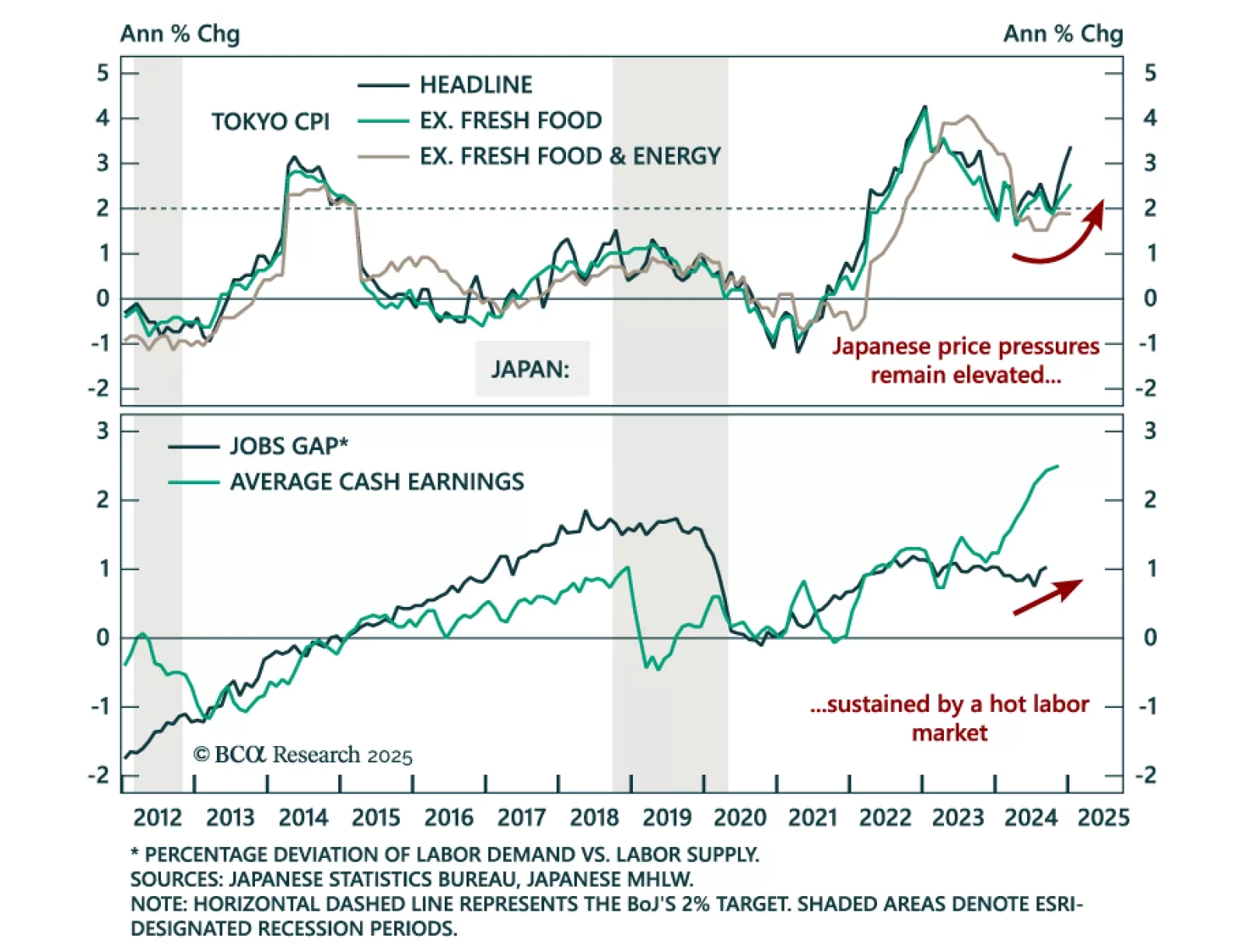

The January Tokyo CPI came in stronger than expected, with headline inflation accelerating to 3.4% y/y from 3.0%, and “core core” (ex. fresh food and energy) accelerating to 1.9% from 1.8%. The jobless rate also decreased 0.1% to 2.4…

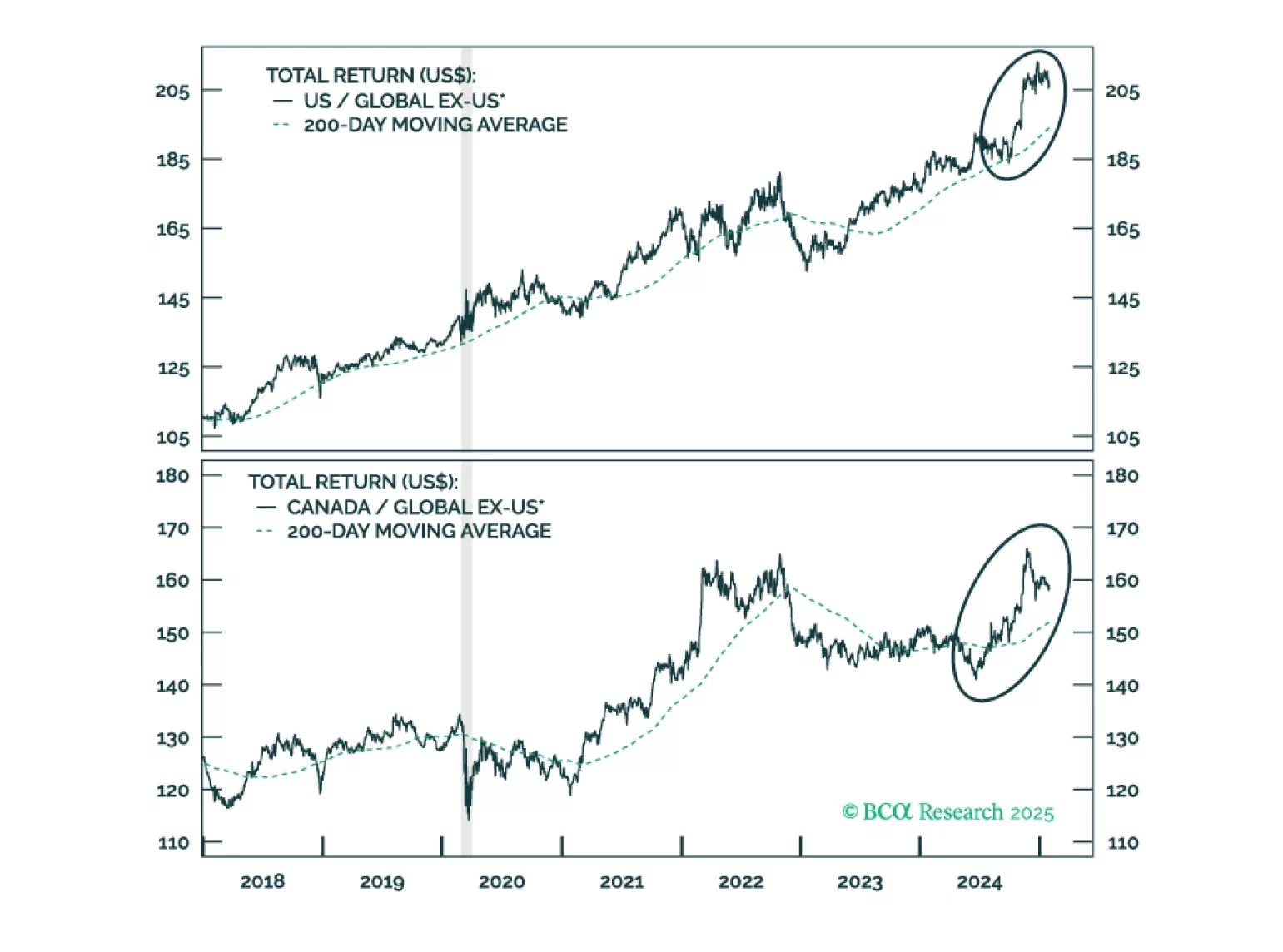

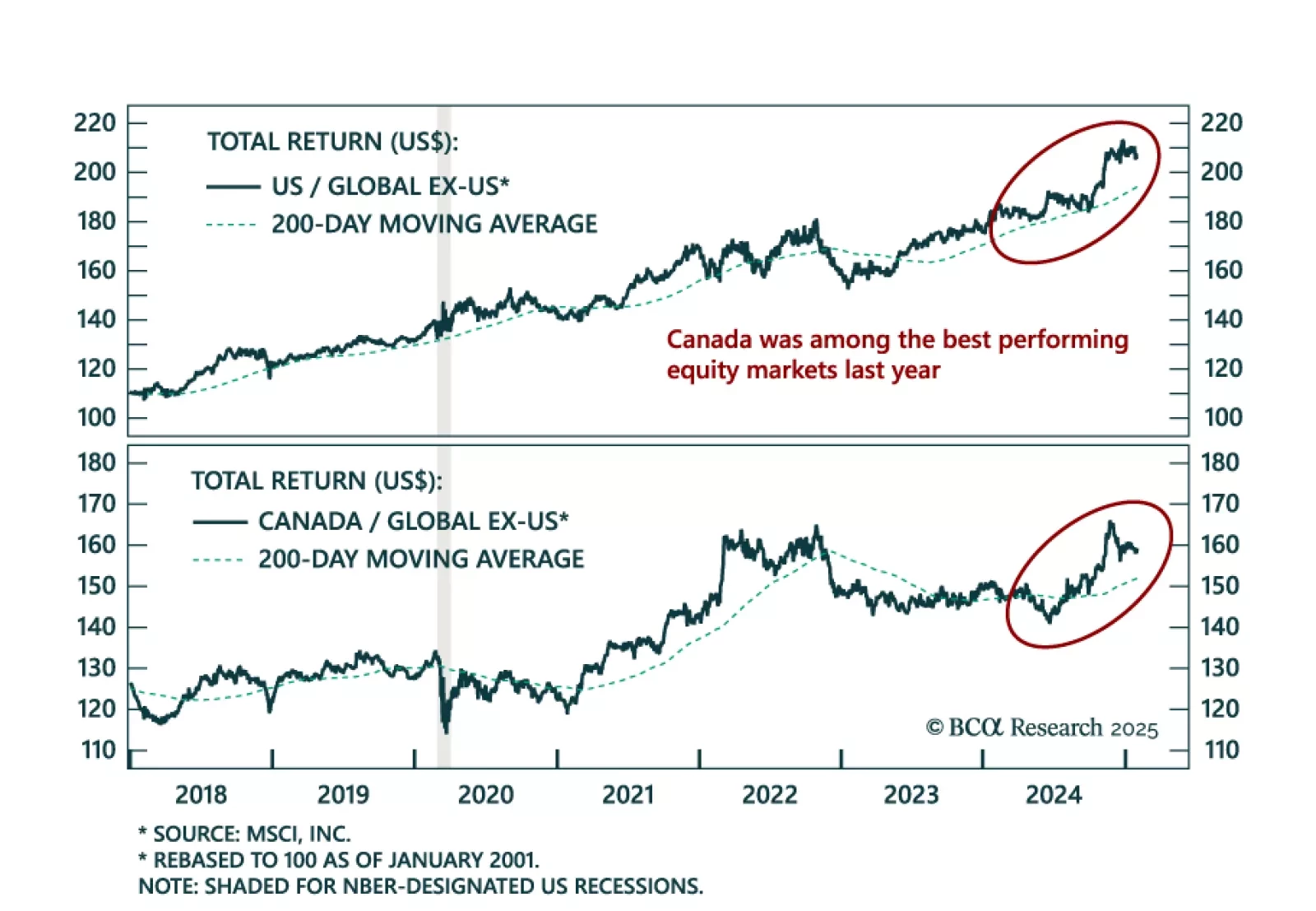

Our colleagues from The Bank Credit Analyst revisited the outlook for Canadian stocks after they outperformed global ex-US stocks in late 2024. The outperformance was driven by financials and tech. While Canadian tech gains were…

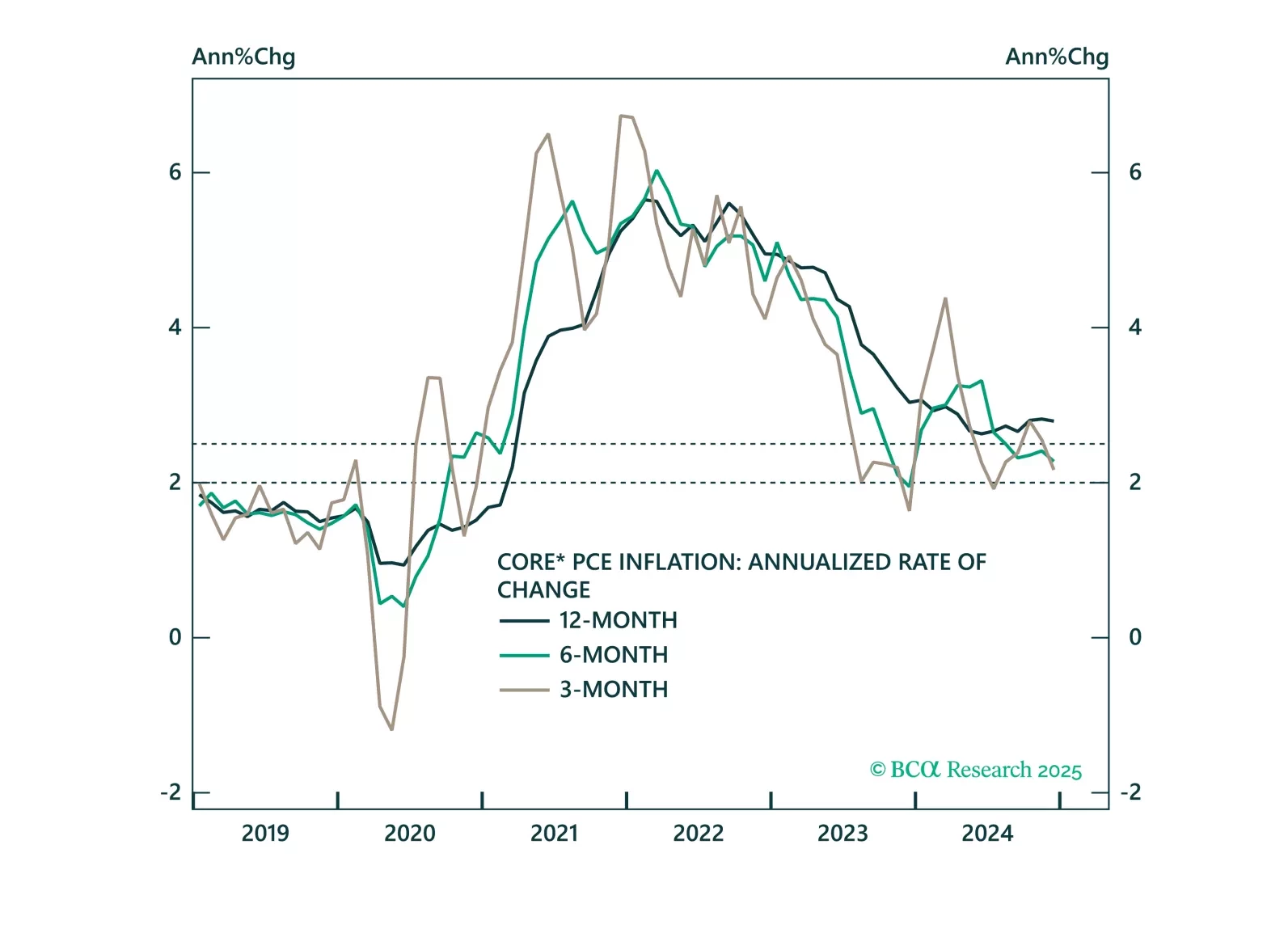

Core PCE inflation came in soft this morning and is tracking well below the Fed’s 2025 forecast. We highlight three upside risks to inflation and preview next week’s employment report.

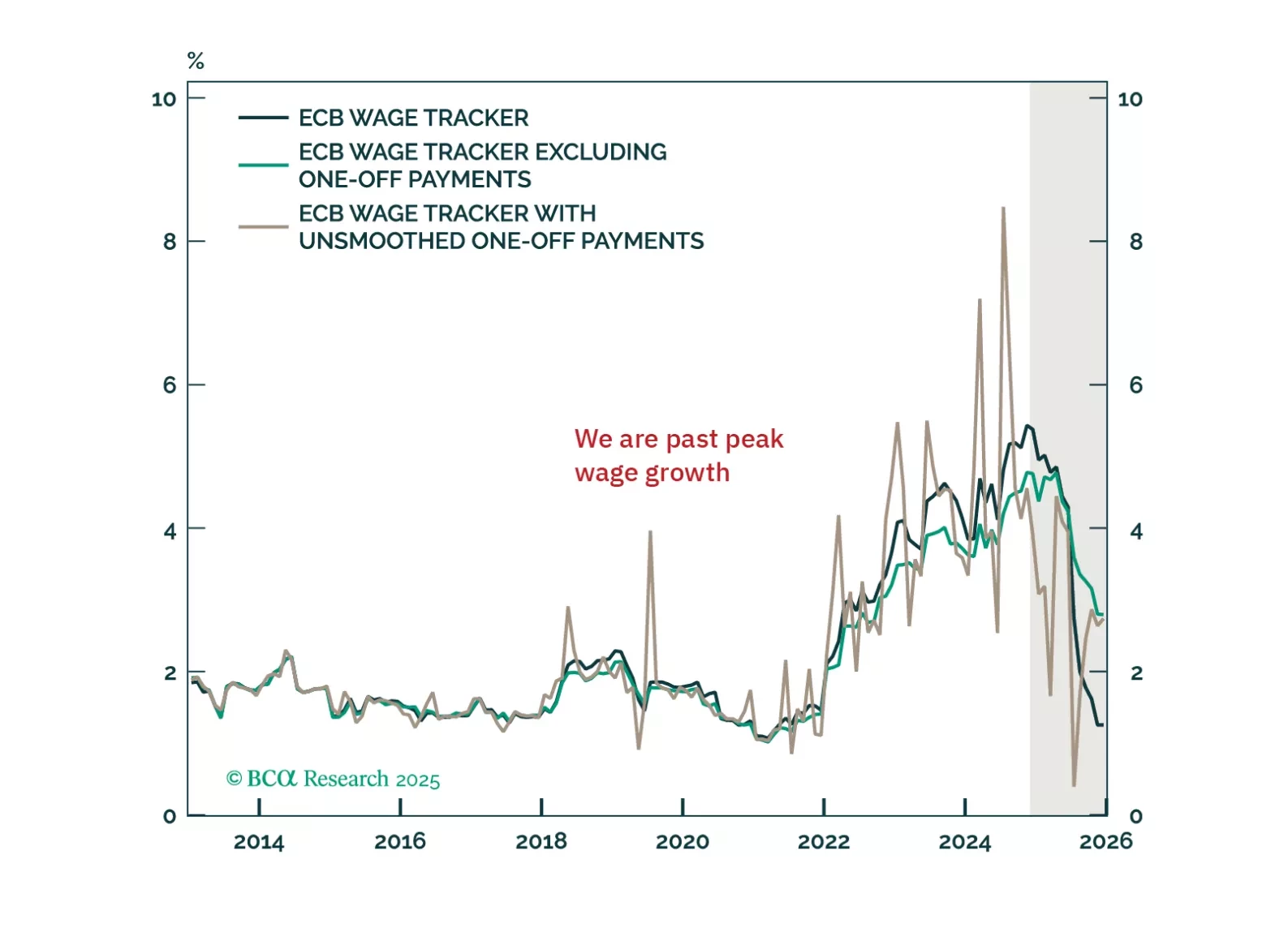

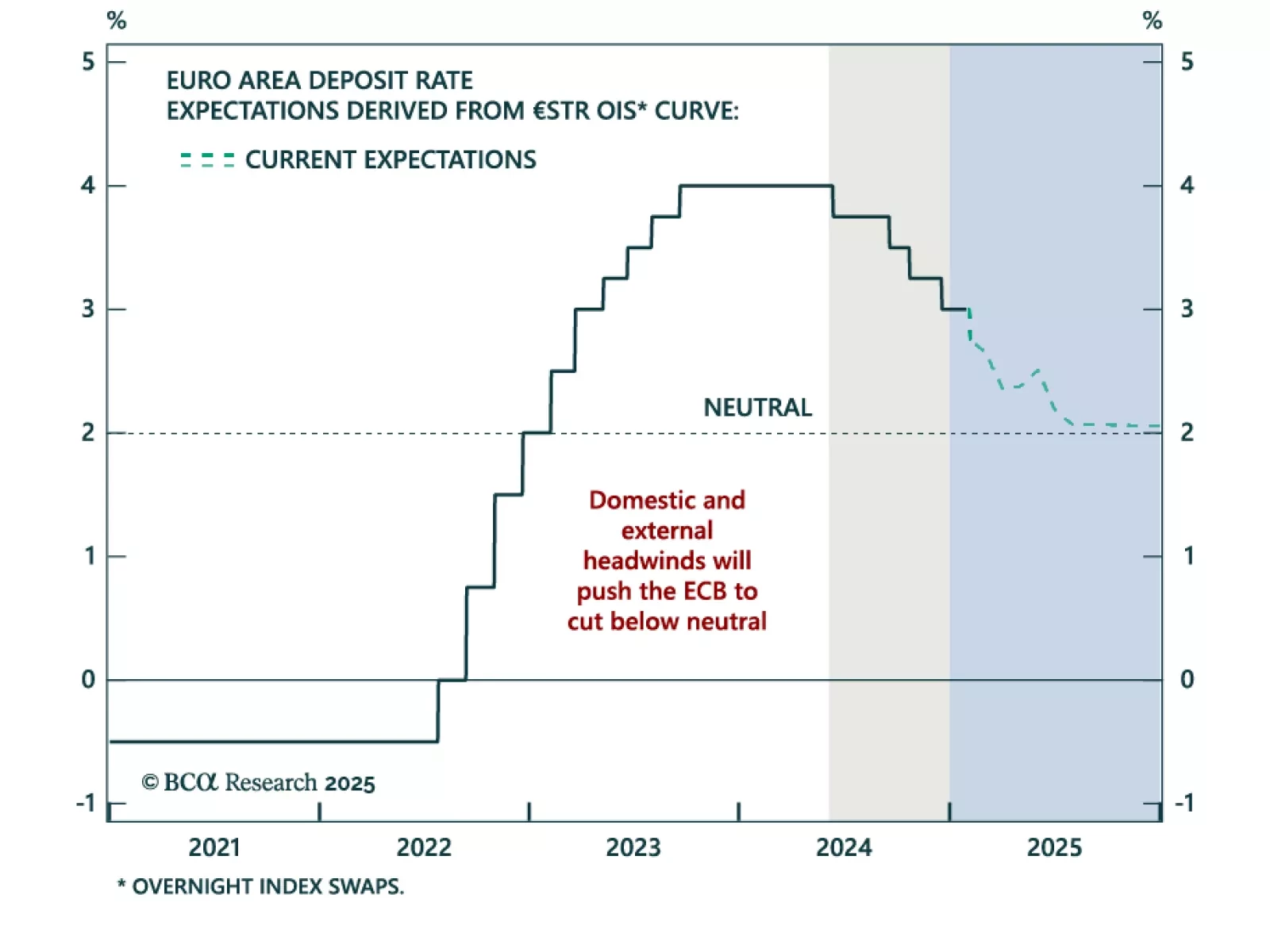

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

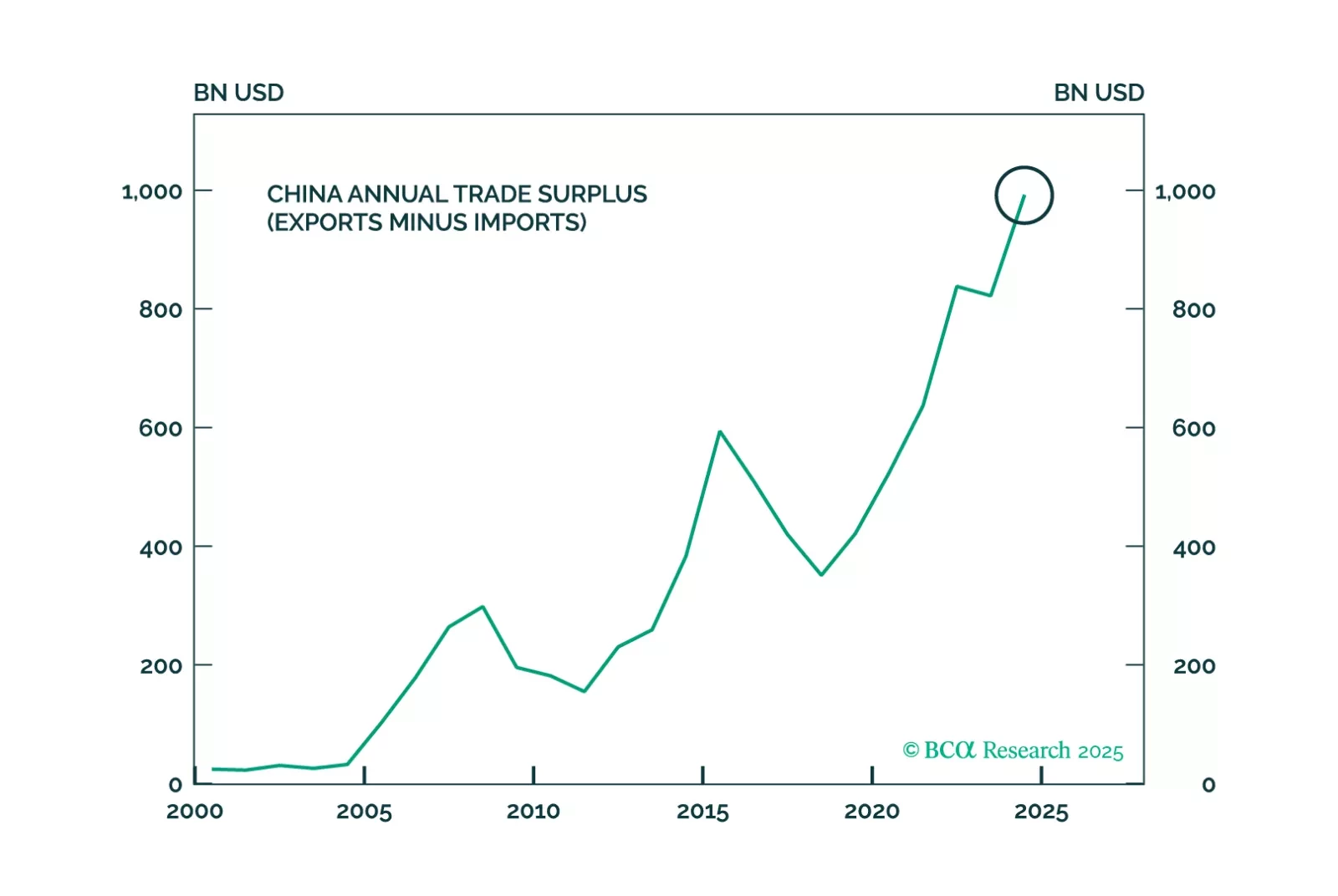

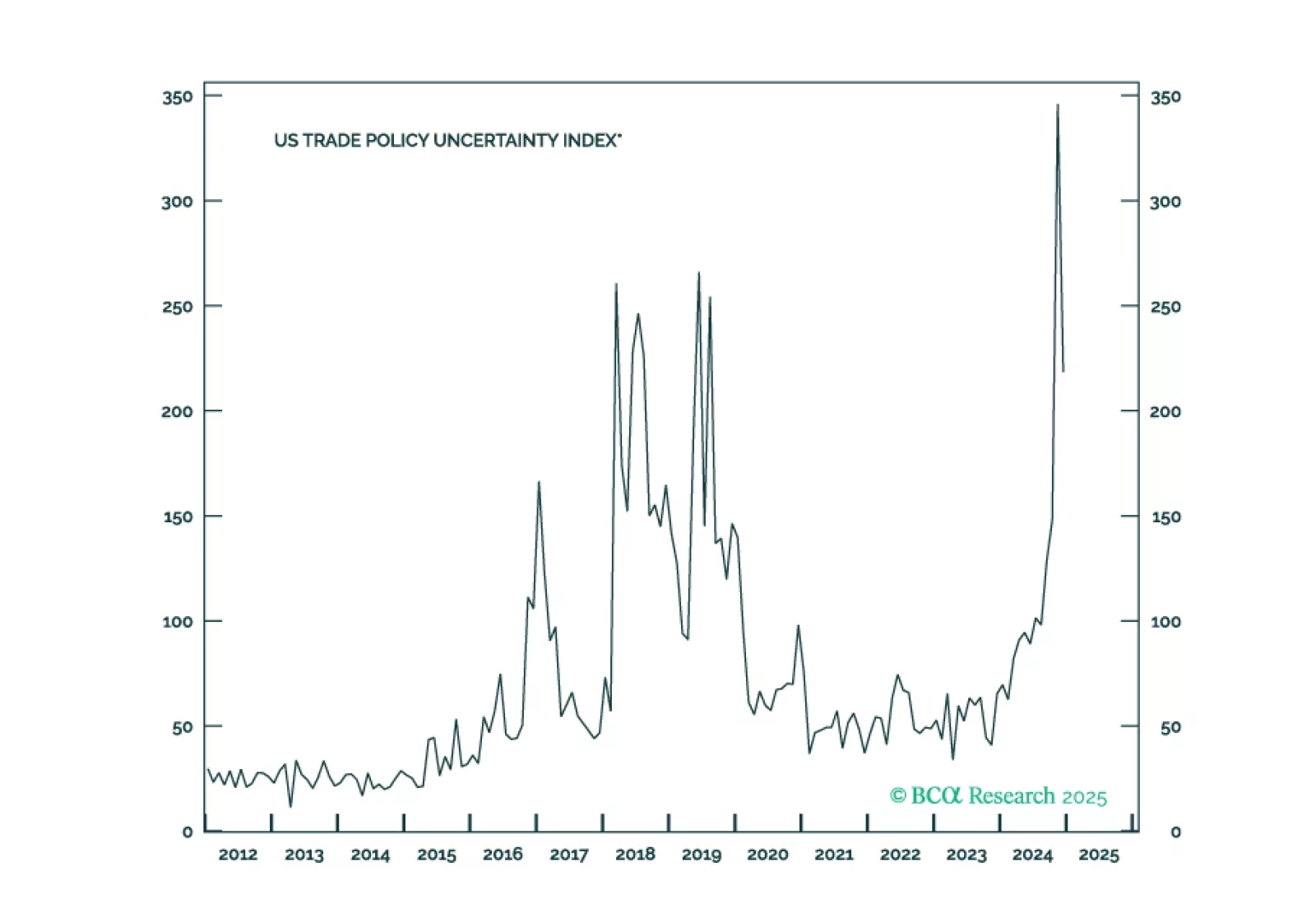

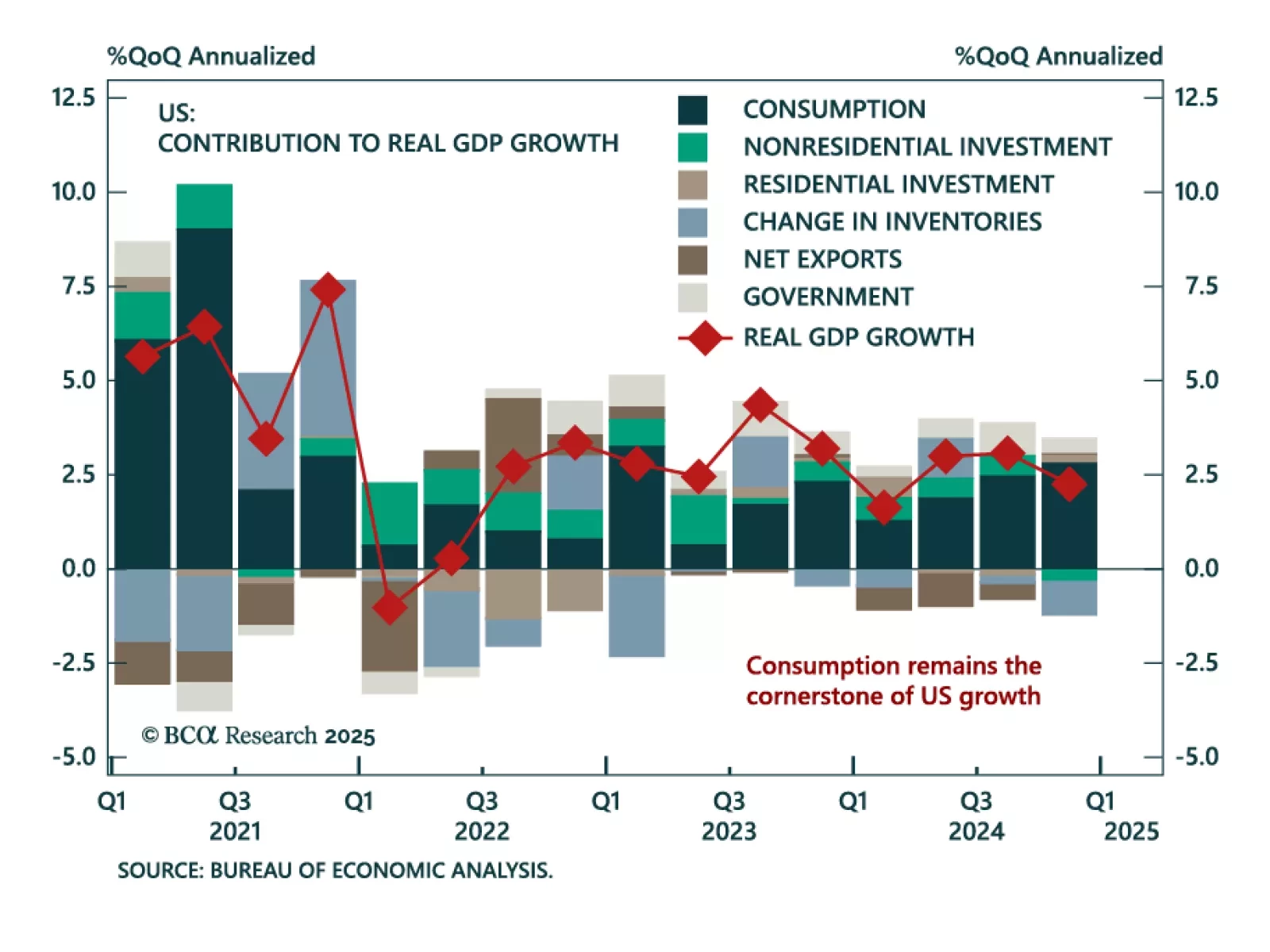

In Section I, Doug highlights that recent trade developments and news from the AI space are both consistent with a conservative investment stance. US final demand was robust in Q4, but the economy is still walking a tightrope as…

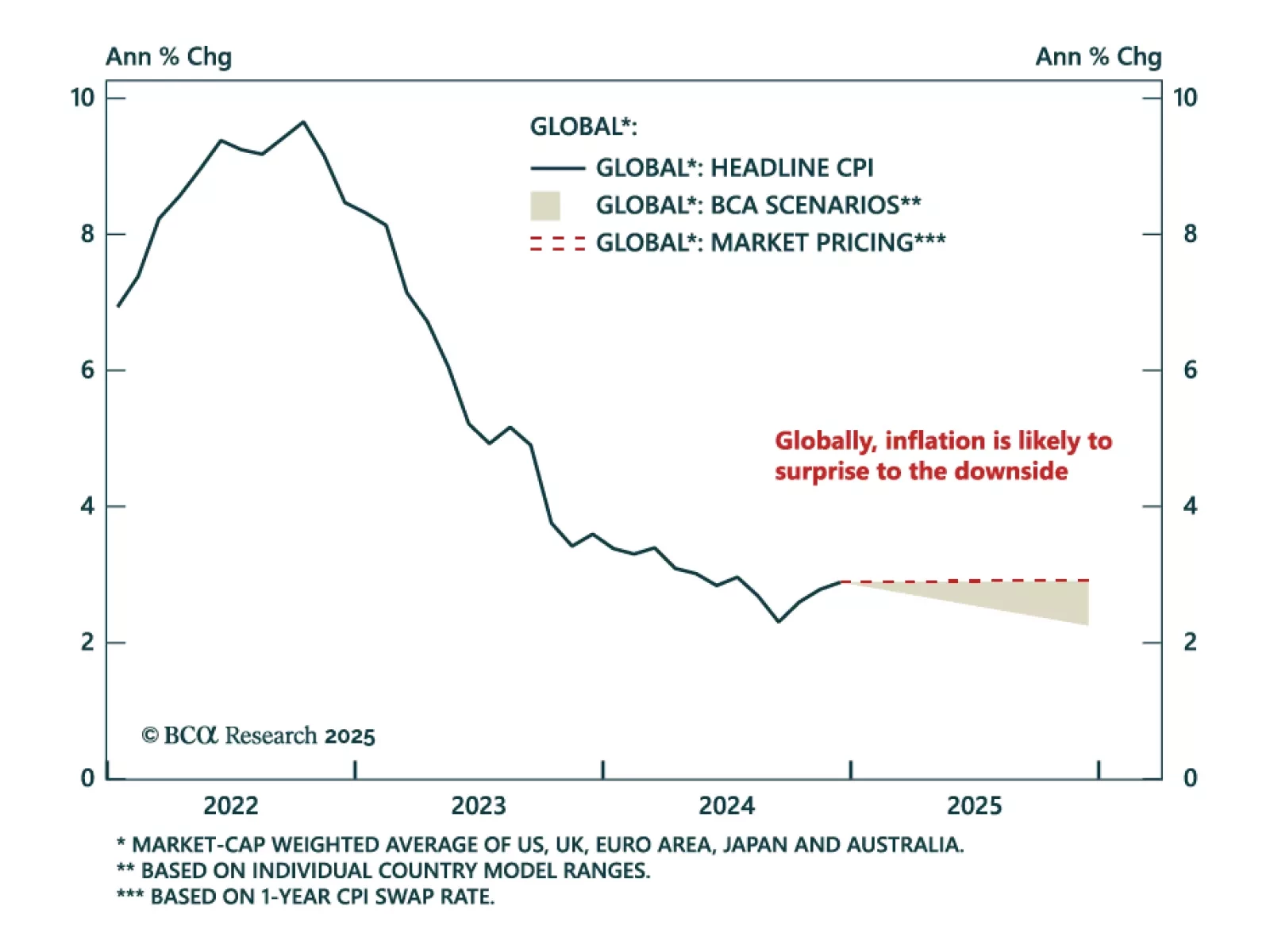

The ECB cut by 25 bps as expected, bringing the deposit facility rate to 2.75%. Despite avoiding committing to a path for policy, President Lagarde reiterated the disinflationary process is “well on track”, and did not push against…

Advanced Q4 US GDP missed estimates, slowing down to 2.3% quarterly annualized growth from 3.1%. The weakness was however driven by inventories. Consumer spending beat estimates and accelerated to 4.2% from 3.7% in Q3. Growth is…

Our Global Fixed Income strategists assessed the risk of a second wave of inflation, and discussed the opportunities within the inflation-linked bond (ILB) market. Global disinflation remains on track, though energy prices and…