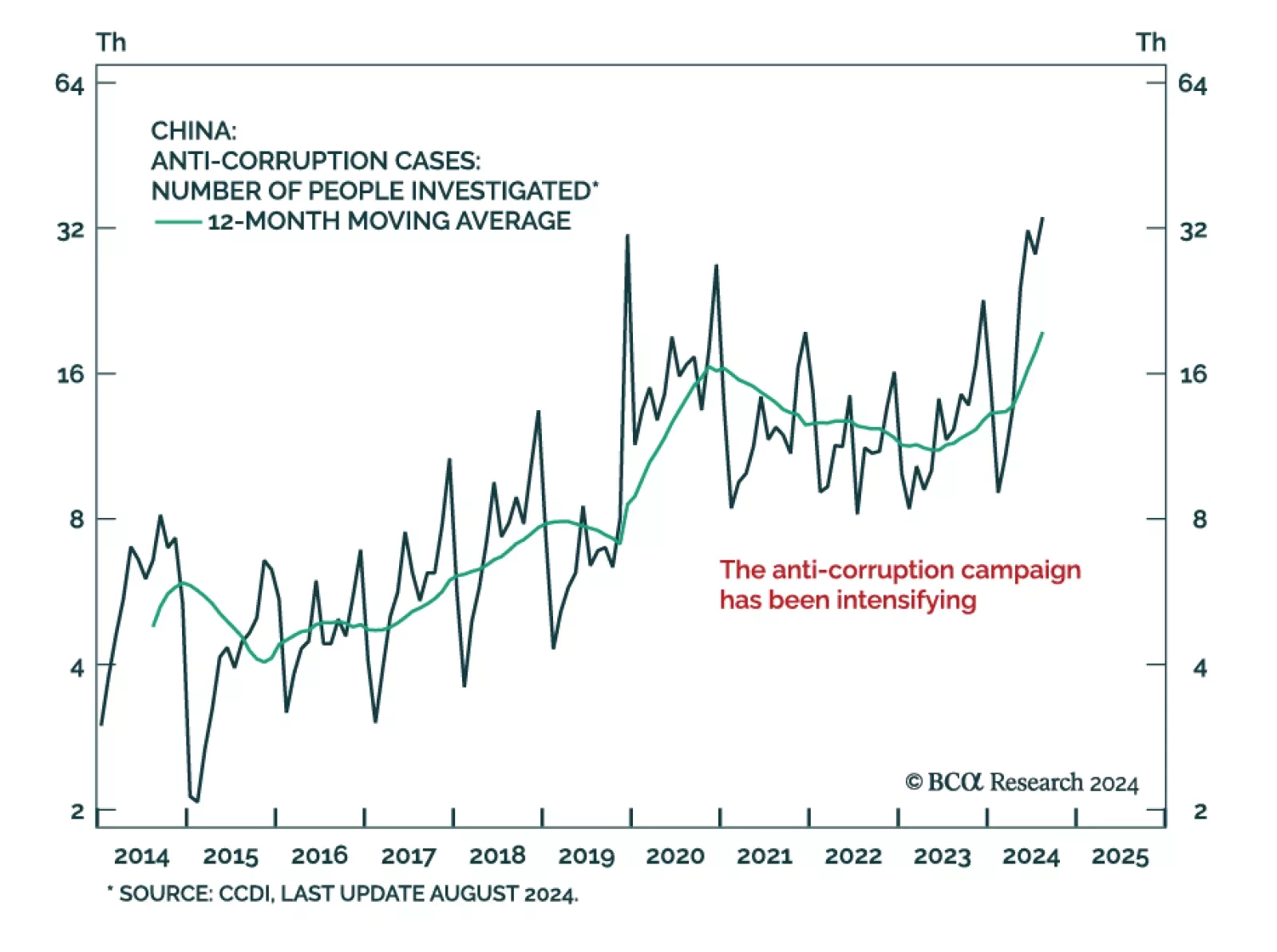

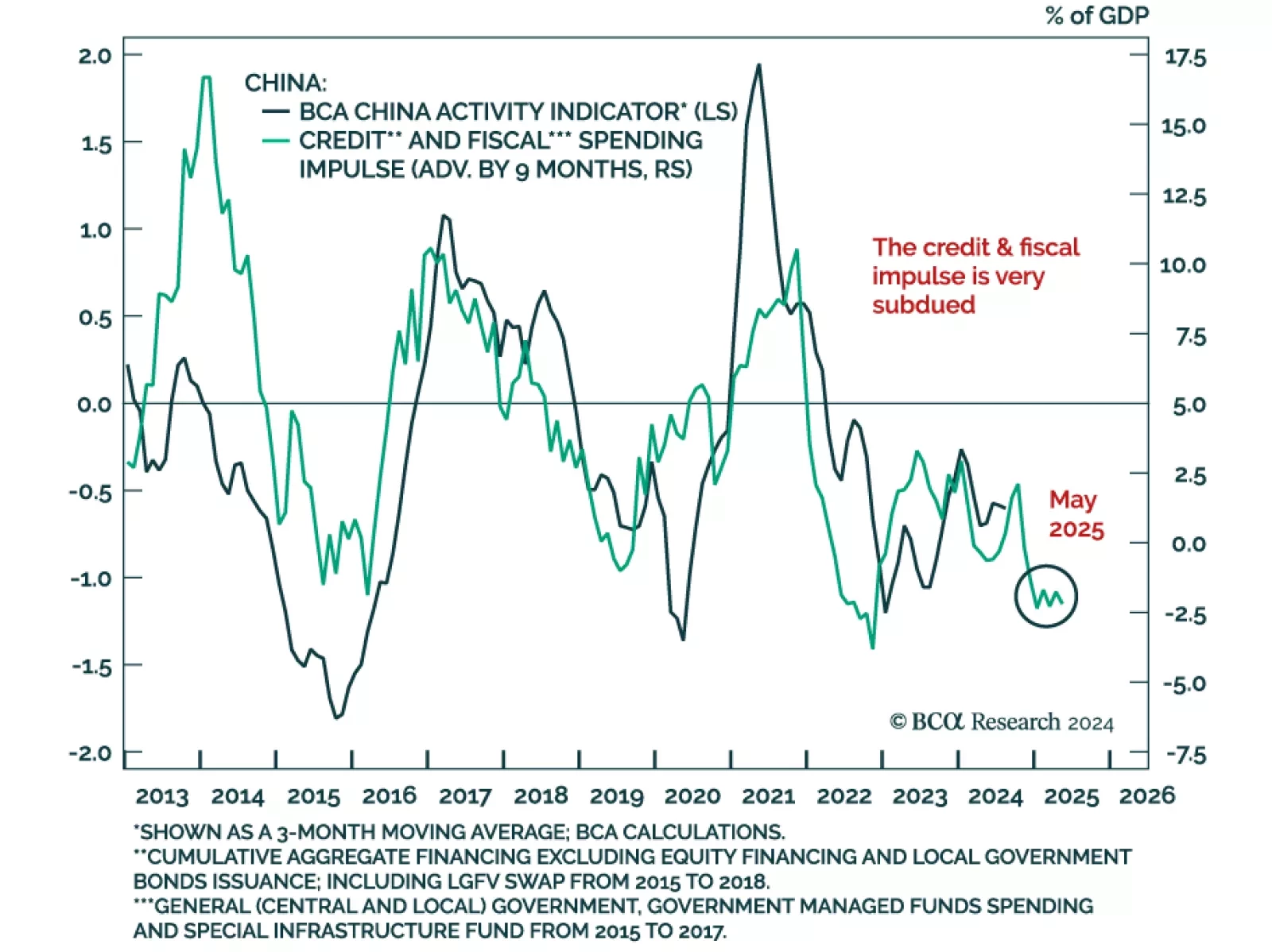

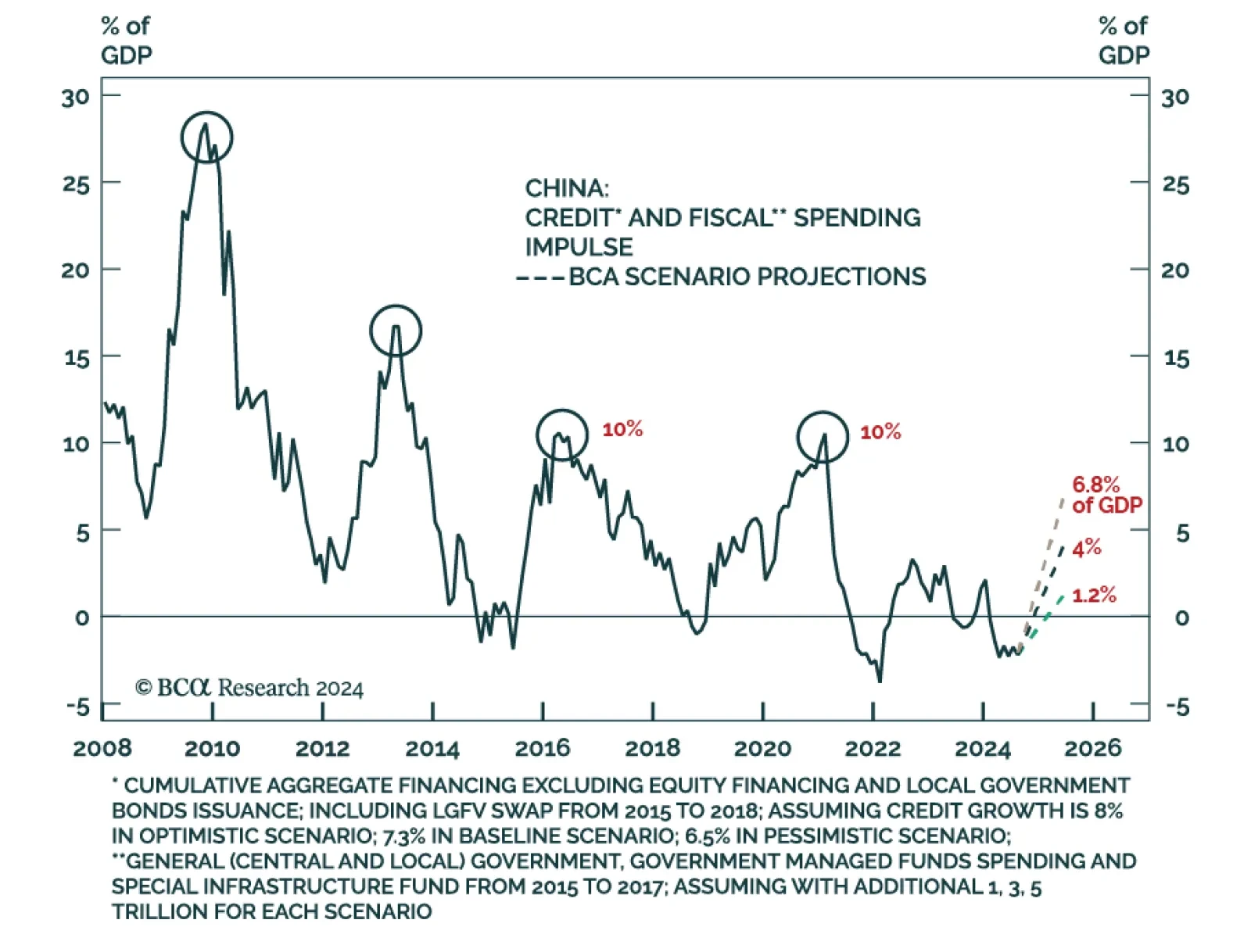

While moving in the right direction, China’s latest stimulus measures are falling short of the mark to reflate the economy. The latest rumors extend this trend. News agencies reported discussions of a CNY 10 trillion…

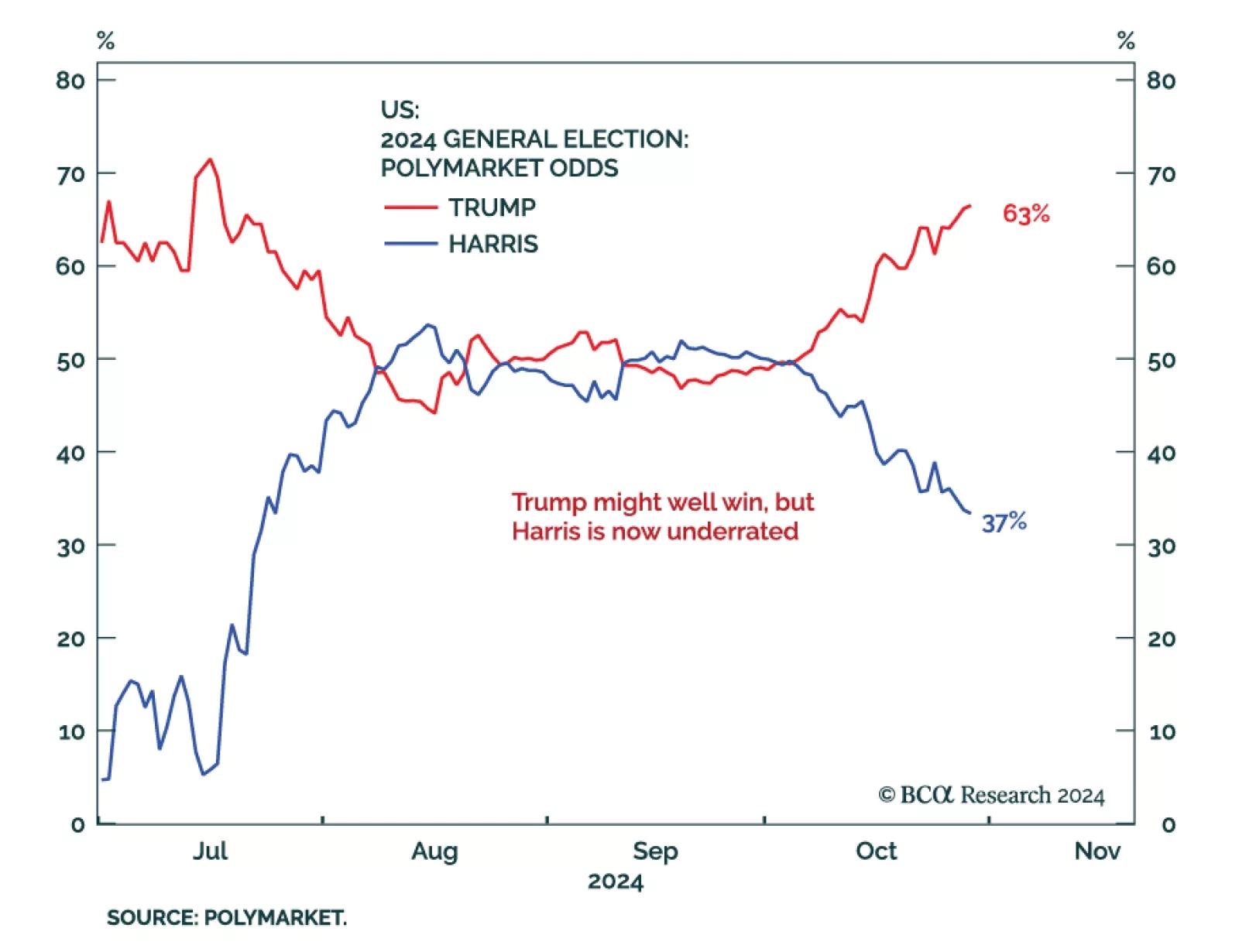

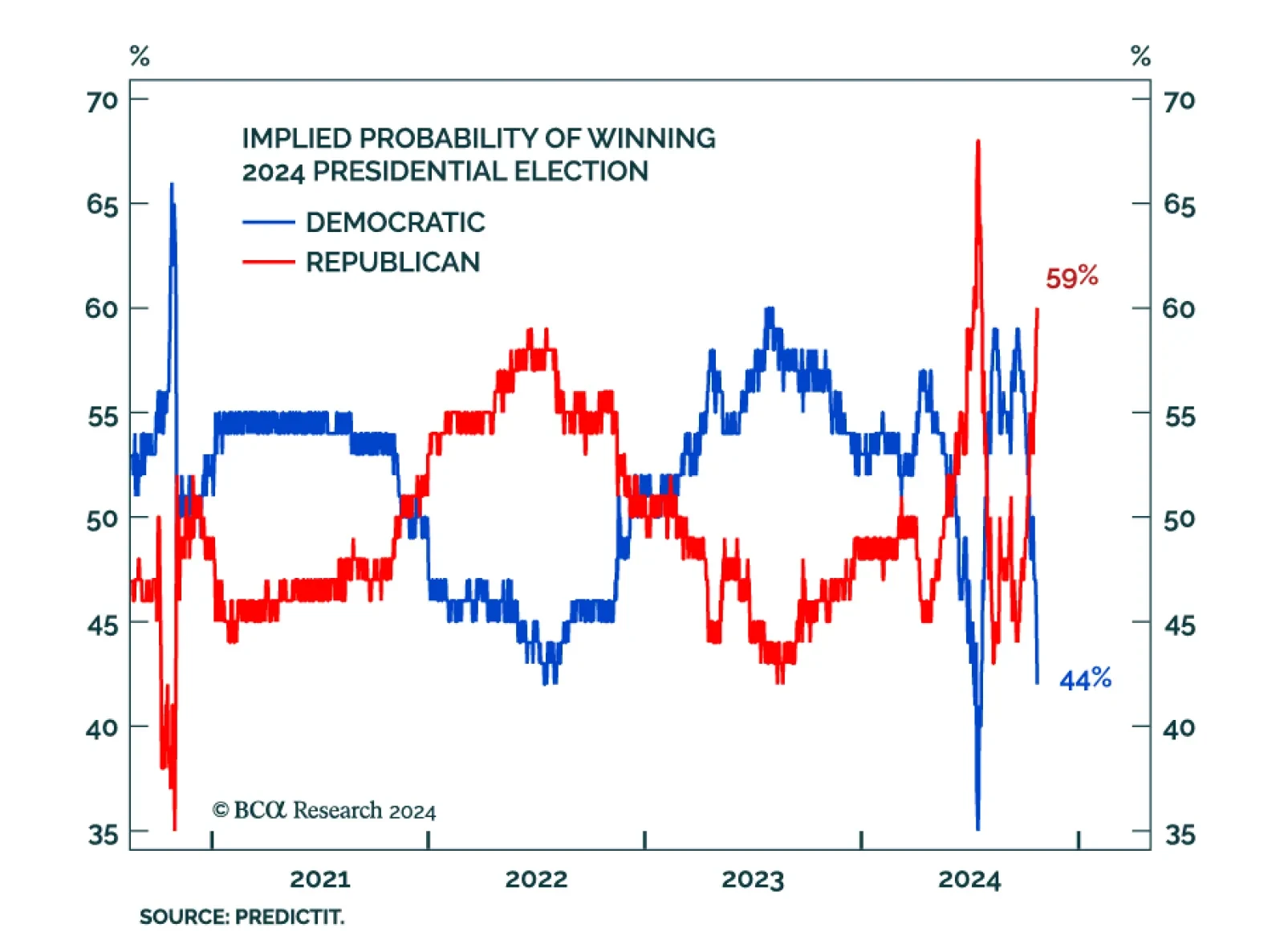

Our US Political Strategy colleagues now see 55% odds of a Trump victory, with odds of a Republican sweep at 47%. As odds of a contested election are rising, they built on their 2020 work to provide answers for next week’s…

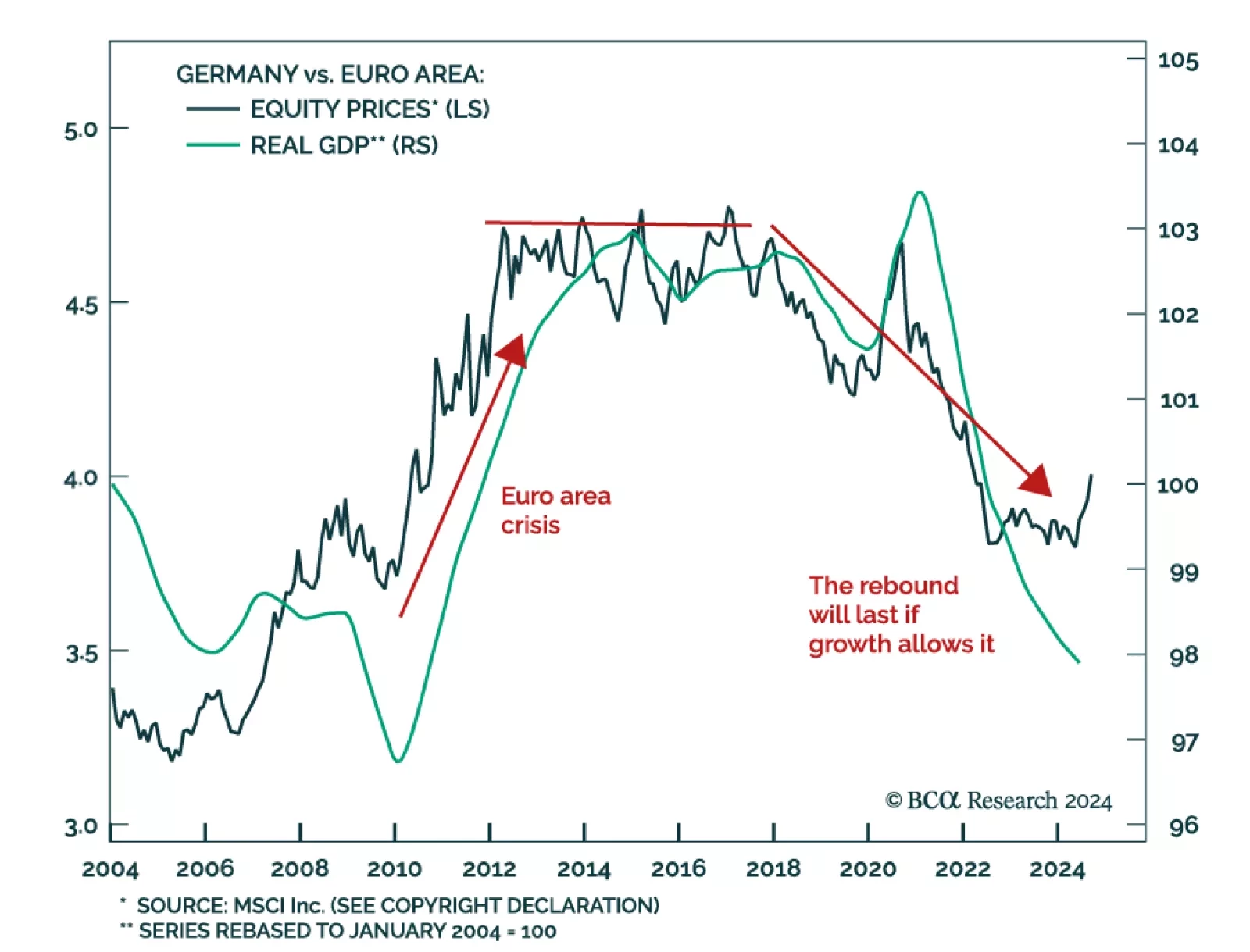

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

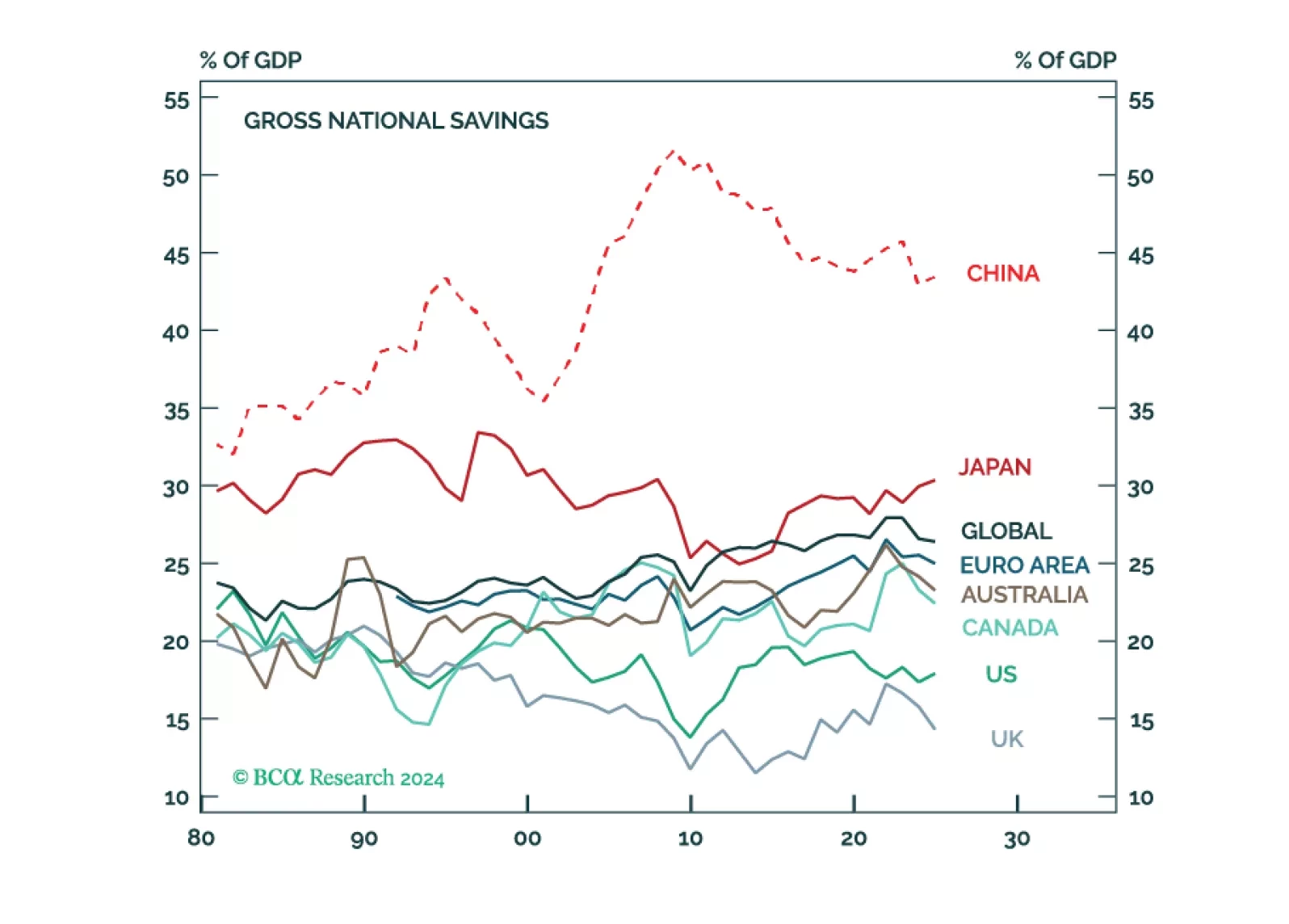

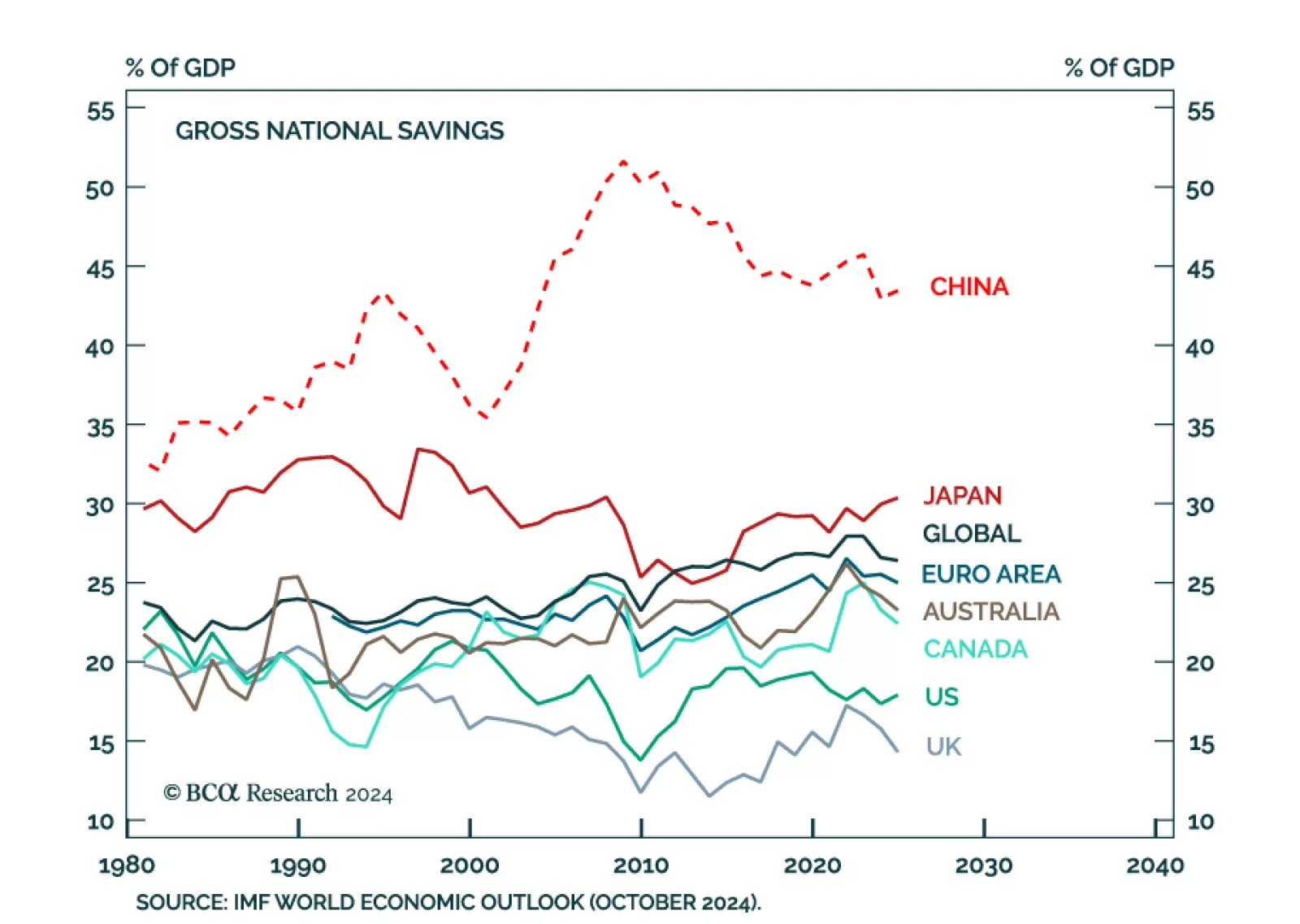

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

In this report, we discuss why we are lifting our US recession probability from 60% to 65% and explain why China’s latest stimulus announcements are welcome, but probably are “too little, too late.”

The US election is tightening in its final weeks, and the latest polls challenge our Geopolitical Strategy’s base case of a Democratic White House. The original thesis was built on the premise of a Democratic incumbent…

Chinese activity data met expectations, with Q3 GDP printing at 4.6% year-on-year, decelerating from 4.7% in Q2 but below the 5% 2024 growth target. Other metrics such as industrial production and retail sales beat expectations…

The UK August employment report was in line with recent data showing an economy humming at a decent pace. The unemployment rate decreased 0.1pp to 4% after peaking at 4.4% before the summer. The BoE will look kindly to the…

Our China and Emerging Market strategy teams analyzed this weekend press conference by the China’s Ministry of Finance (MoF), that provided additional details on the recently announced fiscal stimulus plan. Our…

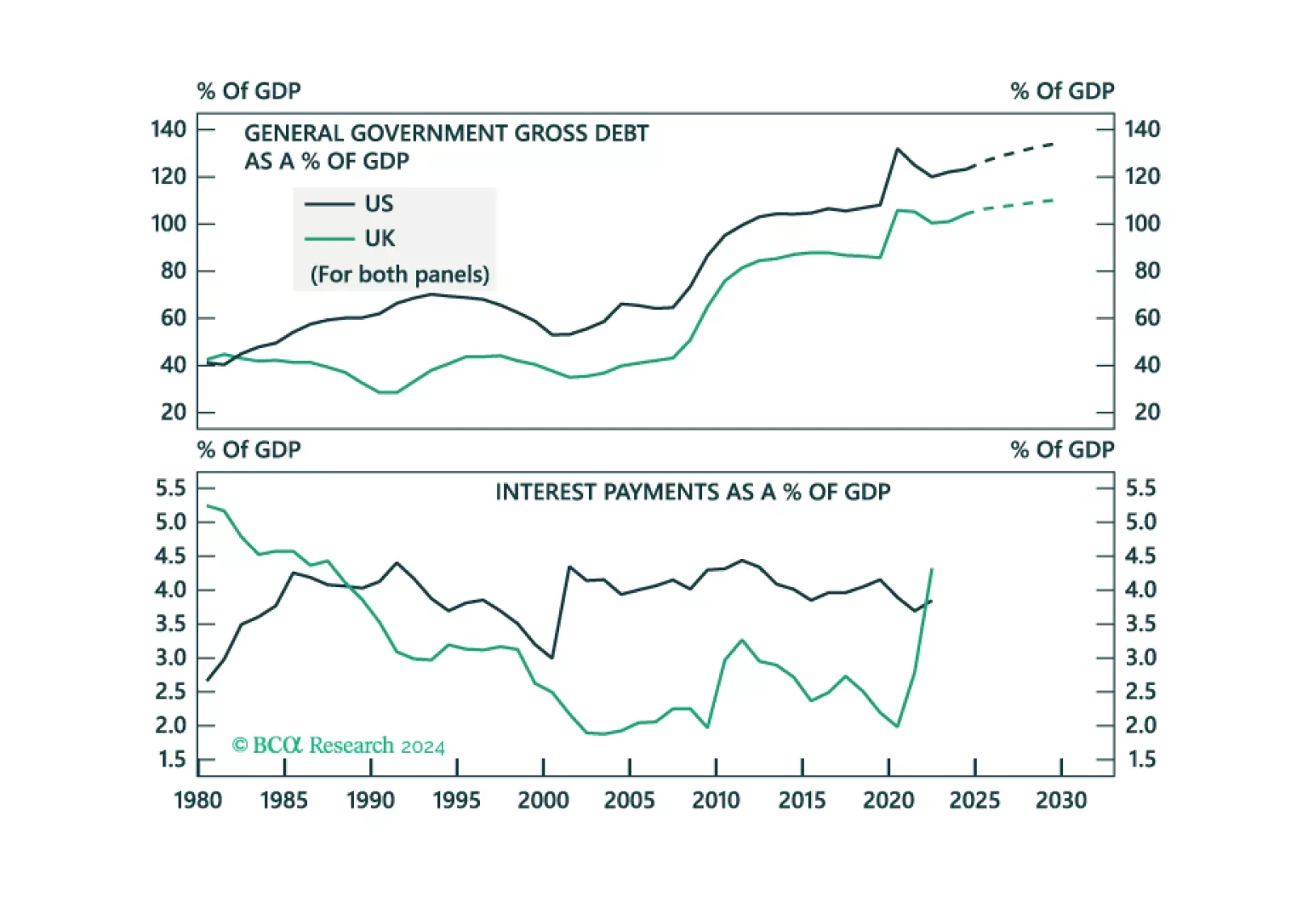

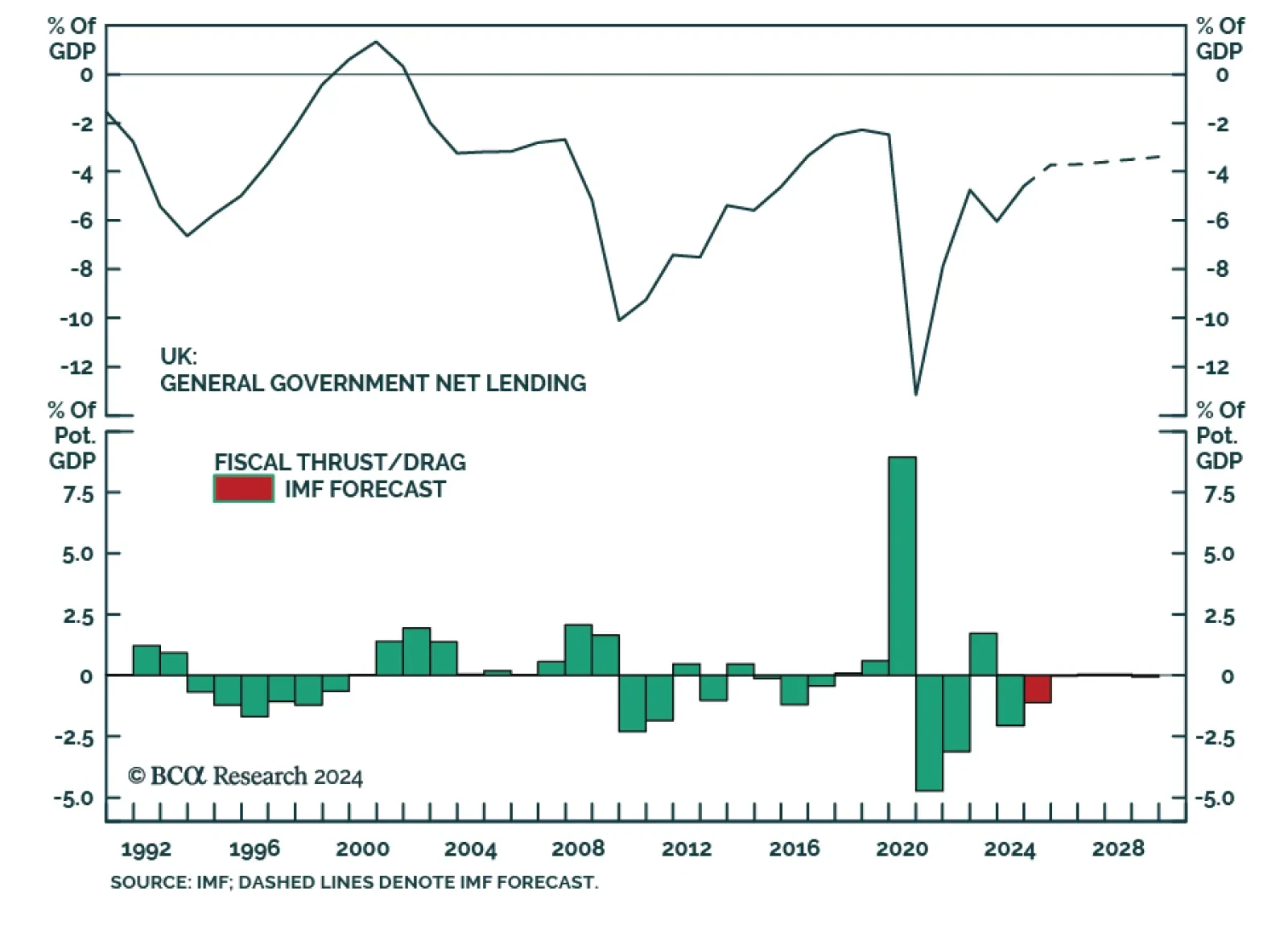

In this Insight, we assess whether investors should expect fiscal turbulence in the UK, that will drive UK yields higher and the pound lower.