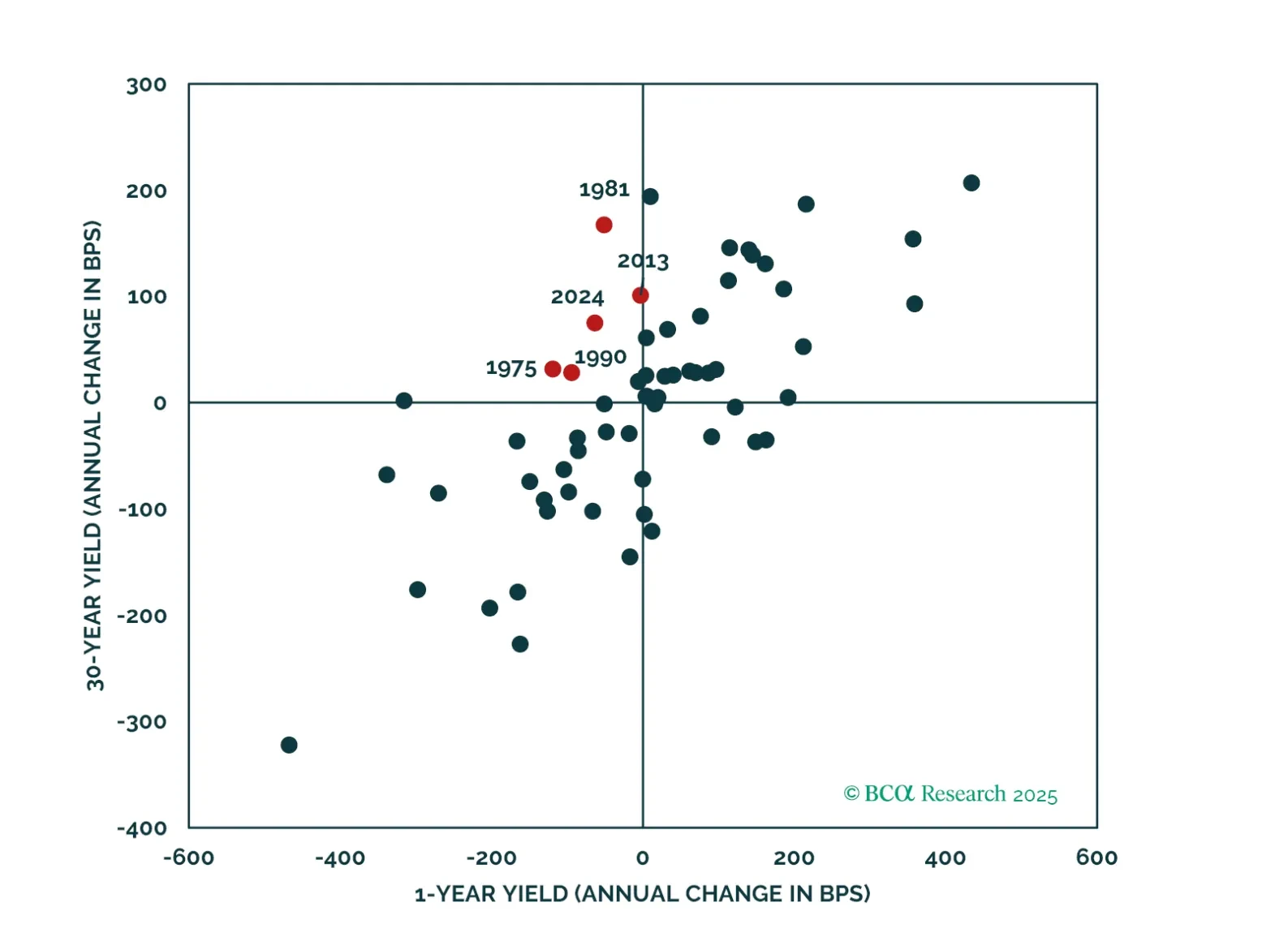

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…

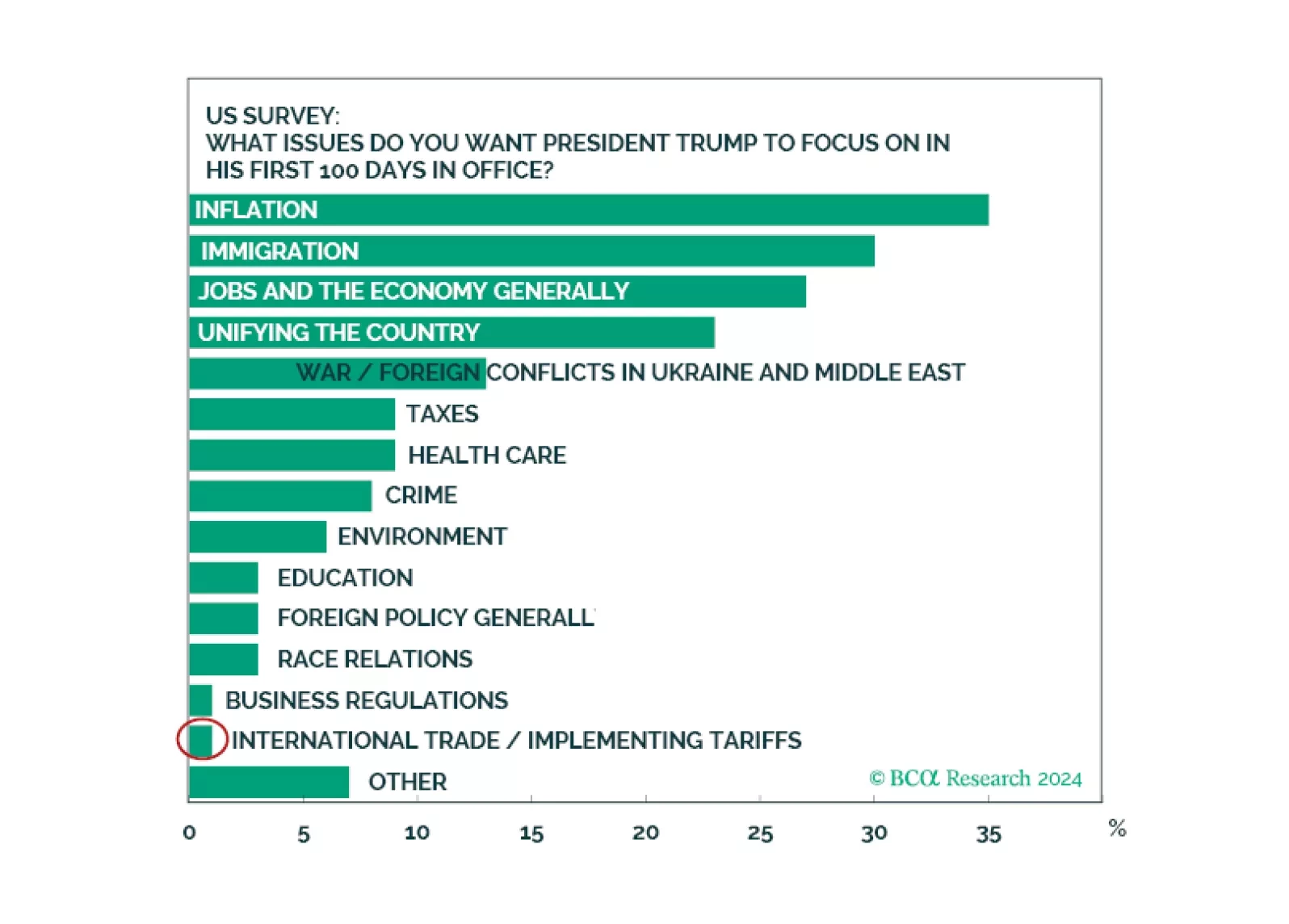

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

This month, our Here, There, And Everywhere Chartpack summarizes our main thesis for 2025: the three main narratives driving markets today – fiscal profligacy, trade war, and geopolitical conflict – will peak at some point in…

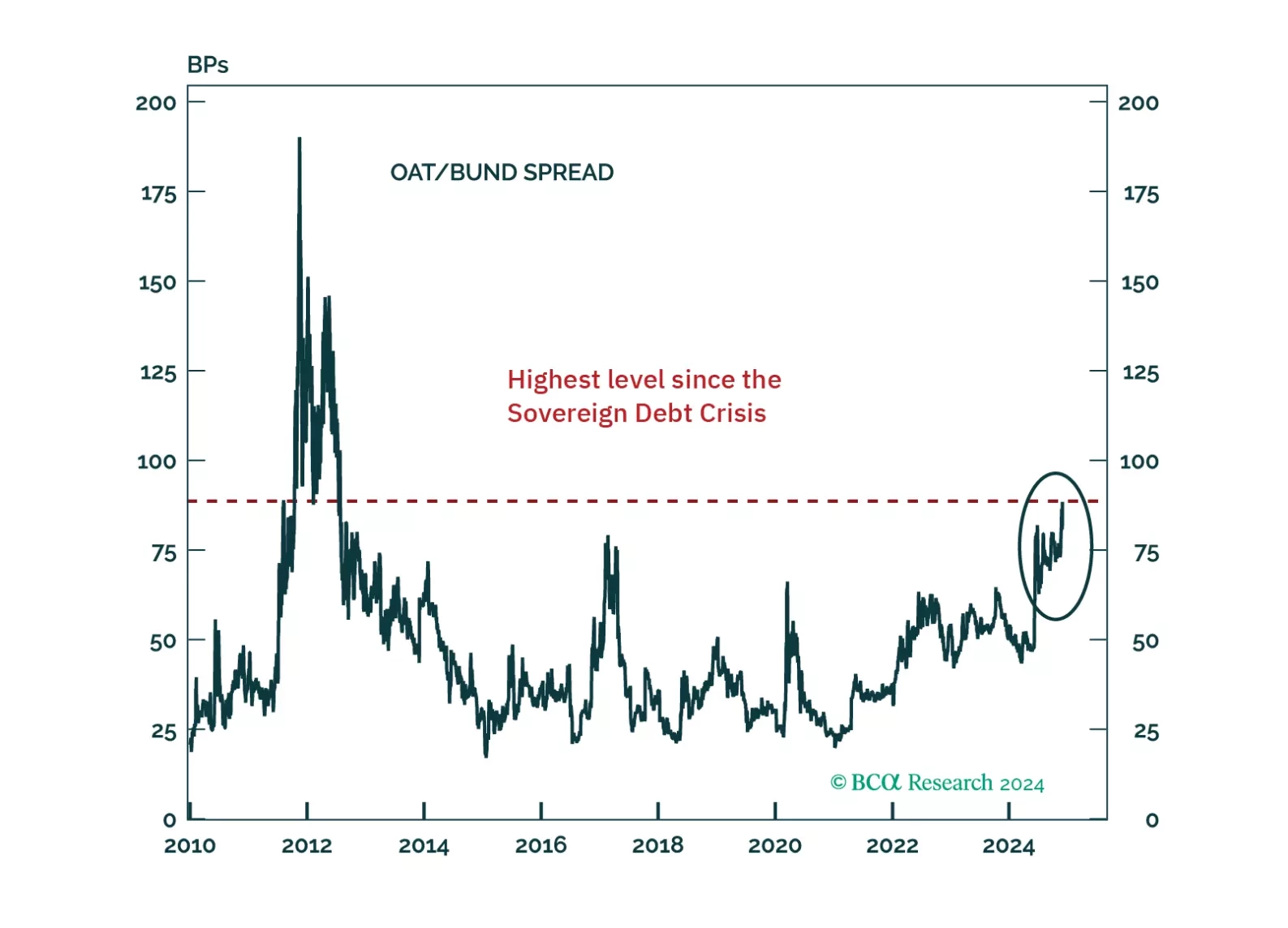

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

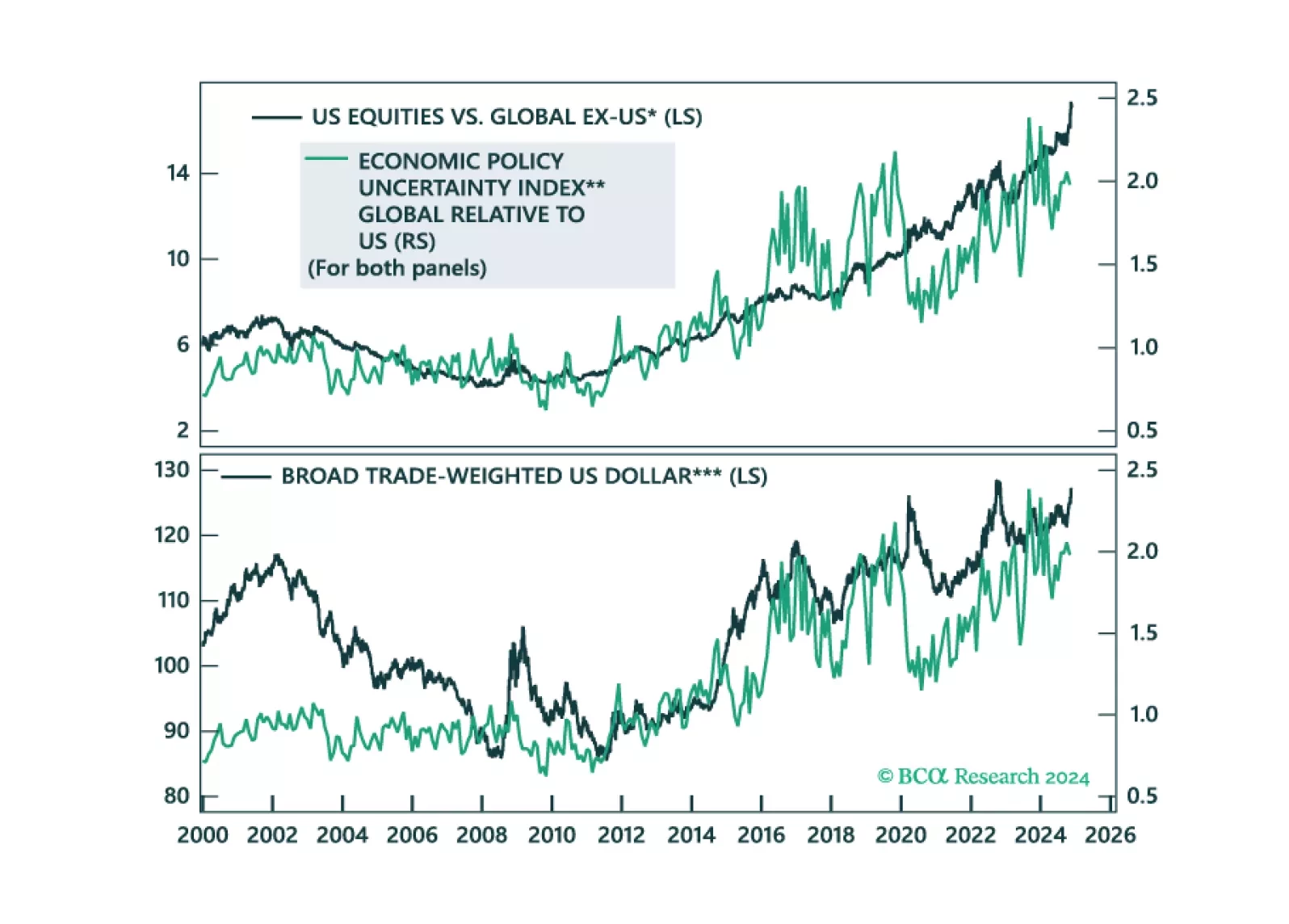

In our Alpha report, we deliver our Annual Forecast. The current macro narrative is that the US will continue to outperform the rest of the world, in large part because President Trump will again deliver fiscally led growth and…

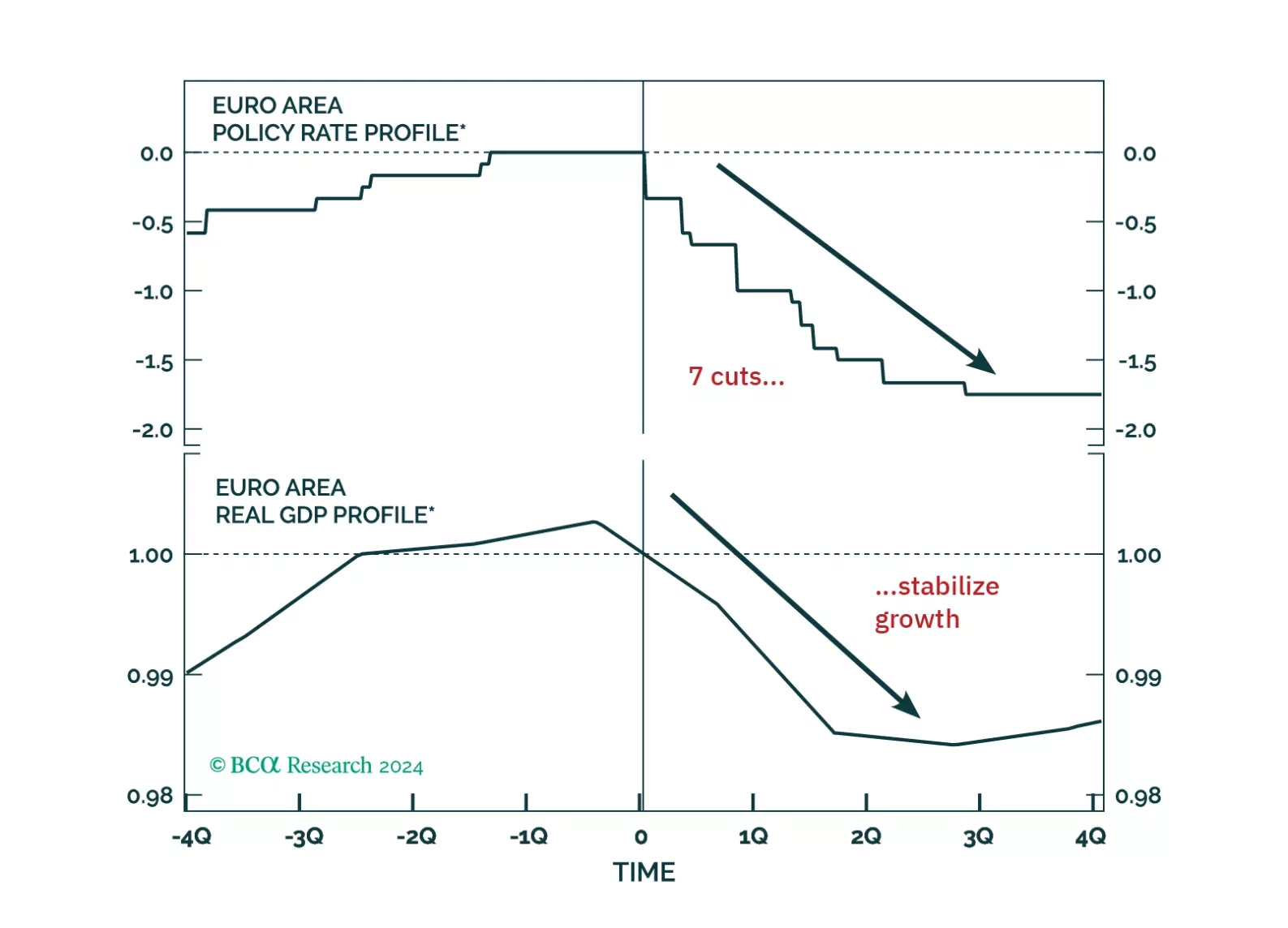

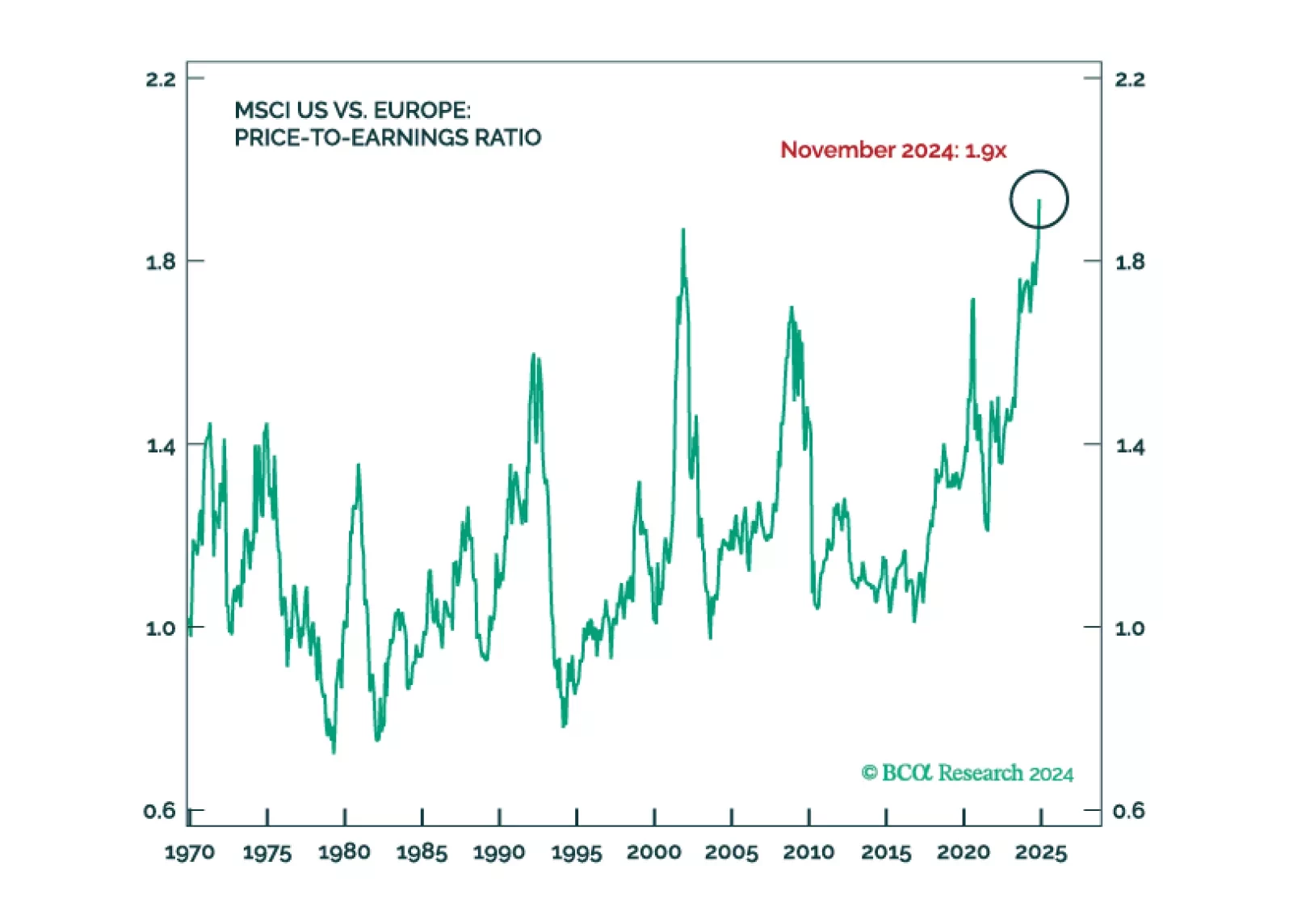

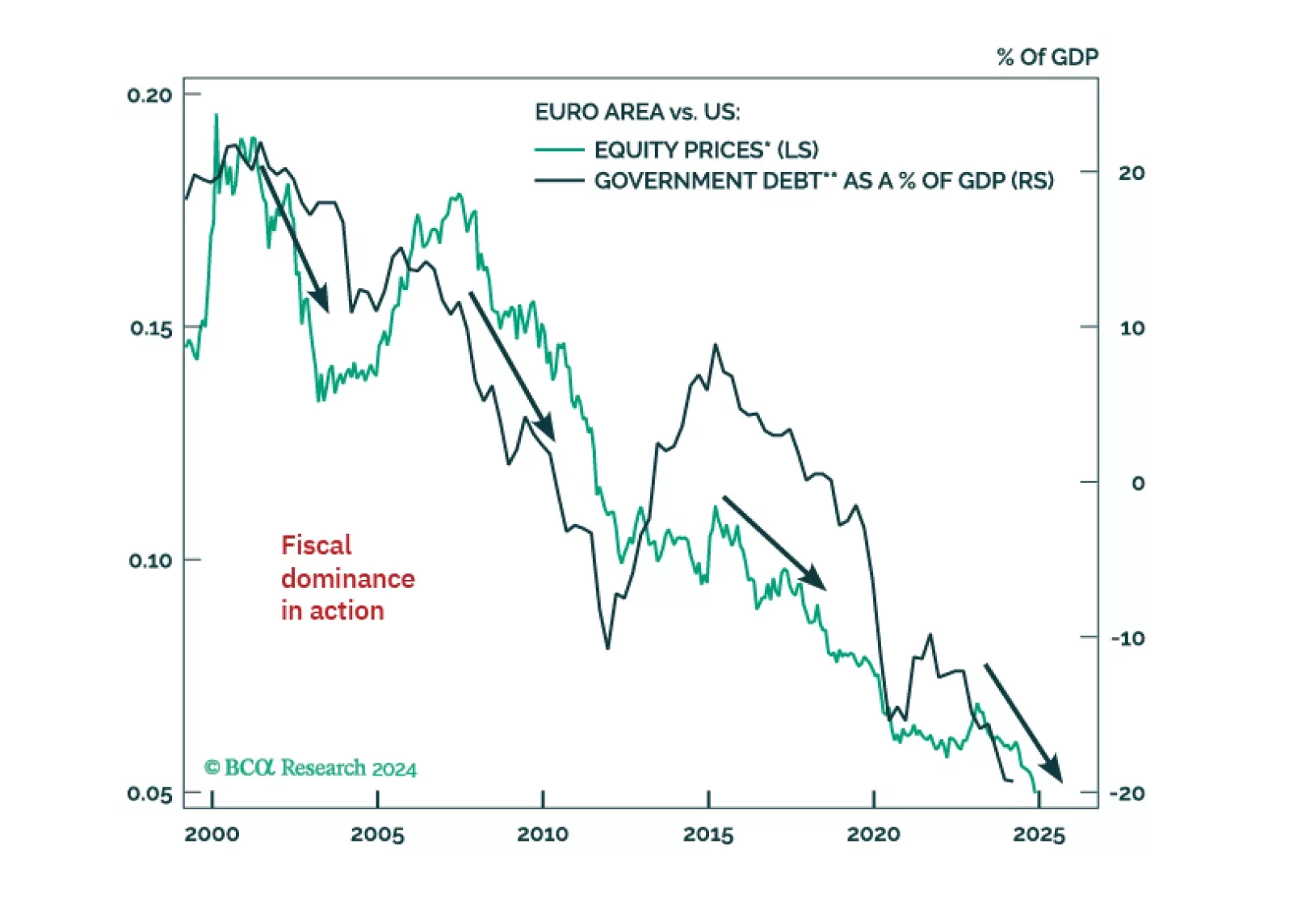

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

Executive Summary Political Uncertainty And The Dollar The consensus is that Republicans will blow out the budget deficit, leading to a higher fiscal risk premium on the dollar. That seems unlikely for now. If the deficit…

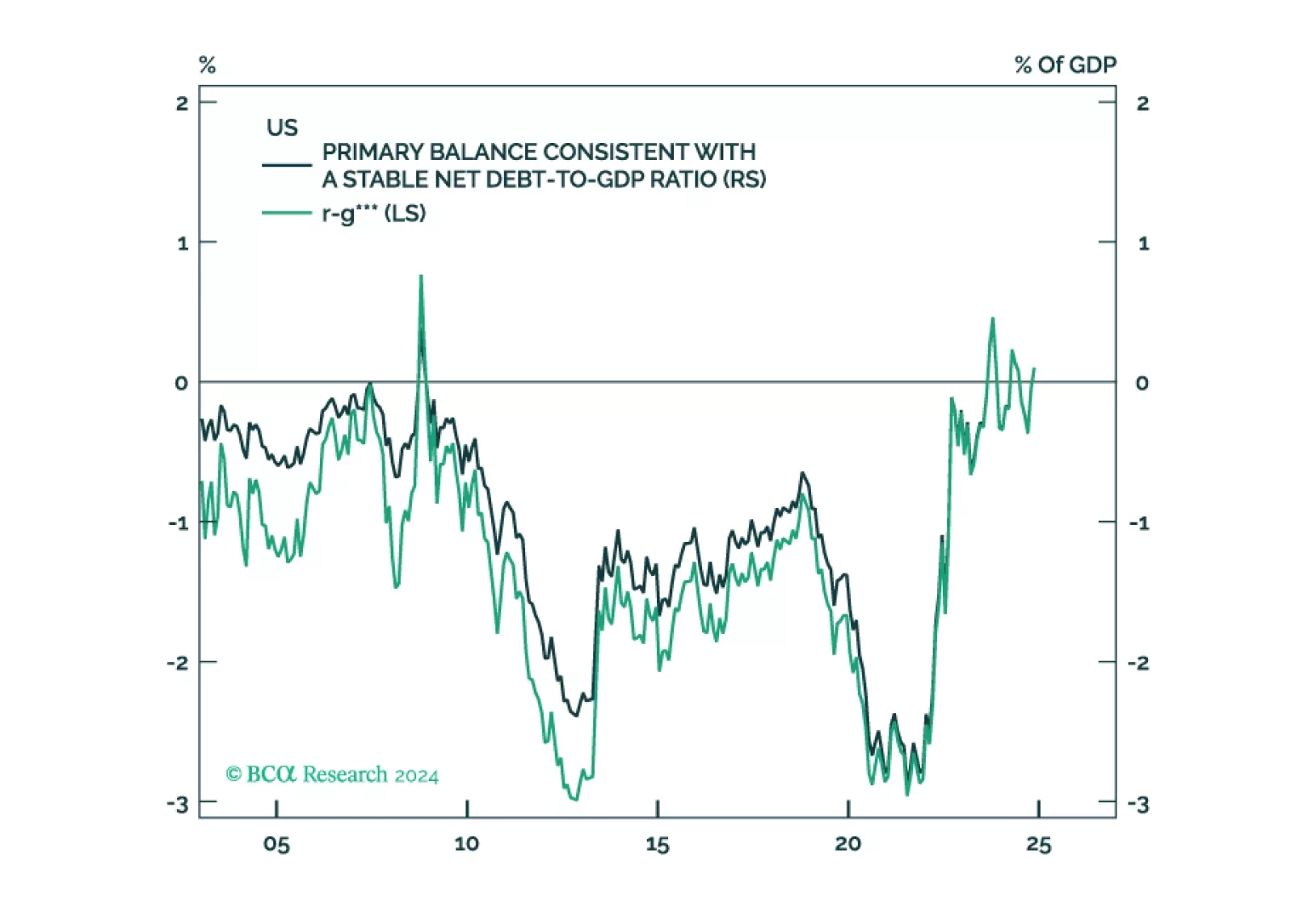

Executive Summary The US Needs To Reduce Its Primary Budget Deficit By Nearly 4% Of GDP To Stabilize Debt Rising government debt in the US has heightened the risk of a fiscal crisis. If interest rates stay where they are, the US primary…