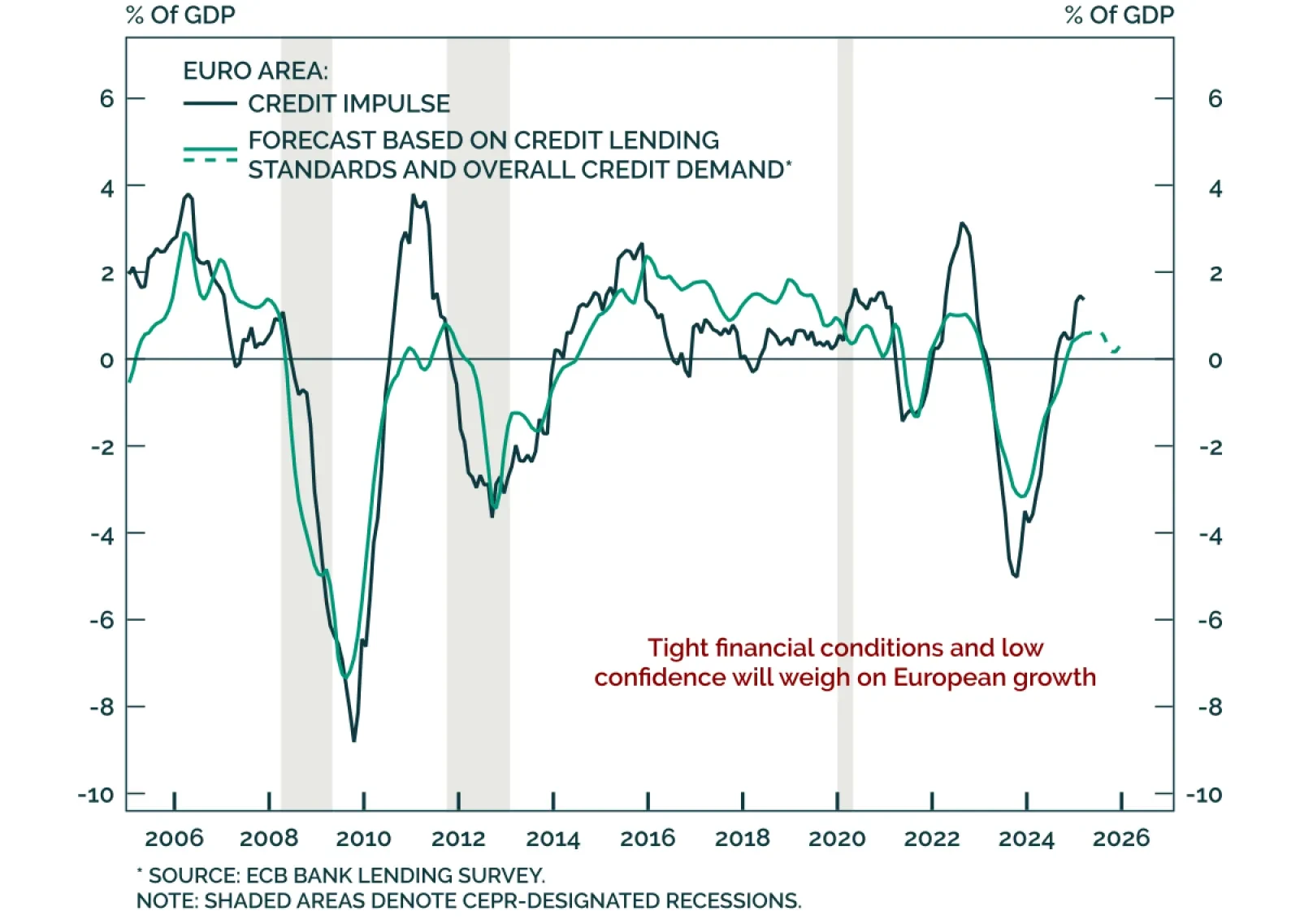

Weak Euro Area sentiment data and tight financial conditions support the case for a tactical US outperformance over Europe. July monetary data came in slightly below expectations, with M3 growth only edging up to 3.4% y/y from 3…

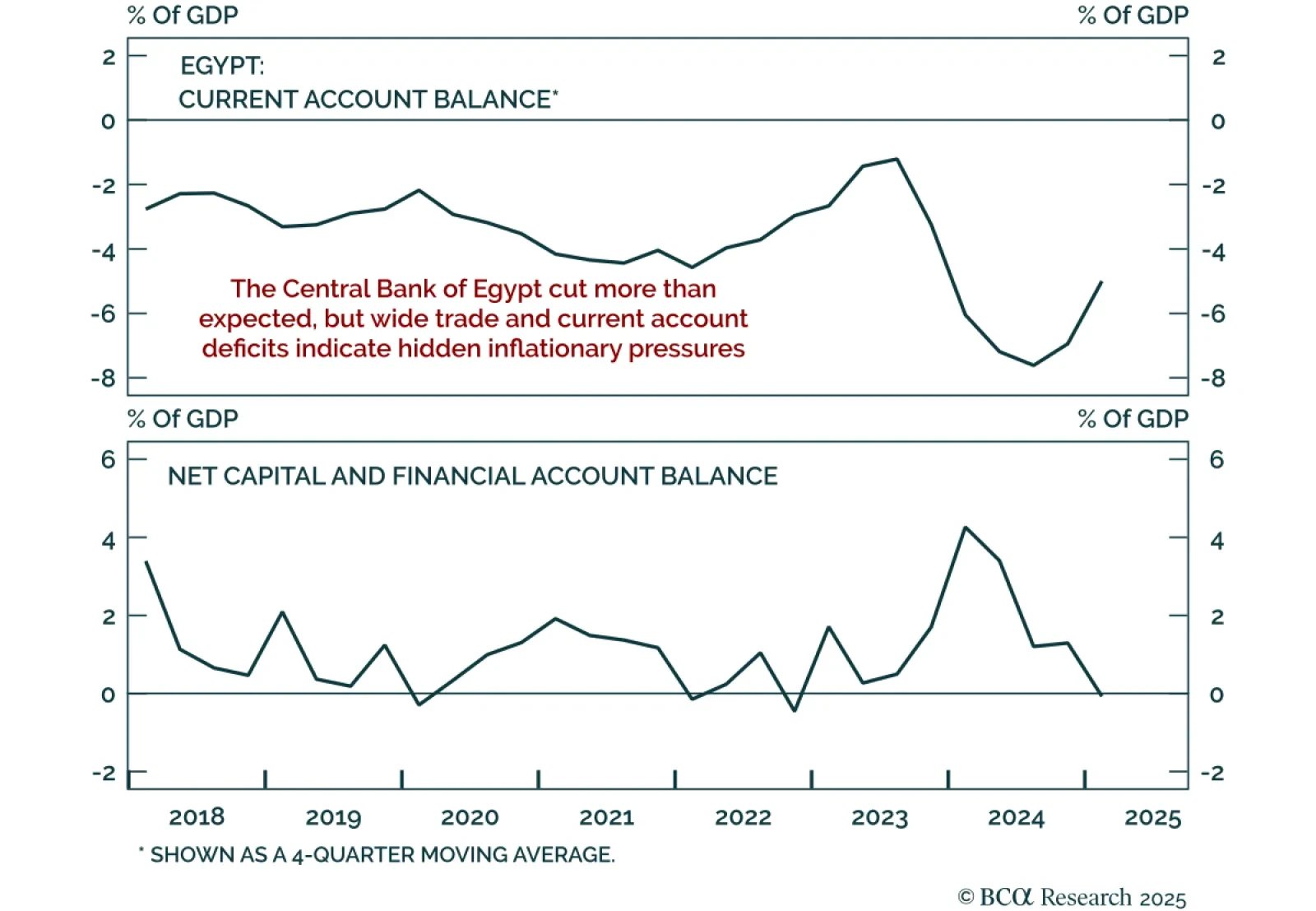

Egypt’s surprise 200 bps rate cut raises risks of re-accelerating inflation and currency pressure. The Central Bank of Egypt lowered the overnight lending rate to 23%, a larger-than-expected move. Our Emerging Markets strategists…

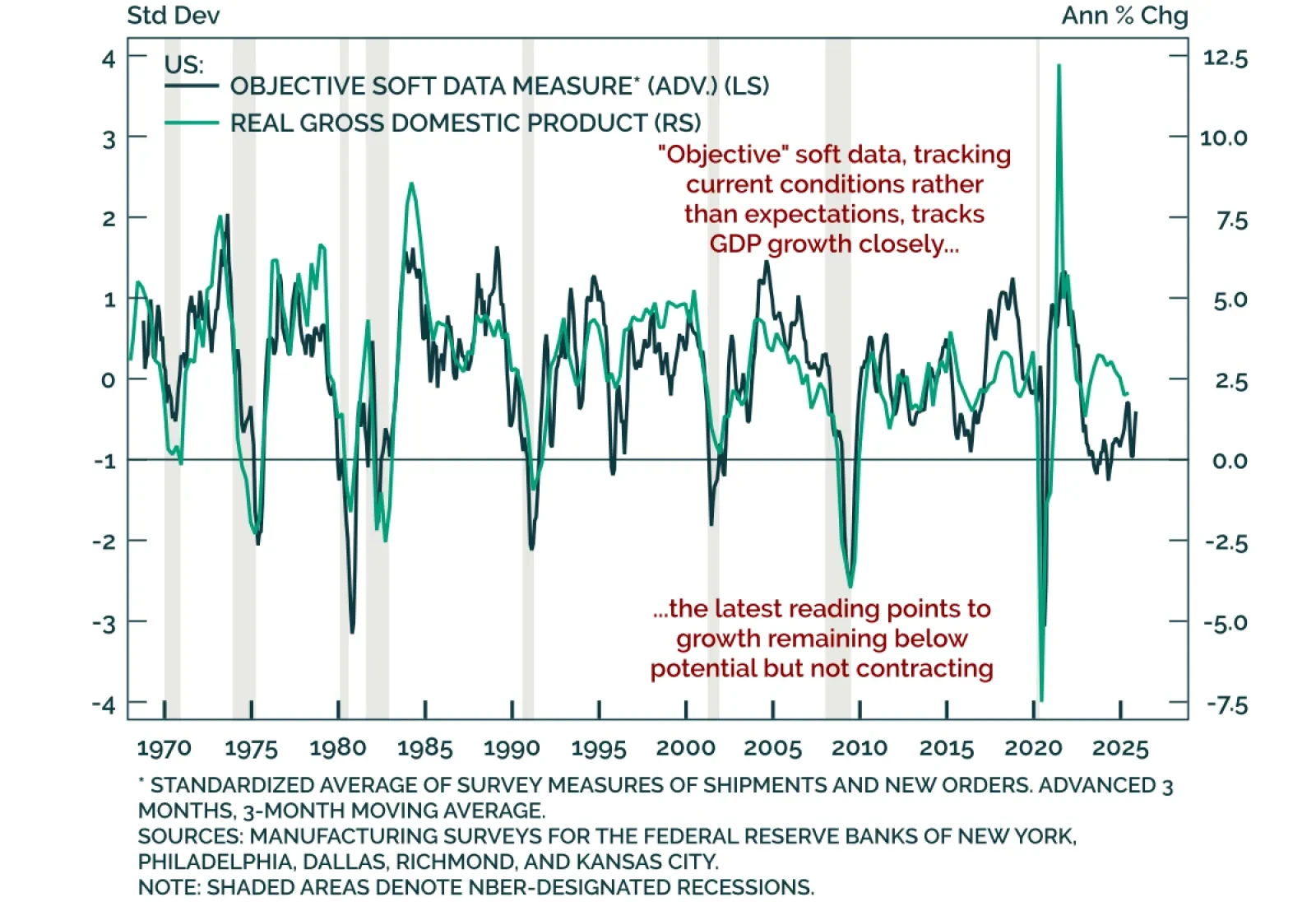

Regional Fed surveys point to low GDP growth, not an outright recession, which tactically supports low growth plays such as duration and tech. These timely surveys provide a snapshot of current month activity, combining “…

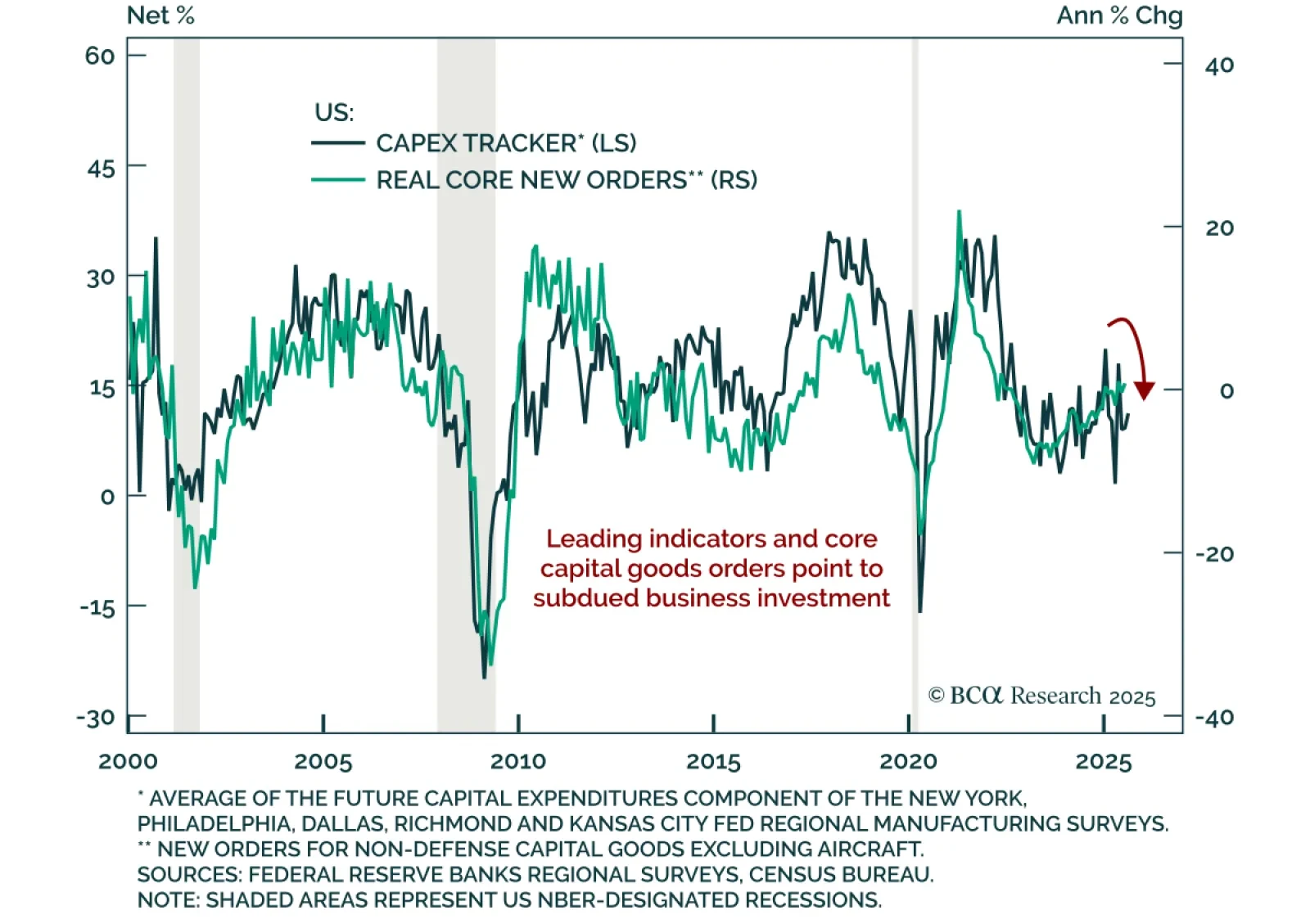

July US durable goods orders rebounded, but investment signals remain subdued and favor duration and tech. Orders fell 2.8% m/m after a 9.4% June drop, better than expected. Core measures excluding volatile components were…

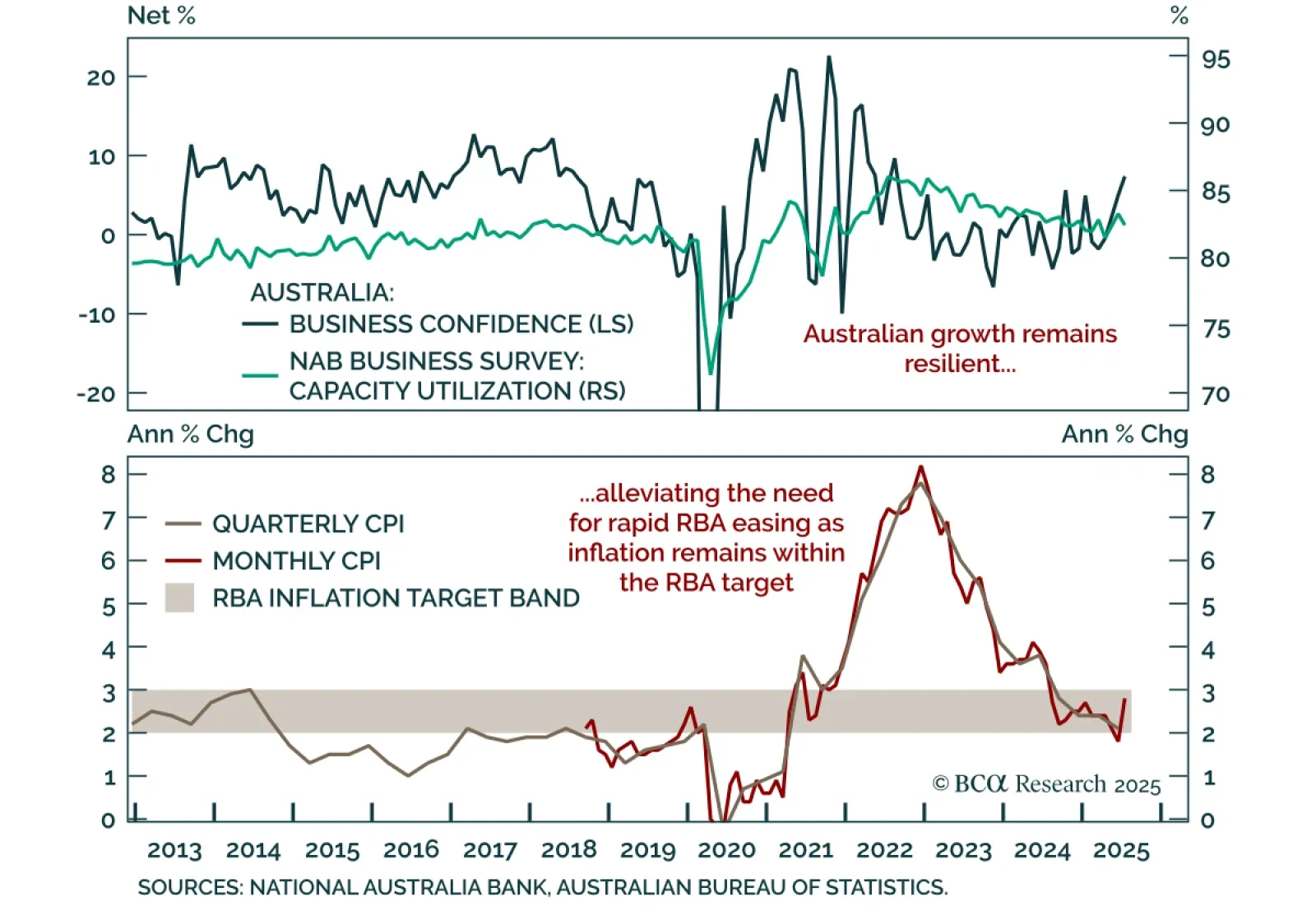

Australia’s July CPI surprise does not justify the aggressive easing priced, keeping us underweight ACGBs. Headline inflation accelerated to 2.8% y/y from 1.9% in June, with trimmed mean rising to 2.7% from 2.1%. Despite the…

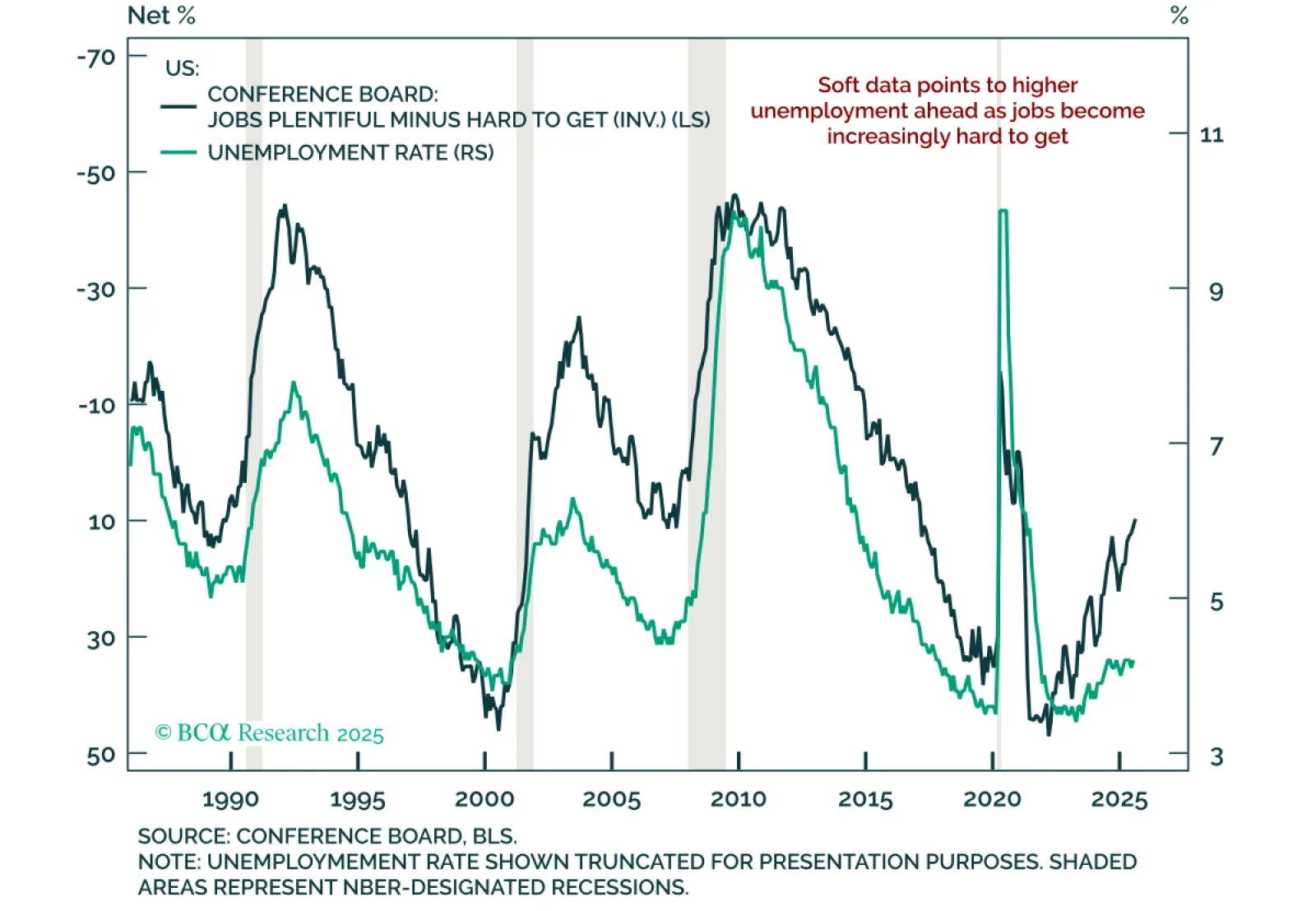

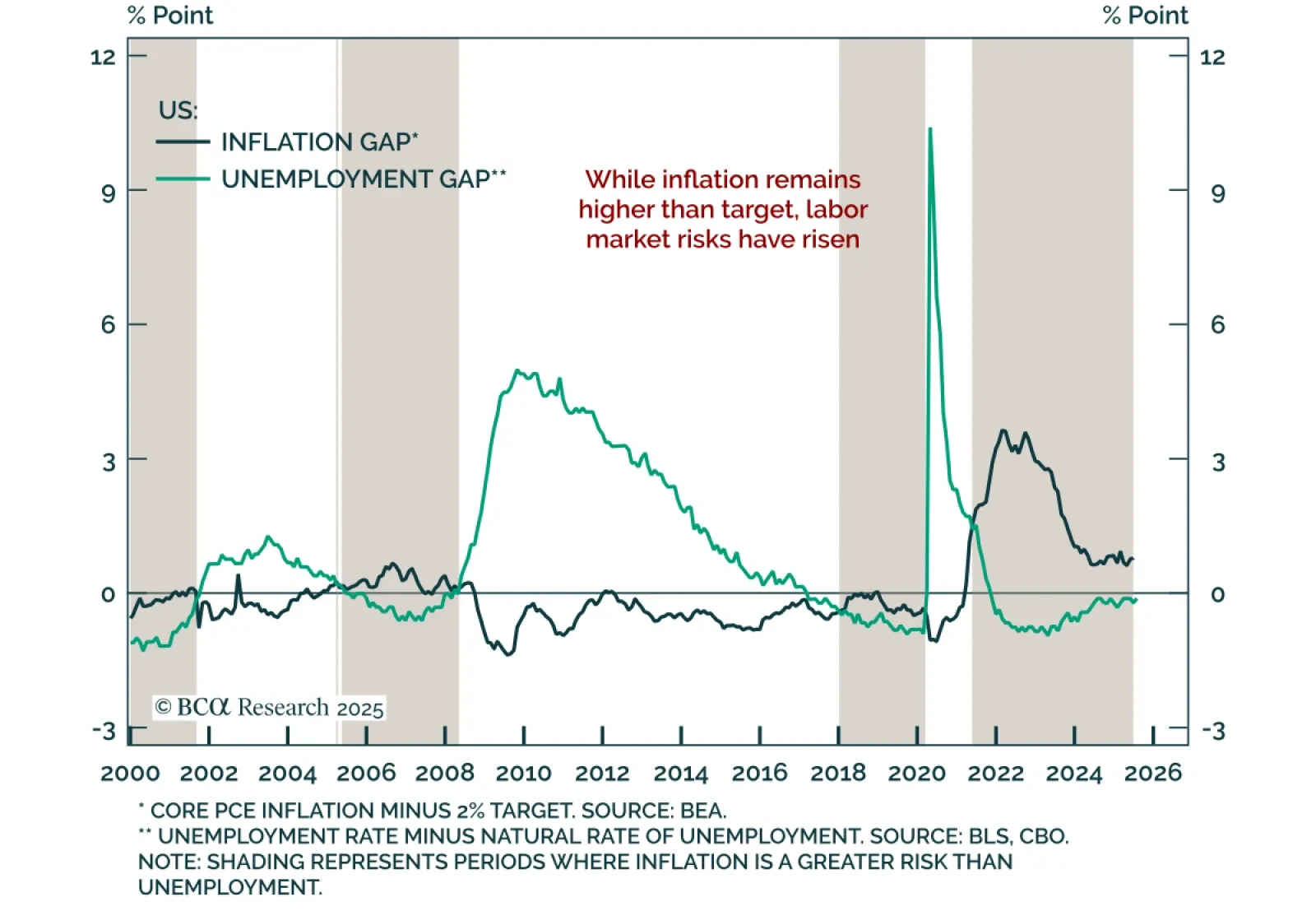

Mixed consumer confidence data and weakening labor signals argue for a modestly defensive stance. The August Conference Board Consumer Confidence Index beat expectations but fell from an upwardly revised 98.7. The present situation…

Powell’s Jackson Hole speech was misread, and points to cautious dovishness. Some commentators called it hawkish, others suggested the Fed abandoned its 2% target. Neither is accurate. Central bank communication is rarely…

The post-Liberation Day rally has broadened, reducing skepticism and strengthening the case for US outperformance versus Europe. The S&P 500’s climb to all-time highs has been unusually smooth, compressing realized…

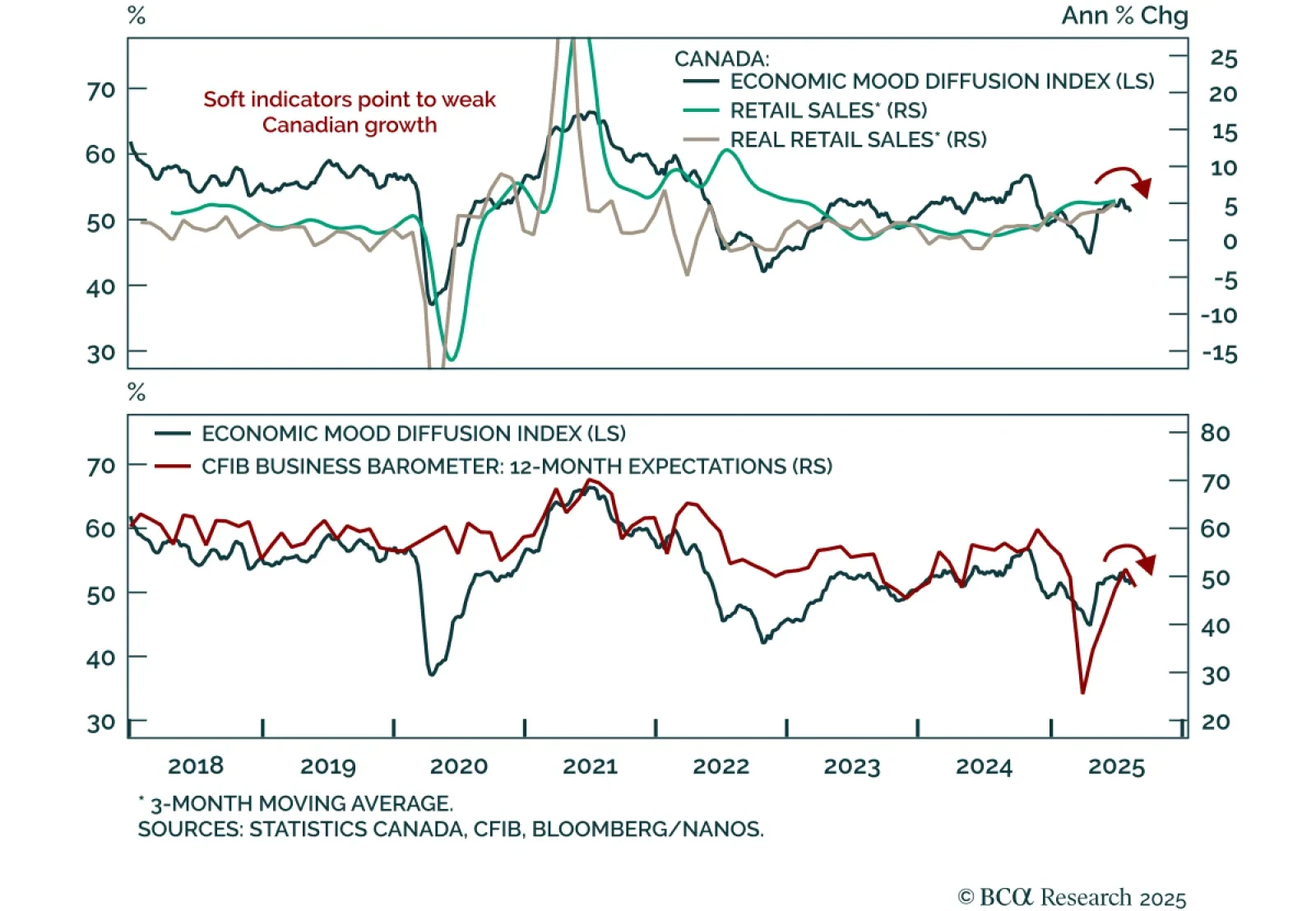

Canada’s fragile growth backdrop reinforces the case for more BoC easing than markets price. June retail sales rose 1.5% m/m, in line with expectations. Excluding autos, sales were stronger at 1.9%. However, the advance estimate…

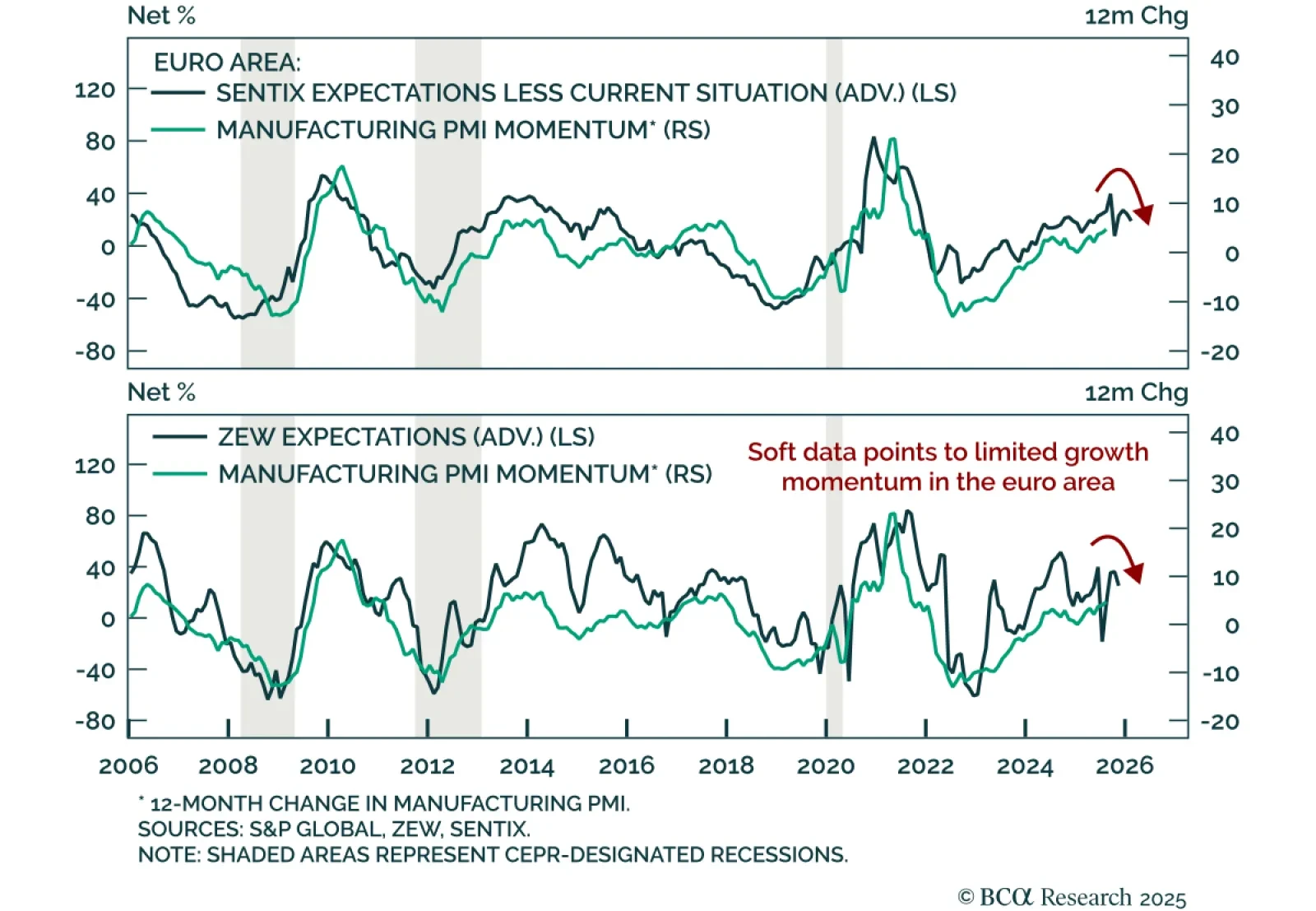

Although Euro area PMIs beat expectations in August, the growth outlook remains weak. The composite index rose to 51.1, driven by manufacturing returning to expansion at 50.5 from 49.8. Meanwhile the services PMI slipped 0.3…