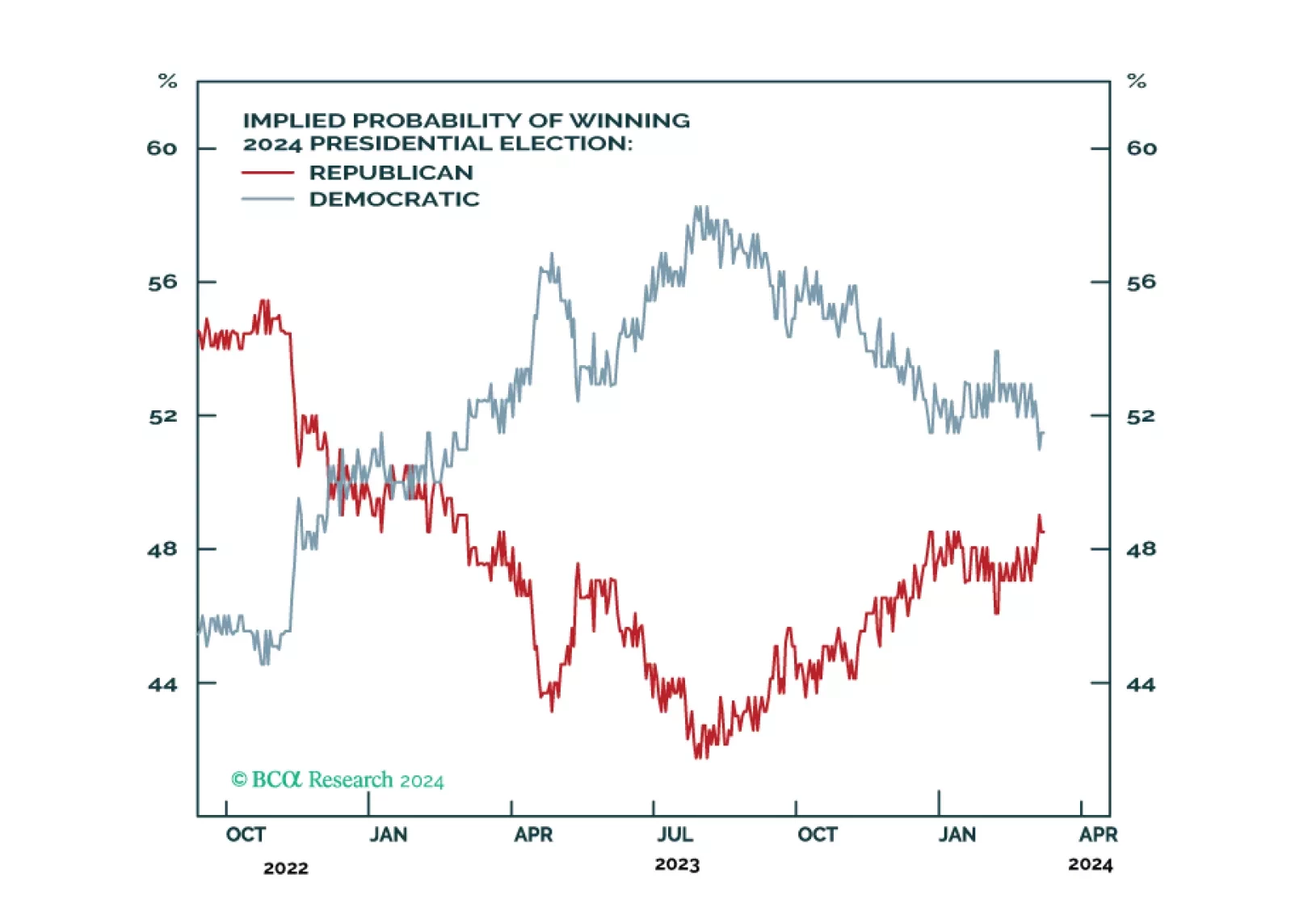

Democrats are still slightly favored for reelection as the incumbent party is presiding over a growing economy. However, Biden’s strong showing in the primary election is not lifting his popular approval yet, and that is a worrying…

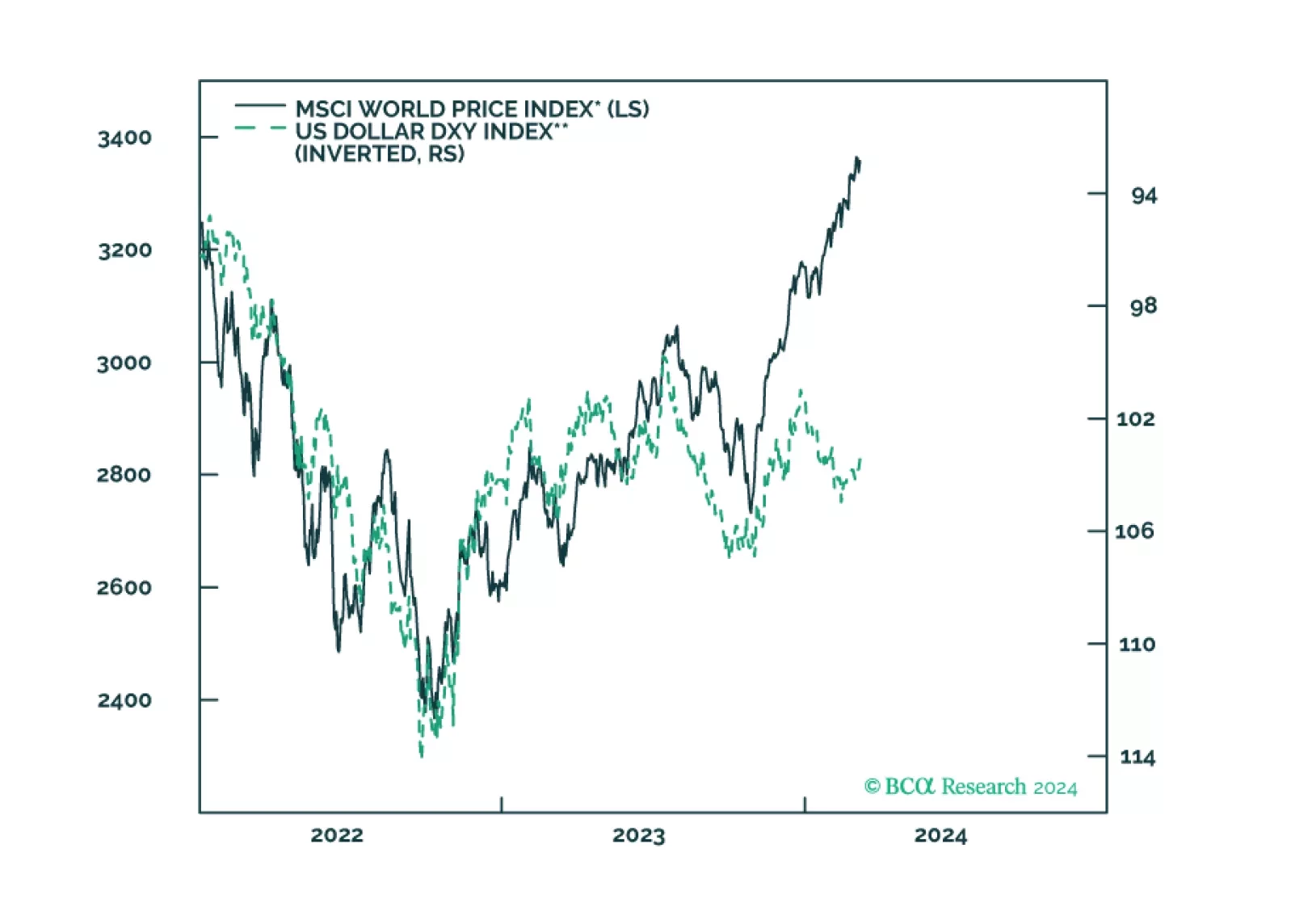

Presently, our four high-conviction themes are: (1) the US dollar will rally as US growth continues to outpace the rest of the world; (2) US equities will continue to outperform EM and European stocks until a major sell-off occurs; (…

This week, we review our currency positions, based on the latest data from G10 economies.

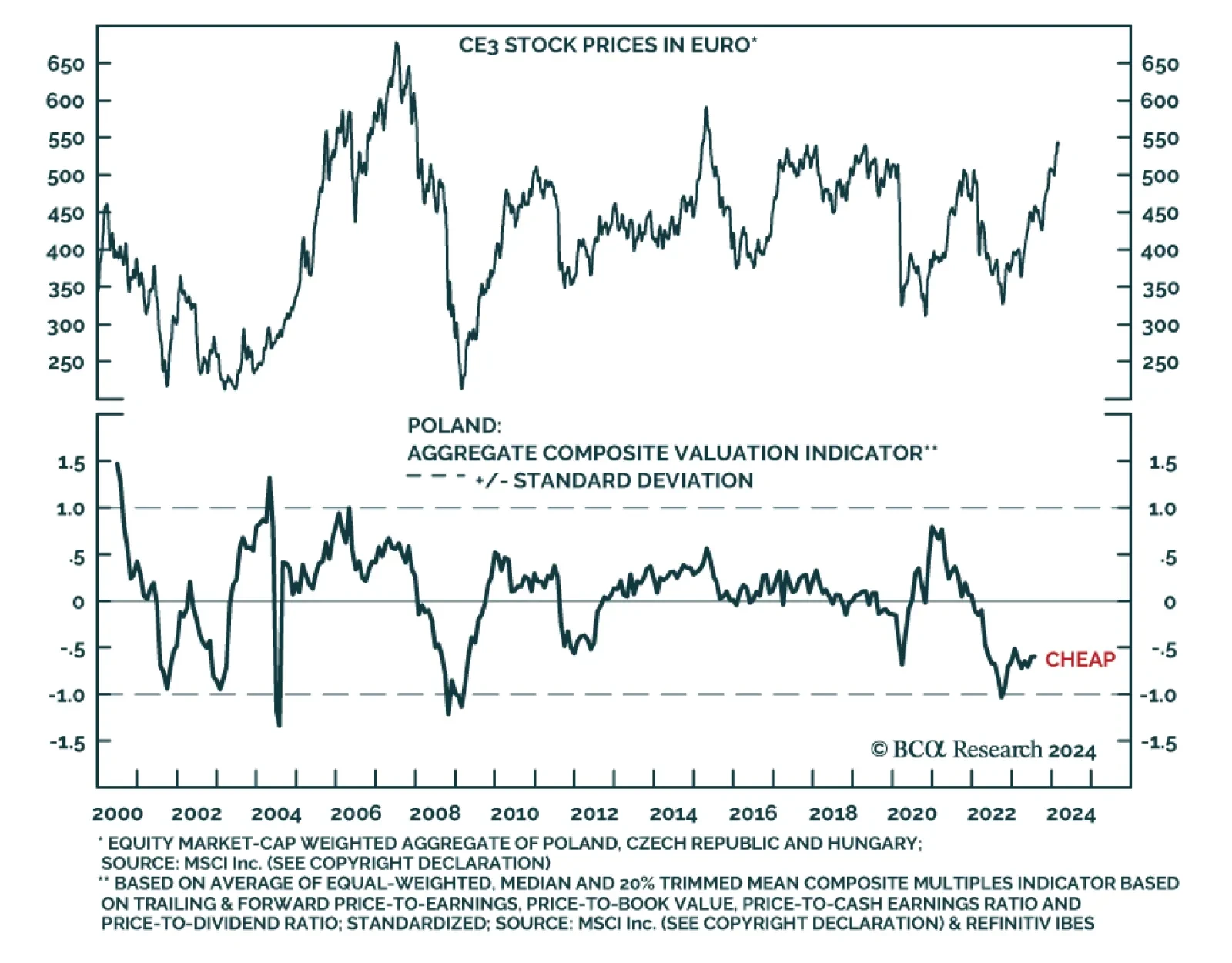

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…

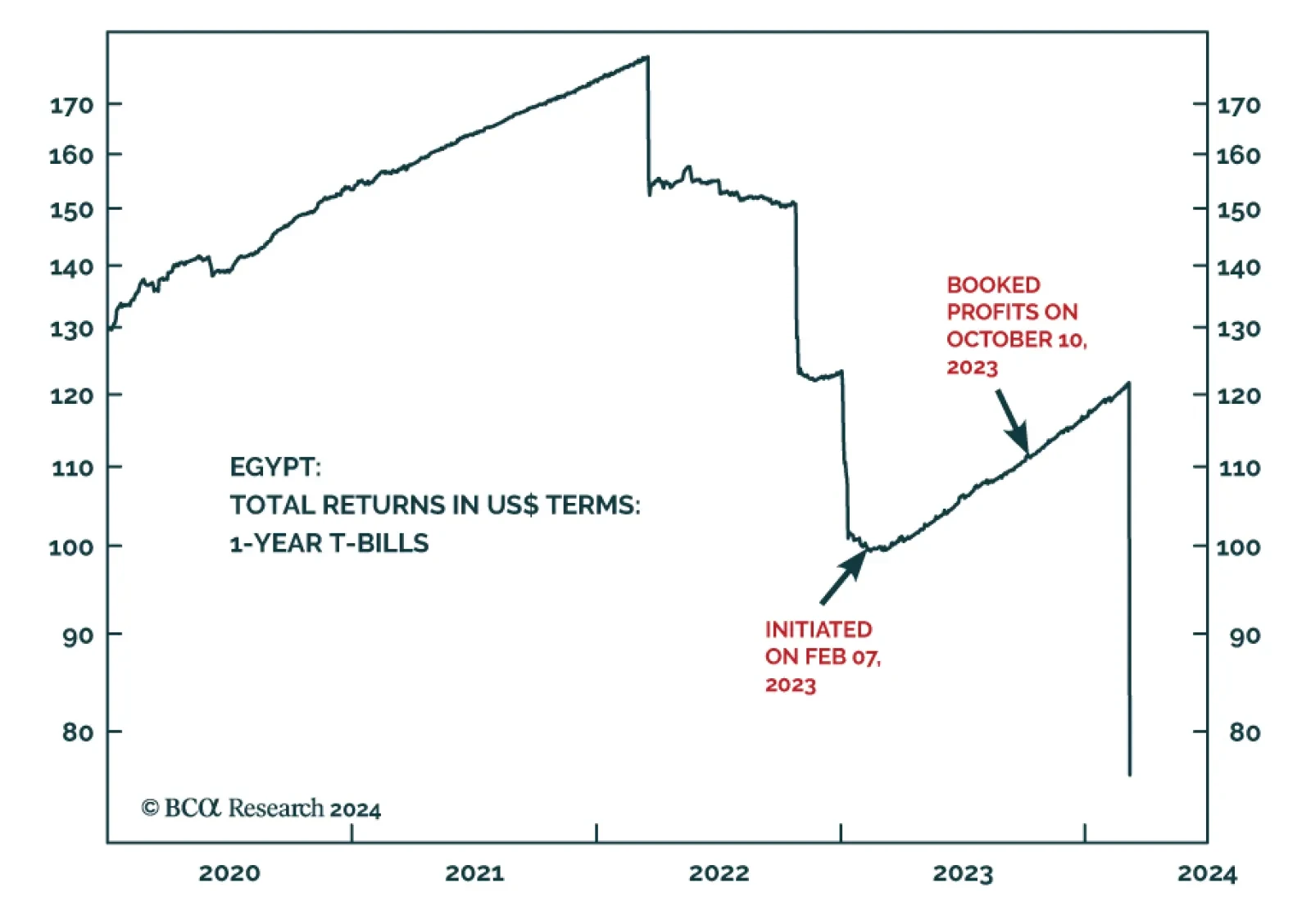

Our Emerging Market Strategy (EMS) colleagues recommended booking an 11.4% gain on their Egyptian T-bill trade initiated earlier in the year. Now that currency-devaluation risk has been removed from the picture for the…

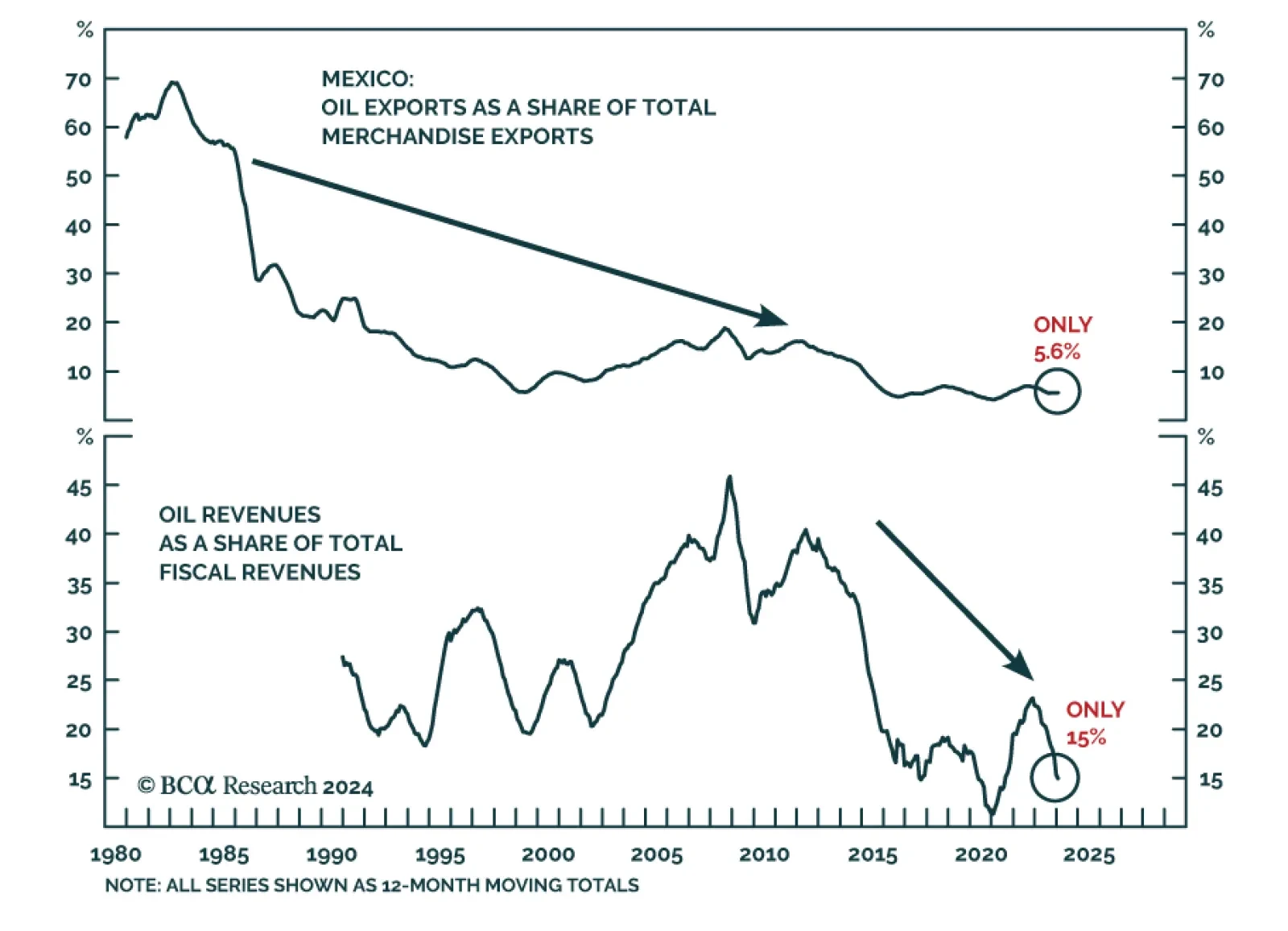

In the past couple of years, Mexico has been among the favorite markets for investors within the EM space. As our Emerging Markets Strategy team argued in a recent report, the cyclical and structural outlook for Mexican risk…

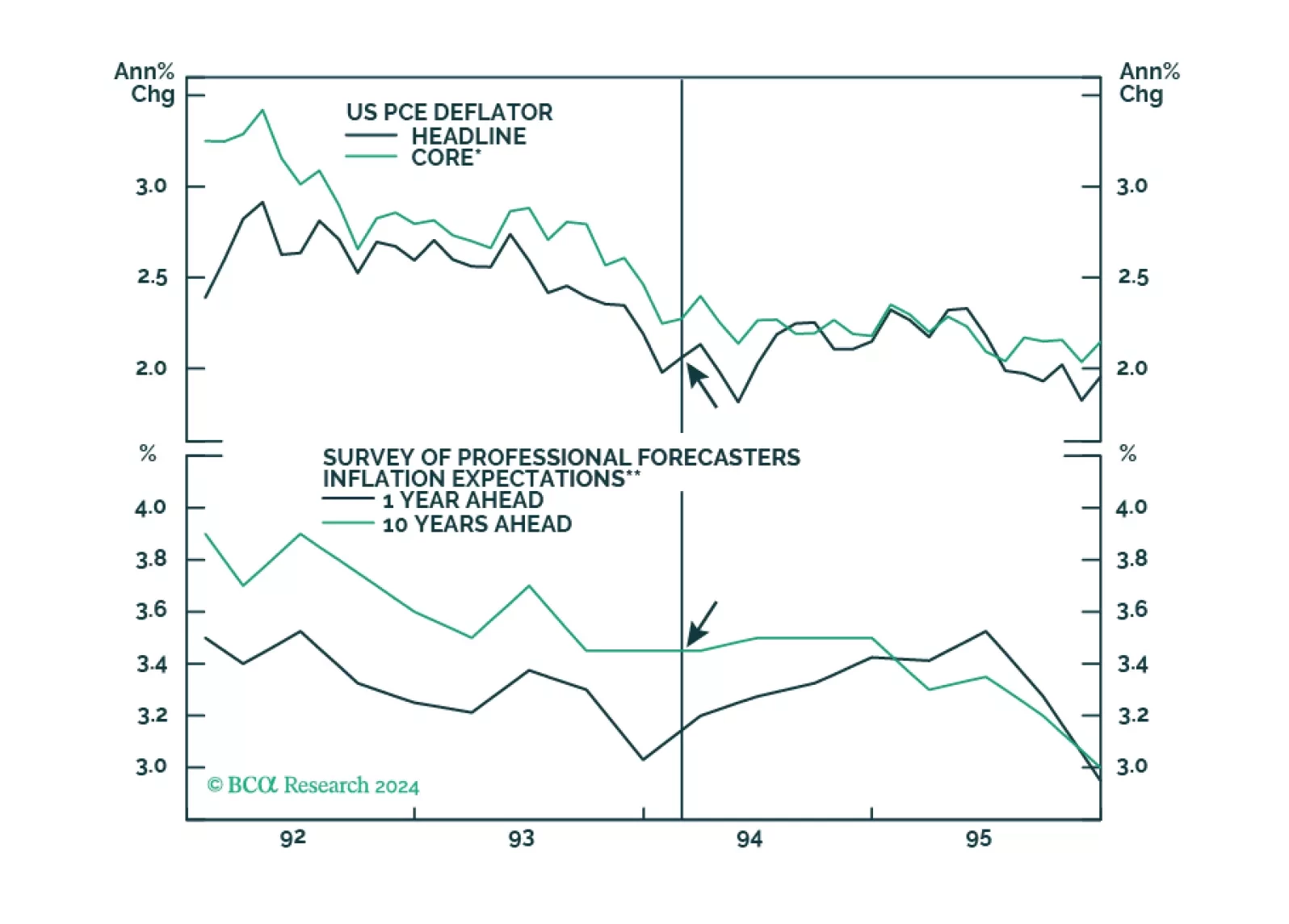

Many investors have cited the 1994 tightening cycle as an example of how the Fed managed to raise rates without triggering a recession. However, the unemployment rate was 6.5% in early 1994, which meant that inflation was less of a…

Qatar’s strategy to raise LNG output 84% by 2030 is a bold bet DM demand for energy security – and EM demand for affordable electricity to support economic and population growth – will remain a higher priority than eliminating fossil…

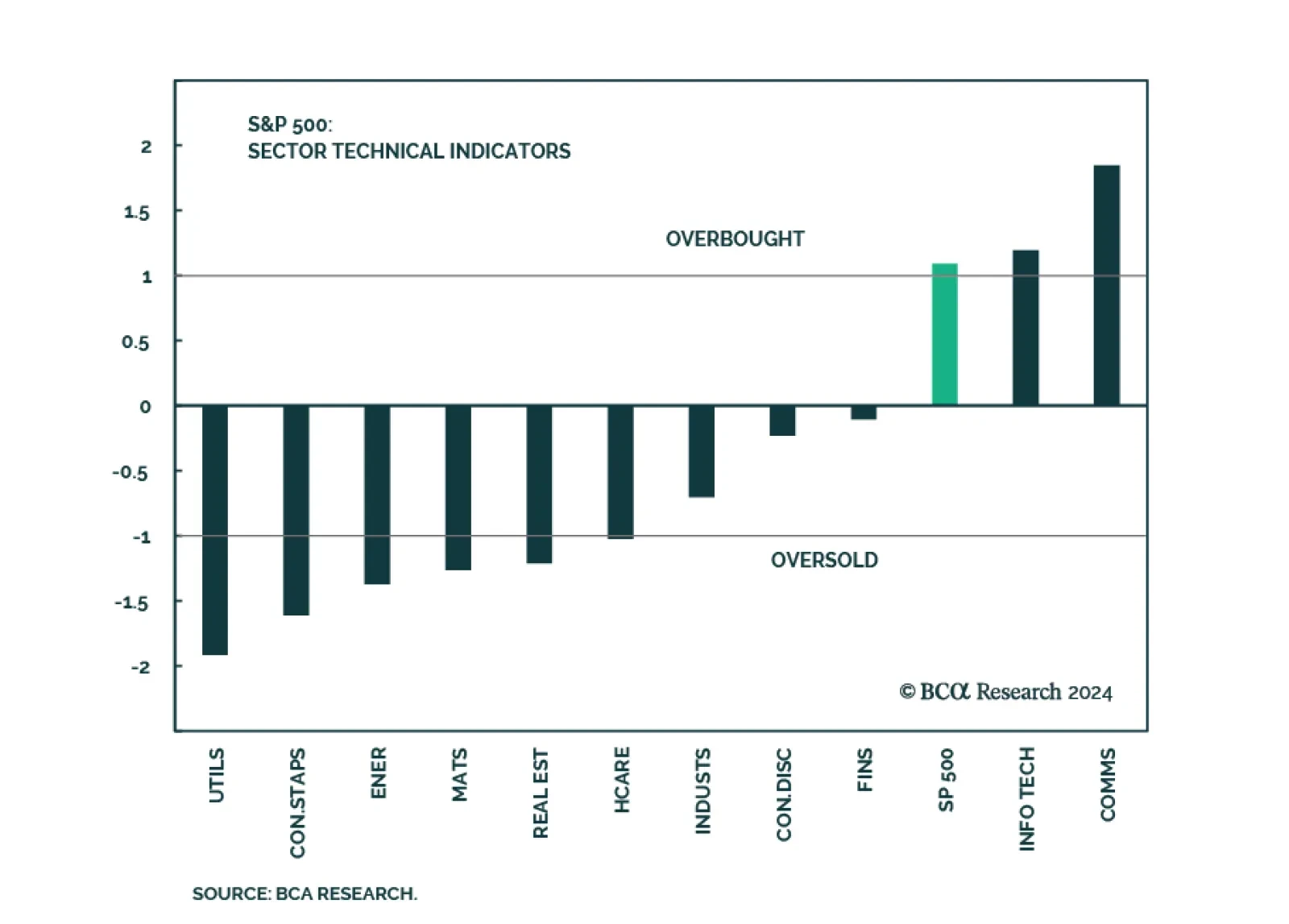

Our US Equity Strategy service released their Sector Chart Pack where they took stock of the recent earnings season and developments in the S&P 500. They observed that this February marked the strongest performance in the…