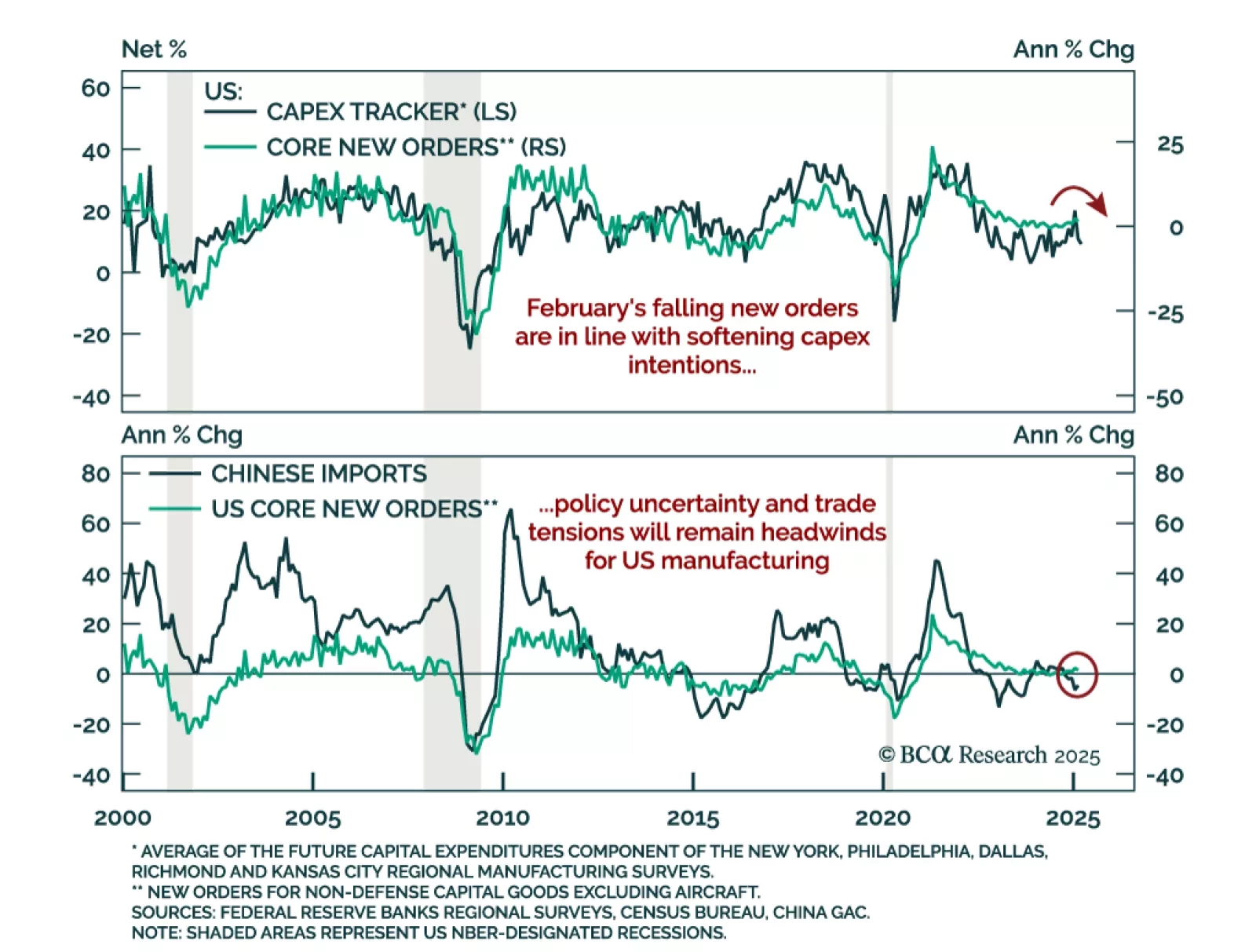

A drop in core capex orders points to slowing business spending and softening global growth. Businesses appear to have front-loaded shipments ahead of potential tariffs while deferring new orders amid policy uncertainty. With hiring…

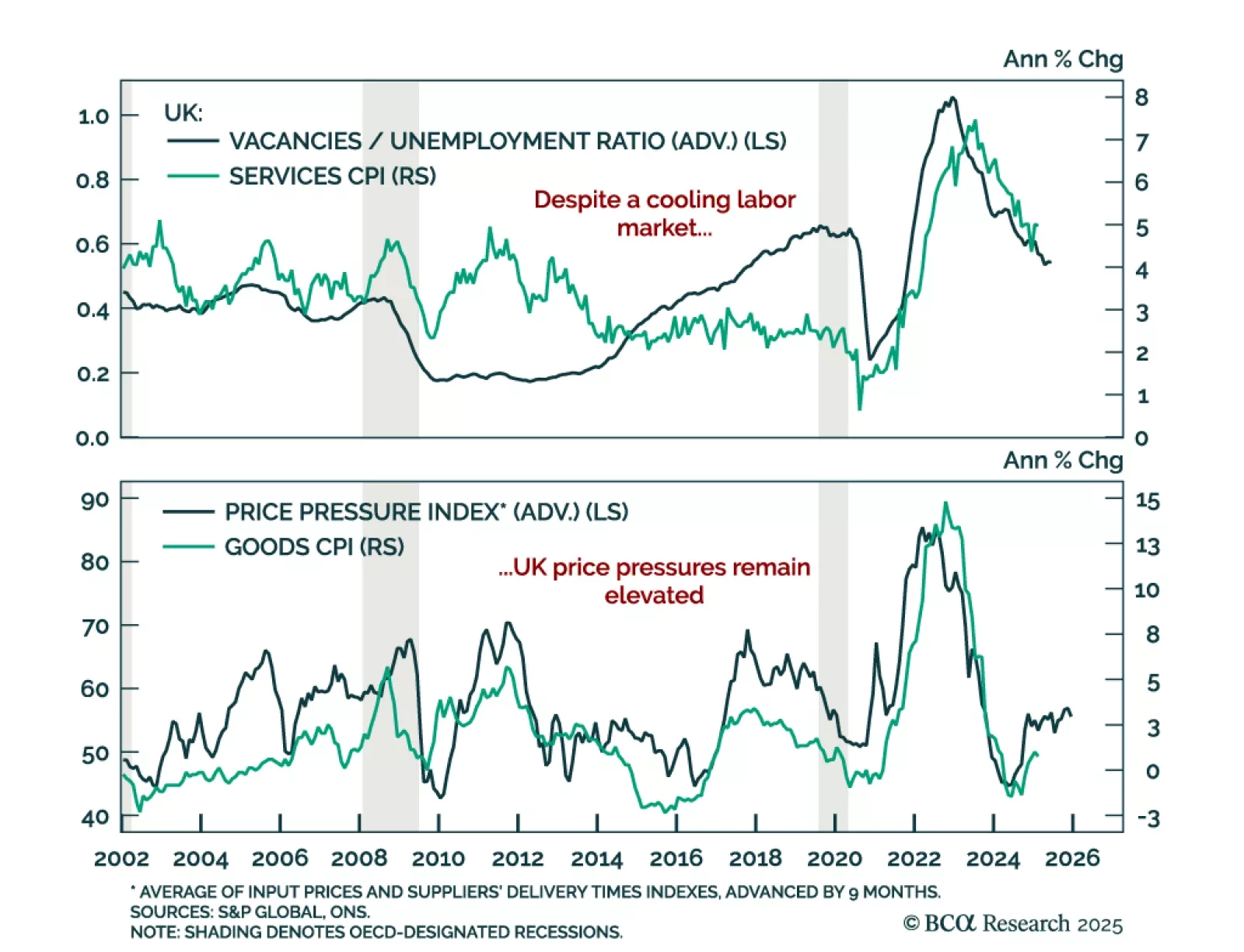

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

Our US Investment Strategy team recommends investors remain defensively positioned. Stay underweight US equities and overweight Treasuries and cash, on both a tactical and cyclical horizon, as the likelihood of a midyear recession…

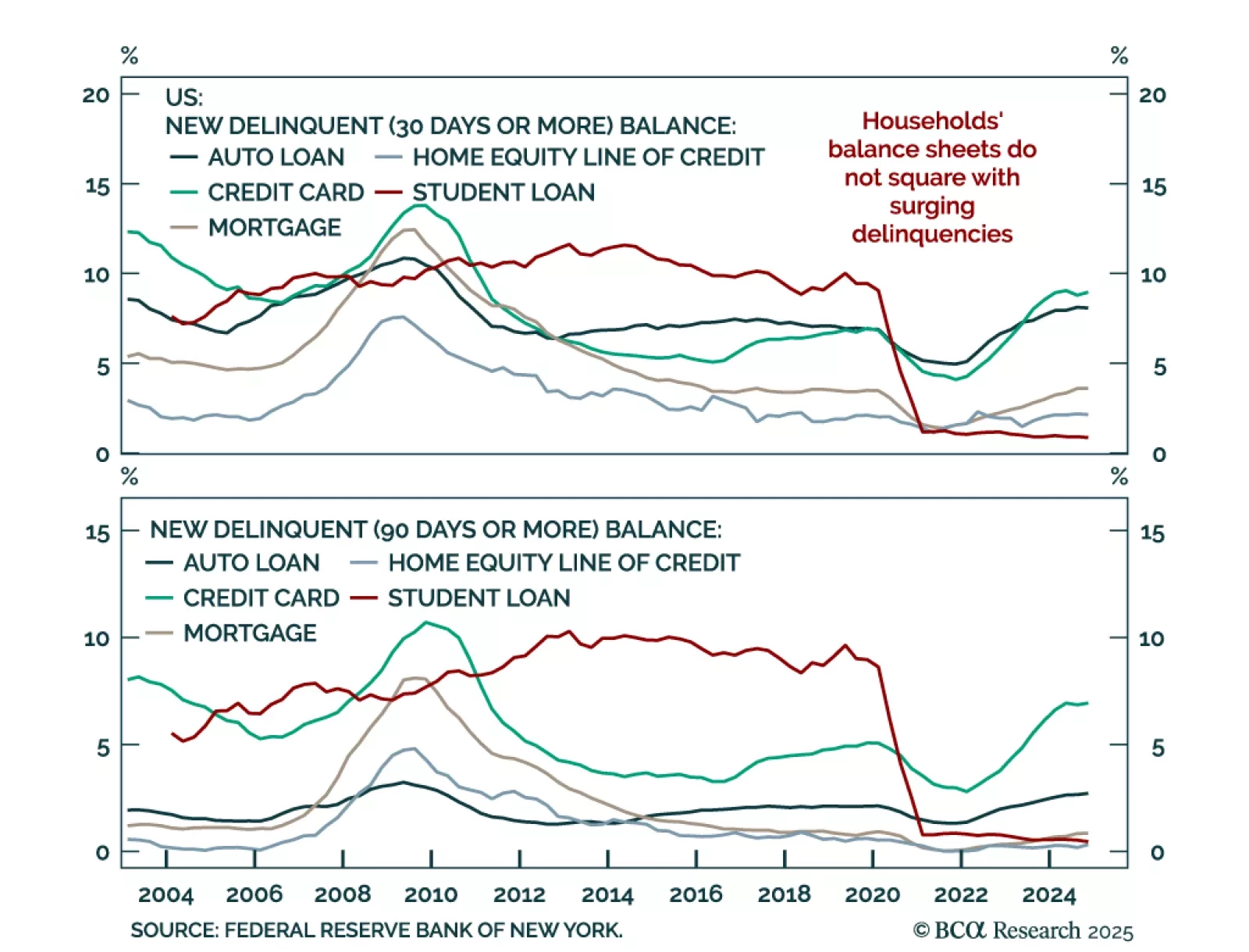

A sharp drop in consumer confidence adds to signs that a consumption slowdown is coming, threatening both US and global growth. Yet rising short-term inflation expectations will keep central banks cautious, weighing on long-term…

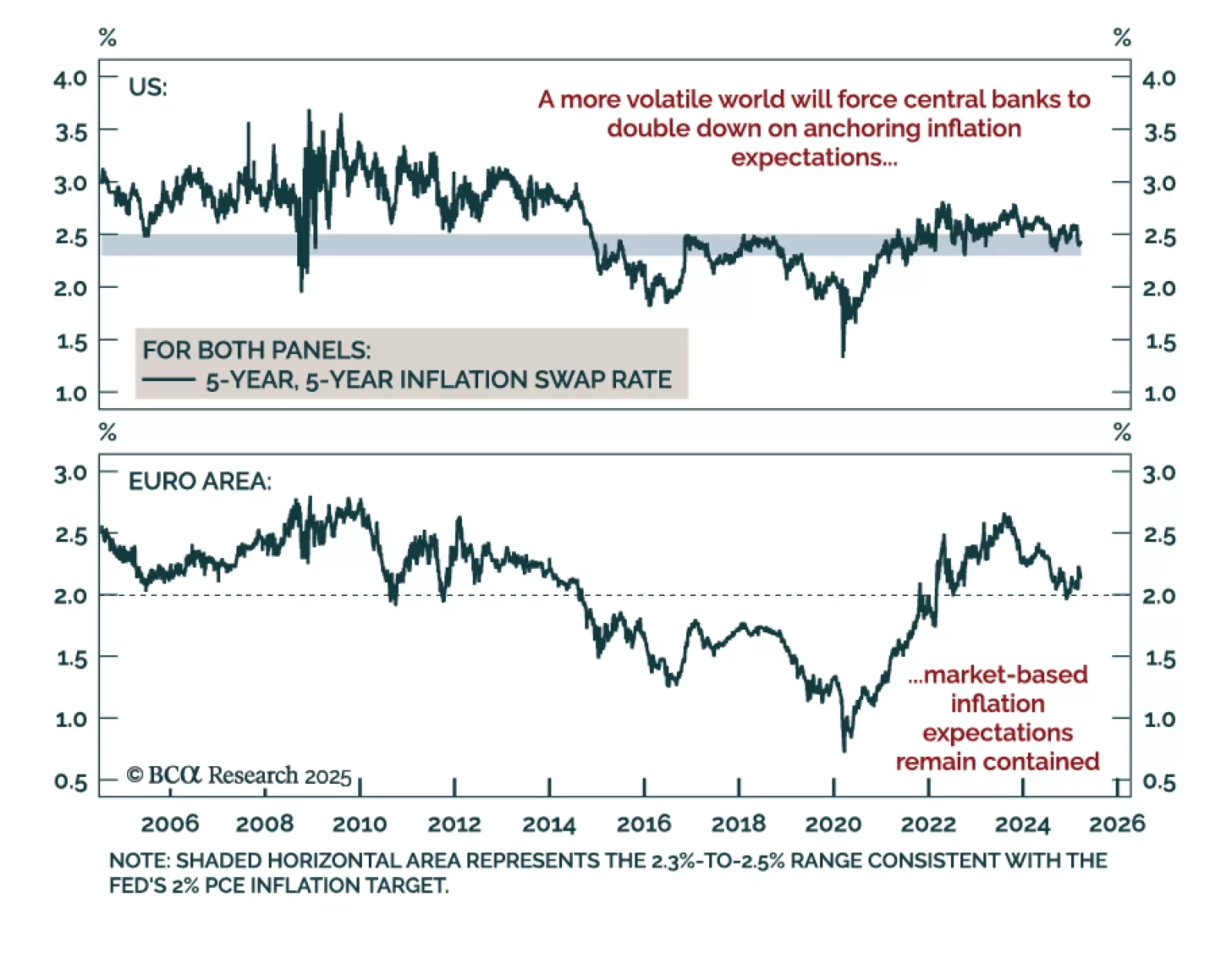

The years ahead will be more complex for investors. Inflation expectations and its leading indicators will matter as much as realized inflation, and rates volatility is likely to remain structurally higher. This calls for increasing…

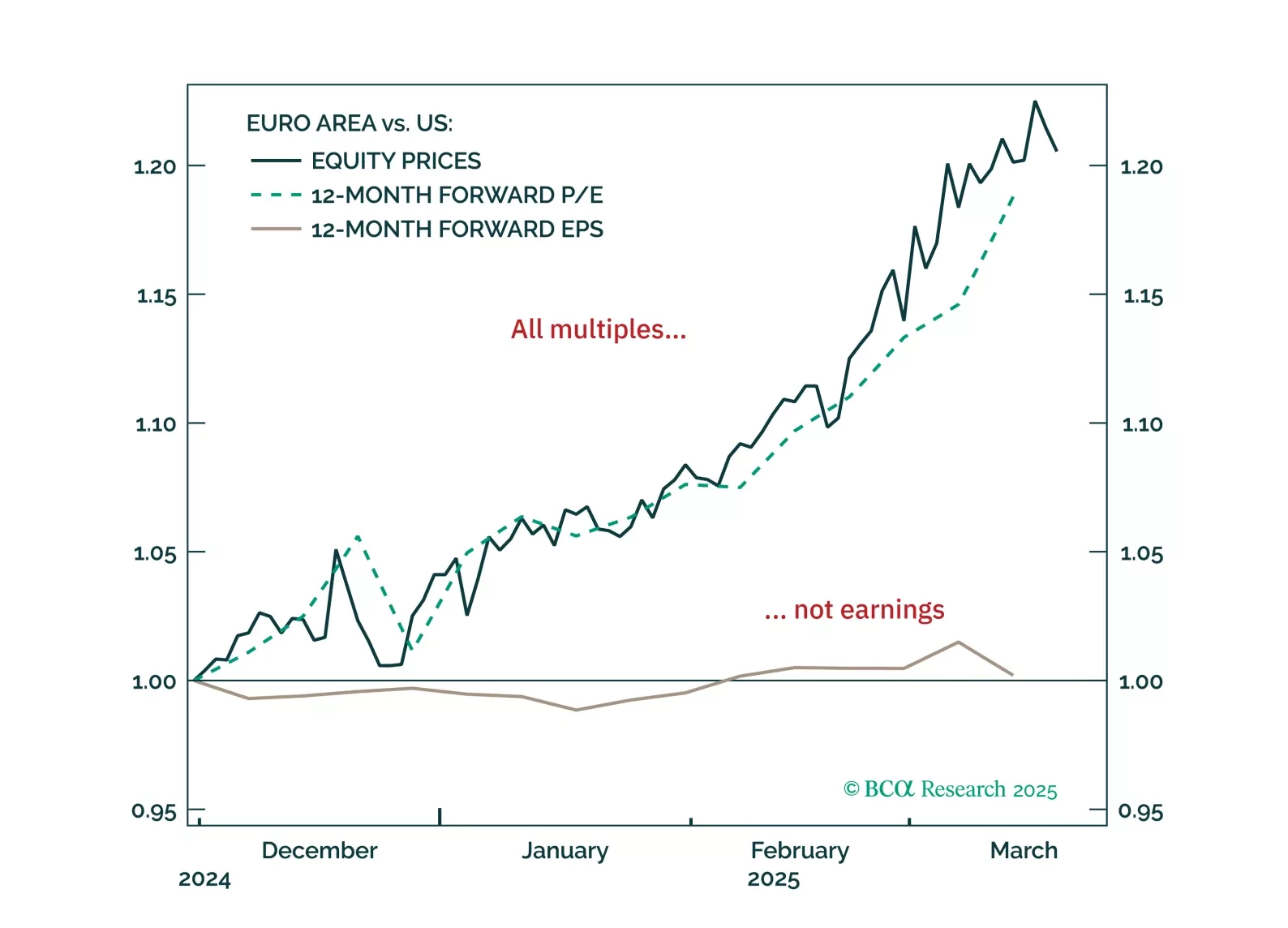

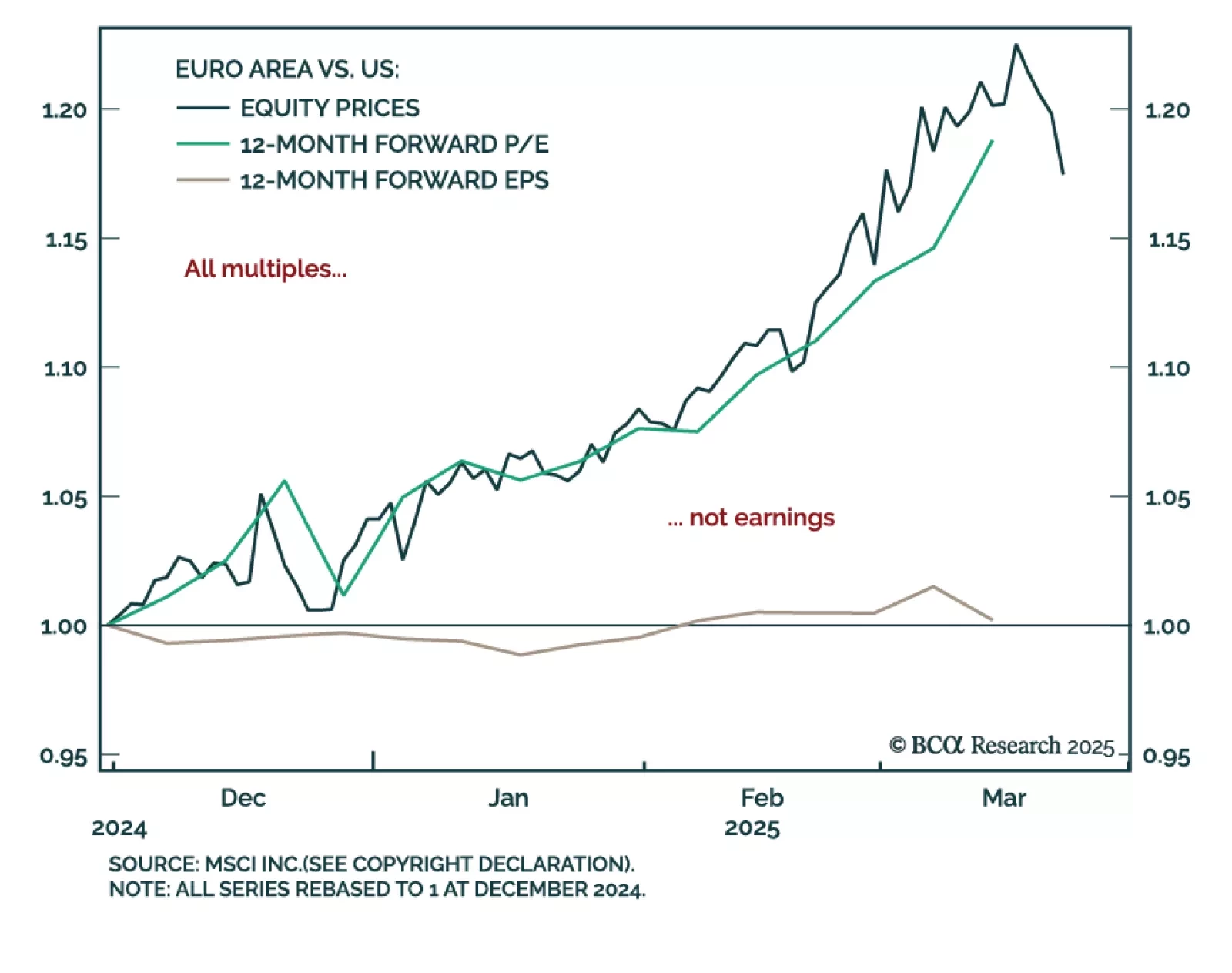

Our European investment strategists recommend underweighting European equities over the next three-to-six months, favoring defensives like telecoms, which may also benefit from reform potential. The rally in European equities…

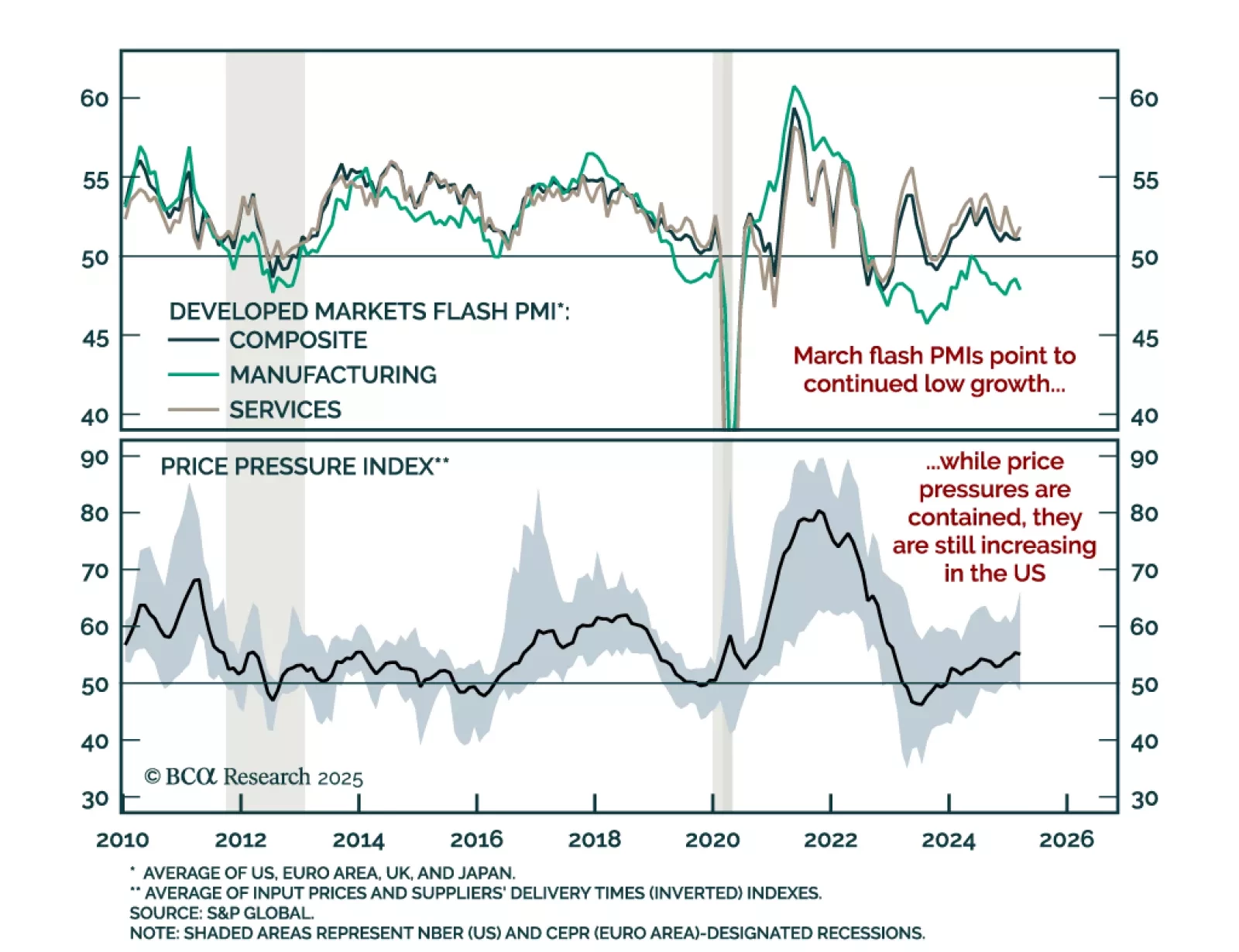

The March PMIs point to a low growth buffer outside the US as uncertainty engulfs the global economy. Aggregate price pressures were contained in March, but input prices still increased in the US. While the market reaction was risk-…

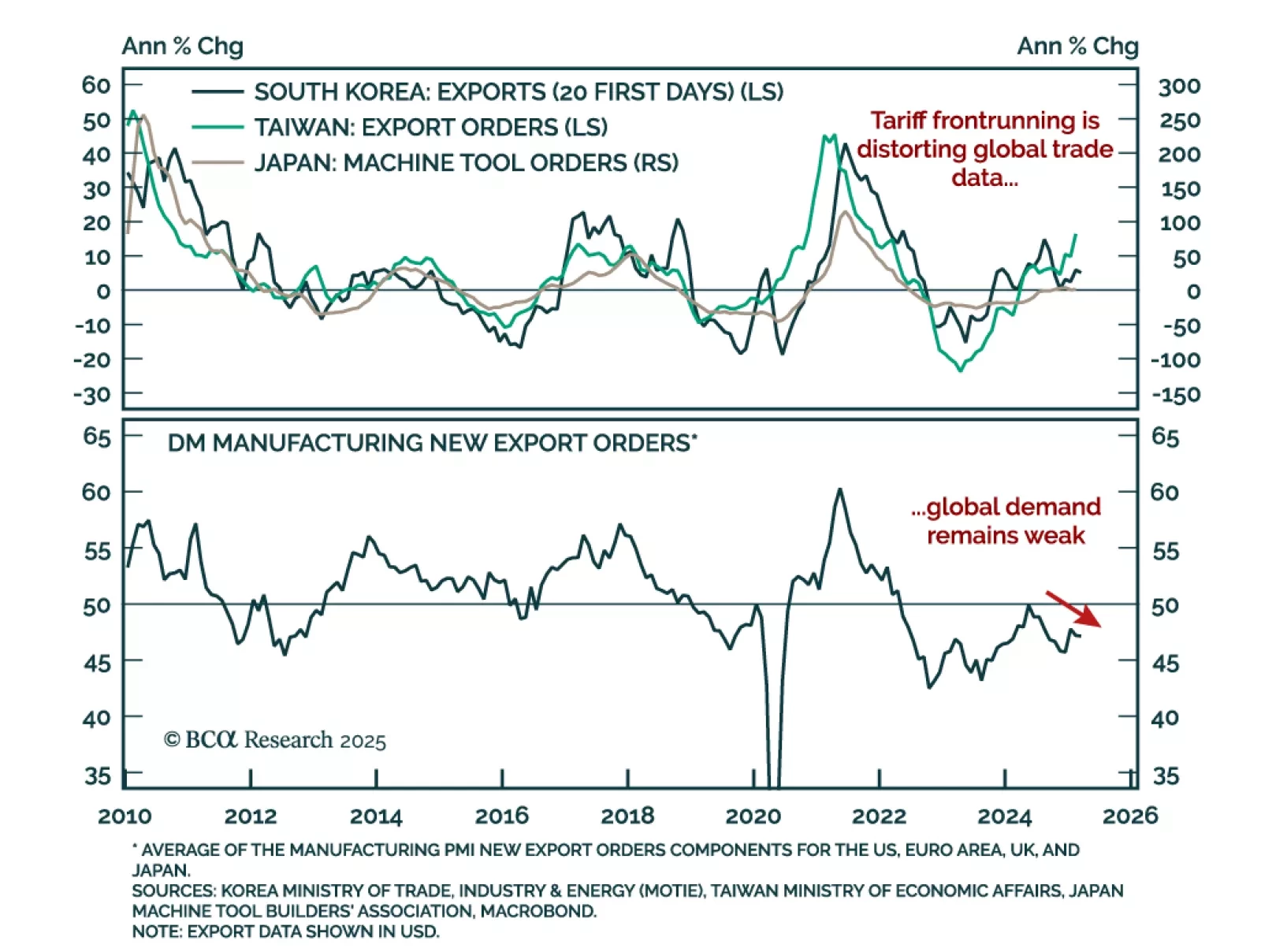

East Asian trade data has been disappointing. Preliminary February data for Japanese machine tool orders showed a slowdown to 3.5% y/y from 4.7% in January. Broader machinery orders were down 3.5% m/m in January. Taiwanese exports…

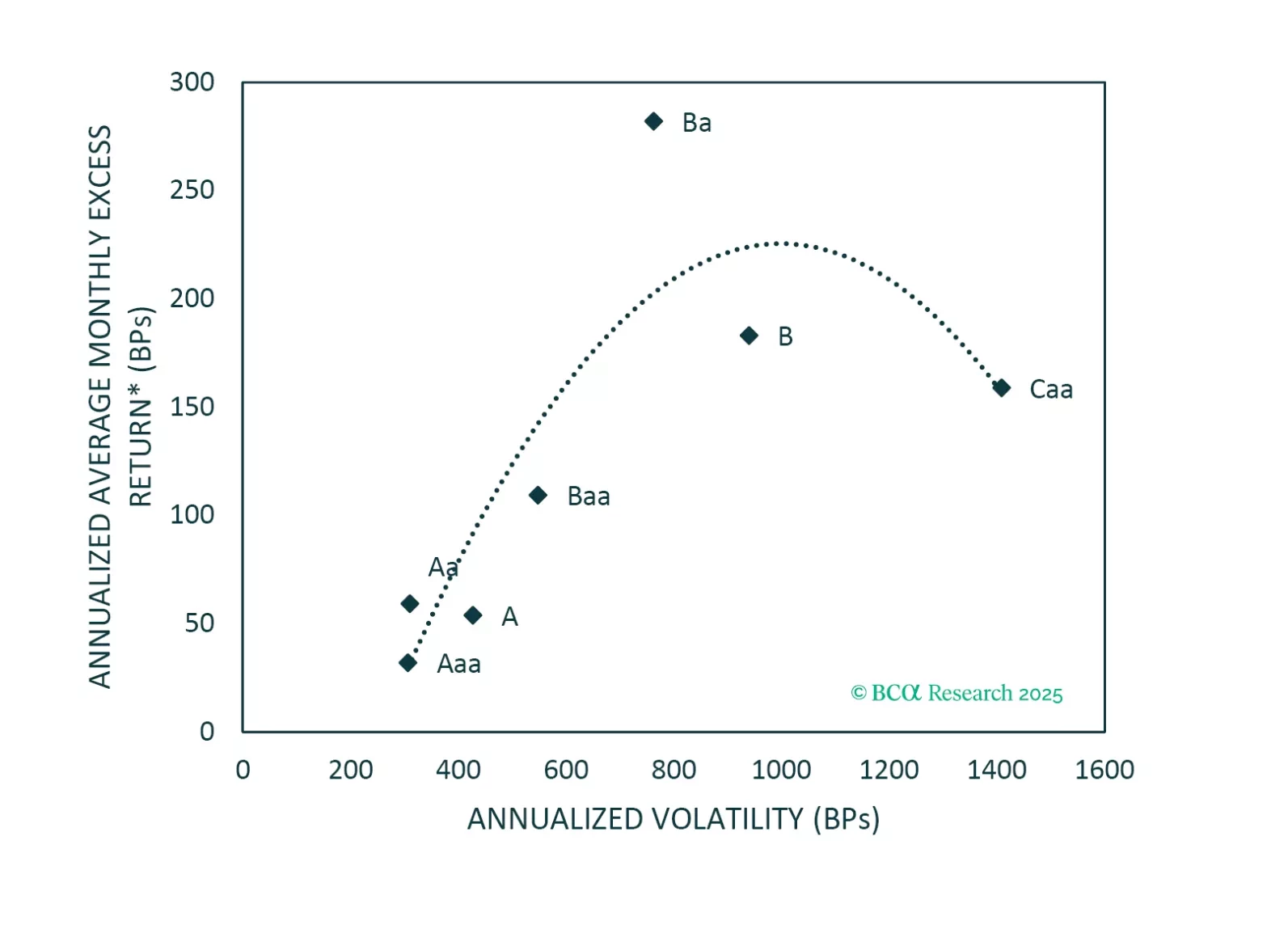

An analysis of historical data shows that Ba-rated bonds outperform other corporate credit tiers in the long-run on a risk-adjusted basis. That said, today’s fragile macro environment warrants a more cautious allocation.

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?