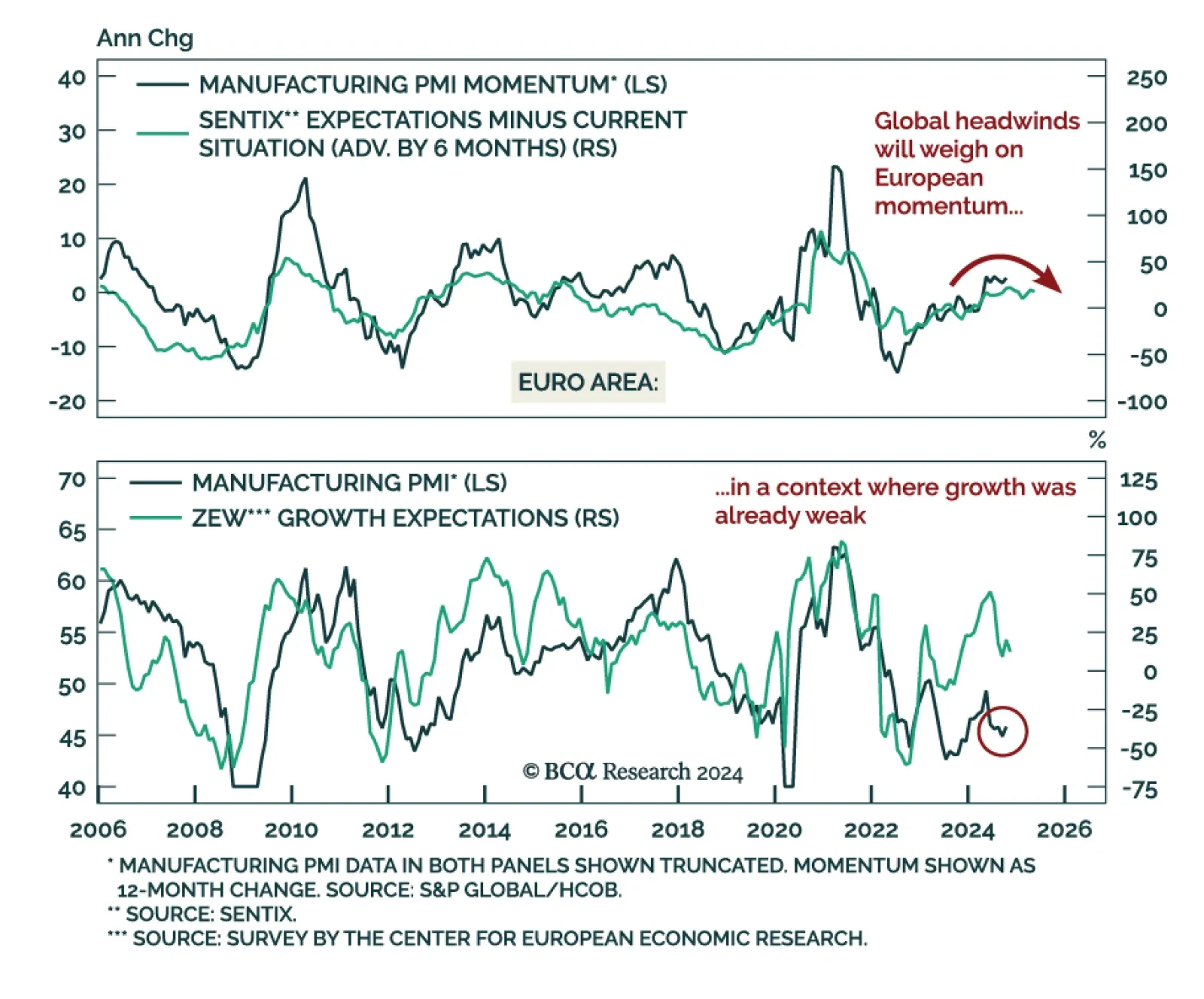

The November Ifo Business Climate index for Germany missed expectations, falling to 85.7 from 86.5 in October. Both subcomponents decreased, with the Current Assessment sliding 1.4 points to 84.3 and Expectations essentially flat…

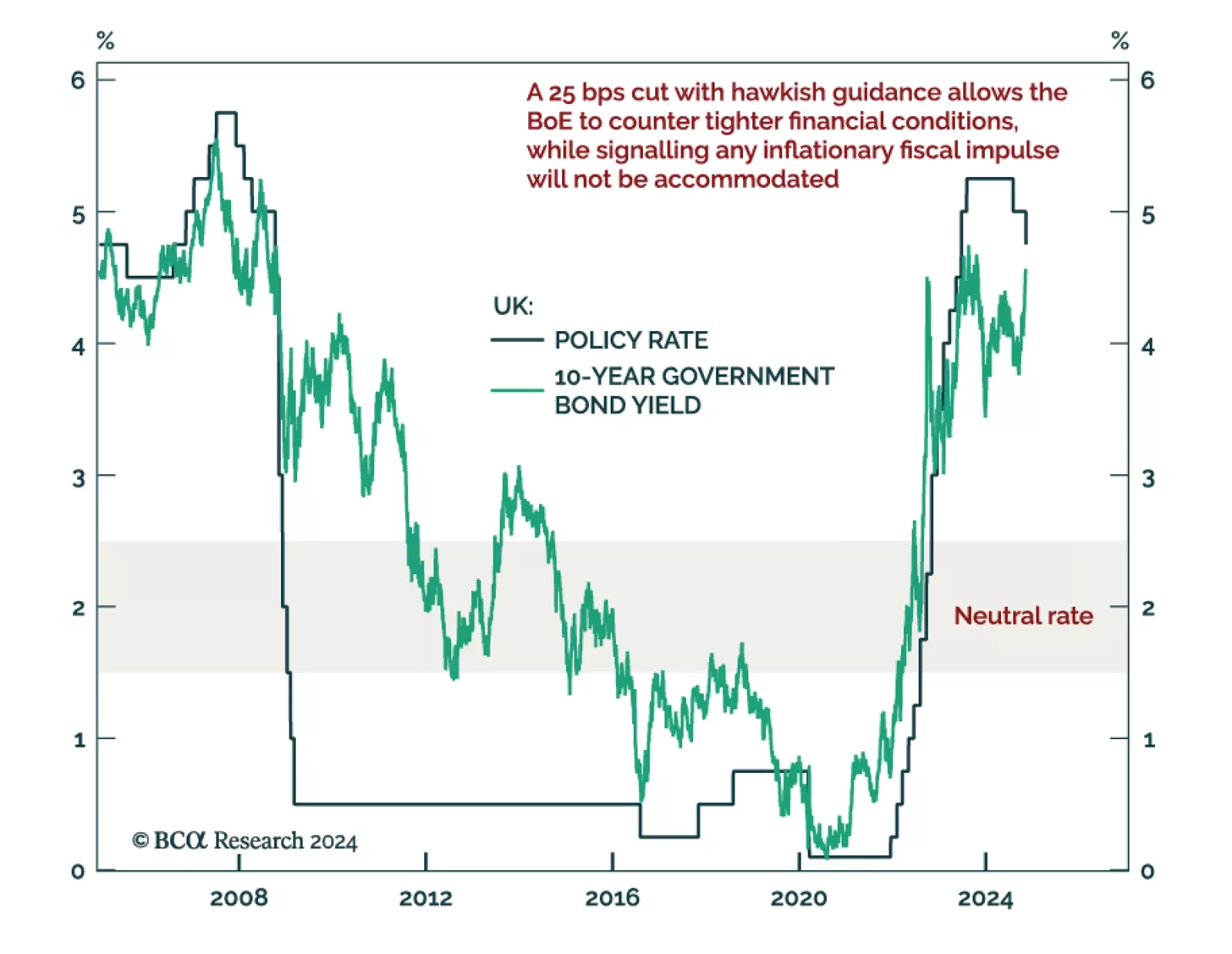

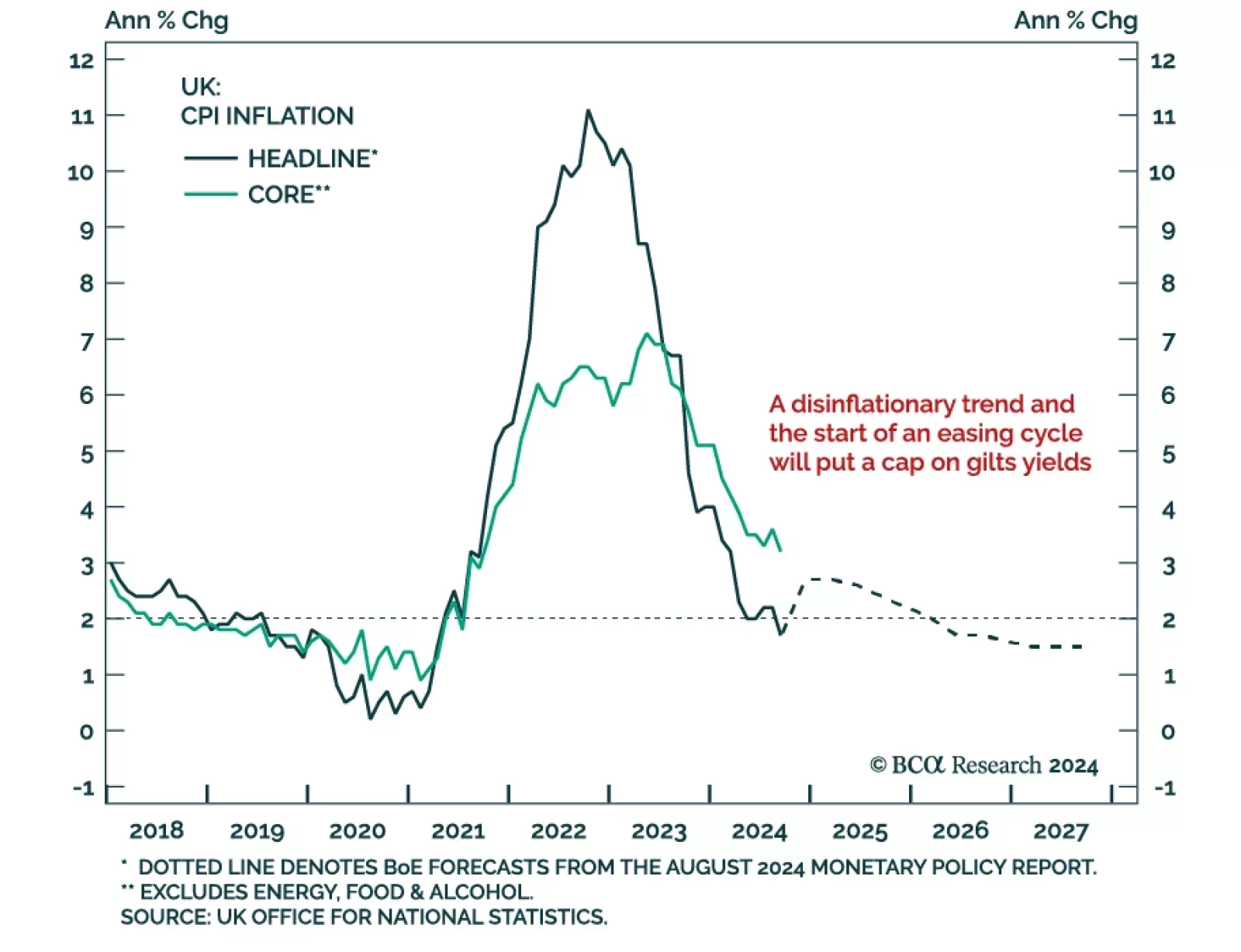

UK inflation was hotter than expected in October, rising to 0.6% m/m from being flat in September. Core inflation also ticked up, printing at 3.3% y/y vs. 3.2% a month prior. Services inflation remains elevated at 5.0% y/y.…

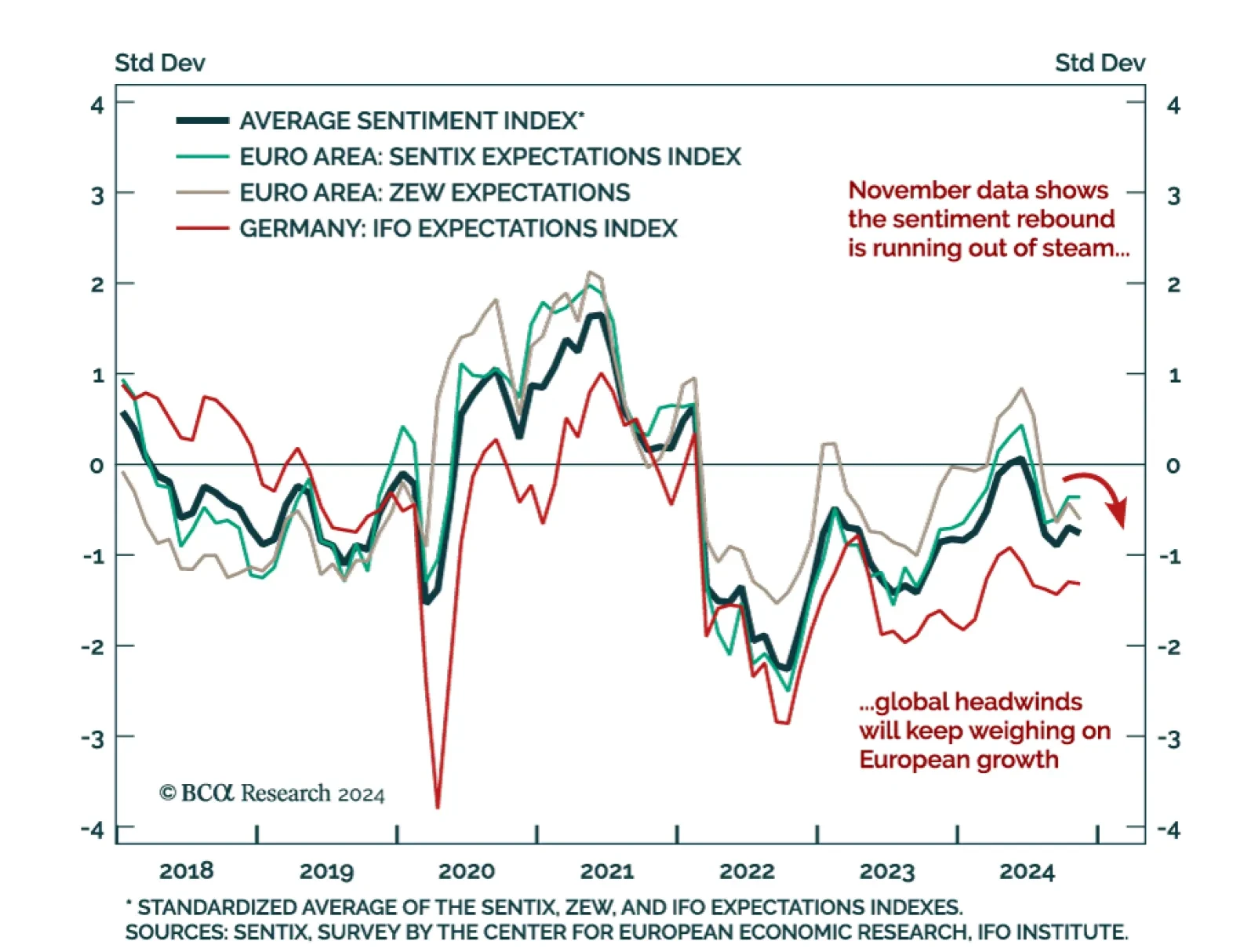

Economic expectations for Germany and the Eurozone disappointed, with the November ZEW decreasing to 12.5 from 20.1. The assessment of current conditions also worsened, implying the sentiment rebound from September will not be…

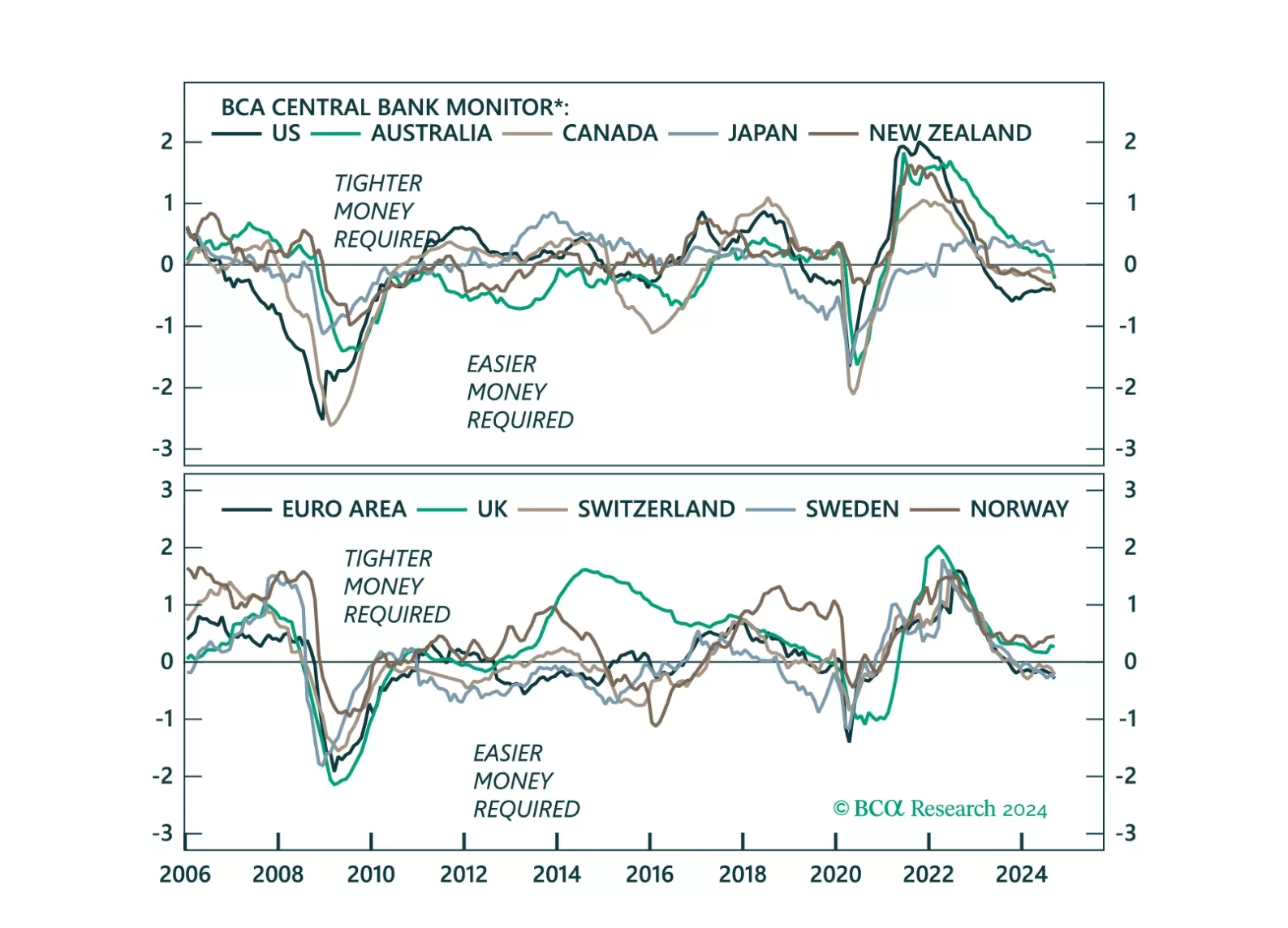

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

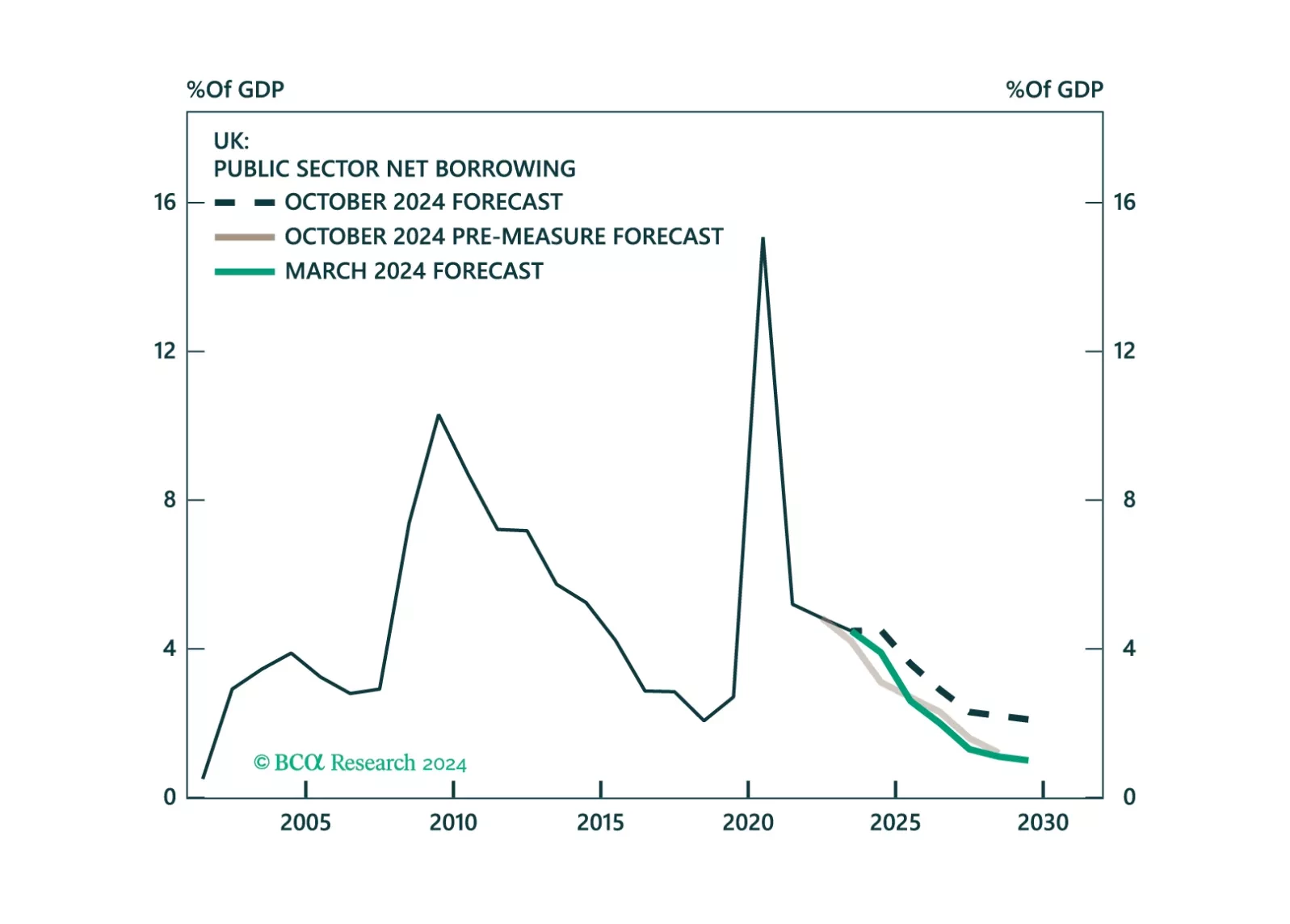

This Strategy Insight presents our view on today’s rate cut by the Bank of England as well as the budget announced by the UK government last week.

The Bank of England cut its policy rate in line with expectations to 4.75%, but it signaled a more gradual pace of cuts as it increased its inflation forecast following last week’s budget. A 25 bps cut with hawkish…

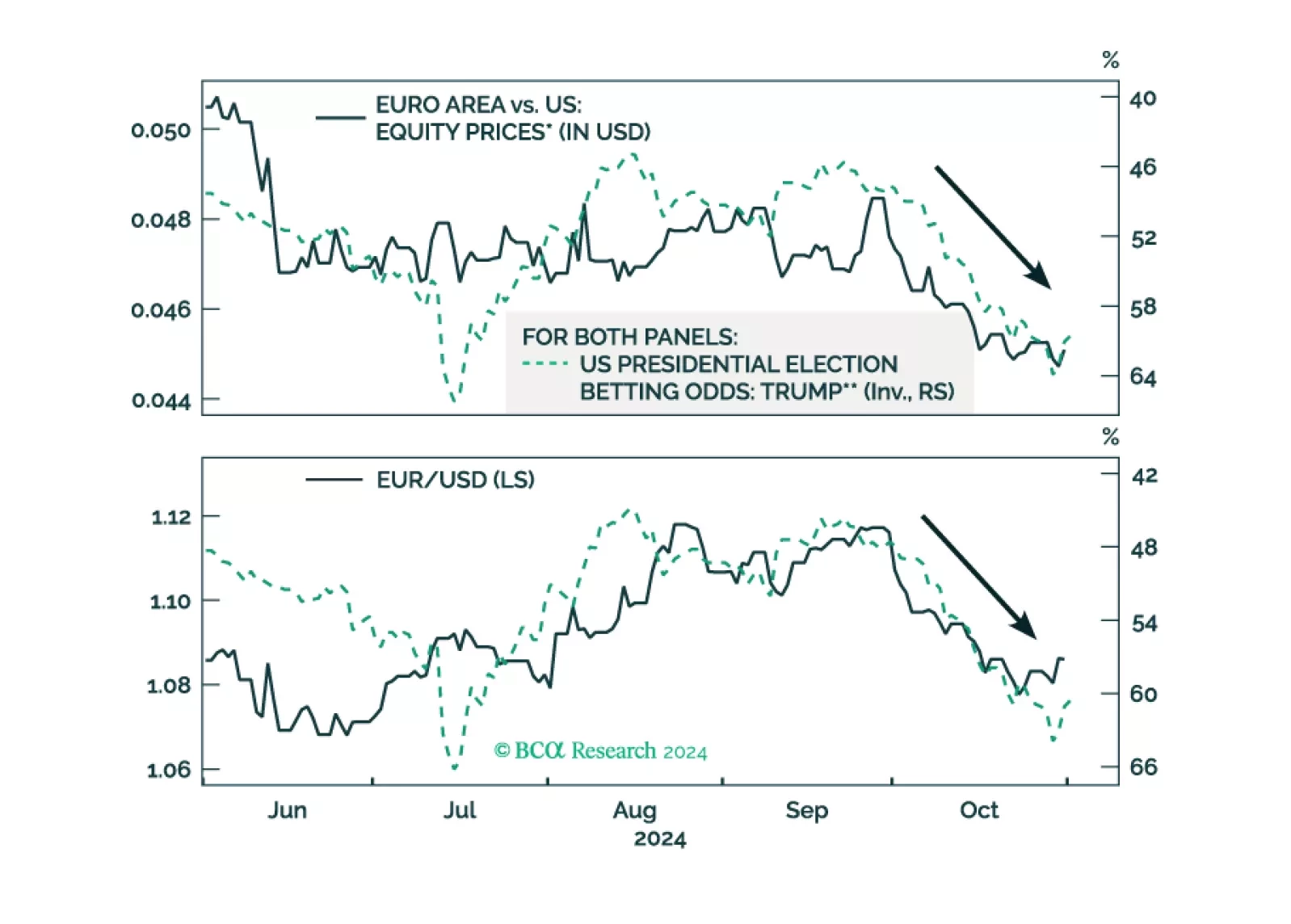

As the odds of a Trump victory rise, European assets underperform US ones. What would be the immediate impact of a Trump victory on European stocks?

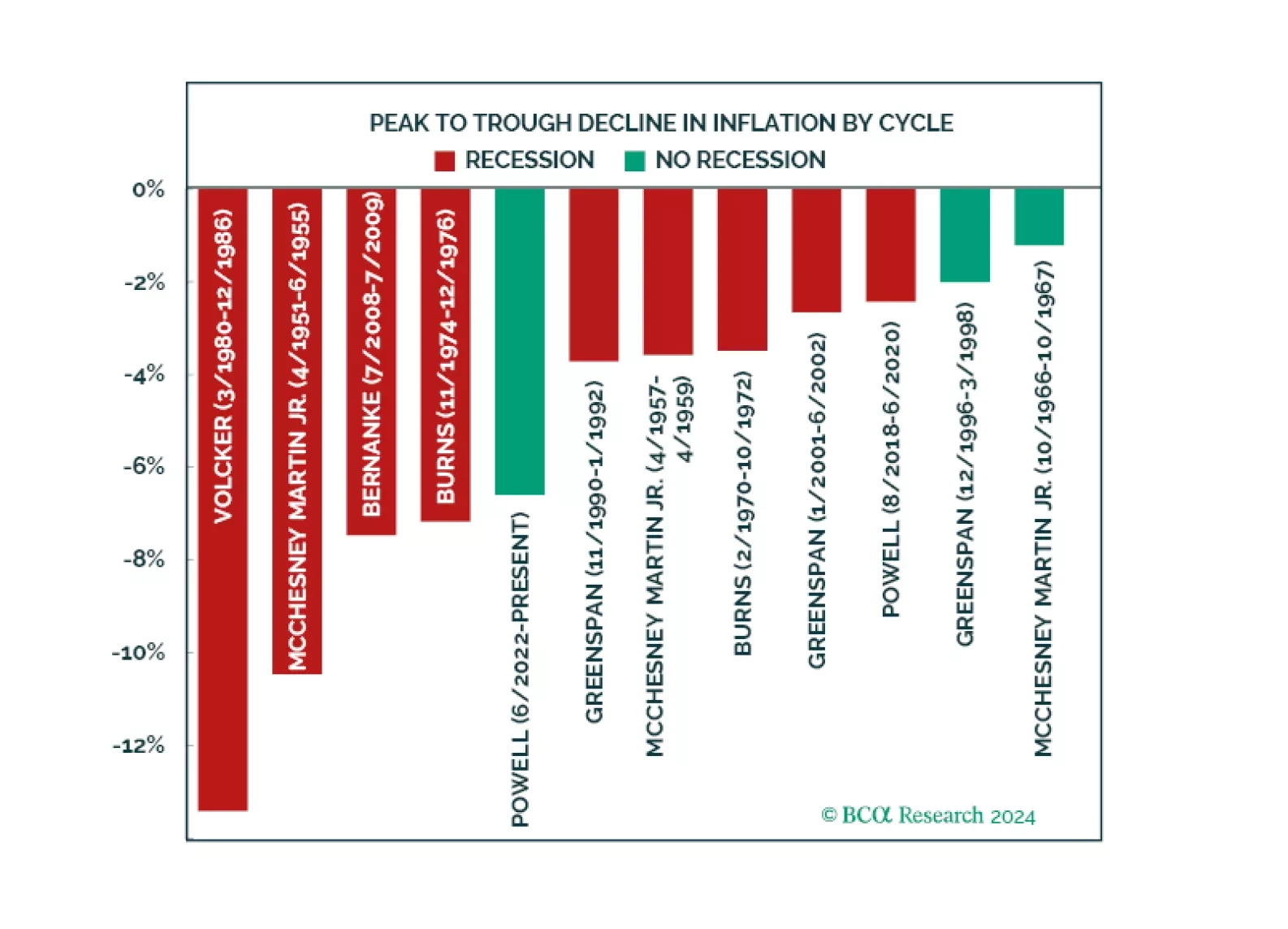

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

We recently pointed to the UK Budget announcement as a pivotal event for UK assets. Following an initially positive reception, the market has turned and priced in further fiscal premia in UK assets, with both gilts and the pound…