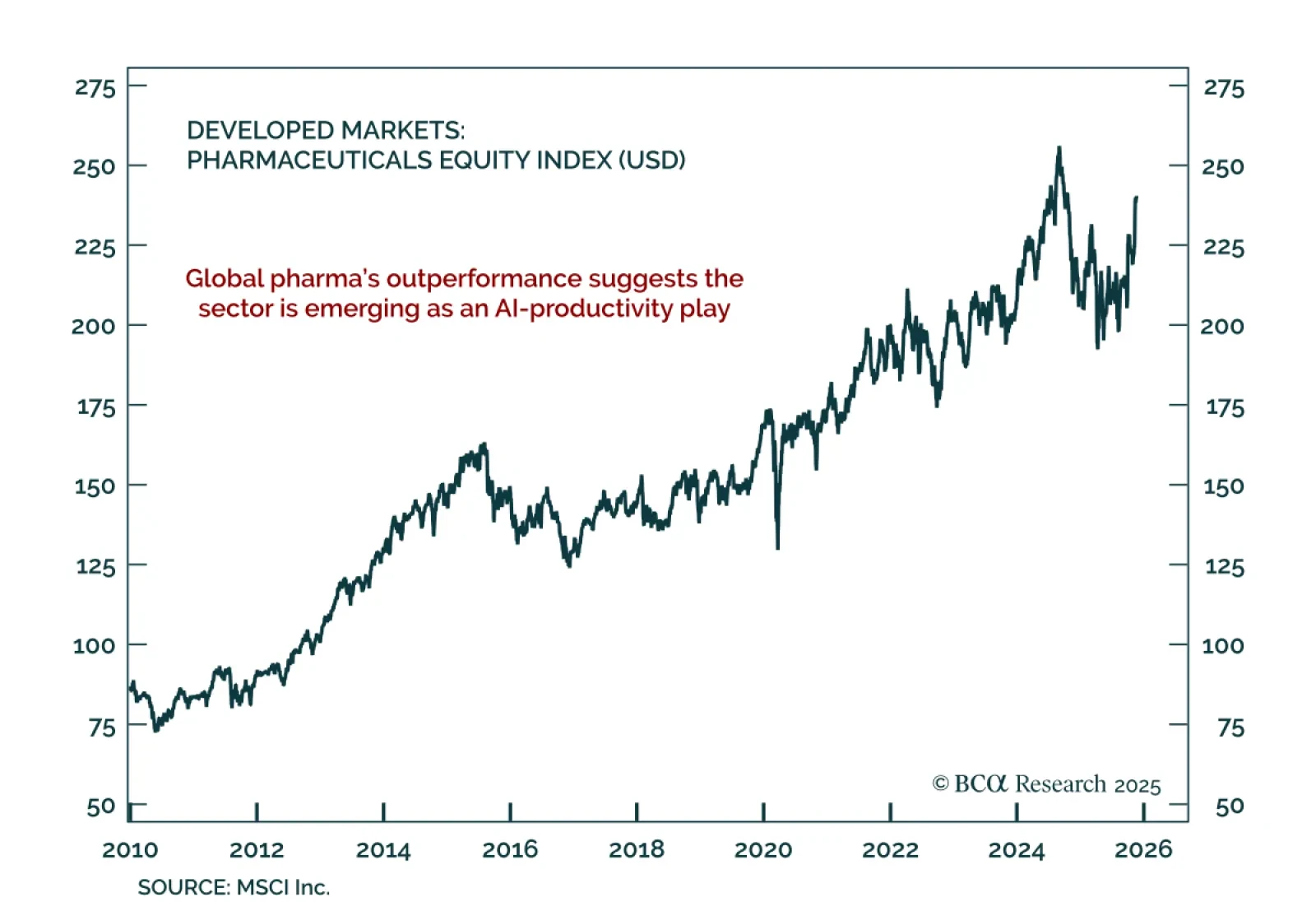

The global pharmaceuticals sector is signaling something more than defensive resilience. Our Chart of the Week comes from Mathieu Savary, Chief Strategist for Developed Markets excl. US, and shows a strong upward trend even as…

The September employment report probably won’t convince enough hawks to vote for a rate cut in December.

Our Portfolio Allocation Summary for November 2025.

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

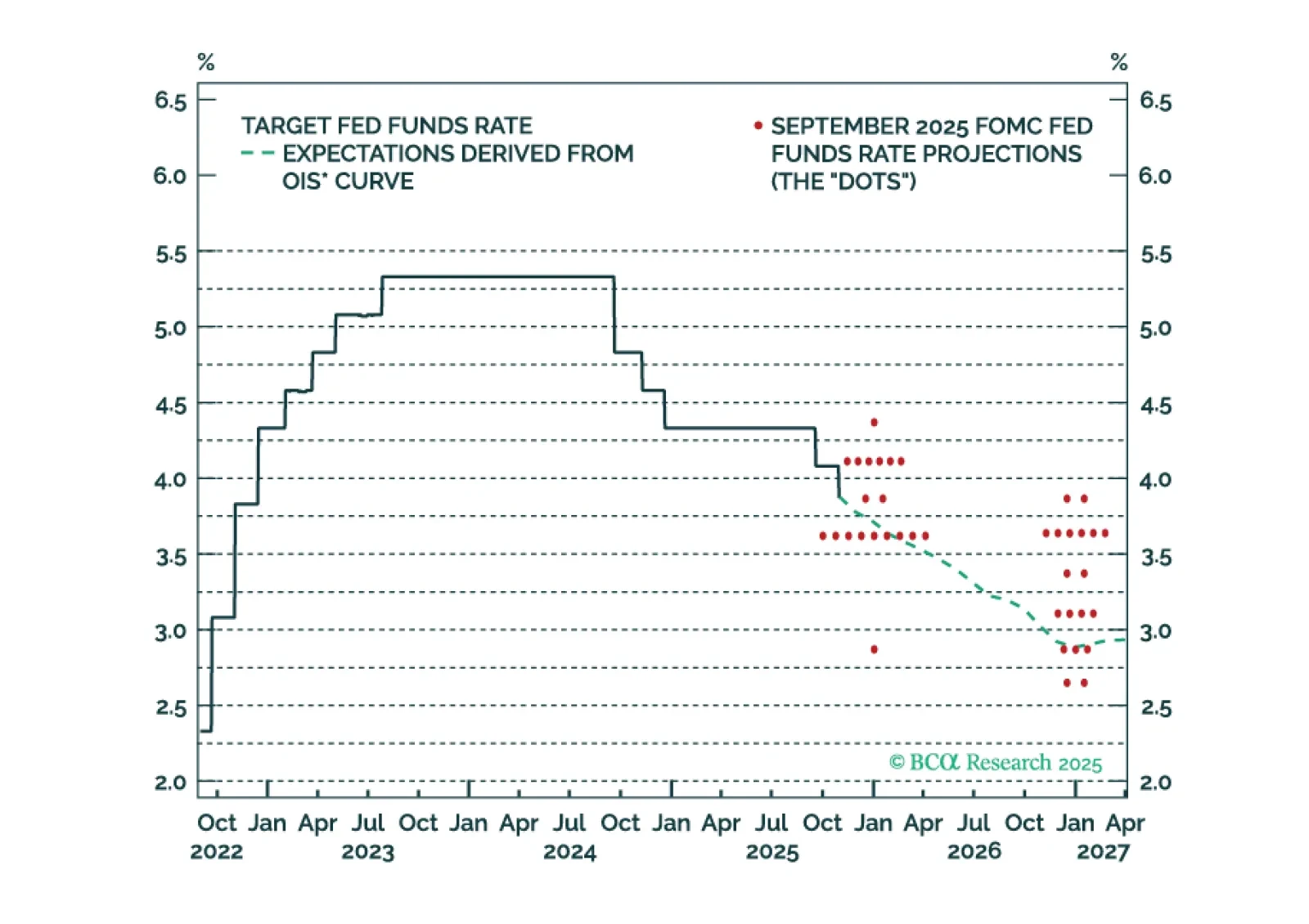

The Fed cut rates today, but a follow-up rate cut in December is uncertain. It will depend, in large part, on who wins a debate about the neutral rate of interest.

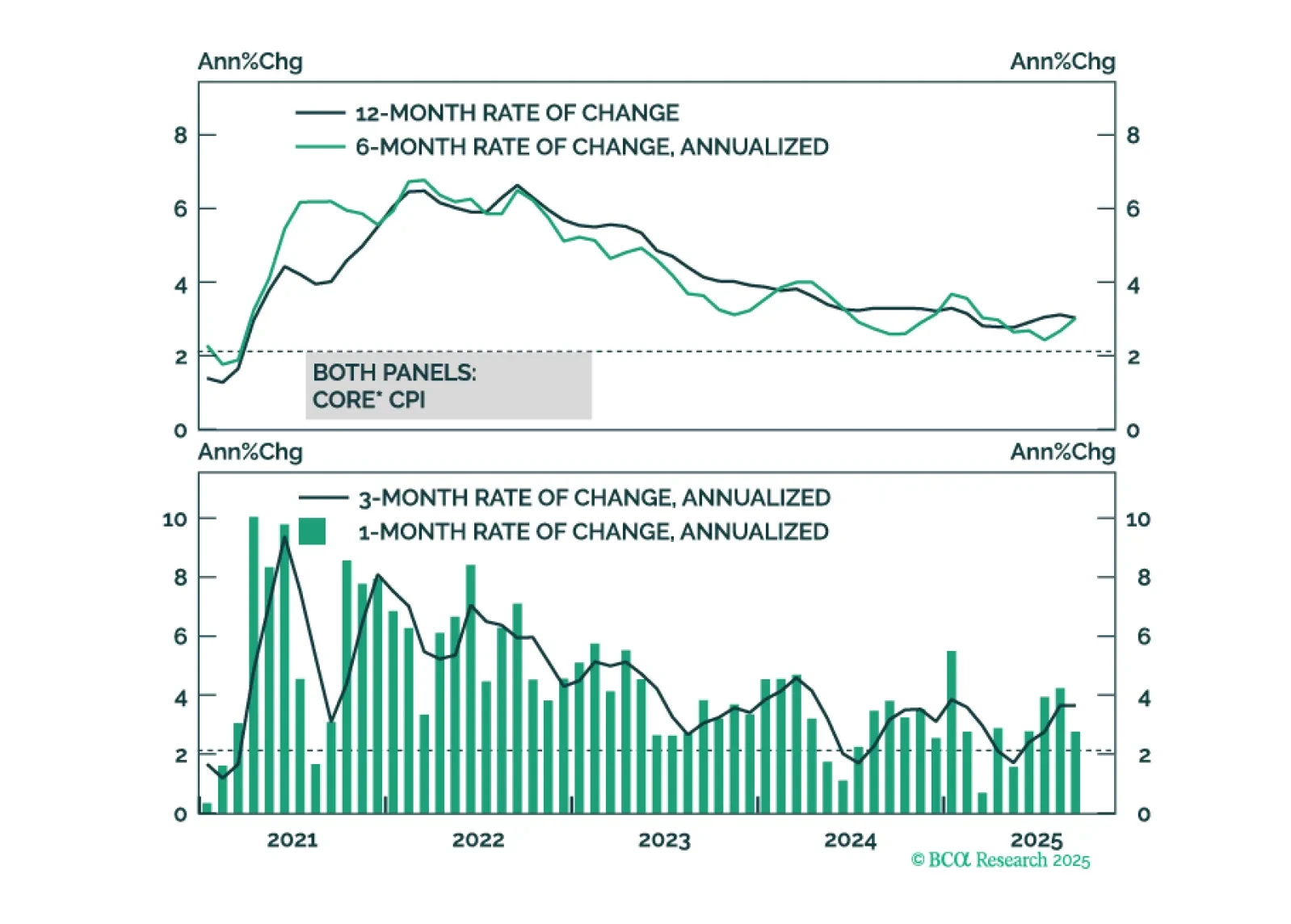

US inflation data continue to show no signs of price pressures beyond a near-term tariff effect.

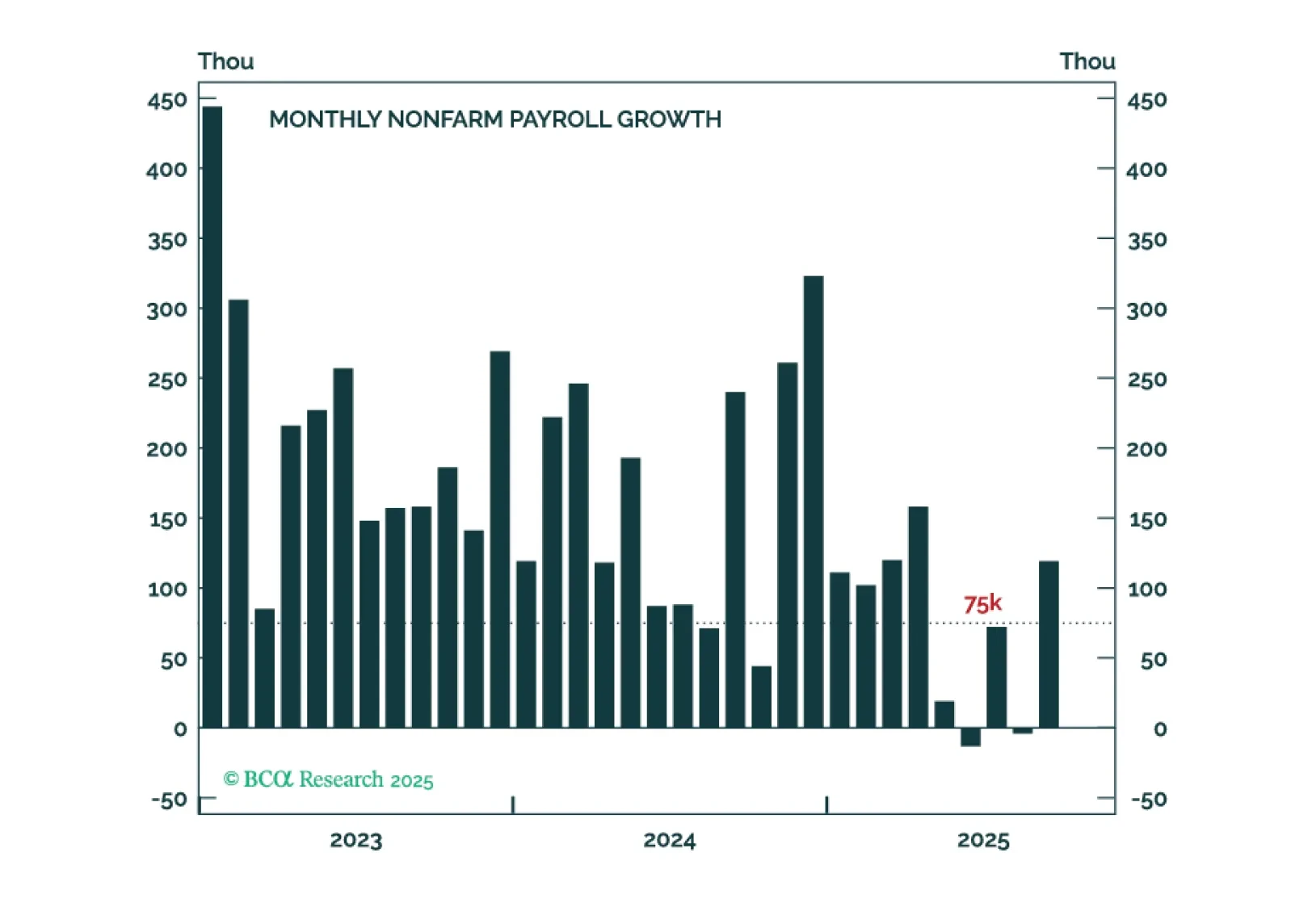

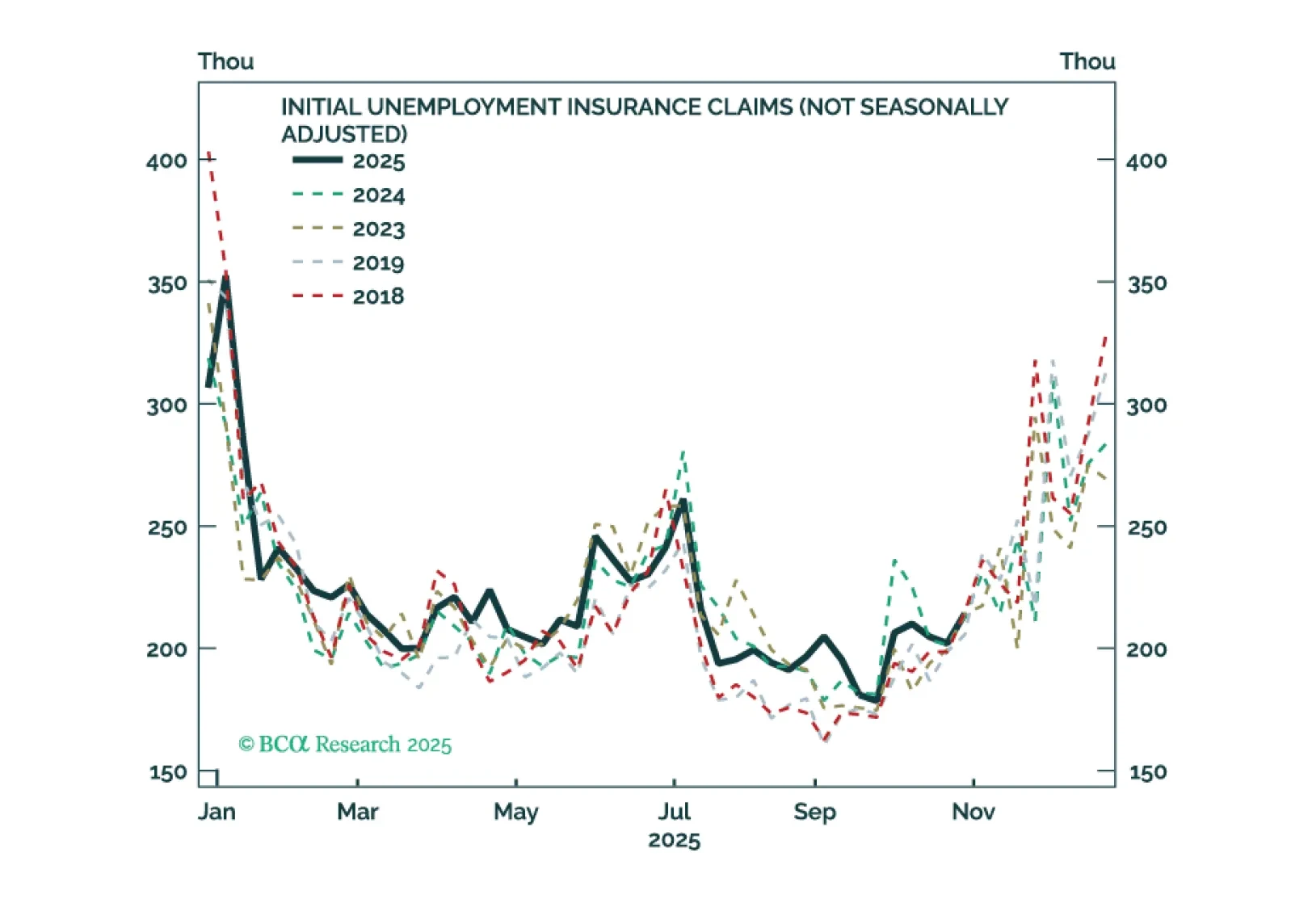

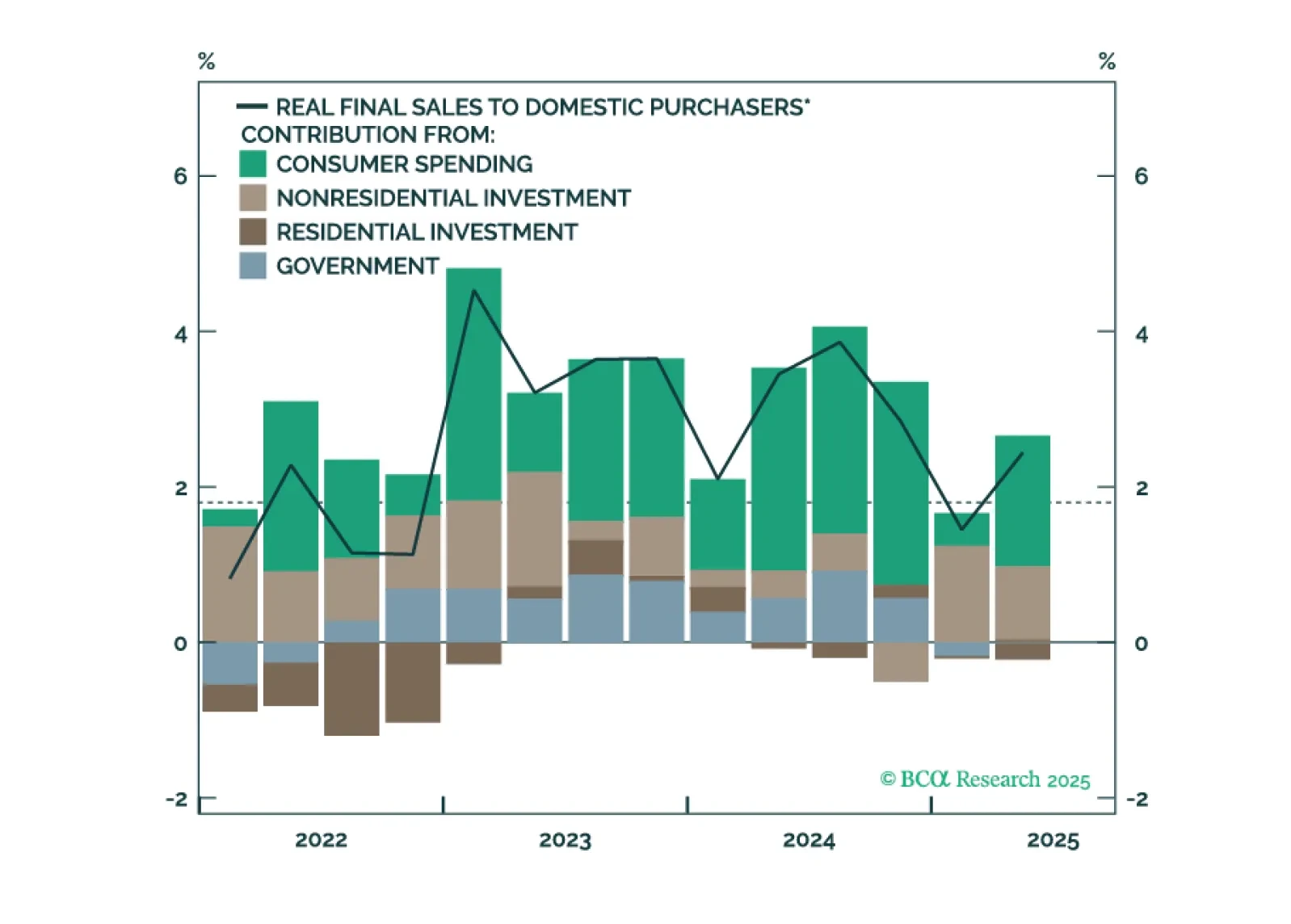

The Fed is poised to deliver a 25-basis-point rate cut this month, but a follow-up rate cut in December will depend on how the divergence between strong consumer spending and weak employment growth is resolved.