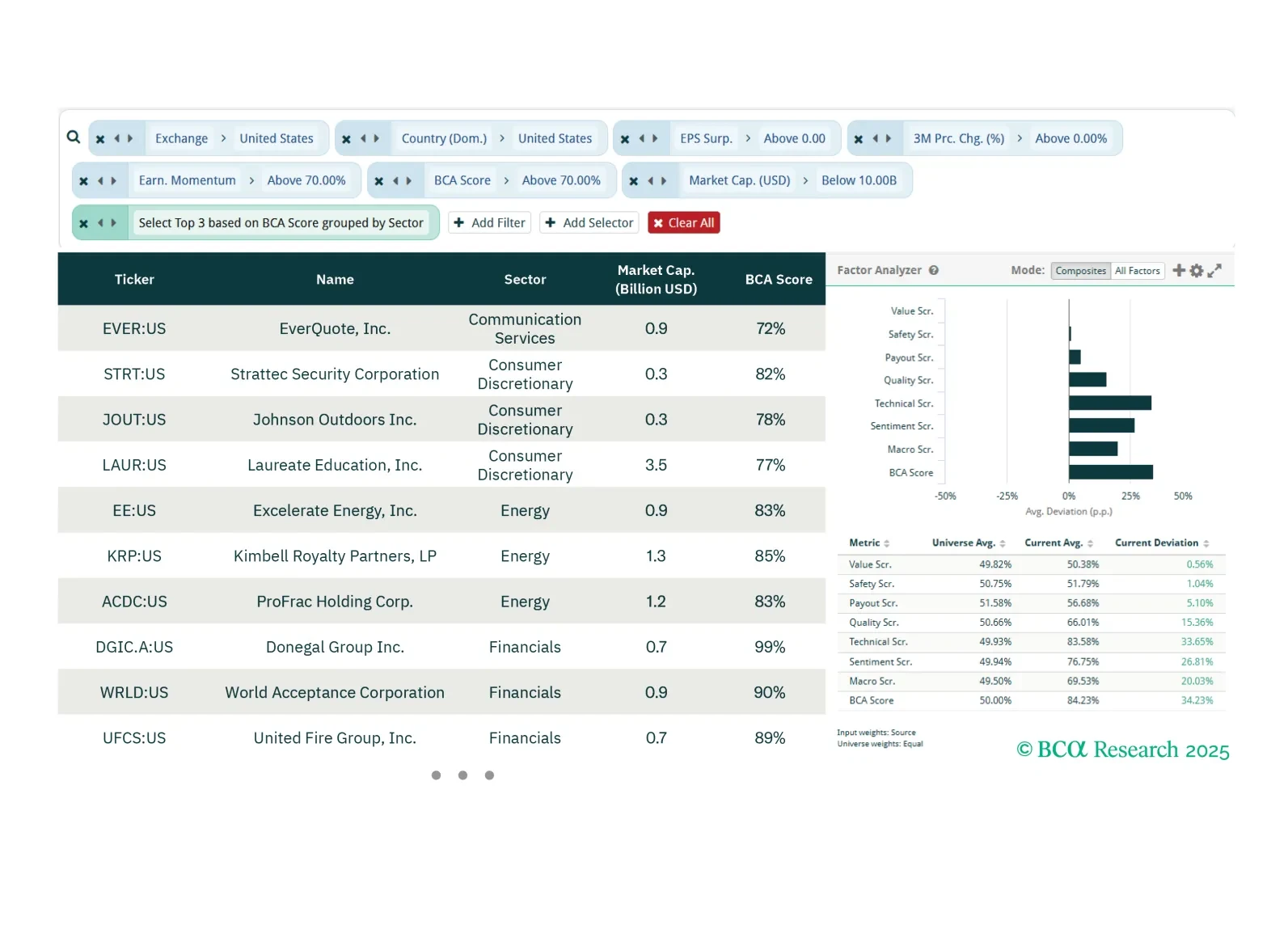

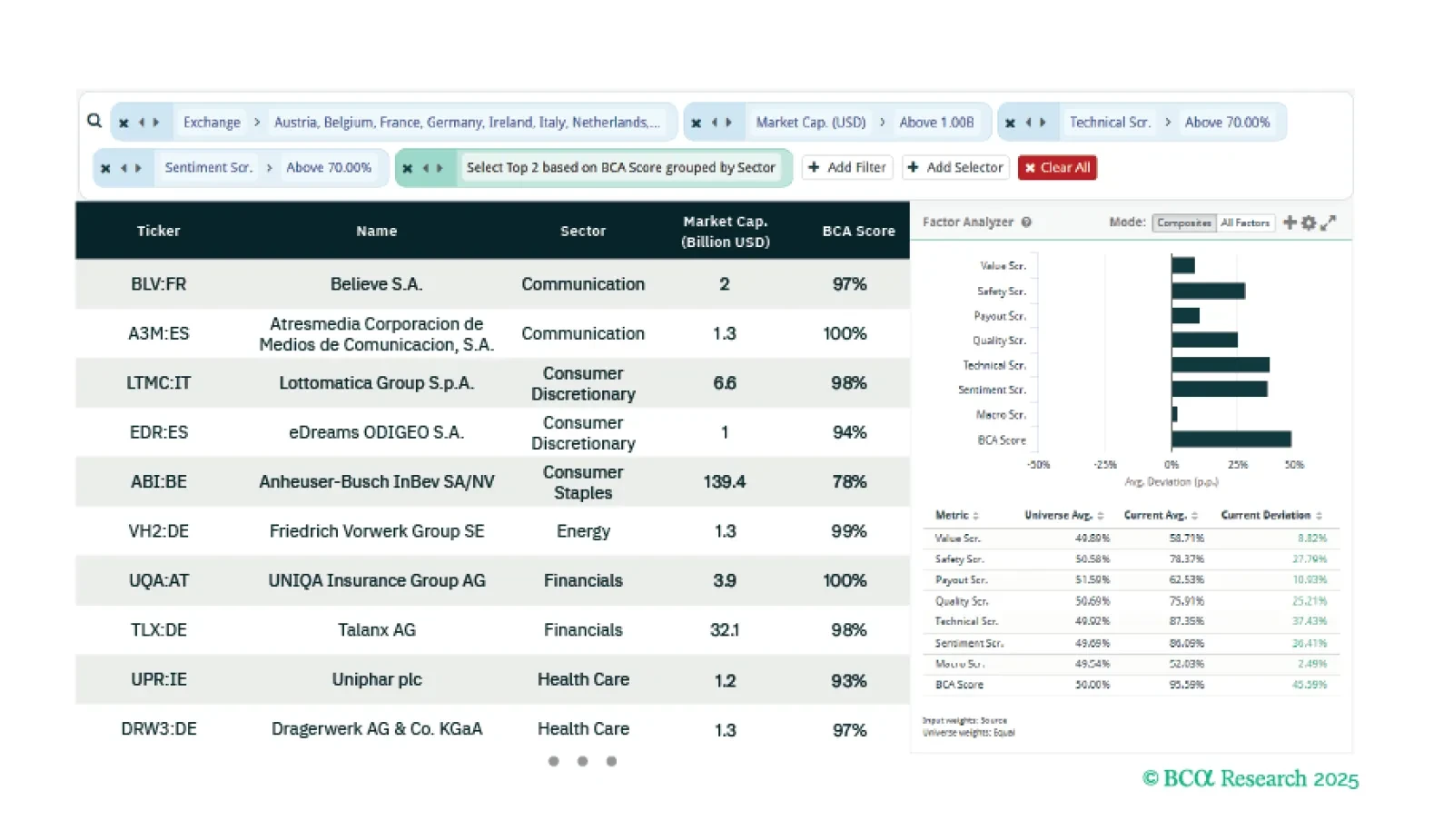

This week our three screeners identify stocks that are likely to keep delivering deliver earnings surprises in the US, European small caps that are high quality and mean reverting, and Japanese large caps picks across GICS 1 sectors…

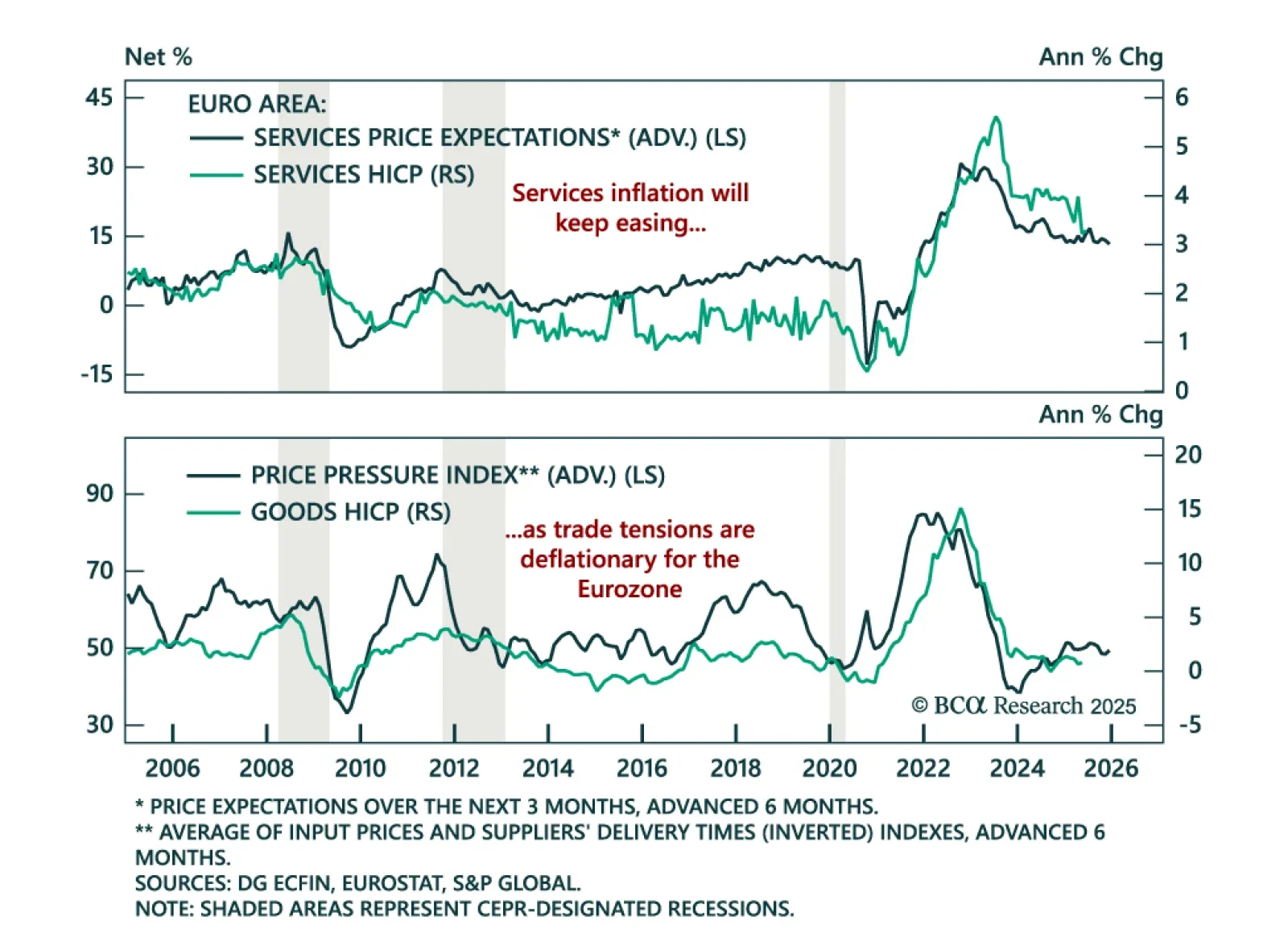

June Eurozone inflation data and soft growth backdrop support further ECB easing and reinforce the case for long European bond exposure. Flash HICP inflation ticked up to 2.0% y/y from 1.9%, while core inflation held steady at 2.3%,…

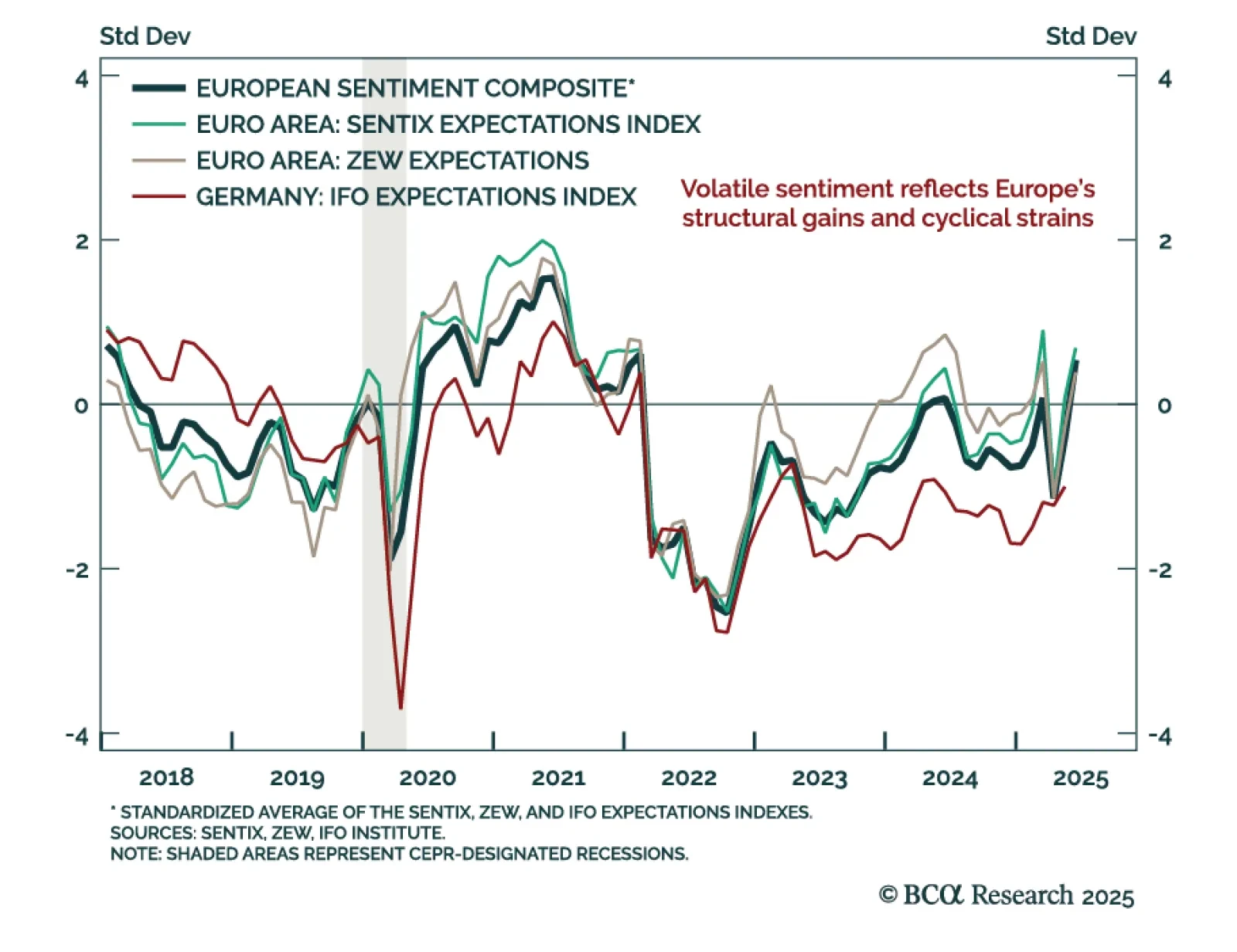

The European economy is losing altitude; and the second half of 2025 could get bumpier.

Join Mathieu Savary and Jérémie Peloso for our European Investment Strategy Webcast as we break down the key drivers shaping the outlook for…

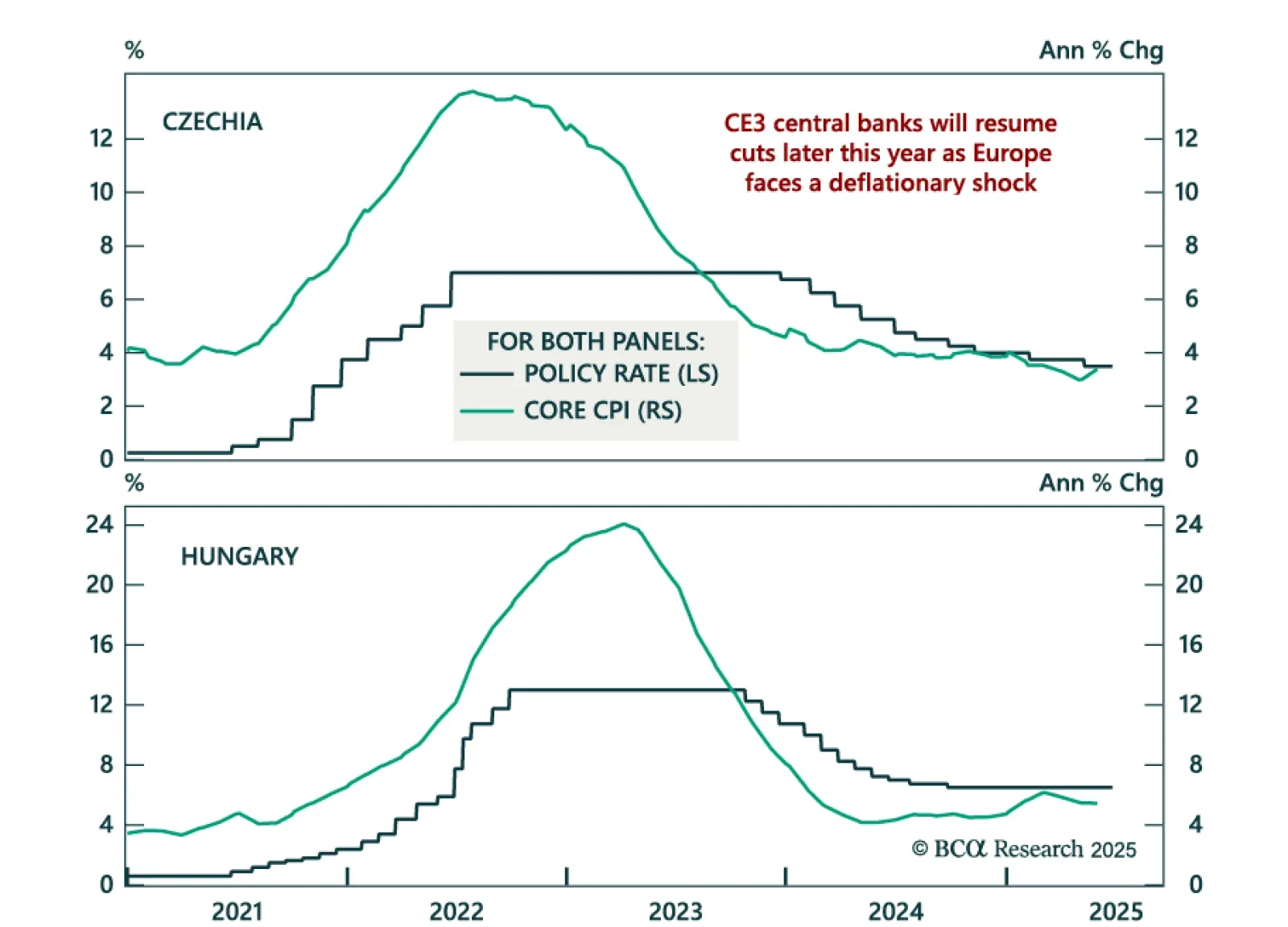

Deflationary pressures and weak core Europe growth support CE3 bond longs as rate cuts loom. The Czech and Hungarian central banks held rates steady at 3.5% and 6.5% this week, following Poland’s earlier decision to keep rates…

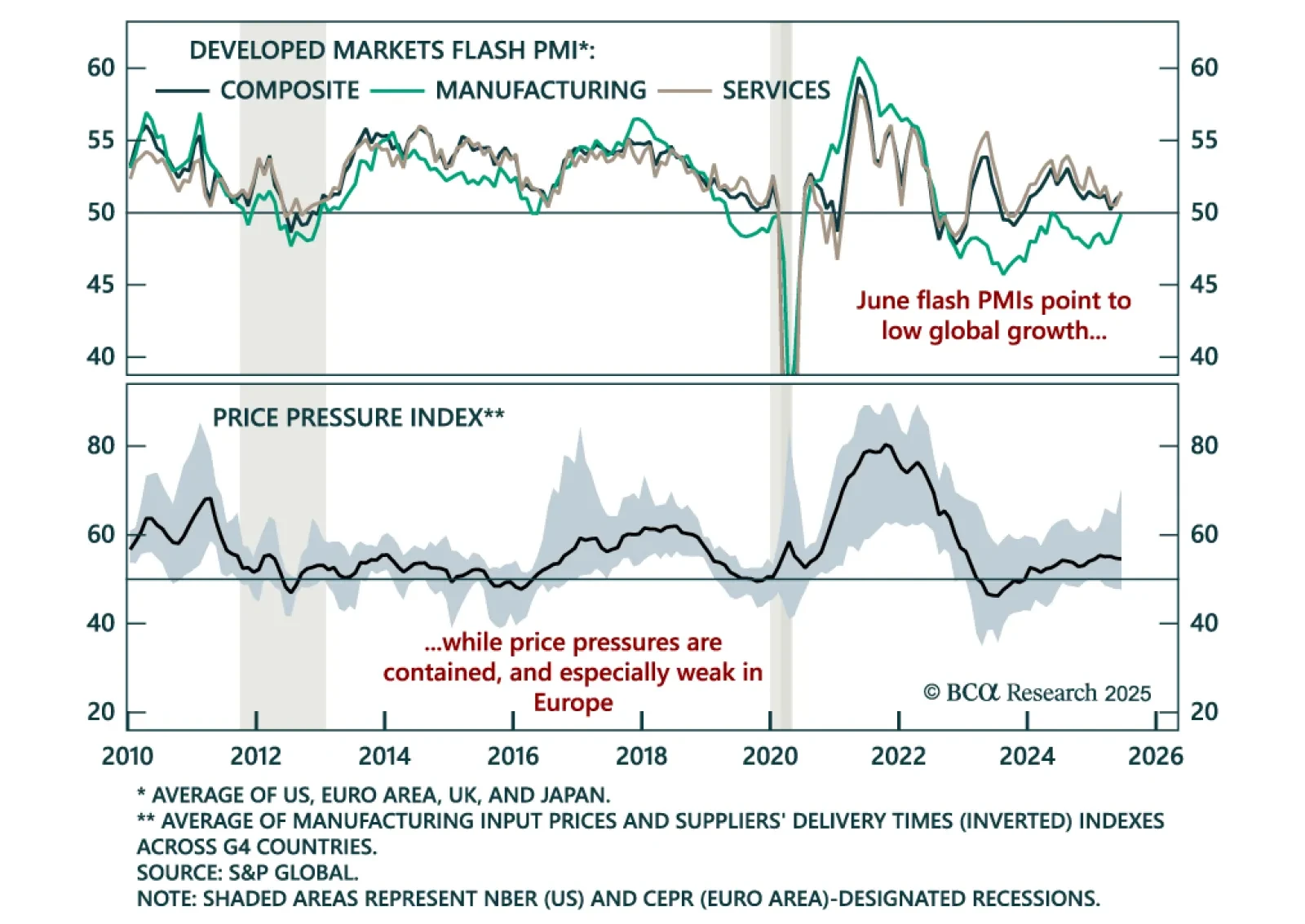

June PMIs confirm low global growth and support a long duration stance as price pressures remain contained. The flash PMIs were mixed across DMs: Sideways in the US and euro area, but firmer in the UK and Japan. Yet the overall…

This week our three screeners explore: Equity trades across the Euro Zone focusing on Technicals and Sentiment; US Oil, Gas and Fuel stocks; and European Small Caps.

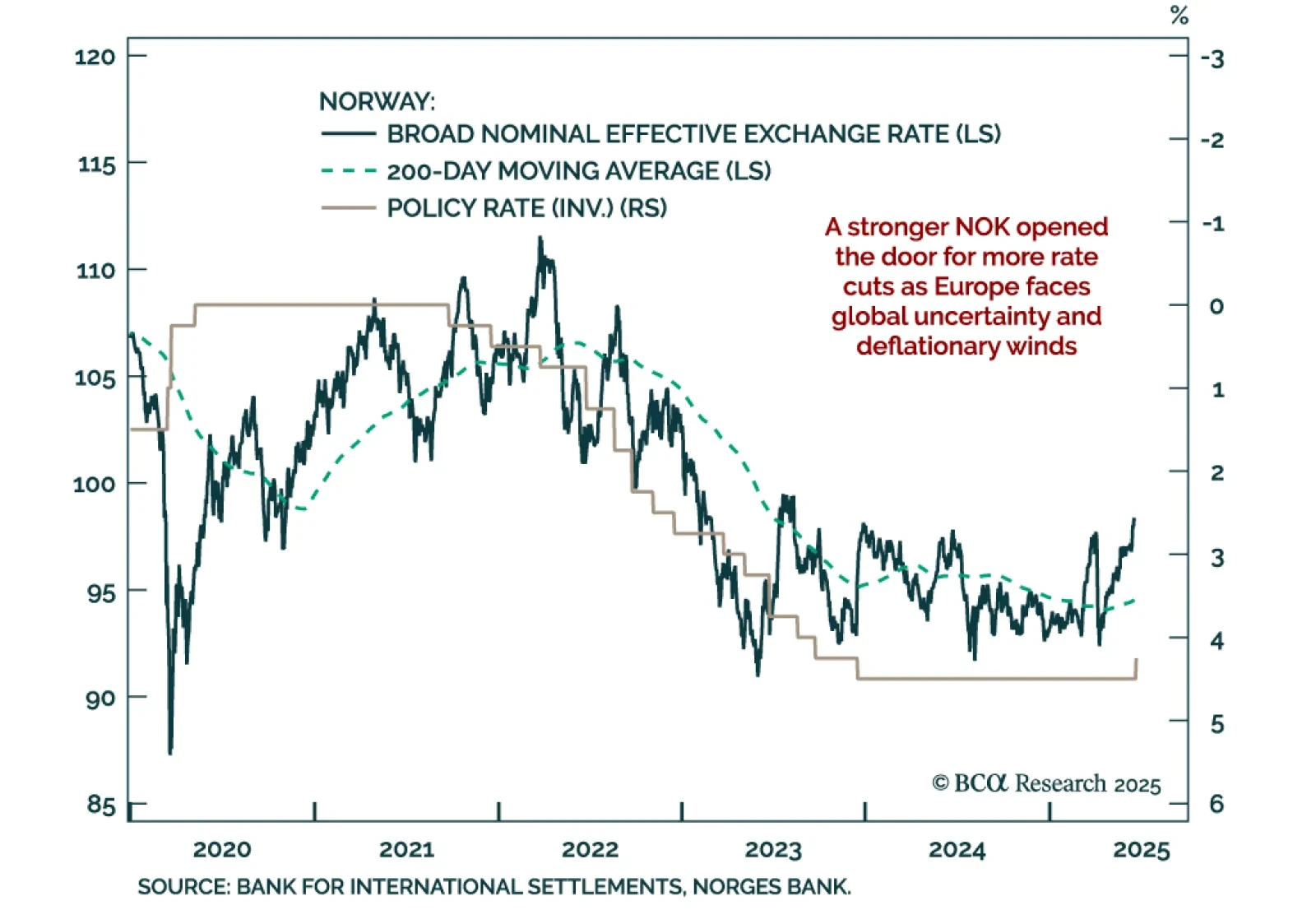

A stronger Norwegian krone has opened the door to more rate cuts, making Norwegian government bonds more attractive. Our Chart Of The Week comes from Jeremie Peloso, European Strategist. With its surprise 25 basis point cut, the…

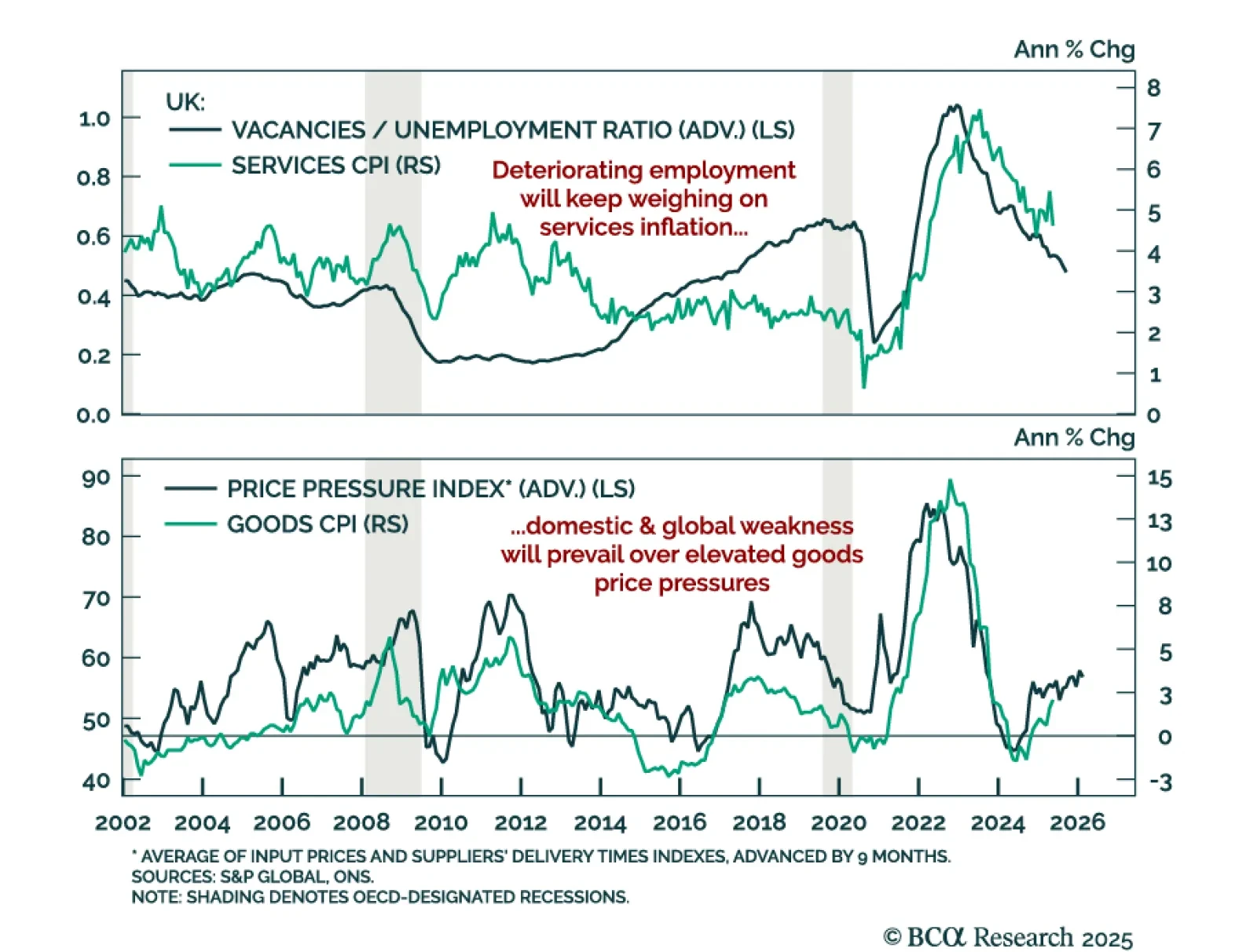

UK disinflation and labor market softening support our overweight in Gilts and short GBP trade. UK CPI came in slightly hotter than expected in May, with headline inflation at 3.4% y/y (vs. 3.5% in April) and core CPI meeting…

Sweden’s economic fragility and disinflation support further easing, reinforcing our long SEK rates and NOK/SEK trades. The Riksbank cut rates by 25 bps to 2.0% and projected an additional cut, consistent with prior OIS pricing.…

ZEW expectations jumped in May, but underlying macro fragility supports a cautious stance on eurozone assets. The ZEW expectations index for the euro area rose to 35.3 from 11.6, with Germany also beating expectations. The current…