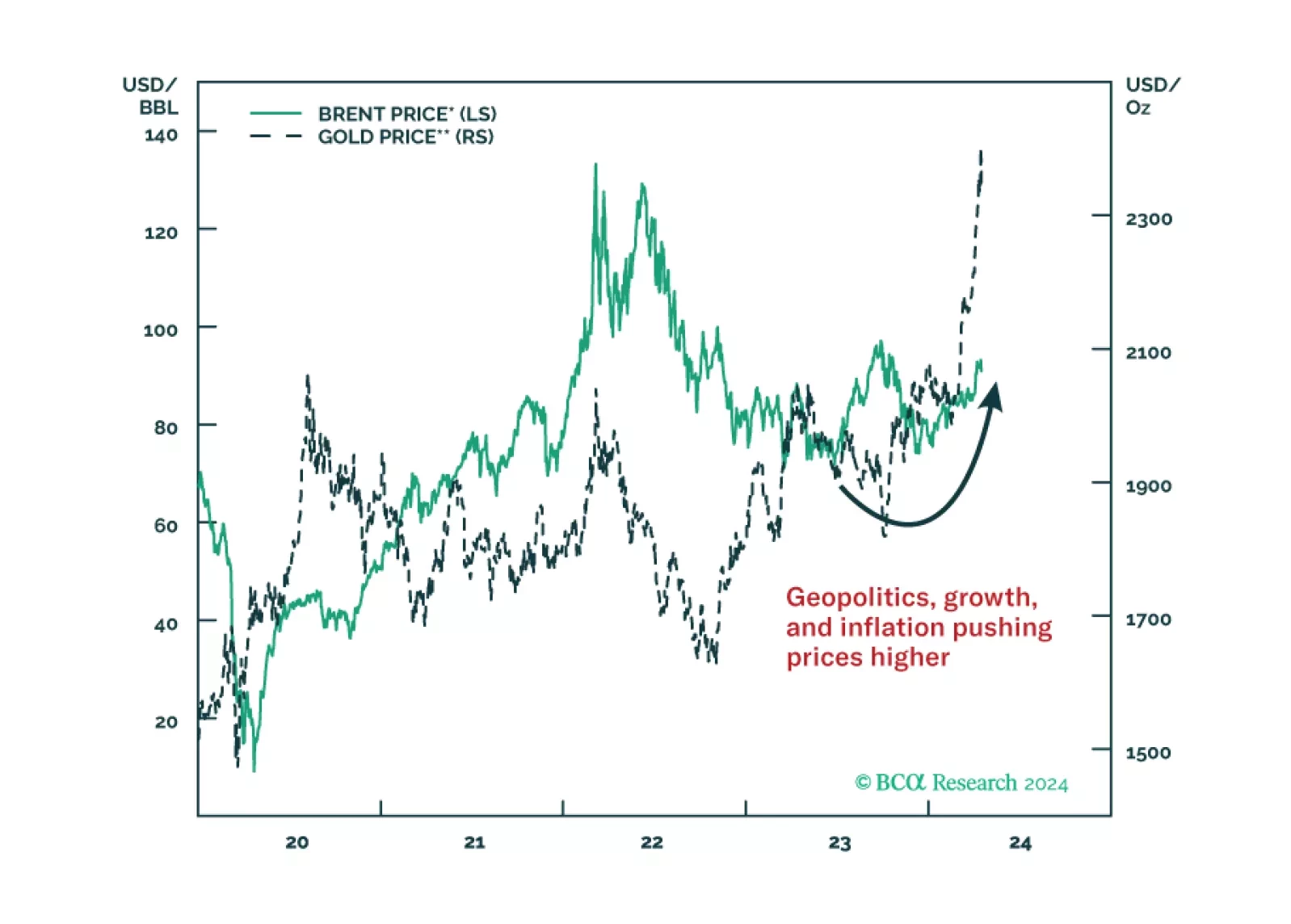

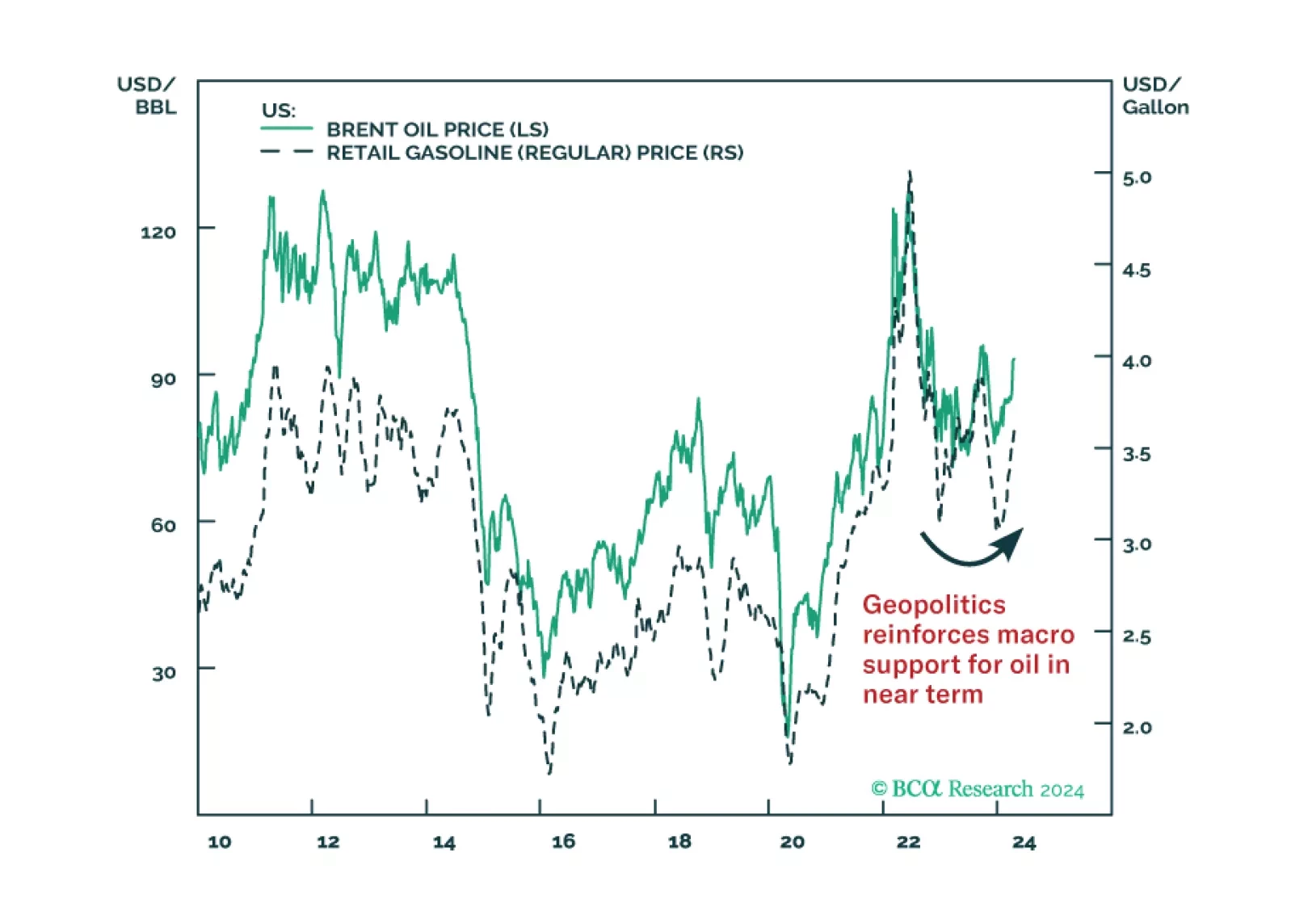

The implication is that Israel chose not to escalate the risk of direct war with Iran. Hence we remain in our base-case “Minor War, Minor Oil Shock” scenario.

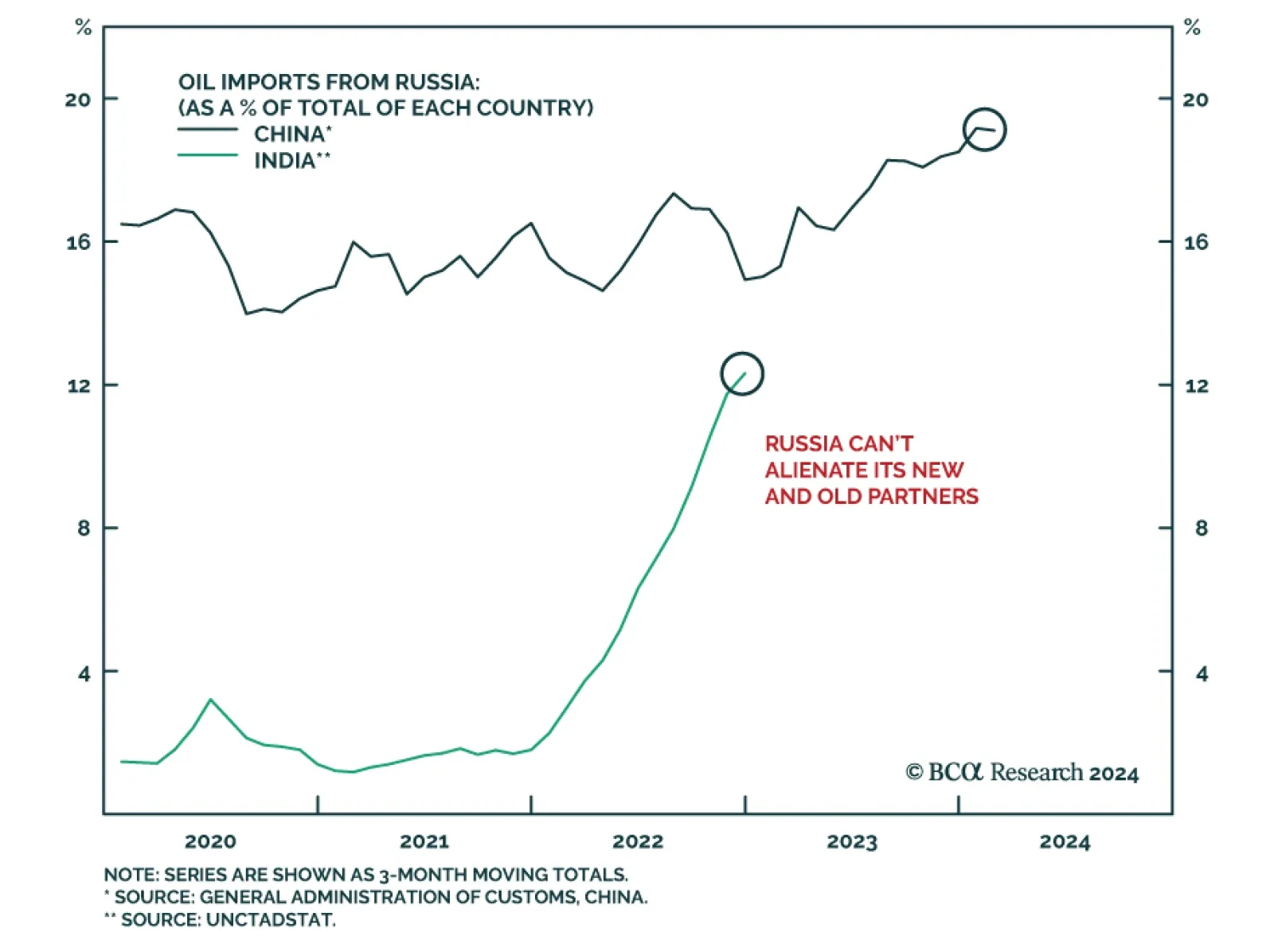

According to BCA Research’s Geopolitical Strategy service, the US-Russia conflict will re-escalate pre-election. Russia has taken 18% of Ukraine’s territory but has not yet clinched its victory. The western powers…

Our quant models suggest Democrats are still slightly favored for the White House. Our Senate model favors Republican control, though Montana and Ohio are the weak links that could deliver Democrats a de facto Senate majority in the…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

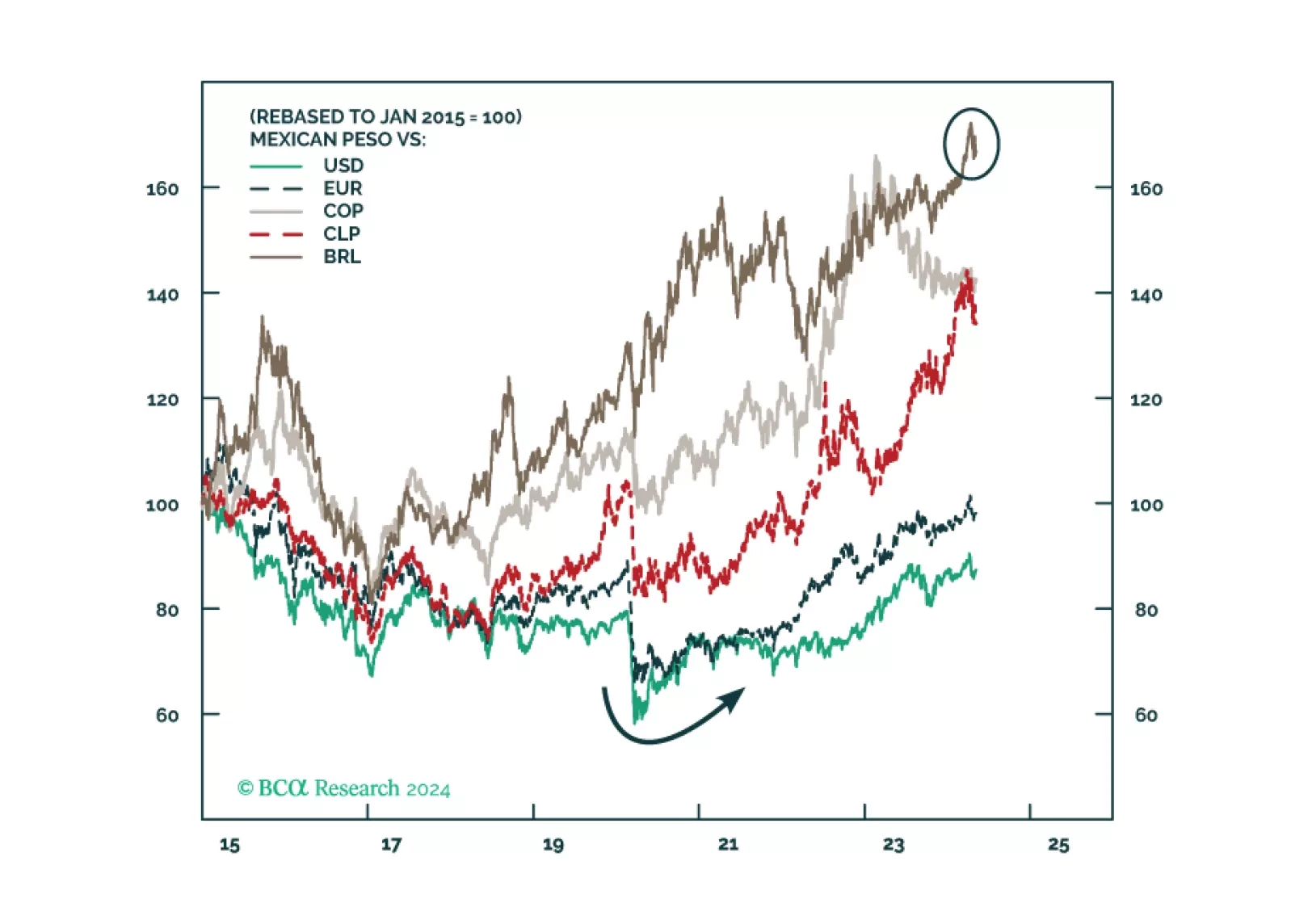

Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.

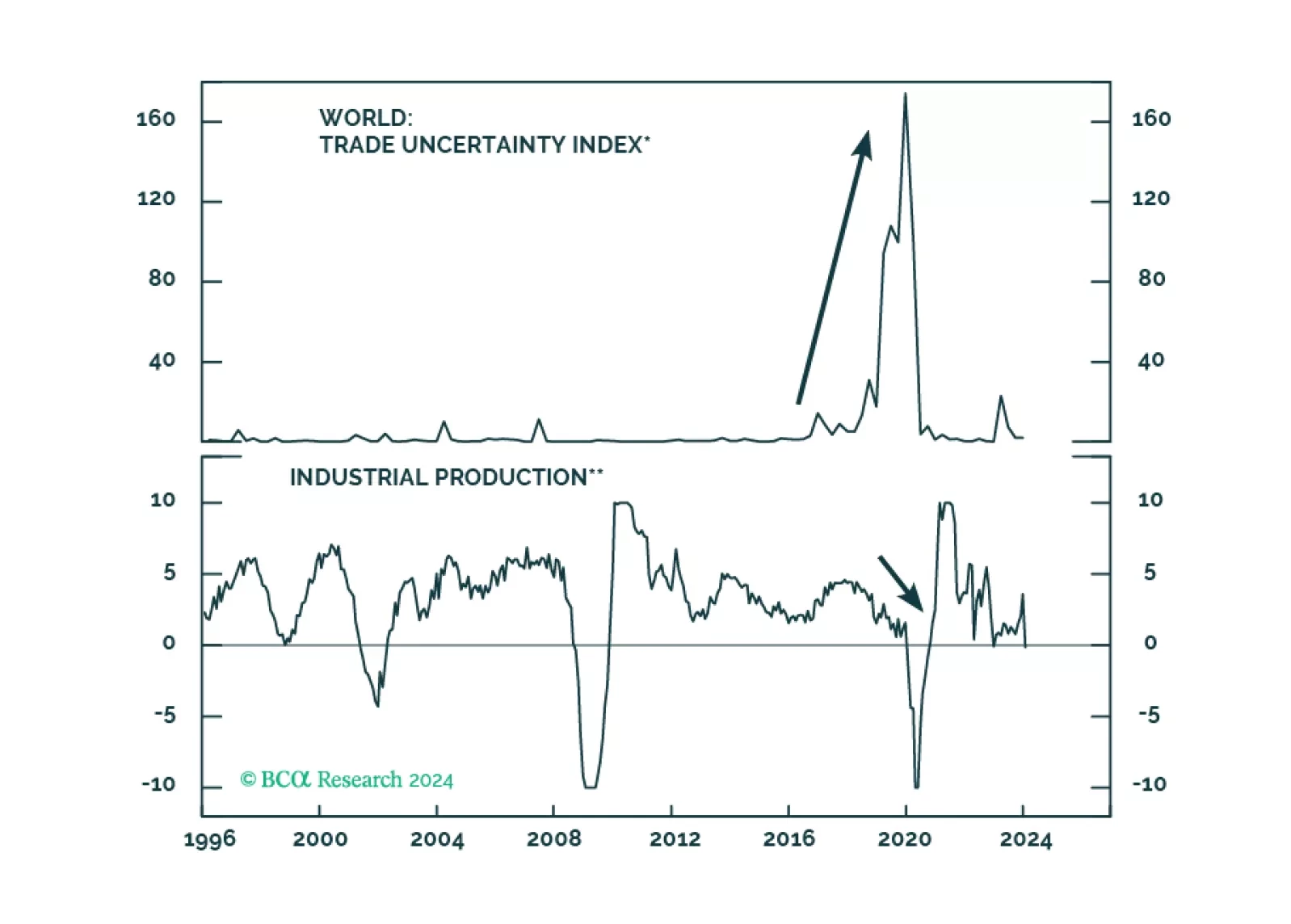

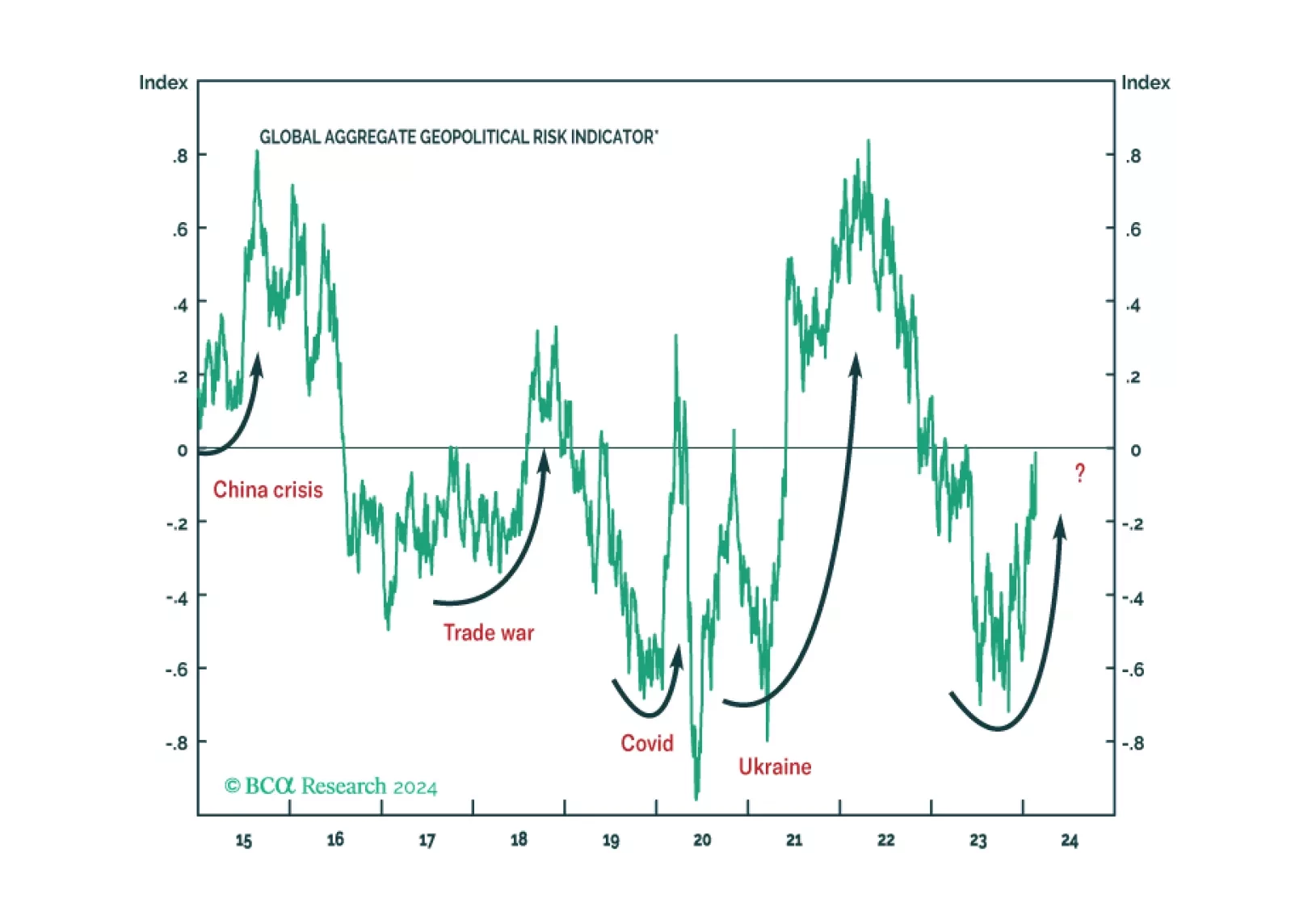

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…