US job openings fell to a 10-month low in July, underscoring continued labor market weakening. Openings declined to 7.18m from 7.36m. The decline was led by non-cyclical sectors such as education and health services, which had…

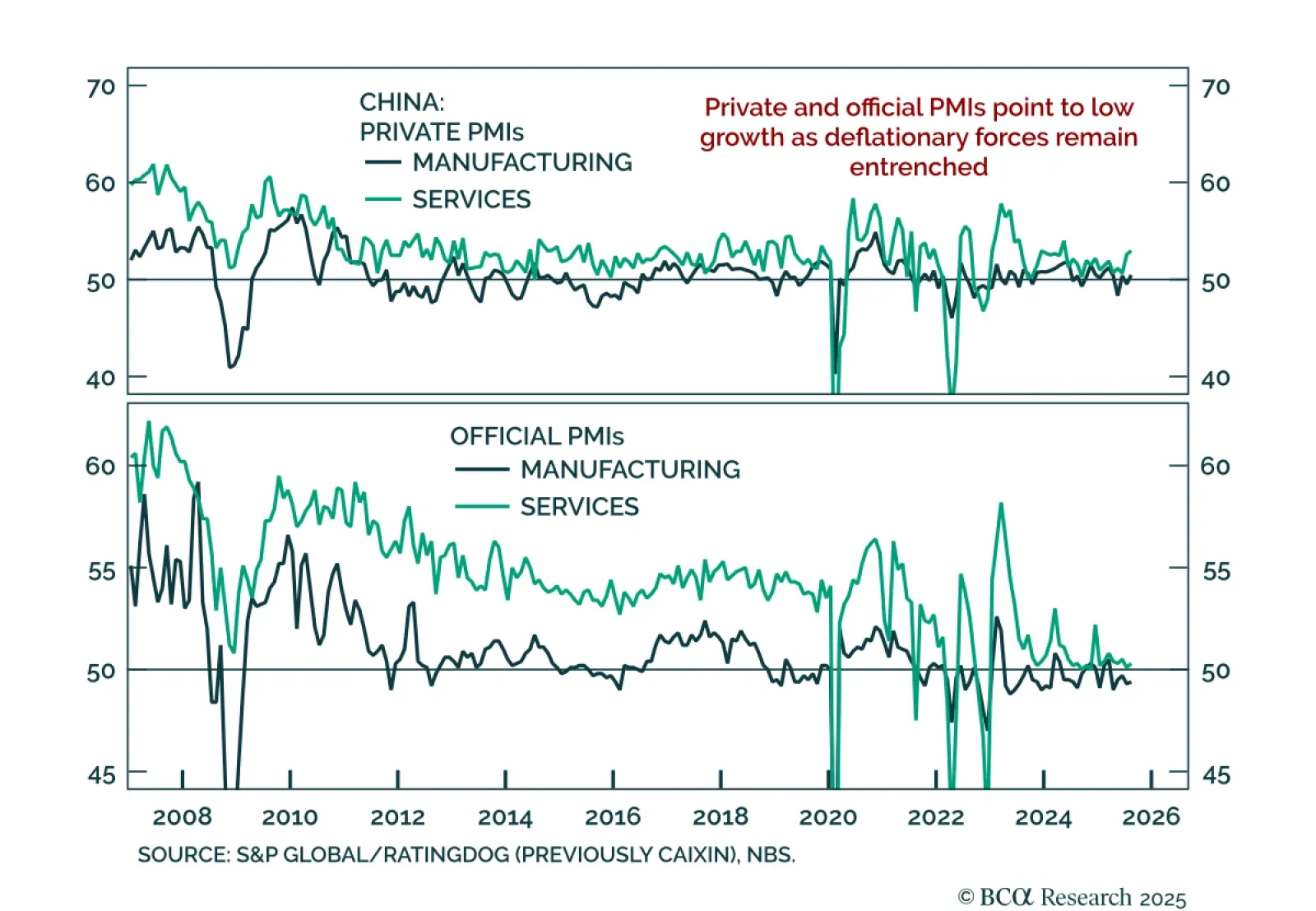

China’s August PMIs improved, but underlying data point to persistent weakness and limited momentum. The official NBS composite rose to 50.5 from 50.2, with manufacturing still in contraction at 49.4 and services edging higher to 50.…

Our Portfolio Allocation Summary for September 2025.

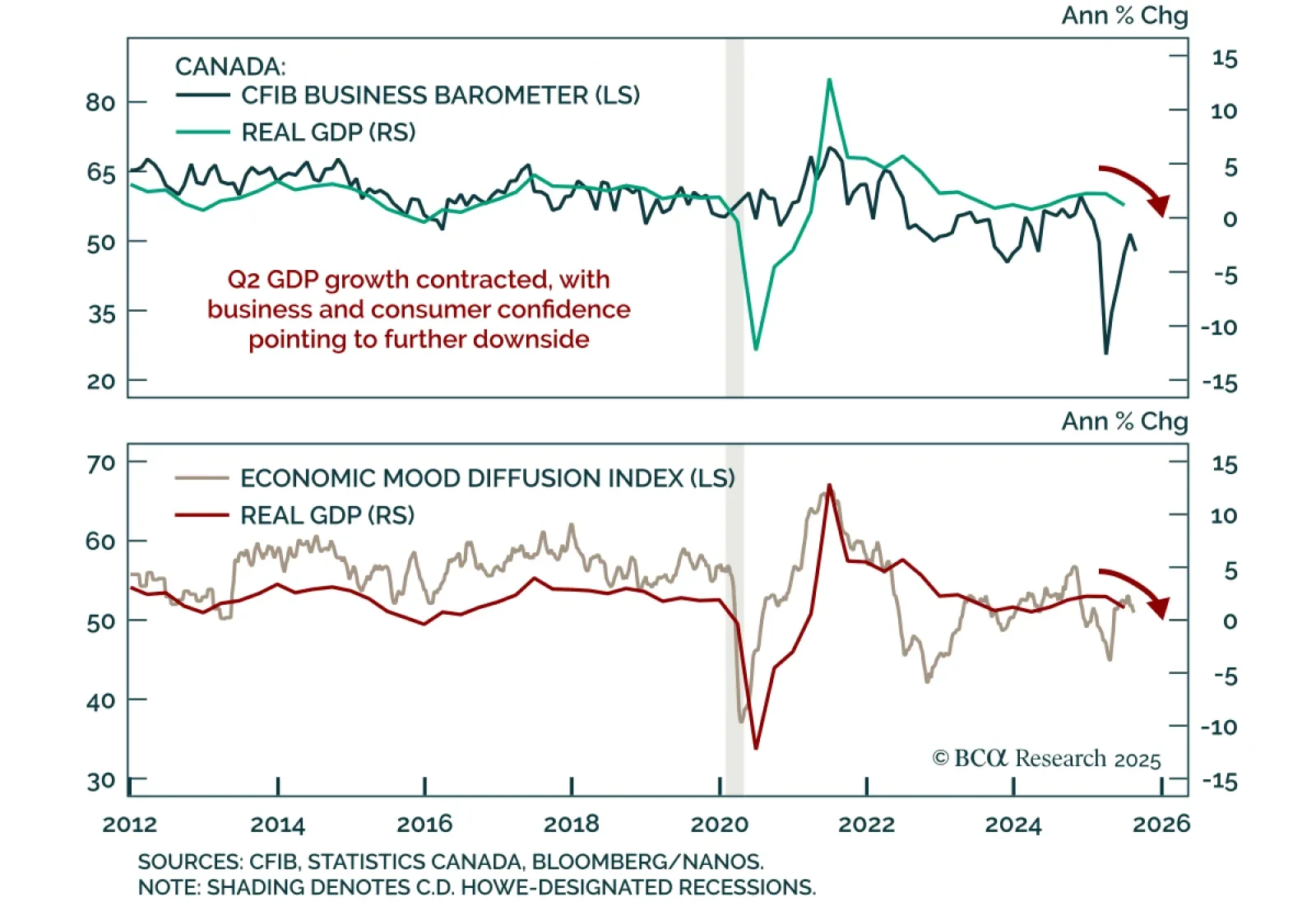

Canada’s Q2 GDP contraction underscores a fragile backdrop where growth risks will outweigh inflation, supporting further BoC easing. Real GDP contracted at an annualized 1.6% after expanding 2.2% in Q1, consistent with survey data…

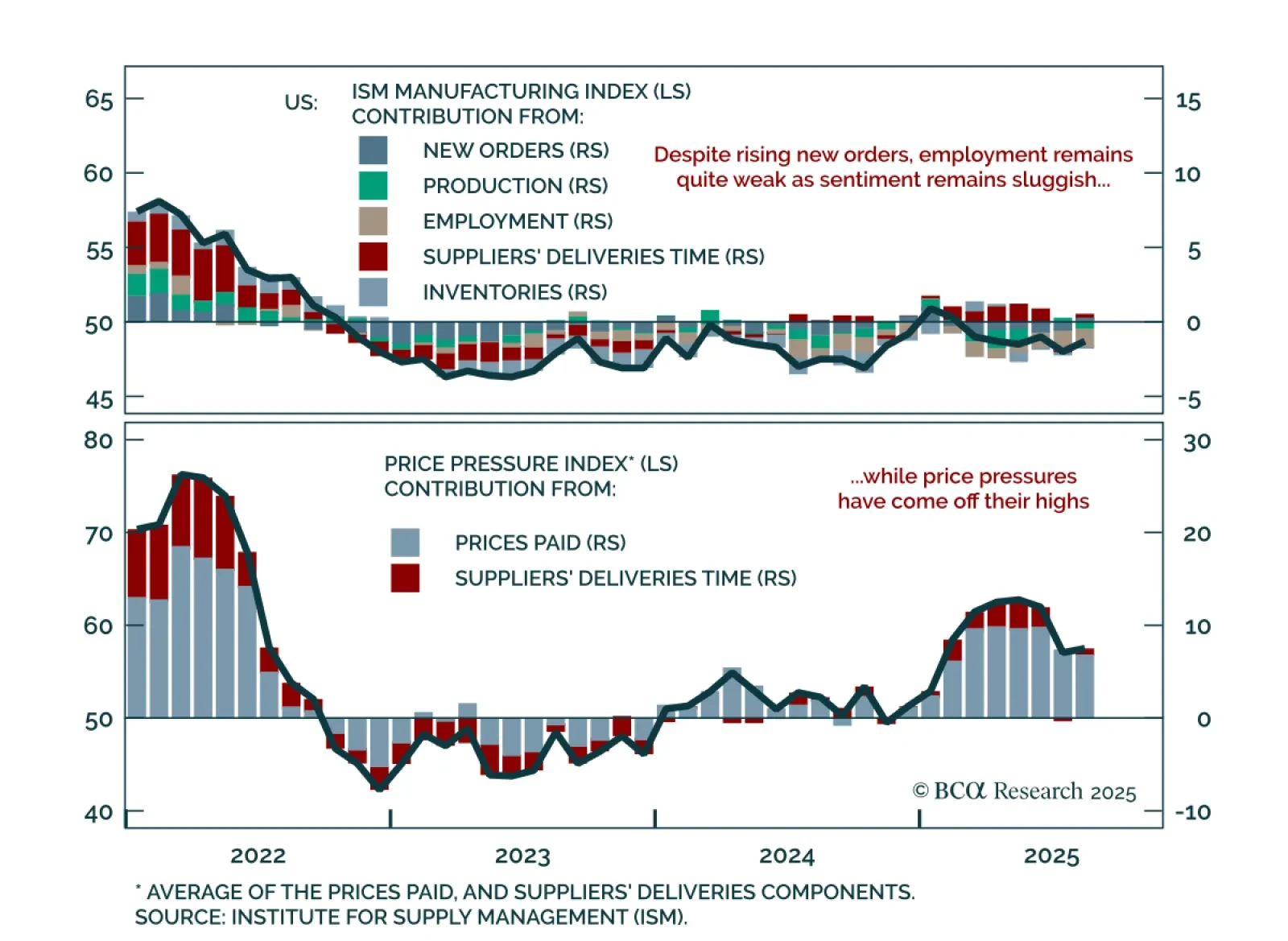

August ISM Manufacturing was mixed, with stronger orders offset by weak production and employment. The headline rose to 48.7 from 48.0, missing expectations. New orders beat estimates, rising into expansion at 51.4 and lifting…

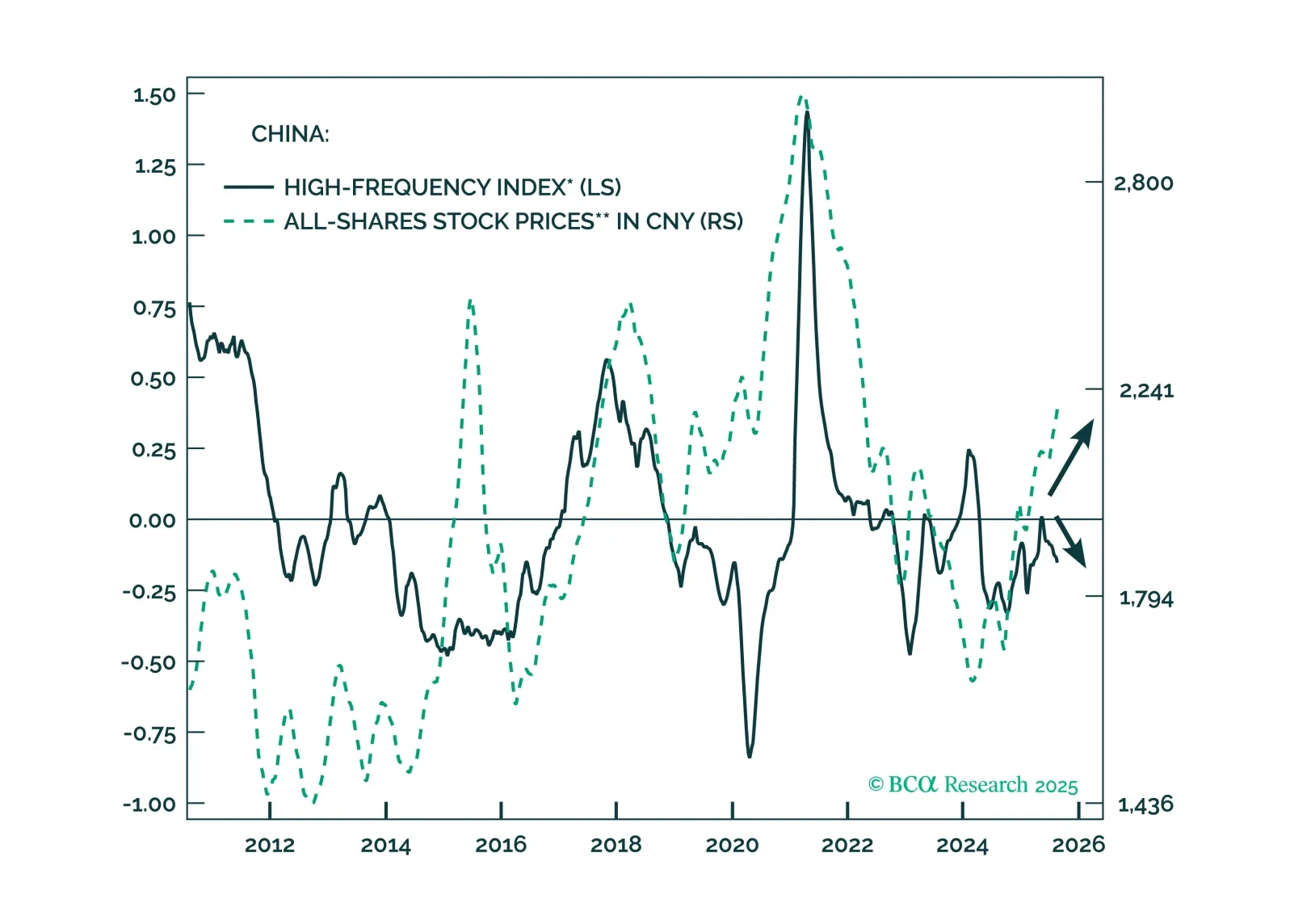

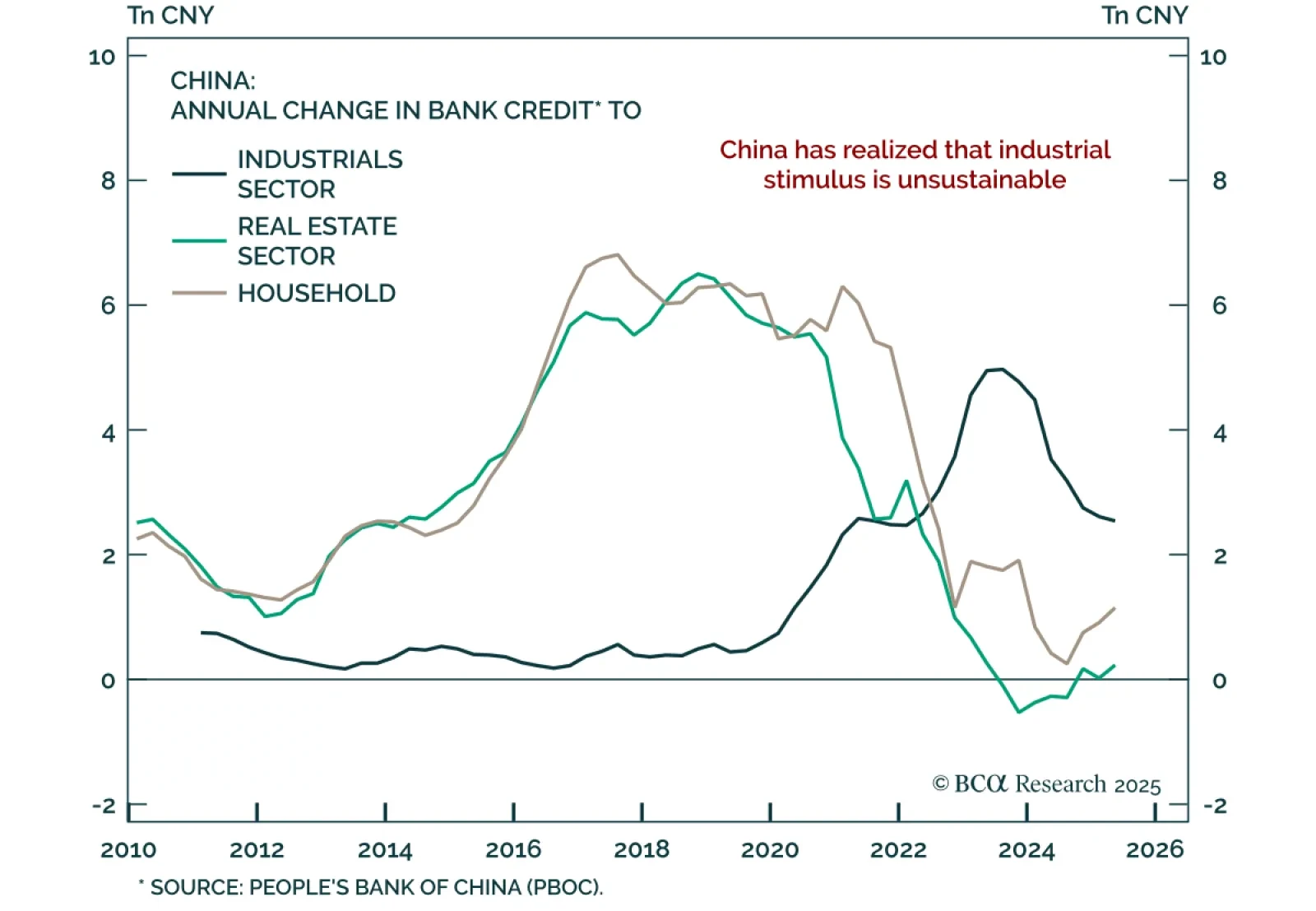

Our Global Asset Allocation strategists upgrade the Chinese yuan to overweight as global imbalances between production and consumption begin to reverse. The US continues to overconsume and underproduce, while China overproduces and…

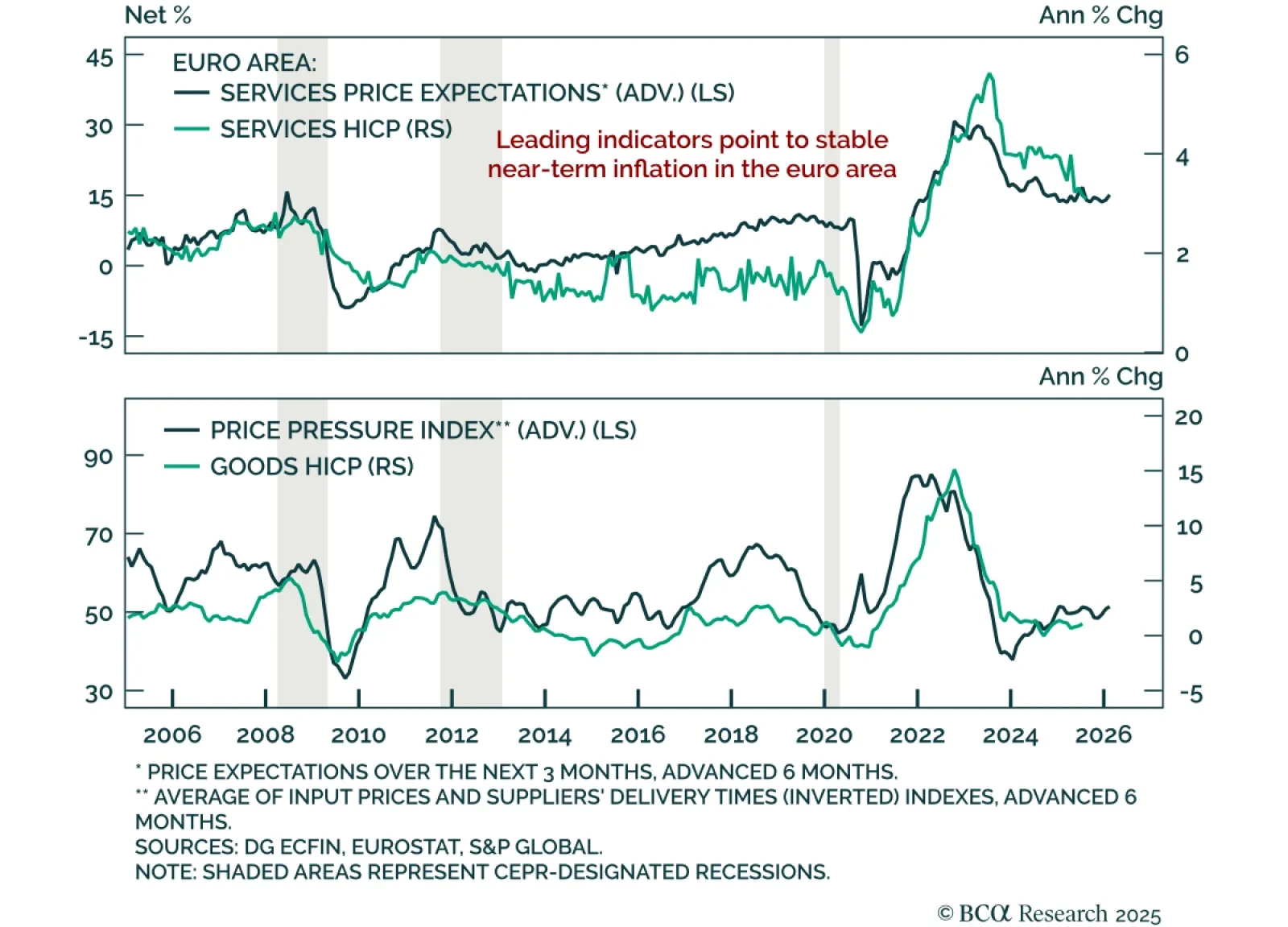

Euro area August flash HICP was slightly hotter than expected, reinforcing the case for the ECB to stay put in September. Headline inflation rose to 2.1% y/y from 2.0%, with the monthly print surprising at 0.2% m/m. Core inflation…

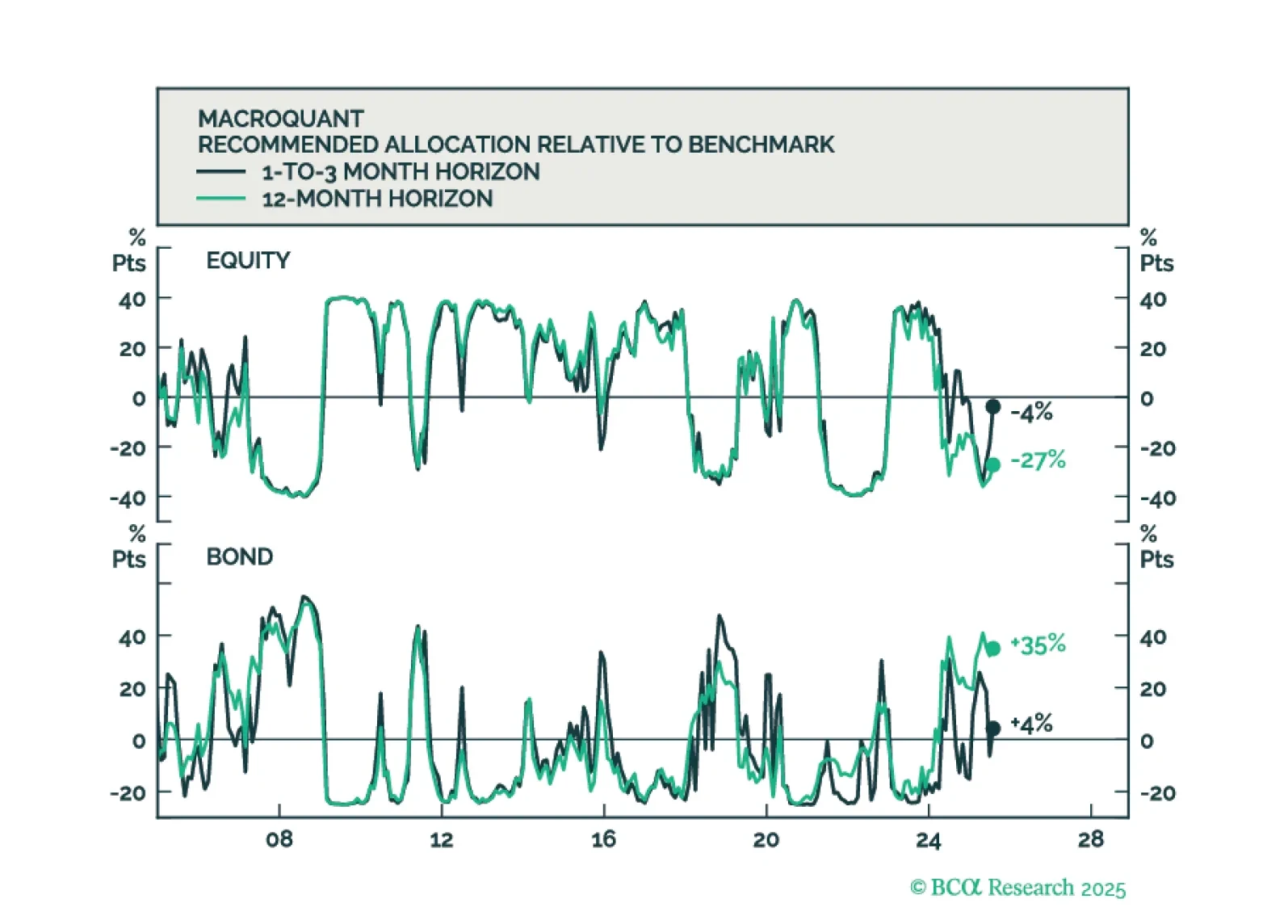

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

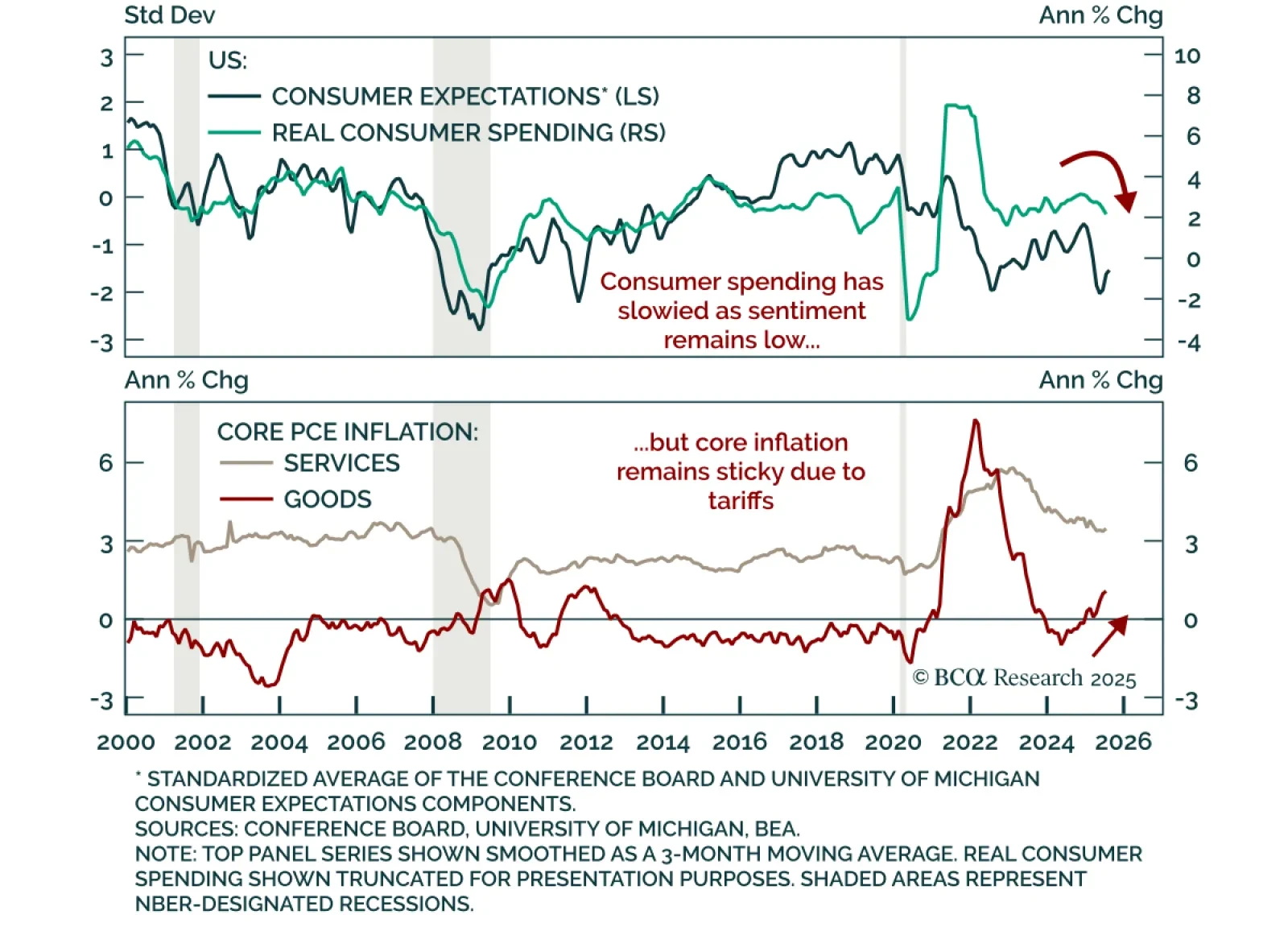

July income and spending data confirmed resilient consumption and sticky inflation, however, slowing labor momentum keeps us defensive. Real personal spending increased 0.3% m/m. Personal income rose 0.4% m/m, with real income…