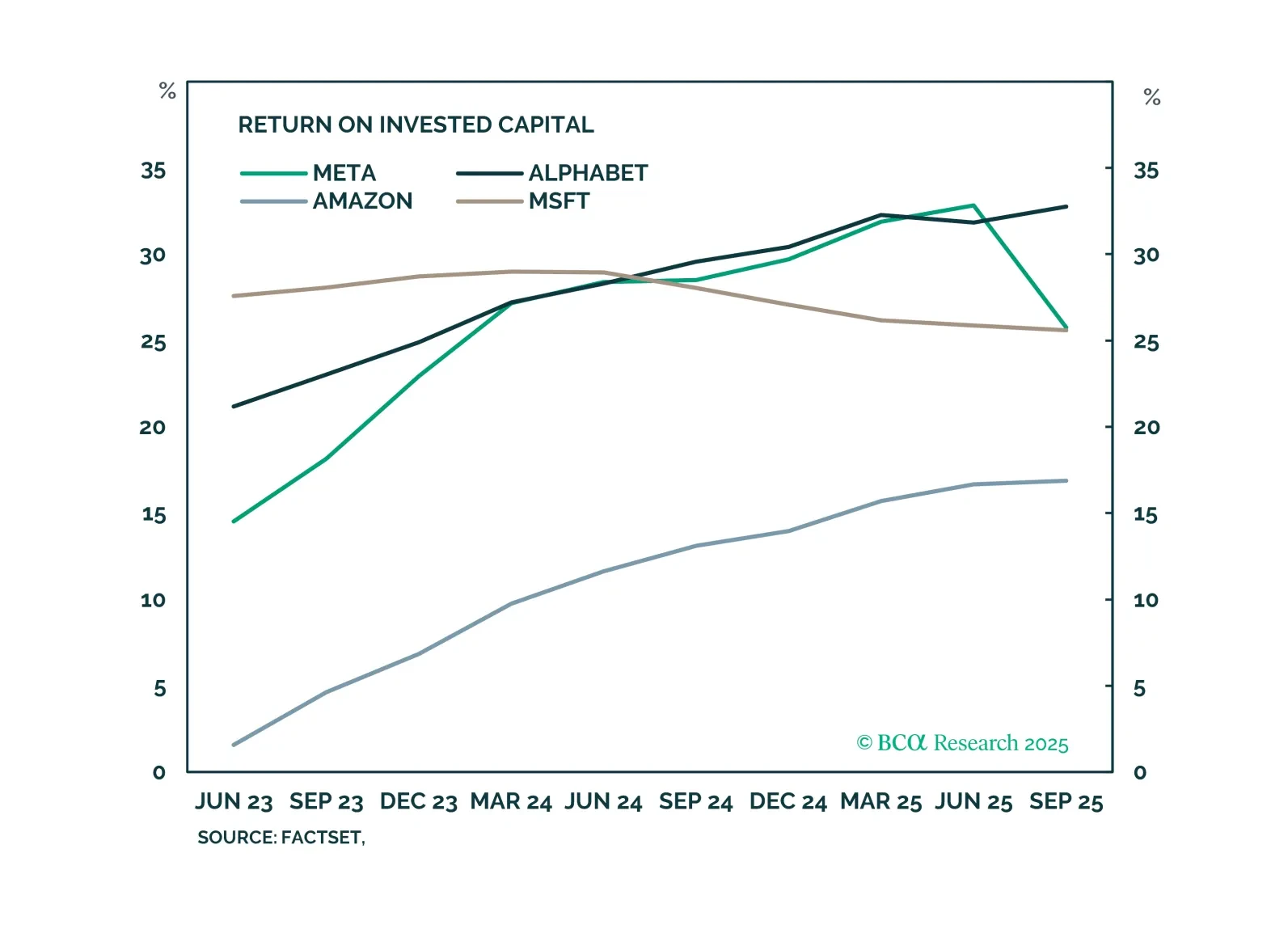

Investor reaction to Meta’s GenAI is an admonition against overspending, rather than a sign of a fraying GenAI rally. Other hyperscalers’ investments are driven by buoyant demand and remain profitable. With valuations stretched and…

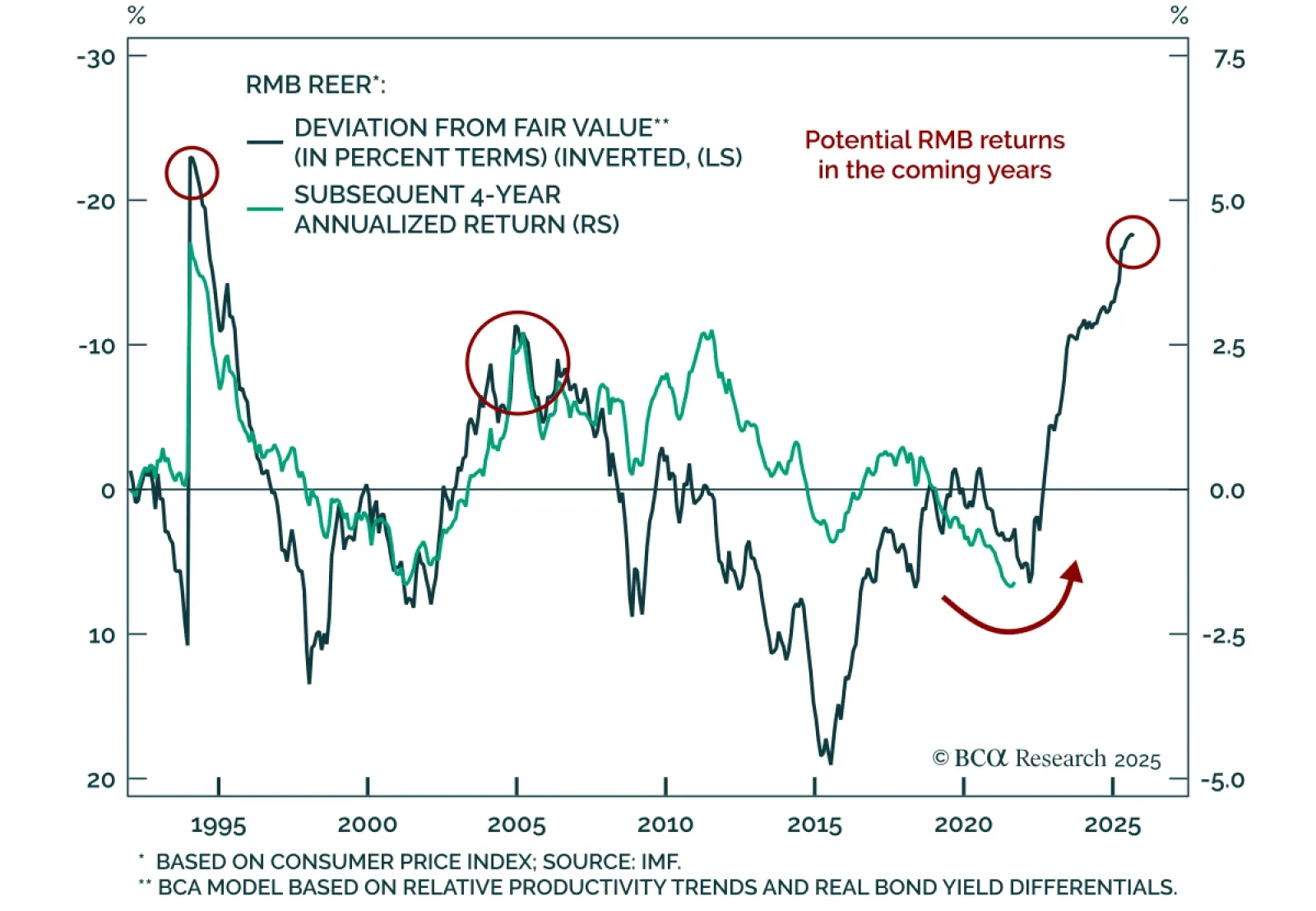

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

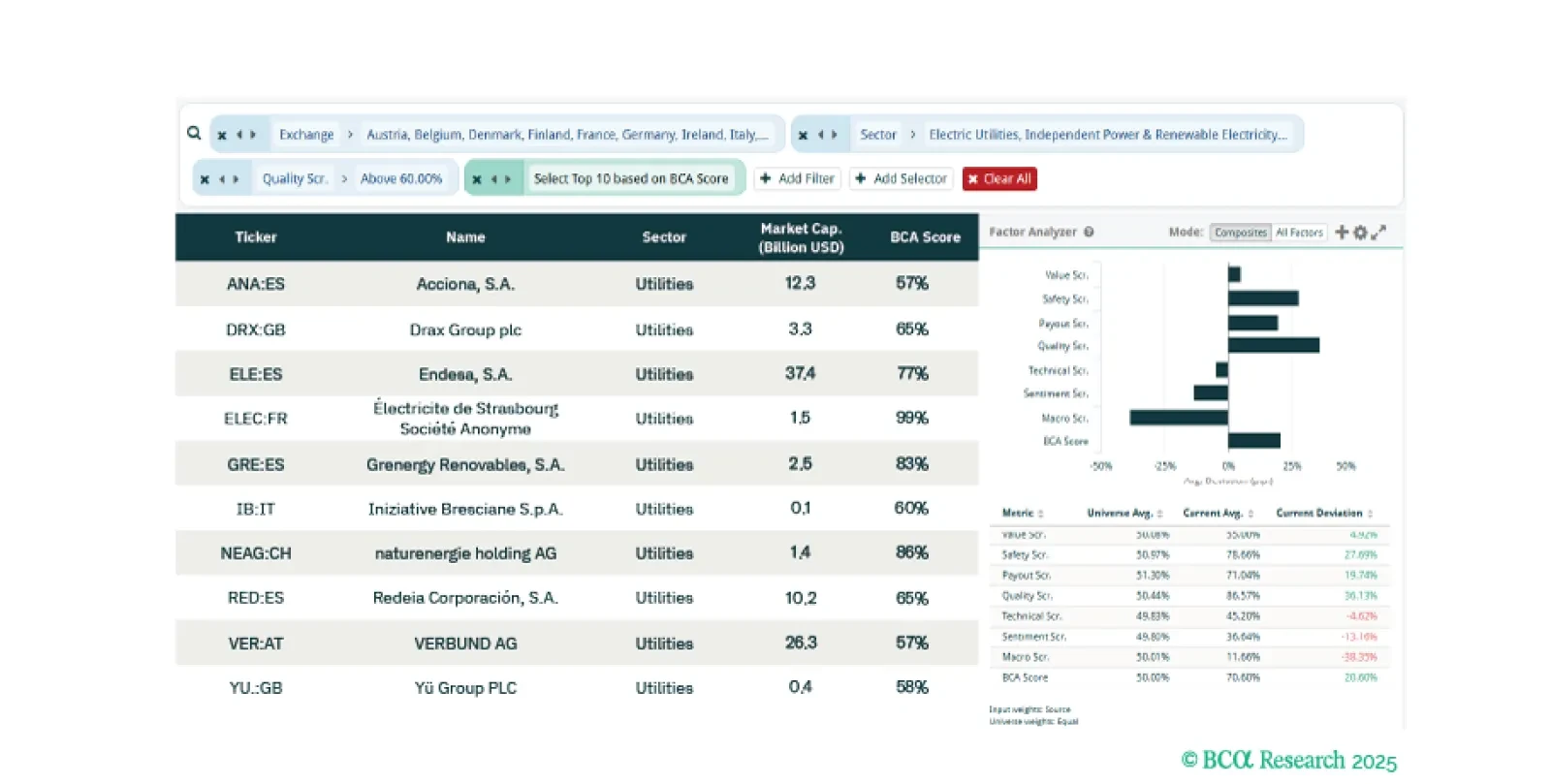

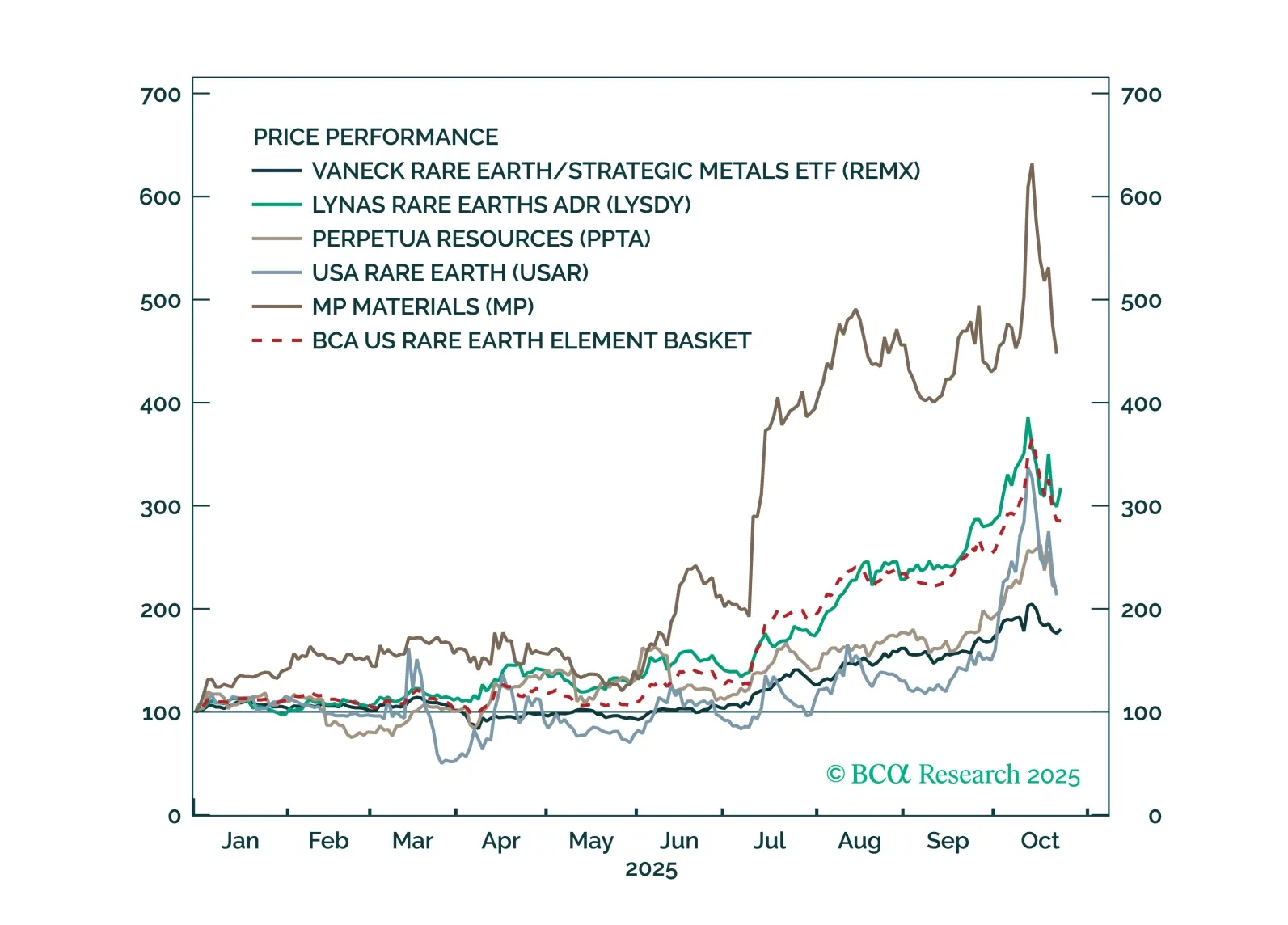

This week, our screeners explore opportunities arising from Europe’s electrification, identify high-quality Rare Earth plays, and propose a portfolio to hedge against a major global conflict.

China’s Fourth Plenum outlined priorities for its 2026–2030 plan, emphasizing household consumption and technological upgrading but signaling continuity over change. The document highlights a rebalancing toward consumption as a share…

In this week’s note, we share the main implications for European investors from what was discussed at the BCA Conference in New York and provide a short list of the questions most frequently asked by investors we met recently in…

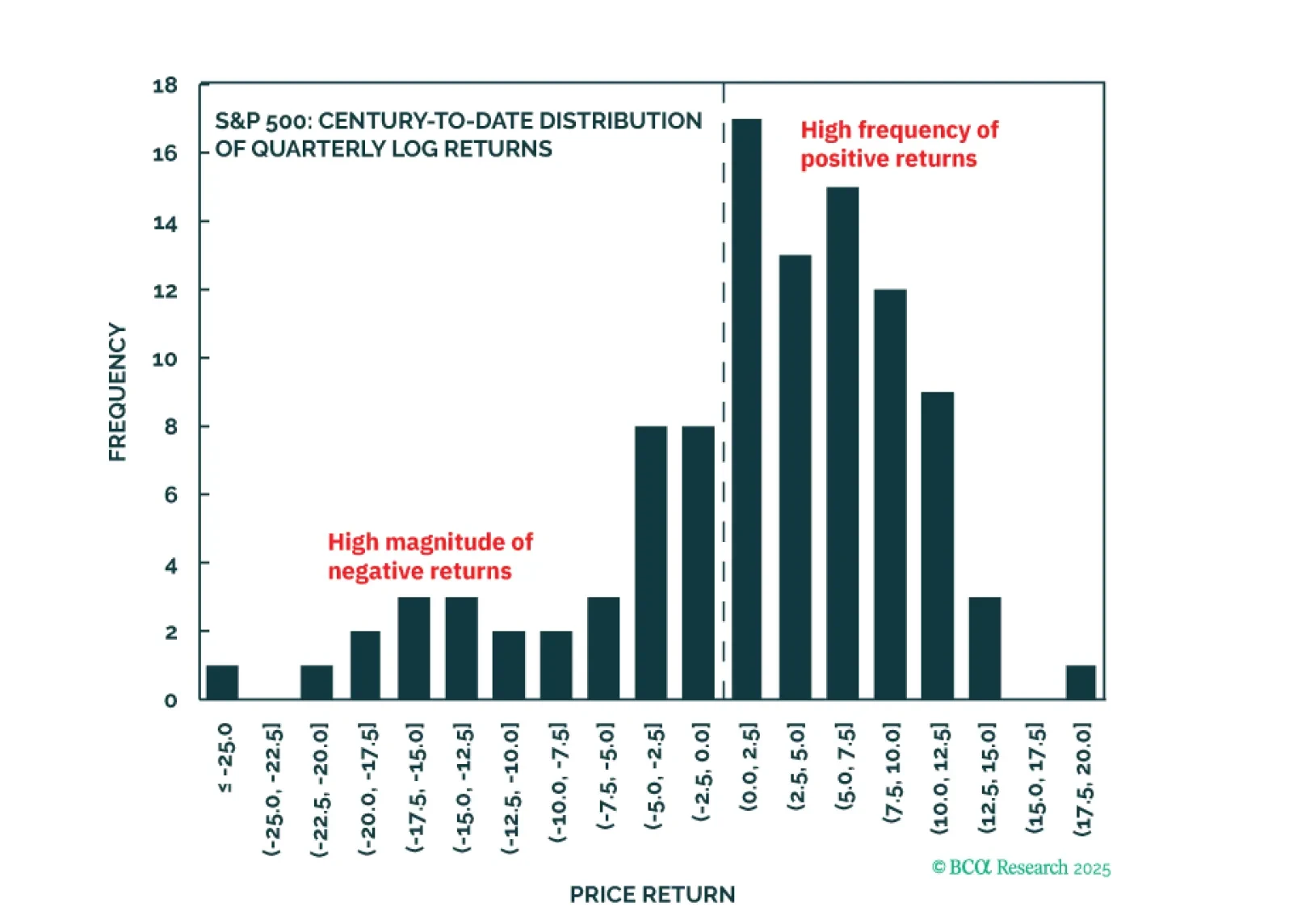

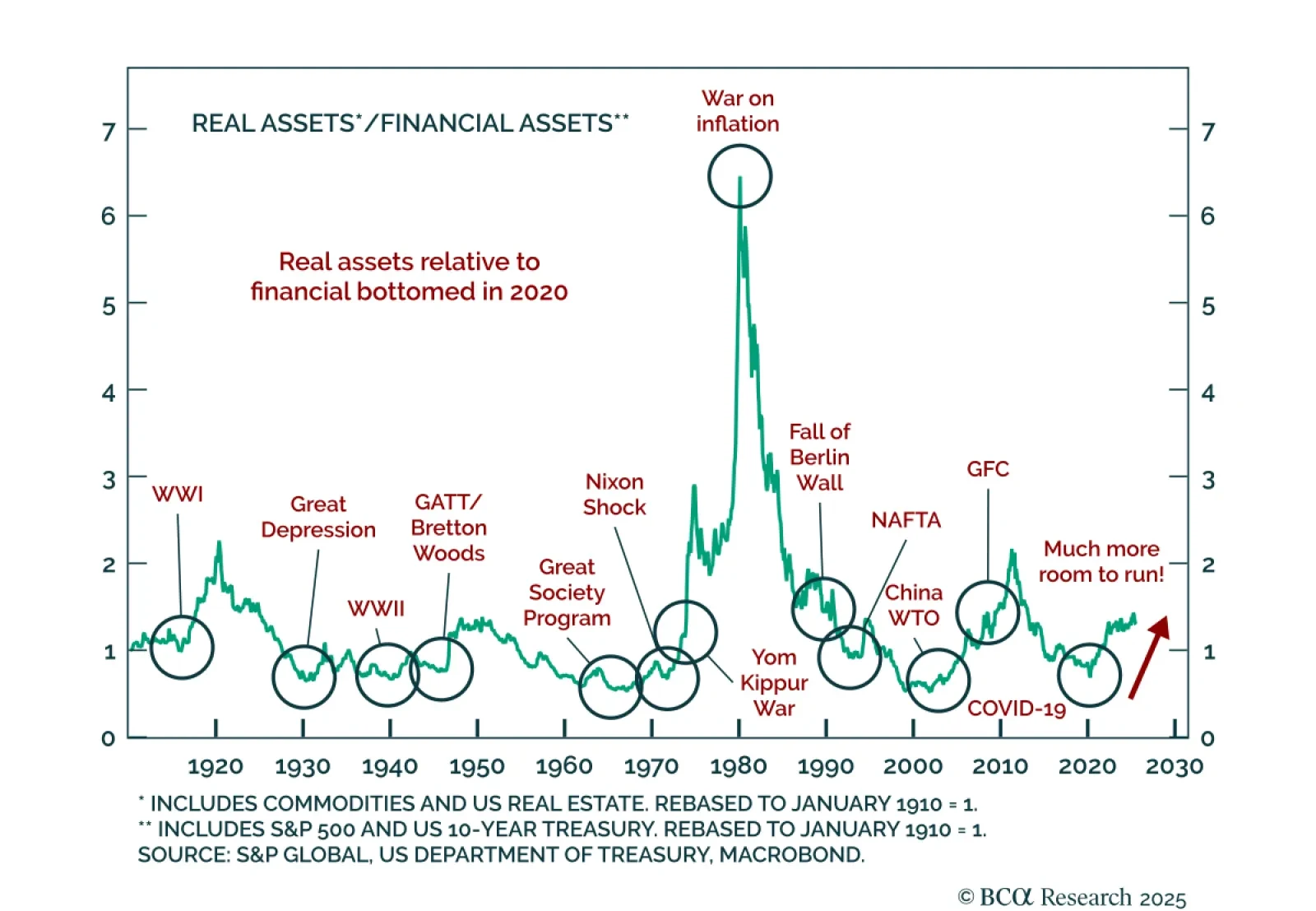

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

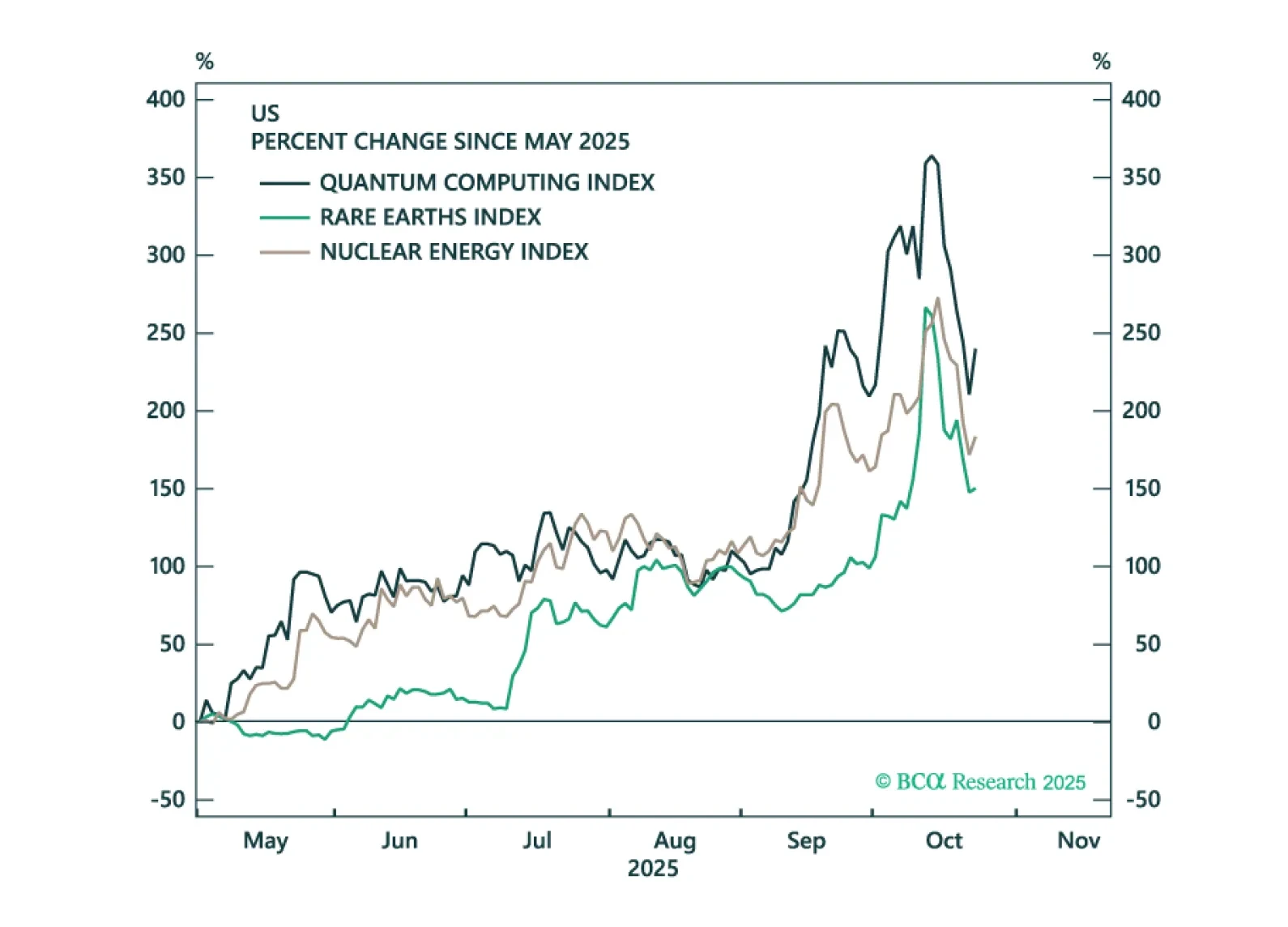

In global markets, speculative forces have intertwined with the sound fundamentals of specific equity segments, perplexing investors. This report aims to distinguish between excessive price run-ups and healthy fundamentals…

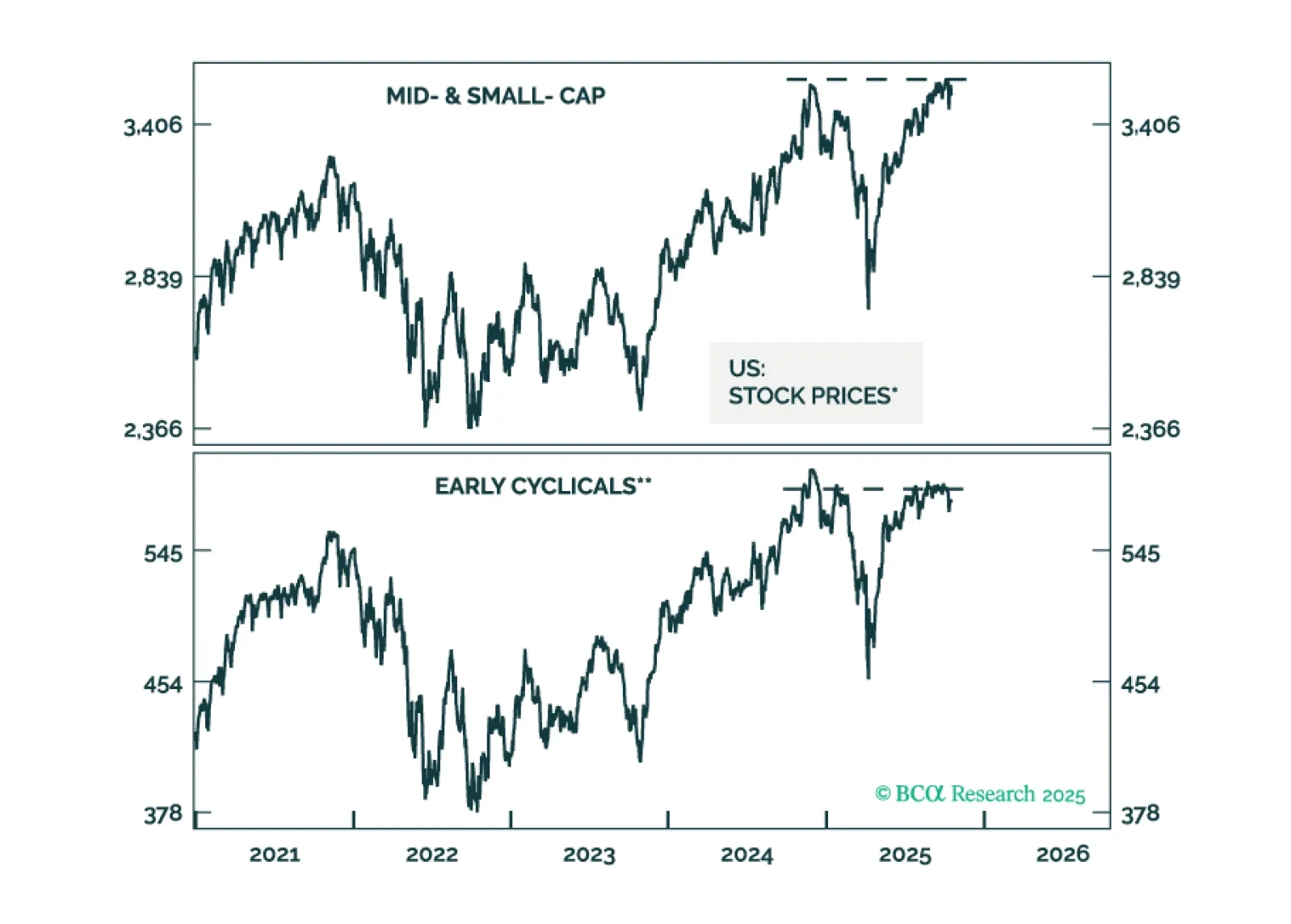

Our GeoMacro strategists remain overweight equities and bonds for now but warn that markets will soon test their “melt-up” thesis, as the cycle transitions from cash- to leverage-driven growth. The dominant theme of 2025 is not AI,…