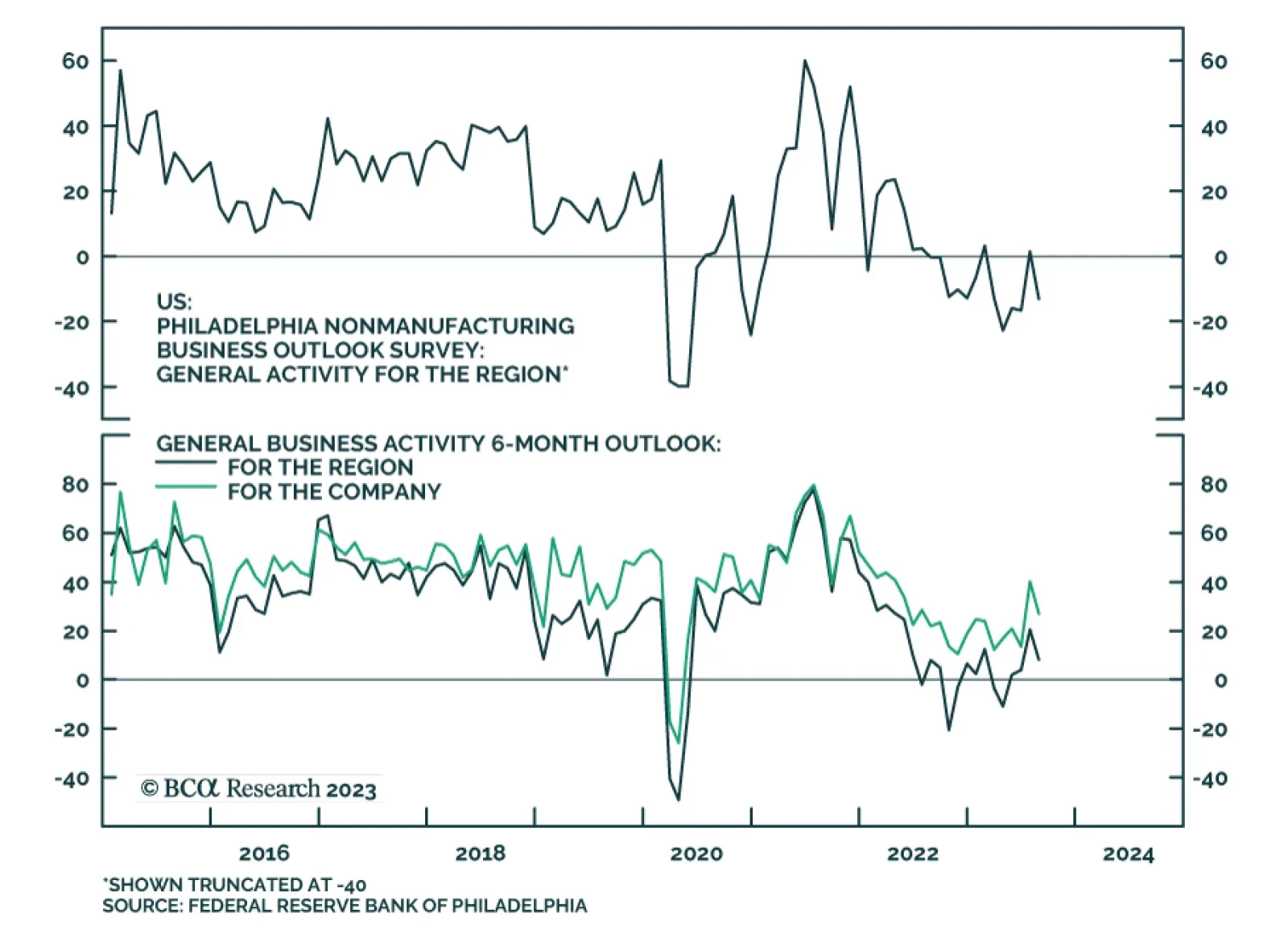

Results of the Philadelphia Fed’s August Nonmanufacturing Business Outlook Survey sent a negative signal on Tuesday. The diffusion index for firms’ assessment of general business activity across the region relapsed…

Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…

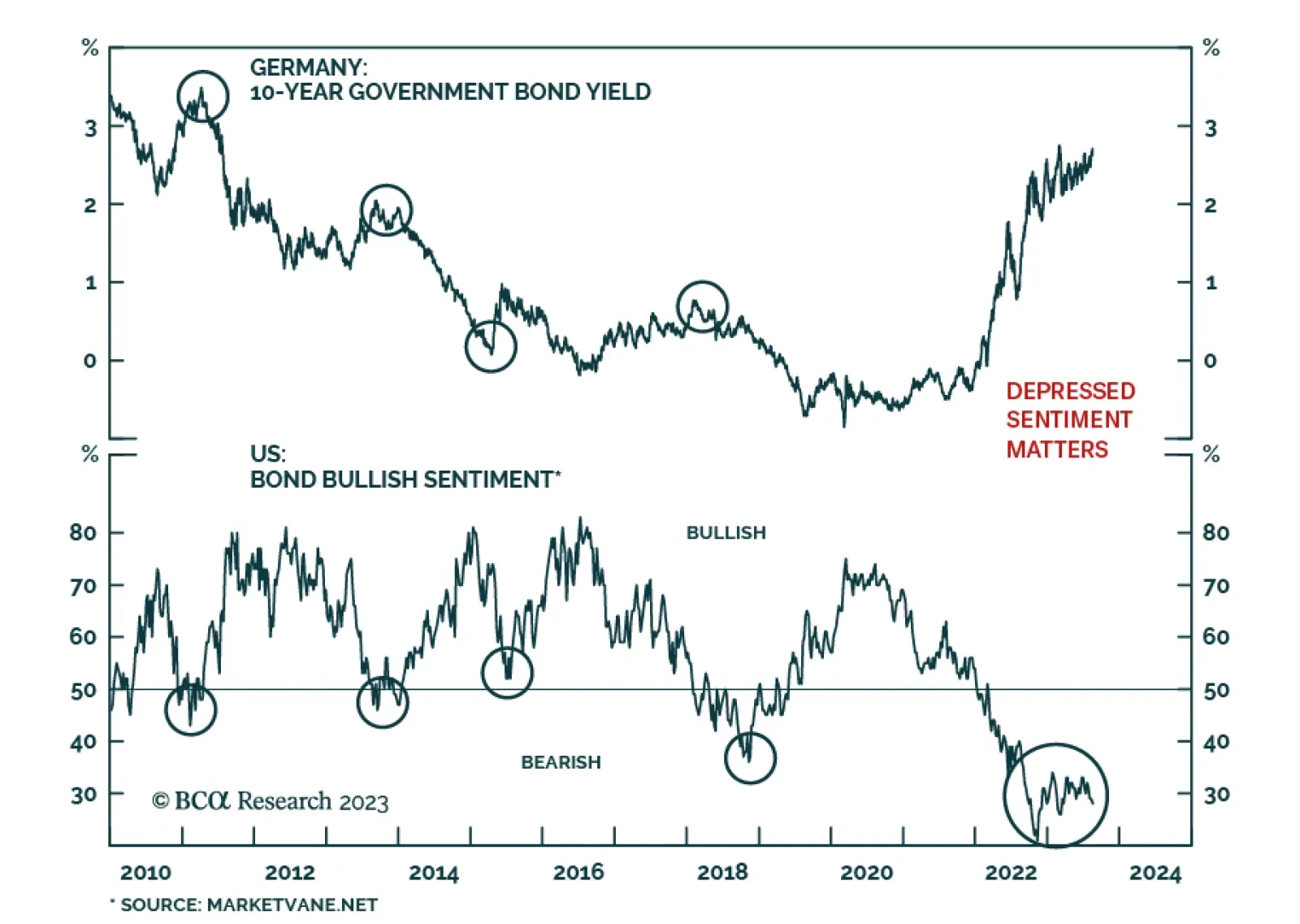

According to BCA Research’s European Investment Strategy service, German yields are unlikely to experience a decisive break out that would carry them to 3%. Five economic forces suggest that German yields are unlikely to…

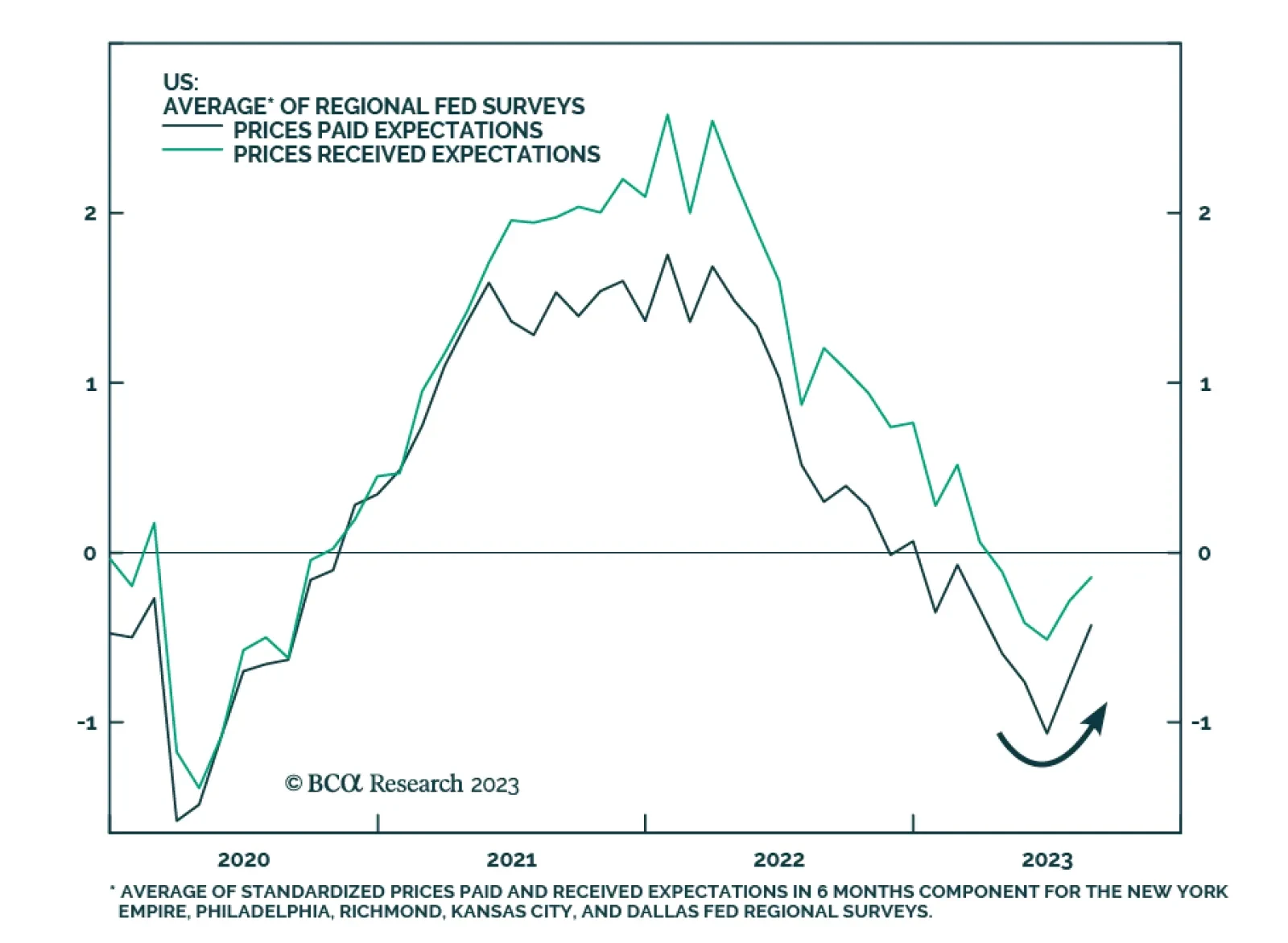

In an Insight last month, we noted that the Global Investment Strategy service increased its subjective odds for the resurgence of US inflation later this year or early next year from 20% to 30%. Here are some of the data points…

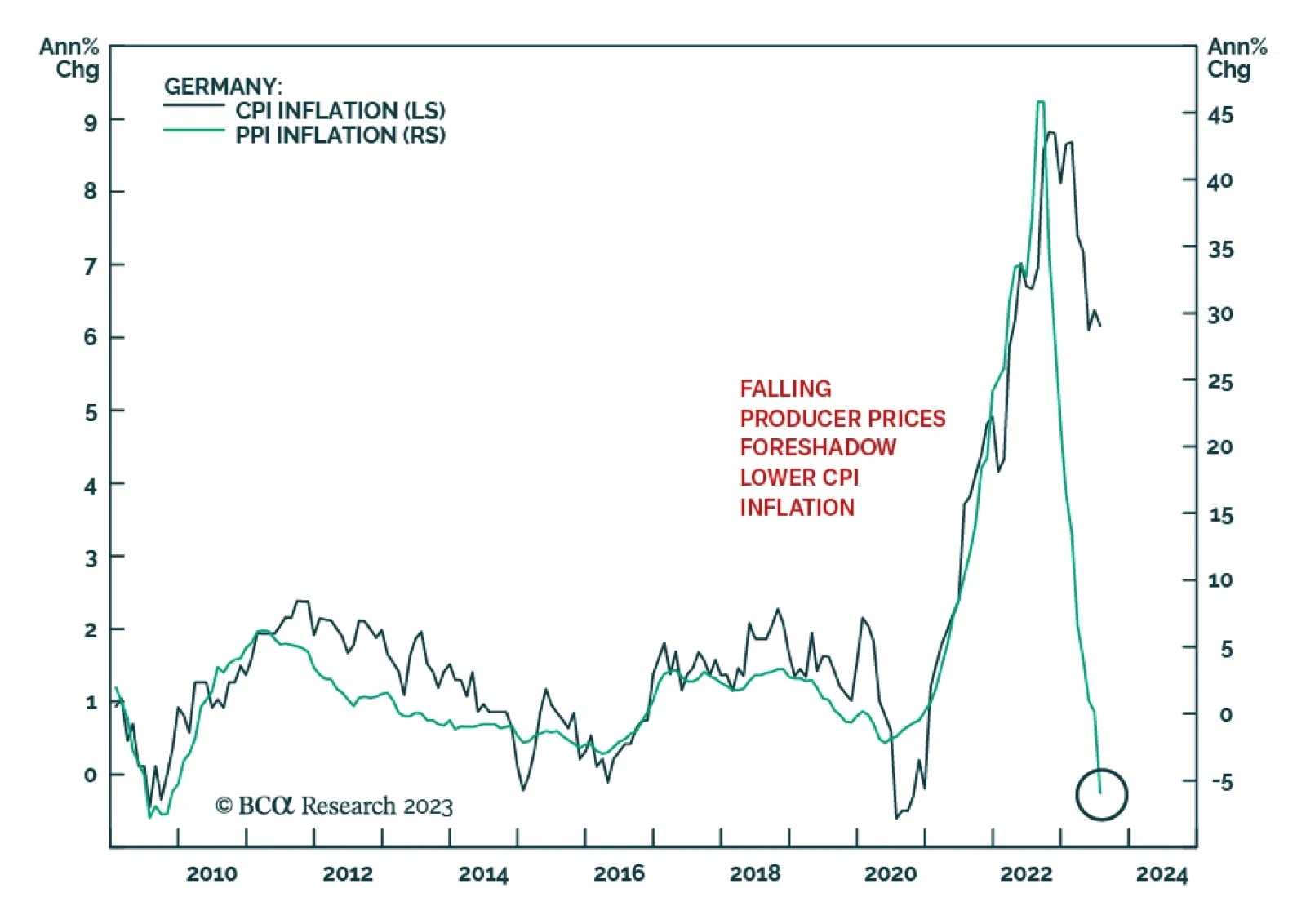

German producer prices indicate that inflationary pressures continue to moderate. The producer price index’s 6.0% y/y drop in July is more pronounced than the anticipated 5.1% y/y decline and marks the first annual decrease…

European yields are testing the upper end of their recent trading range. Is the European economic outlook consistent with an imminent breakout?

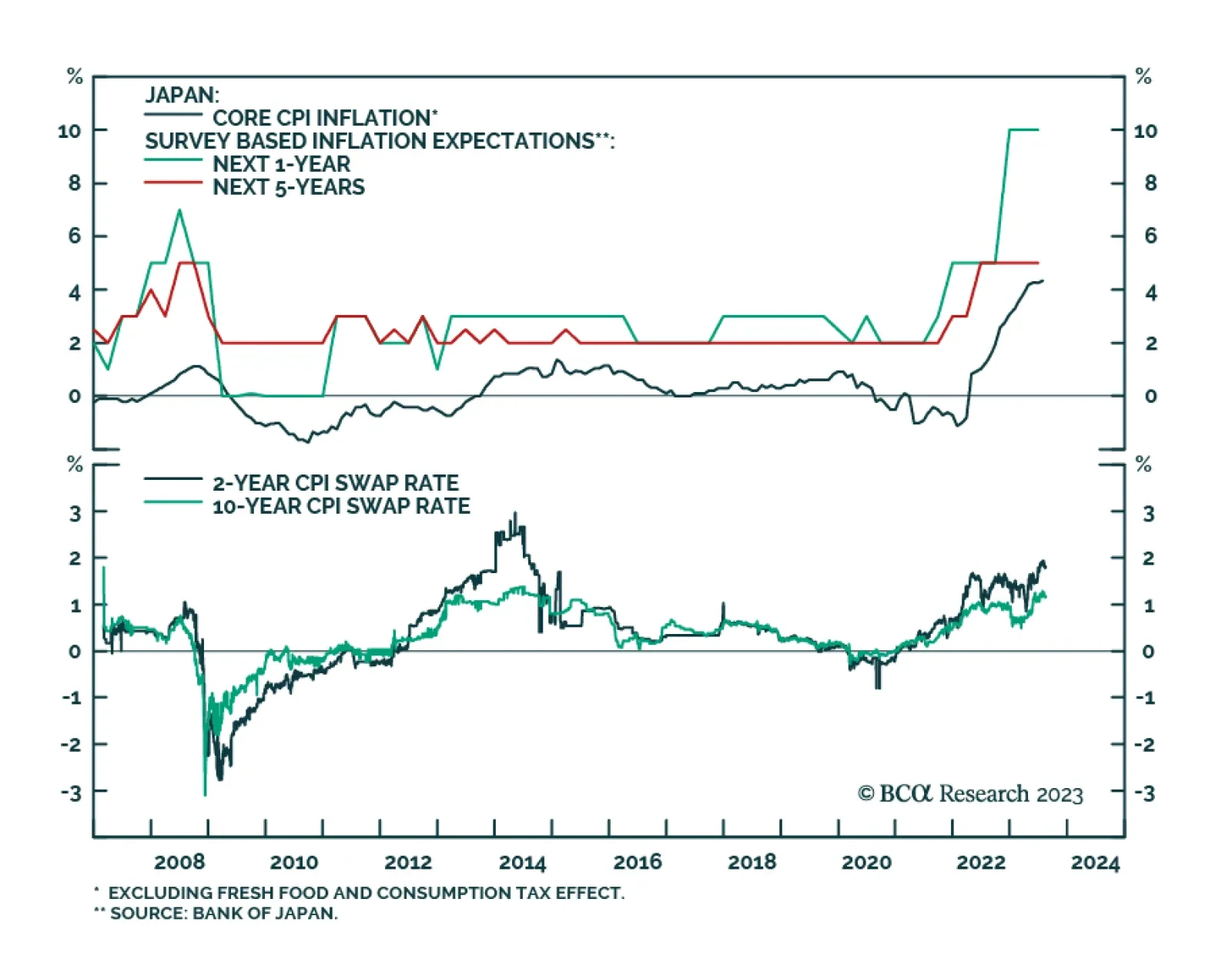

According to BCA Research’s Foreign Exchange Strategy and Global Investment Strategy services, most indications of Japanese inflation are pointing to upside surprises. This will boost interest-rate differentials in…

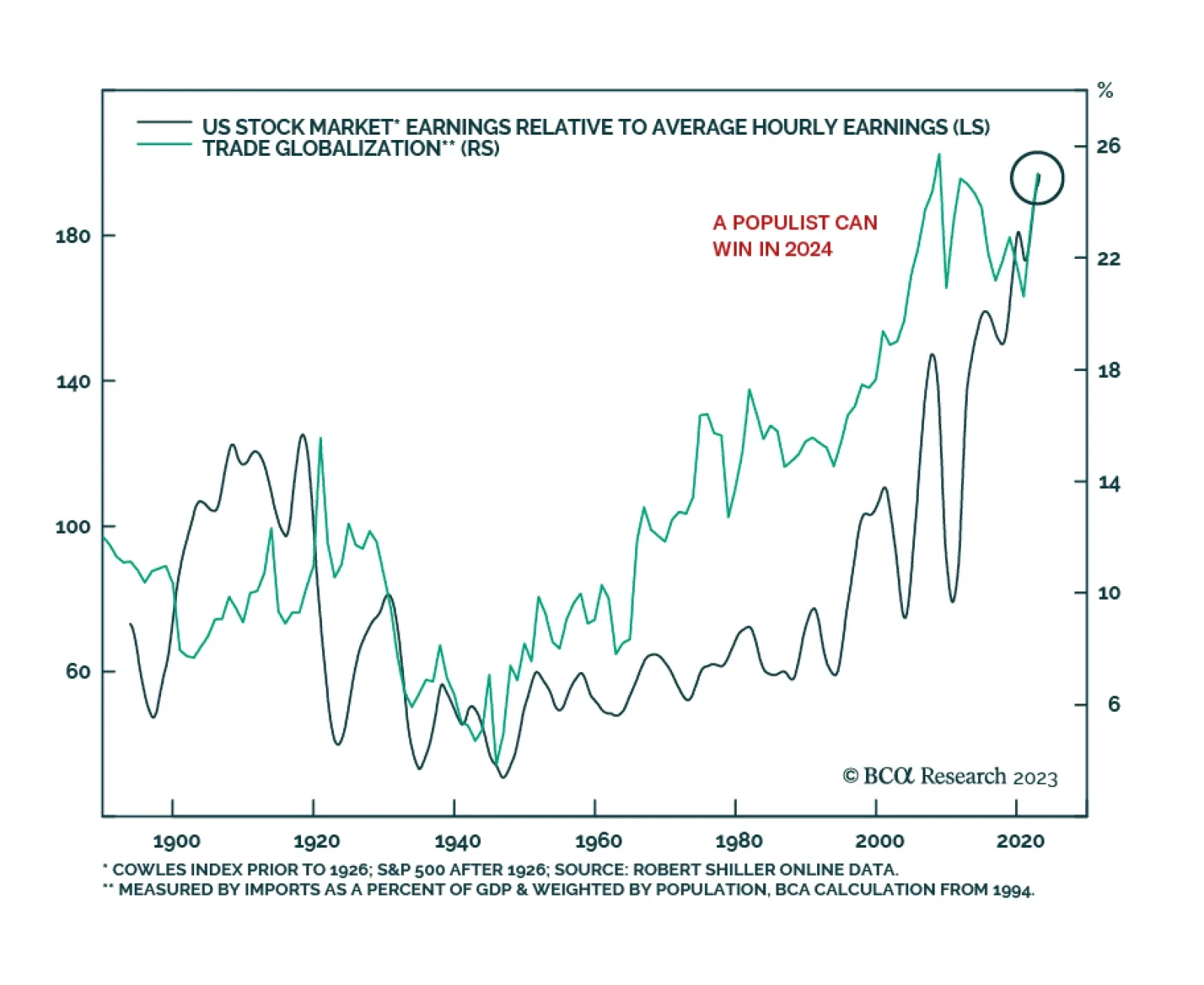

The chief question of the 2024 election is whether US anti-establishment or populist politics is a viable electoral strategy, according to BCA’s US Political Strategy. That will have domestic and global effects not only in…

While the bearish bond trade currently has a lot of momentum, we continue to think that Treasury yields are close to a cyclical peak and will be lower on a 6-12 month horizon.