Our US bond team’s thoughts on this afternoon’s FOMC meeting and yesterday’s CPI release.

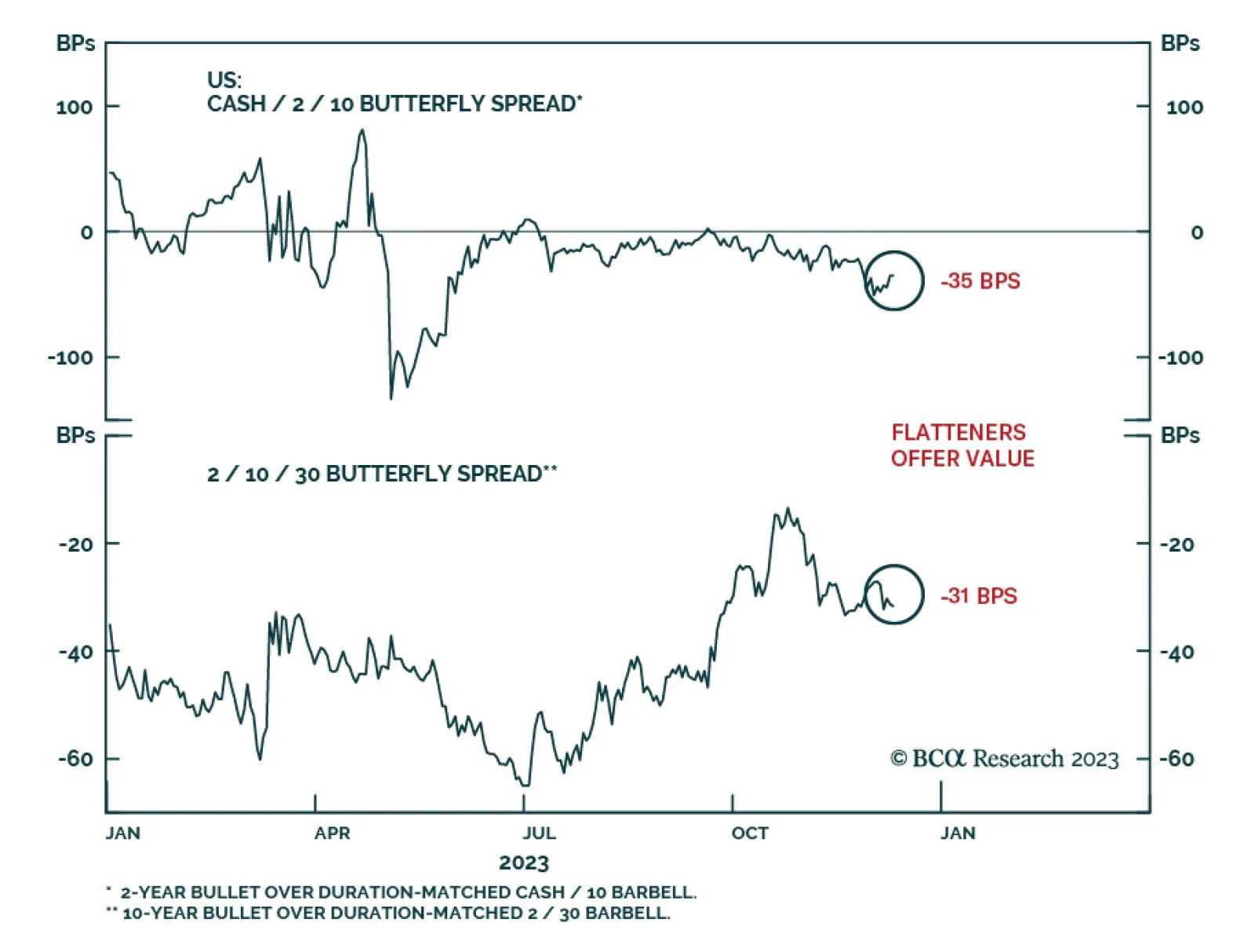

According to BCA Research’s US Bond Strategy service, Treasury curve steepeners will pay off handsomely once the next recession hits. However, curve flatteners (aka barbelled Treasury portfolios) offer better value for the…

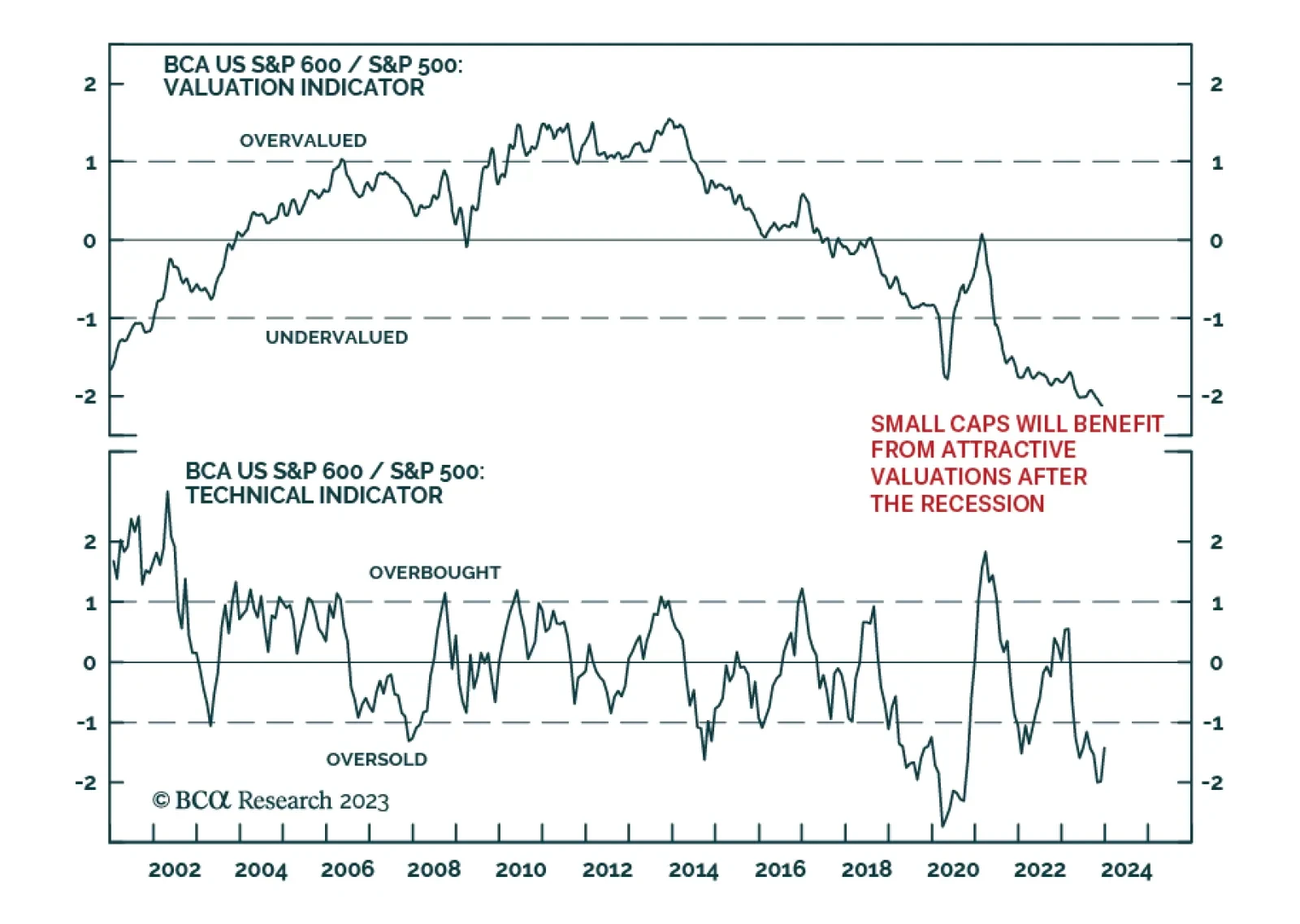

US small-cap stocks have benefitted from the recent improvement in risk sentiment. The S&P 600 is up 10% over the past month – exceeding the S&P 500’s gains by 5.4 percentage points after having underperformed…

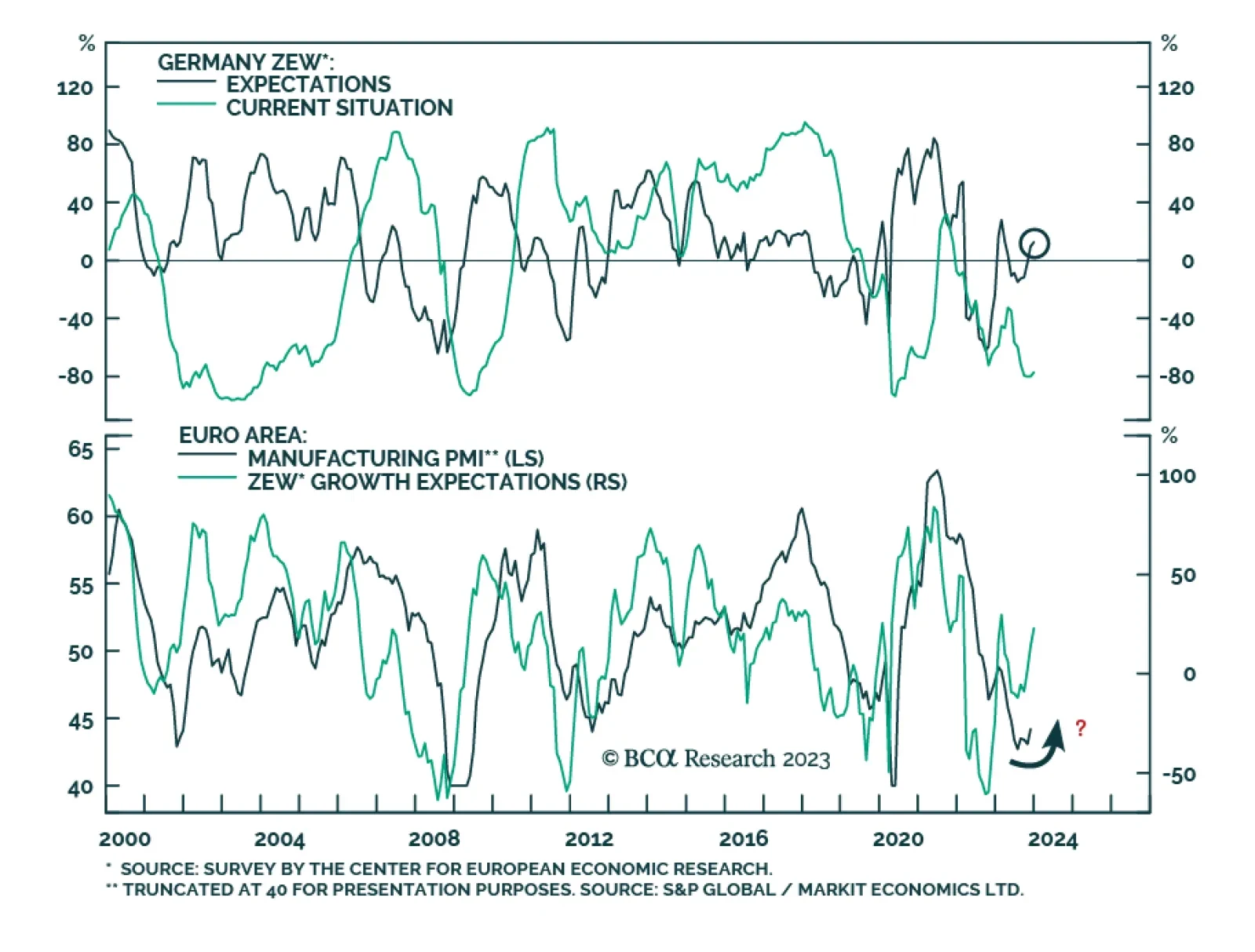

The continued improvement in German investor morale captured by the ZEW survey corroborates other indicators pointing to near-term support for Eurozone stocks. Economic sentiment jumped three points to a 9-month high of 12.8 in…

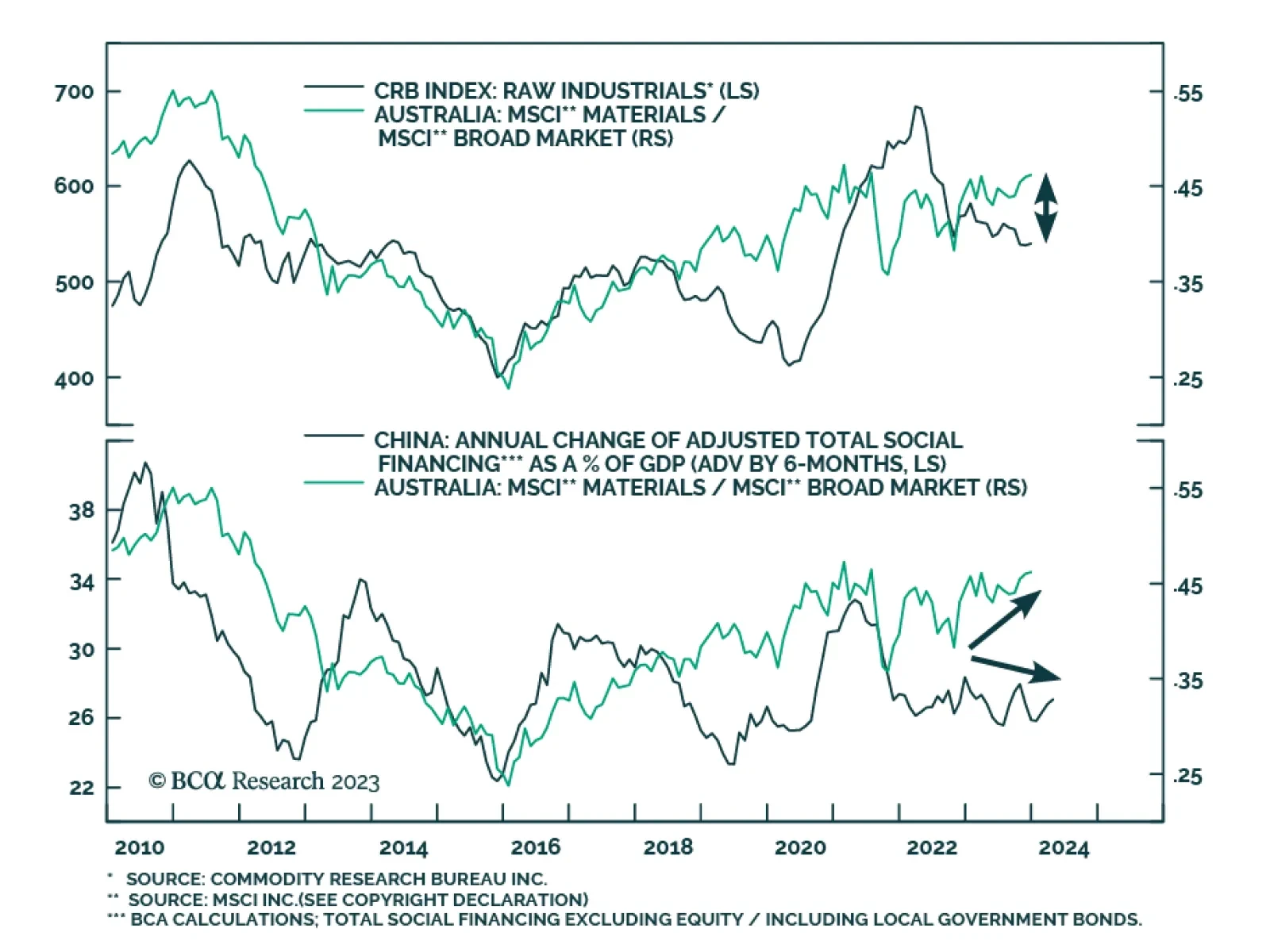

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

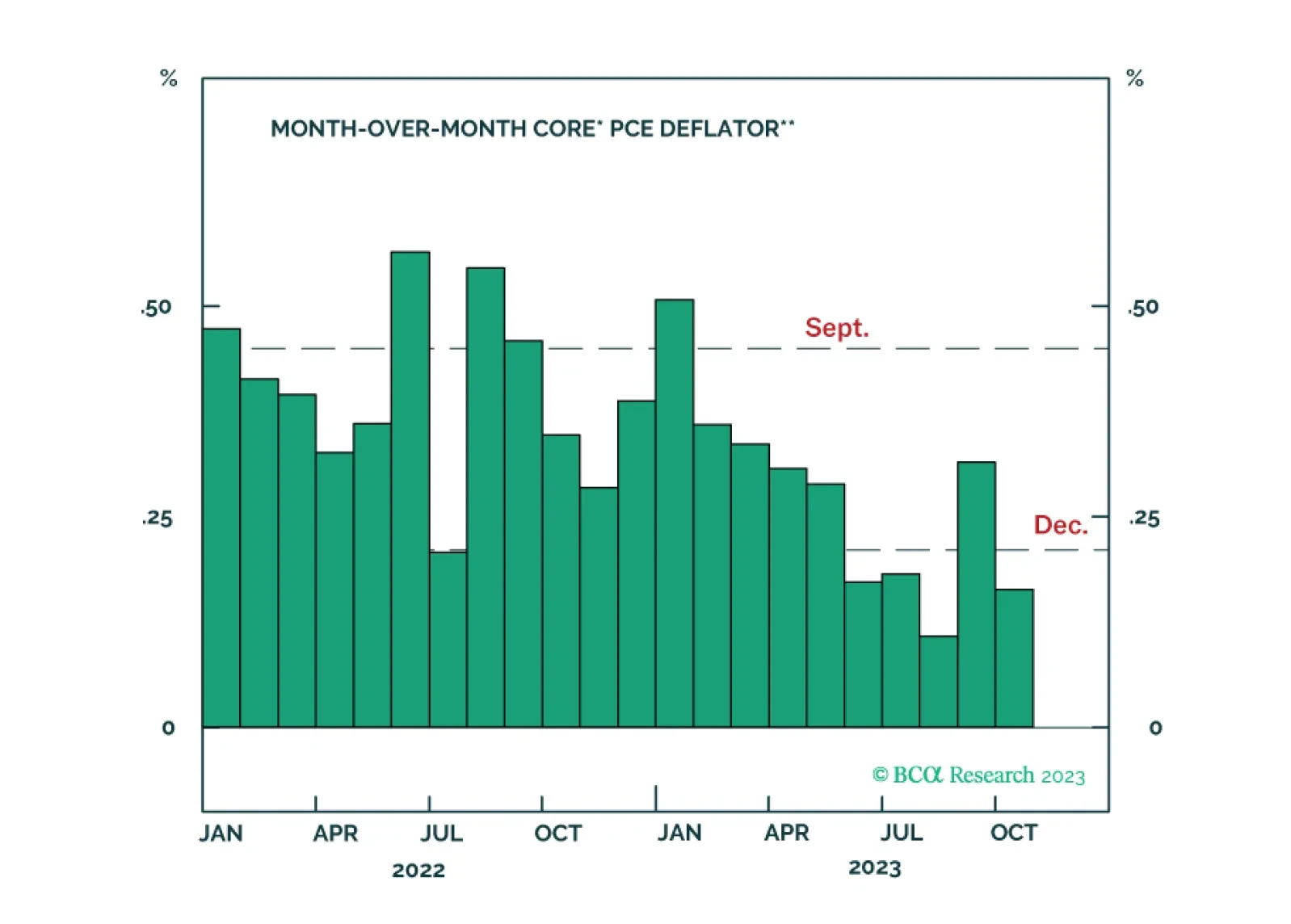

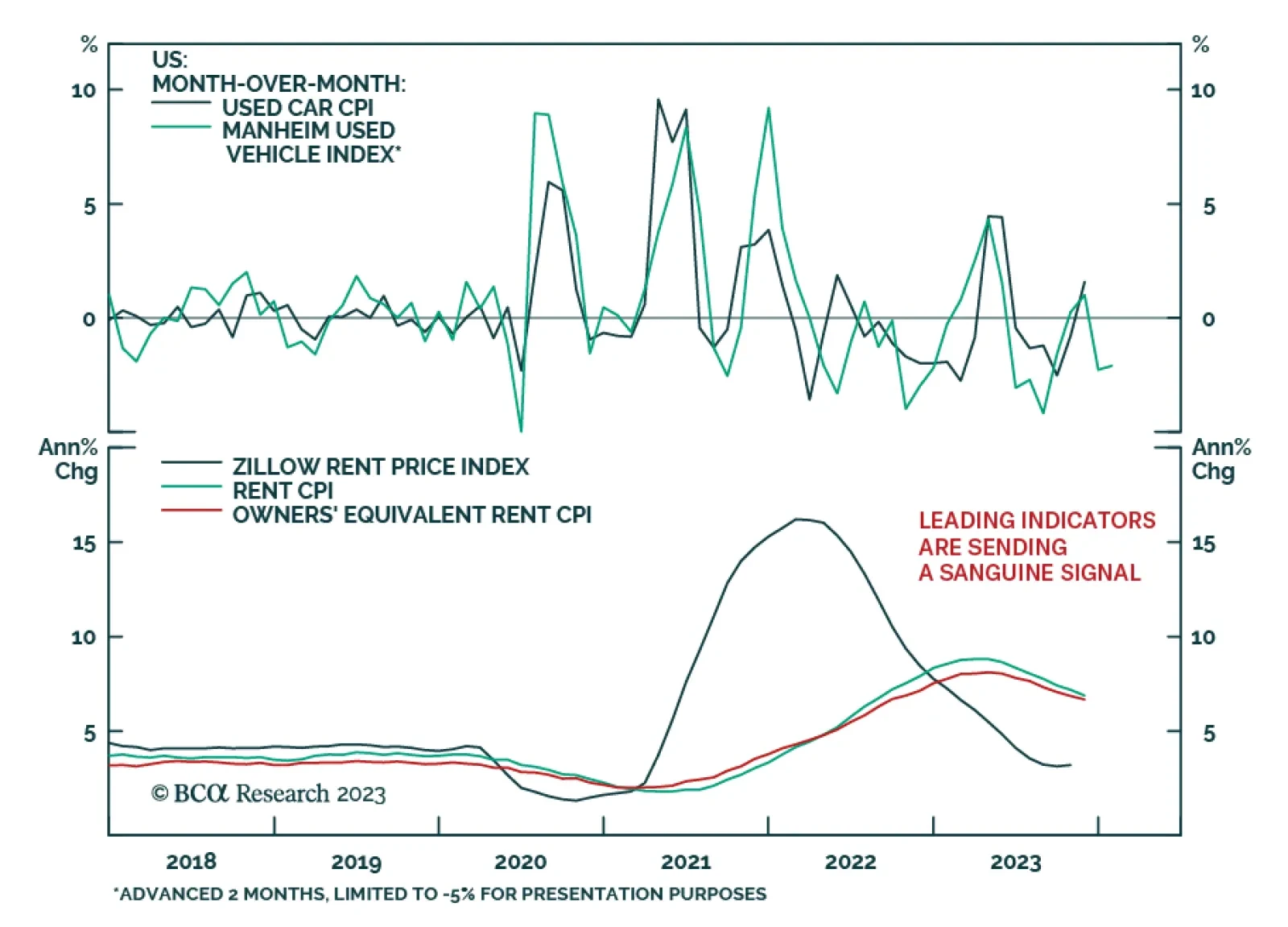

The November US CPI release came in broadly in line with consensus expectations on Tuesday. On an annual basis, headline CPI inflation eased from 3.2% y/y to 3.1% y/y while core inflation was unchanged at 4.0% y/y. On a monthly…

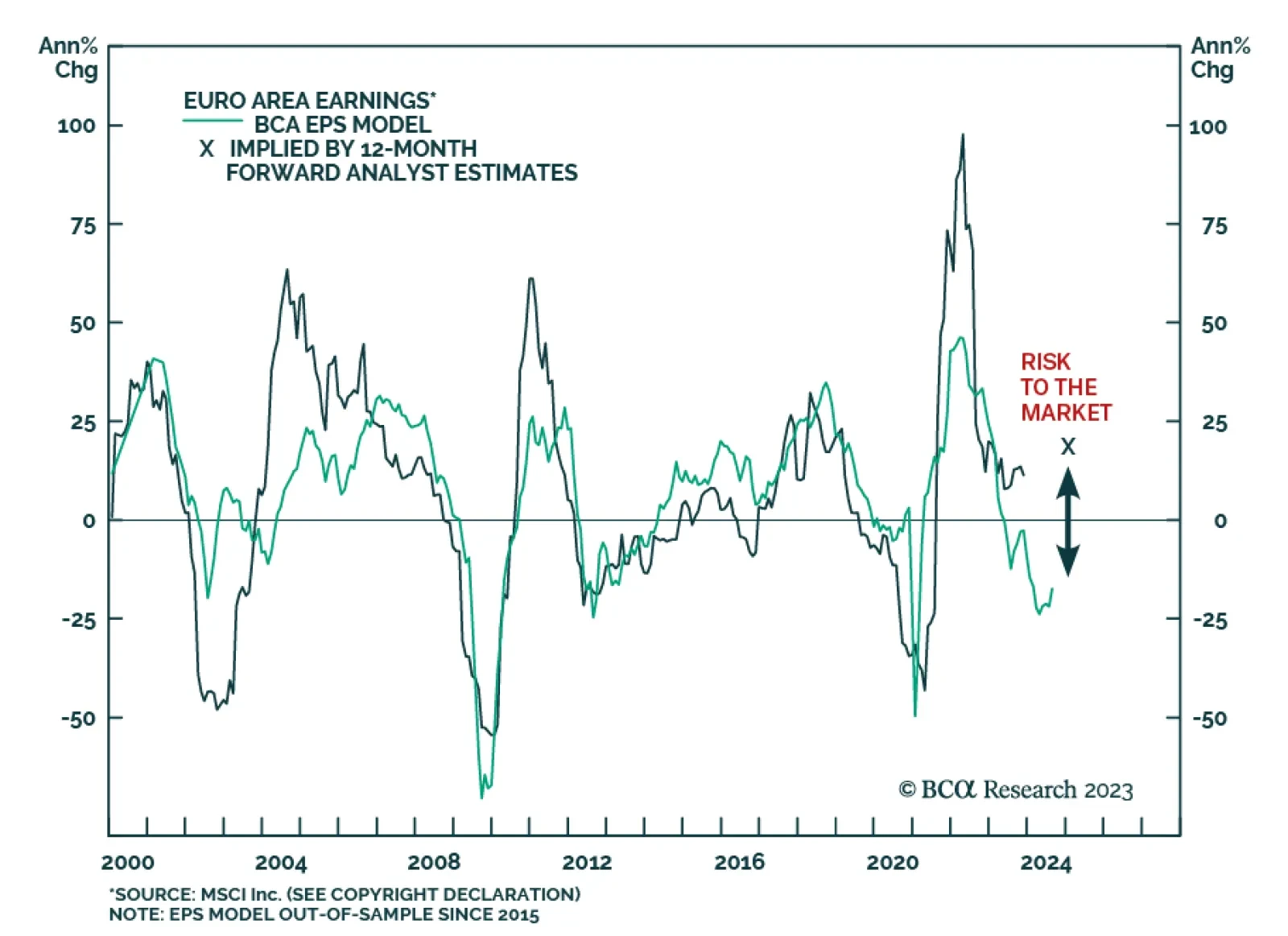

According to BCA Research’s European Investment Strategy service, European equities near cycle highs are vulnerable to weaker earnings. The team’s earnings model for Eurozone equities continues to point to a double…

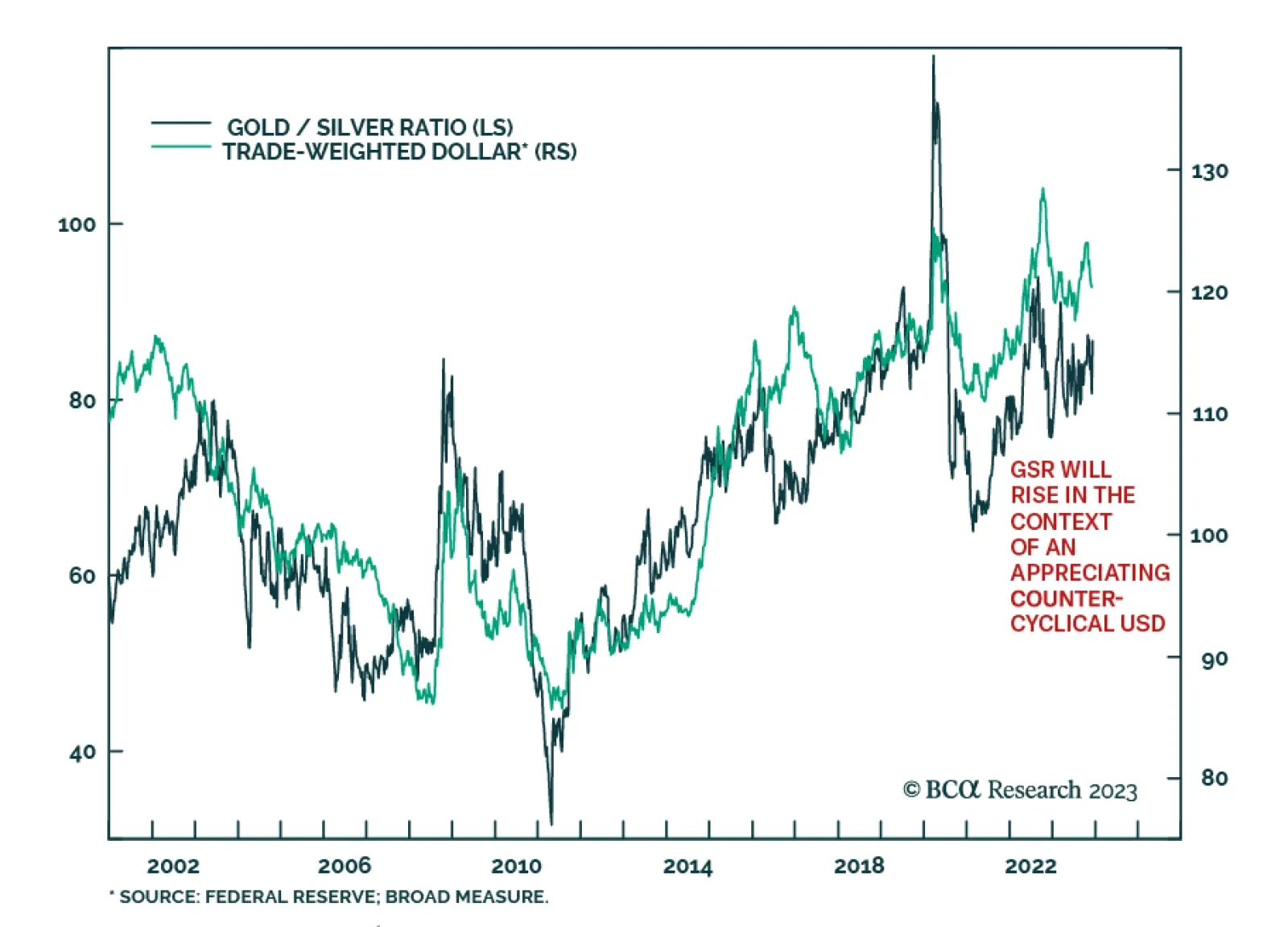

The gold/silver ratio (GSR) confirmed the improvement in global risk sentiment in November. It declined on the back of a 9.2% rally in silver, which outpaced the 1.9% rise in gold. Since then, the GSR has soared amid a more…

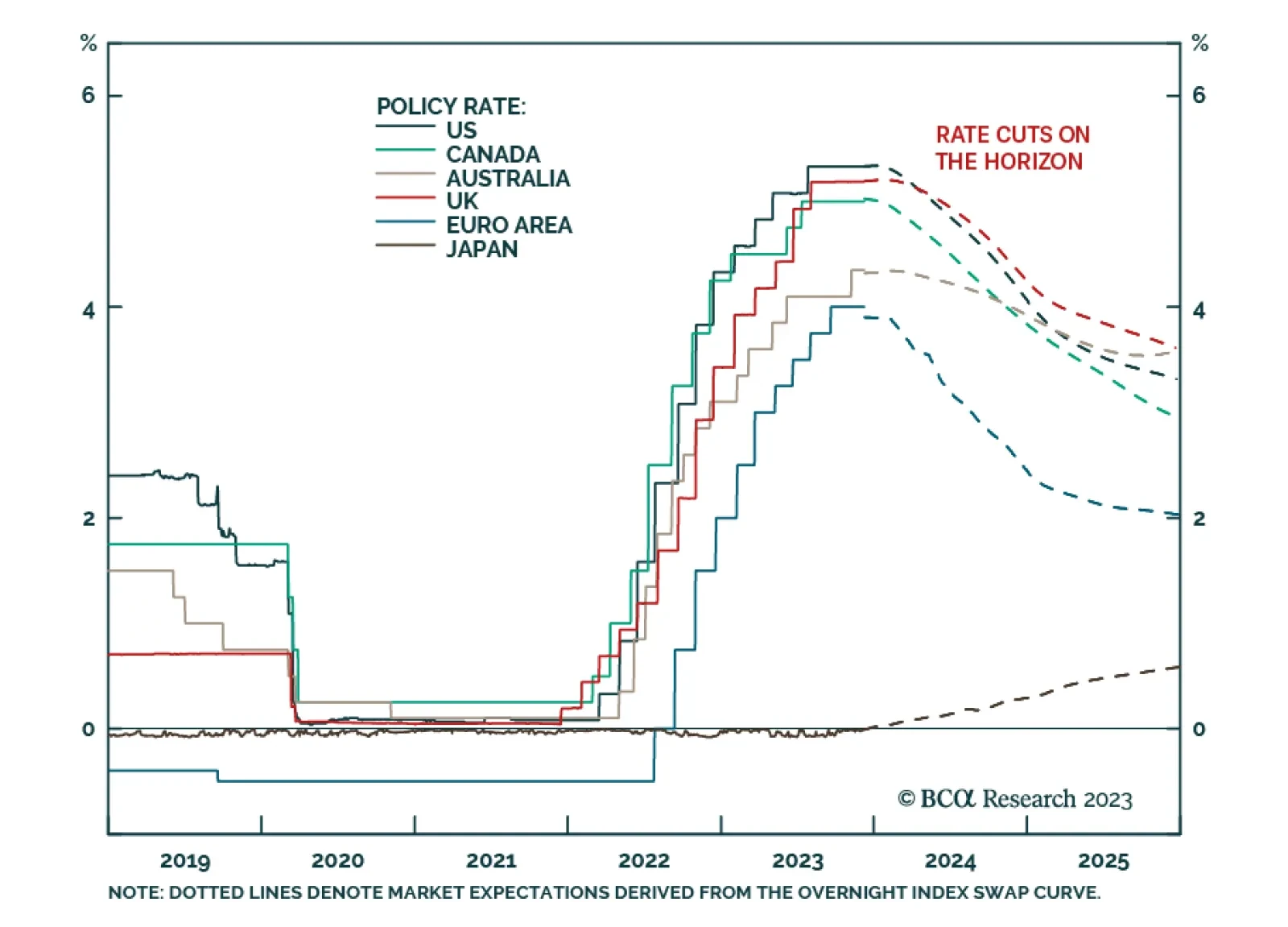

Multiple major DM central banks are scheduled to decide on monetary policy this week. The US Fed will meet on Wednesday, followed by the ECB, BoE, and Norges Bank on Thursday. It comes after the BoC and RBA both opted to keep…