The month of November has brought us S&P 6,000! President Trump has won a “Red Sweep” (as we expected all year) and has ushered in a regime change in America. For now, we are open to chasing momentum. However, the biggest risk to…

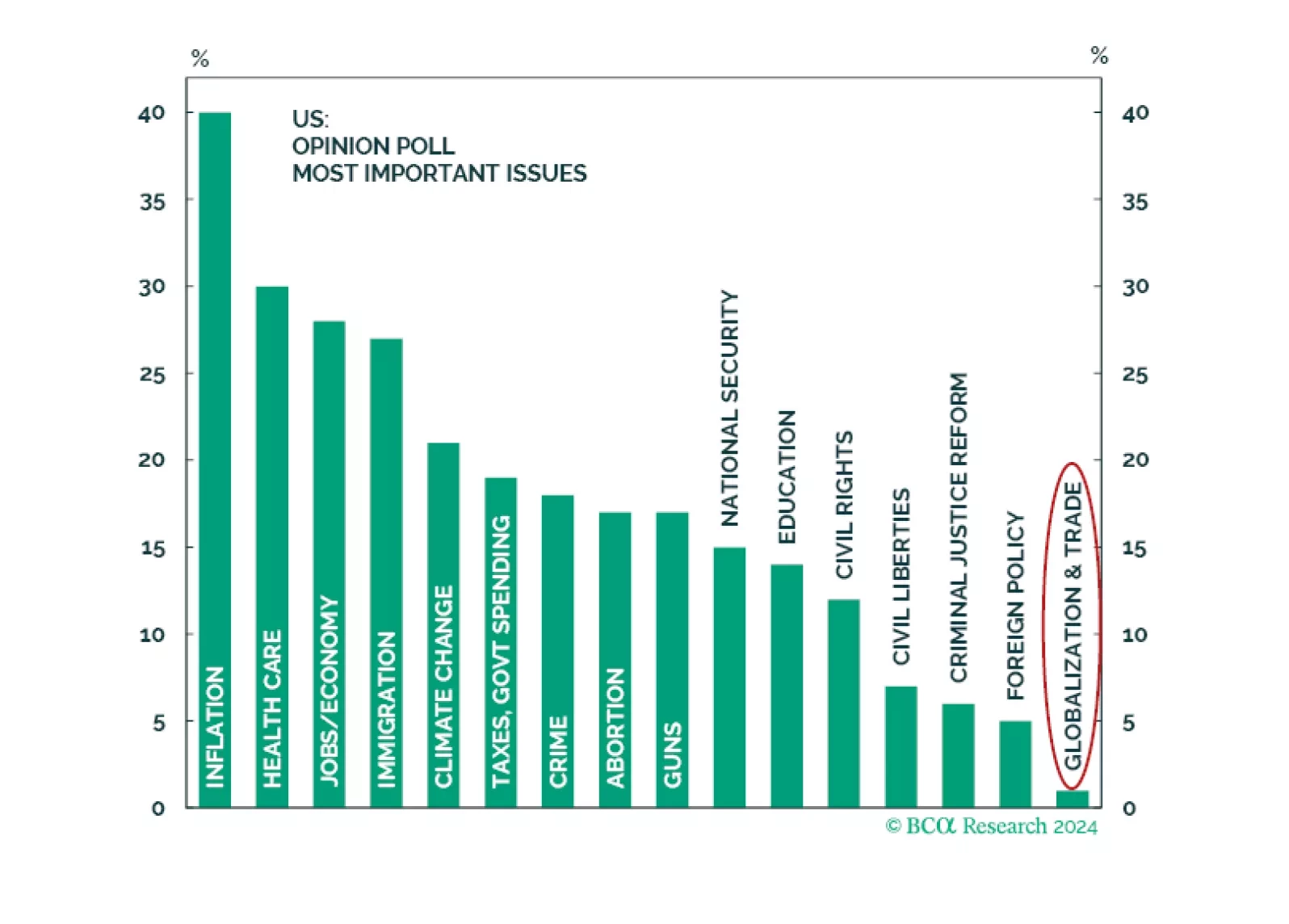

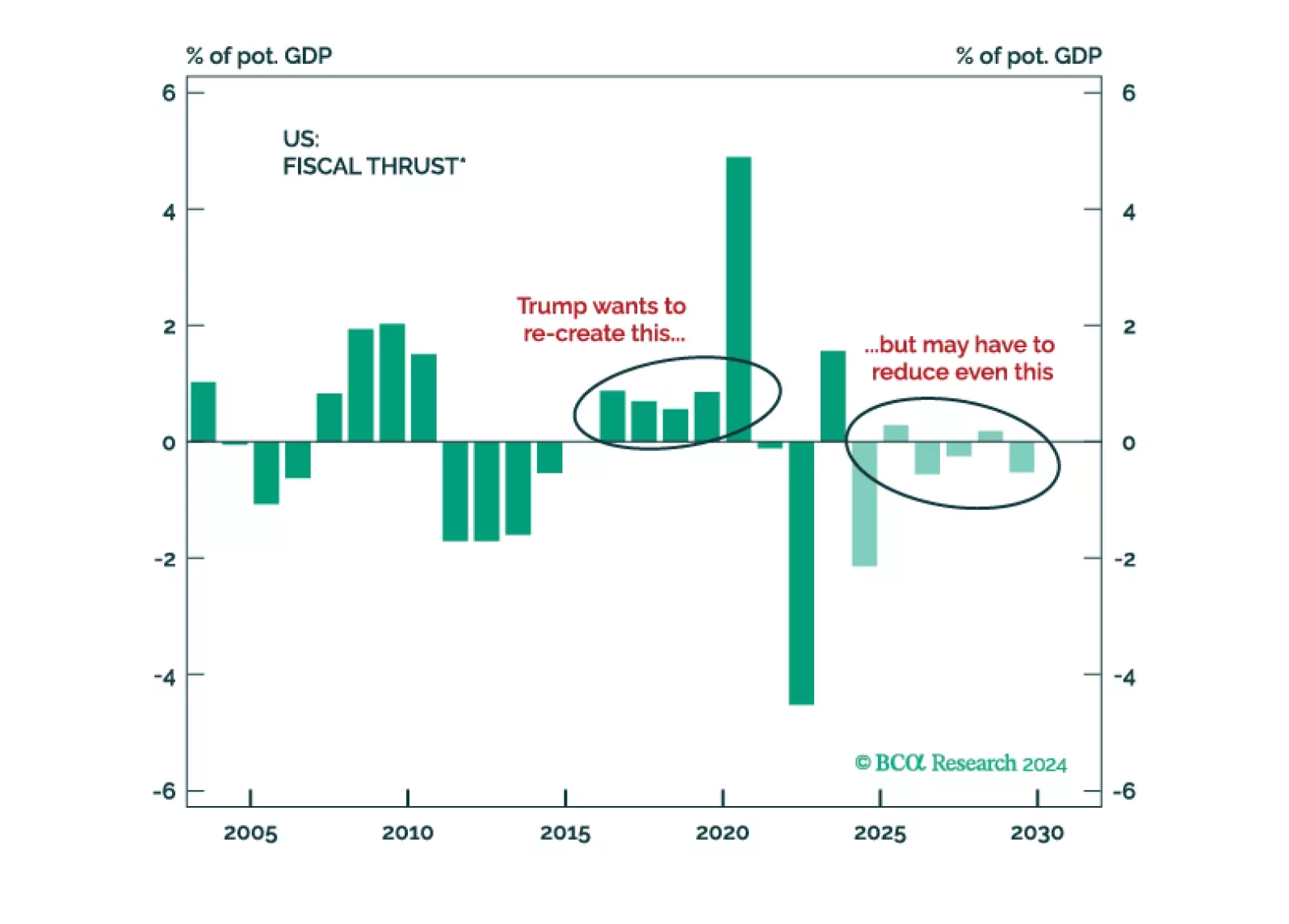

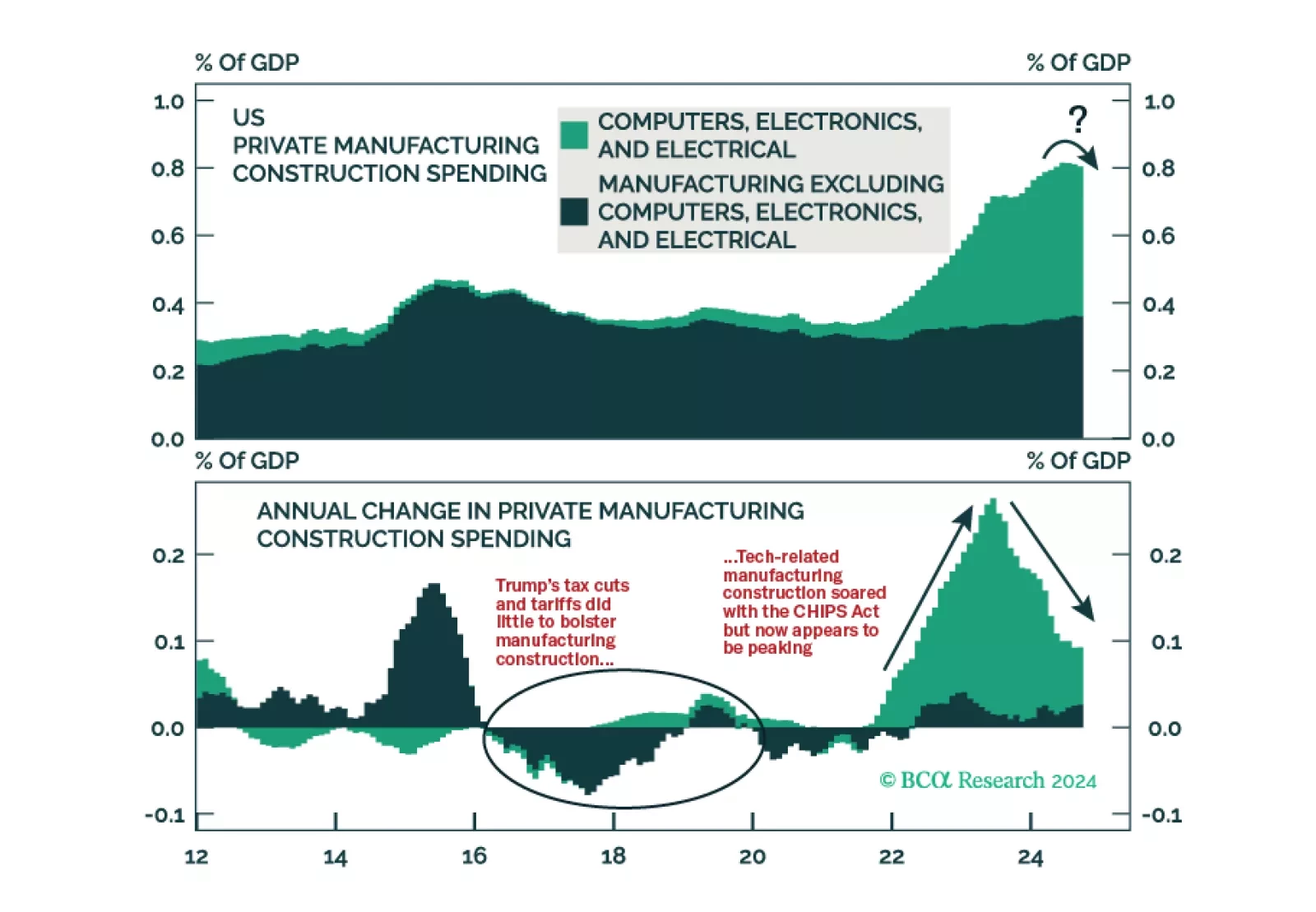

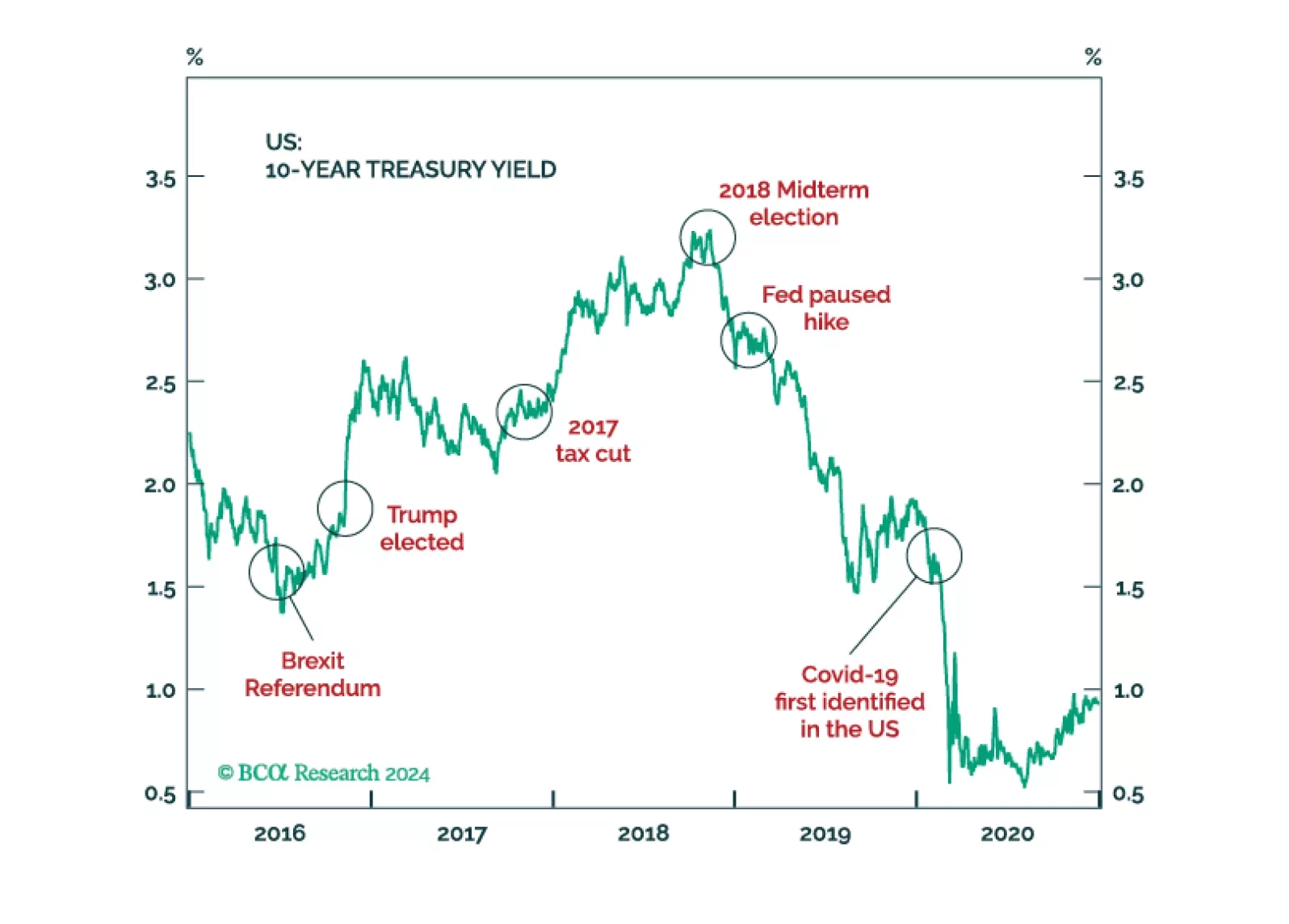

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…

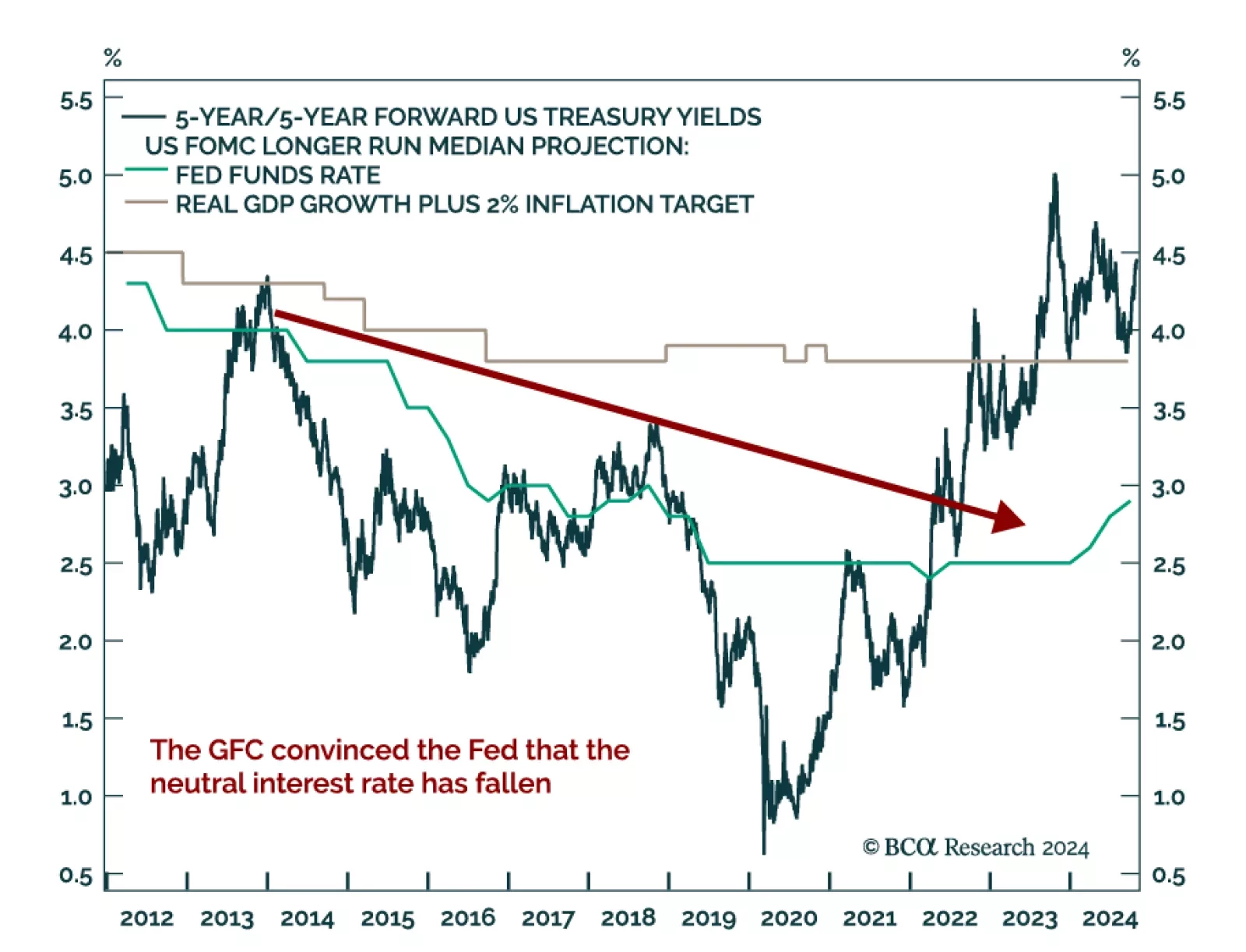

Given the charged atmosphere surrounding the US election, our Bank Credit Analyst colleagues investigate whether the Fed’s dovish pivot last December was politically motivated. The Fed’s actions appear overly…

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

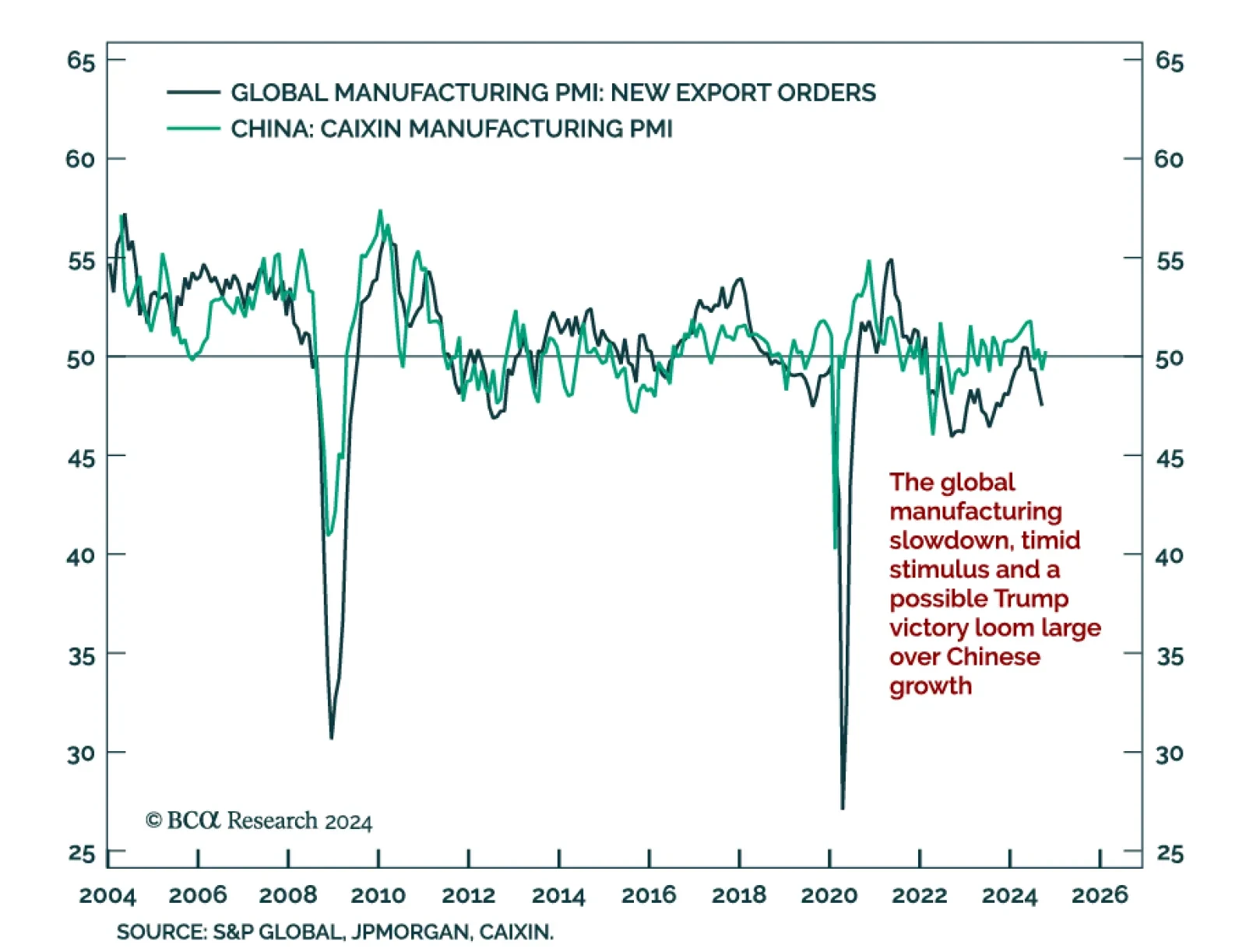

China’s Caixin Manufacturing PMI rebounded one point in October to 50.3. This was in line with the NBS PMIs from earlier this week, which also showed a modest rebound. We are looking for a turning point in China as the…

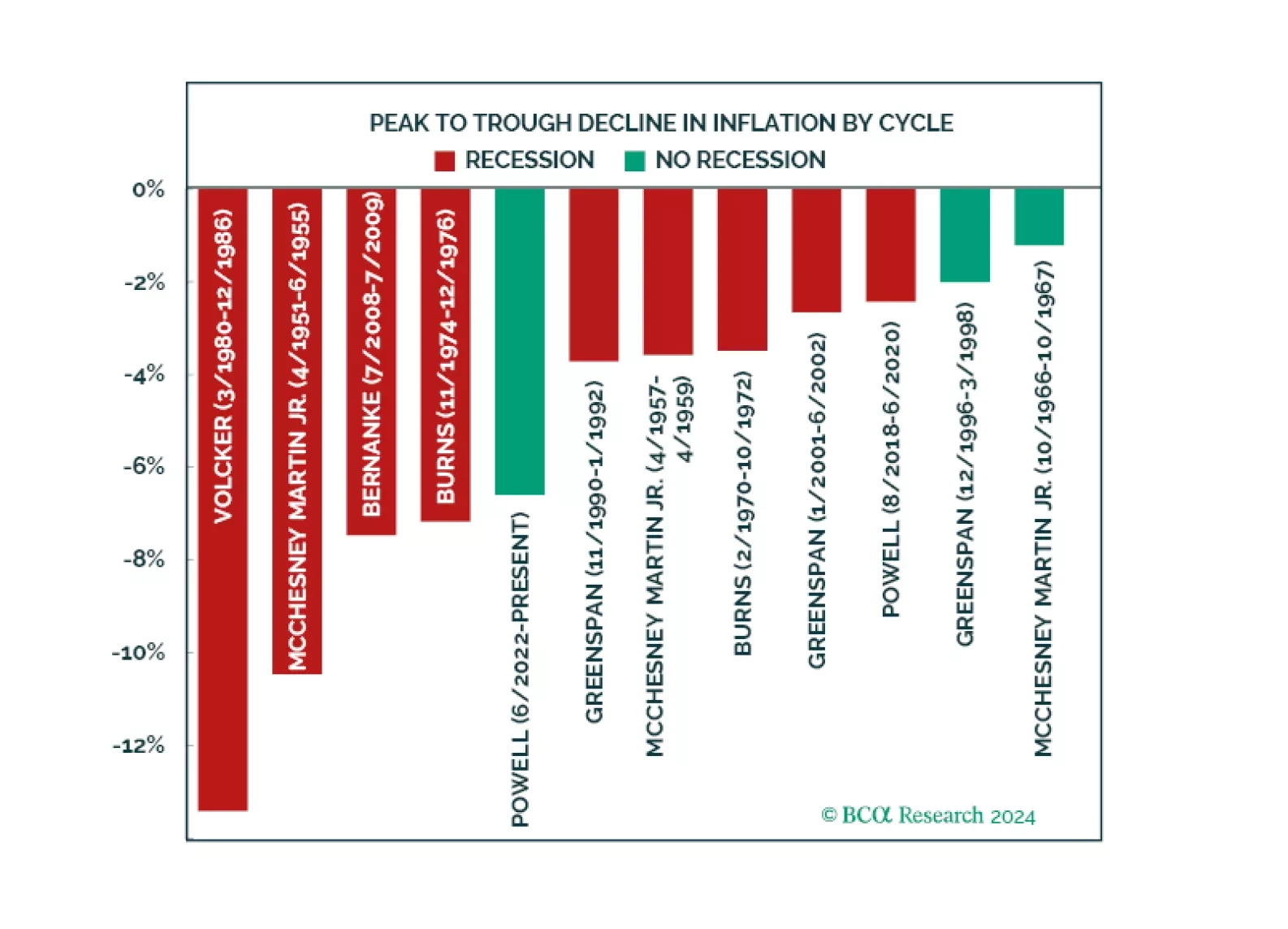

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

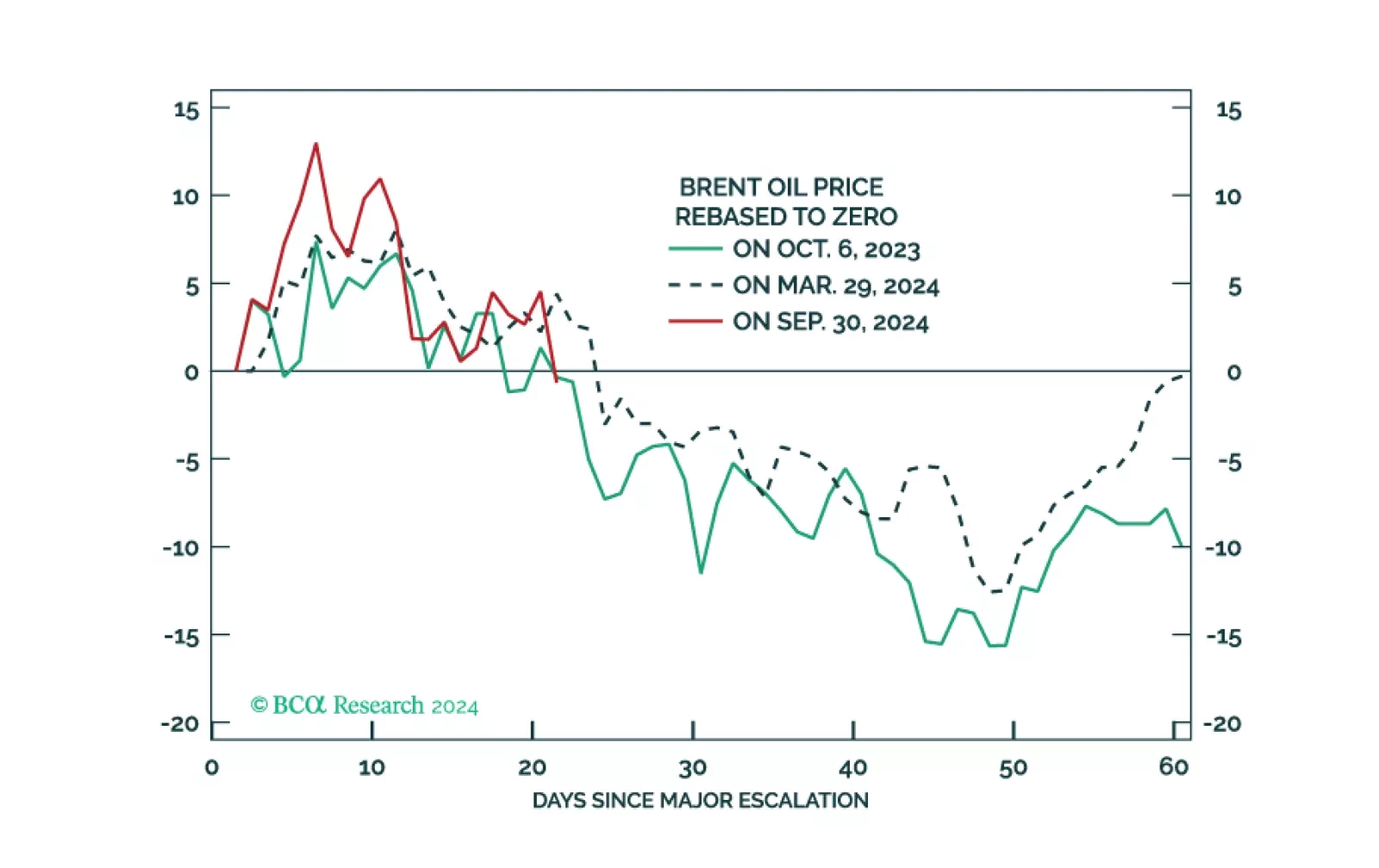

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.