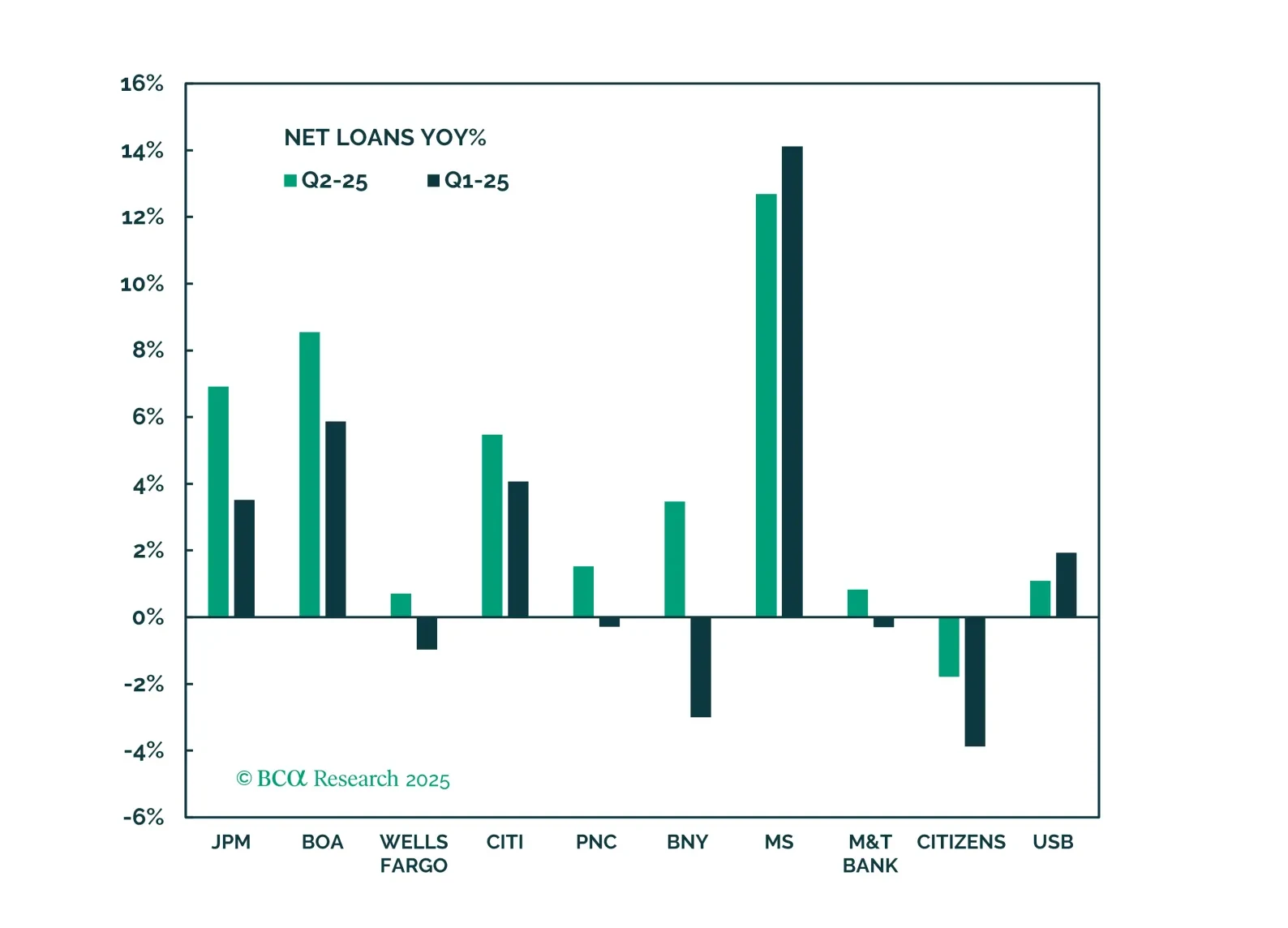

Banks have had a strong run and may continue to outperform, supported by a rebound in capital market activity, improving momentum in the core banking business, and the potential for rerating driven by deregulation. While risks remain…

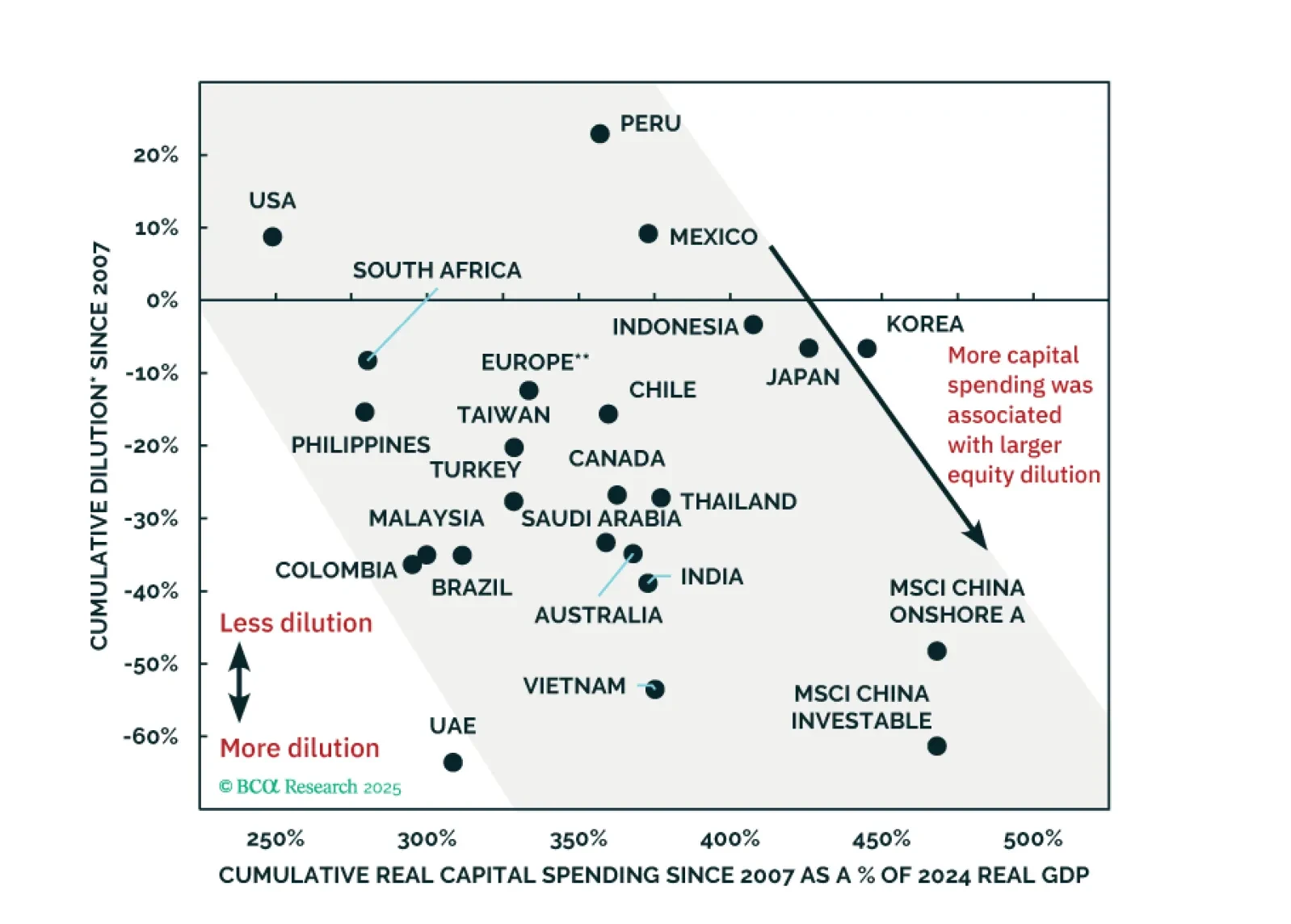

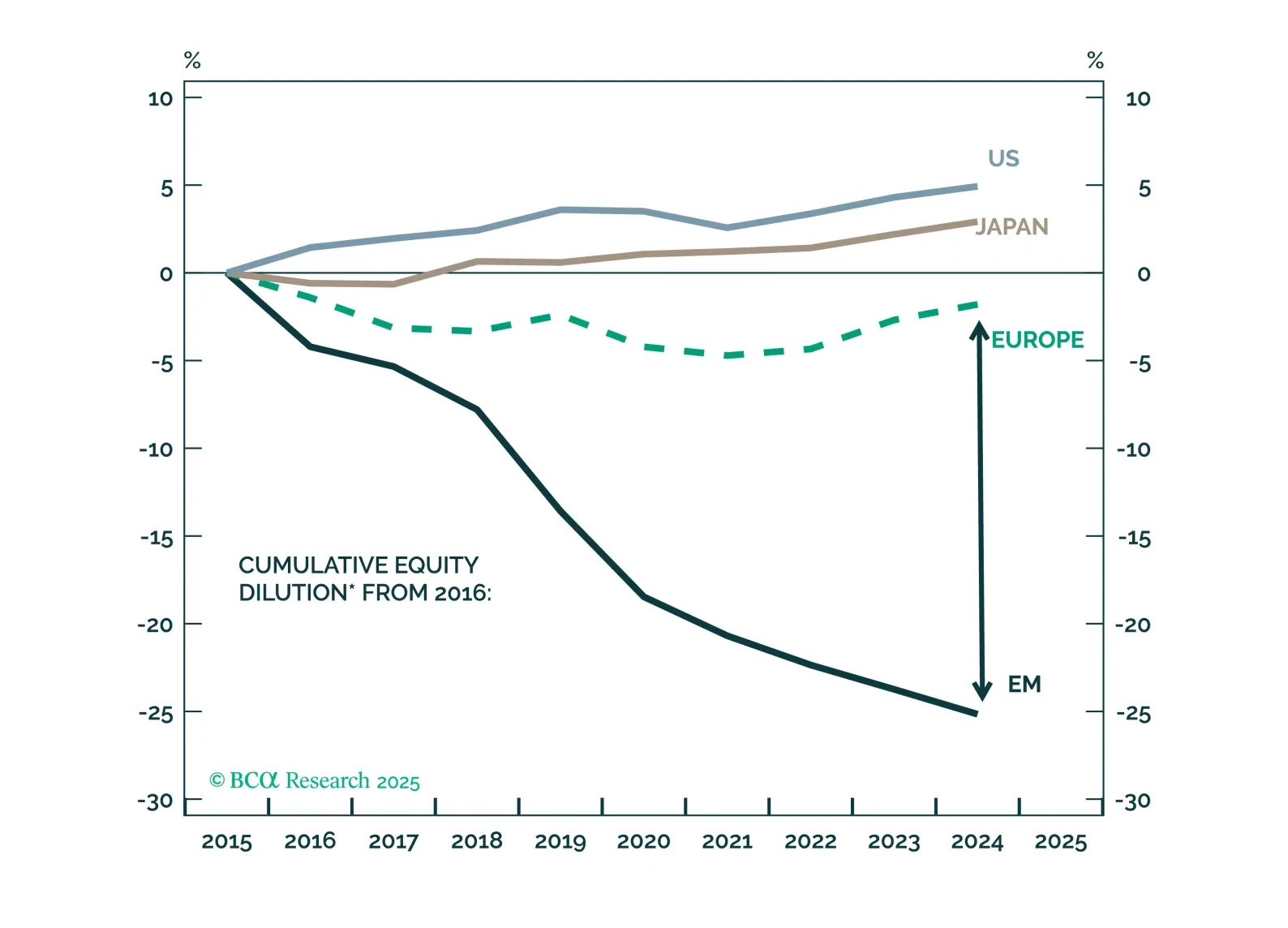

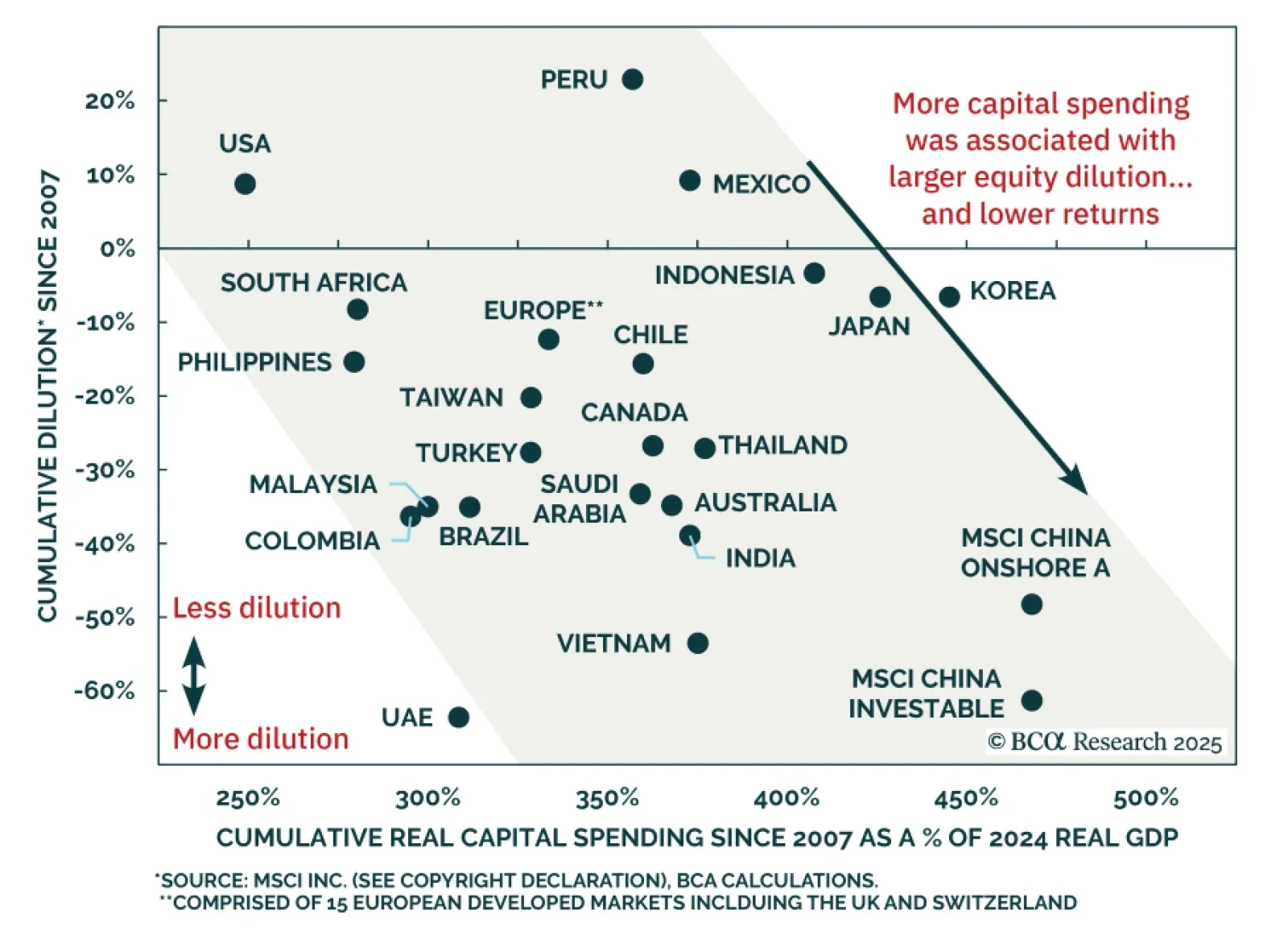

BCA’s Emerging Markets strategists remain negative on EM stocks in absolute terms but recommend a neutral weighting within global equity portfolios. Economic growth does not reliably translate into earnings per share or shareholder…

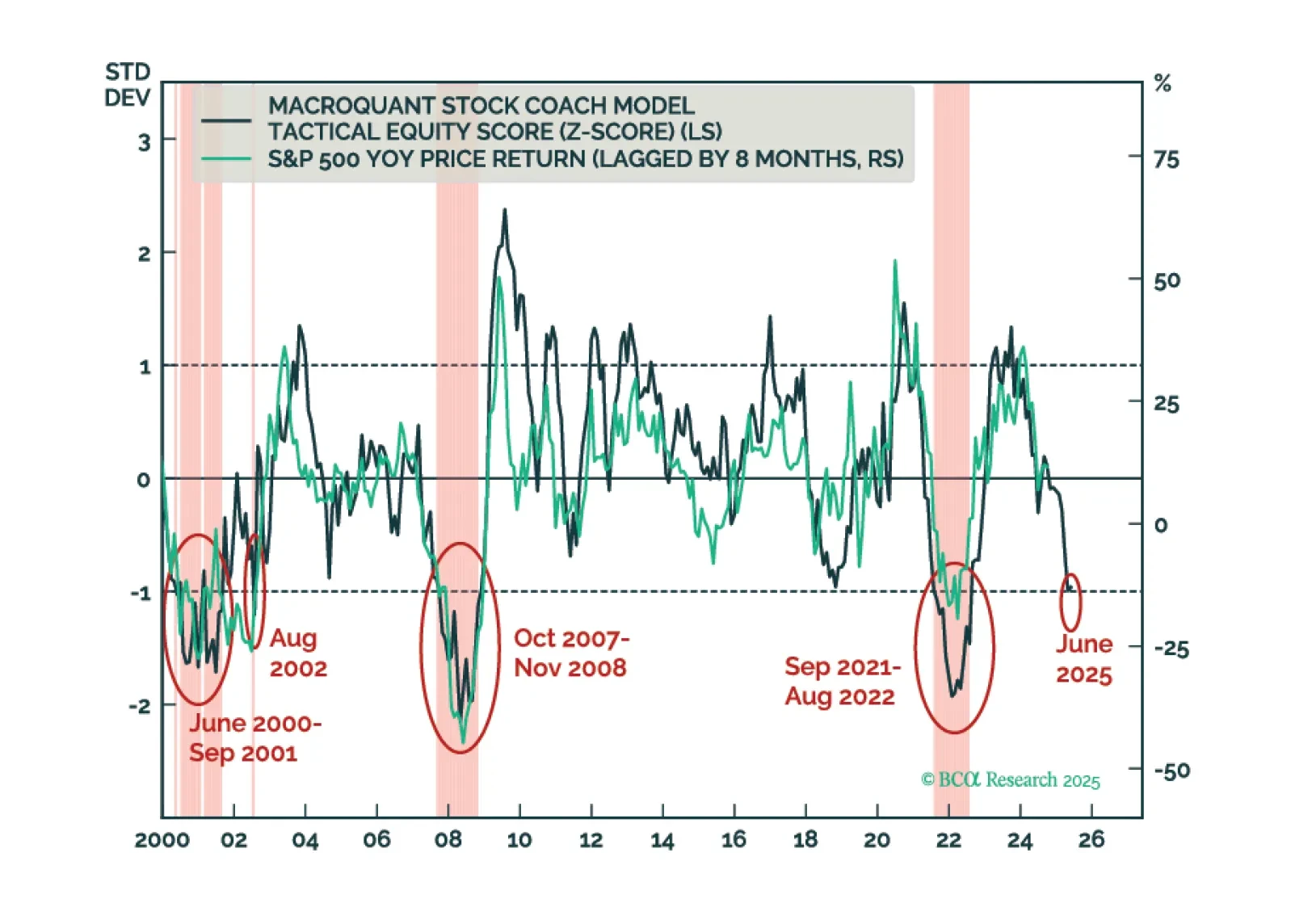

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

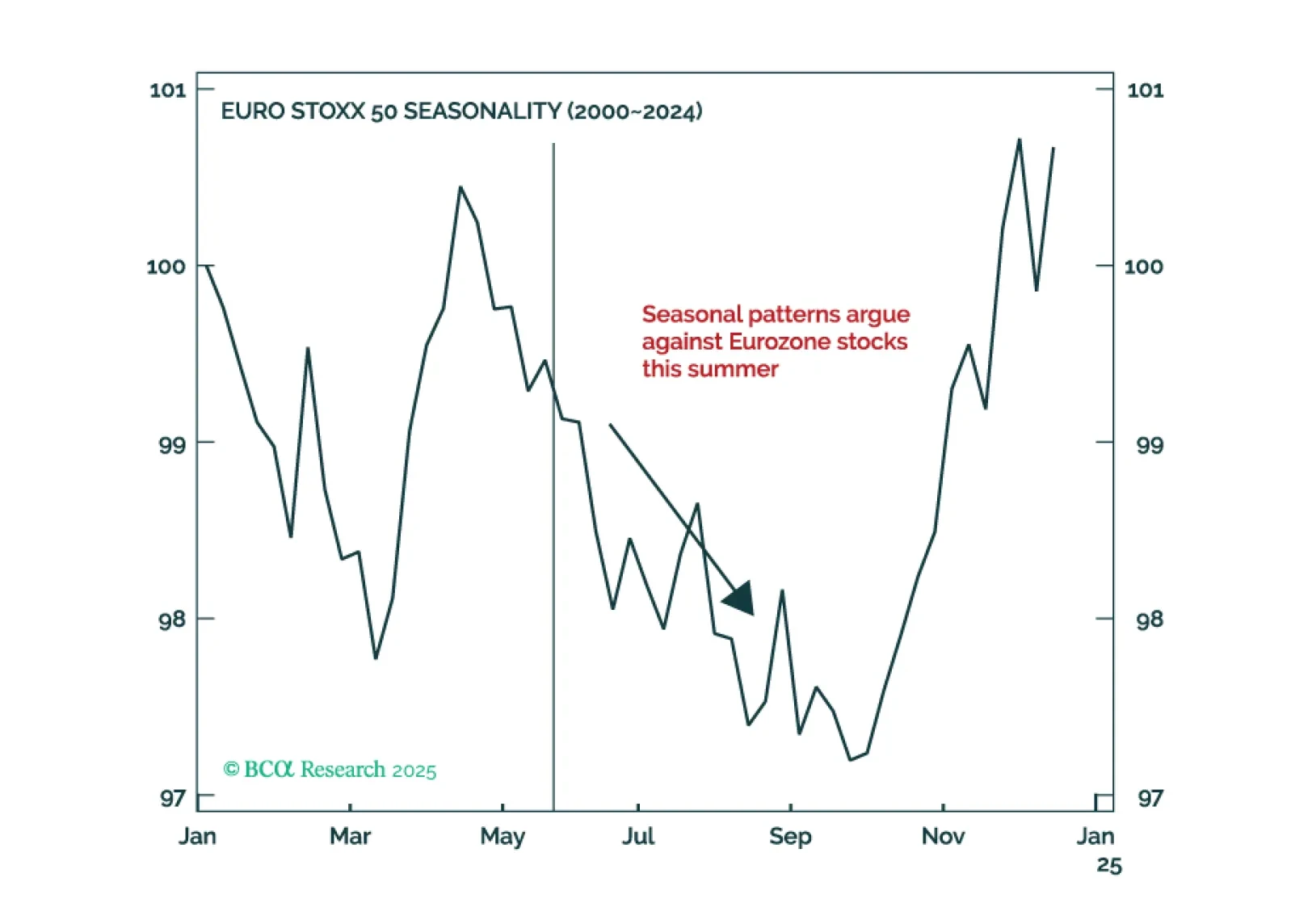

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

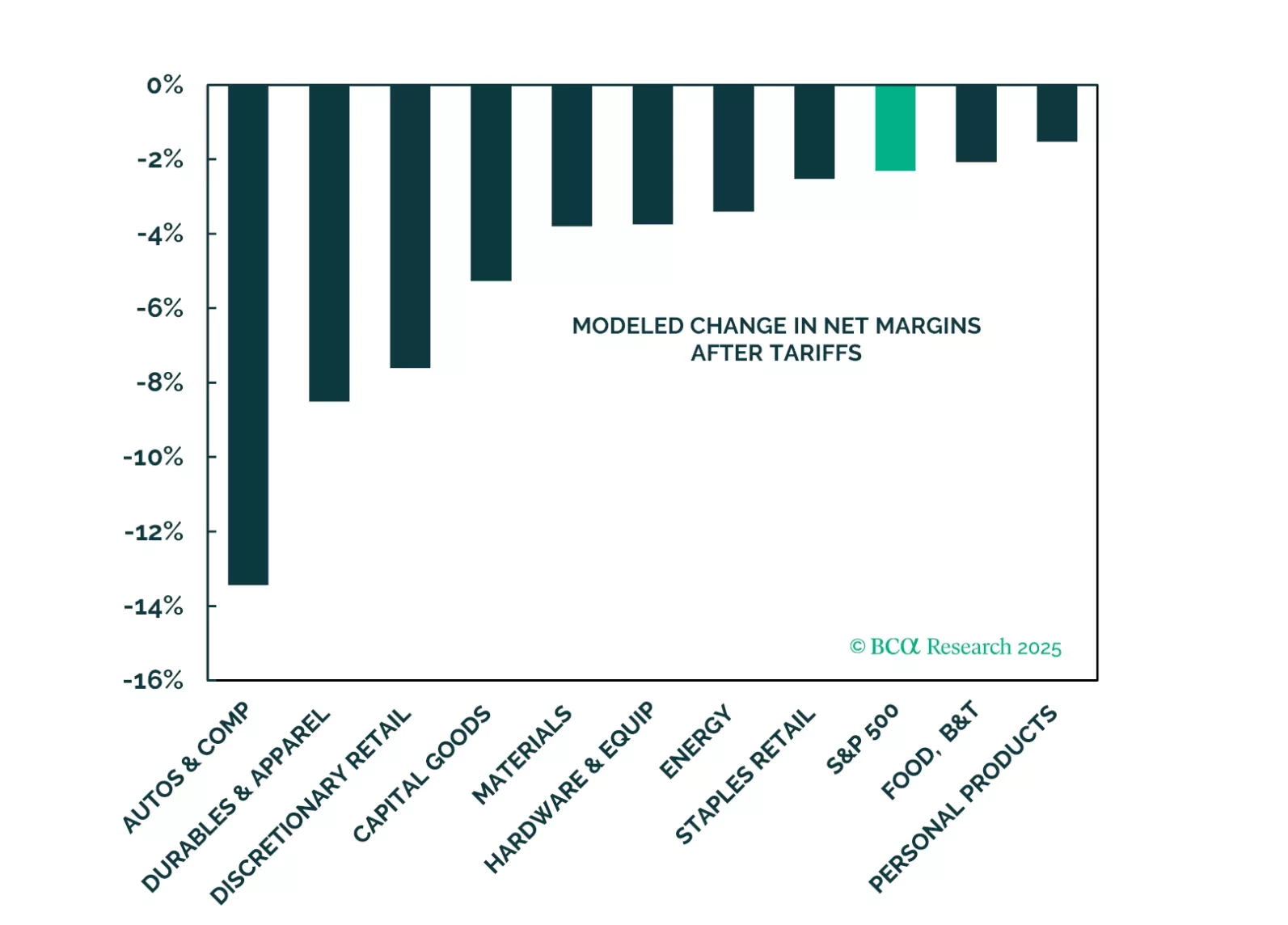

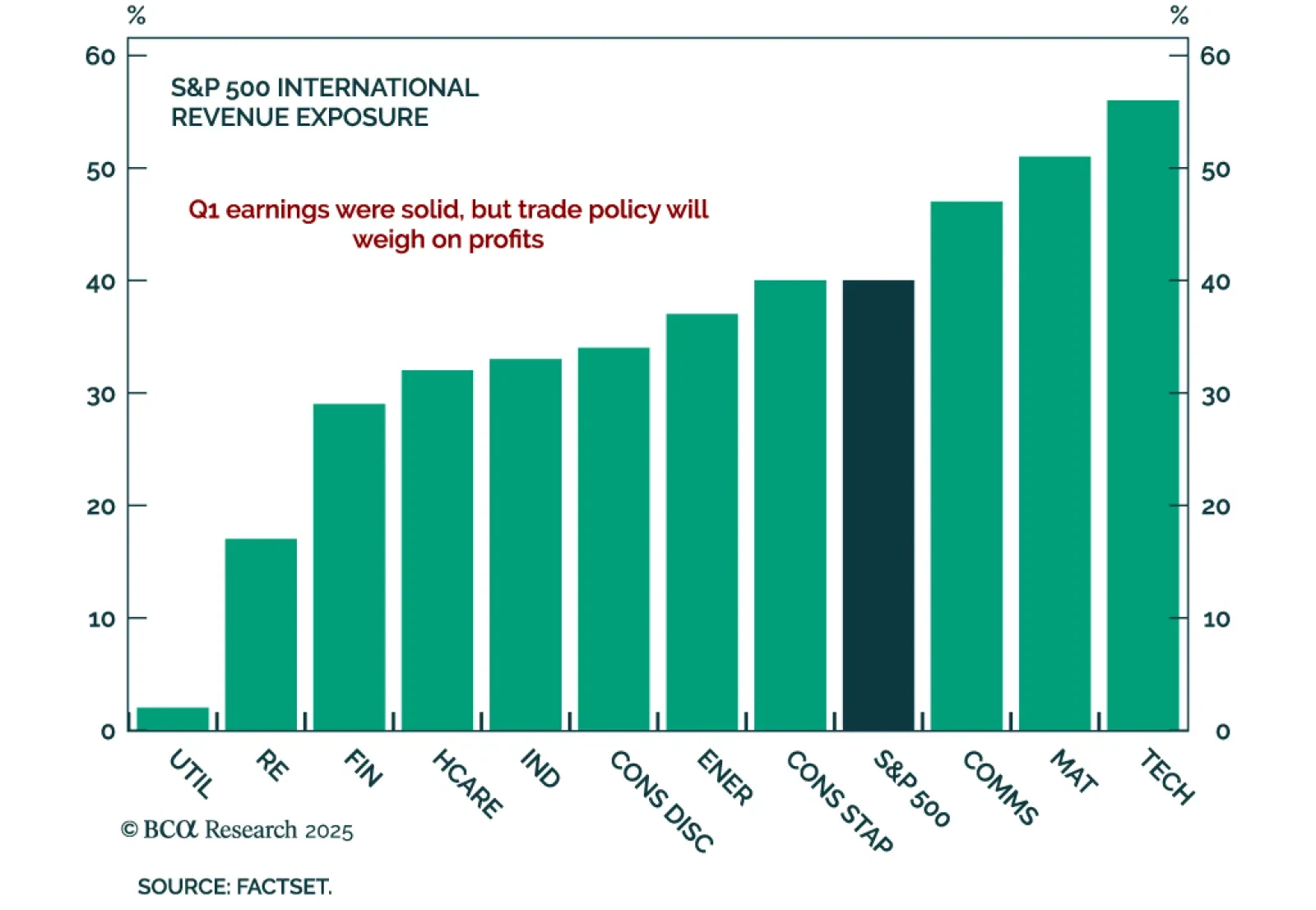

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

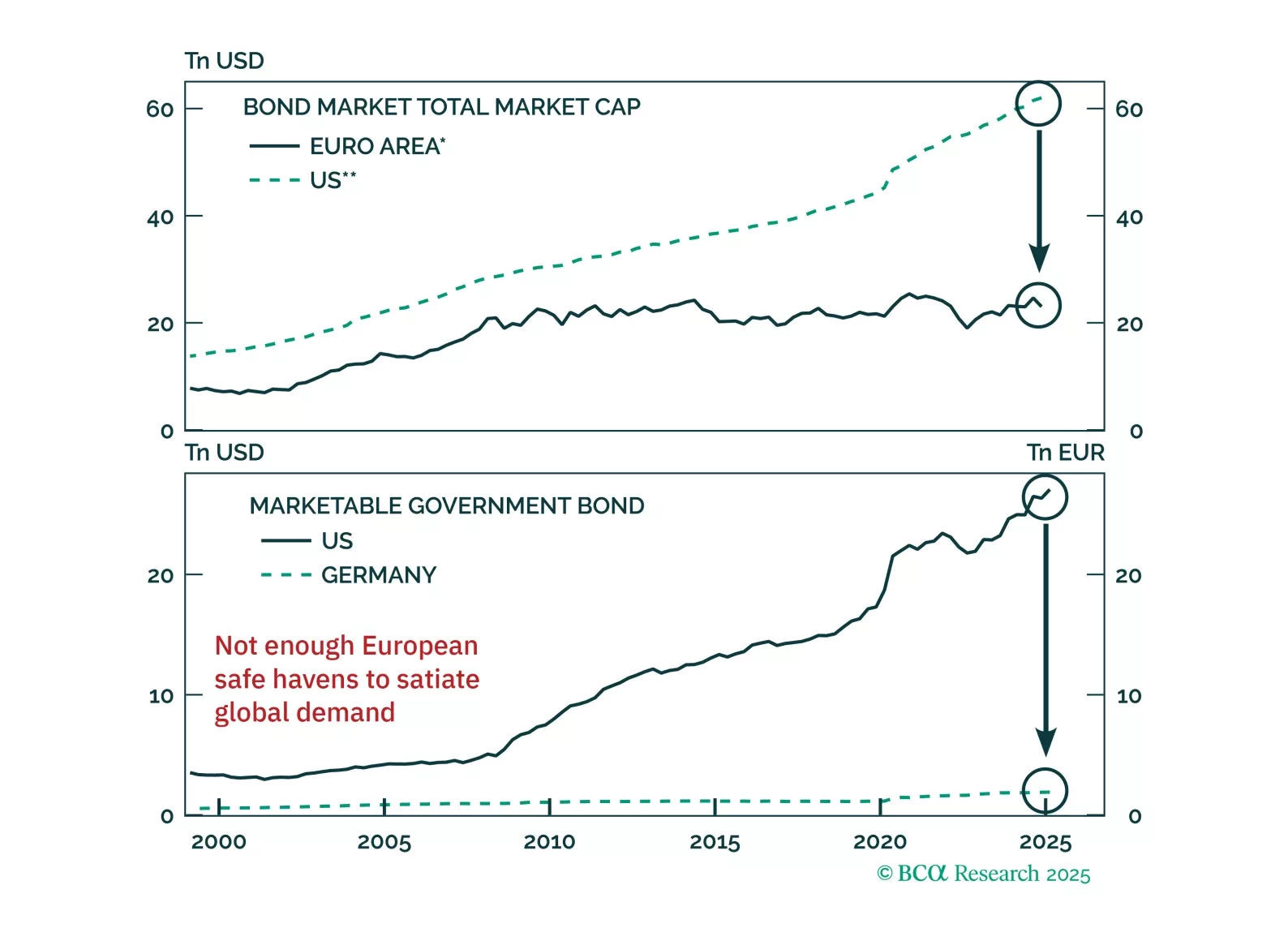

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

Last week, we hosted two webcasts for our clients globally to discuss the effects of tariffs on US equity sectors, preview the Q1 earnings season, and map out the trajectory of S&P 500 price performance. We also asked the webcast…

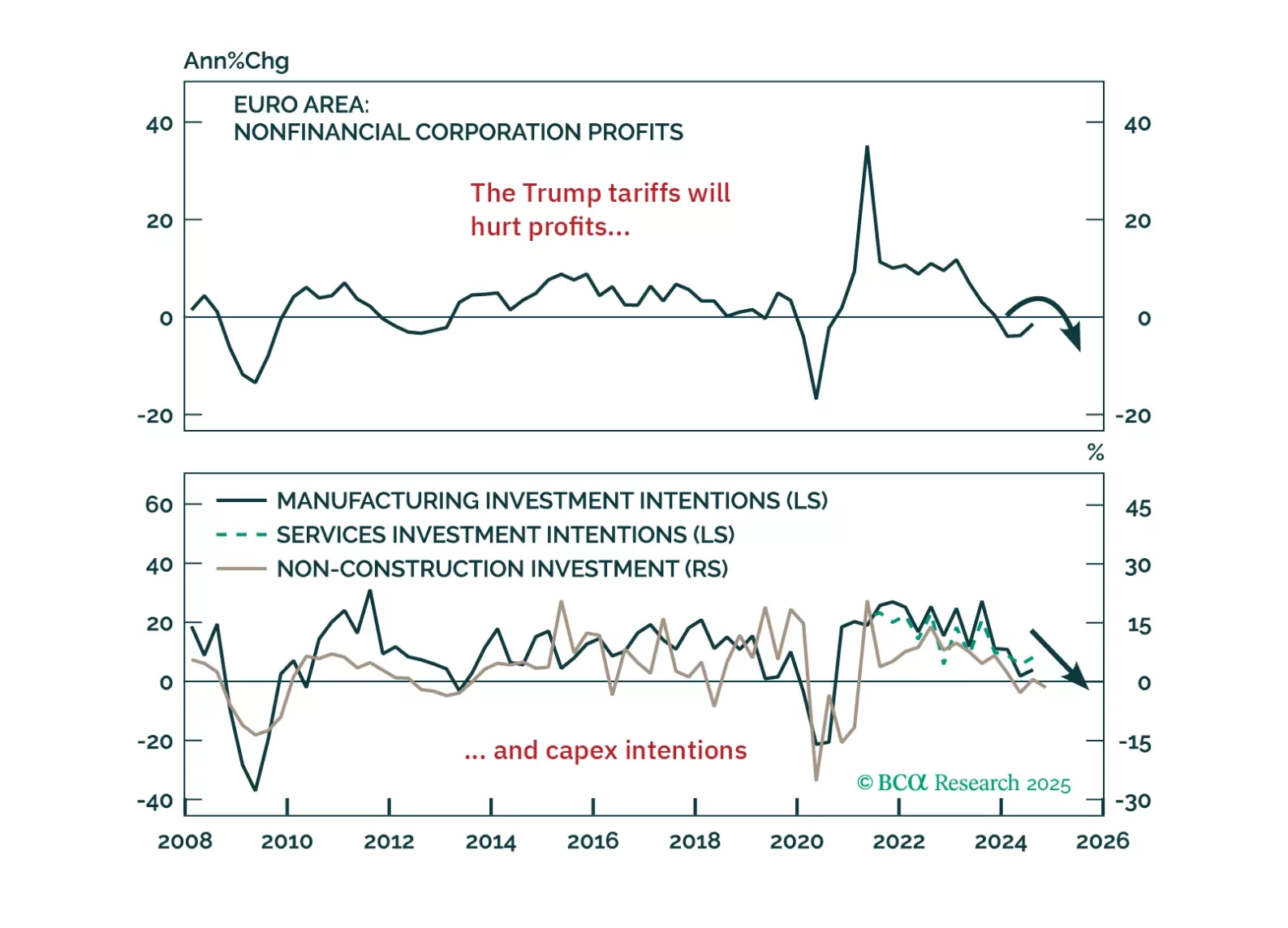

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…