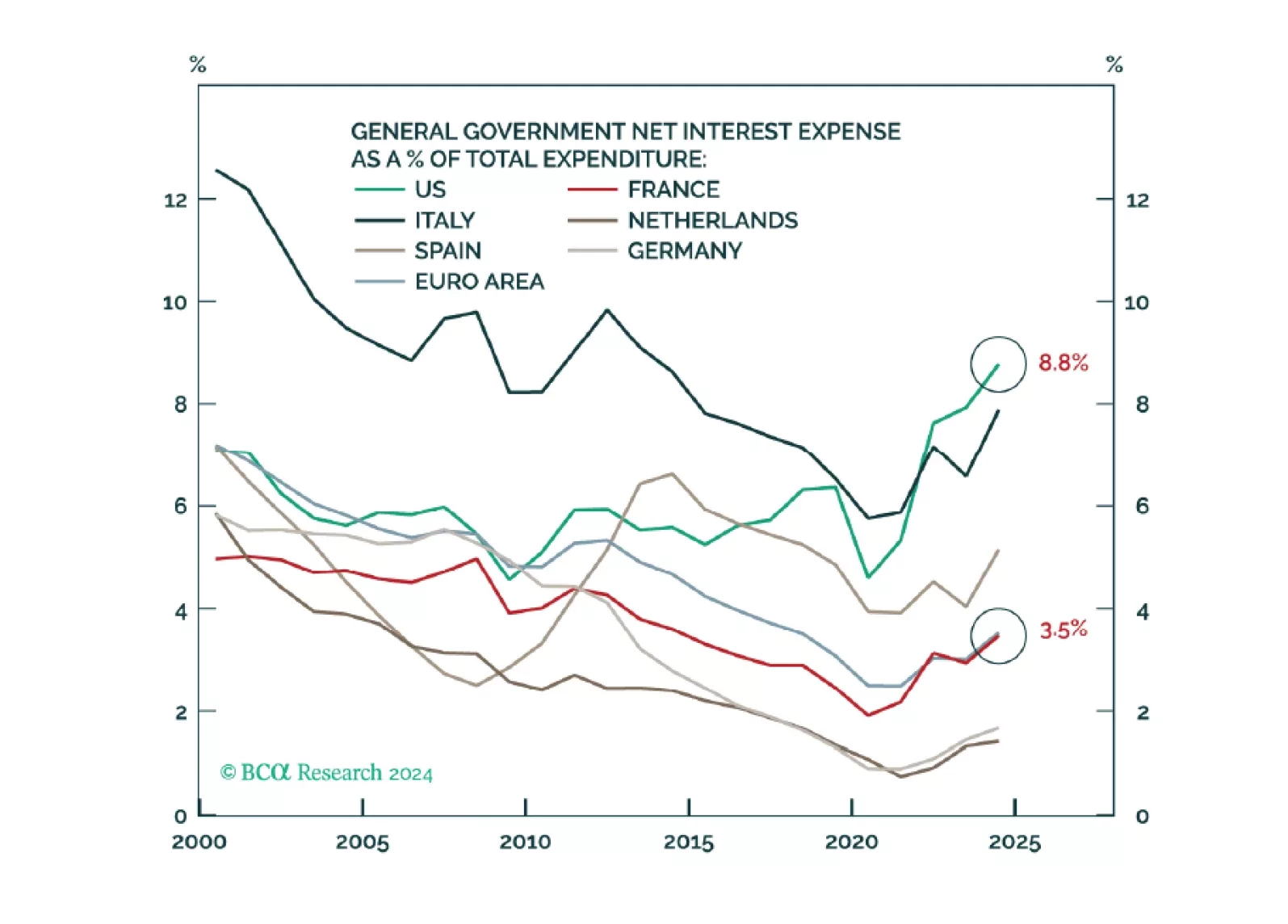

In our Volume I – The Alpha Report – we posit that the French bond market reaction is a mere amuse bouche for what is coming to the US. All year, we have warned investors that US politics could induce a bond market riot. This moment…

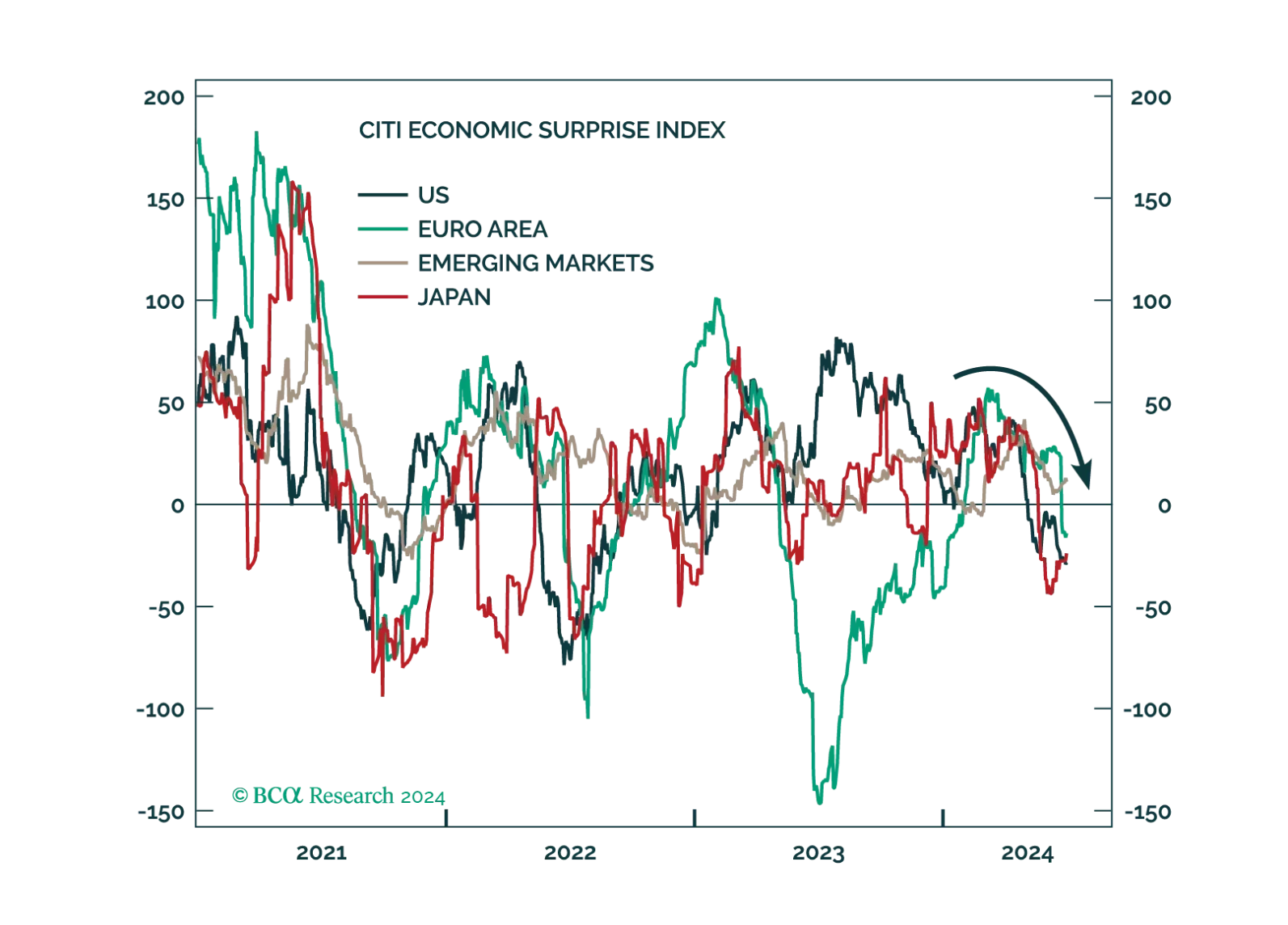

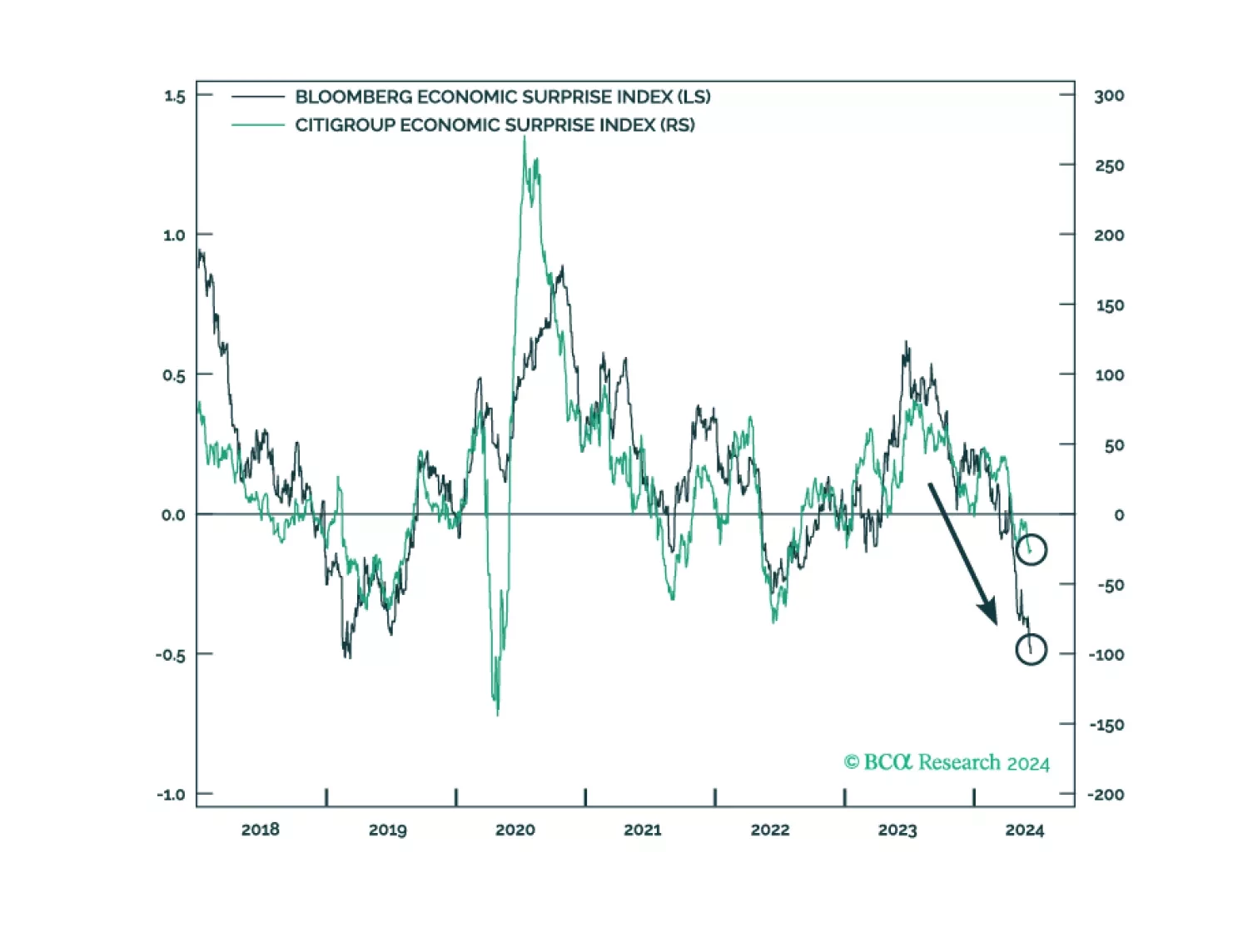

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

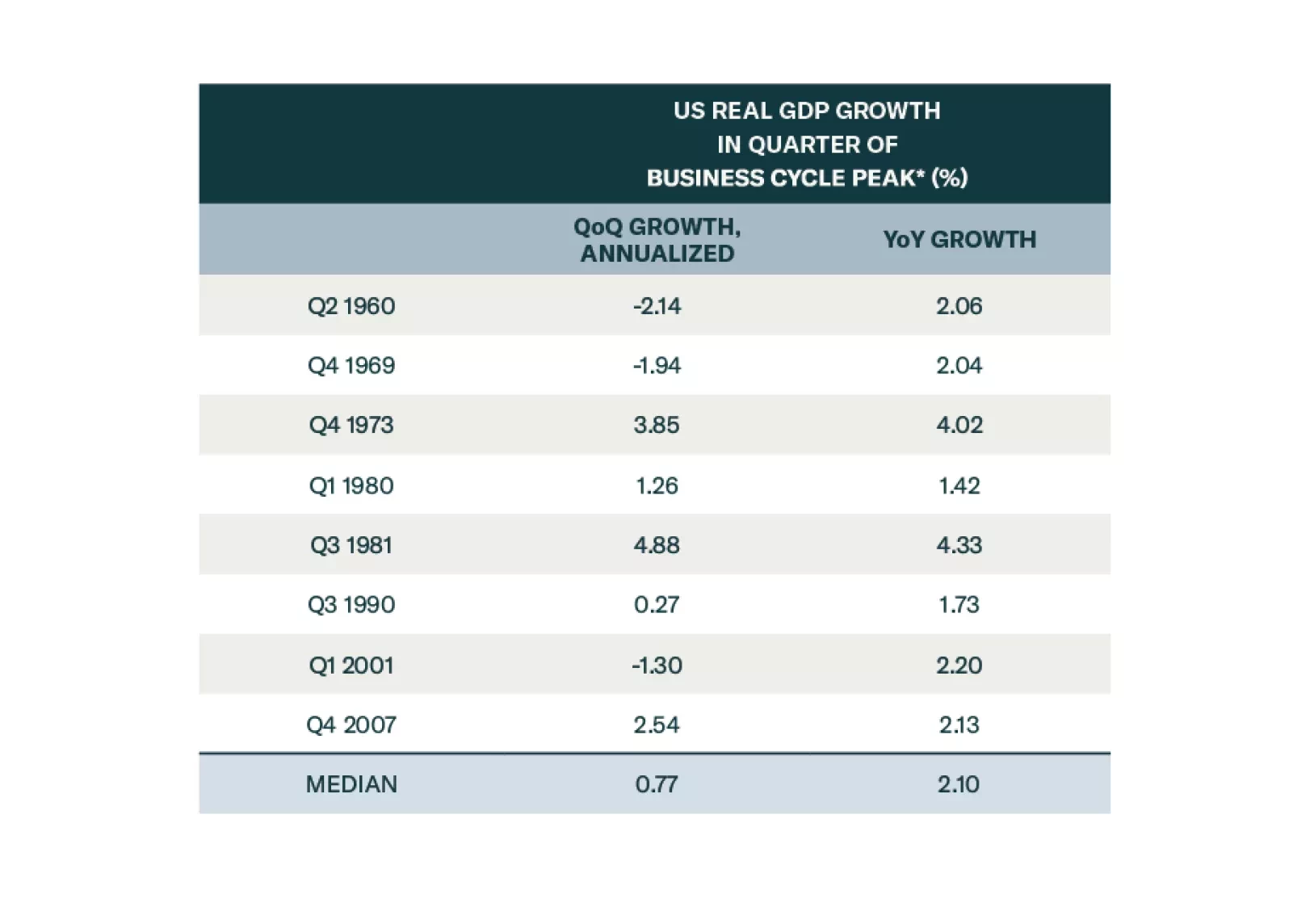

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

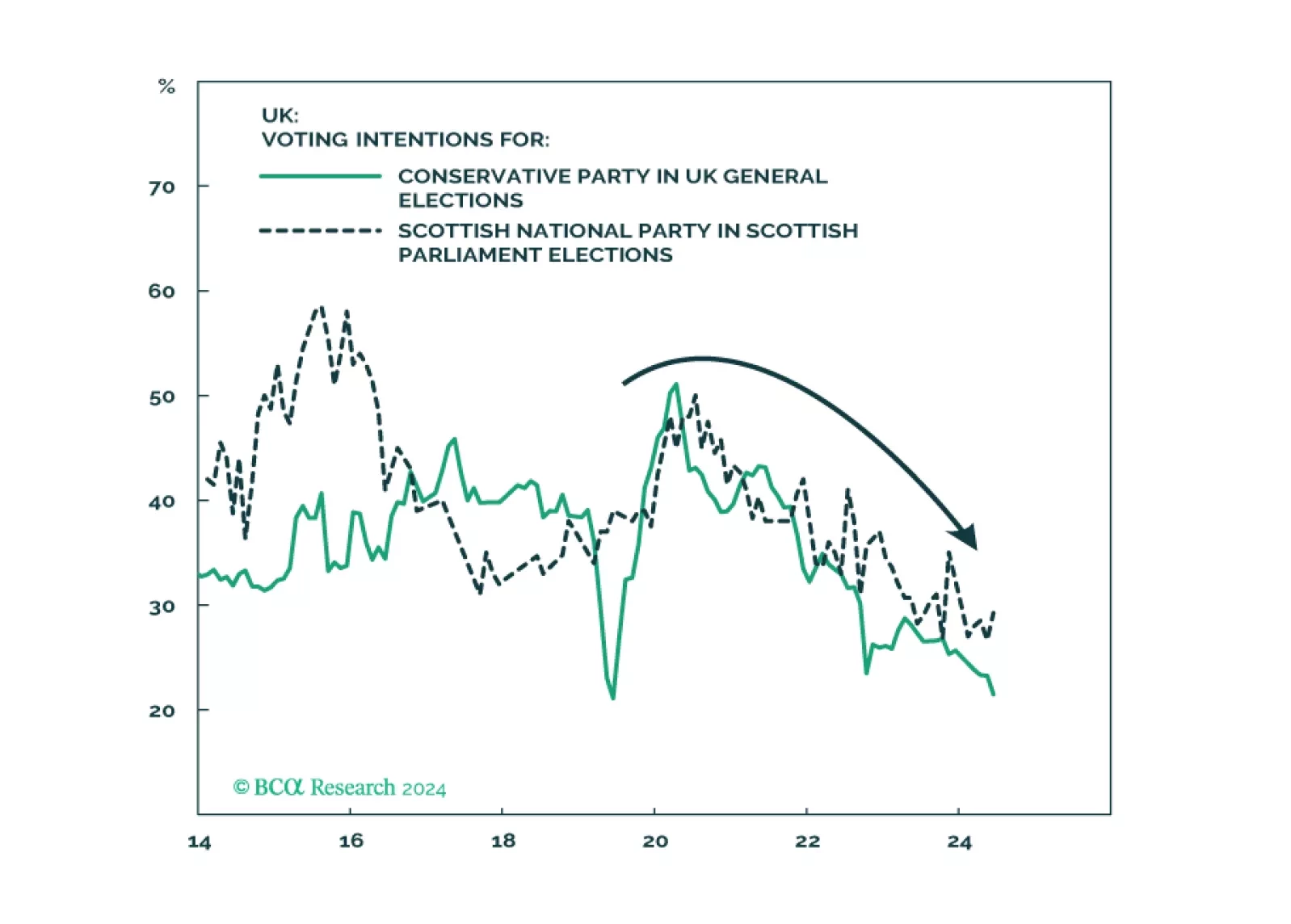

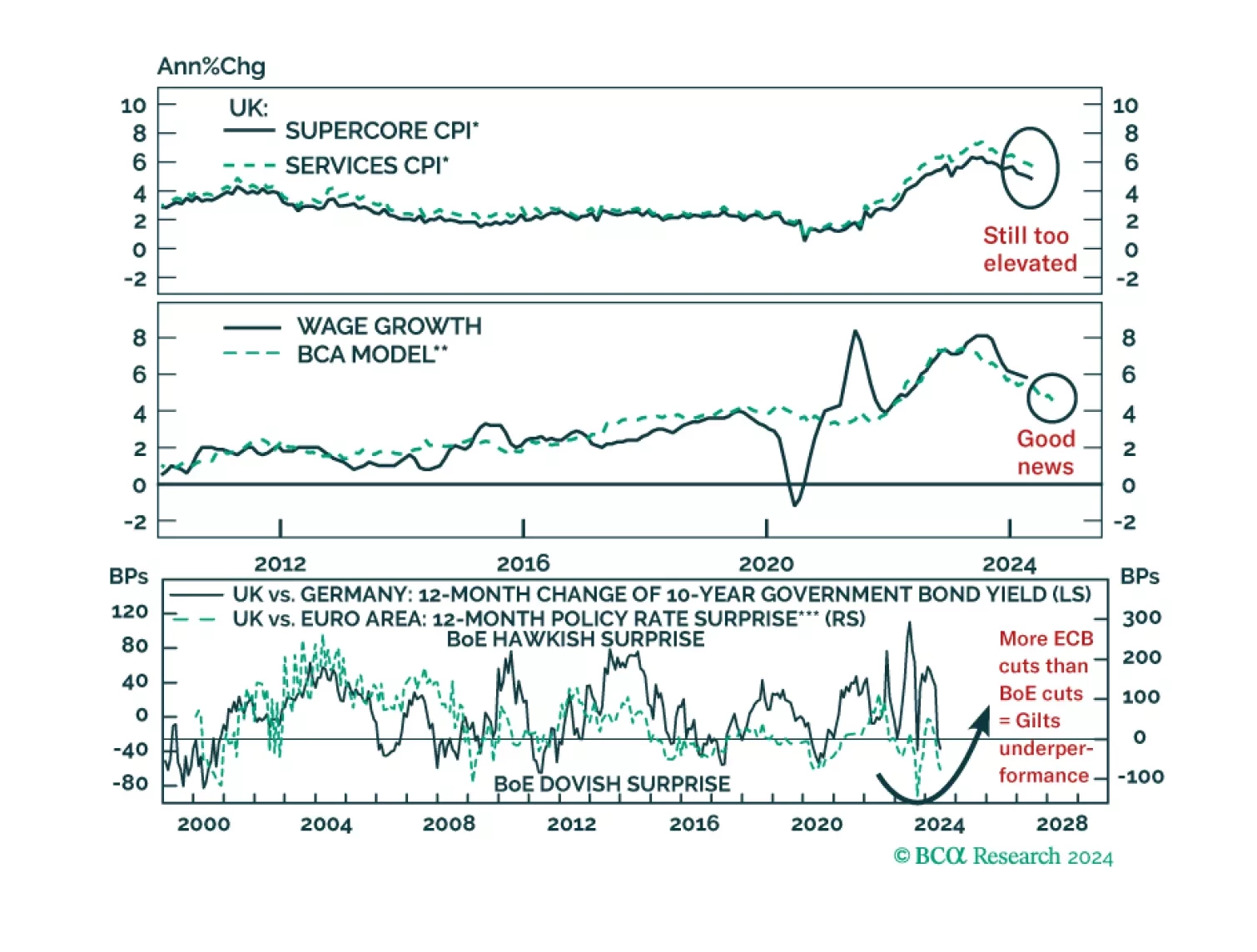

According to BCA Research’s European Investment Strategy service, the BoE will start cutting rates in September, but the pace of subsequent rate cuts will be modest until a recession engulfs Western economies in early 2025…

According to the results of the latest German IFO survey, overall sentiment deteriorated slightly in June. The IFO Business Climate index declined from 89.3 in May to 88.6 in June, disappointing expectations of a modest…

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

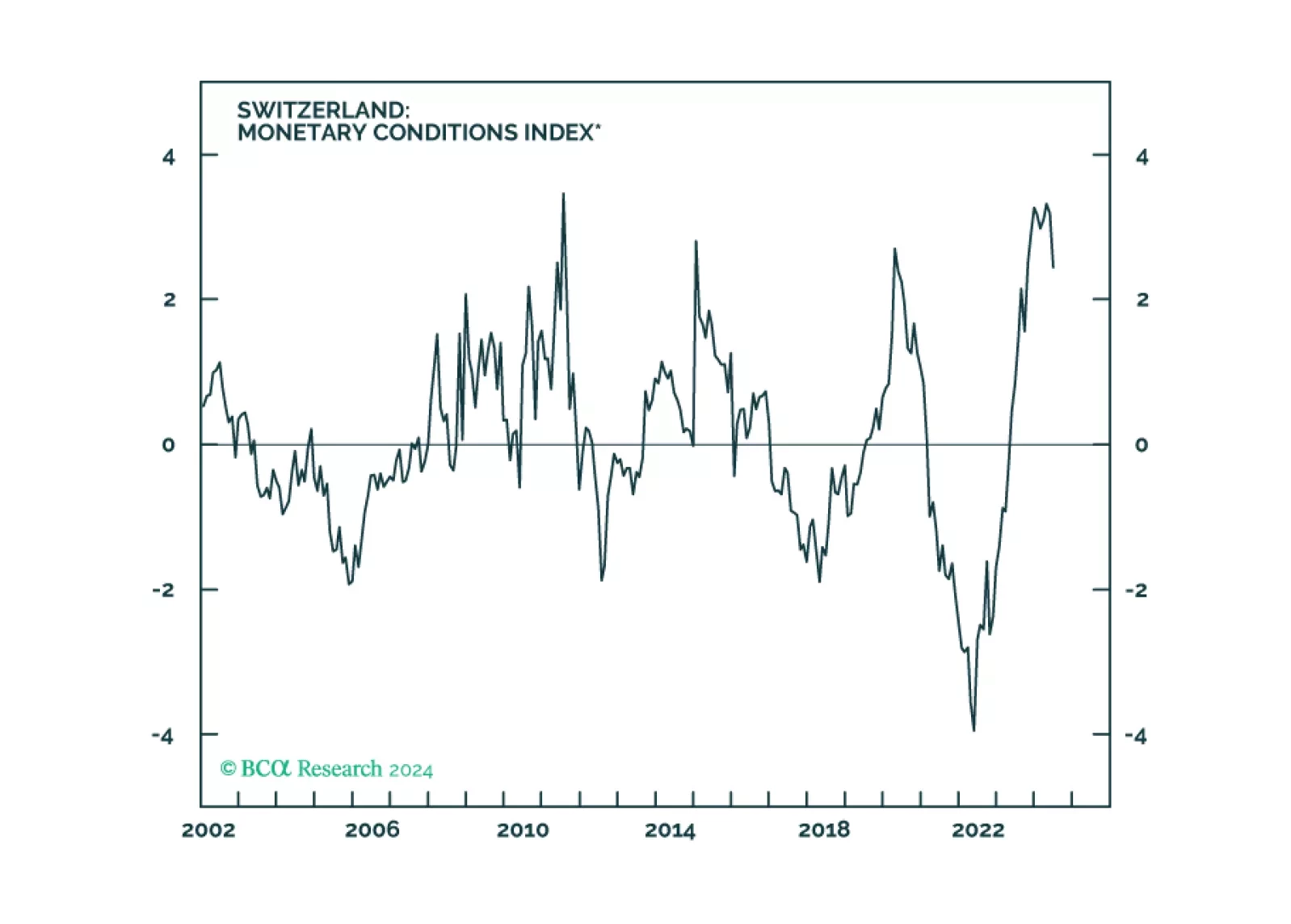

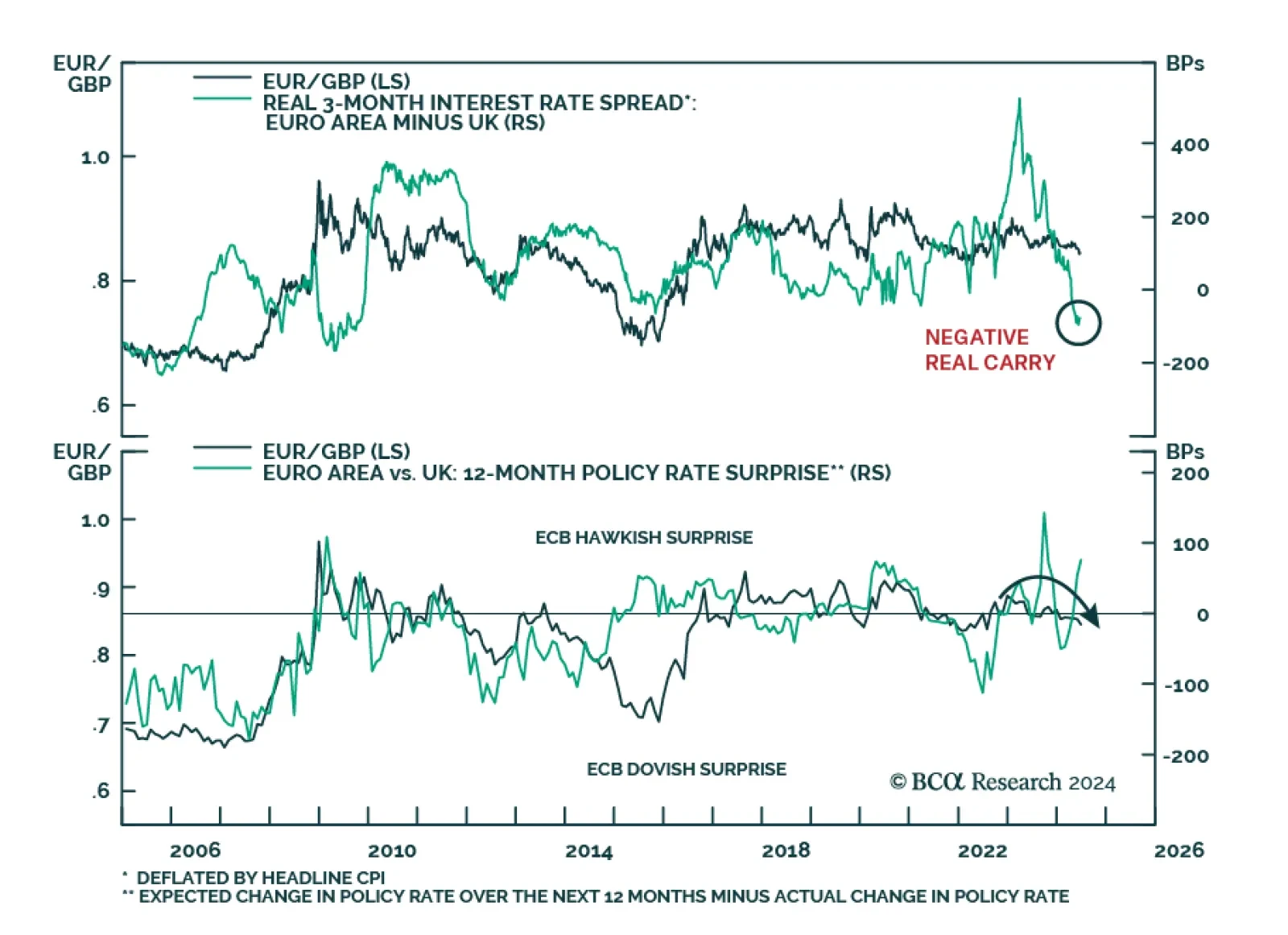

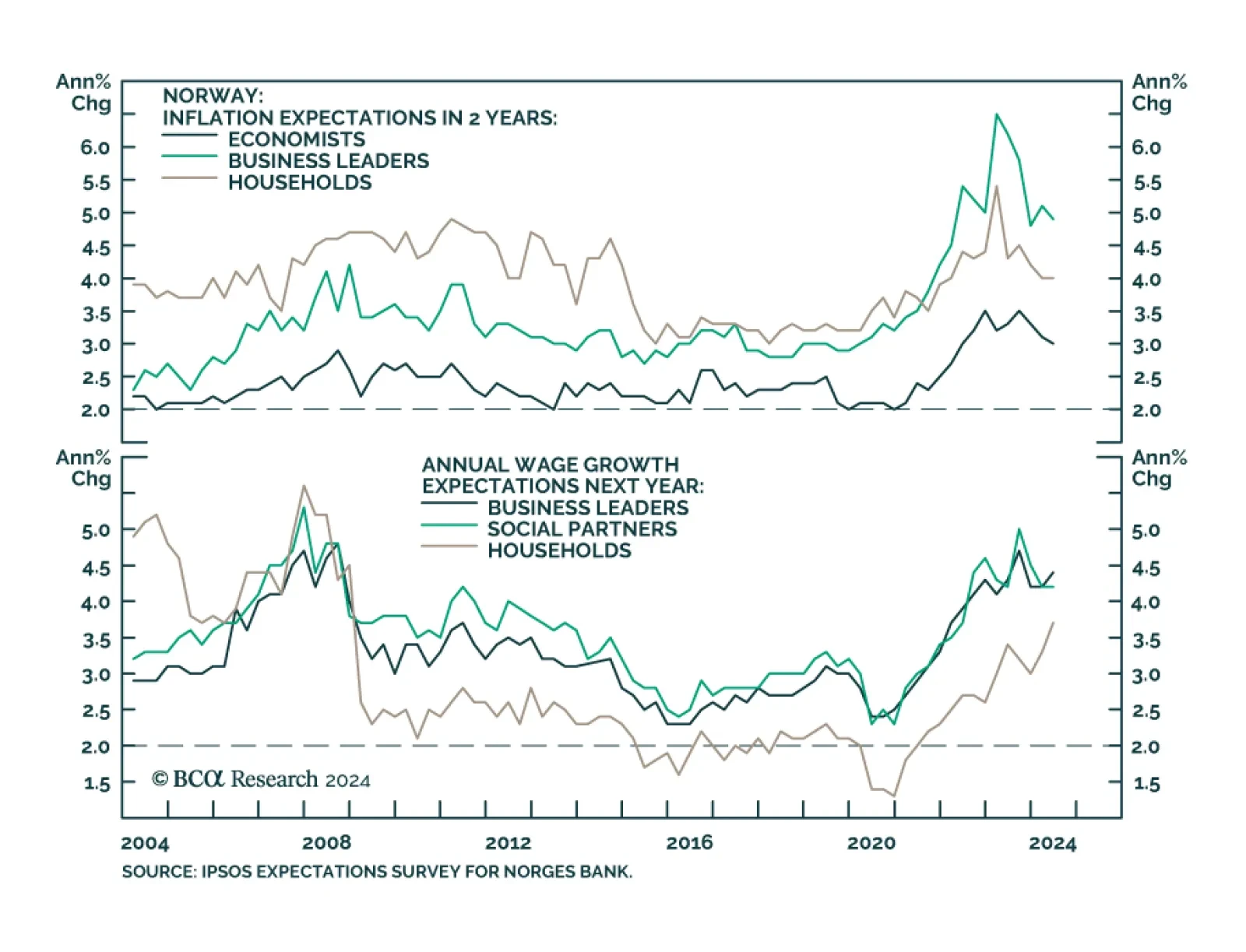

According to BCA Research’s Foreign Exchange Strategy service, the Norges Bank will be one of the last central banks to cut rates. The Swiss National Bank, Bank of England, and Norges Bank all held policy meetings on…

We look at the implications a various European central bank meetings this week, for currency strategy.