European risk assets sold off and commodities rallied on Thursday on news that Russia launched an invasion of Ukraine that includes attacks on the capital Kyiv and dozens of other Ukrainian cities. President Putin’s goal is…

Executive Summary Copper Demand Follows GDP European copper demand will increase on the back of still-accommodative monetary policy, coupled with a loosening of COVID-19-related gathering and mobility restrictions as the…

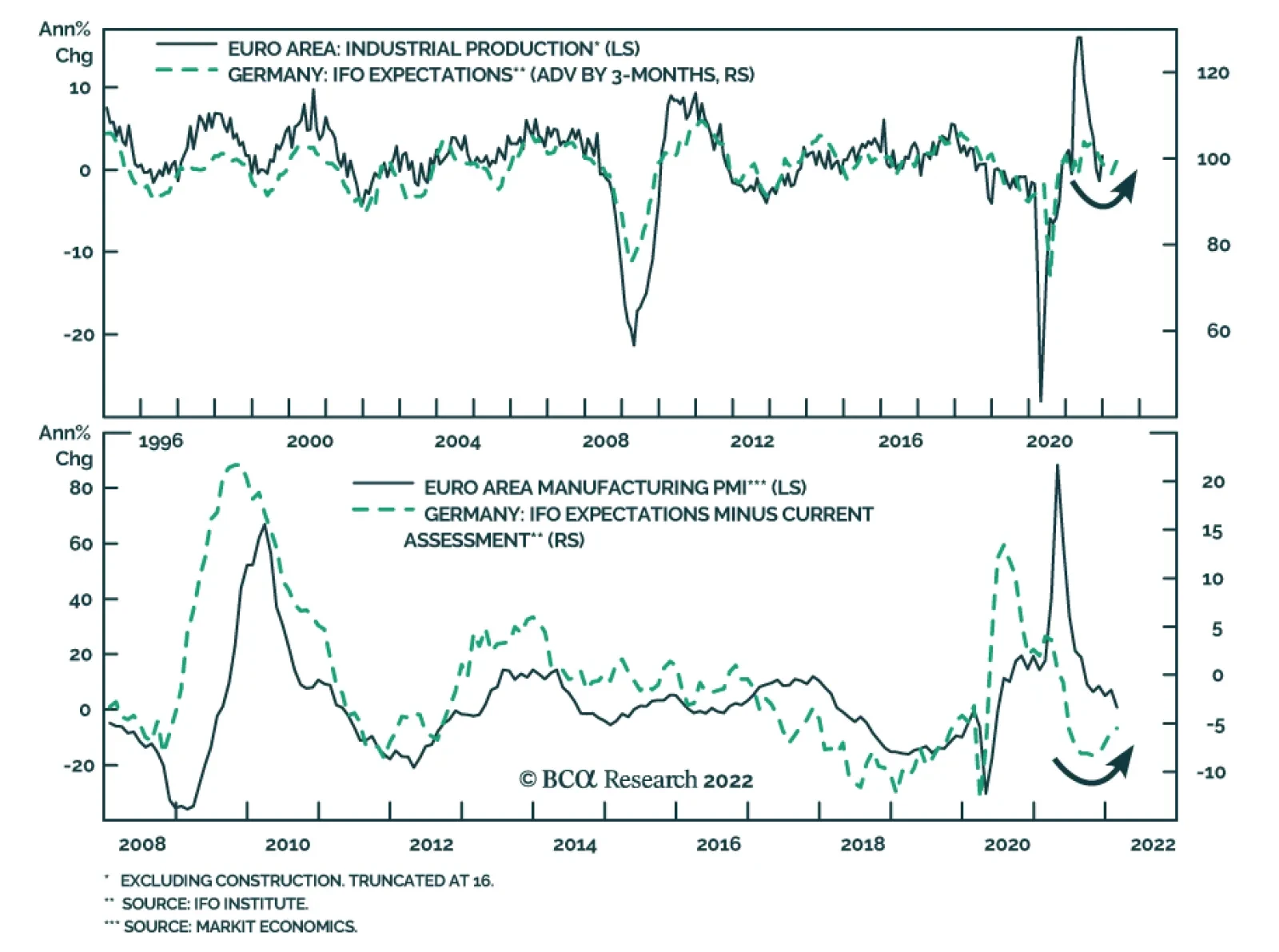

The German Ifo survey for February corroborates the upbeat signal from the Eurozone Flash PMIs, highlighting that the recent soft patch does not reflect underlying economic weakness. The Business Climate Index increased from…

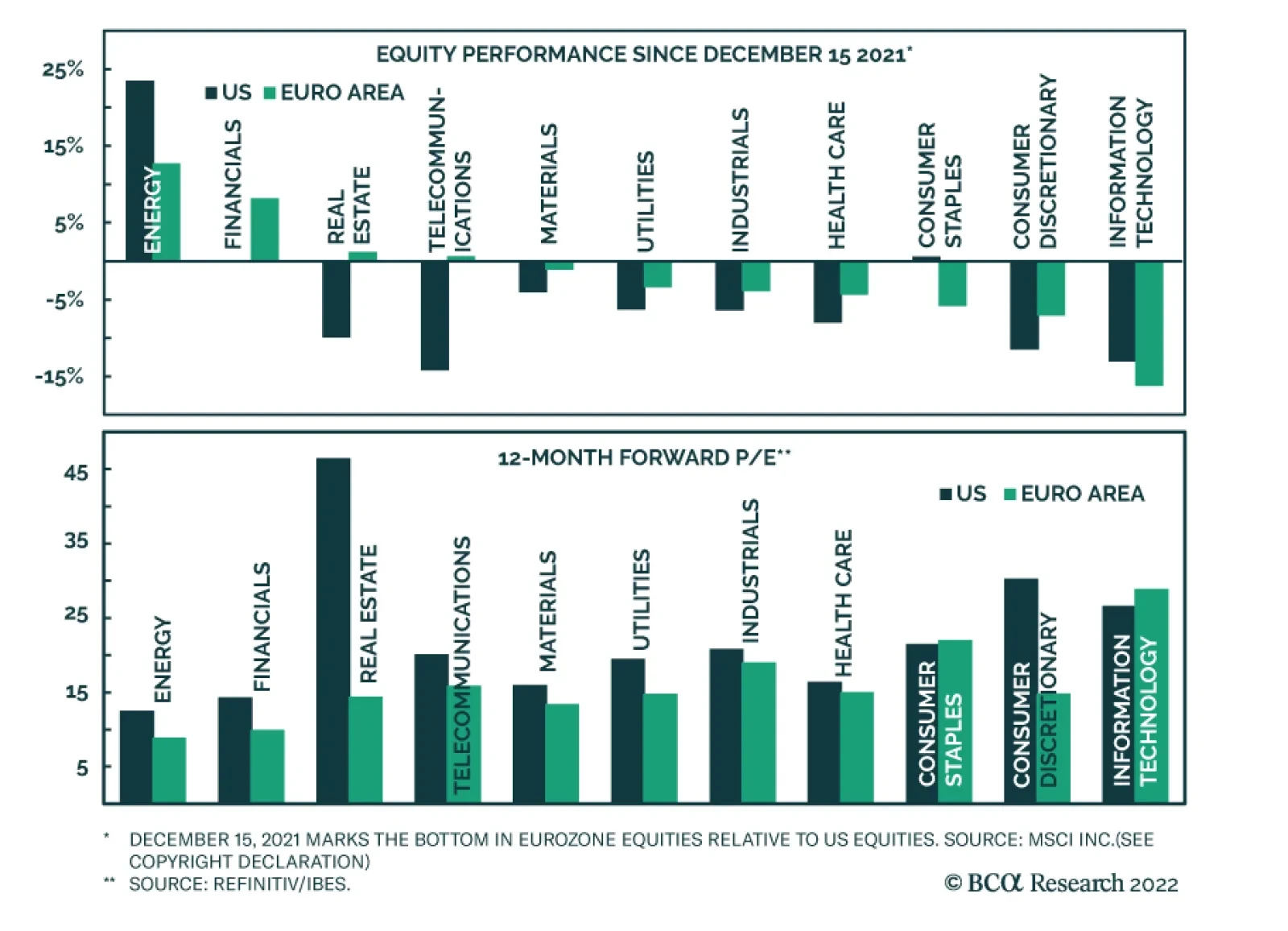

Even though the Eurozone economy is more exposed to potential negative ramifications from the deterioration in Russia’s relationship with the West, Euro Area equities have been passively outperforming US ones since mid-…

Executive Summary A Swedish Warning Stocks are oversold but downside risks persist. The Fed is on the verge of beginning a tightening cycle, which creates a process often linked to deeper and longer equity corrections…

Feature This week, we present the third edition of the BCA Research Global Fixed Income Strategy (GFIS) Global Credit Conditions Chartbook – a review of central bank surveys of bank lending standards and loan demand. The data from…

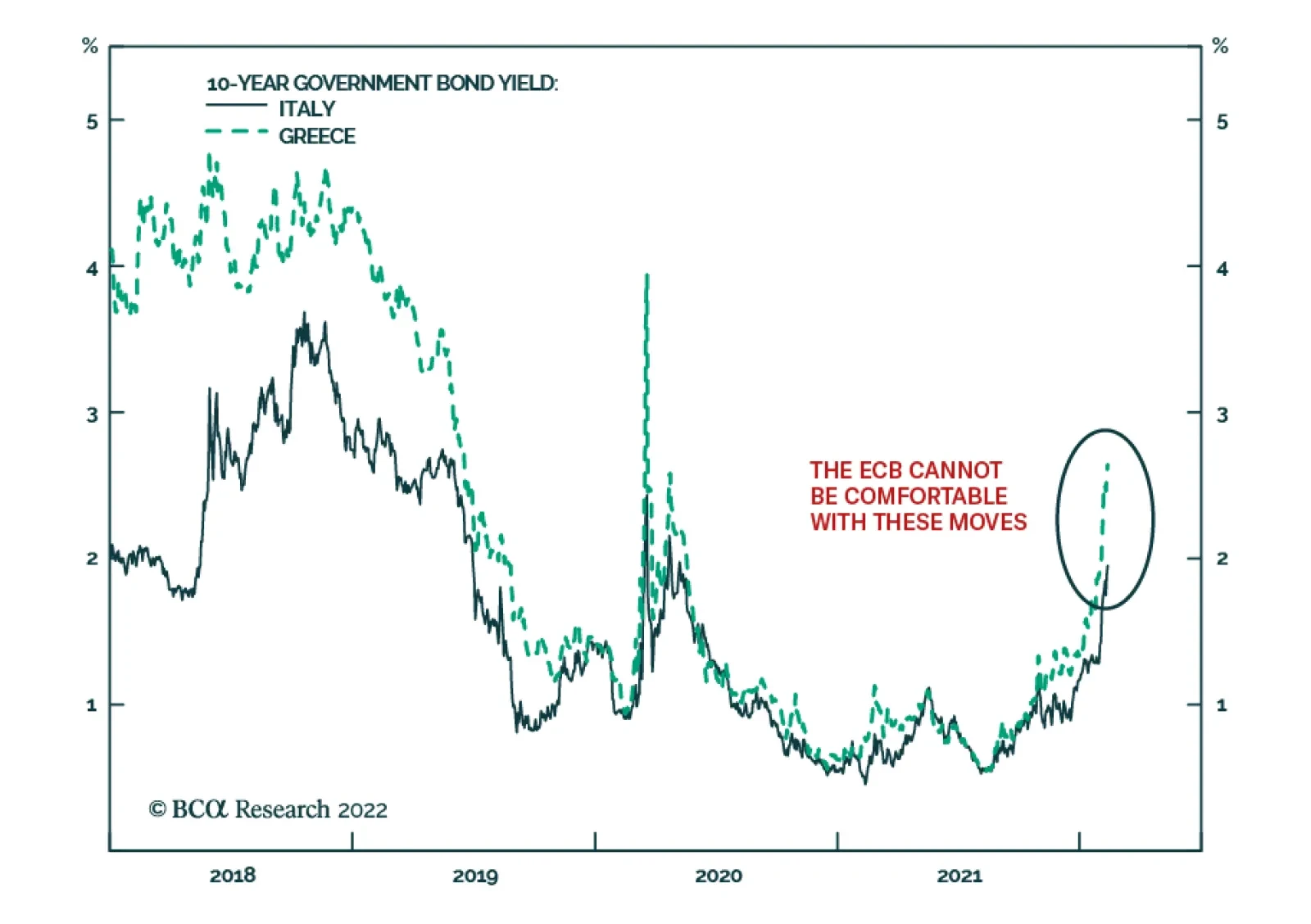

BCA Research’s European Investment Strategy service concludes that tightening financial conditions will preempt the European Central Bank from hiking rates as much as the money market is pricing in. First, the behavior…

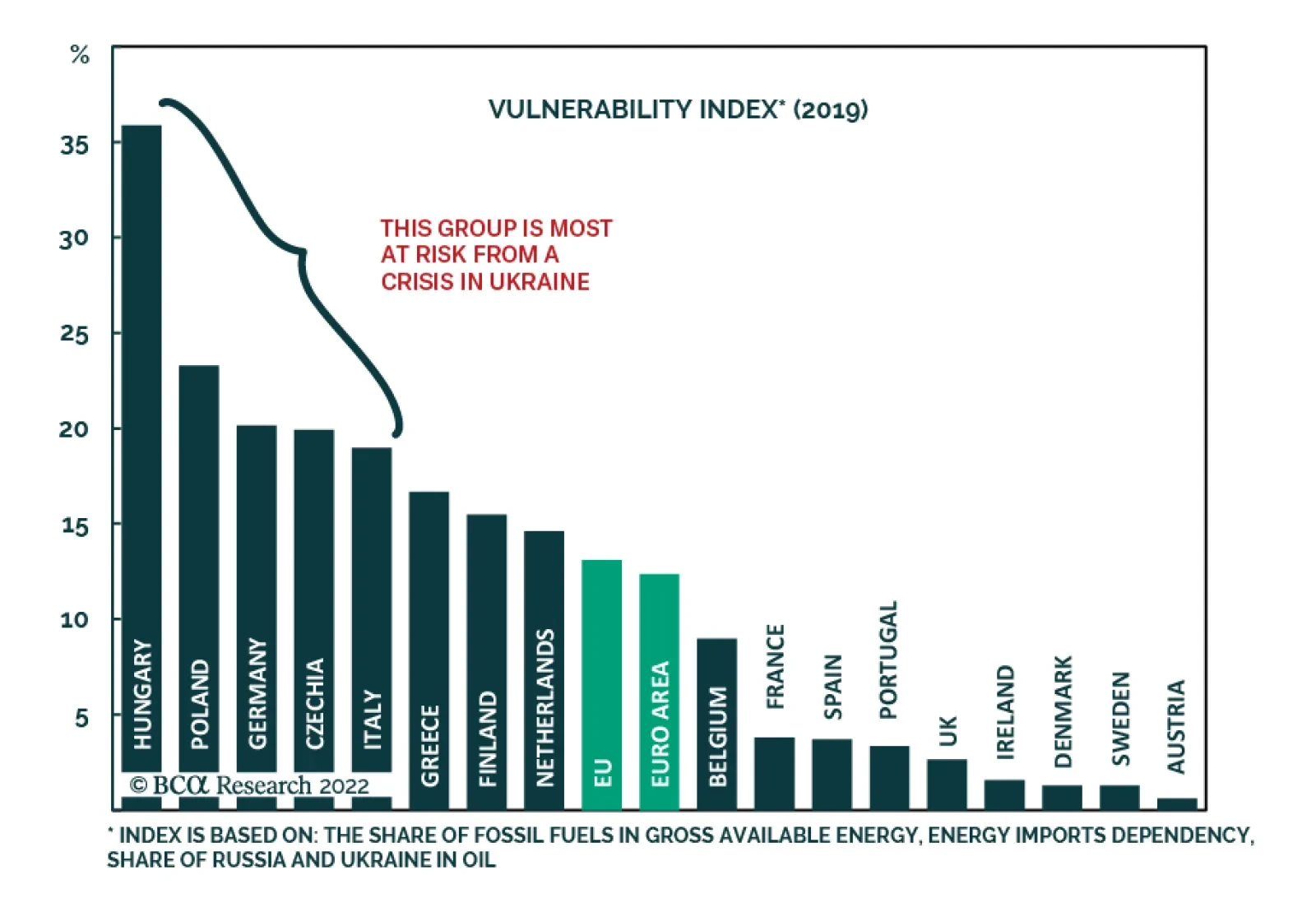

Highlights A feedback loop has emerged in European markets. Tightening financial conditions will preempt the European Central Bank from hiking rates as much as the money market is pricing in. The widening in peripheral and credit…

Executive Summary The Euro And Relative Growth The euro is likely to appreciate over the course of 2022. But the path will be volatile, with a retest of recent EUR/USD lows within the central band of possible outcomes. Our…