Highlights The risk to European stocks from higher yields is overstated for 2022. Not only do equities possess a valuation cushion compared to bonds, but also the stock returns/bond yields correlation remains positive. This positive…

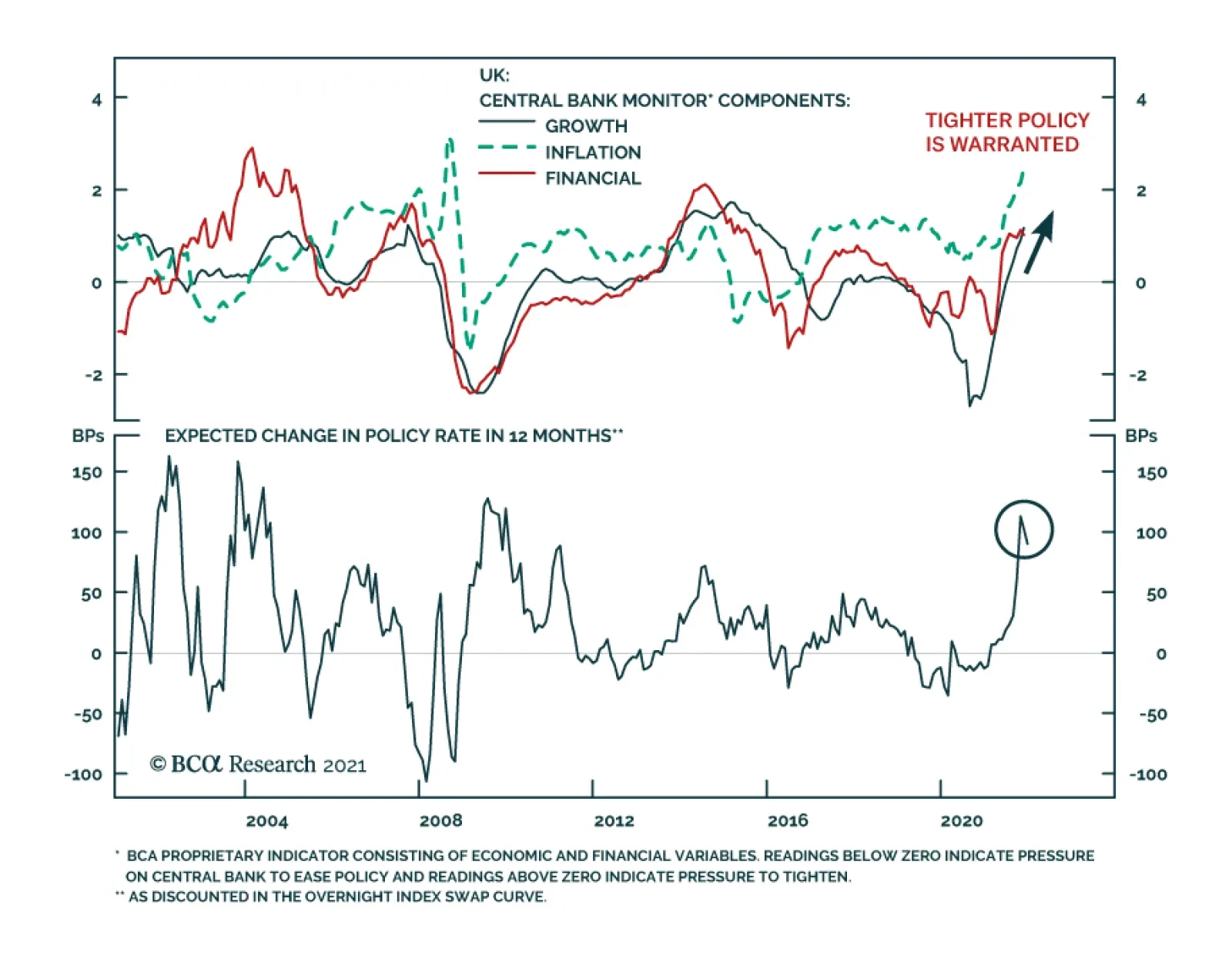

Market participants have been rolling back their rate hike expectations for the BoE. The emergence of the omicron variant and economic risks around tighter restrictions have only reinforced this trend. Meanwhile, UK Gilts have…

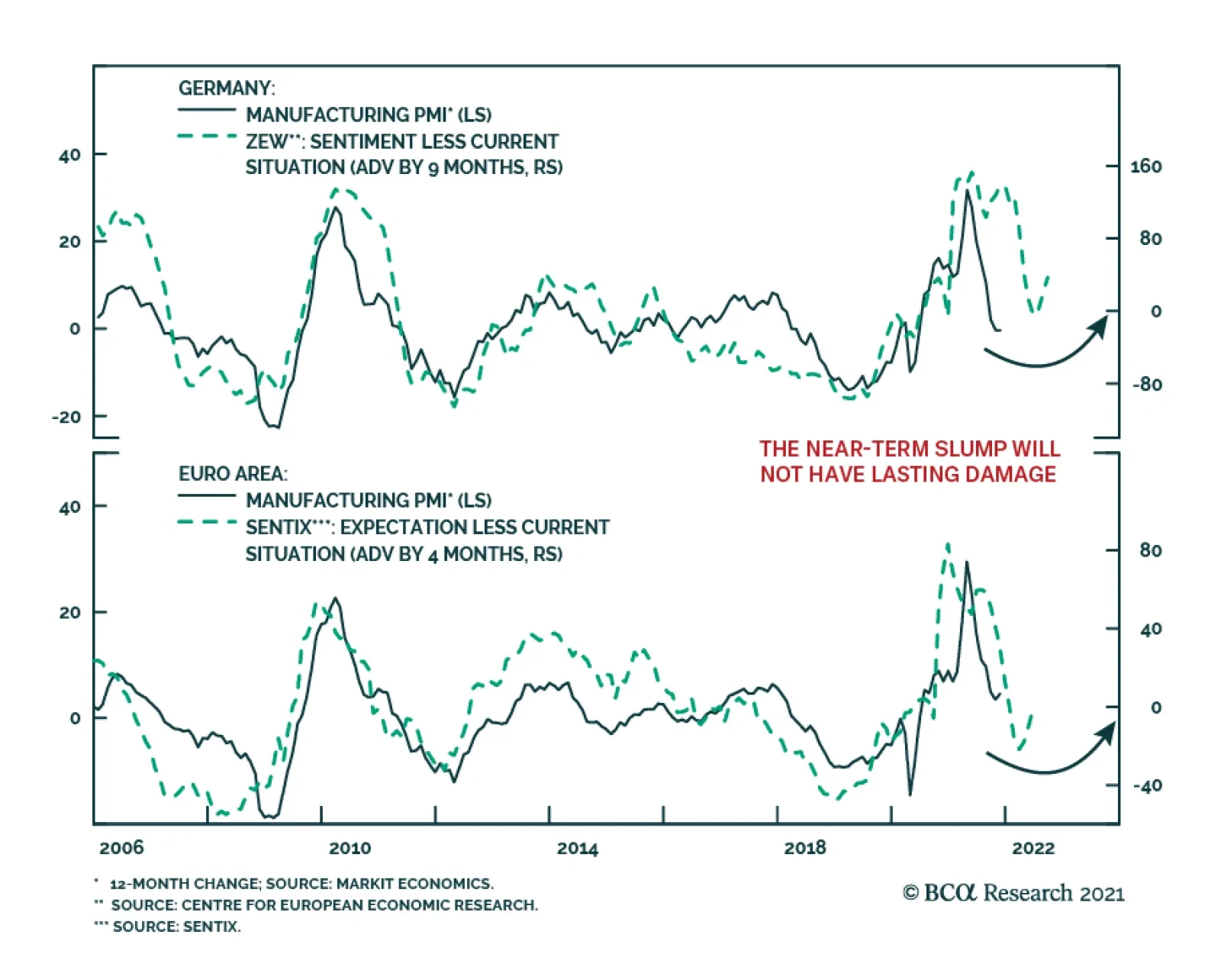

The Zew survey of investor sentiment reveals that confidence in Germany’s economic situation and outlook deteriorated in December. The current situation indicator lost 19.9 points and fell to a 6-month low of -7.4. A…

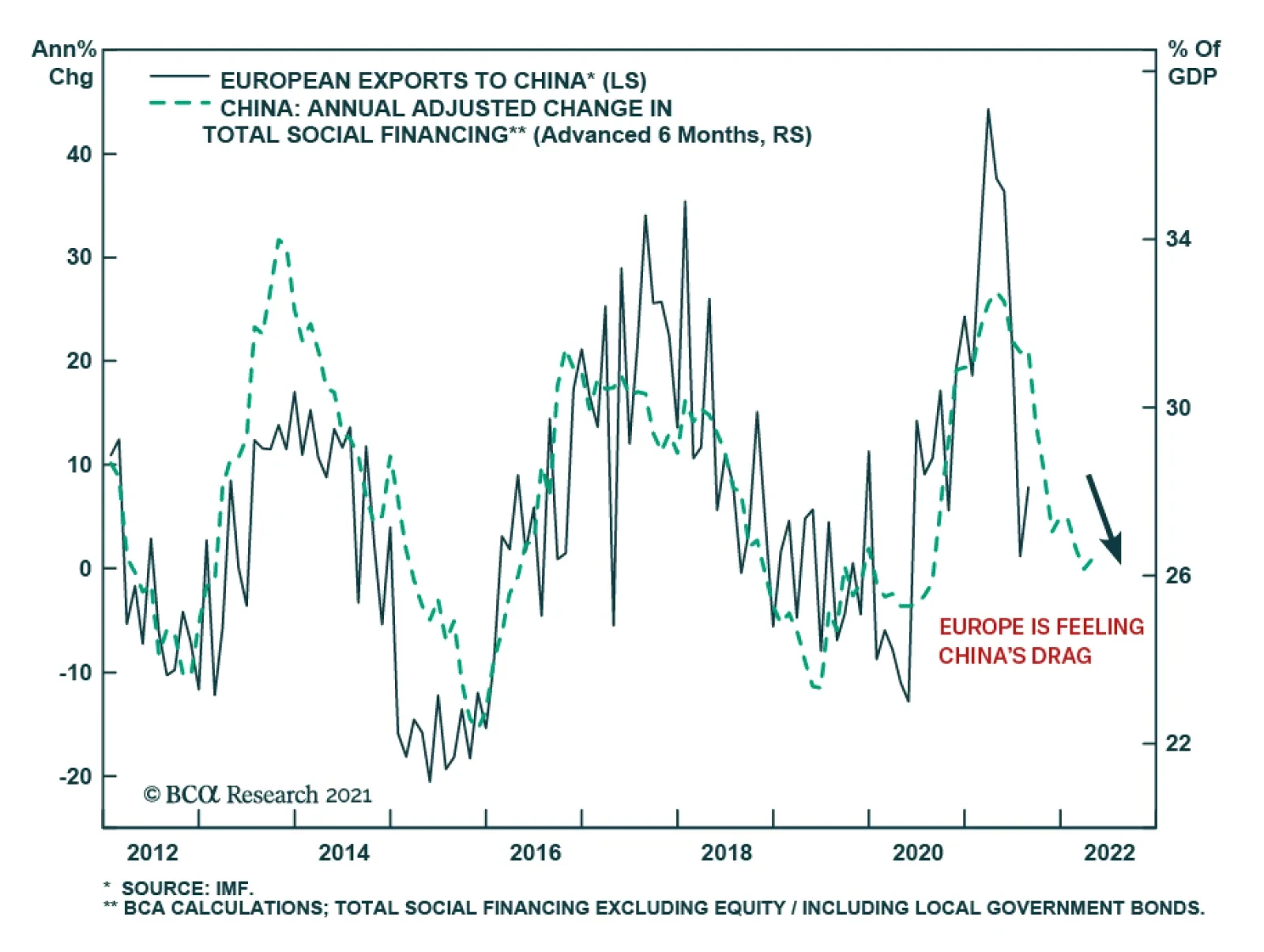

BCA Research’s European Investment Strategy service concludes that despite the ongoing recovery, the European economy will face significant headwinds in the first half of the year. China’s economic travail…

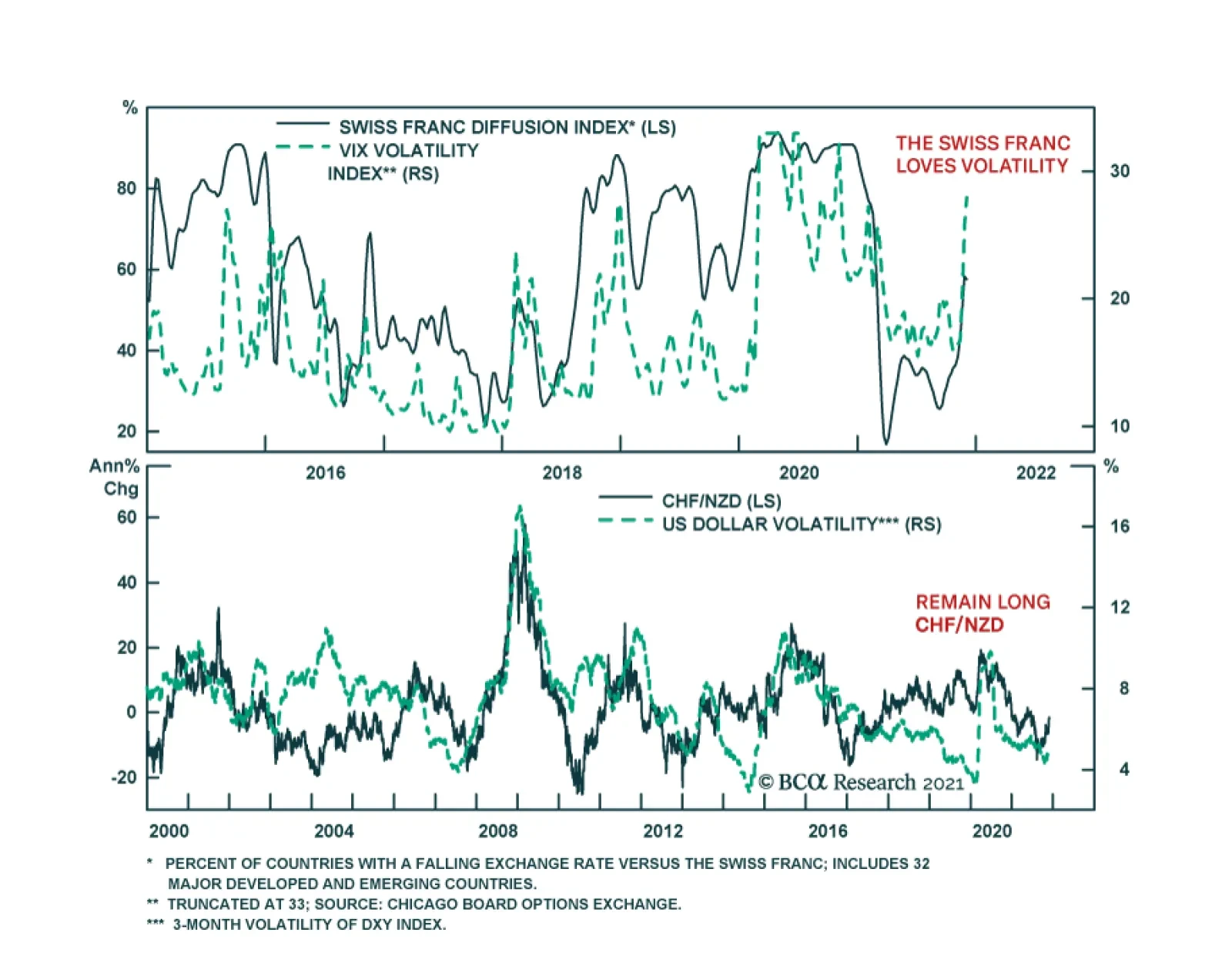

BCA Research’s Foreign Exchange Strategy service expects the Swiss franc to benefit in the very near term as volatility stays elevated. The CHF is as much driven by global dynamics as domestic actions by the SNB. With…

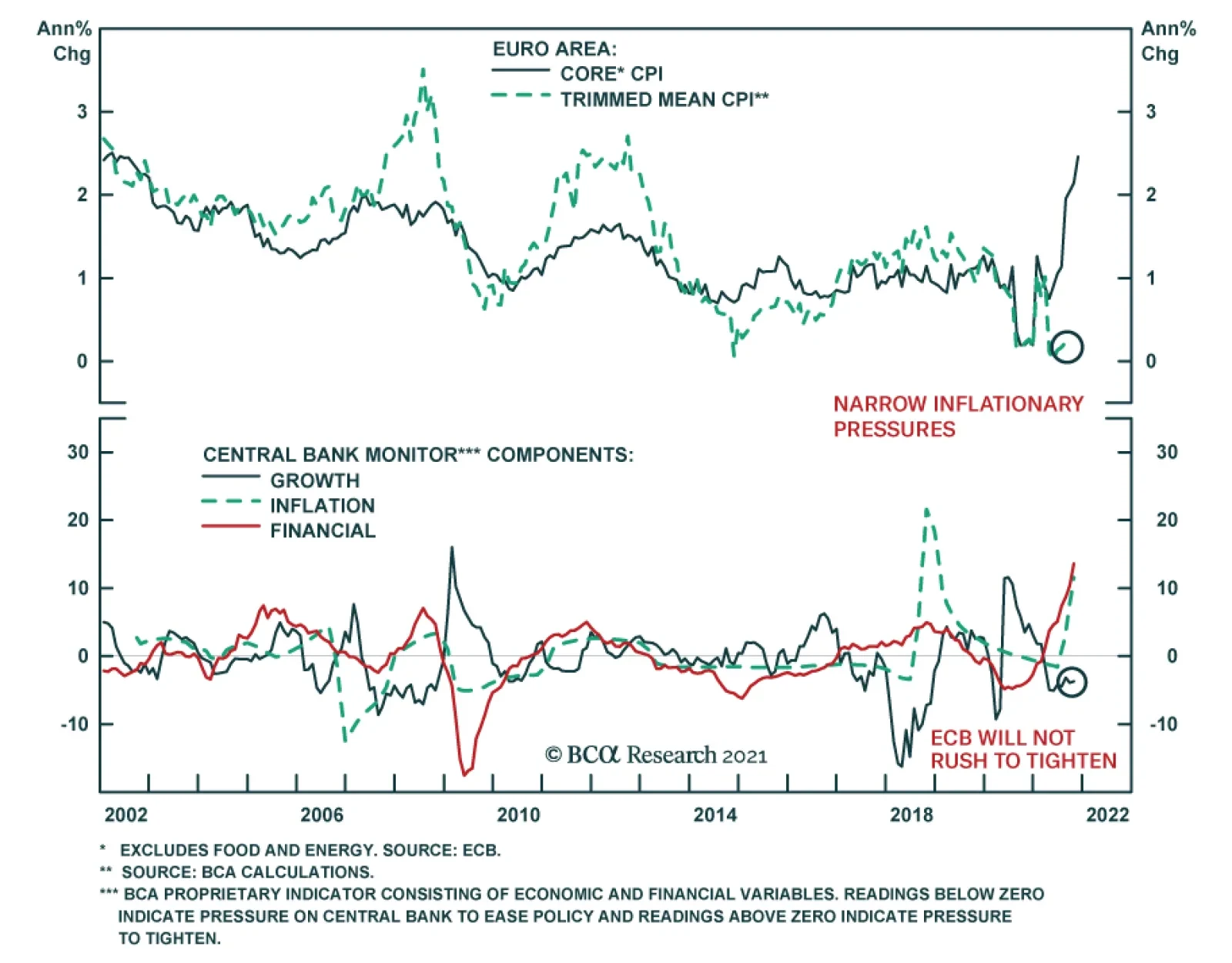

Euro Area CPI inflation jumped 0.8 percentage points to 4.9% y/y in November – a record high and above expectations of a 4.5% increase. The core measure also surprised to the upside and climbed higher above the 2% target to…

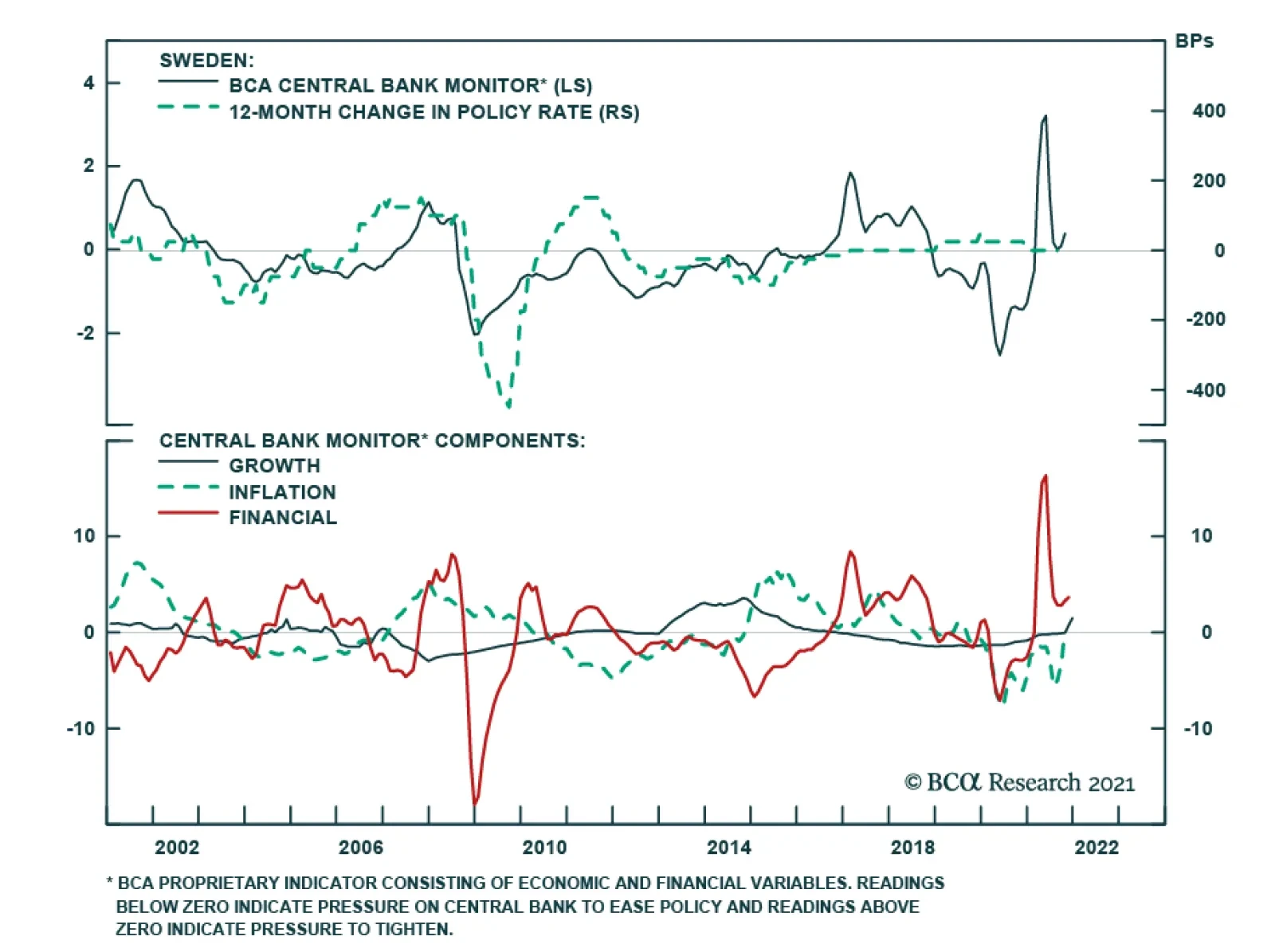

BCA Research’s European Investment Strategy & Global Fixed Income Strategy services conclude that Swedish sovereign debt is not an attractive underweight candidate in global government bond portfolios. Their Riksbank…

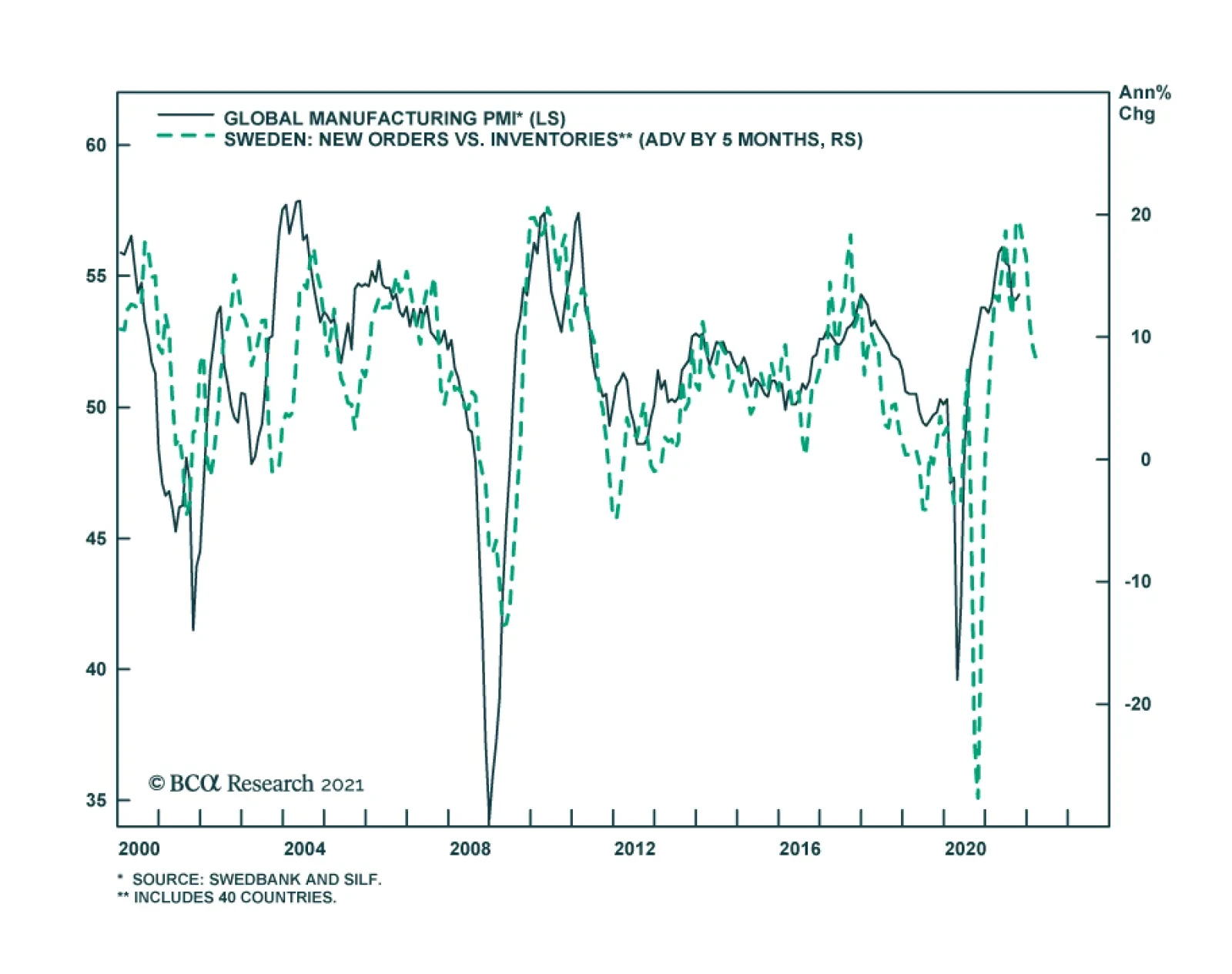

The Swedish new-orders-to-inventories ratio is a leading indicator of the global manufacturing cycle. Sweden is a small open economy that is very sensitive to global growth dynamics. Moreover, Swedish exports are weighted towards…