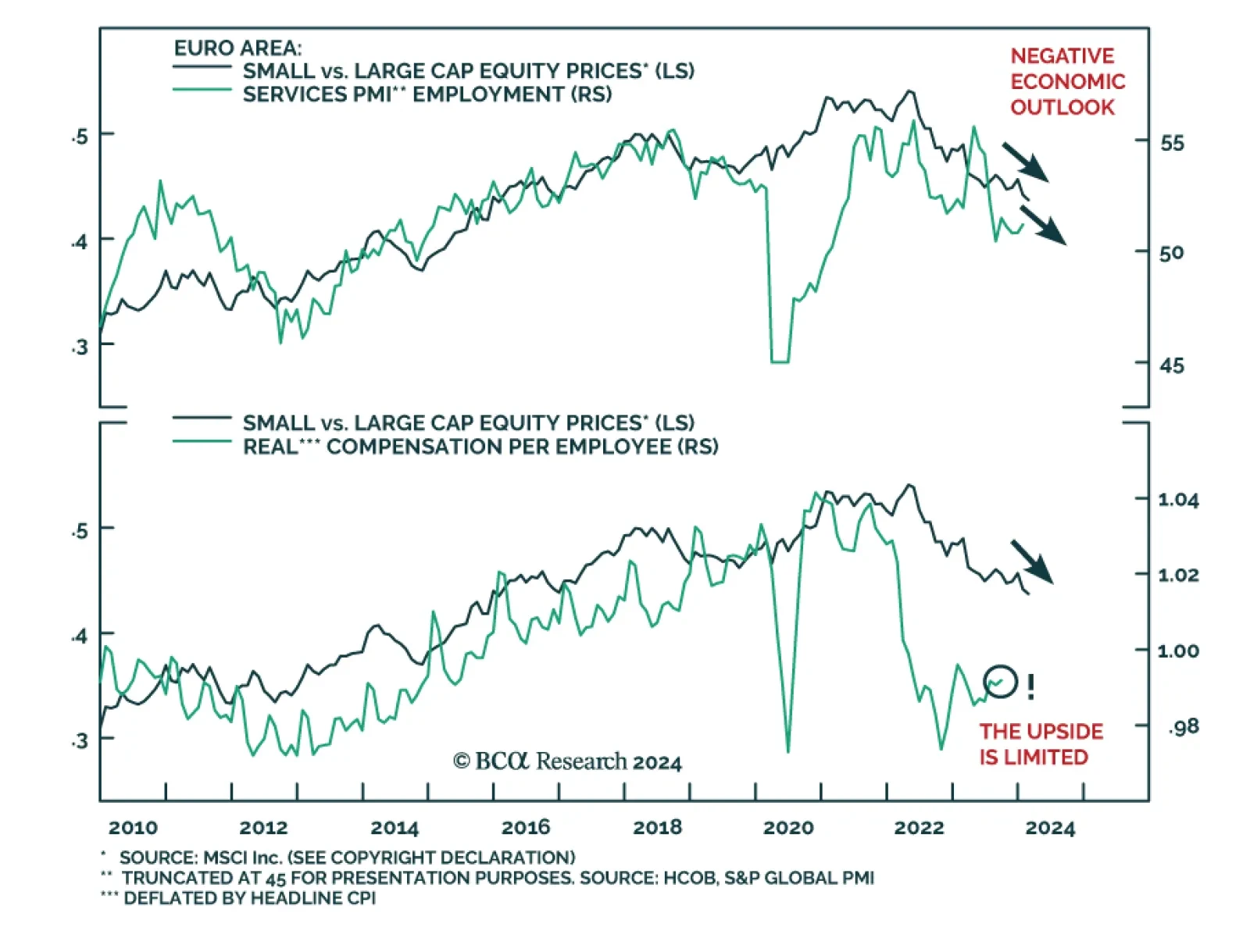

Euro area small-cap stocks are attractively valued compared to their large-cap counterparts. They have underperformed by 20% since April 2022, but small caps’ earnings have kept pace with those of large-cap firms. Hence,…

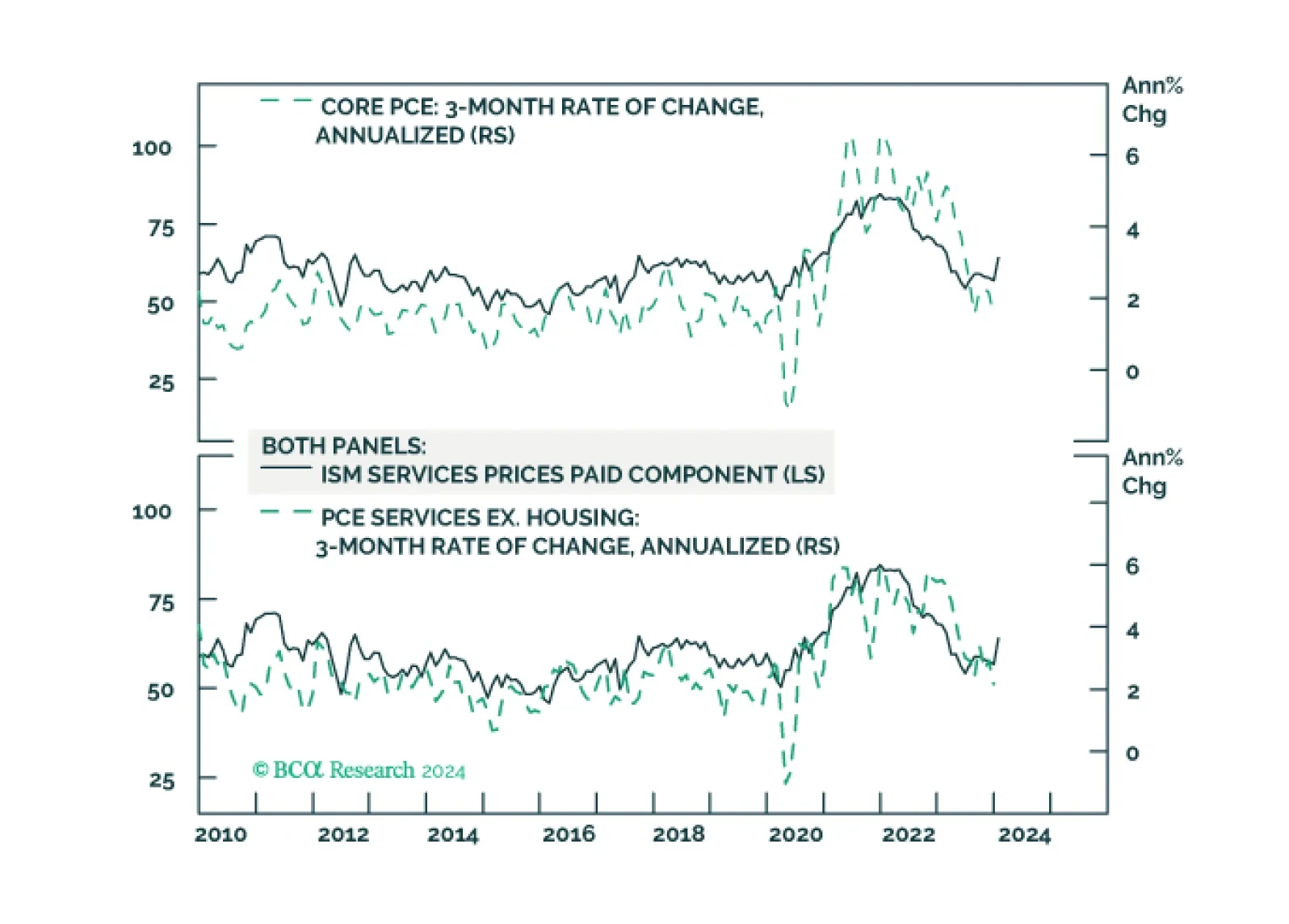

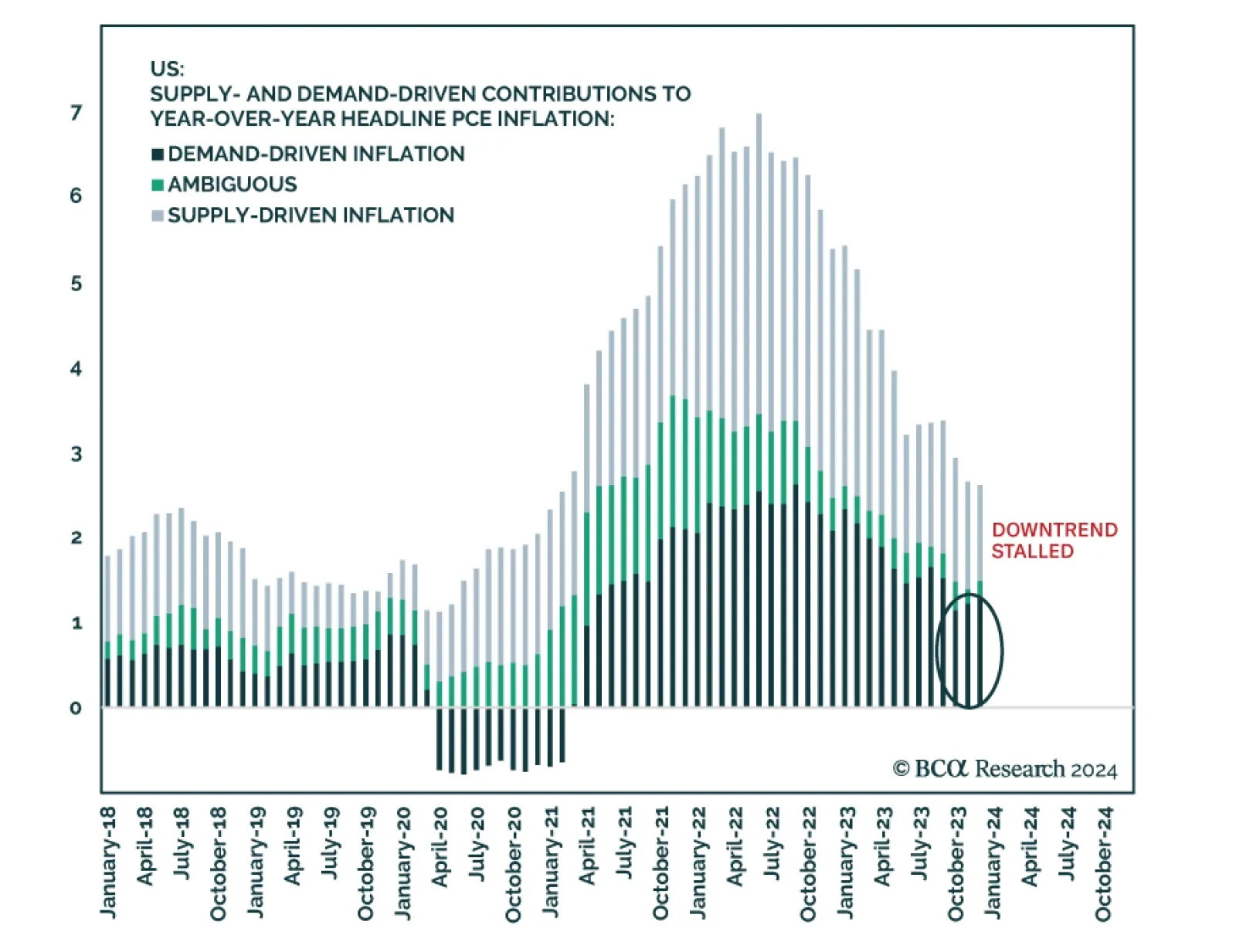

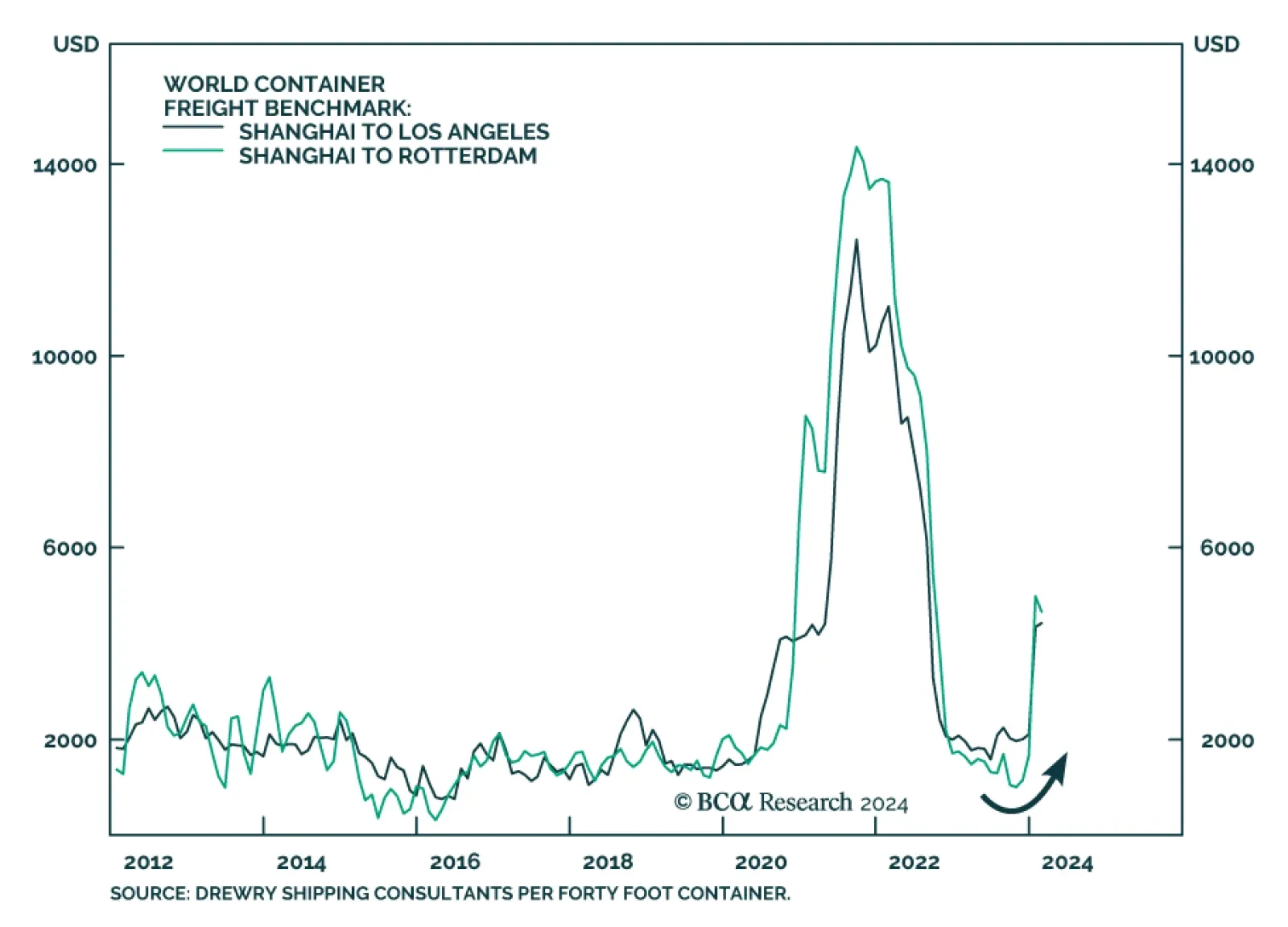

Although our base case remains that a continuation of the disinflation process will allow policymakers to pivot to rate cuts this year, we continue to monitor risks to this outlook. On this front, some key indicators have…

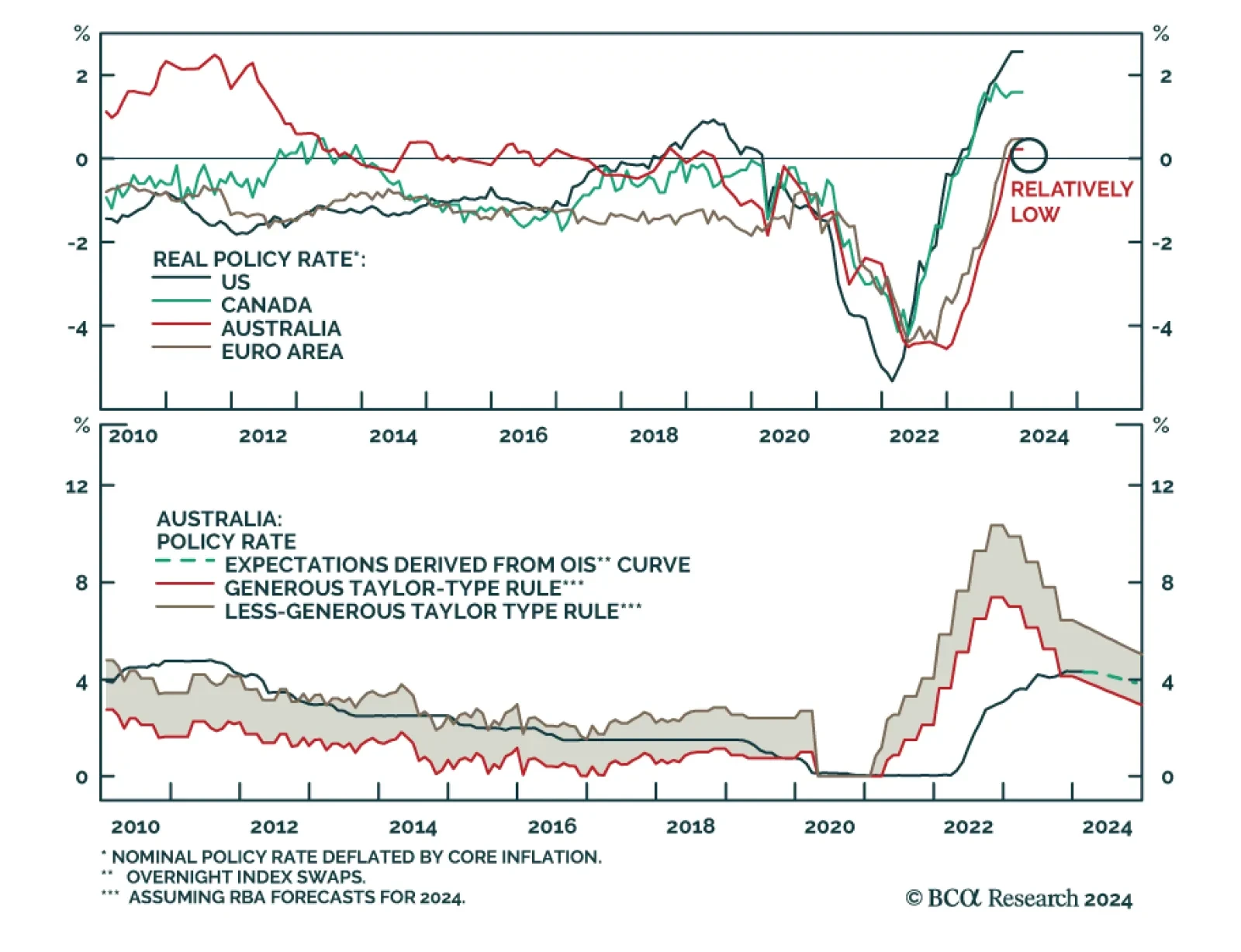

As expected, the Reserve Bank of Australia kept the policy rate unchanged at 4.35% on Tuesday. The updated economic forecasts show a downward revision to the growth outlook for this year versus the previous round of…

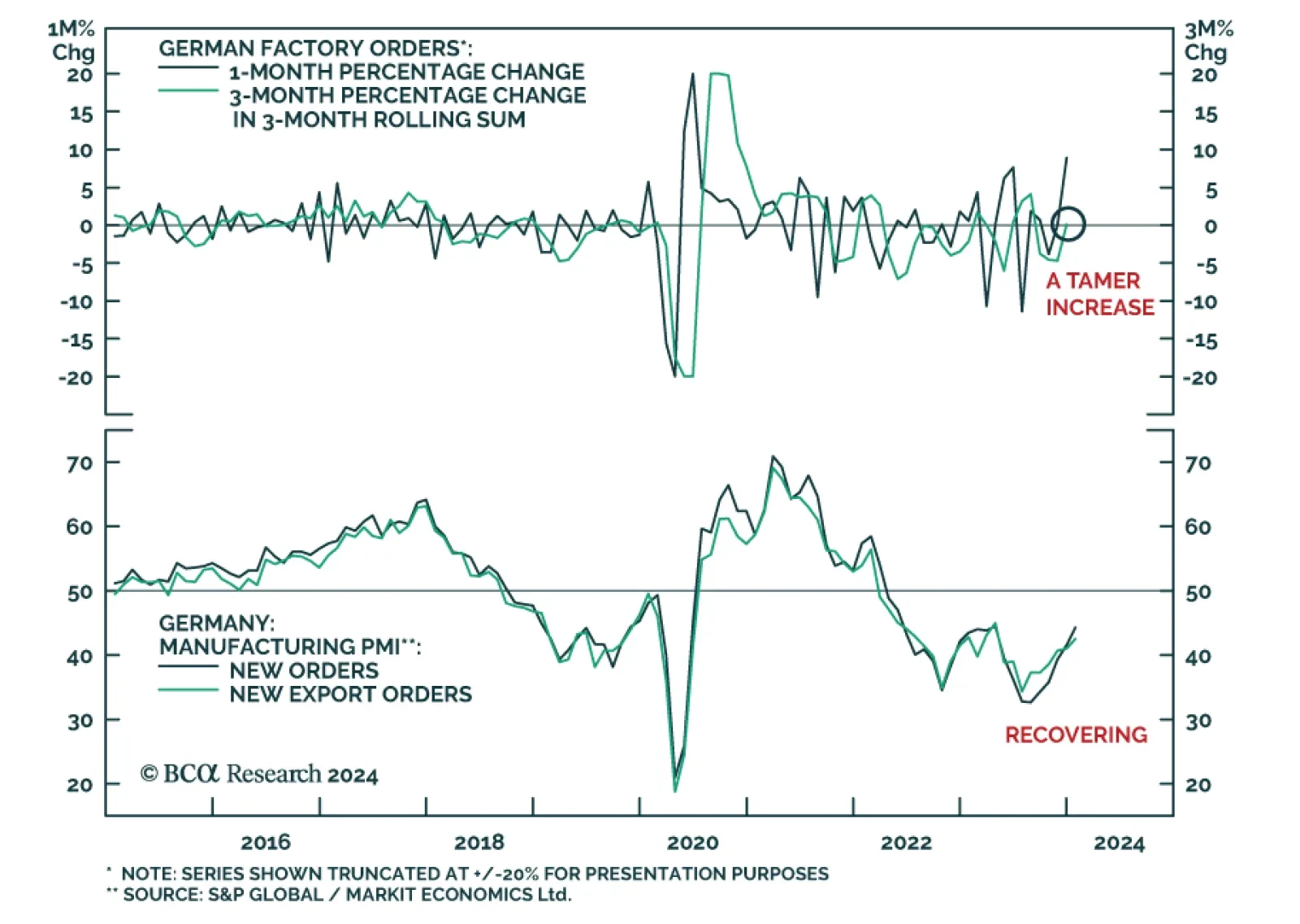

German factory orders delivered a positive surprise on Tuesday, unexpectedly increasing on both a monthly and annual basis. The 8.9% m/m increase in December came in well above consensus estimates of a 0.2% m/m decline. This…

Our Portfolio Allocation Summary for February 2024.

BCA Research’s European Investment Strategy service upgrades Swedish government bonds to neutral from underweight within European fixed-income portfolios. The Riksbank kept its policy rate steady at 4% last week.…

Since the pursuit of a nuclear deterrent makes it inevitable that the US and Israel will oppose Iran in the coming years, Iran must seize the initiative today. It cannot afford to assume that the Democratic Party will stay in…

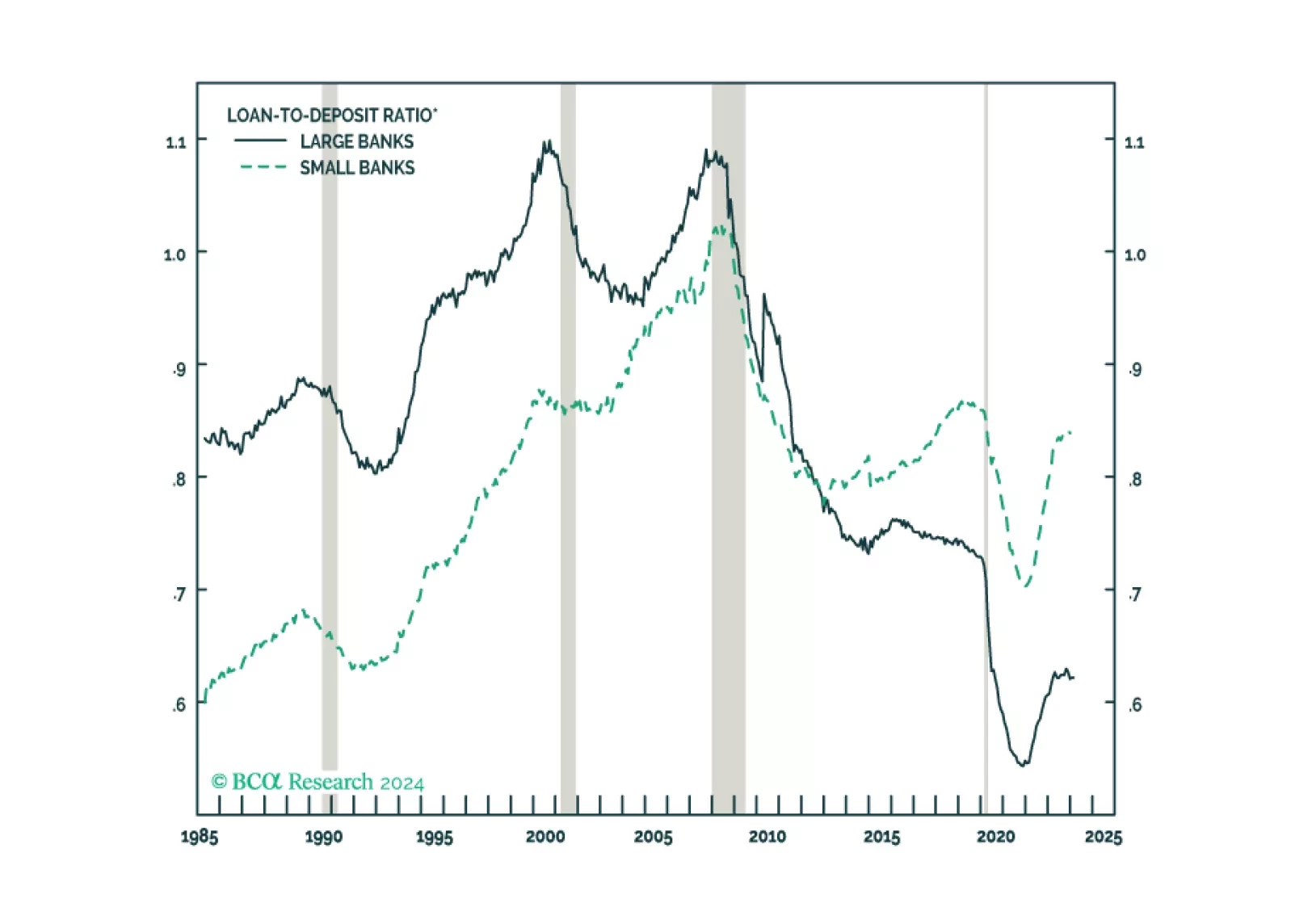

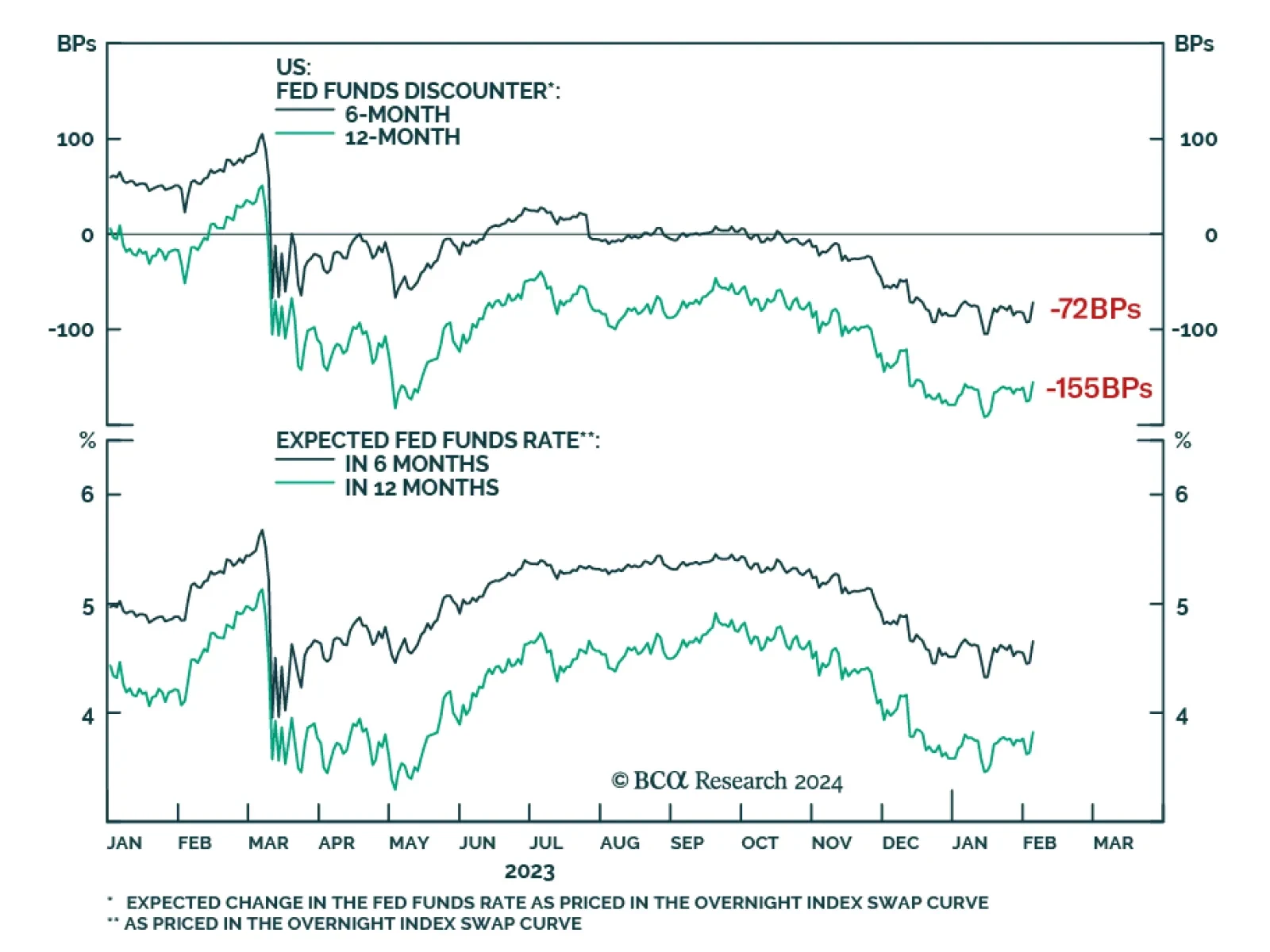

Treasury yields continued to push higher on Monday, bringing the total increase over the past two trading days to 29bps. The move comes on the back of strong economic data releases indicating that conditions in the US are…

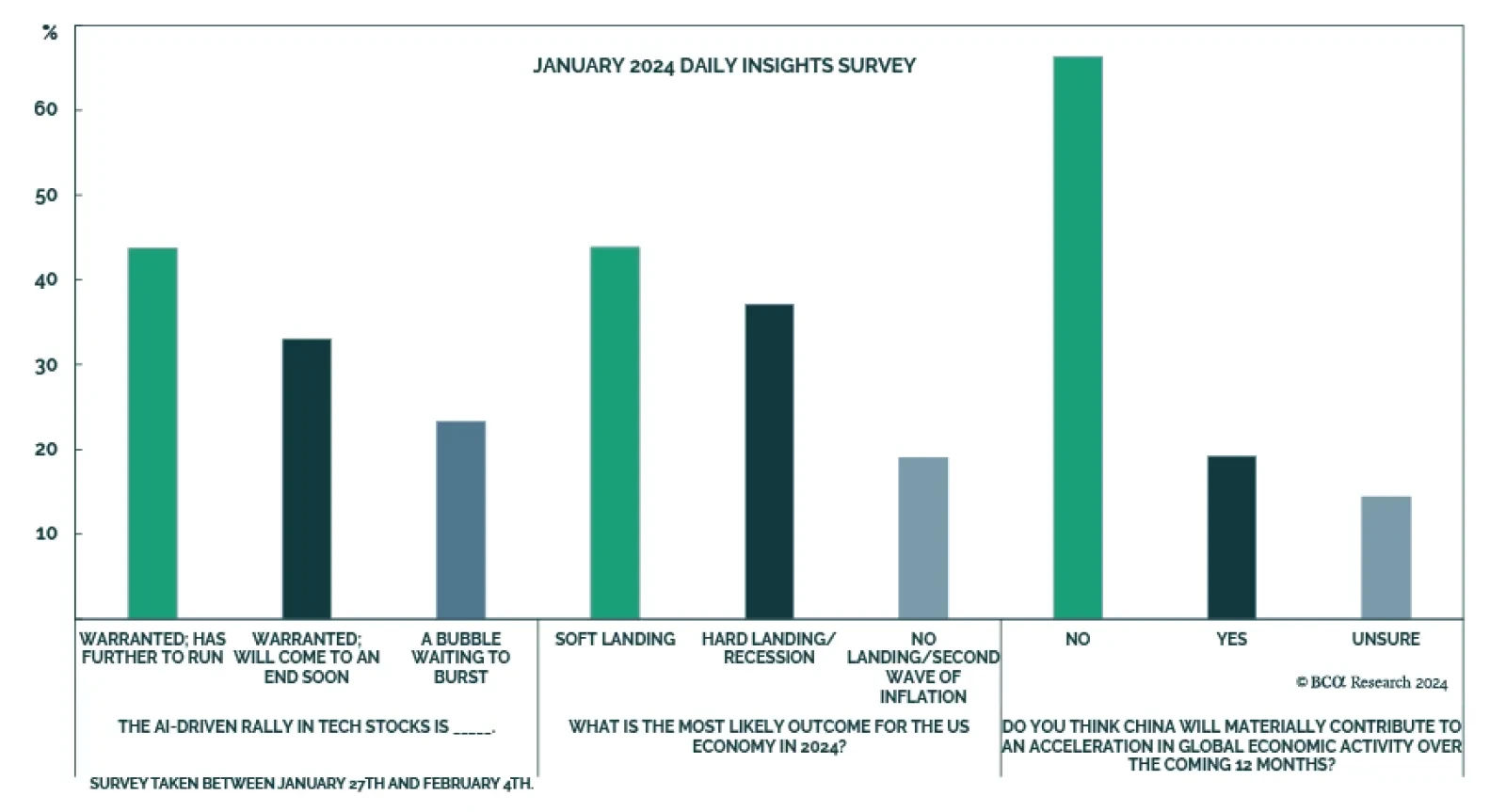

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ views on tech stocks, the US economy in 2024, and China’s contribution to global growth. Regarding tech stocks, 44%…