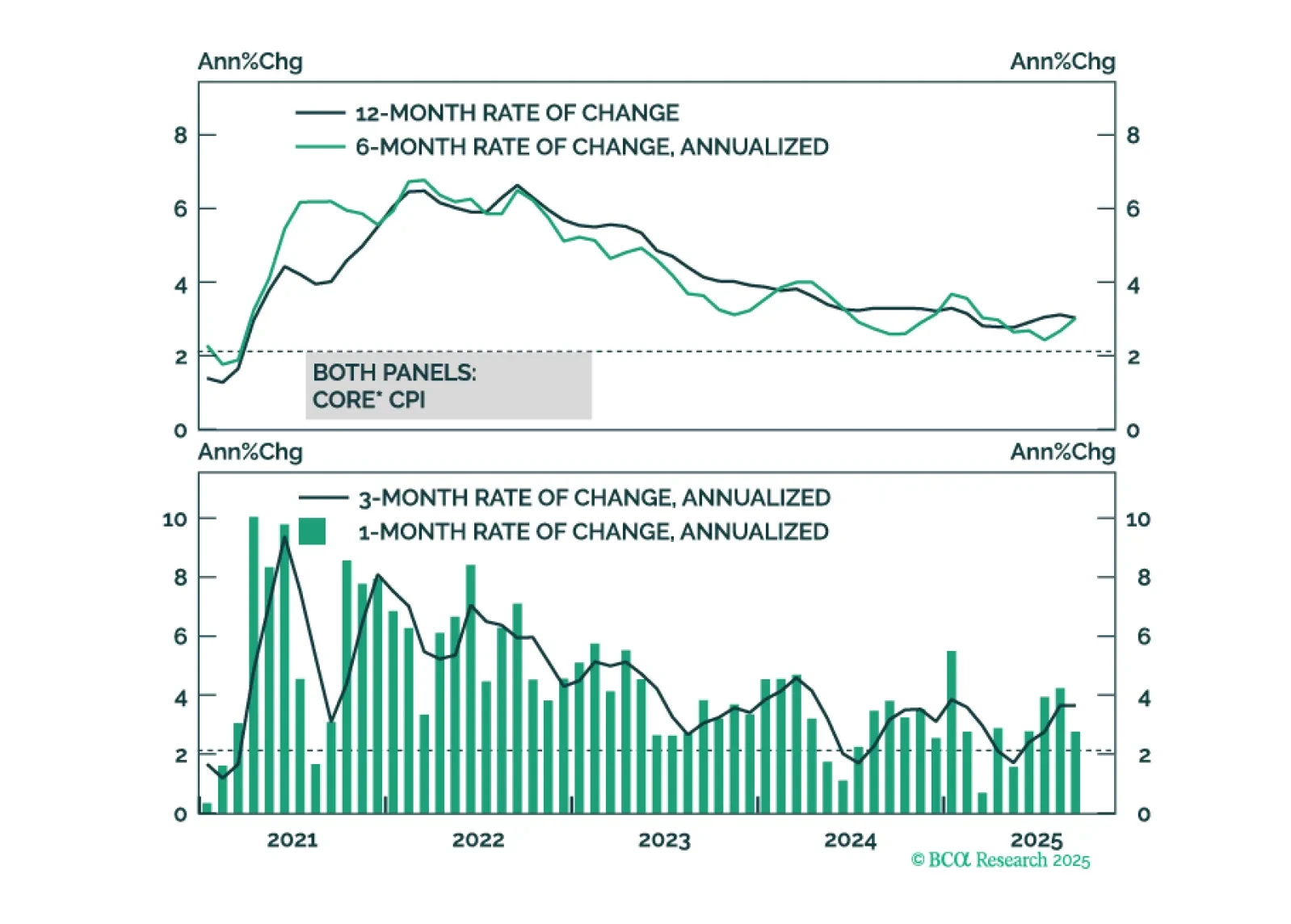

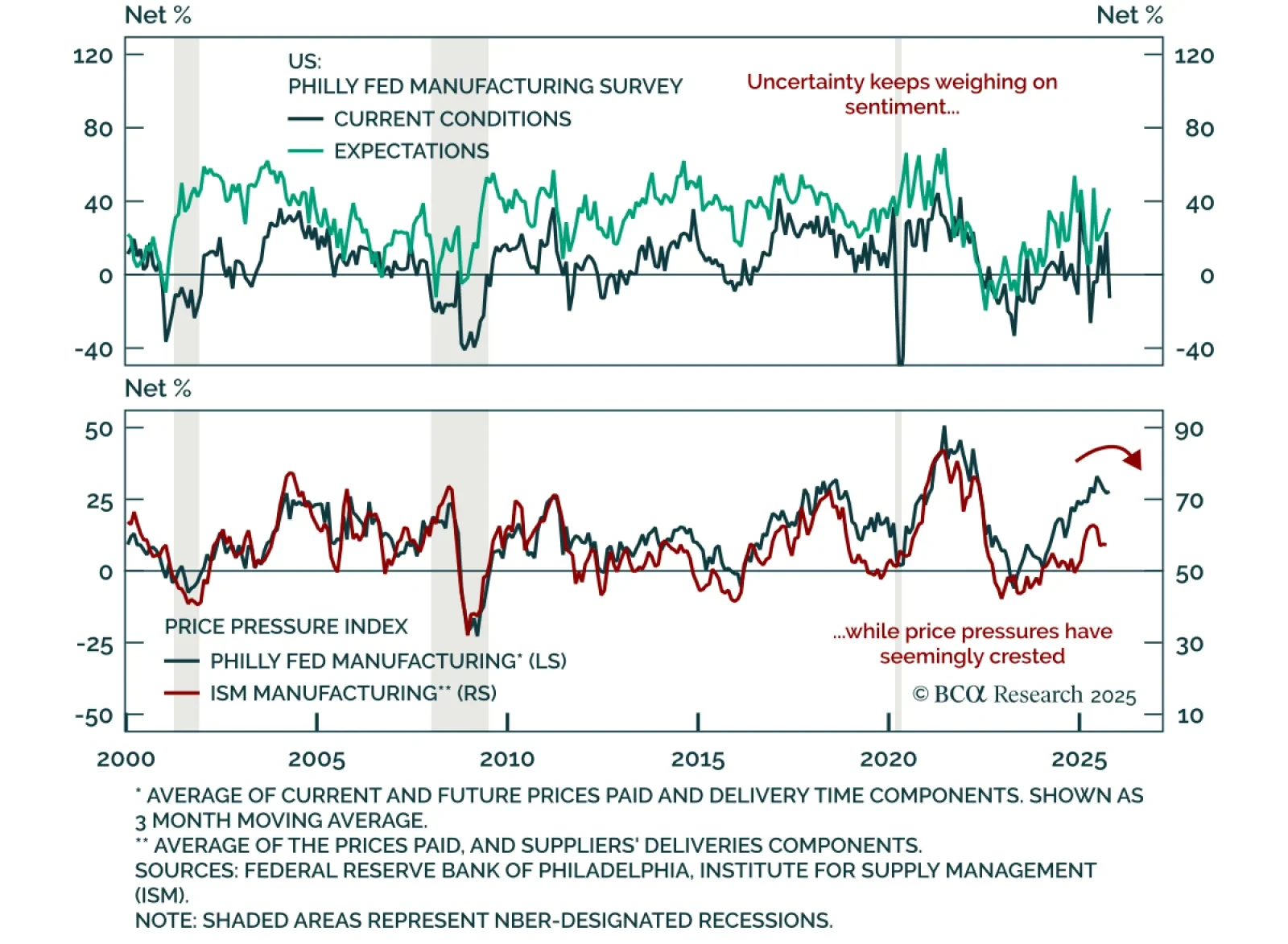

US inflation data continue to show no signs of price pressures beyond a near-term tariff effect.

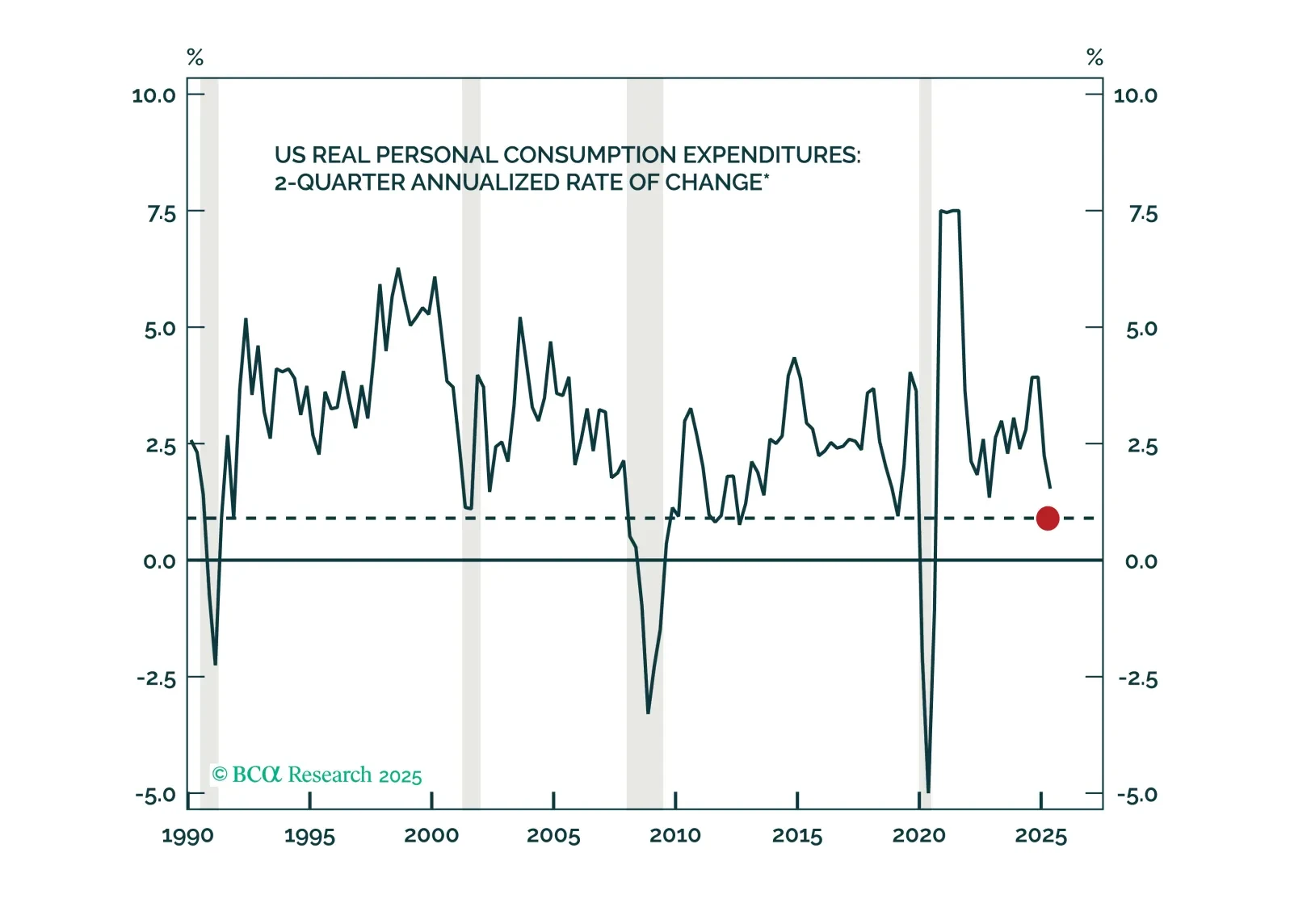

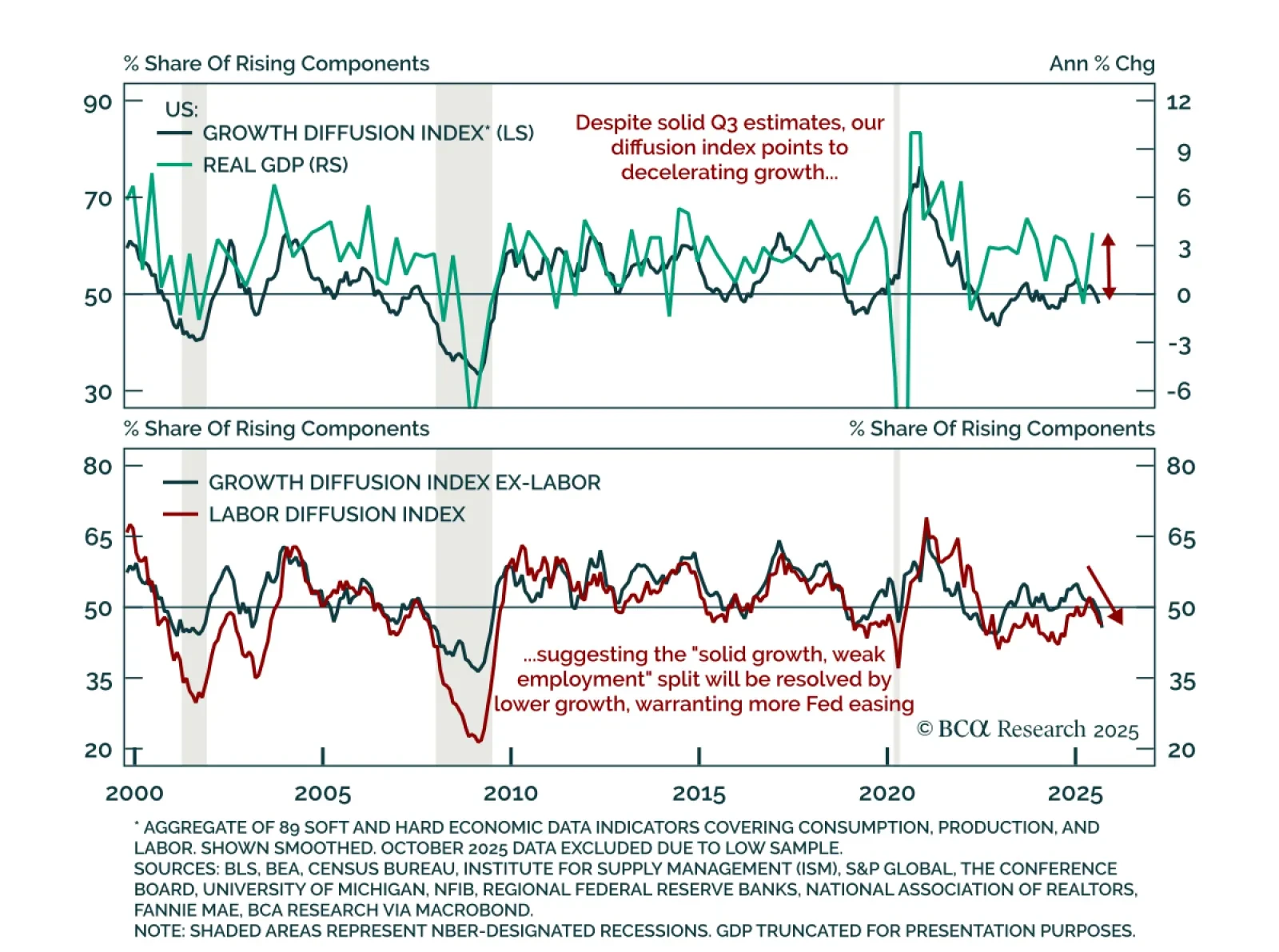

The Fed is poised to deliver a 25-basis-point rate cut this month, but a follow-up rate cut in December will depend on how the divergence between strong consumer spending and weak employment growth is resolved.

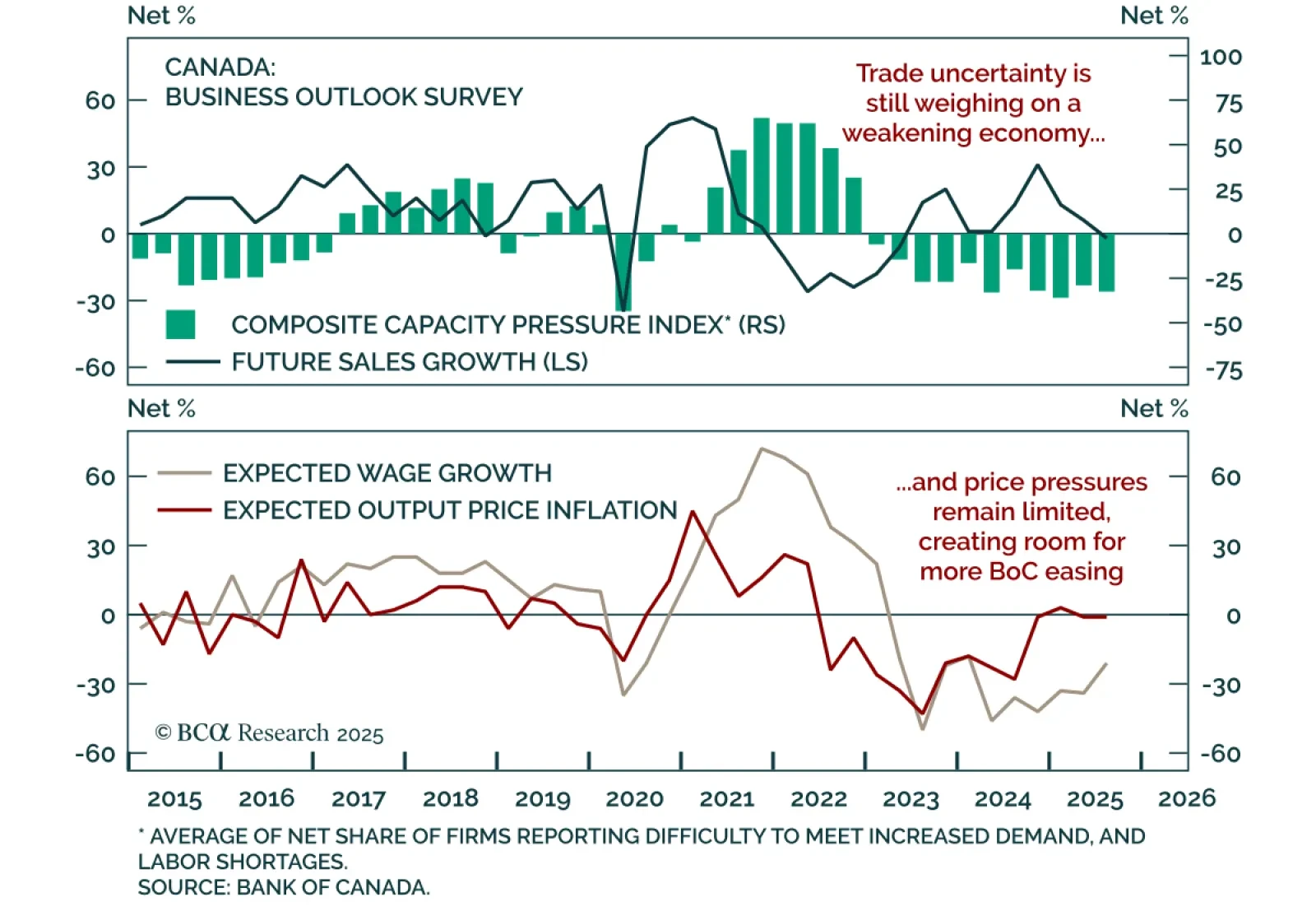

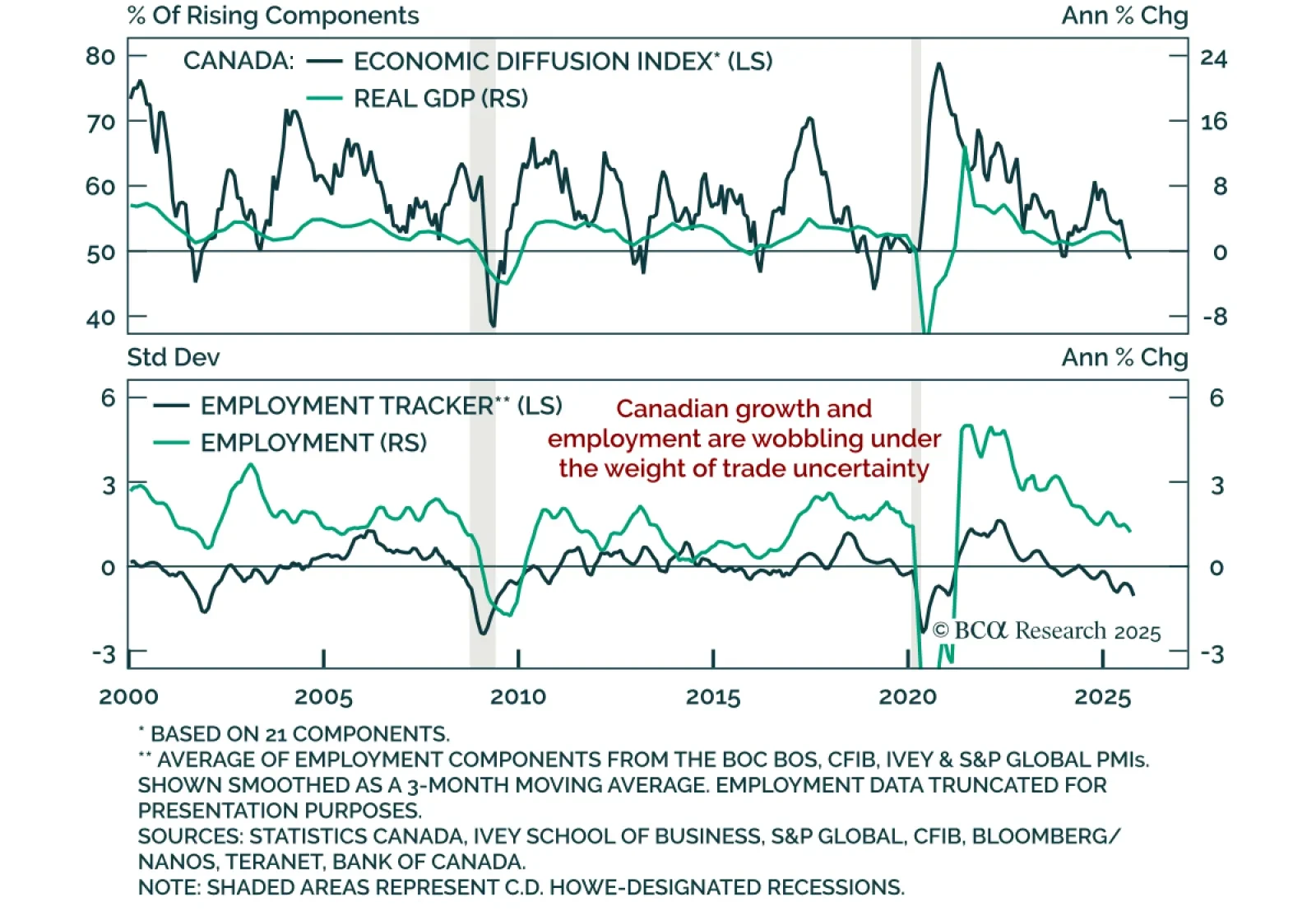

Canada’s Q3 Business Outlook Survey paints a weak macro picture with limited price pressures, supporting an overweight on CGBs and CAD 5s10s steepeners. The BOS Indicator ticked up marginally to -2.3 from -2.4, as low capacity…

The most significant divide in the stock market and the economy is the gap between companies positioned to benefit from the AI boom and companies without a link to it. The former are surging while many of the latter are struggling.

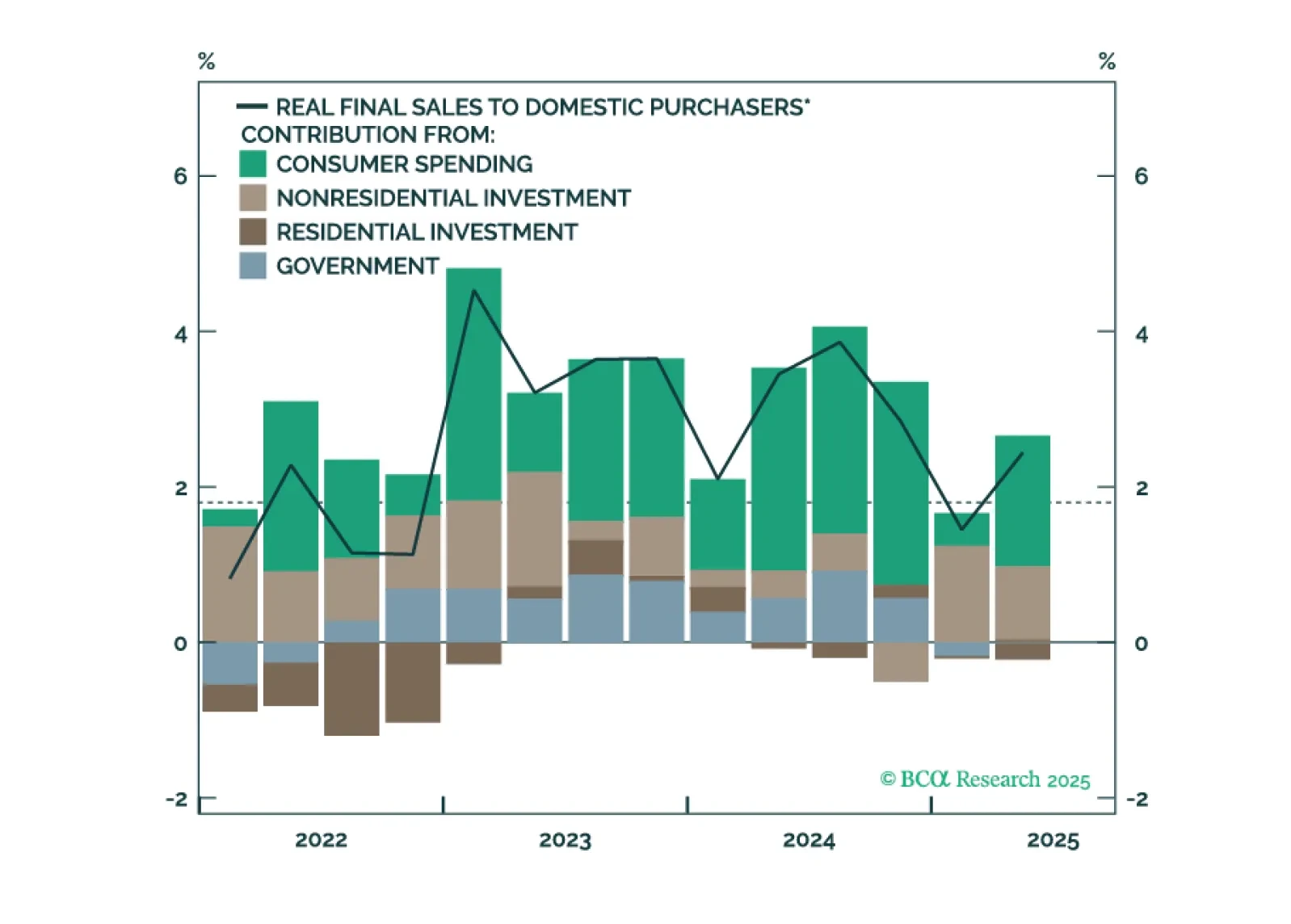

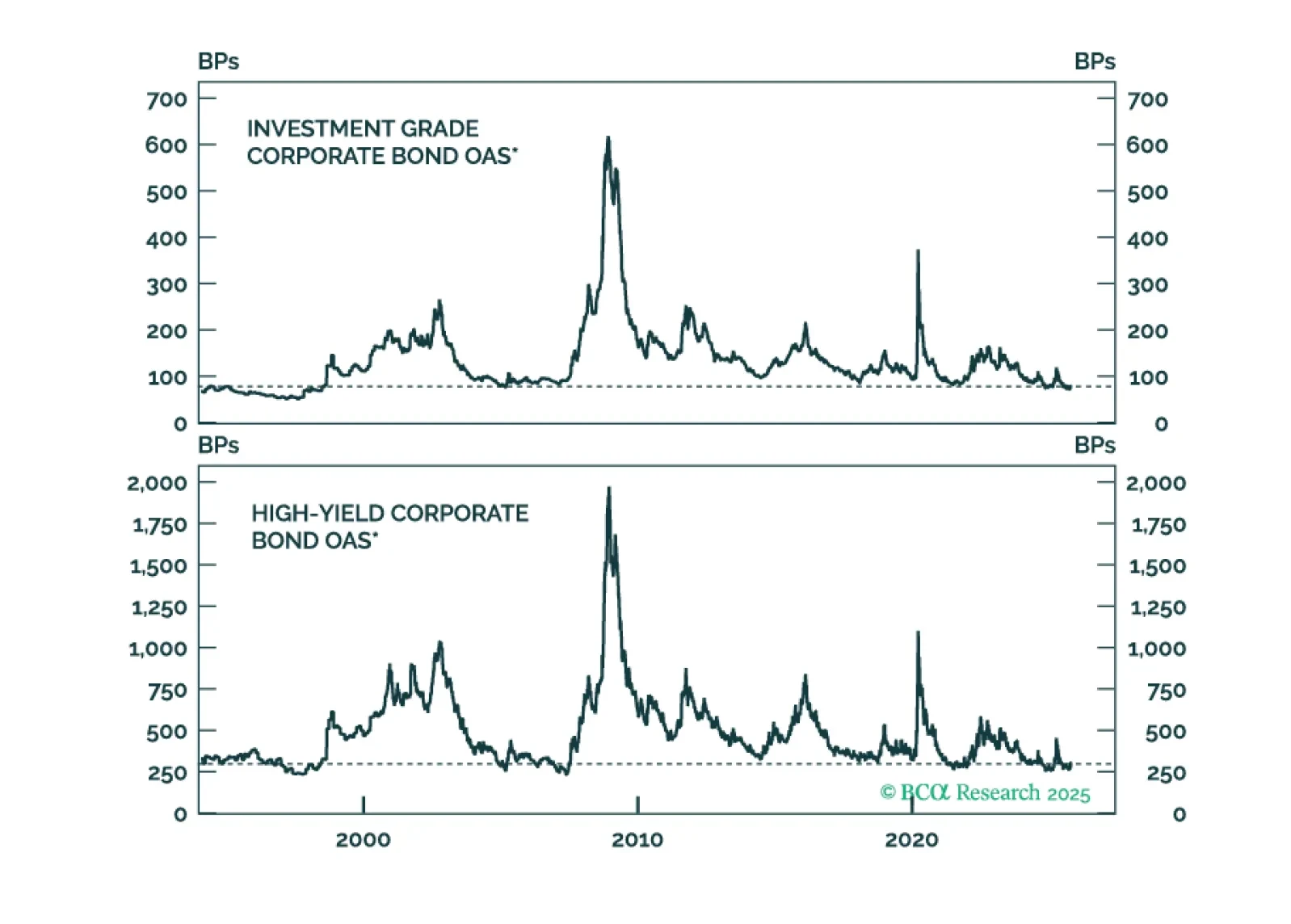

We expect the divergence between resilient growth and weakening employment to be resolved by lower growth estimates, supporting long duration and steepeners. Economic activity and employment usually move together in a circular…

The October Philadelphia Fed manufacturing survey was mixed, showing weak headline data but steadier underlying components. The headline index fell to -12.8 from 23.2, the lowest level since April 2025. Underlying details were not as…

Recent Canadian data confirm slowing growth, reinforcing support for government bonds and steepeners. The October CFIB Business Barometer fell to 46.3 from 50.2, indicating contraction and underscoring the risk posed by small…

The October Empire Manufacturing survey beat estimates, but weak investment and hiring intentions temper its positive signal. The index rose to 10.7 from -8.7, indicating modest activity growth. New orders ticked up, and shipments…

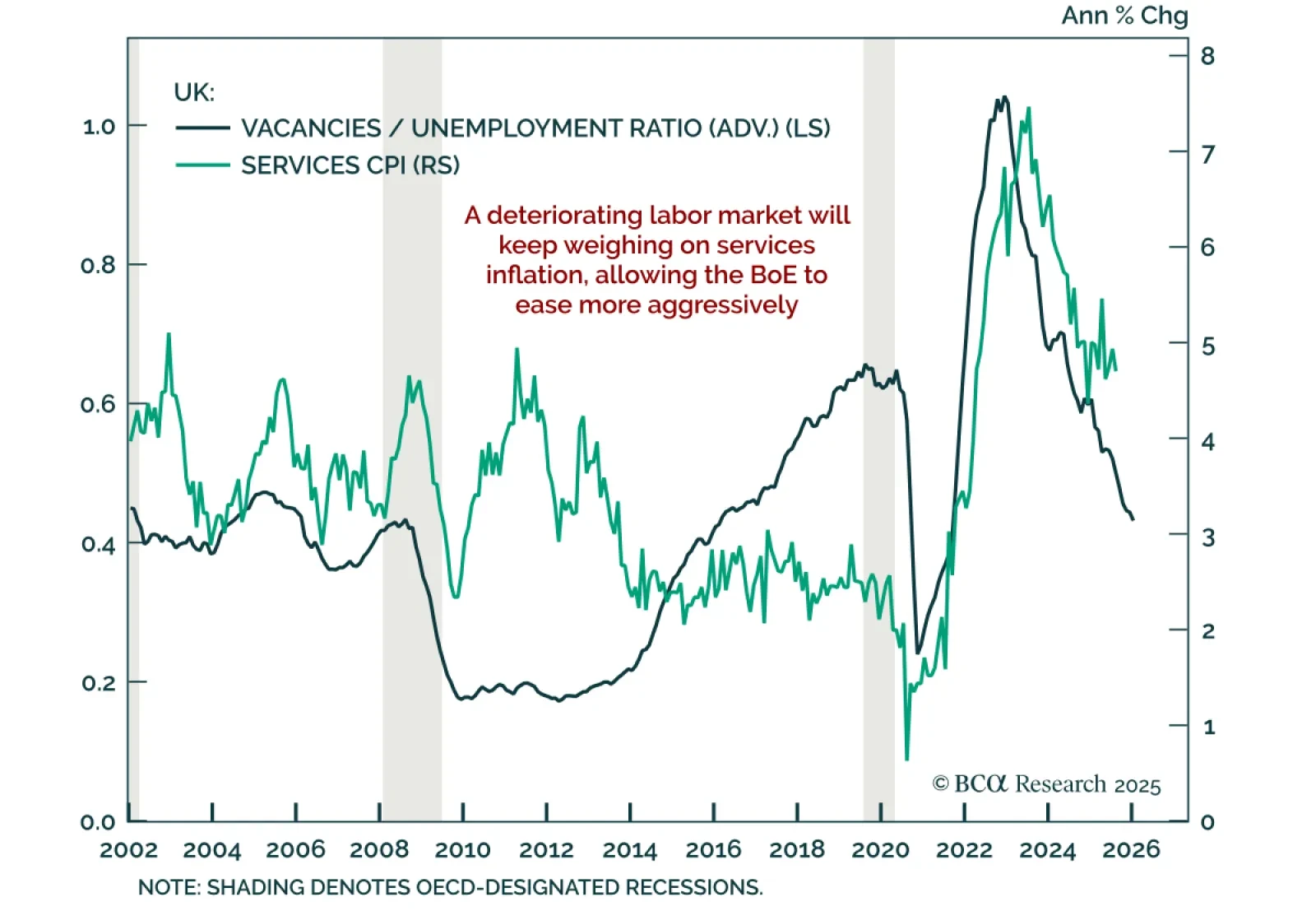

UK labor data weakened in August and September, reinforcing downside inflation risks and supporting overweight Gilts with 2s10s steepeners. Payrolls fell by 10k in September, while job vacancies continued to slide to cyclical lows as…