Overweight Last April following the massacre in oil prices and the consequent slam in the S&P oil & gas exploration & production (O&G E&P) group, we created the USES Crash Indicator to try to forecast a likely…

Highlights For the month of February, our trading model recommends shorting the US dollar versus the euro and Swiss franc. While we agree a barbell strategy makes sense, we would rather hold the yen and the Scandinavian currencies.…

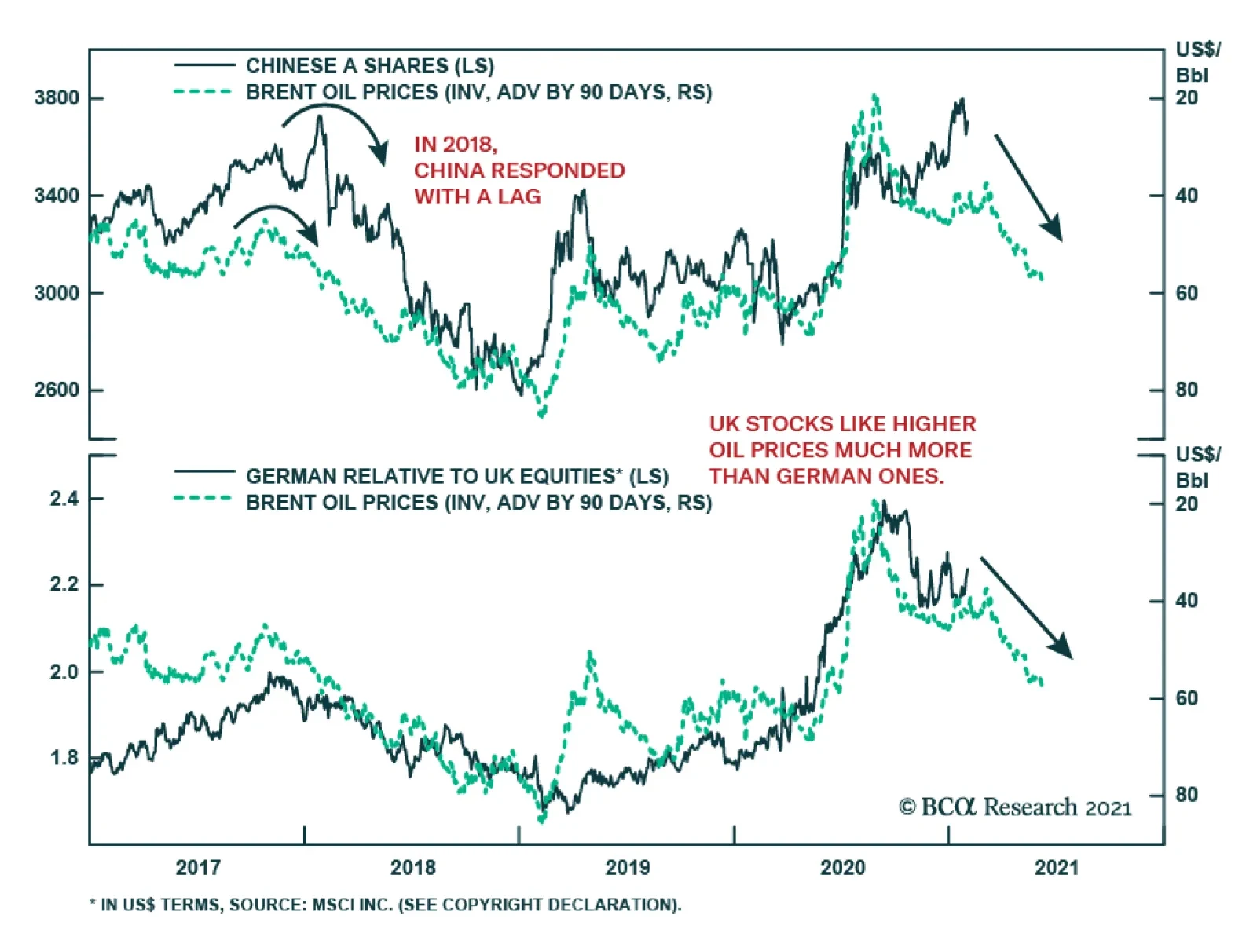

The recent oil rally will have consequences for asset prices beyond the energy market. While higher oil prices benefit oil exporters, they hurt the economies of oil importers, often with a lag. A great example of these…

As the economy is transitioning from liquidity to growth, the oil-to-gold price ratio has caught our attention again this year. As a reminder, last year we successfully traded this high-octane pair using the S&P oil & gas…

Highlights Pandemic uncertainty and global economic policy uncertainty likely will rebound with increasing COVID-19 infection, hospitalization and death rates, which will keep the USD well bid as a safe haven, and continue to stymie…

Highlights Rising commodity prices and a weaker dollar will lead to higher inflation at the consumer level beginning this year. In the real economy, tighter commodity fundamentals – restrained supply growth, increasing demand,…

Highlights Markets largely ignored the uproar at the US Capitol on January 6 because the transfer of power was not in question. Democratic control over the Senate, after two upsets in the Georgia runoff, is the bigger signal. US…

Highlights OPEC 2.0 output will fall 850k b/d, following a surprise production cut of 1mm b/d by Saudi Arabia announced after two days of OPEC 2.0 meetings. Russia and Kazakhstan will be allowed to increase production by…